Wages (employee remuneration) - remuneration for work depending on the employee’s qualifications, complexity, quantity, quality and conditions of the work performed, as well as compensation and incentive payments. From these payments, the employer is obliged to make mandatory payments to the budget - insurance premiums. People often ask: What is a contribution? What are insurance premiums? What types of insurance premiums are there? Where is the employer obliged to pay them, and what liability can he incur for non-payment? Answers to these questions in the article Firmmaker.

What are insurance premiums and when did they arise?

Insurance contributions are mandatory payments for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance, collected from organizations and individuals for the purpose of financial security for the implementation of the rights of insured persons to receive insurance coverage for the corresponding type compulsory social insurance (Article 8 of the Tax Code of the Russian Federation).

Compulsory social insurance is part of the state system of social protection of the population, the specificity of which is the insurance of working citizens, carried out in accordance with federal law, against possible changes in financial and (or) social status due to reaching retirement age, disability, loss of a breadwinner, illness, injury, accident at work or occupational illness, pregnancy and childbirth, the birth of a child (children), caring for a child under the age of one and a half years and other events established by the legislation of the Russian Federation on compulsory social insurance (Article 1 of the Federal Law No. 165-FZ of July 16, 1999) .

The history of insurance premiums is quite young. The emergence of social insurance was facilitated by the development of the economy and the emergence of labor relations, as a result of which employees began to need social protection. The first mentions of social insurance go back to the 19th century, at which time the Bismar Code of Imperial Laws appeared in Germany.

In Russia, a significant leap in the development of insurance was the abolition of serfdom. At this time, the first law in this area of insurance, “On the mandatory establishment of auxiliary partnerships at state-owned mining plants,” was adopted.

To ensure more progressive economic mechanisms and to regulate pension provision, the Pension Fund was created on December 22, 1990. Even before the formation of the Pension Fund, the budget was replenished from the general wage fund of organizations.

On January 1, 1991, the Social Insurance Fund was created, designed to regulate relations in the field of social insurance of citizens.

On February 24, 1993, the Health Insurance Fund was created to finance medical care.

What is included in compulsory social insurance

The administration of the first three types of social insurance contributions is carried out by the Federal Tax Service. The FSS is responsible for insurance payments for injuries. The total rate of the first three types is 30%.

Such offset/reimbursement relates to excess expenses for benefits based on the results of the reporting (calculation) period. And within the reporting period, the following rule applies: the amount of contributions to VNIM is reduced by the amount of expenses incurred for the payment of benefits for this type of insurance.

The basic amount of social security contributions is 2.9% of the employee’s monthly payment. For certain categories of employers, the contribution amount may be reduced or completely eliminated.

The FSS will conduct a desk audit within a maximum of 3 months according to the rules prescribed in Law N 125-FZ.

Are amounts paid by employers remaining at their disposal after paying income tax for treatment and medical care of employee family members subject to insurance premiums?

In other words, all these amounts are actually paid by the policyholder, but then they are presented for credit to the Social Insurance Fund, that is, they are counted against contributions to the Social Insurance Fund.

At the same time, the payment of insurance premiums from these payments is not ... - employees are not payers of insurance premiums. Establishment of deductions of insurance premiums from the income of citizens in...

Moreover, the Ministry of Finance of Russia considers it possible to count the amounts of expenses under OSS in case of temporary disability and in connection with maternity for periods before January 1, 2022 against upcoming payments of insurance premiums for OSS in case of temporary disability and in connection with maternity after January 1, 2017.

When the costs of paying benefits exceed the amount of contributions to VNiM after the end of the reporting period, the payer will also be able to offset the specified difference against upcoming payments of insurance premiums, since the Fund’s confirmation of expenses after the tax authorities send calculations for insurance premiums will occur in a short time.

And the indicator for each of these lines is calculated as the difference between accrued contributions and paid benefits.

The insurance premium rate for VNiM is 2.9%. The exception is foreign employees who temporarily stay in the Russian Federation - they are subject to a 1.8% rate.

Contributions for the Pension Fund and the Social Insurance Fund do not always need to be paid from the entire amount of the employee’s income. For the calculation of contributions, a limit is established, above which contributions are not paid or the rate for them is reduced. This base is indexed annually based on the growth of average wages.

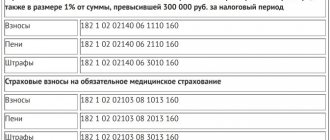

BCC for insurance premiums for 2022 are budget classification codes, the purpose of which is the grouping and distribution of payments received by the budget and extra-budgetary funds.

Federal Law of December 29, 2006 N 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity.” The author and presenter of the seminar is Nikitina Elena Viktorovna, consultant in economics and public sector accounting, Master of Public Administration and Business Administration, practicing chief accountant.

How are insurance premiums regulated?

- Chapter 34 of the Tax Code;

- Federal Law “On compulsory social insurance against accidents at work and occupational diseases” Federal Law No. 125-FZ dated July 24, 1998;

- Federal Law “On the Basics of Compulsory Social Insurance” No. 165-FZ dated July 16, 1999;

- Federal Law “On Compulsory Pension Insurance in the Russian Federation” No. 167-FZ dated December 15, 2001;

- Federal Law “On compulsory social insurance in case of temporary disability and in connection with maternity” Federal Law No. 255-FZ of December 29, 2006;

- Federal Law “On Compulsory Medical Insurance in the Russian Federation” Federal Law No. 326-FZ of November 29, 2010.

Loss of benefits

One of the conditions for the application of reduced tariffs is the inclusion of information about the economic entity in the register of SMEs. This register is maintained by the Federal Tax Service of Russia (Article 4.1 of the Federal Law of July 24, 2007 No. 209-FZ). With the adoption of Federal Law No. 349-FZ dated October 27, 2020 (came into force on November 7, 2020), the SME register is updated monthly on the 10th day, and not once a year, as before.

What if there is no information in the registry? This may happen due to the organization’s failure to comply with any of the conditions established by paragraph 1 of part 1.1 of article 4 of Federal Law No. 209-FZ. The officials' answer is clear: reduced insurance premium rates do not apply from the 1st day of the month in which insurance premium payers were excluded from the SME register

.

Who is required to pay insurance premiums

The policyholder who pays wages and other payments in favor of the insured persons is obliged to pay insurance premiums (clause 1 of Article 419 of the Tax Code). The policyholder pays insurance premiums from the organization’s funds, without deducting this amount from the employee’s salary.

In this case, the insurers include:

- organizations;

- individual entrepreneurs;

- individuals who are not individual entrepreneurs.

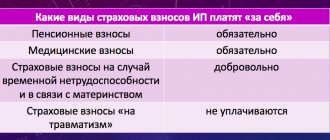

For example, individual entrepreneurs who have employees on their staff are required to pay insurance premiums from employee payments at generally accepted rates. Please note that in addition to insurance premiums for employees, individual entrepreneurs are required to pay insurance premiums for themselves (clause 2 of Article 419 of the Tax Code of the Russian Federation).

Insurance premiums for individual entrepreneurs for themselves for 2022

Compared to 2022, they have not changed. In 2022, for all individual entrepreneurs, fixed insurance premiums for income not exceeding 300 thousand rubles:

- RUB 32,448 — for pension insurance;

- RUB 8,426 - for medical purposes.

The maximum amount of annual pension contributions for yourself also remained the same - 259,584 rubles. (fixed contribution of 32,448 rubles, 1% additional contributions on income over 300 thousand rubles).

Starting from 2022, entrepreneurs with a patent will be allowed to deduct insurance premiums for themselves and their employees from the cost of the patent. The deduction operates by analogy with the simplified tax system of 6% and the canceled UTII. Individual entrepreneurs without employees can reduce the cost of a patent by the amount of contributions paid up to 100%, individual entrepreneurs with employees - up to a maximum of 50%.

Types of insurance premiums

There are the following types of insurance premiums (Article 8 of the Tax Code of the Russian Federation):

- insurance contributions for compulsory pension insurance (OPI);

- insurance premiums for compulsory health insurance (CHI);

- insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (VNiM);

- insurance premiums for injuries (accident insurance).

These types of contributions are calculated from wages and other payments accrued for each employee.

Other payments for which insurance premiums must be calculated and paid include (Article 420 of the Tax Code of the Russian Federation):

- bonuses;

- vacation pay and compensation for unused vacation;

- financial assistance over 4000 rubles. per employee per year.

Example 1. From what amount to calculate insurance premiums

Employee of Imperia LLC Ivanov I. I. was accrued the following payments for the month:

| Type of payment | Amount, rub. | Base | |

| taxable | tax-free | ||

| Wage | 10000 | 10000 | 0 |

| Prize | 5000 | 5000 | 0 |

| Material aid | 7000 | 3000 | 4000 |

| Total | 22000 | 18000 | 4000 |

Thus, insurance premiums must be paid from the amount of 18,000 rubles, i.e. from wages, bonuses and financial assistance over 4,000 rubles.

Preferential rates of insurance premiums for IT companies

From January 1, 2022, insurance premiums have been reduced for organizations in the information technology sector. Instead of 14%, the total tariff was 7.6%, of which:

- 6% - for pension insurance;

- 1.5% - for social insurance in connection with disability and maternity;

- 0.1% - for health insurance.

The right to reduced tariffs was given to organizations that are engaged in the design and development of electronic component products and electronic (radio-electronic) products (clause 18, clause 1, article 427 of the Tax Code of the Russian Federation).

IT companies can receive benefits on insurance premiums if the following conditions are met:

- state accreditation in the Ministry of Telecom and Mass Communications (inclusion in the special register);

- the share of income from IT activities is at least 90% of total income;

- The average number of employees is at least 7 people.

In letter No. 03-07-07/111669 dated December 18, 2020, the Ministry of Finance explained how to determine the share of income and gave examples of the use of tax benefits. If the IT company meets the necessary criteria, you can apply new tariffs without reporting it to the tax office.

What payments are not subject to insurance premiums?

Payments not subject to insurance premiums include (Article 422 of the Tax Code of the Russian Federation):

- state benefits (unemployment benefits, temporary disability benefits, maternity benefits);

- severance pay, if this amount does not exceed three times the employee’s average monthly earnings;

- performance of work and provision of services under a civil law contract are not subject to insurance premiums for compulsory social insurance and injuries. But contributions for compulsory health insurance and compulsory medical insurance will have to be calculated;

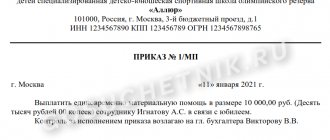

- one-time financial assistance in connection with an emergency, natural disaster, in connection with the death of a family member, as well as in connection with the birth of a child. Please note that in order to provide financial assistance to an employee, it is necessary to issue an order and attach supporting documents to it, otherwise the inspection authorities may attribute these amounts to taxable insurance contributions;

- financial assistance up to 4000 rubles. per employee per year;

- amounts of payments under employment contracts and civil contracts in favor of foreign citizens and stateless persons temporarily staying in the territory of the Russian Federation, if these persons are not recognized as insured in accordance with the law.

Sample payment order for payment of insurance premiums to the Social Insurance Fund

We have numbered each payment order detail and provide detailed recommendations for filling it out.

| Number | Props | Filling Features |

| 1 | Number | We indicate the date of completion and serial number of the payment order |

| 2 | Document date | |

| 3 | Payment type | Leave the field empty |

| 4 | Taxpayer status |

|

| 5 | Suma in cuirsive | We write all words in this field of the payment order without abbreviations. The value of kopecks is indicated in numbers. For example, “five rubles 12 kopecks” |

| 6 | TIN | We indicate the full name, INN and KPP of the payer as contained in the registration documents. In the electronic payment, the data is filled in automatically |

| 7 | checkpoint | |

| 8 | Name | |

| 9 | Amount in numbers | An example of writing an amount containing kopecks: 123-25 (one hundred twenty-three rubles 25 kopecks). Example of writing the amount without kopecks: 565= (five hundred sixty-five rubles) |

| 10 | Account number | We indicate the bank details of the premium payer (the policyholder). The bank's BIC always contains 9 characters, the current account and correspondent account - 20 each. The last three digits of the BIC coincide with the last three digits of the correspondent account |

| 11 | BIC bank | |

| 12 | Correspondent account | |

| 13 | Payer's bank | We fill out the paper document in accordance with the details of the payer’s bank. Data is entered automatically in the electronic payment |

| 14 | payee's bank | Contributions to VNiM are transferred to the territorial department of the federal treasury (UFK). In parentheses we additionally indicate the name of the tax office where the payer is registered. You can find out the details of your tax office on the Federal Tax Service website. |

| 15 | Recipient's TIN | |

| 16 | Recipient's checkpoint | |

| 17 | Recipient's name | |

| 18 | BIC of the recipient's bank | |

| 19 | Recipient's account | |

| 20 | Type of operation | Type of operation when transferring insurance premiums - “01” |

| 21 | Purpose of payment | Leave it blank |

| 22 | Code | Leave it blank |

| 23 | Payment due date | Leave it blank |

| 24 | Payment order | Budget payments have the fifth priority of payment |

| 25 | Res. Field | Leave it blank |

| 26 | Payment Description | We indicate the full name and month for which we pay insurance premiums. To facilitate the identification of contributions in case of errors in the KBK or OKTMO, we recommend indicating the registration number of the policyholder in the Social Insurance Fund system |

| 27 | Signature | The order is signed by the head of the organization or the entrepreneur whose signatures are indicated on the bank’s sample signature card |

| 28 | Bank mark | Payers do not fill out |

| 29 | Seal | Place for a seal imprint (if you use one) |

How to calculate insurance premiums. Rates. Payment deadline

Accrued and paid monthly

Insurance premiums are calculated monthly for each employee on the last day of the month, based on the base for calculating insurance premiums. And paid no later than the 15th day of the next calendar month. That is, insurance premiums for February must be paid no later than March 15. If the 15th falls on a weekend, then insurance premiums are paid on the next working day after the weekend. For example, insurance premiums for March must be paid before April 15, but since April 15 is a non-working day, payment is postponed to April 16.

You can pay earlier, but not later. However, if you are late in payment, you still need to pay as soon as possible, since penalties will then be charged for each day of delay.

Calculation of insurance premiums

Insurance premiums are calculated based on the rate and base for calculating insurance premiums. The base for calculating insurance premiums is defined as the amount of payments and other remunerations accrued separately in relation to each individual from the beginning of the year on an accrual basis (Article 421 of the Tax Code of the Russian Federation).

The rates and maximum base 2022 for each type of contribution are set as follows (see table). How the base of insurance premiums changed (graph)

| Base for calculating insurance premiums | Pension insurance | Social insurance | Health insurance | |

| Limit value of the base for the year | 1 565 000 | 1 032 000 | no max size | |

| Limit value of base per month=Base/12 months | 130 416 | 86 000 | no max size | |

| Bid | 22,00% | 2,90% | 1,80% | 5,10% |

| Contribution amount =Base*Rate | 344 300 | 29 928 | 18 576 | |

| Rate if the base is exceeded | 10% | 0% | 0% | 5,10% |

Example 2. Example of calculating insurance premiums

The organization LLC "Chocolate" (general taxation system, type of activity - sale of confectionery products) pays wages to employees, we will calculate the amount of insurance premiums for December.

Option 1 – the base for calculating insurance premiums did not exceed the established limit, the salary was 20,000 rubles. OPS = 20,000 rubles * 22% = 4,400 rubles. Compulsory medical insurance = 20,000 rubles * 5.1% = 1020 rubles. VNIM = 20,000 rubles * 2.9% = 580 rubles. Injuries = 20,000 rubles * 0.2% = 40 rubles. The Social Insurance Fund may set a different coefficient; for example, we take 0.2%. It depends on your main type of activity. You can find out which coefficient applies to your organization either from the “Notice on the amount of insurance contributions for compulsory social insurance against industrial accidents and occupational diseases” or directly from the social insurance fund. Option 2 - the base for calculating insurance premiums exceeded the established limit for compulsory health insurance and VNIM, wages amounted to 200,000 rubles. In this case, insurance premiums in case of temporary disability and in connection with maternity are not accrued or paid, contributions for compulsory pension insurance are paid at a rate of 10%. OPS = 200,000 rub. * 10% = 20,000 rub. Compulsory medical insurance = 200,000 rubles * 5.1% = 10,200 rubles. Injuries = 200,000 rubles * 0.2% = 400 rubles.

Reduced insurance premium rates 2022

Since 2022, payers of insurance premiums included in the register of small and medium-sized businesses will pay insurance premiums at a reduced rate (Article 427 of the Tax Code of the Russian Federation).

Reduced tariffs apply only to wages above the minimum wage, even if the employee works part-time. For example, the salary is 24,000 rubles for a full-time employee, an employee works at 0.5 times the rate, respectively, his salary will be 12,000 rubles. This is less than the minimum wage, which means that insurance premiums from this salary are charged in full.

Table - Reduced insurance premium rates

| Insurance type | Salary rate above the minimum wage |

| Pension insurance | 10% |

| Social insurance | 0% |

| Health insurance | 5% |

Example 3. Calculation of insurance premiums with a reduced tariff

The Omega LLC organization is a small business entity. The organization's staff consists of 7 people. The base for calculating insurance premiums is RUB 345,000. Let's calculate insurance premiums.

The minimum wage as of 01/01/22 is 13,890 rubles.

7 employees * 13890 rub. = 97230 rub. From this amount we calculate insurance premiums in full.

345,000 rubles - 97,230 rubles = 247,770 rubles. Insurance premiums at reduced rates are calculated from this amount.

Table - calculation of regular and reduced tariffs

| Base | Pension insurance | Social insurance | Health insurance | |||

| 22% | 10% | 2,9% | 0% | 5,1% | 5% | |

| 97230 rub. | 21390,60 | — | 2819,67 | — | 4958,73 | — |

| RUR 247,770 | — | 24777 | — | 0 | — | 12388,50 |

| Total | RUR 46,167.60 | 2819.67 rub. | RUB 17,347.23 | |||

An example of calculating contributions with the maximum base value reached in 2022

Let's consider an example of calculating contributions for the financial director of a company, A.A. Morozov. with a salary of 170,000 rubles. For simplicity, let’s assume that he only received salary in the same amount and was not entitled to any non-taxable payments.

Free accounting services from 1C

Pension contributions

The contribution base is calculated from the beginning of the year, that is, for February it will be 170,000 + 170,000 = 340,000 rubles, for March 510,000 rubles, and so on. In September, Morozov’s taxable income will reach 1,530,000 rubles. This is more than the maximum base value established for the calculation of pension insurance contributions in 2022. For January-September, we will calculate contributions to the Pension Fund as follows:

- from the amount of 1,000 – at a rate of 22%;

- from the difference between the base and the limit (1,170,000 – 1,150,000) – at a rate of 10%.

Contributions until the end of 2022 will be calculated similarly.

Table 3. A. A. Morozov’s contributions to pension insurance (in rubles)

| Month | Taxable income from the beginning of the year | Cumulative contributions | |||

| Total | at a rate of 22% | at a rate of 10% | at a rate of 22% | at a rate of 10% | |

| January | 170 000 | 170 000 | — | 37 400 | — |

| February | 340 000 | 340 000 | — | 74 800 | — |

| March | 510 000 | 510 000 | — | 112 200 | — |

| April | 680 000 | 680 000 | — | 149 600 | — |

| May | 850 000 | 850 000 | — | 187 000 | — |

| June | 1020 000 | 1020 000 | — | 224 400 | — |

| July | 1190 000 | 1190 000 | — | 261 800 | — |

| August | 1 360 000 | 1 360 000 | — | 299 200 | — |

| September | 1 530 000 | 1 465 000 | 65 000 | 322 300 | 6 500 |

| October | 1 700 000 | 1 465 000 | 235 000 | 322 300 | 23 500 |

| November | 1 870 000 | 1 465 000 | 405 000 | 322 300 | 40 500 |

| December | 2 040 000 | 1 465 000 | 575 000 | 322 300 | 57 500 |

| Total | — | — | — | 379 800 | |

If the regressive scale had not been applied, contributions at a rate of 22% would have to be paid on the entire amount of Morozov’s income: 2,040,000 × 22% = 448,800 rubles. The savings amounted to 448,800 – 379,800 = 69,000 rubles.

Submit reports online

Contributions for illness and maternity

In the first half of the year, we will charge contributions at a rate of 2.9%. But already for June, the amount of Morozov’s taxable income will be 1,020,000 rubles. Since contributions are not accrued above the maximum base size, the calculation will be as follows: 966,000 × 2.9% = 28,014 rubles. For July you need to pay the difference between this amount and the amount of contributions transferred for six months. There is no need to make any more contributions to VNiM in 2022.

Table 4. Contributions for insurance for temporary disability and maternity (in rubles)

| Month | Taxable income from the beginning of the year | Base for calculation at a rate of 2.9% | Income since the beginning of the year in excess of the limit (contributions are not charged) | Contributions at a rate of 2.9% |

| January | 170 000 | 170 000 | — | 4 930 |

| February | 340 000 | 340 000 | — | 9 860 |

| March | 510 000 | 510 000 | — | 14 790 |

| April | 680 000 | 680 000 | — | 19 720 |

| May | 850 000 | 850 000 | — | 24 650 |

| June | 1 020 000 | 966 000 | 54 000 | 28 014 |

| July | 1 190 000 | 966 000 | 224 000 | 28 014 |

| August | 1 360 000 | 966 000 | 394 000 | 28 014 |

| September | 1 530 000 | 966 000 | 564 000 | 28 014 |

| October | 1 700 000 | 966 000 | 734 000 | 28 014 |

| November | 1 870 000 | 966 000 | 904 000 | 28 014 |

| December | 2 040 000 | 966 000 | 1 074 000 | 28 014 |

It turns out that there is no need to accrue contributions from A. A. Morozov’s income in the amount of 1,074,000 rubles. The savings will be 1,074,000 × 2.9% = 31,146 rubles.

Other contributions

We will calculate deductions for medicine throughout the year at a rate of 5.1%, because there is no maximum base for them. For contributions for injuries, we will take the minimum rate of 0.2%, established, among other things, for “office” companies and retail enterprises. All data is in the following table.

Table 5. Contributions for health insurance and injuries

| Month | Taxable income from the beginning of the year | Medical contributions from the beginning of the year at a rate of 5.1% | Contributions for injuries from the beginning of the year at a rate of 0.2% |

| January | 170 000 | 8670 | 340 |

| February | 340 000 | 17340 | 680 |

| March | 510 000 | 26 010 | 1020 |

| April | 680 000 | 34 680 | 1 360 |

| May | 850 000 | 43 350 | 1 700 |

| June | 1 020 000 | 52 020 | 2 040 |

| July | 1 190 000 | 60 690 | 2 380 |

| August | 1 360 000 | 69 360 | 2 720 |

| September | 1 530 000 | 78 030 | 3 060 |

| October | 1 700 000 | 86 700 | 3 400 |

| November | 1 870 000 | 95 370 | 3 740 |

| December | 2 040 000 | 104 040 | 4 080 |

Let's sum it up

In total, in 2022, for Morozov A.A. it is necessary to pay contributions in the amount of: 379,800 + 28,014 + 104,040 + 4,080 = 515,934 rubles. Thanks to the regressive scale, it was possible to save 69,000 rubles on pension insurance and another 31,146 rubles on contributions for illness and maternity. The total savings per employee amounted to 100,146 rubles. Of course, such savings on insurance premiums are achieved only with a high employee salary.

Where are insurance premiums paid?

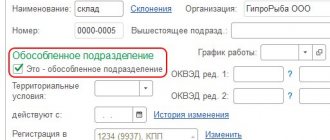

Insurance premiums for compulsory medical insurance, compulsory medical insurance, and in the event of VNiM are paid to the Federal Tax Service at the location of the organization, and insurance premiums for injuries are paid to the Social Insurance Fund . If an organization has a separate division in another city, then insurance premiums must be paid at the location of its parent organization. However, if a separate unit is vested with powers, then insurance premiums are required to be paid at the location of the separate unit. In this case, insurance premiums are paid based on the size of the base for this division.

Each type of insurance premium is paid in separate payment documents. Please pay attention to the correctness of the BCC, which you indicate in the payment order; it is different for each insurance premium.

How is payment of insurance premiums verified?

The correctness and timeliness of payment of contributions is carried out through desk and on-site inspections. Since 2022, control over the payment of insurance premiums is carried out by the tax authorities, with the exception of contributions for injuries, these contributions are controlled by the Social Insurance Fund. We talked about this in detail in the article “Insurance Premium Reform.”

The Social Insurance Fund also retains:

- desk audits for reimbursement of social insurance funds at the request of the employer;

- Conducting on-site audits together with tax inspectors;

- consideration of complaints based on inspection reports.

Tax authorities monitor the correctness and timeliness of payment of insurance premiums using:

- desk audit of calculations of insurance premiums;

- reconciliation of accrued and paid amounts of insurance premiums;

- conducting on-site inspections, together with the Social Insurance Fund.

Example 4. What documents may be required when checking insurance premiums

The organization Karat LLC (general taxation system, type of activity - wholesale trade in automobile parts) received a decision to conduct an on-site inspection, the subject of which is the correctness of calculation and timely payment of insurance premiums, as well as the legality of the expenses incurred by the policyholder for the payment of insurance coverage for 2014-2017 year.

The following documents were required for the verification:

- labor and civil contracts;

- employment orders;

- work books;

- time sheets;

- payroll, payslips for wages;

- personal cards of employees;

- certificates of incapacity for work;

- application and order for maternity leave, calculation of the amount of benefits;

- documents confirming payment of monthly maternity benefits (copy of birth certificate, application for leave, order, calculation of the amount of benefits, certificate from the father’s place of work stating that he does not receive benefits);

- orders for financial assistance and documents confirming the basis for its payment.

Also, the tax office and the Social Insurance Fund may request other documents related to the audit being carried out. On the day the inspection was completed, a certificate of the inspection was signed.

Reimbursement of funds from the Social Insurance Fund

If the audit result is positive, the expenses will be accepted, and the Federal Tax Service will offset or return the difference between contributions and expenses (Part 1.1, 5.8, Article 4.7 of the Federal Law of December 29, 2006 No. 255-FZ).

In general, the fund must transfer the money to the bank account of the organization that requested the return within 10 calendar days from the date of submission of the documents.

Before allocating funds, the Social Insurance Fund may conduct an inspection and require the submission of documents confirming the validity of the assignment and payment of benefits. This:

- sick leave for temporary disability and maternity benefits;

- certificates of registration in the early stages of pregnancy for appropriate benefits;

- a child’s birth certificate for child care benefits up to one and a half years old or one-time benefits at birth;

- employment contract with the employee.

The FSS will transfer money to the bank account only after the verification is completed. This is three months in the case of a desk inspection and two months from the date of the decision to schedule an on-site inspection.

However, the accrued benefit must be paid to the employee within ten days, regardless of whether the FSS transferred the money or not.

What responsibility does an employer bear for non-payment of insurance premiums?

In case of non-payment of insurance premiums, the employer bears tax, administrative and criminal liability.

Administrative liability for non-payment of insurance premiums - fine

Administrative liability for non-payment of insurance premiums is established only for officials of government agencies, as well as other organizations and institutions that keep budget records (Article 15.15.6 of the Code of Administrative Offenses of the Russian Federation). Administrative punishment is not directly provided for directors and other responsible persons of other organizations, although there is an opinion that they can be prosecuted under Art. 15.11 of the Code of Administrative Offenses of the Russian Federation, which establishes liability for non-payment of taxes and fees.

Tax liability for non-payment of insurance premiums - arrears, penalties, fines

They are brought to tax liability for non-payment, incomplete payment of contributions as a result of understating the base for calculating insurance premiums, and other illegal actions. This type of liability is the most common type of liability for non-payment of insurance premiums. And, as a rule, it entails simultaneously the collection of arrears (the amount of unpaid tax) from the employer and the accrual of penalties for each day of delay in payment, and also, at the same time, it is possible to impose a fine in the amount of 20% of the amount of unpaid insurance premiums, and if intentional non-payment - 40% of this amount. However, this penalty can be avoided. The Ministry of Finance clarifies the imposition of a fine for non-payment of insurance premiums in Letter No. 03-02-07/1/31912 dated May 24, 2017: “The inaction of the taxpayer, expressed solely in the failure to transfer to the budget the amount of tax specified in the tax return, does not constitute an offense, established by Article 122 of the Tax Code. In this case, penalties will be collected from the taxpayer.”

Thus, if you did not pay insurance premiums on time, but correctly reflected the accruals and submitted the calculation on time, no fine is imposed. You will only need to pay the arrears and accrued penalties. You can also avoid a fine if you incorrectly reflected the accruals, which led to an understatement of the tax base. To do this, you must first pay off the arrears and penalties that have arisen, and then submit an updated Calculation of insurance premiums. At the same time, the organization must detect the error before the tax office finds it and before it finds out that the inspectorate has ordered an on-site inspection (Article 81 of the Tax Code of the Russian Federation).

Example 5. What happens if the LLC does not pay insurance premiums

The organization LLC "Ikra" (general taxation system, type of activity - wholesale trade in fish, seafood and canned fish) paid insurance premiums for March 2022 in the amount of 10,000 rubles. 05/17/2018 (instead of 04/16/2018), thereby delaying payment by 30 days. The tax office sent a demand for payment of arrears in the amount of debt - 10,000 rubles. and a penalty. In this case, the penalties will be equal to: 10,000 rubles. x 7.25% (refinancing rate in effect during the period of delay) x 1/300 x 30 days. = 72.50 rub. The employer incurred tax liability for non-payment of insurance premiums in the form of penalties. Arrears and penalties have different BCCs, so they must be paid using different payment documents.

Criminal liability for non-payment of insurance premiums - fine, arrest, imprisonment

Criminal liability is borne by employers who, as in the case of tax liability, did not pay (did not pay in full) insurance premiums, did not submit a calculation, or included knowingly false information in it, which resulted in a distortion of the tax base on a large or especially large scale . If the employer committed this crime for the first time and fully paid the fine, all amounts of arrears and penalties, then he is released from criminal liability.

This type of responsibility is quite young. The prospects for introducing criminal liability for non-payment of insurance premiums have been considered since 2013, however, the article defining this type of liability was introduced by Federal Law No. 250 - FZ only on July 29, 2022.

Criminal liability for individuals for insurance premiums (Article 198 of the Criminal Code of the Russian Federation):

- imposition of a fine from 100 to 300 thousand rubles or in the amount of wages for a period of up to 2 years;

- compulsory work for up to one year;

- arrest up to 6 months;

- imprisonment for up to one year.

If this act is committed on an especially large scale, then the individual is punished:

- a fine of 200 to 500 thousand rubles. or in the amount of wages for a period of up to 3 years;

- compulsory work for up to 3 years;

- imprisonment for up to 3 years.

Results

Insurance contributions are mandatory payments for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance, collected from organizations and individuals for the purpose of financial security for the implementation of the rights of insured persons to receive insurance coverage for the corresponding type compulsory social insurance.

These types of contributions are calculated from wages and other payments accrued for each employee monthly on the last day of the month based on the base for calculating insurance premiums. And paid no later than the 15th day of the next calendar month.

Insurance premiums for compulsory medical insurance, compulsory medical insurance, and in the event of VNIM are paid to the Federal Tax Service at the location of the organization, and insurance premiums for injuries are paid to the Social Insurance Fund.

In case of non-payment of insurance premiums, the employer bears tax, administrative and criminal liability.

Firmmaker, July 2018 (updated in February 2022) Olga Kruglova (Uss) When using materials, reference is required

How to pay insurance premiums in 2022: changes

The calculation procedure has not been changed (Article 52 of the Tax Code of the Russian Federation): as in the previous calendar period, the tax base is multiplied by the established tariff. The procedure for determining the taxable base is now established by Art. 420 - 421 Tax Code of the Russian Federation. Insurance payments, which should not be included in the base for calculating SV, are enshrined in Art. 422 of the Tax Code of the Russian Federation. In comparison with the norms of Law No. 212-FZ, the list of insurance payments has been modified in terms of daily allowances, payments to guardians and employer payments for voluntary social security.

The rate or tariff is set in accordance with Art. 425 - 429 Tax Code of the Russian Federation. A number of preferential categories of policyholders have been established who have the right to make payments on insurance premiums in 2022 at reduced rates.

The procedure for paying insurance premiums in 2022 is enshrined in Article 431 of the Tax Code of the Russian Federation. Key points:

- The policyholder is obliged to settle payments by the 15th day of the month following the reporting month. That is, for August the SV should be transferred by September 15th.

- Transfers are made by type of insurance coverage (compulsory insurance, compulsory medical insurance, VNIM).

- When paying VNIM, a new procedure for offsetting employer expenses applies (Part 2 of Letter of the Federal Tax Service of Russia dated 02/01/2017 No. BS-4-11/2748). Participants in the pilot project do not offset expenses when paying for VNIM.