Examples of selecting OKVED codes depending on the chosen field of activity

The applicant’s idea of the proposed activity codes does not always coincide with the logic of the structure of the OKVED classifier. For example, it is understandable when it comes to activities related to the rental of apartments and offices. The following OKVED codes are suitable:

- 68.20 Rent and management of own or leased real estate

- 68.20.1 Rent and management of own or leased residential real estate

- 68.20.2 Rent and management of own or leased non-residential real estate

Also, quite logically, activities related to trade or the provision of taxi services are structured. But, for example, a designer associated with Internet advertising can work under the following OKVED codes:

- 18.12 Other types of printing activities

- 74.20 Activities in the field of photography

- 62.09 Activities related to the use of computer technology and information technology, other

- 73.11 Activities of advertising agencies

- 73.12 Representation in the media

- 90.03 Activities in the field of artistic creativity

- 90.01 Performing arts activities

- 62.01 Computer software development

As you can see, when selecting suitable OKVED codes, it is not always possible to limit yourself to one class or classifier group.

We recommend that you use a special selection of OKVED codes by type of business: Ready-made sets of OKVED codes by type of business

Which version of the directory to use: changes from 2022

Please note that OKVED with decoding by type of activity in 2018 must be used in its most current version. So, in 2017, Rosstandart made changes to it twice. All details are given in the table below.

| Document with changes to OKVED | Start of action | What codes did I change? | What was added: new OKVED codes |

| Order of Rosstandart dated August 3, 2017 No. 791-st <Change 13/2017 OKVED 2˃ | From November 1, 2022 with the right of early application from January 1, 2014 | 71.12 – Activities in the field of engineering surveys, engineering and technical design, construction project management, construction control and supervision, provision of technical advice in these areas | 10.86.3 – Production of meat products for baby food, including poultry 10.86.6 – Production of specialized food products, including dietary foods 10.92 – Production of ready-made feed for non-productive animals |

| Order of Rosstandart dated 09/08/2017 No. 1045-st <Change 14/2017 OKVED 2˃ | From December 1, 2022 with the right of early application from January 1, 2014 | 71.12.8 – Activities to provide engineering and technical consultations on energy saving and increasing energy efficiency | 10.86.7 – Production of drinking water, non-alcoholic drinks for baby food 10.86.8 – Production of fish products for baby food 10.86.9 – Production of bakery and confectionery products for baby food |

How many OKVED codes can be indicated in the application?

As much as you like, it is not forbidden to include at least the entire Classifier in the application (the only question is how much you need it). In the sheet where OKVED codes are indicated, you can enter 57 codes, but there can be several such sheets, in this case the main type of activity is entered only once, on the first sheet.

Please note that if the OKVED code you have chosen relates to the field of education, upbringing and development of children, medical care, social protection and social services, youth sports, as well as culture and art with the participation of minors, then to register an individual entrepreneur you will need a certificate of no criminal record (clause 1(k) of article 22.1 of law No. 129-FZ). The document is submitted upon an interdepartmental request, but in order not to delay the registration process, you can, after checking with the registration inspection about this possibility, request a certificate in advance.

The law stipulates this requirement only for individuals, that is, individual entrepreneurs, and when registering an LLC such a certificate is not required.

Responsibility for conducting activities not in accordance with OKVED

As such, there is no liability for activities not in accordance with OKVED. Both judicial practice and letters from the Ministry of Finance confirm that an entrepreneur is not subject to liability for carrying out activities not specified in the Unified State Register of Individual Entrepreneurs or the Unified State Register of Legal Entities.

At the same time, if you operate under an OKVED code that is not registered or was not entered later, you may be brought to administrative liability in the amount of up to 5,000 rubles under Art. 14.25 of the Code of Administrative Offenses of the Russian Federation for “...failure to submit, or untimely submission, or submission of false information about a legal entity or an individual entrepreneur.” OKVED codes are included in the list of such mandatory information in Art. 5 (5) of Law No. 129-FZ of 08/08/01, so you will need to hurry to make changes within three days after the start of activities under the new code.

Main activity according to OKVED

But here you need to be careful. The fact is that the calculation of contributions for workers for insurance against industrial accidents and occupational diseases occurs according to the tariffs for the main type of activity. The more risky (traumatic or provoking occupational diseases) the activity is, the higher the insurance premium rate.

Before April 15 of the year following the reporting year, employers must submit to the Social Insurance Fund documents confirming the main type of activity, in the manner prescribed by Order of the Ministry of Health and Social Development No. 55 of January 31, 2006. Organizations submit such confirmation annually, and individual entrepreneurs - employers only if they have changed their main type of activity. The main type of activity is considered to be the type of activity from which the income received is higher in comparison with the income from other activities for the previous year.

If confirmation is not submitted, then the FSS sets the highest tariffs of all types of activities specified by the policyholder, and this is where excessively specified OKVED codes can turn out to be very inappropriate.

Where can I find OKVED-2018 codes with breakdowns by type of activity?

The current OKVED-2018 with decodings by type of activity was approved by Rosstandart order No. 14-st dated January 31, 2014, has the official number OK 029-2014 (NACE, rev. 2) and is mandatory for use from January 1, 2017. For brevity, it is also called OKVED 2. In the period from the date of approval to the year of mandatory application, it could be used on a voluntary basis.

For information on how OKVED 2 data is linked to the codes contained in the classifier that preceded it, read the material “The Federal Tax Service explained how OKVED 2 codes were assigned.”

The OKVED-2018 code classifier with decoding has a number of differences from the original version of this document, since changes were repeatedly made to it during 2015-2017. The latest of them were made at the end of December 2022 and came into force on March 1, 2018, extending their validity to the period beginning in 2014. Thus, OKVED-2018 with decoding by type of activity in its final version has an edition dated December 21, 2017, created by Rosstandart orders No. 2046-st and No. 2048-st dated this date.

The 2022 OKVED 2 reference book with decoding of the codes is a rather voluminous document. It is divided into lettered sections that correspond to the main areas of possible areas of activity:

- Agriculture;

- mining;

- provision of energy resources;

- water supply, drainage, waste disposal;

- construction;

- trade;

- transportation;

- hotel services and catering;

- communication services;

- financial and insurance activities;

- real estate transactions;

- scientific, technical and certain types of professional activities;

- administrative;

- public administration, security and social security;

- education;

- healthcare;

- culture, sports, entertainment;

- other types of services;

- household;

- extraterritorial structures.

Within these sections, activities are divided into classes that are numbered throughout the entire directory and detailed as necessary. This detailing ensures the creation of a digital OKVED code. Section letter designations are not used in this code.

You can download the full version of the current OKVED-2018 classifier with deciphering the codes on our website.

How are tax regimes and OKVED codes related?

All special, or preferential, tax regimes (USN, Unified Agricultural Tax, PSN) have restrictions on the type of activity. If you intend to engage in certain types of activities and at the same time choose a mode in which such activities are not provided, then there is a conflict of interest. It will be necessary to change either the tax regime or the desired OKVED. To avoid getting into such a situation, we recommend that you consult with experts in advance on the issue of choosing an appropriate taxation system.

Free tax consultation

For example, under the simplified tax system 2022 it is impossible to carry out insurance activities, extract minerals, except for common ones, or produce excisable goods, except for grapes and wines made from them. On PSN you can only provide certain types of services and engage in retail trade with restrictions.

Read more: Types of activities covered by patent in 2022 for individual entrepreneurs

Unified agricultural tax is generally intended only for activities related to agriculture and fisheries. The general taxation system (OSNO) has no restrictions related to types of activities, but it has the highest tax burden.

Tax disputes related to activities under an unspecified OKVED code

The entire “reinforced concrete” logic of tax officials is based on their constant desire to not recognize the taxpayer’s right to a tax benefit or to reduce the tax base. Everything comes into play here, including the refusal to accept expenses for transactions with counterparties if they do not indicate the type of activity for which the business transaction took place.

Most often, such refusals are associated with the recognition of expenses when calculating income tax and VAT refund. Judges in such disputes, as a rule, side with the businessman, but if you do not want to bring the matter to court, then it is better to make sure that your partner has the required OKVED code.

Another important point is when tax authorities unreasonably try to prove that activities under an unspecified OKVED code are, in principle, not entrepreneurial. In particular, there are known denials of the right to apply a tax rate of 6% for an entrepreneur on the simplified tax system for income if he received this income under unspecified OKVED codes. The Federal Tax Service is trying to tax such income with personal income tax at a rate of 13%, as received by an individual from activities not related to business.

How many types of activities can be carried out on the simplified tax system?

An additional advantage of the simplification is that to calculate the tax, the total income from different types of activities is taken into account.

For example, an entrepreneur on the simplified tax system is engaged in retail trade. He also owns several trucks, so he is also launching a road transportation business. Things are going well, and at some point the individual entrepreneur decides to open two catering outlets, moreover, in another city.

In this case, he reports for all areas of business in one annual declaration. All income is simply summed up and taxed at the same rate, regardless of the number of activities. There is no requirement to register with the Federal Tax Service for various types of activities. The entrepreneur pays taxes from all areas of business and places of activity to one inspectorate - according to his registration.

It would seem that what is surprising here? But if an individual entrepreneur chose the PSN regime for his business, he would have to apply for several different patents and pay separately for each of them. It would also be necessary to track the validity period of each patent and submit an application for a new one in a timely manner. So, the simplification for individual entrepreneurs in terms of tax registration is really simpler than other preferential systems.

How to report a new OKVED code or exclude the previous code

Above, we have already noted the need to inform your tax office within three days that you have changed the types of activities you carry out. Individual entrepreneurs report changes (adding or deleting) OKVED codes using form P24001.

Organizations submit a notification of changes to OKVED codes, regardless of whether changes are made to the charter or not, in form R13014. The fact of changes in the charter is taken into account when filling out the form itself.

Change of OKVED for LLC in Moscow on a turnkey basis

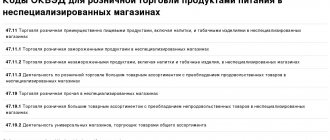

Decoding OKVED codes and their classification 2022

Classifier of OKVED codes 2022 Classifier of OKVED codes 2022 is a classifier for all-Russian purposes, which determines the types of economic activity. Its codes are used if a company wants to change the type of activity. According to the new order of the Russian standard, the official entry into force occurred on July 11, 2016. In accordance with the rules of OKVED, regardless of the form of ownership and source of investment, the classifier is the same for everyone, so it is important to take this into account when registering. Anyone who wants to start their own business must register as an individual entrepreneur and indicate the type of activity in accordance with the OKVED 2022 code classifier. Beginning entrepreneurs face difficulties due to a lack of knowledge on the use of OKVED and its practical purpose. As a result, they have many questions related to specifying the activity code. Selection of OKVED codes Selection of codes is carried out in the following way:

- We look and indicate the desired subsection;

- In the subsection with a detailed description, indicate the item “necessary”. Only four-digit codes can be used; the use of two- and three-digit codes in the application is prohibited.

You can choose an unlimited number of codes, but you need to make a choice on one main one, which will make it possible to make a profit with an interest rate of no more than 60 percent of the amount of revenue in this area of activity. Features of deciphering OKVED codes OKVED 2022 contains many codes, but there will be no difficulties in orienting the classifier due to simple and understandable navigation parameters. The classifier contains 21 sections, divided into 88 class subsections with a detailed description and decoding of any code and types of activities, allowing for error-free selection. What is it needed for?

To determine the purposes of using the classifier, it is necessary to note the functional parameters:

- Classifies and codes types of economic activities in the process of registering entrepreneurs;

- Determines the main and additional types of economic activities of entrepreneurs;

- Contains information about business entities for registration

- Encodes information based on the types of economic activities in the information system.

The codes provide authorities with detailed information about the activities of individual entrepreneurs in a standard form. Selecting OKVED 2020 When choosing a type of activity, it is necessary to take into account that the classifier is divided into two types:

- Basic;

- Additional.

There are no restrictive barriers to the number of codes chosen, but it is important to determine the main type of activity. If an entrepreneur is involved in the field of trade and vehicle rental, then he needs to determine the main direction. The main type determines the amount of social contributions in insurance of an individual. To determine the correct code, you must do the following:

- Decide on the type of activity;

- Select a code that corresponds to the activity;

- Mark the code in the application when registering an individual entrepreneur or organization.

When expanding or changing the list of activities, it is necessary to change and add codes. To carry out these operations, you need to make the necessary additions and send them to the organization where the company registered the codes. The organization will review the application and make the necessary changes. It is important to do this on time, as the entrepreneur may be fined.

A short minimum you need to know about OKVED

- OKVED codes are a digital designation of the types of activities that the applicant indicates in the application for registration of an individual entrepreneur or LLC.

- You must indicate at least one activity code in the application; the maximum number of OKVED codes is theoretically unlimited.

- There is no point in indicating as many codes as possible in the application (just in case), because... When registering an individual entrepreneur, among them there may be those for which, in addition to the usual package of documents, you must present a certificate of no criminal record.

- If you have chosen a special tax regime, then when choosing OKVED codes you must take into account restrictions on the types of activities in this regime.

- If there are employees, the main type of activity must be confirmed with the Social Insurance Fund before April 15: for organizations annually, for individual entrepreneurs only if the main code is changed, because The rates of insurance premiums for employees depend on this.

- There is no liability for activities using unspecified OKVED codes, but an administrative fine of up to 5 thousand rubles may be imposed for late (within three days) notification of a change in codes.

- If you or your counterparty do not have the appropriate OKVED codes, tax disputes are possible, with a refusal to reduce the tax base or apply another tax benefit for the transaction.

What to follow

Current OKVED codes with interpretation for 2022 must be taken from the All-Russian Classifier of Types of Economic Activities. Its official abbreviated name is OK 029-2014 (NACE Rev. 2). The current OKVED directory for 2022 was approved by order of Rosstandart dated January 31, 2014 No. 14-st.

Also see “OKVED and activities in the field of accounting”.

OKVED is required:

- for state registration of organizations and individual entrepreneurs when registering with the Federal Tax Service;

- when determining benefits for various taxes;

- when setting the tariff for contributions to the Social Insurance Fund for injuries;

- when filling out tax reports and other documents where you need to indicate the type of economic activity of the company (IP);

- to resolve the issue of mandatory quotas for foreign labor, etc.

Also see Foreign Labor Quota 2022.