Change in cadastral value

How to reflect in 1C the recalculation of land tax for the past 3 years due to the fact that the cadastral value was changed by court decision? How to inform the tax office about changes, including for 2020, when the declaration was no longer submitted?

If the cadastral value (CV) of land changes in connection with the establishment of its market value, the organization can recalculate the land tax based on the new value of the CV from the year the disputed indicator began to be applied (clause 1.1 of Article 391 of the Tax Code of the Russian Federation). The Ministry of Finance insists that recalculation is possible only within 3 years (Letters of the Ministry of Finance dated 07/15/2019 N 03-05-05-02/52329, dated 07/11/2019 N 03-05-04-02/51243, dated 04/05/2019 N 03-05-06-02/23839). For taxes calculated for periods before 2020 , updated land tax returns must be submitted.

Income tax

Recalculation of land tax by court decision does NOT lead to recalculation of income tax (Letters of the Ministry of Finance dated 01/23/2014 N 03-03-10/2274, Federal Tax Service dated 02/12/2014 N ГД-4-3/ [email protected] ).

Reduction of land tax - non-operating income of the current period

, i.e. income of previous years identified in the reporting period (clause 10 of article 250 of the Tax Code of the Russian Federation, clause 6 of clause 4 of article 271 of the Tax Code of the Russian Federation).

The organization owns the site by right of ownership:

- KS - 8,000,000 rubles, tax rate - 1.5%

On August 10, a court decision was received, according to which the cadastral value of the plot was set at 5,500,000 rubles. On August 24, the new KS was entered into the Unified State Register of Real Estate.

A message about the calculated land tax for 2022 was received with the amount of 120,000 rubles. Land tax for 2022, 2019, 2020 is subject to recalculation

For 2022, 2022, updated land tax declarations are submitted in the form in force during these years (clause 5 of Article 81 of the Tax Code of the Russian Federation).

For 2022, land tax will be recalculated by the tax authority after:

- submission of information on changes to the Constitutional Code by Rosreestr (within 10 working days from the date of registration in the Unified State Register of Real Estate) (clause 4 of Article 85 of the Tax Code of the Russian Federation);

- obtaining information from Rosreestr upon request, in connection with informing the Federal Tax Service by the taxpayer.

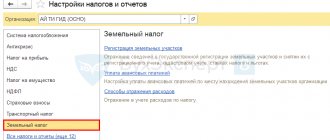

The main thing - Taxes and reports - Land tax - Registration of land plots

Federal Tax Service: Letter No. SD-4-21/ [email protected] dated 07/27/2021

About the definition

period for recalculation of land tax in case of change

cadastral value of the land plot due to

establishing its market value

In order to ensure the application of paragraph 2.1 of Article 52 and paragraph 1.1 of Article 391 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), we send for study the Cassation ruling of the Eighth Court of Cassation of General Jurisdiction dated May 19, 2021 No. 88A-7563/2021 in administrative case No. 2a-3666/ 2020. We draw attention to the following provisions established by the courts.

According to paragraph 1.1 of Article 391 of the Code (as amended by Federal Law No. 334-FZ dated August 3, 2018), in the event of a change in the cadastral value of a land plot based on the establishment of its market value by decision of the commission for resolving disputes on the results of determining the cadastral value or by a court decision, information about cadastral value established by a decision of a commission or court, entered into the Unified State Register of Real Estate, are taken into account when determining the tax base for the tax starting from the date of application for tax purposes of the cadastral value that is the subject of a challenge.

This actually stipulates that the changed cadastral value should be applied for all tax periods in which the changed cadastral value, which is the subject of a challenge, was applied to the taxable land plot as the tax base.

Recalculation of land tax in relation to the object of taxation included in the tax notice (hereinafter referred to as the tax) must be carried out in compliance with paragraph 2.1 of Article 52 of the Code (as amended by Federal Law dated 03.08.2018 N 334-FZ), according to which the recalculation of tax is carried out no more than for three tax periods preceding the calendar year of sending a tax notice in connection with the recalculation, except for the case when the recalculation is not carried out, since it entails an increase in the previously paid tax amount.

Thus, the condition of tax recalculation for no more than three tax periods applies to recalculation entailing the sending of a tax notice, in which, by virtue of paragraph 3 of Article 52 of the Code, the amount of tax to be paid after recalculation must be indicated.

In the dispute under consideration, the use of the cadastral value, established in the amount of the market value of the land plot, as the tax base for the tax, did not entail the sending of a tax notice in connection with the recalculation of the tax, since as a result of the recalculation, the amount of tax paid for previous tax periods decreased.

In addition, as the courts have indicated, Article 52 of the Code does not limit the taxpayer’s right to recalculate tax in connection with the exercise of the right to use a different tax base. Taking into account the legal position expressed in the Resolution of the Constitutional Court of the Russian Federation dated February 15, 2019 N 10-P, the taxpayer in the above case has the right to demand tax calculation based on the cadastral value of the land plot, while the tax legislation does not contain restrictions on the period for which recalculation of tax in order to exercise this right.

In connection with the above, the refusal to recalculate the tax (when changing the cadastral value of a land plot based on the establishment of its market value) for a tax period exceeding a three-year period and in which the variable cadastral value was applied was declared unlawful by the courts.

Provide information to subordinate tax authorities.

These clarifications are for informational and reference purposes only (advisory, not mandatory) in nature, do not establish generally binding legal norms and do not interfere with the application of legal regulations and judicial acts in a meaning different from the above clarifications.

Valid

state councilor

Russian Federation

2 classes

D.S.SATIN

Hello Guest! Offer from "Clerk"

Online professional retraining “Chief accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Recalculation of land tax for 2018-2019 in 1C

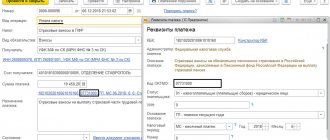

Transactions - Transactions entered manually

Updated land tax declarations - manually

.

Other income and expenses

See also:

- Using the new cadastral value of land

- Does the cadastral value of the property change annually?

- How to calculate land tax if the cadastral value was recalculated during the year?

- Where to file an application to dispute the value of land?

- [10/26/2021 entry] Calculation of property taxes for 9 months of 2021 in 1C

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Land tax rate when transferring a plot for temporary use Officials explained the procedure for applying reduced land tax rates in relation to...

- Calculation of land tax 2022 for a plot for housing construction...

- Is it possible to include the costs of acquiring a land plot in the simplified tax system expenses? The Ministry of Finance considered the issue of including in the base for simplifying expenses...

- Using coefficients when calculating land tax...

Grounds for recalculation of land tax

Recalculation of land tax is a process, the essence of which is to change the volume of transfers for this fee. In some cases, the amount may be reduced, and in some situations, on the contrary, increased.

We advise you to read:

- ✅ Act of property damage: sample

- ✅ Power of attorney for registration of a land plot: sample

- ✅ How to get a tax deduction for apartment renovation?

- ✅ How to draw up a statement of claim for the division of jointly acquired property of spouses?

As a rule, the procedure for recalculating land tax is initiated by land use entities. This is done in order to reduce the rate that is subject to the fee. In this regard, an important rule needs to be noted. If a change in the price according to the cadastre took place in the current period as a result of an increase in value, then the volume of transfers for the specified period will remain the same. That is, the citizen or organization will pay the same amount.

However, the procedure provides for two reasons on which the amount payable for the taxable period may change significantly. Such grounds should be specified in more detail:

- The basis for recalculation is a technical or arithmetic error. This is quite possible and happens due to the fault of the employee in question. Perhaps there was a glitch in the program and the numerical values were distorted;

- The basis is a revaluation of the territory used by a citizen or legal entity.

The cost of the cadastre is often inflated, which causes justified dissatisfaction among land users. Therefore, they initiate a procedure for an independent assessment of the land. If the result is a different value, then it is necessary to recalculate. Consequently, another figure in the base means the basis for reducing the amount of the fee. This means that at the end of the year, a citizen or legal entity will pay a smaller amount of land tax. In this case, recalculation for another assessment in most cases becomes the result of a judicial procedure.

By the way, an article on the redistribution of land plots between owners may be useful.

How to recalculate land tax?

The procedure for recalculating land tax occurs in proportion to the decrease or increase in the base. For example, if the price according to the cadastre has decreased by 20%, then this is the basis for reducing the size of the transfer by one fifth.

However, the period when the citizen or legal entity applied for such a change is also important. According to the requirements of the law, we are talking specifically about the tax deadline. That is, a different fee amount will be paid for the calendar year. And the specific month when the overvaluation or undervaluation was revealed does not matter.

If a citizen or legal entity declared the need to change the amount in one year, and it was made the next, then the land tax in a smaller amount can be paid for the period when this was declared. In such cases, the fiscal authorities do not return the funds spent. They take them into account as the next payment or as part of such a payment for a subsequent period.

By the way, sometimes recalculation is done after correcting an existing cadastral error.

Sample application for recalculation of land tax

An application to the tax office for recalculation of land tax is a special form. This is an electronic form that is filled out by the applicant. It reflects the reasons for the changes and the period for which they need to be made. An important condition for filling out the relevant document is entering accurate and complete data.

Recalculation of land tax when cadastral value changes

Recalculation of land tax due to changes in cadastral value is the most common reason for adjustments. In all cases, this occurs on the initiative of a citizen and legal entity who does not agree with the cadastre price declared by the state.

To implement this process, specialists from appraisal companies are invited. They determine the new value according to the standard procedure. The market price of the property is taken as the basis. If the overstatement is confirmed, this serves as the basis for adjusting the amount of the fee.

Recalculation of land tax by court decision

Often, the authorities do not agree with the conclusions of the appraisers and call them into question. Only the court can put an end to the dispute. Therefore, the interested party applies to the judicial authority with a corresponding claim. If the court makes a positive decision, the adjustment period will begin from the year in which the claim was filed.

Recalculation of land tax for previous periods

If a citizen proves that the amount of the fee was overestimated, he has the right to demand a change in the amount for previous periods. In this case, the reference point will be the period of circulation of such a person. It is not possible to change the amount for all previous periods. This is expressly prohibited by law. Therefore, if you disagree with the state’s point of view, it is necessary to independently attract specialists to implement this procedure.

If it is necessary to reduce the amount of tax payments for land, a citizen or an individual organization has the right to apply to the appropriate authorities for this purpose. In some cases, it may be necessary to involve outside, disinterested experts in this process.