The VAT rate was increased from 18 to 20 percent from January 1, 2022 on the basis of Federal Law No. 303-FZ of August 3, 2022, which amended the Tax Code.

The preferential VAT rate of 10 percent has been retained and applies only to socially significant goods. These include: food products (except delicacies), children's products, periodicals and book products (except erotic and advertising), medicines. A small group of companies have the right to take advantage of the zero VAT rate. These include exporters and air carriers.

General VAT rules

As a general rule, the seller calculates VAT at the rate of 18/118 on prepayments received in 2022. And for shipments in 2019, a rate of 20/120 applies. But tax is deducted at a rate of 18/118 from the prepayment received.

The new rate is valid for contracts regardless of the time of their conclusion - until 2022 or later. This means that you need to apply the rate that is in effect at the time the tax base is determined. Therefore, to calculate the tax, be guided by the moment the VAT base is determined.

The moment of determining the value added tax base is the earlier of two dates in accordance with paragraph 1 of Article 167 of the Tax Code of the Russian Federation: the day of shipment of goods (work, services) or the day of payment, including partial.

Return of goods shipped before 2022

The contract may provide that goods not sold by a certain date are returned to the seller.

The question arises: how to do this taking into account changes in the VAT rate? After all, when returning goods, the seller has the right to deduct the VAT paid on such goods. To do this, the seller must reflect it in the accounting of adjustment transactions in connection with the return of goods or refusal of goods. Such VAT can be deducted only within one year from the date of return or refusal of the goods. Moreover, in the event of a decrease in the number of goods shipped, the basis for deducting VAT from the seller is the adjustment invoice issued by the seller. Therefore, the Federal Tax Service of Russia in all cases of return of goods from 01/01/2019, regardless of the acceptance of goods by the buyer for registration, the seller is recommended to issue adjustment invoices for the cost of goods returned by the buyer.

The VAT rate on the adjustment invoice is the same as on the shipment invoice. It is recommended to follow the same procedure for returning goods for shipments made in 2022. And the buyer can only restore the VAT accepted for deduction based on the adjustment invoice received from the seller. The obligation to restore VAT previously accepted for deduction on returned goods does not depend on the period of shipment of the goods.

What to do if the goods were purchased from a foreign organization that is not registered with the tax authority in the Russian Federation, and the place of sale is recognized as the territory of the Russian Federation?

In this case, the tax is paid by the tax agent simultaneously with the payment of funds to such taxpayers. At the same time, the tax base is not determined at the time of shipment. In this connection, if payment for goods shipped in 2022 was transferred in 2022 or earlier, then the tax agent on the date of payment in 2022 had to calculate and pay to the budget at an estimated rate of 18/118%. And for shipment in 2022, VAT will not be recalculated. The calculated rate of 18//118% is also applied when paying a foreign taxpayer in 2022 for goods shipped before 01/01/2019, because the new VAT rate of 20% applies to goods shipped from 01/01/2019, work performed and services rendered.

The same procedure for calculating VAT by tax agents is applied when renting federal property, property of constituent entities of the Russian Federation and municipal property.

Foreign organizations providing electronic services on the territory of the Russian Federation, from 01/01/2019, pay VAT themselves, if this is not the responsibility of the tax agent. From 01/01/2019, the estimated VAT rate for such services is 16.67%, and until January 1, 2022 - 15.25%. A foreign organization providing electronic services, when receiving payment in 2022, must apply an estimated VAT rate of 15.25% if the electronic service was provided before 01/01/2019. The new VAT rate applies only to shipments in 2022.

Payment 2022 – implementation 2022

Now let’s figure out how to calculate VAT if the payment took place in 2018 and the sale took place in 2022. The tax base is determined in 2018.

Consequently, the seller pays VAT, and the buyer deducts tax at a rate of 18 percent. The tax increase from January 2022 does not entail a change in the tax obligations of the parties to the transaction. There is no need to recalculate the database at the time of payment. EXAMPLE 1. HOW TO CHARGE VAT IN 2022 UPON SHIPMENT, AND IN 2019 AFTER PAYMENT?

In November 2022, Prince LLC shipped goods to the buyer for a total amount of 118,000 rubles.

(including VAT at the rate of 18% - 18,000 rubles). The buyer paid for the goods in January 2022. The seller made the following entries in the accounting: Debit 62 Credit 90-1

- 118,000 rubles.

– revenue from sales of goods in 2018 is reflected; Debit 90-3 Credit 68 subaccount “Calculation of VAT”

- 18,000 rubles.

– VAT is charged on proceeds from the sale of goods at a rate of 18%. Debit 51 Credit 62

- 118,000 rub. – payment received from the buyer in 2022.

Before the introduction of the new VAT rate, at the end of 2022, it is beneficial for all sellers to draw up contracts in such a way as to have time to ship before the beginning of 2022. Even if the buyer doesn't pay until next year, the seller will benefit from the lower tax rate of 18 percent.

What else will change with the VAT increase?

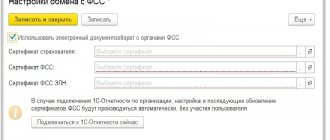

Due to changes in the VAT rate, the tax return, as well as the form of sales and purchase books, will change. Accounting programs will also need to make some adjustments. However, our clients will not feel all these “organizational” changes – the transition from the “old” VAT to the new one will occur as usual.

In addition, simultaneously with the law increasing the VAT rate to 20%, amendments to the Tax Code were adopted, reducing the period for desk audits for VAT by a month (Federal Law No. 302-FZ dated August 3, 2018). The law has already come into force - on September 3, 2018, and inspectors are given two months to conduct their “camera work” on VAT. But the inspection will go faster only if the inspectors do not have suspicions or questions about the reporting and supporting documents. If they suspect the slightest violation, the inspection period will be extended by a month.

Any innovation in the rates and calculation of value added tax affects the activities of companies paying this tax. We’ll tell you what the threat is from the decision to increase VAT from January 1, 2022, from what date VAT 20 will be introduced, and how the authorities “mitigated” the consequences of the upcoming changes.

Payment 2022 – shipment 2022

Now let's consider another situation: how to apply the VAT rate if payment took place in 2022, and shipment took place in 2022.

VAT is determined both at the time of receipt of the advance payment and upon further shipment. If an advance payment of 100 percent was received in 2022, and shipment occurs in 2022, then VAT on the advance payment in 2022 must be charged at a rate of 18 percent. The same amount can be deducted in 2022 after shipment of the goods.

VAT on shipments in 2022 must be calculated at a rate of 20 percent. In this case, the date of conclusion of the contract and the presence of prepayment do not affect the shipping rate.

If a partial prepayment was received in 2022, and the shipment took place in full in 2022, in 2022 VAT must be charged on the advance payment at the rate of 18/118.

In 2022, shipments should take place at a rate of 20 percent. You must deduct VAT on the partial advance in an amount calculated at a rate of 18 percent. EXAMPLE 2. HOW TO CHARGE VAT FOR PAYMENT IN 2022 AND SHIPMENT IN 2019?

The price in the contract is indicated including VAT: in the amount of 118,000 rubles, including VAT of 18,000 rubles. When the supplier receives an advance for the entire contract amount, he must pay VAT at a rate of 18%. This will amount to RUB 118,888. × 18/118 = 18,000 rubles. On the date of shipment, the supplier must provide an advance payment using the calculation method at a rate of 20%. This will be 118,000 × 20/120 = 19,666 rubles. Even if the price of the goods remains the same, the amount of VAT will increase. The difference can be covered either at the expense of the buyer or at the expense of the seller.

How will the difference arising due to the VAT increase be covered at the expense of the buyer or at the expense of the seller? The answer to this question must be found in advance; the parties can formalize the decision in an additional agreement to the contract. It is better to do this before the beginning of 2019.

Correction of invoice for shipment from 2022 to 2022

What to do if a mistake was made earlier and discovered in 2022?

According to the rules of paragraph 7 of the Rules for filling out invoices, approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137, an invoice is corrected by drawing up a new copy of the invoice. It does not allow only correction of line 1. The serial number and date of correction are indicated in line 1a. If it is necessary to correct such an invoice issued in 2022 and earlier in 2022, column 7 indicates the VAT rate of 18%, that is, the VAT rate that was on the date of shipment of goods, works, services, transferred property rights.

How to create invoices?

If the buyer made an advance payment and then decided to pay an additional “delta” of two percent before shipment, there are two possible options for further actions.

First: if the difference that appeared due to the VAT increase is transferred in 2022, this is an additional payment of cost. VAT should be transferred from it at the rate of 18/118. For this difference, you need to issue an adjustment invoice or another advance invoice with a rate of 18/118.

Second: if the difference that appeared due to the VAT increase is transferred in 2022, this is an additional tax payment. You need to issue an adjustment invoice for the difference in tax amount.

At the time of shipment, the seller calculates VAT at a rate of 20 percent. And the tax, which is calculated on the basis of adjustment invoices, is accepted for deduction. But if the parties agree to make an advance payment this year, which is calculated taking into account the new rate, adjustment invoices will not have to be drawn up.

If the buyer is not a VAT payer, another document is drawn up instead of an adjustment invoice. This could be an accounting document.

VAT rate from the Contracts directory

Filling out the VAT rate in documents under a counterparty agreement is provided for the following types of agreements:

- With supplier;

- With a principal (principal) for sale;

- With a commission agent (agent) for sale;

- With a commission agent (agent) for purchase;

- With a factoring company.

To do this, a new detail has been added to the contract card : Filling out the VAT rate in documents .

Possible values of this attribute:

- Automatic (default);

- From the item card;

- Without VAT.

When recording a counterparty agreement, if the Filling in VAT rate field in the documents is not filled in, the program defaults to Automatic . PDF

The new method of filling out the VAT rate in documents is automatically recorded in the new information register VAT rates under contracts , which is used to store rates under contracts and fill out data in primary documents.

Let's consider the options for filling out VAT rates in documents from the contract in more detail.

Automatically

Filled in by default by the program when recording a contract, if the user has not filled in the data manually. In this case, the VAT rate is determined using the following algorithm: PDF

- if the VAT , then the rate from the item card is set;

- if the VAT is not filled in, the rate Without VAT .

From the item card

Filled in manually by the user in the contract card. The VAT rate will be taken from the item card. In the register VAT Rates for Contracts, the method of filling out the rate is indicated. From the item card .

Without VAT

Filled in manually by the user in the contract card. In the VAT Rate for Contracts register, the method of filling out the rate Without VAT .

There is no provision for filling out the VAT rate under the contract in documents for the types of contracts:

- With buyer;

- With the committent (principal) for the purchase;

- Other.

In this case, the default VAT rate is indicated: PDF

- if the organization is a VAT payer - 20% from 2022 and 18% until 2019;

- if the organization is not a VAT payer - Without VAT .

What to do before January 2022

There are a number of ordinary, but important things that an accountant needs to do before the beginning of 2022, so that there are no problems with either partners or the tax office.

Conduct an audit of contracts that were concluded in 2022 (or earlier) and continue to be valid in 2022. Together with the director, agree with business partners at whose expense the difference arising from the tax increase will be covered. Draw up and sign additional agreements to contracts regarding the cost of goods, works, and services. Or terminate previously concluded contracts and sign new ones with a VAT rate of 20 percent.

Don’t forget to determine in advance how to organize the company’s document flow if the partners cover the difference arising from the VAT increase at their own expense. You can issue a correction invoice or another advance invoice.

Retail companies need to remember to update their online checkout software. When selling goods in 2022 that will be shipped in 2022, VAT of 20 percent must be indicated on receipts. And, of course, update the accounting software to take into account the new VAT rate.

Changes in the cost of goods shipped in 2022

It happens that after the shipment of goods, works, services, transferred property rights, the seller and the buyer agree on price changes.

In this case, the seller must issue an adjustment invoice to the buyer no later than five calendar days from the date of drawing up a document confirming the buyer’s consent (fact of notification) to change the cost of shipped goods. This requirement is established by paragraph 3 of Article 168 of the Tax Code of the Russian Federation. Such an adjustment invoice, among other indicators, indicates the tax rate and the amount of tax determined before and after changes in the cost of shipped goods, works, services, and transferred property rights. Since the shipment took place in 2022, when the VAT rate was 18%, then if the cost of shipped goods, works, services, transferred property rights in 2022 changes in column 7 of the adjustment invoice, the VAT rate of 18% is indicated, that is, the same the VAT rate, which was indicated in column 7 of the invoice to which the adjustment invoice was drawn up.

What will the VAT increase bring?

According to the government, the VAT increase for 2022 in the Russian Federation will not affect ordinary citizens. Thanks to this, it is expected to receive a larger volume of budget payments coming from the gas and oil industry. This will make it possible to finance social projects, which will benefit ordinary Russians.

However, financial experts also predict an increase in inflation (by 0.5-1 point). The industries that will suffer the most from the increased tax are construction, the automobile industry, and mechanical engineering, which already suffered a lot during the crisis.

Back

Updating and reflashing cash registers for VAT 20%

The Federal Law on increasing VAT entails not only the re-issuance of documentation, but also the re-flashing of online cash registers.

There are three types of online cash registers that require their own approach to reflashing.

- Autonomous cash registers that work independently of a computer. Independent flashing of such devices must be carried out in strict accordance with the attached instructions.

- Fiscal registrars operating under computer control. Not only the cash register requires updating, but also the software installed on the PC.

- Smart terminals. You can reflash some models only after removing the seal, which is a reason for refusing warranty service. It is recommended to upgrade smart terminals only at service centers. But some manufacturers have prepared for such changes in advance. For example, the company Evotor, which produces and services smart terminals, has released an update for its models, which is fully adapted to calculate VAT at 20%. You can download the updated Evotor software here.

Although you can update cash registers yourself, we strongly recommend that you do the flashing at certified service centers. This way you can save time, nerves and money. Errors in reporting that may occur during self-updating will cost more than professional services.

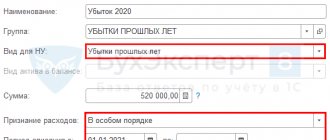

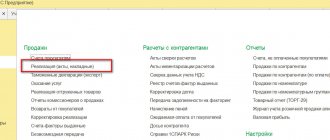

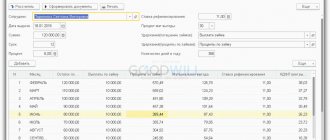

Transition period for VAT using examples in 1C: Enterprise Accounting 8

Published 12/13/2018 23:49 Author: Administrator In this article we will focus on how to prepare and what to change in your work during the transition period from an 18% VAT rate to 20% (Federal Law No. 303-FZ of 03.08. 2018) The law comes into force on January 1, 2019 and applies to the shipment of goods (work, services), property rights, starting from this date. For food, medical and some other socially important goods from the List approved by the Government of the Russian Federation, the VAT rate of 10% remains the same.

The Federal Tax Service of Russia has issued clarifications for the transition period (SD-4-3 / [email protected] dated 10/23/2018), which we will discuss in detail.

The new VAT rate of 20% applies to shipments from January 1, 2022. (calculated rate for advances 20/120) regardless of when the contract was concluded.

Let's check existing contracts for compliance with the new conditions:

— If the contract price is set without VAT, that is, VAT is charged on top of the cost of goods (work, services), property rights: you don’t have to change anything.

— If the contract is concluded without specifying a price, i.e. the contract price is established by additional documents (additional agreement, specification): only the annex that establishes the contract price changes.

-If the contract price is indicated with the addition of the amount of VAT 18% in excess of the cost of goods (work, services), property rights: in the additional agreement you can indicate “a change in the VAT rate of 20% on the basis of Federal Law No. 303-FZ of 08/03/2018.” The cost of goods (work, services), property rights remains the same. In addition The agreement must fix the procedure and terms for additional payment of VAT under transition period agreements.

-If the contract price includes “incl. VAT 18%” and the buyer refuses to change the contract price: it is necessary to allocate VAT by calculation at a rate of 20/120. Such a change is formalized by an additional agreement so that it is clear that the supplier has charged VAT at a rate of 20% (risks in controversial situations when resolving business issues can be recognized “at the expense of the supplier”).

With this option, the supplier’s revenue and, accordingly, profit will be 1.67% less (118/120*100=98.33; 100-98.33=1.67).

Let's consider business situations:

1. Situation “with advance payment for 2022”

— Contract 2022, advance payment in December 2022, shipment in 2019.

- Compiled additional agreement (we fix the VAT rate at 20%).

Attention, possible error No. 1: after signing an additional agreement with a VAT rate of 20%, the buyer plans to pay in 2022. indicated a rate of 20%.

In this case, the seller issues an advance invoice at the rate of 18/118, no adjustment invoice is required.

— Shipment 2022

Attention, possible error No. 2:

— Additional VAT payment (2%) has been received in 2022.

Such an additional payment is considered an additional payment for the cost of goods (work, services), property rights, and VAT is calculated on it at the rate of 18/118. There is an overestimation of the paid price of the goods and an underestimation of the paid VAT.

The seller has a “second advance” date of 2022. draws up an adjustment invoice for the advance for the difference between the amount of the “first advance” for 2022. at a rate of 18/118 and “second advance” at a rate of 18/118.

— Additional VAT payment (2%) has been received in 2022. The buyer pays the difference (2%) in VAT rates before the date of shipment of the goods (work, services).

In this case, the additional payment should not be considered as an advance, but should be considered as an additional tax payment.

The seller, on the date of receipt of the surcharge, issues to the buyer an adjustment invoice for the advance payment for the difference between the amount of tax for the “first advance payment” of 2022, drawn up earlier using the VAT rate of 18/118 and the amount of tax taking into account the surcharge of 2%.

In 1C: Accounting, the operation “Adjustment invoices for advance payments” will be implemented in version 3.0.67. At the time of writing this article, this operation is not available, but we will definitely talk about it later.

If the 2022 invoice from the supplier was received in 2022, then goods (work, services), property rights are accepted for deduction at the VAT rate of 18%, as indicated in the supplier’s invoice.

2. The “postpaid 2022” situation

Contract 2022, VAT rate 18%, shipment in December 2022, postpayment in 2022.

In the payment order for shipment 2022. and with deferred payment (payment transfer to 2022), we indicate the VAT rate as in the supplier’s shipping documents (18%).

3. Return of goods in 2022

In 2022 The approach to reflecting VAT when returning goods has been changed (clause 1.4 of the explanations of the Federal Tax Service of the Russian Federation SD-4-3 / [email protected] dated 10/23/2018)

— In the case of a return (partial return) of goods accepted for registration, the seller will NOT receive an invoice from the buyer for the return sale (since the buyer in this case will be required to draw up an invoice with a VAT rate of 20%). The seller himself issues an adjustment invoice at a rate of 18%.

In the same way, returns of goods shipped in 2019 are processed. The VAT rate will be 20%.

— In the case of returning goods not accepted for registration in 2022, the general rule applies: the seller draws up an adjustment invoice at the VAT rate in effect on the date of shipment to the buyer.

The rules for drawing up adjustment invoices are discussed in more detail in the articles:

— Atypical situations: adjustment invoice in 1C: Accounting (rules for reflecting the buyer)

— Atypical situations: adjustment invoice in 1C: Accounting (rules for reflecting with the seller)

Author of the article: Irina Kazmirchuk

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

JComments

Misconception No. 1. Changes in legislation should not worsen the situation of a businessman

Oh, how wonderful it would be if this were really so! In the meantime, legislative innovations rarely take business interests into account. Thus, after the VAT increase, the majority of merchants who previously entered into contracts under Federal Law N 44-FZ “On the contract system in the field of procurement...” will be trapped: after all, the contract price includes 18% VAT, and 20% will need to be paid to the budget. Moreover, according to the law, the contract price in most cases cannot be changed ─ it is fixed and is determined for the entire period of execution of the contract (Article 34 of Federal Law No. 44-FZ).

VAT has been increased, but the law does not allow changing the contract price! And no transition period for you!!!

Officials very “competently” divided the financial result in such a situation (Letter dated August 20, 2018 N 24-03-07/58933):

Risks and losses go to business, and additional income from increasing the tax rate goes to the state! And, naturally, no one will compensate the businessman for his losses.