Is it necessary to conduct an OS inventory?

Companies must regularly check the actual availability of their fixed assets.

Cases of mandatory inventory are specified in the Regulations on accounting and reporting in the Russian Federation (hereinafter referred to as the Regulations), approved. by order of the Ministry of Finance dated July 29, 1998 No. 34n (clause 27), and Methodological Instructions for Inventory (hereinafter referred to as the Methodological Instructions), approved. by order of the Ministry of Finance dated June 13, 1995 No. 49 (clause 1.5). Test yourself: how to take an inventory. Completion time: about 5 minutes. Take the test

There are few such cases, and they are associated with the company’s plans to sell property or rent it out. Inventory is also needed after a fire and other extreme situations, before drawing up a liquidation balance sheet, etc. The most common situation is carrying out an inventory before drawing up an annual balance sheet. If the company's statements are subject to mandatory audit, then without carrying out an inventory procedure it will be problematic to confirm the accuracy of the balance sheet (namely, it contains information about the company's property status).

For information about who is required to have an external audit, read the material “What are the features of audited financial control? ”

conclusions

Inventory of fixed assets is a lengthy process in production and is a mandatory accounting report.

Any accountant or responsible person should be able to fill out the inventory list correctly. At the same time, it is important that all recorded funds are described as much as possible, their numbers are indicated and their actual cost is taken into account.

Such inventories are carried out upon liquidation of an enterprise or upon transfer of ownership rights. The procedure is also carried out in case of natural disasters and large-scale accidents.

Inventory list of fixed assets: registration procedure

To properly conduct an inventory, it is necessary to create a commission and issue an order. The procedure itself is simple, but requires knowledge of individual regulations.

Thus, the commission can check the actual availability of fixed assets only in the presence of financially responsible persons (clause 2.8 of the Methodological Instructions) - otherwise, the inventory results may be invalidated. Monitoring the presence of OS can be carried out once every 3 years (clause 1.5 of the Guidelines, clause 27 of the Regulations).

Find out how to properly conduct an inventory of fixed assets at ConsultantPlus. If you don't have access to the system, get a free trial online.

The results of the inventory need to be documented - for this, a document such as an inventory list is usually used. You can download the unified form for the inventory list of fixed assets INV-1, approved by Decree of the State Statistics Committee of Russia dated August 18, 1998 No. 88, on our website using the link below:

Also, an inventory list of fixed assets can be developed by the company independently - it is not necessary to use standardized forms now.

Read more about this in the article “Primary document: requirements for the form and the consequences of its violation .

The inventory list of form INV-1 is compiled in 2 copies for each location where the OS is stored. It contains information about the actual availability of objects; if an object reflected in accounting is missing, data on it is also included in the inventory. An inventory list of fixed assets in the INV-1 form must be compiled separately for fixed assets for production and non-production purposes, as well as for own and leased property. If the company has leased fixed assets, then an inventory list for them is also prepared for the lessor.

Also find out the nuances of conducting an inventory of real estate, both listed as fixed assets and those that do not belong to fixed assets. To do this, study the ready-made solution prepared by ConsultantPlus experts. If you do not have access to the K+ system, get temporary demo access for free.

Inventory inventory of fixed assets INV-1.

Inventory list of fixed assets

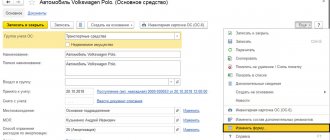

(Form No. INV-1) - used to prepare inventory data of fixed assets (buildings, structures, transfer devices of machines and equipment, vehicles, tools, computer equipment, production and household equipment, etc.).

The inventory list is drawn up in two copies and signed by the responsible persons of the commission separately for each place of storage of valuables and by the person responsible for the safety of fixed assets. One copy is transferred to the accounting department for drawing up a matching statement, and the second remains with the financially responsible person(s). form form No. INV-1 in Word and Excel format:

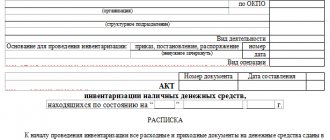

Before the start of the inventory, a receipt is taken from each person or group of persons responsible for the safety of valuables. The receipt is included in the header portion of the form.

The inventory list according to form N INV-1 is printed with loose-leaf sheets according to the model of the 2nd page of the form, the number of which is determined by the customer of the forms.

When automated processing of data for recording inventory results, Form N INV-1 is issued to the commission on paper or computer storage devices with completed columns 1 to 9.

In the inventory, the responsible person of the commission fills out column 10 regarding the actual availability of objects. When identifying objects that are not reflected in accounting, as well as objects for which there is no data characterizing them, the responsible persons of the commission must include the missing information and technical indicators for these objects in the inventory list. By decision of the inventory commission, these objects must be capitalized. In this case, their initial cost is determined taking into account market prices, and the amount of depreciation is determined according to the technical condition of the objects with the mandatory execution of relevant acts.

Inventories are compiled separately for groups of fixed assets (production and non-production purposes).

Column 9 “Passport number” is filled in for fixed assets containing precious metals and stones.

For fixed assets accepted for lease, an inventory is drawn up in triplicate separately for each lessor, indicating the lease term. One copy of the inventory list is sent to the lessor.

Download other forms on our website:

| Power of attorney for a car | Summary | Help 2-NDFL | Hotel form |

| Advance report JSC-1 | Invoice Torg-12 | Sales receipt | Invoice |

| Receipt cash order KO-1 | Travel certificate | Expense cash order KO-2 | Invoice |

Didn't find what you wanted - use the site map

Sample and example of filling out an inventory list of fixed assets

For clarity, we invite you to look at the example we have of filling out the inventory list of fixed assets INV-1. You can download it for free from the link below:

Read about the inventory procedure in the material “Procedure for conducting an inventory of fixed assets .

Who does it?

The inventory is compiled by the responsible persons of the commission that deals with the inventory.

The form must be filled out in two copies, one of which then goes to the accounting department, and the other to the financially responsible person.

In accounting, specialists create a matching statement based on the inventory list.

Since the inventory commission also includes an accountant, all documents are drawn up under his supervision.

At the very beginning of the inventory process, a corresponding receipt is taken from all persons who participate in the procedure. Most often, the filling is carried out by the chief accountant or his deputies.

In any case, this must be an employee with suitable education, work experience and responsible authority.

This is a financially responsible person who has access to the material assets of the enterprise in accordance with his job description.

How to fill out the unified INV-1 form?

The audit, as a result of which the inventory list is filled out, is usually carried out in three cases:

- Upon liquidation of the company, as well as upon transfer of its ownership to another person.

- Rent or alienation of someone else's property.

- Emergency situations at the enterprise, as a result of which the main property was damaged.

To correctly enter basic data, a standard unified form is used.

The company may make some changes, but the following details must be indicated in the basis:

- The name of the organization, its legal form and all OKOD codes.

- The structural unit in which the inventory itself takes place.

- The basis for the inventory (order, its number and date). Any inspection occurs by order directly from the employer and the main manager.

- Start and end dates of the process. Usually they coincide, but with large volumes of work, the inventory of fixed assets can last several days.

- Inventory number and date of its preparation.

- Title of the document (Inventory list of fixed assets).

- Fixed assets (specify the type, for example, metal rolling equipment or computer equipment).

- Who owns these funds?

- Where is the location of the operating systems that are subject to inventory.

- A receipt (in the title part), in which the responsible persons indicate that all documents on the operating system have been submitted to the accounting department, and that what needs to be capitalized or disposed of has been disposed of. The position and full name of the responsible persons, as well as their signatures, are also indicated here.

This is the first page of the inventory list. Then the second and subsequent pages of the document are filled out.

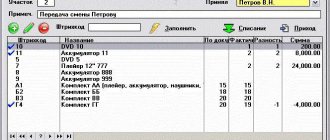

Filling occurs in the form of a table that has 13 columns:

- The serial number of the object.

- Its name and characteristics.

- The name of the document that confirms the acceptance of this object for storage.

- Number of the confirmation document.

- Its date.

- The year the object was created, produced or built.

- Inventory number.

- Factory number.

- Number of the passport or document on registration of the object.

- Actual availability in pieces.

- Cost of actual availability.

- Number of pieces according to accounting.

- Cost according to accounting.

At the end of the page, under the table, it is indicated how many serial numbers are in this table, as well as the total number of objects and their actual total cost.

Results

The owner is primarily interested in conducting an inventory of property: both the property is under control and the reporting is reliable.

An inventory list, which can be compiled according to the unified INV-1 form, helps to correctly document the results of the inventory of fixed assets. The procedure for filling out and a sample inventory of fixed assets is discussed in detail in this article. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What is it used for?

This form of inventory list is used when taking inventory of property related to the fixed assets of the enterprise.

These are buildings, machines, any equipment, as well as computer equipment, equipment, production and economic.

This may be due to either the liquidation of the enterprise or natural disasters that damaged the main property.

Using this form, the results of the inventory of fixed assets at the enterprise are compiled.

It is necessary to fill out the INV-1 form strictly in accordance with the financial statements in order to avoid confusion and errors that will lead to shortages or loss of valuable property.

Inventories are written separately for production fixed assets and non-production assets. At the same time, for each structural unit its own inventory list INV-1 is drawn up.

Therefore, when recalculating fixed assets, it is necessary to create separate documents for each department, and the responsible people fill out all fines so that the inventory is complete.

Inventory of unfinished construction: regulatory platform

The inventory is regulated by the Methodological Instructions approved by the Ministry of Finance of the Russian Federation on June 13, 1995 No. 49. The frequency of the inventory of work in progress is set by the head of the company himself, based on the need that has arisen, for example, due to the reorganization of the company, abnormal or emergency events, transfer of valuables to another responsible person, or based on other grounds listed in the Directions.

The inspection is initiated by issuing a corresponding order, which indicates:

- an object;

- timing of the inventory and presentation of its results;

- commission listing positions and names participating in the inventory.

An inventory of unfinished construction is carried out in the manner established by the above-mentioned methodology No. 49 in the section of the same name (clauses 3.32 - 3.35).

Based on the results of the inspection, an inventory report of work in progress is drawn up. The special form has not been normatively approved. Typically, enterprises use unified INV forms. Companies are given the right to generate their own documents to record the results of inventories, subject to the condition that they contain all the necessary details established by Law No. 402-FZ.