Inventory of goods in a warehouse is a check to clarify data about the inventory and material assets stored in it. The research results are compared with the information specified in accounting and financial documents. Such an audit allows you to timely identify surpluses and theft in production.

When is it necessary to conduct a warehouse inventory?

There are scheduled and unscheduled inspections. The first type of procedure is carried out once a year according to the approved schedule. The second type of audit is appointed by the company's management or regulatory authorities in the presence of special circumstances.

The list of special cases is prescribed in Federal Law No. 402 of 2011. Such situations include:

- change of management or transfer of ownership and management of the company;

- reduction of more than 50% of the workforce;

- transfer of the organization to another form of ownership;

- fact of theft, illegal use of property, damage;

- complete or partial destruction of stocks as a result of an emergency.

Emergency situations mean events related to force majeure. These include floods, fires, hurricanes and other disasters not related to human factors. Below we will look at how inventory is carried out correctly in a warehouse and what documents are drawn up at the end of the event.

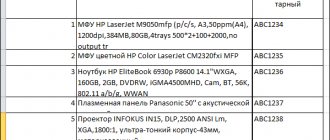

Documents for download.

- – a decision by the manager about all the steps that need to be taken regarding the event. At large enterprises, several copies of the form are allowed for different types of warehouse inventory. Most often, a large number of orders are created when it is necessary to conduct an audit of several premises within one company.

- – required in 2 copies to record the total upon counting of products. The documents are kept by the employee being inspected and in the accounting department.

- previously issued (INV-4 form) - filled out for items received for which there is no payment. For such positions there are special conditions for the transfer of ownership rights. The form classifies them into two categories: revenue not received due to delays and due to non-arrival of the payment date.

- , which is kept by the employee responsible for savings (INV-5 form) - all inventories are taken into account. The receipt for the form indicates which items need to be capitalized or written off. Facts of disagreement with accounting data in the accounting department are recorded in the statement (form INV-19).

- not arrived at the warehouse (INV-6) - appropriate for accounting for products that were not delivered due to long-term transportation, are delivered, they are declared with the appropriate notes during the inventory of goods in the warehouse; we will consider in more detail below how to correctly carry out such a check.

Reasons for conducting an inventory of goods and materials

You need to understand that management independently determines the regulations and periodicity of scheduled inspections. Depending on how intensive the turnover is in the company, processes may be more frequent or less frequent. Only before submitting financial statements is there always a major reconciliation. Then it is at the discretion of the directors. But at the same time, usually serious companies with large turnover strive for indicators once every three months. That is, 4 times a year.

But this is what concerns planned variations. And there are still a lot of unplanned ones. They arise for various reasons. The most common reasons include the following:

- Transfer of property. These are often a variety of options, renting part of production or other assets, selling or buying. For example, a batch of new equipment was purchased. And they were placed in a specific storage facility. It would be a good idea to check after checking both the availability of the entire supply and whether previous models have disappeared and will need to be transferred to another department.

- The emergence of a new responsible person. Even before a new employee begins his work, it is worth checking everything of value accurately. Otherwise, it is not clear whether the shortage was the fault of the previous employee or the mistakes of the new one.

- Change of leader. The principle is approximately the same, only this employee could carry out illegal manipulations with property on a much larger scale. Therefore, you need to understand whether after his departure the property part of the company remained intact.

- Also, an inventory of inventory items is carried out if there has been a change in the organizational structure of a legal entity. Including the complete liquidation of an existing enterprise. It is necessary to understand that this is especially important if liquidation in bankruptcy is implied. The presence of debts presupposes the formation of a bankruptcy estate, which includes all the company’s material assets in full.

- Emergency situations, force majeure circumstances and similar. Various natural disasters, fires in a warehouse, sales area. As well as minor local problems. For example, flooding due to problems with plumbing. It is unclear how many objects could have deteriorated and lost their usability as a result.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Who conducts the warehouse inventory?

Control of balances is carried out at the initiative of the head of the company to compare the actual amount of inventory with the total data specified in the documents. The event makes it possible to establish natural loss that occurs in the process of spoilage and other reasons not related to the human factor, arithmetic and technical errors in primary documentation, misgrading, deficiencies and excesses.

The procedure for conducting inventory in a warehouse is regulated by the provisions of the Methodological Instructions approved by Order No. 49 of the Ministry of Finance of June 13, 1995; if a theft or suspicion of theft is detected, third-party services are involved. These include independent expert commissions, auditors, representatives of law enforcement agencies and the tax service. Representatives of each type of inspection are included in the firm’s commission and approved by issuing a special order.

Composition of the commission

The recount is carried out in the presence of the employee responsible for storage, but he is not included in the commission. This is approved by an order issued by the manager. In a small company, at least three people are appointed, in a large enterprise - from 6 people. It is recommended to appoint the following specialists:

- chief accountant or his deputy;

- director or deputy of the company;

- head of the department;

- representative of the logistics department;

- security or security officer of the company;

- employee responsible for compliance with labor rights.

The composition of the commission when conducting inventory in a warehouse is selected at the discretion of the manager. The goal is to ensure an efficient recount. The inspection must include the equipment necessary for weighing and counting, as well as the appropriate equipment for counting and transportation. If the number of employees in the commission is approved less than the minimum allowable number, the results of the event will be considered invalid.

Inventory procedure

You need to start with the formation of matching statements. These documents document the discrepancy between the papers and the real situation in the warehouse. For example, the accounting report indicates 100 units of goods, but only 98 units are found in the warehouse. That is, a shortage of 2 units was established. It is indicated in the matching statement. During the inventory process, a conclusion is formed. To prepare it, you need to create a single register that contains inventories and statements.

If there are temporarily stored products in the warehouse, a separate statement will be required for it. For convenience, an electronic document can be generated. The absence of property in the warehouse must be recorded. This is done exclusively in the presence of the person responsible for the goods.

Inventory of products in the warehouse is carried out in accordance with this algorithm:

- Formation of the commission.

- Formation of a plan for upcoming events.

- The head approves the members of the counting commission.

- An order is issued prohibiting all actions with property in the warehouse.

- Accounting documents are being prepared.

- The responsible employee confirms that the provided accounting information is current.

- Representatives of the counting commission are instructed to create inventories.

- The property is being counted.

- The correctness of filling out the inventory is checked after the calculations are completed.

- At the end of the event, the availability of products in the warehouse is re-established, if the corresponding provision is in the documents.

- Formation of the statement.

- Sending reports to accounting. Department.

If there are ambiguous points, you need to compare the generated reports and the units of goods in the warehouse.

ATTENTION! During the procedure, moving property and any other manipulation with it is prohibited. Compliance with this rule will prevent errors and inaccuracies in the report. If new goods arrive at the warehouse during the inventory process, they are reflected in the register in the presence of representatives of the commission.

Types of inventory

Full inventory control involves recalculation and comparison of all property in the enterprise. Objects that the company rents are also subject to inspection.

Partial audit is a study of only some goods and values. If a shortage is identified during the event, the scope of inspection expands.

Selective - implies the recalculation of only certain types of stocks or values.

Scheduled – assigned according to the approved schedule. The list of objects to be studied is determined by the director.

What is inventory?

The company's assets and liabilities are subject to inventory. This rule is spelled out in Part 1 of Art. 11 Federal Law No. 402.

Inventory

– this is an event, the results of which determine whether there are available corresponding objects indicated in the data of the organization’s accounting registers.

This type of control is carried out strictly according to the rules established by current legislation. The need for legislative regulation is explained by the fact that only the results of the inventory properly confirm the very fact of existence, as well as the state of the company’s property and liabilities.

Preparatory work

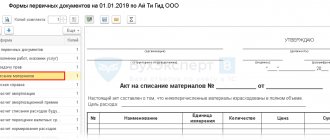

The warehouse is being put in order. Many people have a question: where to start, how to carry out inventory in a warehouse effectively. Initially, documents are prepared for the commission related to receipts, write-offs, movements and other operations (damage, loss, expenses) for the period under review.

In papers relating to the previous reporting period, o. Preparing them allows you to speed up the audit process and promptly detect discrepancies between facts and the source document.

The financially responsible person gives the sorted package of papers to the commission for signature. Documents on inventories written off as expenses are attached to all inventories. The write-off is certified by a signature.

Warehouse inventory procedure

According to the rules for conducting inventory, matching statements are prepared at the warehouse. During the recalculation process, they will be updated with current information related to the discrepancy in fact with the information in the documents. The data is entered into a single register in which all statements and inventories are recorded. At the end of the procedure, a conclusion is drawn up according to the information in the register.

Goods that are temporarily in the warehouse are recorded in a separate statement. All facts of discrepancy, including absence, must be recorded. The financially responsible person must be at the workplace during the registration of such a disagreement. If ambiguous situations are detected, the copies are re-compared with the information from the generated report.

Step 1. Issue an order to conduct an inventory

The issuance of an order is the beginning of the inventory process. The order is drawn up in any form or on a form (INV-22). It states the reason for the inspection, the composition of the commission, the list of stocks or objects being inspected, the date and deadline for completion.

Sample document

The order is drawn up in accordance with the norms of office work in a printed version according to the sample. This order is given for familiarization to all members of the inventory commission against signature on the document.

Step 2. Property audit

A warehouse audit is the identification of the actual availability of stocks and balances. The information is recorded in the inventory in sections: type of product, grade, article and other important identification data in accordance with paragraph 3.15 of the Methodological Instructions. Comparison is carried out through reweighing and re-measuring. information is entered into the statement only upon the fact of recount; recording from the words of, including the interested person, is not allowed. The following are subject to mandatory audit:

- names on the way;

- goods issued for which payment has not been received;

- company assets stored on the premises of other companies;

- materials transferred for processing to other organizations.

The container is examined by the commission according to its type, condition and purpose of use in accordance with paragraph 3.26 of the Guidelines. If during the procedure it is necessary to receive new goods, they are accepted in the presence of the commission and placed in the receipt at the end of the inventory check. The fact of receipt is recorded in a separate statement.

If the inventory regulations in the warehouse are violated, the inspection period is delayed, the release of products is allowed after written permission from management. The released goods are recorded in a separate statement, and the issue is carried out in the presence of the commission. If the financially responsible person has several storage facilities at his disposal, the inspection is carried out gradually. After completing the inspection of the premises, they seal it with a sealer and proceed to inspect the next one.

Step 3. Registration of warehouse inventory results

The results of the inventory audit are documented in a package of documents:

- inventory (INV-3);

- document on verification of shipped goods (INV-4);

- act of settlement for positions en route (INV-6);

- matching statement (INV-19).

Papers are generated confirming the facts of the shortage. If the culprit is not identified, such a discrepancy is recorded by postings:

- DT2 CT1;

- DT94 KT1;

- DT91/2 KT64.

There are limits to shortages that can be attributed to production costs. If the quantity of missing goods exceeds acceptable standards, additional investigations are ordered to identify the culprits and the reasons for the discrepancy. If the commission has identified the culprit of the shortage, the information is marked with the following entries:

- DT73 KT94;

- DT50 KT73.

The surplus is registered with the wiring DT1 KT91/1. Many people have difficulties with preparing the final documents for the audit in the warehouse; we will consider how the final stage is carried out below.

What are the features of conducting an inventory of inventories?

Inventory of inventories (MP) at an enterprise can be:

- voluntary,

- mandatory.

The procedure for carrying out the first version of the inventory is determined by the management of the company in separate local standards.

In the second option, inventory is carried out:

- if inventories are leased, purchased, or sold;

- before the formation of financial statements for the year (for those inventories whose inventory was not carried out before October 1 of the reporting year);

- after a change of employees in the status of financially responsible persons;

- upon detection of violations regarding the handling of reserves;

- in case of emergency situations at the enterprise;

- upon transformation or liquidation of the company.

Inventory of inventories is carried out for the purposes of:

- identifying their actual quantity and comparing the corresponding indicators with the information reflected in the accounting;

- checking the quality of reflection in accounting for the assessment of inventories;

- control over compliance with the rules for storing materials.

Inventory inventory can be:

- planned (in accordance with the approved schedule),

- unscheduled,

- full (when all stocks are checked),

- selective.

Inventory equipment at an enterprise may be:

- in warehouses that are independent structural divisions of the company;

- in warehouses that belong to production structural divisions;

- at facilities not classified as warehouses.

Inventory of inventories located in separate warehouses is carried out regardless of the corresponding procedure in any other divisions of the company. In other types of warehouses, as well as in facilities that are not warehouses, the inventory is carried out simultaneously with that carried out in the departments where warehouses or other facilities for storing inventories are located.

ConsultantPlus describes in detail the procedure for conducting an inventory before annual reporting. To do everything right, get trial access to the system and go to the Practical Guide to Annual Reporting. It's free.

Inventory of inventories can be carried out by:

1. Standing commission.

This intra-corporate structure is endowed with functions that involve promptly carrying out all types of inventories according to plan or if necessary. As a rule, it is established in large companies where there is a need to constantly carry out an inventory of any assets or liabilities.

2. Permanent working commissions.

They are “branches” of the standing committee. Called upon to assist the standing commission in the event that an inventory of inventories is carried out, dispersed over a large territory, in representative offices of the organization, or if the reserves are presented in a very large volume.

3. Temporary working commissions.

They are established on a periodic basis, usually in small and medium-sized enterprises, where inventories are carried out quite rarely (often only those that are required by law).

Let us now consider the order in which an inventory of inventories can be carried out.

End of the event

After drawing up the final documentation based on the results of the inspection, a protocol on the work of the commission is formed and discrepancies are calculated in monetary terms. This indicator can confirm losses or savings in production. The cause of the shortage is improper storage, theft, or negligence of the person responsible for the valuables. Excesses (savings) on a large scale appear as a result of dishonest work by employees or fraudulent actions with primary documents or accounting programs.

Persons found guilty of discrepancies between facts and accounting data are subject to financial liability. They compensate for losses by reimbursing the required amounts from earnings in the amount in accordance with the provisions of the liability agreement and the contract. The manager has the right to demote the guilty party in position, and in case of theft on a large scale, dismiss from the enterprise under the relevant article of the Labor Code or transfer the case to law enforcement agencies.

Inventory automation

Used to replace manual comparison with information collection using equipment. Such an audit helps reduce the likelihood of inaccuracies associated with the human factor. The labeling process is labor intensive. offers updated programs, for example, Warehouse 15 - for working under new reporting conditions, as well as projects for labeling different product groups.

Special mobile readers are used to read stickers and barcodes. Balances are recalculated through the database terminal. Information is entered into the database automatically for each item of goods. The advantages of the Cleverens automated check include:

- reducing the time for collecting and processing information by 2 times;

- there is no requirement to close the warehouse during the audit period;

- there are no errors due to human factors;

- the costs of introducing automation will pay off within 2 years;

- the risk of information distortion is minimized.

The implementation of automation is carried out in stages. Initially, a database is formed, in the appropriate sections of which information on property, goods, inventories and other material assets in the enterprise is entered. Each reporting unit is marked with a sticker or barcode, allowing you to find the position in the database. A scanner is used to read data from such stickers. The information is processed and stored in the database.

Matches are recorded immediately, and information about missing copies or missing items becomes available after the verification is completed. The terminal automatically notifies you of a shortage. The obtained data is recorded in electronic format and used for calculations and analysis. The Cleverence company offers software for automating business processes that allows you to label products and track statistics on which brands for a given item are delivered to the warehouse complex.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

What not to do when taking inventory of inventories

During the audit, it is not allowed to mix items or transfer them for storage to other sections or premises. During the inspection period, the release of inventories and consumables to production is prohibited, except in situations where the need for release is confirmed by written permission from the manager.

If the inventory is being carried out over a long period of time, employees, including the head of the department, are not allowed to enter the territory without the presence of a commission. At the end of the working day, the object is sealed with the exact time indicated on the seal.

The inventory commission is carried out before drawing up the annual final documentation.

The results of the event are subject to mandatory documentation. At the end of the inspection, a protocol is drawn up, which is endorsed by the signature of the manager and the company’s seal. Inventory of goods in a warehouse is the only way to confirm the integrity of the storage of material assets in the company’s warehouse. Number of impressions: 47138

What it is

Essentially, this is a check, an accounting of objects: whether they exist, whether they are located in warehouses, counters, or are in the process of being transported from one warehouse to another. And also accounting for whether the written-off products were actually withdrawn from circulation and sent for disposal.

Although the frequency itself directly depends on the manager or owner of the enterprise, the timing and regulations, as well as the corresponding decisions based on the results, are identified through the basic provisions on accounting.

Basically, the process has two main tasks. The first is the actual reconciliation. The second is derivative in nature. If any discrepancies are identified, then it is necessary to determine the amount of surplus or deficiency for various items.

Several responsible persons take part in the preparation of inventory of inventory items. The start occurs through the decision of the manager, who issues the appropriate order. It immediately notes a lot of initial data. Whether the inspection is scheduled or unscheduled, whether it concerns a specific location, department, branch, warehouse, or, in principle, all the property of the enterprise will be taken into account. The form of implementation is revealed. As well as the composition of the commission that will carry out this activity. Moreover, it is heterogeneous; among the members there is also a leader who will be responsible for making decisions and reporting on the results. And he bears obligations for the correct execution of the task by all members of the commission. Materially responsible persons are also involved in the actual verification of inventories and balances of goods. In most cases, this is the storekeeper. Who will be interested in ensuring that accounting occurs as correctly as possible. Otherwise, he will often have to compensate for the defects of lost products personally.

The summed up results are processed, analyzed, and after that a certain verdict is made. If the results are satisfactory, then activities continue as normal. If there are unaccounted losses, which, however, are quite understandable, for example, burned in a fire, the economic plan for the next period changes. The new course is being developed taking into account new information. And if subsequent documentation of the inventory of goods and materials reveals discrepancies, but the reason for them has not been established, a special investigation is often initiated within the enterprise. Its purpose, naturally, is to establish the source of expenses.