Hello, Vasily Zhdanov is here, in this article we will look at long-term liabilities on the balance sheet. All debts an organization has are reflected in the balance sheet in order to analyze the efficiency of the enterprise, develop a strategy for its development, correct errors in management and timely repayment of debts. Thus, borrowed funds can sometimes be repaid over ten to fifteen years, and in some cases the debt must be repaid no later than in a year. In the first case, long-term liabilities are recorded in the balance sheet, and in the second - short-term ones. The most favorable effect on the company's work is the attraction of long-term borrowed capital.

What are long-term liabilities on the balance sheet

Liabilities of an enterprise are debts existing at the reporting date that the company has incurred as a result of certain facts of its production activities, which will ultimately lead to the expenditure of assets to repay them. An economic entity may have obligations due to:

Take our proprietary course on choosing stocks on the stock market → training course

- business customs;

- legal norm;

- agreement.

Long-term liabilities mean debts to legal entities and individuals that must be repaid no earlier than 12 months from the reporting date . These may be, for example, estimated liabilities, deferred tax payments, and various types of debts.

It also happens that an organization attracts financing with a long repayment period, but part of the loan must be repaid in a fairly short time. Therefore, when financial experts look at existing long-term liabilities on a company's balance sheet to assess its financial condition, such debts are divided into 2 categories:

- The portion of long-term accounts payable that is due to be repaid within the next year, starting from the reporting date.

- The share of long-term accounts payable that will need to be repaid more than 1 year from the reporting date.

| Business valuation | Financial analysis according to IFRS | Financial analysis according to RAS |

| Calculation of NPV, IRR in Excel | Valuation of stocks and bonds |

How assets and liabilities are classified according to IFRS

Paragraph 60 of IFRS 1 Presentation of Financial Statements requires that an entity present current and non-current assets and liabilities as separate classes in its statement of financial position (in accordance with paragraphs 66–76 of IFRS 1). An exception would be when presenting information based on liquidity provides reliable and more relevant information.

IFRS 1 specifically states that an entity should present separately:

- assets and liabilities that are expected to be recovered or settled within 12 months or less after the end of the reporting period, and

- assets and liabilities that are expected to be recovered or settled more than 12 months after the end of the reporting period.

In simple terms:

if in your accounting at the reporting date you have a long-term bank loan with a repayment period of 5 years registered, then you should separate the part that will be repaid within the next 12 months after the reporting period. And disclose the short-term part of this loan in the reporting.

An entity designates an asset or liability as current if one of the following conditions is satisfied.

The organization must classify all other assets and liabilities as non-current.

You probably noticed that the standard also takes into account the fact that each organization may have a different operating cycle, which does not always coincide with twelve months. If an enterprise has an operating cycle longer than 12 months, then it has the right to classify its assets and liabilities based on its cycle. Provided that its length can be clearly determined.

IFRS 1 also provides specific rules that should be taken into account when classifying assets and liabilities. You can familiarize yourself with them in the standard itself. I would like to draw your attention to the impact of such classification on financial performance and decision-making.

Long-term liabilities on the balance sheet (Section IV)

Important! Liabilities (short-term and long-term) on the balance sheet are always reflected in Liabilities.

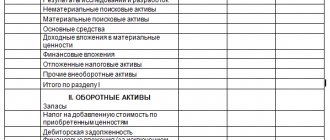

In the balance sheet, information on all long-term liabilities of the enterprise can be found in section IV, which includes the following items:

- Borrowed funds (line 1410). These are loans and borrowings issued by a legal entity, interest on the use of funds and associated costs (fees for checking a loan agreement, paid consultations, commercial information, etc.).

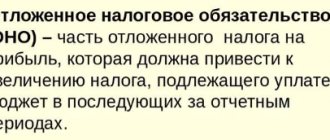

- Deferred tax liabilities (line 1420). This is the portion of the organization's deferred income tax, which will ultimately increase the income tax planned for transfer to the budget in the next reporting period or in later periods.

- Estimated liabilities (line 1430) . Debts of an enterprise that are planned to be repaid no earlier than in a year.

- Other obligations (line 1450) . All other debts that do not fall into any of the categories listed above.

Let's see what the mentioned section IV looks like:

Let’s look at Section IV “Long-term liabilities” line by line and see how each line of the balance sheet is filled out:

| Section IV line | Line formation order | Algorithm for calculating the indicator* *K_ - credit balance |

| 1410 "Borrowed funds" | Information on all obligations of the company taken for a long term (this is considered to be a period of time from 1 calendar year) must be reflected. Accounts payable can arise as a result of receiving a loan in cash or in kind, in the form of an obligation on a bill of exchange, or a bank loan. To form a line, you need to take the credit balance of account 67 only for debts with a long payment period. | K67 (long-term debts only) |

| 1420 “Deferred tax liabilities” | Filled out only by enterprises guided by PBU 18/02. The line is formed by indicating the credit balance of account 77. In cases where firms allow themselves to offset tax liabilities and assets and present them in a consolidated form, the line must be filled out only when the credit balance of account 77 > debit balance of account 09 (by the amount of the difference between these indicators). | K77 |

| 1430 “Estimated Liabilities” | The amount of reserves formed according to PBU 8/2010 for long-term liabilities is indicated. As an example, we can point out the reserves formed for warranty repairs. The line is created by reflecting in it the credit balance of account 96 (for debts with a repayment period of 1 year or more), which was not written off as of December 31 of the reporting period. | K96 (only estimated liabilities with a long period of fulfillment) |

| 1450 “Other obligations” | Contains information about debts to counterparties with a repayment period of 1 year. It is formed as the balance of the following accounts: — account 60 (debts to contractors and suppliers for previously received deferred payments and installment plans for payment for goods supplied, only for credit debts with a long repayment period); — account 62 (debts to customers and consumers for advances received, prepayments for future supplies of goods, commercial loans, only for long-term debts); — account 68 (accounts payable with a long repayment period that arose in connection with payments to the budget (taxes, fees), for example, upon receipt of installment plans and deferrals for federal tax collections, investment tax credit); - account 69 (debts of an enterprise for the payment of insurance premiums with a long repayment period, for example, arising due to the restructuring of debt to extra-budgetary funds); — account 76 (debts not included in other categories with a long repayment period); - account 86 (loan account 86 - targeted financing with a time period of fulfillment of obligations of at least 1 year, for example, when a developer becomes obligated to transfer the finished object to investors after receiving targeted financing for construction). | K60+K62+K68+K69+K76+K86 (only long-term liabilities) |

| 1400 “Total for Section IV” | Amount of lines 1410-1450 (total liabilities of the company). |

The total for the “Long-term liabilities” section is calculated in accordance with the following formula:

Long-term liabilities: borrowed funds (line 1410)

Borrowed funds reflected in line 1410 of Section IV include all bank loans issued at the end of the reporting period for a period of 1 year or more, various loans, bonded and bill of exchange debts. Such debts accumulate in the account. 67.

The amount of the loan taken is reflected in accounting in the amount specified in the loan agreement, not exceeding the amount of finance actually taken. Such an agreement is recognized as concluded at the time of actual receipt of funds (or other assets) from the borrower.

Debt on loans and credits is shown on the balance sheet, taking into account interest on the use of funds accumulated at the end of the reporting period.

Important! In the case of receiving a credit (not a loan), the amount under the agreement is subject to reflection in the balance sheet as accounts payable, but taking into account the terms of the agreement. This is due to the fact that banks reserve the right not to issue funds (if such a condition is contained in the agreement), and that in the event of an unreasonable refusal to issue a loan, the bank will be obliged to pay compensation to the client.

Long-term liabilities: deferred tax liabilities (line 1420)

Reflected on account 77 by type of obligation. Accounting entries:

- DEBIT 68.4.2 CREDIT 77 (occurrence of deferred tax liabilities);

- DEBIT 77 CREDIT 68.4.2 (reduction of deferred non-refundable assets).

Deferred tax liabilities appear on the balance sheet because taxable temporary differences arise (in effect, they are deferred taxes that will subsequently increase income taxes payable). These are reflected in accounting taking into account all taxable differences, and such obligations are recognized precisely in the period during which they arose .

A temporary difference is income that forms profit (and expenses that form loss) within one reporting period, while the tax base is formed in another (other) periods.

Important! If a debt or an asset for which deferred tax liabilities were accrued is disposed of, the amount of IT is written off to the profit and loss accounts, which, according to the Tax Code, will not increase taxable profit.

Long-term liabilities: estimated liabilities (line 1430)

They are taken into account by accountants on account 96, recognized if 3 conditions are simultaneously met:

- The impossibility of avoiding the fulfillment of an obligation that arose earlier due to the implementation of economic activities.

- Probability of expense (reduction of economic benefits in order to fulfill an obligation).

- Possibility of a reasonable assessment of the amount of possible expenses (amount of obligation).

The listed conditions for accounting for estimated liabilities are not applicable in some cases. So, they are not taken into account when it comes to:

- amounts that are accounted for according to PBU 18/02 and affect the amount of income tax planned for transfer to the budget in the following periods or in later periods;

- valuation reserves;

- reserves that were formed from retained earnings; reserve capital;

- contracts under which at least one of the parties has not fulfilled its obligations in full as of the reporting date (with the exception of obviously unprofitable contracts, and an agreement under which a party can refuse to fulfill obligations unilaterally without any penalties is not recognized as such) .

Other obligations. Line 1450

This line reflects other obligations of the organization, not mentioned above, the maturity of which exceeds 12 months after the reporting date (clause 19 of PBU 4/99). It is necessary to take into account that the long-term obligations of the organization, information about which is material, must be reflected in section. IV Balance sheet separately. Therefore, significant indicators should not form the indicator of line 1450 “Other obligations” (paragraph 2 of clause 11 of PBU 4/99, Letter of the Ministry of Finance of Russia dated January 24, 2011 N 07-02-18/01).

What is included in other long-term liabilities?

Other long-term liabilities may include, subject to insignificance, accounts payable and liabilities accounted for in the following accounting accounts (Instructions for the use of the Chart of Accounts, paragraph “d”, paragraph 3.1.8 of the Regulations on Accounting for Long-Term Investments, Letter of the Ministry of Finance of Russia dated January 29 .2008 N 07-05-06/18):

- 60 “Settlements with suppliers and contractors” - in terms of debt to suppliers and contractors, the repayment period of which exceeds 12 months (the specified debt characterizes the organization’s long-term obligations to pay for goods, works, services received from suppliers and contractors, including obligations on commercial loans) ;

- 62 “Settlements with buyers and customers” - in terms of debt to buyers and customers, the repayment period of which exceeds 12 months (the specified debt arises in the event of receiving an advance (prepayment) for the supply of products, goods (performance of work, provision of services) and includes debt on commercial loans);

- 68 “Calculations for taxes and fees” - in terms of long-term debt for taxes and fees (for example, when providing an organization with an investment tax credit, deferment or installment plan for the payment of federal taxes and fees);

- 69 “Calculations for social insurance and security” - in terms of long-term debt on insurance contributions (for example, when restructuring debt to extra-budgetary funds);

- 86 “Targeted financing” - in terms of obligations whose fulfillment period exceeds 12 months (for example, when developer organizations receive targeted financing from investors, which gives rise to the developer’s obligations to investors to transfer the constructed facility to them);

- 76 “Settlements with various debtors and creditors” - regarding other long-term accounts payable and obligations.

How is the amount of accounts payable determined?

The amount of accounts payable is determined on the basis of accounting data. Settlements with creditors are reflected by the organization in amounts recognized by it as correct. The amounts reflected in the financial statements for settlements with banks and the budget must be agreed upon with the relevant organizations and identical. The amount of debt under commercial and investment tax credits is formed by both the amount of the principal debt and the amount of interest due at the end of the reporting period in accordance with the terms of the agreements (clause 1 of PBU 15/2008, clauses 73, 74 of the Accounting Regulations and financial statements).

If the agreement for the acquisition of an asset (performance of work, provision of services) provides for a deferred (installment) payment and the fee for a commercial loan is not separately established, then its amount, taken into account in the price of the agreement, is determined by the organization independently. This amount, being the economic content of interest payable to the lender (creditor), is recognized in accounting evenly until the end of the deferment period (installment plan) in the manner prescribed by PBU 15/2008 (Appendix to the Letter of the Ministry of Finance of Russia dated 06.02.2015 N 07- 04-06/5027).

Attention!

Accounts payable expressed in foreign currency (including those payable in rubles), for reflection in the financial statements, are recalculated into rubles at the rate in effect on the reporting date (clauses 1, 5, 7, 8 PBU 3/2006).

The exception is accounts payable arising in connection with the receipt of an advance payment, prepayment or deposit. In addition, the balances of target financing received in foreign currency are not recalculated. Such accounts payable and liabilities are shown in the financial statements at the exchange rate as of the date of receipt of funds (acceptance for accounting) (clauses 7, 9, 10 of PBU 3/2006).

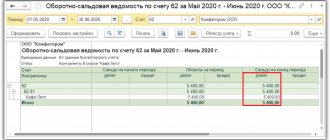

What accounting data is used when filling out line 1450 “Other liabilities”?

When filling out this line of the Balance Sheet, analytical accounting data on the balances of accounts 60, 62, 68, 69, 76 and the credit balance of account 86 (in terms of long-term accounts payable) as of the reporting date can be used. Balances on these accounts form the indicator of line 1450 “Other liabilities” only if this information is insignificant. Long-term obligations of the organization, information about which is material, should be reflected in section. IV of the Balance Sheet separately (paragraph 2 of clause 11 of PBU 4/99, Letter of the Ministry of Finance of Russia dated January 24, 2011 N 07-02-18/01).

According to the clarifications of the Ministry of Finance of Russia, when an organization receives payment, partial payment towards the organization's upcoming deliveries of goods (performance of work, provision of services, transfer of property rights), accounts payable are reflected in the balance sheet as assessed minus the amount of VAT payable (paid) to the budget (Letter Ministry of Finance of Russia dated 01/09/2013 N 07-02-18/01).

Attention!

When reflected in reporting, offsetting between items of assets and liabilities (debit and credit balances on accounts 60, 62, 68, 69 and 76) is not allowed (clause 34 of PBU 4/99).

Line 1450 “Other liabilities” = Credit balances on accounts 60.62. If an organization has accounts payable on accounts 62, 76 in the amount of the prepayment received, including VAT, then when determining the indicator for line 1450 it is necessary to reduce the credit balances on these accounts by the corresponding amounts VAT (Letter of the Ministry of Finance of Russia dated 01/09/2013 N 07-02-18/01), 68.69.76 + Credit balance on account 86

In general, the indicators on line 1450 “Other liabilities” as of December 31 of the previous year and as of December 31 of the year preceding the previous year are transferred from the Balance Sheet for the previous year. If the indicator of line 1450 as of the reporting date is formed according to other rules, then the indicators as of December 31 of the previous year and as of December 31 of the year preceding the previous one must be adjusted as if they were determined according to the same rules as the indicator for reporting date. In other words, the comparability of comparative indicators must be ensured (paragraph 2, clause 10 of PBU 4/99).

The “Explanations” column provides an indication of the disclosure of this indicator. If an organization draws up Explanations to the Balance Sheet and the Statement of Financial Results according to the forms contained in the Example of Explaining Explanations given in Appendix No. 3 to Order of the Ministry of Finance of Russia No. 66n, then in the column “Explanations” on line 1450 “Other liabilities” a table may be indicated 5.3 “Availability and movement of accounts payable”, which discloses the indicators of long-term liabilities, the expected fulfillment period of which exceeds 12 months after the reporting date.

Example of filling out line 1450 “Other obligations”

Indicators for account 86 (there are no indicators for accounts 60, 62, 68, 69, 76 in terms of long-term accounts payable): rub.

| Index | As of the reporting date (December 31, 2014) |

| 1 | 2 |

| 1. Balance on the credit of account 86 (analytical account for accounting for long-term obligations to investors for the transfer of construction projects) | 4 053 404 |

Fragment of the Balance Sheet for 2013

| Explanations | Indicator name | Code | As of December 31, 2013 | As of December 31, 2012 | As of December 31, 2011 |

| 1 | 2 | 3 | 4 | 5 | 6 |

| 5.3 | Obligations to investors regarding the transfer of construction projects | 1435 | 2933 | 1500 | — |

| Other obligations | 1450 | — | — | 580 |

Solution

The amount of long-term liabilities, representing debt to investors for the transfer of construction projects, is:

as of December 31, 2014 - 4053 thousand rubles;

as of December 31, 2013 - 2933 thousand rubles;

as of December 31, 2012 - 1,500 thousand rubles.

There are no other long-term liabilities as of December 31, 2014, December 31, 2013 and December 31, 2012.

A fragment of the Balance Sheet will look like this.

| Explanations | Indicator name | Code | As of December 31, 2014 | As of December 31, 2013 | As of December 31, 2012 |

| 1 | 2 | 3 | 4 | 5 | 6 |

| 5.3 | Obligations to investors regarding the transfer of construction projects | 1435 | 4053 | 2933 | 1500 |

| Other obligations | 1450 | — | — | — |

Regulatory and legislative acts on the topic

| Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n | Approval of the balance sheet form |

| clause 7.3 of the Concept approved by the Methodological Council for Accounting under the Ministry of Finance | On the grounds for the emergence of obligations |

| clause 19 PBU 4/99 | Definition of long-term liabilities |

| Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n | Algorithm for calculating indicators of items of long-term liabilities |

Answers to frequently asked questions on “Long-term liabilities on the balance sheet”

Question: Is accounts payable reduced due to the accrual of value added tax on advances received by the enterprise?

Answer: Yes, accrued VAT on advances received by the company reduces the amount of accounts payable in the balance sheet on which the tax amount was calculated. In the same way, VAT on an advance issued by an organization is not reflected in the Liability side of the balance sheet, but reduces the amount of receivables in the Asset. Regarding your question, let's give an example: on the reporting date, an advance of 118 thousand rubles was received, including the amount of VAT at a rate of 18%, in Liability we will write (118 thousand rubles - 118 thousand rubles x 18/118) = 100 thousand. R.

Question: What to do with the assessment of deferred tax liabilities if the Tax Code of the Russian Federation provides for different income tax rates for certain types of company income?

Answer: In such a situation, the tax rate must correspond to the type of income that will lead to a decrease in the amount or complete repayment of the taxable temporary difference in future years (following the reporting or subsequent periods).

| Business valuation | Financial analysis according to IFRS | Financial analysis according to RAS |

| Calculation of NPV, IRR in Excel | Valuation of stocks and bonds |

Analyzing the results

Based on the results of the analysis, the following conclusions can be drawn:

1. The balance sheet currency decreased by the end of the year by 12,414 thousand rubles. (–16.71%). This indicates that the assets and capital of the organization, i.e., its main activities, have decreased. Reasons for the decline:

- reduction of equity capital (and above all, losses; see the balance sheet line “Capital and reserves”);

- financing capital investments through short-term liabilities. The growth of non-current assets in the balance sheet under the section “Non-current assets” exceeds the total growth of equity capital and long-term liabilities under the section “Capital and reserves” and “Long-term liabilities”.

2. The value of non-current assets increased due to fixed assets (+362 thousand rubles, or +27.61%) and intangible assets. According to the results of the vertical analysis, it can be seen that the ratio of non-current assets to the balance sheet at the end of the year (5.77%) increased by 2.64% compared to the beginning of the year (3.13%). This is a positive result, indicating an increase in the production potential of the organization.

3. The value of current assets decreased for all items (except for VAT and short-term financial investments) and by 13,659 thousand rubles. (-18.98%).

Inventories decreased by 62.07%, which indicates a drop in production volumes, a reduction in inventories of raw materials and finished products.

4. Accounts receivable decreased by 10.82% (RUB 5,360 thousand), however, the share of this balance sheet item during the reporting period increased by 4.72%.

For your information

The difference in the results of calculations of accounts receivable when conducting horizontal and vertical analysis arose due to the fact that accounts receivable did not decrease as significantly as the balance sheet total. Therefore, the increase in the share of receivables in the structure of property is a negative fact, which indicates a decrease in the mobility of property and a decrease in the efficiency of turnover.

5. , accounts payable also decreased by 20.43% (RUB 13,086 thousand). This indicates a reduction in urgent debts. The vertical analysis showed a decrease in the share of accounts payable by 3.85%.

On the one hand, this contributes to the growth of the organization’s liquidity, but on the other hand, the reduction in the amount of accounts payable is twice as large as the reduction in the amount of receivables, and this leads to a reduction in its own working capital and a decrease in the financial stability of the organization.

6. The amount of equity capital decreased by 2193 thousand rubles. (–32.68%) due to a reduction in the volume of retained earnings, i.e. the financial results of the organization’s activities worsened, and the margin of financial stability decreased.

7. A reduction in long-term liabilities indicates the repayment of debt to banks. But the absence of short-term loans and borrowings in the capital structure while simultaneously reducing accounts payable may indicate the low creditworthiness of the organization.

8. The dynamics of financial ratios indicate a decrease in the mobility of turnover and property in general; a decrease in production capabilities as a result of a reduction in inventories. A positive aspect is the increase in the provision of reserves with own funds.

9. Coefficients of financial independence (autonomy, attraction, “leverage”) show the share of equity (borrowed) capital in total sources of funds.

For your information

The capital structure depends on the area of activity of the organization. For industrial enterprises, the recommended share of equity capital in the total amount of sources of funds is at least 50%. An increase in the share of equity capital is assessed positively, as it reduces the level of financial risk and strengthens the financial stability of the organization.

In the organization under consideration, the value of the autonomy coefficient is low and continues to decline: at the beginning of the year, equity capital was only 9% of the total capital, at the end of the year - 7.3%.

10. The value of the equity capital maneuverability coefficient at the beginning of the year - 1.1788 (> 1) - indicates that turnover is ensured by long-term borrowed funds, which increases the risk of insolvency.

11. The absolute liquidity ratio shows what part of the current debt can be repaid in the time closest to the time of drawing up the balance sheet, which is one of the conditions for solvency. The normal value is 0.2–0.5.

The actual coefficient value (0.02) does not fall within the specified range. This means that if the cash balance is maintained at the reporting date level (due to the uniform receipt of payments from partners), the existing short-term debt cannot be repaid in 2-5 days.

12. The quick liquidity ratio reflects the projected payment capabilities of the organization, subject to timely settlements with debtors. The value of this coefficient should be » 0.8.

In our problem, the quick liquidity ratio = 0.83. We can conclude that the organization is able to repay its debt obligations (non-current) subject to timely repayment of receivables 13. The current liquidity (coverage) ratio shows the extent to which current assets cover short-term liabilities. It characterizes the payment capabilities of the organization, subject to not only timely settlements with debtors and favorable sales of finished products, but also in the event of the sale, if necessary, of material working capital.

The level of the coverage ratio depends on the industry of production, the length of the production cycle, the structure of inventories and costs. The norm is 2.0 < Ktl < 3.0, i.e. for every ruble of short-term liabilities there are from two to three rubles of liquid funds.

Failure to comply with this standard (in the balance sheet in question, Ktl = 1.14) indicates financial instability, varying degrees of liquidity of assets and the inability to quickly sell them in the event of simultaneous requests from several creditors.