In previous articles, we examined in detail the issue of business taxation, examining in detail LLC taxes, individual entrepreneur taxes, and a new tax for the self-employed. But regardless of whether you are in business or not, you will still have to pay taxes for individuals.

We'll talk about them today. You will learn about what taxes individuals pay in Russia, what benefits exist, compare Russian taxes with other countries and tell you about possible ways to pay less taxes. First, let's look at the definition of tax and the types of taxes existing in Russia, after which we will tell you about each tax in more detail.

Personal income tax (NDFL)

The first tax that will be discussed must be paid by every resident of Russia engaged in labor activity. The object of taxation is the income received by Russian citizens both on the territory of our country and abroad. Non-residents pay this tax only on income received in the Russian Federation.

The tax period for personal income tax is a calendar year. The tax base is recognized as all income of the taxpayer received by him during the tax period. The legislation identifies the following types of income that must be taken into account when calculating tax:

- Income in cash,

- Income in kind,

- Income received in the form of material benefits,

- The taxpayer's rights to dispose of income.

Cash income includes:

- Income from professional activities,

- Income from the sale of real estate, vehicles, etc.,

- Income from rental of real estate or other property,

- Income from equity participation in organizations received in the form of dividends

- Income from winnings in the lottery, sweepstakes (from 4,000 rubles per year), etc.

Let's take a closer look at what is meant by other options. When a taxpayer receives income from organizations in kind (in the form of goods, work, services, property), the tax base is determined as the cost of these goods (work, services, property). income in the form of material benefits:

- savings on interest for the taxpayer’s use of borrowed (credit) funds received from organizations or individual entrepreneurs;

- acquisition of securities, financial instruments of futures transactions;

- acquisition of goods (work, services) in accordance with a civil contract from individuals, organizations and individual entrepreneurs who are interdependent in relation to the taxpayer.

According to the method of paying this tax, all taxpayers can be divided into two groups:

- Hired employees. The employer pays the tax for them. He must do this no later than the next day after salary payment.

- Individuals who must pay tax themselves . This category includes individual entrepreneurs, self-employed, privately working notaries and lawyers. Also, those who sold property or received other types of income from which tax was not withheld pay their own income tax. In this case, the payer must submit a declaration by April 30 of the next year and pay the tax by July 15.

The personal income tax rate for citizens of the Russian Federation is generally 13 %. For non-residents it is 15% when receiving dividends from participation in the authorized capital of organizations and 30% in other cases. For some types of income, the tax rate increases to 35% (clause 2 of Article 224 of the Tax Code of the Russian Federation).

In addition to 13%, the employer is obliged to transfer contributions to insurance funds in the amount of 30% (Chapter 34 of the Tax Code of the Russian Federation):

- 22% - for compulsory pension insurance,

- 5.1% - for compulsory health insurance,

- 2.9% - for compulsory social insurance.

In accordance with the law, the following categories of transactions and taxpayers are exempt from paying personal income tax:

- State benefits and one-time financial assistance,

- Pensions of all types and alimony,

- Income from the sale of property that has been owned for more than five years

- Receiving an inheritance or gifts from close relatives,

- Grants and international awards,

- Interest income from bank deposits,

- Sale of crop, livestock and beekeeping products grown on private farms,

- Sale of property worth up to 250 thousand rubles,

- Prizes for athletes for participation in the Olympic Games and World Championships, etc.

As benefits for other categories of citizens, tax deductions are provided, which allow them to receive part of previously paid income tax. We will look at tax deductions in detail in the next article, but now we will simply list their main types:

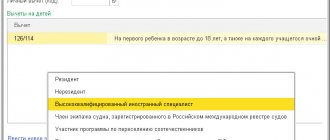

- Standard (3000, 500, 1400 rubles) - for preferential categories of citizens,

- Social (25% of the amount of income, in the amount for training, for treatment services, in the amount of the cost of medicines, but not more than 120 thousand rubles),

- Property (in amounts received from the sale of real estate no more than 1 million rubles; sales of other property no more than 250 thousand rubles; in the amount of actual expenses incurred for new construction or acquisition of real estate, but no more than 2 million rubles and 3 million rubles when repaying interest on target (mortgage) loans),

- Professional (20% of the income of an individual entrepreneur).

Taxes on individuals in Russia

Let's take a closer look at all existing taxes for individuals, incl. how to find out about existing tax debts, how to pay them off, what to pay attention to when calculating taxes on existing property and transactions.

Object of taxation for individuals

The object of taxation for individuals is income (salary, inheritance, gifts, dividends...) and property (apartments, cars, dachas...). It is important to know that illegal income will not only incur administrative or criminal liability, but also pay taxes.

Who is the taxpayer

Tax payers can be adult and minor citizens of Russia (actually staying on the territory of Russia for at least 183 calendar days over the next 12 consecutive months) and non-residents - persons carrying out activities on the territory of the Russian Federation with citizenship of other states.

- Minors and minor children can own property, incl. by inheritance, which is the object of taxation. The responsibility for payment falls on the shoulders of parents and legal representatives.

- In addition, resident individuals (spending 183 or more days a year within the country) and non-residents of the Russian Federation are required to pay taxes.

Property tax for individuals

Taxpayers of property tax for individuals are individuals who have the right of ownership of property recognized as an object of taxation. The objects of taxation for property tax include:

- House;

- apartment, room;

- garage, parking place;

- single real estate complex;

- unfinished construction project;

- other building, structure, structure, premises.

In general, the tax base is the cadastral value of all objects owned by the taxpayer. If local authorities have not decided to switch to the “cadastral” method of calculation, then until 01/01/2020 property tax can be calculated on the basis of inventory value. Let's look at the differences in tax calculation for cadastral and inventory values.

The inventory method evaluates objects based on the cost of the materials from which they are built, as well as taking into account their wear and tear. Thus, the inventory value is the replacement price of the property minus depreciation. This method was developed in the 60s of the last century and is now considered obsolete.

This system is especially beneficial for owners of older properties because wear and tear, along with obsolete materials, significantly reduces the tax base. In addition, the cost of such property can be up to 10 times lower than its market price.

Unlike the inventory value, the cadastral value of any real estate is formed by many different parameters. These include: the number of floors of a building or structure, convenience, location, category of the object, service life, infrastructure, availability of parking, security, etc.

This method of assessment increases the tax base and, as a consequence, property tax, because The cadastral value is closer to the market value, although it remains 1.5 - 2 times lower.

The tax rate is set at the local level in the range from 0.1% to 2% (Article 406 of the Tax Code of the Russian Federation ). The rate depends on the type, method of calculation and value of the property.

- Cadastral method

Tax rates are established by the regulations of each region separately, but they should not exceed:

- 0,1% (almost all types of real estate: houses, apartments, garages, outbuildings, etc.),

- 2% (in relation to taxable objects provided for in paragraphs 7 and 10 of Article 378.2 of the Tax Code, as well as for real estate, the cadastral value of which exceeds 300 million rubles),

- 0,5% (for other taxable items).

If tax rates are not determined by regulatory legal acts of municipalities or federal cities, then taxation is carried out at the tax rates specified in the Tax Code.

- Inventory method

When calculating the tax from its inventory value, the total inventory value of taxable objects is taken into account, multiplied by a deflator coefficient (taking into account the taxpayer’s share in the common ownership of each of such objects):

- Up to 300 thousand rubles. inclusive – no more than 0.1%,

- From 300 thousand rubles. up to 500 thousand rubles. – from 0.1% to 0.3%,

- Over 500 thousand rubles. – from 0.3% to 2%.

If tax rates are not determined by the regulatory legal acts of municipal bodies, taxation is carried out at a tax rate of 0.1% (for a total inventory value of up to 500 thousand rubles) and 0.3% in all other cases.

Each region has the right to establish differentiated rates depending on the total cadastral or inventory value, the type of taxable object and its location. Property tax for individuals is calculated for the year and is payable before December 1 of the following year (Article 409 of the Tax Code of the Russian Federation).

benefits when paying this type of tax, among them: heroes of the USSR and heroes of Russia; disabled people of groups I, II and disabled children; pensioners; military personnel who took part in hostilities or nuclear weapons testing; immediate relatives of military personnel who died while performing a combat mission, etc. Local authorities may establish additional benefits for citizens not listed in the list of federal benefits.

If property tax is calculated on the territory of a constituent entity of the Russian Federation based on the cadastral value of objects, the following tax deductions provided for by the Tax Code are applied:

- for an apartment or part of a residential building, the cadastral value is reduced by the cadastral value of 20 square meters, and for a room - 10 square meters of total area;

- for a residential building, the cadastral value is reduced by the cadastral value of 50 square meters of area (at the same time, houses and residential buildings located on land plots provided for personal farming, dacha farming, vegetable gardening, horticulture, individual housing construction are classified as residential buildings) ;

- for a single real estate complex, which includes at least one residential building, the cadastral value is reduced by one million rubles;

- if there are three or more minor children, the cadastral value of the taxable property is reduced by 5 square meters of apartment area and 7 square meters of house area per each minor child.

For taxable objects that are in common shared ownership, the tax is calculated for each participant in shared ownership in proportion to his share in the right of ownership, and for objects of common joint ownership - for each participant in equal shares.

What is professional income tax

The professional income tax is a new type of taxation that began as an experiment, but in 2022 it will apply throughout Russia. The regime is called preferential or special because it exempts individuals from paying personal income tax at a rate of 13%.

The concept of professional income is established in Article 2 of Law No. 422-FZ of November 27, 2018: “Income of individuals from activities in which they do not have an employer and do not attract employees under employment contracts, as well as income from the use of property.” NAP payers can be not only ordinary individuals, but also those who have registered individual entrepreneurs.

Separately, it is worth mentioning the reservation regarding employers. Payers of professional income tax can simultaneously work under an employment contract, but not in the type of activity for which they are recognized as self-employed. Moreover, the law states that the tax payer cannot provide services or perform work for a customer who was his employer less than two years ago. This was done specifically to prevent mass layoffs of hired workers and their transfer to NAP payers.

At its core, the tax on professional income is closest to the simplified tax system Income regime. Here, too, to calculate the tax base, only income received without expenses incurred is taken into account. However, compared to the simplified tax system, income restrictions in the regime for the self-employed are greater.

| USN Income | Professional income tax |

| Annual income – no more than 219.2 million rubles (*) | Annual income – no more than 2.4 million rubles |

| You can hire up to 130 workers under GPC and labor contracts (*) | Workers under employment contracts cannot be hired |

| You can engage in trade, production, services, works | You cannot engage in trade; the types of activities are services, work and the sale of goods of your own production. |

(*) The simplified tax system is subject to not only regular, but also increased limits. Tax rates depend on compliance with limits.

You can become self-employed with Sberbank right now. Leave a request in the service and receive all the advantages of the application from the Federal Tax Service, plus additional benefits from Sberbank.

Become self-employed with Sberbank

Land tax

The next tax that your property is also subject to is land tax. Payers of land tax are individuals who own land plots recognized as an object of taxation in accordance with Art. 389 of the Tax Code of the Russian Federation, on the right of ownership, the right of permanent (perpetual) use or the right of lifelong inheritable possession (clause 1 of Article 388 of the Tax Code of the Russian Federation).

Individuals are not recognized as taxpayers in relation to land plots that are in their gratuitous use, including gratuitous fixed-term use or transferred to them under a lease agreement.

The object of taxation is land plots located on the territory of municipalities in whose territory the tax has been introduced. The following are not recognized as objects of taxation:

- Land plots occupied by particularly valuable cultural and archaeological heritage sites, nature reserves, museums or world heritage sites,

- Land plots from the forest and water resources,

- Land plots included in the common property of an apartment building,

- Land plots withdrawn from circulation in accordance with the legislation of the Russian Federation.

The tax base for land plots that are in common shared ownership is determined for each of the taxpayers who are the owners of this land plot in proportion to its share in the common shared ownership, and in the case of being in common joint ownership - in equal shares.

The tax base is defined as the cadastral value of land plots recognized as an object of taxation in accordance with Art. 389 Tax Code of the Russian Federation. Information on the cadastral value of land plots is posted on the official website of Rosreestr on the Internet. The tax period for land tax is one year; the tax must be paid before December 1 of the following year.

Land tax rates are established by regulatory legal acts of municipalities and cities of federal significance and cannot exceed:

- 0,3% cadastral value for agricultural lands, lands acquired for personal subsidiary plots not used in business activities, as well as housing lands and their infrastructure,

- 1,5% cadastral value of other land plots.

Let us pay attention to some features of the calculation of land tax described in Art. 396 Tax Code of the Russian Federation. In the event that a taxpayer acquires (terminates) during the tax (reporting) period the right of ownership (perpetual use, inheritable possession) to a land plot (its share), the tax amount is calculated taking into account a coefficient defined as the ratio of the number of full months during which this the land plot was owned by the taxpayer by the number of calendar months in the tax (reporting) period.

If the emergence of the right of ownership or use occurred before the 15th day of the corresponding month, inclusive, or the termination of the specified right occurred after the 15th day of the corresponding month, the month of occurrence (termination) of the specified right is taken as the full month.

If the emergence of the right or use occurred after the 15th day of the corresponding month or the termination of the specified right occurred before the 15th day of the corresponding month inclusive, the month of occurrence (termination) of the specified right is not taken into account when determining the coefficient specified in this paragraph. The tenure period is calculated similarly for other property taxes.

The list of categories of citizens who are entitled to receive land tax benefits is similar to the preferential categories for property tax. For them, the tax base is reduced by the cadastral value of 600 square meters of land area owned, permanent (perpetual) use or lifetime inheritable possession of taxpayers.

Also added to this list are the indigenous peoples of Russia (in relation to land plots used for the preservation and development of their traditional way of life, farming and crafts), who are exempt from paying land tax.

Transport tax

Transport tax is a regional tax. Payers of transport tax are persons on whom, in accordance with the legislation of the Russian Federation, vehicles recognized as an object of taxation are registered (Article 358 of the Tax Code of the Russian Federation).

The objects of taxation are: cars, motorcycles, scooters, buses, trucks and other self-propelled machines and mechanisms, airplanes, helicopters, motor ships, yachts, sailing ships, boats, snowmobiles, motor sleighs, motor boats, jet skis, non-self-propelled (towed vessels) and others water and air vehicles registered in accordance with the established procedure in accordance with the legislation of the Russian Federation.

In other words, if a vehicle that drives, flies or floats is registered to you, then you automatically become a payer of this tax.

The following types of vehicles are exempt from tax: cars equipped for use by disabled people; fishing vessels; watercraft or aircraft carrying out passenger or cargo transportation; vehicles registered to agricultural producers and used for the production of agricultural products; planes and helicopters of air ambulance and medical service, etc.

The tax is calculated as follows:

Depending on the type of vehicle, the tax base for calculating tax is calculated in one of the following ways:

- as engine horsepower in relation to vehicles having engines;

- as thrust is the total thrust of jet engines in kilograms of force in relation to air vehicles;

- as gross tonnage in relation to non-propelled (towed) water vehicles;

- as a vehicle unit in relation to other water and air vehicles.

Next, let's talk about tax rates, which depend on the type of vehicle. In this article we will present the most popular vehicles; tax rates for other types of transport can be found in the Tax Code (Article 361). The object of taxation for all these vehicles is the engine power in horsepower:

| Type of vehicle | Object category n/a | Tax rate (in rubles) |

| Cars | Up to 100 hp | 2,5 |

| 100 –150 hp | 3,5 | |

| 150 – 200 hp | 5 | |

| 200 – 250 hp | 7,5 | |

| Over 250 hp | 15 | |

| Motorcycles and scooters | Up to 20 hp | 1 |

| 20 – 35 hp | 2 | |

| Over 35 hp | 5 | |

| Snowmobiles and motor sleighs | Up to 50 hp. | 2,5 |

| Over 50 hp | 5 | |

| Boats and motor boats | Up to 100 hp | 10 |

| Over 100 hp | 20 | |

| Jet skis | Up to 100 hp | 25 |

| Over 100 hp | 50 |

For passenger cars costing more than 3 million rubles, the following increasing factors are established:

- From 3 to 5 million rubles, not older than 3 years – 1.1;

- From 5 to 10 million rubles, not older than 5 years – 2;

- From 10 to 15 million rubles, not older than 10 years – 3;

- From 15 million rubles, not older than 20 years – 3.

Rates can be increased (decreased) by the laws of the constituent entities of the Russian Federation, but not more than 10 times. In addition, the laws of the constituent entities of the Russian Federation may establish differentiated tax rates for each category of vehicles, as well as taking into account the useful life of the vehicle and (or) their environmental class.

The number of months of vehicle ownership is considered similar to other property taxes, and the tax is also paid no later than December 1 of the year following the expired tax period.

If there is information documented and not refuted by the tax authority confirming the complete destruction of the vehicle, transport tax is not charged, since there is no object of taxation for transport tax by virtue of Articles 38 and 358 of the Tax Code of the Russian Federation, regardless of the date of termination of registration of such a vehicle with the authorized registration authorities .

Types of indirect taxes in the Russian Federation

Above we have listed the types of direct taxes that every working-age resident of Russia pays. However, as we discussed earlier, there are taxes that you and I pay indirectly, in the cost of purchased goods and services. Let's figure out what these taxes are.

Value added tax

Value added tax (VAT) is an indirect tax that is calculated by the seller when selling goods (work, services, property rights) to the buyer. The objects of VAT taxation are:

- Operations for the sale of goods, works, services on the territory of the Russian Federation,

- Import of goods into the territory of the Russian Federation (import),

- Carrying out construction and installation work for one’s own consumption and transfer of goods, works, and services for one’s own needs.

Currently, there are 3 VAT rates for organizations and entrepreneurs (Article 164 of the Tax Code of the Russian Federation):

- 0% — for export goods (exported from the territory of the Russian Federation); goods of a free customs zone, international transportation services and some other operations.

- 10% — in cases of sale of food products, goods for children, periodicals and book products, medical goods.

- 20% - in all other cases.

The following organizations and entrepreneurs are exempt from the obligation to pay VAT:

- Applying one of the special tax regimes,

- Participants of the Skolkovo project,

- For those who, over the previous 3 consecutive calendar months, the amount of revenue from the sale of goods (work, services) did not exceed a total of 2 million rubles, they can submit a notification and receive an exemption from the duties of a VAT payer for a year (Article 145 of the Tax Code of the Russian Federation), etc.

One of the features of VAT is the ability to reimburse (deduct) part of the VAT paid. It works as follows: the selling company has the right to deduct from the amount of tax received from the buyer the amount of tax paid to its supplier. The VAT refund period is usually 2-3 months.

VAT was first introduced in 1958 in France. In Russia, VAT was introduced in 1992. Currently, 137 countries levy VAT. Among developed countries, VAT is absent in countries such as the USA and Japan, where sales tax is applied instead (in the USA - at a rate of 0% to 15% depending on the state, in Japan - a fixed 10%).

Excise taxes

An excise tax is an indirect tax imposed at the time of production on consumer goods (tobacco, alcohol, etc.) within the country (as opposed to customs duties, which have the same function, but on goods delivered from abroad, i.e. e. from other countries).

The excise tax is included in the price of goods or the tariff for services and is thereby actually paid by the consumer. Excise taxes serve as an important source of revenue for the state budget of modern countries. The excise tax on many goods reaches half, and sometimes 2/3 of their price.

Excise goods in the Russian Federation are: alcohol-containing products, medicines, cars and motorcycles, gasoline, diesel fuel, motor oils, tobacco, grapes (used for making wine) and others. The fee can be set for 1 liter, kg, ton, piece, etc., depending on the type of product. More details about excisable goods, calculation of the tax base and excise tax rates can be found in Art. 181 – 191 Tax Code of the Russian Federation.

Fees

Another type of indirect taxes can be called customs duties and fees. In general, a duty is a monetary fee levied by authorized government bodies when they perform certain functions provided for by law.

There are different types of fees, for example, when applying to the courts; when performing actions to register property rights; upon receipt of documents; customs duties, etc. Within the framework of our topic, we will consider only the last type.

Customs duty is a mandatory payment levied by customs authorities in connection with the movement of goods across the customs border. These include import duties, export (export) duties, customs duties and excise taxes when importing goods into the Russian Federation. This type of fees is regulated by the Customs Code of the Russian Federation.

Full exemption from customs duties and taxes is provided if the value of goods imported into the customs territory of the Russian Federation, with the exception of vehicles, does not exceed 65 thousand rubles.

In other cases, citizens and organizations will be required to pay duties, which will vary depending on the customs value, type of goods and the country from which the goods are imported (exported). For some categories of goods, customs duty can be up to 20% of the customs value of goods.

Other taxes and fees

Next, let's talk about other types of taxes that exist in Russia. Some of these taxes apply only to organizations, others may apply to individuals as well. Most likely, you will not encounter these taxes unless you are engaged in entrepreneurial or specialized activities. But, in my opinion, it will be useful for you to know about them.

Corporate income tax. The object of taxation for income tax is the difference between the income and expenses of the organization. The income tax rate is generally 20%. A preferential zero rate of 0% is provided for organizations in the fields of education, medicine and agriculture.

Organizational property tax. Payers of property tax are organizations that own real estate, which is recorded on the balance sheet as fixed assets. The following are not recognized as objects of taxation: movable property, land plots, etc.

The value of property can be calculated as an average annual (residual) or cadastral value. The rate of this tax cannot exceed 2.2% when using the average annual value of the property or 2% when using the cadastral value.

Trade fee . Another tax for organizations is the trade tax. It is established in relation to organizations and individual entrepreneurs engaged in trading activities through movable or immovable property.

These include: stationary retail facilities (with or without a sales area); non-stationary retail facilities; warehouses. Payers of the trade tax are only organizations using the simplified tax system and the special tax system located in Moscow. Other regions also have the right to introduce this tax, but have not yet used it. More details about the trade fee can be found in Chapter 33 of the Tax Code of the Russian Federation.

Water tax. Payers of water tax are citizens, individual entrepreneurs and organizations that use water bodies subject to licensing. As a rule, tax payers include companies that collect water or use water areas. The tax is calculated per 1 thousand cubic meters. water, depending on the type of water body.

Tax for the use of fauna or aquatic biological resources. This tax is paid by citizens, individual entrepreneurs and organizations that have received special permission to hunt certain types of animals. The taxpayer is required to pay a tax for each animal or ton of aquatic objects harvested. The fee amount can vary from 10 to 30,000 rubles.

Mineral extraction tax. As the name implies, companies pay this tax if they extract minerals in Russia. Rates vary from 0 to 8%, depending on the type of raw material mined. For oil, gas and coal, separate fees are established per ton (cubic meter for gas).

Gambling tax. If an organization operates in the gambling business, it becomes a payer of this tax. Tax rates are calculated for each property from which a company can generate income. For example, a slot machine, a gaming table, a betting office at a bookmaker's office, etc. Tax rates typically range from RUB 5,000 to RUB 125,000, and the tax period is a calendar month.

NAP tax rate

Professional income is taxed at different rates, depending on to whom the services or work were provided:

- 4% when selling to ordinary individuals;

- 6% when selling to organizations and individual entrepreneurs.

The law guarantees that until the end of 2028 these rates will not increase, and the permissible income limit of 2.4 million rubles will decrease.

In addition, NAP payers are entitled to a tax deduction of up to 10,000 rubles. This means that the calculated tax can be reduced by this amount, but in a special manner:

- if the income is received from an individual, then instead of 4% you will have to pay only 3%;

- if the income is received from an organization or individual entrepreneur, then instead of 6% you will have to pay only 4%.

This will continue until the tax savings reach 10,000 rubles. The self-employed themselves do not need to worry about this; the deduction will be automatically taken into account when issuing a tax notice.

If the entire deduction amount is not received in one year, the balance will be carried over to the next year. In fact, taking into account this deduction, if the clients of a self-employed person are only individuals, then on the first million rubles of professional income he will pay tax at a rate of 3%.

How to pay less taxes

If you are asking yourself the question: “How can I pay less taxes?”, then there is no magic recipe. The tax system is designed so that you cannot avoid paying taxes. But there are several options, for example:

- Know all the types of taxes that you are required to pay and the deadlines for their payment, so as not to receive fines and penalties from the Federal Tax Service.

- If you provide services to individuals and legal entities, then in order not to pay 13% personal income tax, you can open an individual entrepreneur or become self-employed. Of course, you can try not to pay tax at all, but there is a risk of running into fines.

- When purchasing property, you can choose those options that will fall into the lower tax category or register the property in the name of relatives who have any benefits. You can calculate that it might be more profitable not to purchase property, but to rent it.

- Use tax deductions to get back some of the taxes you previously paid.

How to pay tax on professional income

The NPT payer does not need to calculate his tax on his own. The calculation is generated automatically through the “My Tax” application. As soon as a self-employed person issues a check through this application, the amount of income goes into the tax base.

At the end of each month, no later than the 12th day of the month following the reporting month, the self-employed will receive a tax payment notice indicating the details. For convenience, you can link a bank card to the application, then the tax is debited automatically.

The deadline for paying tax on professional income is until the 25th day of the month following the reporting month. For violation of the payment deadline, a fine of 20% of the arrears is imposed. If the tax amount is less than 100 rubles, you do not need to pay it yet; it will be added to the tax for the next period. And if there is no income in the reporting month, there will be no tax to pay; there is no obligatory fixed amount here.

If a self-employed person receives an income of more than 2.4 million rubles in a calendar year, then he loses the right to pay NAP. What to do if you exceed the established income limit? There is only one way out here - to register the business in the usual manner with the tax office.

But if the payer of the NAP was already a registered individual entrepreneur, then he has 20 days to switch from this regime to another preferential one (USN, Unified Agricultural Tax, PSN). Otherwise, further income of individual entrepreneurs will be taxed within the framework of the general system with the payment of personal income tax and VAT.