The company systematically conducts an inventory of its own assets.

The goal is to check the correspondence between documentary information and the actual availability of property assets owned by the company. Monitoring of fixed assets (fixed assets) is of particular importance, since this property, as a rule, is characterized by significant value and retains its properties for a long time.

The results of the inventory may be different:

- full compliance of the real state of affairs with accounting data;

- identifying discrepancies in the form of surpluses or shortages.

Information about established surpluses/shortages for certain fixed assets is subject to mandatory reflection in the accounting system.

First of all, it is necessary to consider how surplus operating systems discovered during inventory are accounted for and accounted for.

What is this concept?

The procedure for inventorying company assets involves the sequential implementation of the following activities:

- Determination of regulations for the upcoming inventory. The composition of the executive commission is formed, deadlines are set, and the reasons and grounds for conducting an inventory of existing objects are specified. All these points must be reflected in a written order, which is specially issued by the management of the organization.

- Direct inventory of groups of objects of interest. The commission determines the actual quantity and actual condition of the property being inspected. The results of the actions taken are reflected in the inventory documentation, which includes an inventory of assets.

- Comparison of received and initial information. At this stage, the results of the audit are compared with accounting data. The information is clarified - identified surpluses are credited, detected shortages are written off. Comparison statements are generated and the final results of the inventory are documented. The company's management is taking appropriate administrative measures.

When conducting an inventory of assets, the appointed executive commission must follow the instructions of the Ministry of Finance of the Russian Federation, which clearly regulate the procedure for carrying out this procedure, recording its results, as well as the necessary actions in case of detection of inconsistencies - shortages, surpluses.

Thus, surplus fixed assets are objects of the corresponding group of non-current assets that were previously absent from the organization’s balance sheet, but were identified (discovered) based on the results of the inventory.

Indeed, an inventory of an enterprise's assets often reveals unaccounted for items.

Of course, such surpluses are most often found in the category of material reserves, but sometimes the executive commission manages to find fixed assets that for some reason are not listed according to accounting data.

Of course, the presence of unregistered (“extra”) OS objects in an enterprise is a consequence of errors made in the accounting system.

What to do if the inventory reveals unaccounted assets?

When the inventory commission has completely completed the comparison (comparison) of factual information with accounting information, the head of the organization approves the results of the inspection by issuing an appropriate order.

A natural consequence of the execution of this administrative act will be the introduction of the necessary changes into the accounting (accounting) registers, determined by the results of the inventory.

Thus, identified shortages are correctly written off, and surpluses found are correctly accounted for and are registered.

An important clarification is that the inventory should be completely completed by the time the head of the company must sign the prepared reports.

The necessary adjustments to the accounting registers are carried out by specialists on the date of the inventory procedure.

Thus, the manager’s order ordering the capitalization of found surpluses is the legal basis for the proper correction of detected errors in accounting.

An administrative act can be drawn up according to a template adopted in a particular organization.

How to capitalize identified objects?

Unaccounted for fixed assets discovered during a scheduled inspection are accounted for, as required by current standards, at market value.

It should also be clarified that the surplus found must be received exclusively on the date of the inventory.

Accounting rules provide for several options for crediting surplus fixed assets to income.

The choice of a specific approach is determined by the specifics of the situation in which a specialist needs to capitalize a specific object discovered during the inventory process.

Lack of postings: correspondence and cost (including original)

The correspondence of accounting accounts in entries for the shortage of fixed assets reflects, on the one hand, the disposal of fixed assets, and on the other hand, at the expense of whose funds this occurs. Fixed assets are depreciable property, and at the time of detection of its absence, it can be depreciated either completely or partially. Therefore, first of all, you need to determine the value of its residual value - it will be the amount of damage caused by the disappearance of the equipment.

The formation of the residual value of a retiring fixed asset is usually reflected in a separate subaccount of account 01, where the difference between the original cost and accrued depreciation is shown. That is, the shortage of the device in the postings will be reflected by writing off the original cost within account 01 (Dt 01/disposal Kt 01) and assigning to account 01 the entire amount of depreciation accrued for this fixed asset (Dt 02 Kt 01/disposal).

The result obtained after these postings on the debit of subaccount 01/disposal is subject to write-off from accounting by posting Dt 94 Kt 01/disposal. The use of account 94 in this case is mandatory, since it is precisely this correspondence in the posting that will show that the inventory revealed a shortage of fixed assets or their damage.

Further accounting entries will reflect at whose expense the amount of the shortfall will be taken into account:

- financially responsible person - Dt 73 Kt 94;

- third-party individual or legal entity - Dt 76 Kt 94;

- owner of the missing OS - Dt 91 Kt 94.

If the lost fixed asset was subject to revaluation and the amount of its revaluation is listed on account 83, then this amount should be written off by posting Dt 83 Kt 84.

Accounting for regrading

Regrading is considered one of the most common circumstances under which unrecorded assets discovered during inventory are usually accounted for.

It often appears if, during a scheduled check, deficiencies are identified along with surplus OS. Such regrading often allows for the offset of identified shortages and found surpluses.

Thus, if the cost of the identified shortage turns out to be higher than the cost of the recorded surplus, the difference, as an option, can be recovered from the guilty entities.

If such persons are absent or, for example, not identified, the corresponding difference is simply written off to the periodic financial result - debit of account 91 (under subaccount 91-2).

In addition, if the shortage did not arise through the fault of entities with financial responsibility, comprehensive explanations are provided regarding this difference in the inventory documentation.

Thus, it is necessary to justify why this difference is not compensated by the guilty parties.

The opposite situation is that the actual cost of the missing fixed assets turns out to be lower than the cost of the surplus found for the same group of assets. In this case, the value difference between the shortage and surplus is attributed to other income.

Accounting in the absence of shortage

If during the inspection no shortages are identified in fixed assets, the surpluses found are transferred to the financial result.

Moreover, they are accounted for on the date of the inventory at the cost that corresponds to the current market valuation.

Such a reflection is carried out on the credit of the “Other income” account (designated 91-1), which corresponds with the debit of the active account corresponding to the detected surplus (namely 01).

As for the tax accounting of fixed assets found during inventory, in this aspect the surpluses relate to non-operating income.

Example

Initial data:

During the inspection, a previously unaccounted for asset was found - a hydraulic pump. Its market value is 45,000 rubles.

It is necessary to capitalize this surplus according to accounting rules.

The main transactions are in the table:

| Operation | Amount, rubles | Account debit | Account credit |

| The object is accounted for | 45 000 | 08 | 91-1 |

| The facility was put into operation | 45 000 | 01 | 08 |

Implementation

If an organization decides to sell an asset previously identified by inventory as surplus, then this operation is also subject to accounting.

Example

Initial data:

During the inventory carried out at the enterprise, an unaccounted asset was found - a garage. Its market value is 210,000 rubles.

The discovered garage (surplus) was capitalized in November 2022, and on December 23, 2022, this property was sold at a price of 247,800 rubles, while the VAT included in the sale amount was 37,800 rubles.

On the date of sale of this object, depreciation of 4,000 rubles was accrued in accounting.

The main transactions carried out under such circumstances are presented in the table:

| Operation | Amount, rubles | Account debit | Account credit |

| Depreciation calculation | 4000 | 20 | 02 |

| The primary cost of the object is written off | 210 000 | 01 (sub-account for disposal of fixed assets) | 01 |

| Accrued depreciation is written off | 4000 | 02 | 01 (sub-account for disposal of fixed assets) |

| The residual value of the asset is reflected in other costs | 206 000 | 91-2 | 01 (sub-account for disposal of fixed assets) |

| Sales income is recorded | 247 800 | 62 | 91-1 |

| Calculation of sales VAT | 37 800 | 91-2 | 68 |

Surplus during inventory of inventories and operating systems 1C: Accounting 8 edition 3.0

In accordance with paragraphs. 26-28 Regulations on accounting and financial reporting in the Russian Federation, to ensure the reliability of accounting data and financial reporting, organizations are required to conduct an inventory of property and liabilities, during which their presence, condition and valuation are checked and documented. The number of inventories in the reporting year, the dates of their conduct, the list of inspected property and liabilities are determined by the head of the organization, with the exception of cases when an inventory is required. Discrepancies identified during the inventory between the actual availability of property and the data in the accounting registers are reflected in the accounting accounts.

In this article, we will use a specific example to look at how, in the 1C: Accounting 8 edition 3.0 program, to correctly capitalize excess inventories and equipment identified based on inventory results.

Let's look at an example. The organization "Rassvet" applies the general taxation regime - the accrual method and PBU 18/02 "Accounting for calculations of corporate income tax." The organization is a VAT payer. In September 2022, due to a change in the financially responsible person, an inventory of property was carried out in the organization. As a result of the inventory, surpluses were identified: purchased goods Women's suit 1 piece (book value 3,000 rubles), material Woolen material 4 meters (book value of one meter 1,000 rubles) and a Dell laptop (market value at the time of inventory 125,000 rubles).

Due to the specifics of the program, we will have to split our example into two parts. First, we will conduct an inventory of inventories, and then an inventory of fixed assets.

To carry out an inventory of inventories, the program uses the Inventory of Goods document.

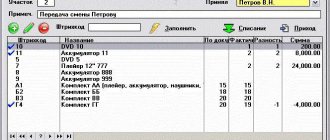

The header of the document indicates the warehouse (storage location) and the responsible person. The tabular part on the Products tab is filled in automatically, when you click the corresponding button, with the items listed in the accounting records at the corresponding warehouse. Fill in the average cost, accounting quantity, actual quantity and amounts. Moreover, initially, the actual quantity and amount correspond to the accounting ones. On the Inventory bookmark, the inventory period, the number and date of the inventory order, and the reason for the inventory are indicated. On the Inventory Commission tab, the composition of the commission is indicated. Then the Inventory List of Goods (INV-3) is printed and the inventory is carried out directly - checking whether the actual availability of inventories corresponds to the accounting data. Based on the inventory results, corrections are manually made to the tabular section on the Products tab. The actual quantity column is adjusted. Thus, deviations are recorded in the document: shortages and surpluses. An example of filling out the document Inventory of goods with identified deviations is shown in Fig. 1.

Picture 1.

The matching statement compiled based on the inventory results is presented in Fig. 2.

Figure 2.

When posted, the Goods Inventory document does not generate any postings. This document is needed only for conducting inventory, printing inventories and statements. But based on it, you can create documents that write off shortages and incoming surpluses.

In accordance with clause 28 of the Regulations on accounting and financial reporting, excess property is accounted for at market value on the date of the inventory, and the corresponding amount is credited to the financial results. Current market value refers to the amount of money that can be received from the sale of a property. Other income is recognized as a financial result. Moreover, the market value of property accepted for accounting, recognized as other income, is determined without taking into account the amount of VAT.

Thus, for our example, the excess material should be accounted for in the debit of account 10.01 “Raw materials and materials”, the excess of purchased goods - in the debit of account 41.01 “Goods in warehouses” in correspondence with the credit of account 91.01 “Other income”.

For profit tax purposes, in accordance with paragraph 2 of Art. 254 of the Tax Code of the Russian Federation, the cost of inventories and other property in the form of surpluses identified during the inventory is determined as the amount of income recorded by the taxpayer in the manner prescribed by paragraph 20 of Article 250 of this Code. Article 250 of the Tax Code of the Russian Federation is non-operating income. In accordance with paragraph 5 of Art. 274 of the Tax Code of the Russian Federation, non-operating income received in kind is taken into account when determining the tax base, based on the transaction price, taking into account the provisions of Article 105.3 of this Code, that is, based on the market value of the property.

In order for the received non-operating income to be correctly reflected in the income tax return, it is necessary to use the item of other income and expenses with the correct type of item - Surplus of goods identified as a result of inventory. This type of article appeared in the program quite recently.

An example of the item of other income and expenses we use is presented in Fig. 3.

Figure 3.

To capitalize excess inventories, we will use the Goods Inventory document (the document can be created based on the Goods Inventory document). In the “header” of the document, select the inventory document and the corresponding item of other income. The tabular part of the document is filled in automatically based on the inventory document. The Price column contains the accounting value of inventories. If the accounting price does not correspond to the market value, then the market value of the property must be indicated in the column. In our example, the book price corresponds to the market value. When carried out, the document in accounting and tax accounting records the surplus on the debit of accounts 10.01 and 41.01 in correspondence with the credit of account 91.01 with analytics (item of other income and expenses) Surplus goods identified as a result of inventory.

An example of filling out the Goods Receipt document and the result of its implementation are presented in Fig. 4.

Figure 4.

The document has a printed form, which is shown in Fig. 5.

Figure 5.

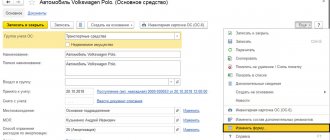

Now let's move on to the inventory of fixed assets. During the inventory process, a new (not used) Dell laptop was discovered that was not included in the accounting records. The current market value of the property is 125,000 rubles. The laptop was accepted for accounting as an object of fixed assets and put into operation in the Directorate division. The object belongs to the second depreciation group. The useful life is set in accordance with OKOF equal to 25 months. Depreciation is calculated using the straight-line method.

To carry out an inventory of fixed assets, the program uses the OS Inventory document.

The header of the document indicates the department and the financially responsible person. The tabular part on the Fixed Assets tab is automatically filled in with fixed asset objects listed in the department of the given financially responsible person. For each object, its inventory number and book value are filled in. The Availability according to accounting data and Actual availability checkboxes are enabled. The Inventory bookmarks and Inventory commission bookmarks are similar to the bookmarks in the Goods Inventory document.

Based on the inventory results, it is necessary to manually make corrections (if there are deviations) in the tabular section on the Fixed Assets tab. If there is a shortage, you just need to turn off the Actual availability checkbox. If there are surpluses, you need to add lines, create the corresponding elements for the identified surpluses in the Fixed Assets directory, select them, indicate the market value and enable the Actual availability checkbox.

An example of filling out the OS Inventory document with identified surpluses is shown in Fig. 6.

Figure 6.

The matching statement compiled based on the results of the inventory of fixed assets is presented in Fig. 7.

Figure 7.

To reflect the fact of acceptance for accounting and commissioning of a fixed asset item identified as a result of the inventory, the program uses the document Acceptance for accounting of fixed assets with the type of operation According to the results of the inventory (can be created based on the document Inventory of fixed assets).

The header of the document indicates the financially responsible person, the location of the fixed asset and the event Acceptance for accounting with commissioning. On the Non-current asset tab, the method of receipt of the fixed asset item is indicated (only Other is suitable), the required item of other income is selected and the market value of the item is indicated for accounting and tax accounting. In the tabular part, on the Fixed Assets tab, select the corresponding element of the Fixed Assets directory. On the Accounting tab, the accounting account is indicated - 01.01 “Fixed assets in the organization”, the accounting procedure is Depreciation, the depreciation account is 02.01 “Depreciation of fixed assets accounted for on account 01”, the method of calculating depreciation, the method of reflecting depreciation expenses and the useful life use. On the Tax Accounting tab, the procedure for including costs in expenses and the useful life are indicated. When carrying out the document in accounting and tax accounting, it is capitalized on the debit of account 01.01 at the market value of the fixed asset object in correspondence with the credit of account 91.01 with analytics (item of other income and expenses) Surplus goods identified as a result of inventory and will generate entries in many special registers of information on OS accounting.

An example of filling out the document Acceptance for accounting of fixed assets and the result of its implementation are shown in Fig. 8.

Figure 8.

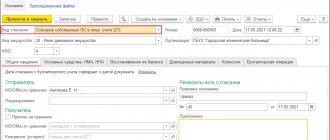

The cost of fixed assets is repaid through depreciation. Depreciation on a fixed asset item begins on the first day of the month following the month in which this item was accepted for accounting.

For tax purposes, depreciation calculation for depreciable property objects begins on the 1st day of the month following the month in which this object was put into operation. Consequently, in October, depreciation in accounting and tax accounting will begin to accrue on the fixed asset item accepted for accounting.

With the linear method of calculating depreciation, the monthly amount of depreciation in accounting and for profit tax purposes is calculated using the following formula:

Am = STp / SPI = 125,000 rubles / 25 months = 5,000 rubles

Posting of the routine operation Depreciation and depreciation of fixed assets for October 2022 is presented in Fig. 9.

Figure 9.

Other income received by the organization from the capitalization of surplus property identified as a result of the inventory is reflected in the Statement of Financial Results.

A fragment of the organization's financial performance report is presented in Fig. 10.

Figure 10.

For profit tax purposes, non-operating income in the form of the value of surplus inventories and other property, which are identified as a result of the inventory, is reflected in Line 104 of Appendix 1 to sheet 02 of the Income Tax Declaration.

A fragment of the Income Tax Declaration is presented in Fig. eleven.

Figure 11.