From our article you will learn:

The average number of employees must be reported to the tax office without fail. This is due to the fact that the indicator affects the method of submitting reports to the Federal Tax Service. If this figure exceeds 100 people, information can only be transmitted in digital format. Otherwise, you face a fine of 200 rubles. If the number of employees is no more than 100 people, you are allowed to choose in what form to submit reports - traditional paper or digital. This indicator also determines the possibility of applying special tax regimes.

First reporting of the newly created organization

Until 2022, one of the first reports was a report on the average number of employees. Newly created organizations submitted data to the Federal Tax Service by the 20th day of the month following the month of registration of the company. Since the beginning of the year, this form has been canceled and there is no need to report on it.

Further reporting deadlines will depend on the types of taxes for which the company is recognized as a payer. Reporting deadlines are shifted if they fall on weekends.

It is important to note that tax returns must be filled out even if the activity is not yet ongoing. In the absence of accrued taxes, zero declarations for each tax or a simplified declaration for several types of taxes at once are submitted.

Accounting statements (balance sheet and appendices) are submitted at the end of the calendar year.

Submit tax and accounting reports online.

Why is average staffing needed?

The average headcount is important for resolving certain issues related to taxes, contributions and reporting in a particular company. One of the most important is about the choice or possibility of using a tax system or rate. In particular:

- if there are more than 15 people, then the individual entrepreneur cannot work on a patent;

- if in a company using the simplified tax system the average headcount has crossed the threshold of 100 people, then it is necessary to apply an increased tax rate (8% or 20% depending on the object of taxation);

- if the SCHR is more than 130 people, then the organization (IP) does not have the right to continue to use the simplified tax system.

In addition, this indicator determines whether the organization/individual entrepreneur can report “on paper” or is required to connect to electronic reporting systems. If there are more than 10 employees, reports on employees are submitted electronically both to the Federal Tax Service (RSV, 6-NDFL), and to the Pension Fund of the Russian Federation and the Social Insurance Fund ( the limit of employees has been reduced from 25 to 10 people from 2022 ).

The Federal Tax Service also uses the average number of employees. For example, it is used to check whether wages in a particular company correspond to the industry average. Also, the SSR is one of the criteria for including a business entity in the SME register, which gives the right, for example, to the use of reduced insurance premium rates and some other preferences.

There are other situations in which the exact number of employees may be of interest to tax authorities.

VAT

The VAT return must be submitted quarterly by the 25th day of the month following the reporting quarter.

The deadlines for reporting quarterly taxes (including VAT) for newly created organizations depend on the date of registration of the company (Article 55 of the Tax Code of the Russian Federation).

Option No. 1. The company or individual entrepreneur is opened no later than 10 days before the end of the quarter (clause 3.1 of Article 55 of the Tax Code of the Russian Federation). The first tax period is calculated from the date of registration of the company until the end of the quarter in which the legal entity or individual entrepreneur was created. For an LLC opened on June 16, 2022, the first reporting period will be the period from June 16, 2021 to June 30, 2021. Accordingly, such a company needs to submit a VAT return for the second quarter. The report must be submitted by July 25, 2021 inclusive.

Option No. 2. The company or individual entrepreneur is registered less than 10 days before the end of the quarter. Then the first tax period is calculated from the date of registration until the end of the quarter following the quarter of creation of the legal entity or individual entrepreneur. For an LLC opened on June 28, 2022, the first tax period will be the period from June 28, 2021 to September 30, 2021. Accordingly, such a company needs to submit a VAT return for the third quarter. The report must be submitted by October 25, 2021 inclusive.

The VAT return is submitted exclusively in electronic form, even in the absence of purchase and sale transactions in the current tax period.

Intermediaries, developers and freight forwarders who are not VAT payers hand over a log of invoices received and issued . The report deadline is the 20th day of the month following the reporting quarter.

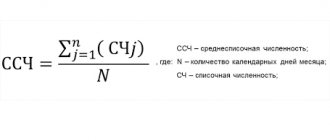

How to calculate the average number of employees (formula)

The NFR is calculated according to the methodology approved by order of Rosstat. Until 2022, Order No. 711 of November 27, 2022 was in effect approving the rules for filling out certain statistical forms. But starting with reporting for January 2022, this order loses force - order No. 832 dated November 24, 2021 is in effect instead.

Accordingly, instructions for filling out statistical reports, and with them the rules for calculating the NFR, are now contained in the new order. However, they remained the same. To calculate the average number of personnel for a calendar year, you must first make a calculation separately for each month:

Step 1. Calculate the number of full-time employees

To do this, we use the following formula:

Ch1 = Chm / Dm

World Cup

– the sum of the average number of employees for each day of the month (that is, it is necessary to calculate the average number of employees for each day of the month and add it up);

Dm

– the number of calendar days in a month.

The result does not need to be rounded

.

The number of employees for a weekend or holiday is taken to be equal to the number for the previous working day.

When calculating the average payroll number, they are not taken into account

:

- External part-time workers (employees whose main place of work is another organization).

- Individuals working under GPC agreements (of a civil nature).

- Women on maternity or child care leave.

- Employees on study leave without pay.

If an employment and civil law contract is concluded with an employee at the same time, then he must be taken into account as one person in the calculation.

Employees working part-time at the initiative of the employer

(probationary period and homeworkers), as well as workers for whom the law establishes

a shortened working day

(including disabled people), are taken into account as

whole units

.

Step 2. We count the number of employees who worked part-time

Employees working under an employment contract part-time (including those who did not come to work due to illness or business travel) are taken into account in proportion to the time worked

.

This is done according to the following formula:

Ch2 = Total / Trd / Drab

Total

– the total number of man-hours worked by these employees in the reporting month.

Trd

– length of the working day, based on the length of the working week established in the organization. For example, with a 40-hour five-day work week, this figure will be 8 hours, with a 36-hour week - 7.2 hours, and with a 24-hour week - 4.8 hours.

Drab

– the number of working days according to the calendar in the reporting month.

The result does not need to be rounded

.

Example

. The employee worked part-time (4 hours) for 22 working days per month, while the working day in the organization is 8 hours. The average number in this case will be equal to:

0,5

(88 / 8 / 22).

Step 3. Calculate the average number of employees for the calendar year

To calculate the average number of employees, it is necessary to add up the headcount indicators ( Ch1

and

Ch2

) for all months of the year and divide the result by

12

months.

If the result is a non-integer number, it must be rounded

(discard less than 0.5, and round 0.5 or more to the whole unit).

Income tax

Organizations on OSNO pay income tax and submit the appropriate declaration. Individual entrepreneurs do not report on this form.

The reporting procedure and deadlines depend on the method chosen by the organization (Article 289 of the Tax Code of the Russian Federation). You can pay taxes and submit returns quarterly, or monthly. By default, the first option is used, where the reporting periods are quarter, half-year, 9 months and year. If a new company decides to pay tax once a month, the Federal Tax Service should be notified about this. Also, the need to report monthly may arise by force of law if revenue exceeds established limits (Article 286 of the Tax Code of the Russian Federation).

Declarations are submitted by the 28th day of the month/quarter following the reporting one.

If a company was created in the first eleven months of the year, the first tax period is considered to be the period from the date of state registration to the end of the calendar year (Clause 2 of Article 55 of the Tax Code of the Russian Federation). The reporting period will begin from the moment of registration of the company and will end within the period established by the articles of the code. Let's say Veter LLC was founded on May 12, 2021. The first profit declaration should be submitted based on the results of the six months before 07/28/2021 inclusive.

If the company is founded in December, the tax period will cover the next calendar year. For example, a company was entered into the Unified State Register of Legal Entities on December 17, 2021, which means that the tax period for the purpose of calculating income tax will be from December 17, 2021 to December 31, 2022. The first reporting period for such an organization will be the first quarter of 2022. Thus, the declaration will have to be submitted by 04/28/2022. The document should include income and expenses reflected in accounting from the moment of registration of the company.

Personal income tax

Personal income tax reporting is submitted when there was a payment of income in the reporting (tax) period. The first tax period for personal income tax is the period from the date of registration of the company/individual entrepreneur until the end of the calendar year (clause 3.5 of article 55 of the Tax Code of the Russian Federation). When creating a company on 08/13/2021, the tax period will be as follows: 08/13/2021 - 12/31/2021.

Tax agents report according to Form 6-NDFL. Information is submitted for the first quarter, half a year, nine months and a year. The annual report of the Federal Tax Service is due until March 1 of the year following the reporting year. Information for other periods is submitted before the end of the month following the reporting period. Champion LLC was created on August 14, 2021, the first report must be submitted based on the results of nine months until October 31, 2021 inclusive (provided that there were payments).

Until recently, individual entrepreneurs reported using Form 4-NDFL. The form has now been discontinued. Entrepreneurs report income only in Form 3-NDFL. If an individual entrepreneur is included in the Unified State Register of Individual Entrepreneurs in 2022, the first report in Form 3-NDFL must be submitted before April 30, 2022 inclusive.

Individual entrepreneur without employees

According to the law, an individual entrepreneur, being an employer, does not have the right to perform this function in relation to himself. This point of view is reflected in the letter of Rostrud No. 358-6-1 dated 02/27/2009 and in the letter of the Ministry of Finance No. 03-11-11/665 dated 01/16/2015. Therefore, an individual entrepreneur does not have the right to regard himself as a staff member when submitting reports. This is explained by the fact that the legislation does not provide for the conclusion of a bilateral agreement, which is an employment contract (Article 56 of the Labor Code of the Russian Federation), with oneself.

But if the average number of employees of an entrepreneur is 0 and the law does not allow an individual entrepreneur to assign himself the payment of wages, he has no obligation to report on employees and accruals in their favor.

IMPORTANT!

An individual entrepreneur without employees does not submit reporting forms, including the DAM, if he does not have hired employees in the billing period (Article 80 of the Tax Code of the Russian Federation).

Single simplified tax return

If the company/individual entrepreneur did not have any profit, account or cash movements in the reporting quarter, and there are no taxable transactions, you can submit a simplified declaration instead of separate declarations for each tax.

You must report using this form by the 20th day of the month following the reporting quarter. Let's assume that on August 17, 2021, a new STM LLC was registered. OSNO taxation system. During the third quarter, there was no activity, there were no transactions for the purchase and sale of goods, the turnover on the current account according to the statement was zero. The company has no specific taxes. The manager was going to report by submitting zero VAT and income tax returns. The accountant of STM LLC suggested submitting a single declaration, including all the data. In fact, the declaration also came out as zero, but instead of two declarations, the Federal Tax Service submitted one generalized one.

Financial statements

Submit financial statements at the end of the year. The reporting includes a balance sheet, income statement and appendices thereto.

When registering a company before the end of September, the first financial statements must be submitted based on the results of work from the moment of registration to December 31 of the current year (Article 15 of the Federal Law of December 6, 2011 No. 402-FZ). The reporting deadline is March 31.

If a company is included in the register during the fourth quarter, the first financial statements can be submitted more than a year later. LLC "Luchik" opened on October 12, 2021. The first balance and applications will include data for the period from 10/12/2021 to 12/31/2022. And reports will need to be sent to the Federal Tax Service only in 2023. If you wish, you can submit your balance earlier, forming it based on the results of your work in 2021.

Calculation example

Initial data

LLC "Company" has a 40-hour, five-day work week.

In 2022, from January to November, 15 people

. In December, there were 11 of them left, as 4 people were laid off due to staff reduction. For September and October, fixed-term part-time employment contracts were concluded with 5 new employees, according to which they worked daily for 4 hours. Throughout the year, the organization employed 3 external part-time workers who are on the payroll of another company.

Order HR services from 1C

Other reporting

In addition to tax reporting, there is reporting on insurance premiums. New companies (IPs) must submit their first reports for the billing (tax) period in which the company was registered.

Insurance premiums are calculated based on the results of the first quarter, half a year, nine months and a year. The deadline for submitting calculations is the 30th day of the month following the reporting period. Mir LLC was registered on April 19, 2021. Calculation of contributions must be submitted by 07/30/2021 inclusive. Mir LLC will send subsequent reports to the Federal Tax Service no later than 10/30/2021 and 01/30/2022.

You must submit Form 4-FSS . The deadline for submission depends on the method of report generation. If a company reports on paper (allowed for up to 25 people), 4-FSS is submitted before the 20th day of the month following the reporting period. With electronic reporting, the deadlines increase by five days. Fishka LLC was created on September 15, 2021, 4-FSS must be submitted by October 20, 2021 (on paper) or by October 25, 2021 (electronically).

Policyholders must report monthly to the Pension Fund in the form SZV-M . The deadline for submitting the form is the 15th. When registering a company in June, the first report must be submitted by July 15 inclusive.

Employees are required to submit the SZV-STAGE . The first time this form should be submitted is at the end of the first working year. If you are establishing a company in 2022, you must submit the form by March 1, 2022. If an employee submits an application for a pension, he will have to report within three days.

Another report that must be submitted is called SZV-TD . As soon as the company has its first employee, this form should be submitted. The company has very little time to submit data: it must report no later than the working day following the day the personnel order is issued. It should be noted that the director is also recognized as an employee, so if there are no other employees in the company, do not forget to send the SZV-TD to the director. Subsequently, the SZV-TD must be taken during personnel movements of employees (hiring, dismissal, transfer). Let's say Breeze LLC was registered on Tuesday, August 24, 2021. On the same day, an employment contract was concluded with the director. The SZV-TD form must be submitted on Tuesday or Wednesday.

Before April 15, you must annually submit an application to the Social Insurance Fund confirming the type of activity . If the company is opened in 2021, the first report will be sent to the fund only in 2022.

Employers are required to conduct a special assessment of working conditions. A report on the activities carried out is presented in the form of a declaration. The new company has a year to evaluate the locations. The assessment is carried out by special accredited organizations. When the official results of the special assessment are available, a declaration should be sent. 30 days are allotted for this.

Report submission deadlines must be adhered to. Upon expiration of the deadlines established by law, regulatory authorities have the right to apply penalties.

Report to all regulatory authorities using current forms.

KND 1110018 is no longer needed

Since 2022, the KND form 1110018 is no longer used as a separate report (Federal Tax Order No. ED-7-11/ dated October 15, 2020), but the Tax Code of the Russian Federation retains the requirement to report to the tax office on the number of working citizens. Managers of organizations are interested in whether the average headcount of an LLC is submitted if there are no employees, and how to report correctly in this case. Now for this they use the title page of the DAM form (calculation of insurance premiums), approved by Order of the Federal Tax Service No. ED-7-11/ dated 10/15/2020. And information that the organization has zero employees according to the Federal Tax Service for 2022 is submitted using the DAM form for the fourth quarter.

How to report quickly and without errors

Any reporting can be sent electronically using the Kontur.Extern system. You can be sure that declarations, calculations and other forms are up to date, because all reports are updated automatically. Convenient navigation of the system makes it possible to quickly find and fill out the required report. The system will indicate arithmetic and logical errors by highlighting them in color. After making corrections, you can send a report to the regulatory authority. You can sign reports using an electronic signature certificate. In Externa you can see the entire process from sending a report to its acceptance. If for some reason the supervisory authority has not received the report, you will receive a notification.