Legal regulation

Treasurers are a separate type of state and municipal organizations created to carry out state tasks and municipal tasks or carry out the functions of government bodies, financed from the corresponding budget on the basis of budget estimates. The rules for organizing and maintaining accounting in government institutions regulate:

- Law No. 402-FZ regarding key issues of accounting organization;

- Instruction No. 157n and Instruction 162n in budget accounting in 2022 for government institutions;

- Instruction No. 132n regarding the formation of budget classification codes to reflect transactions in corporate accounting;

- Instruction No. 191n regarding the composition and procedure for reporting in government organizations;

- Order No. 209n regarding the formation of KOSGU;

- federal accounting standards regulating industry accounting methods;

- methodological recommendations, letters and explanations of the Ministry of Finance of the Russian Federation and individual departments regarding the settlement of issues related to accounting.

The main system of regulatory regulation of accounting includes regional and municipal regulations that establish separate rules for accounting and reporting.

Features of accounting in budgetary, autonomous and government institutions

The table below examines comparisons in the differences between accounting in a budgetary, state-owned and autonomous institution.

| Peculiarities | State-financed organization | State institution | Autonomous institution |

| Participation of the founder in the management of funds | Participates | Participates | Does not participate |

| Opening accounts | In the Federal Treasury | In the Federal Treasury | At any bank institution |

| Receipt of funding | Within the budget of income and expenses | Within the budget of income and expenses | Subsidies and subventions |

| Income from activities | Available to the institution | Receives budget revenue | Available to the institution |

| Right to dispose of property | Available | Not available | Available |

| Conducting transactions with securities | Not implemented | Not implemented | Are being carried out |

| The right to use the simplified tax system | Absent | Absent | Available |

New in budget accounting in 2022

In 2022, accounting, reporting and taxation of a government institution is carried out with the mandatory application of the new Federal Accounting Standards:

- “Personnel payments”;

- "Intangible assets";

- "Non-produced assets";

- "Borrowing costs";

- "Cooperative activity";

- “Information about related parties”;

- "Financial instruments".

Apply the standards in accounting from 01/01/2021, and in reporting - starting from reporting 2022.

In 2022, the following FSBs were introduced:

- "Stocks";

- "Concession agreements";

- “Long-term contracts”;

- “Reserves. Disclosure of information about contingent liabilities and contingent assets";

- “Budget information in accounting (financial) statements.”

Starting from reporting in 2022, the provisions of the Federal Accounting Standards Service “Statement of Cash Flows” are applied, which relate to the reflection of information on derivative financial instruments. In addition, take into account the changes when preparing annual reports for government institutions for 2022: The Ministry of Finance has adjusted instructions No. 33n and 191n (Orders No. 292n dated November 30, 2020, No. 311n dated December 16, 2020). Here's what's changed:

- new accounts have been added to the certificate of availability of property and liabilities on off-balance sheet accounts (form 0503130);

- for Information on accounts receivable and payable (form 0503169) established new requirements for filling out KOSGU 560, 660, 730, 830;

- in Information on changes in balance sheets (form 0503173) included a new section.

New accounting standards from 2022

Seven new FSBUs have determined that accounting will be conducted in a new way in 2022. Accounts and instructions for accounting in government institutions were changed in 2022, and a procedure for accounting for intangible and non-produced assets was introduced. Read more about these changes in the article “Understanding the New Accounting Standards.”

From 2022, all payments to staff are divided into two groups:

- current - wages;

- deferred - vacation pay.

The procedure for assessing and accounting for employee benefits depends on the group. Current ones are taken into account as part of accepted obligations for wages and accruals on them, and deferred ones are taken into account as part of a reserve, on account 0 401 60 000.

From January 2022, the rights to use intangible assets are reflected in new sub-articles of KOSGU:

- non-exclusive rights with a certain useful life - 352, 452;

- non-exclusive rights with an indefinite useful life - 353, 453.

The requirements for reflecting rights to land plots in the reports of budgetary institutions have been changed. If the “Non-produced assets” standard is applied for the first time, land plots on the balance sheet and included in the Unified State Register of Real Estate should be revalued to cadastral value.

Government organizations need to adjust local documents regulating methods and methods of accounting, that is, update accounting policies. These changes should have been approved in December 2022. Check whether all changes are included in the accounting policies for 2022 in the article “Accounting policies: how to prepare according to new requirements.”

Pay attention to the article on how to properly maintain accounting of bank guarantees.

We answer your questions

>Question: Please tell me the entries for a government institution in 2022 when reflecting a budget obligation based on a concluded agreement with a single service provider? Do I need to use account 50217?

Answer: The specified transaction is reflected in the following accounting entry: Debit 1,501 13,000 Credit 1,502 11,000.

More on the topic: Help for concluding accounts (f. 0503110, f. 0503710): changes and features of filling out in 2022 (Video materials for annual reporting 2022 - topic

Published 05/25/2017

Other changes

Officials have adjusted almost all existing budget accounting instructions. The Ministry of Finance has published a new procedure for the formation of budget classification codes to reflect income and expenditure transactions - Order No. 85n dated 06/06/2019 as amended by Order No. 267n dated 11/16/2020. The general structure of the KBK has been preserved, but there are changes, and there are quite a lot of them.

The innovations also affected the current procedure for the formation of KOSGU. When accounting, the new edition of Order No. 209n is applied. New accounting codes have been added, the names of some old ones have been changed, and some have been completely eliminated.

Instruction 162n was amended by Order No. 246n dated October 28, 2020. The adjusted table of the government institution's chart of accounts for 2022 is as follows:

| Account name | Account number | |||||||||

| code | ||||||||||

| analytical according to BC | type of activity | synthetic accounting | analytical according to KOSGU | |||||||

| accounting object | groups | kind | ||||||||

| account digit number | ||||||||||

| 1–17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | |

| 1 | 2 | |||||||||

| BALANCE ACCOUNTS | ||||||||||

| Section 1. NON-FINANCIAL ASSETS | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Fixed assets | 0 | 0 | 1 | 0 | 1 | 0 | 0 | 0 | 0 | 0 |

| Fixed assets - real estate of the institution | 0 | 0 | 1 | 0 | 1 | 1 | 0 | 0 | 0 | 0 |

| Increase in the value of residential premises - real estate of the institution | 0 | 0 | 1 | 0 | 1 | 1 | 1 | 0 | 0 | 0 |

| Decrease in the value of residential premises - real estate of the institution | 0 | 0 | 1 | 0 | 1 | 1 | 1 | 3 | 1 | 0 |

| Fixed assets - other movable property of the institution | 0 | 0 | 1 | 0 | 1 | 3 | 0 | 0 | 0 | 0 |

| Intangible assets | 0 | 0 | 1 | 0 | 2 | 0 | 0 | 0 | 0 | 0 |

| Non-produced assets | 0 | 0 | 1 | 0 | 3 | 0 | 0 | 0 | 0 | 0 |

| Land - immovable property of the institution | 0 | 0 | 1 | 0 | 3 | 1 | 1 | 0 | 0 | 0 |

| Depreciation | 0 | 0 | 1 | 0 | 4 | 0 | 0 | 0 | 0 | 0 |

| Depreciation of the institution's real estate | 0 | 0 | 1 | 0 | 4 | 1 | 0 | 0 | 0 | 0 |

| Depreciation of non-residential premises (buildings and structures) - real estate of the institution | 0 | 0 | 1 | 0 | 4 | 1 | 2 | 0 | 0 | 0 |

| SECTION 2. FINANCIAL ASSETS | 0 | 0 | 2 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Institutional funds | 0 | 0 | 2 | 0 | 1 | 0 | 0 | 0 | 0 | 0 |

| Funds of the institution in personal accounts with the treasury authority | 0 | 0 | 2 | 0 | 1 | 1 | 1 | 0 | 0 | 0 |

| Receipts of funds from the institution to personal accounts with the treasury authority | 0 | 0 | 2 | 0 | 1 | 1 | 1 | 5 | 1 | 0 |

| Disposal of the institution's funds from personal accounts with the treasury authority | 0 | 0 | 2 | 0 | 1 | 1 | 1 | 6 | 1 | 0 |

| Funds of the institution in a credit institution | 0 | 0 | 2 | 0 | 1 | 2 | 0 | 0 | 0 | 0 |

| SECTION 3. OBLIGATIONS | 0 | 0 | 3 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Settlements on debt obligations in rubles | 0 | 0 | 3 | 0 | 1 | 0 | 0 | 0 | 0 | 0 |

| Calculations for accepted obligations | 0 | 0 | 3 | 0 | 2 | 1 | 1 | 0 | 0 | 0 |

| Payroll calculations | 0 | 0 | 3 | 0 | 2 | 1 | 1 | 0 | 0 | 0 |

| Calculations for accruals for wage payments | 0 | 0 | 3 | 0 | 2 | 1 | 3 | 0 | 0 | 0 |

| Calculations for works and services | 0 | 0 | 3 | 0 | 2 | 2 | 0 | 0 | 0 | 0 |

Reflection of transactions in the accounting of a government institution

State institutions organize accounting and preparation of budget reporting in accordance with the provisions of:

- Instructions, approved Order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n (hereinafter referred to as Instruction No. 157n);

- Instructions for the use of the Chart of Accounts for Budget Accounting, approved. Order of the Ministry of Finance of Russia dated December 6, 2010 No. 162n (hereinafter referred to as Instruction No. 162n);

- Instructions on the procedure for drawing up and submitting annual, quarterly and monthly reports on the execution of budgets of the budget system of the Russian Federation, approved. By Order of the Ministry of Finance of Russia dated December 28, 2010 No. 191n (hereinafter referred to as Instruction No. 191n).

According to the provisions of paragraphs. 262, 276 of Instruction No. 157n and paragraph 104 of Instruction No. 162n, accounting for settlements on budget revenues between the administrator of budget revenues and a government institution is carried out using accounts 1 303 05 000 “Settlements for other payments to budgets”, 1 304 04 000 “Internal departmental settlements” " The corresponding calculations are reflected by issuing Notices (f. 0504805).

A government institution that is not a revenue administrator, when depositing cash into an account to be transferred to budget revenue, can immediately indicate the details of the administrator of these cash receipts (see, in particular, Letter of the Ministry of Finance of Russia and the Federal Treasury dated June 2, 2011 No. 02-03-06 /2530/42-7.4-05/5.3-366). In this case, the funds go bypassing the personal account of the recipient of budget funds directly into budget revenue (to the personal account of the budget revenue administrator).

However, as a rule, government institutions that are not their administrators transfer the income received to the cash desk to the personal account of the recipient of budget funds, and then transfer it to income from this personal account. That is, initially these funds are reflected in the personal account of a government institution as a recovery of cash expenses. Accordingly, operations for the receipt of funds at the cash desk, as well as for the movement of funds between accounts and the cash register, should be reflected as a movement of budget “expenses”. Taking into account the provisions of Instruction No. 162n, the accounting entries in this case will look like this:

- Debit KIF 1,201 34,510 (decrease in off-balance sheet account 18 for the “expenses” KOSGU) Credit KDB 1,209 ХХ 660, 1,205 ХХ 660 - income was received by the cash desk of a government institution (clause 49 of Instruction No. 162n);

- Debit KRB 1 210 03 560 (decrease in off-balance sheet account 18 for “expenditure” KOSGU) Credit KIF 1 201 34 610 (increase in off-balance sheet account 18 for “expenditure” KOSGU) – funds handed over from the cash desk for depositing into the personal account of the recipient of budget funds, open to a government institution (clause 92 of Instruction No. 162n);

- Debit KRB 1 304 05 XXX Credit KRB 1 210 03 660 (increase in off-balance sheet account 18 for the “expenditure” KOSGU) - funds are credited to the personal account of the recipient of budget funds (clause 111 of Instruction No. 162n);

- Debit KDB 1 304 04 1ХХ (4ХХ) Credit KDB 1 303 05 730 – a Notice (f. 0504805) was sent to the cash receipts administrator with information about the funds planned to be received as budget income (clause 104 of Instruction No. 162n).

- Debit KDB 1 303 05 830 Credit KRB 1 304 05 ХХХ - funds were transferred to the administrator of the corresponding cash receipts (clause 111 of Instruction No. 162n);

More on the topic: Accounting policy of the institution

The use of off-balance sheet account 18 in the situation under consideration is explained by the fact that, in fact, the restoration of cash expenses is reflected in the accounting of a government institution.

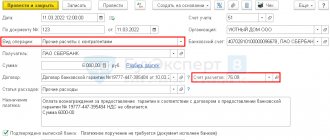

Authorization of expenses in budget accounting

A distinctive feature of accounting in government organizations is the mandatory authorization of expenses incurred. Transactions are reflected in special accounts PAS - 0 500 00 000. An account is used to reflect obligations of the current period and plan years. 0 502 00 000 “Liabilities”. Please note that it is necessary to register transactions only on the basis of documents confirming the fact of accepting a specific obligation. The list of such documentation that the organization uses in its activities should be fixed in the accounting policy.

Accounting entries for authorizing expenses of government organizations should be reflected in the context of creditors, contracts and agreements and other analytical indicators that are established for the accounting entity in its accounting policies. Consolidation and generalization of information, bypassing the organization of reliable analytical accounting, is unacceptable. Balances of accepted obligations at the end of the reporting year are subject to mandatory re-registration in the next period.

Current postings for authorization in a government institution with examples for 2022:

| Contents of operation | Debit | Credit |

| The amount of obligations assumed under a contract concluded as a result of competitive methods of identifying suppliers, performers, and contractors | 0 502 07 000 | 0 502 01 000 |

| Operation in other cases of acceptance of obligations | 0 506 00 000 | 0 502 01 000 |

| Amounts accepted by the institution at the expense of previously formed deferred liabilities | 0 502 09 000 | 0 502 01 000 |

How to correctly prepare any accounting entries, read the article “Accounting entries: what they are and how they are used.”