Expenses and income tax: a brief educational program

For companies that pay income tax, the law establishes certain rules for accounting for such expenses.

Payers of income tax are all Russian legal entities, except for those who apply special tax regimes (simplified system, UTII, Unified Agricultural Tax), as well as payers of tax on gambling business and participants in the Skolkovo project. From 2022, participants in projects of innovative science and technology centers will also be exempt from income tax.

Article 264 of the Tax Code, which regulates the taxation of profits, classifies advertising costs as other expenses associated with production and sales (clause 28, clause 1, article 264). In the same article, paragraph 4 lists the types of expenses that are recognized as advertising. At the same time, the code divides costs according to the method of adoption.

Some expenses are accepted in full (that is, the tax base is reduced by the entire amount of the expense). They are called non-standardized. This, according to the Tax Code:

- expenses for advertising events through the media,

- expenses for lighting and other outdoor advertising,

- expenses for participation in exhibitions, for window dressing, production of advertising brochures and catalogs containing information about goods, as well as for the markdown of goods that have lost their quality during exposure.

PSA: “Feeding the hungry is easier than you think”

Other types of expenses may be taken into account only in an amount not exceeding 1% of sales revenue for the reporting (tax) period. These are standard expenses. These include:

- expenses for the purchase or production of prizes awarded to the winners of drawings during mass advertising campaigns,

- expenses for other types of advertising not specified in Article 264 of the Tax Code.

Guide to Advertising Spending

The basis for accounting for the costs of advertising campaigns (for the purposes of calculating income tax) is the legal definition of advertising. The Tax Code does not contain such a definition. Therefore, tax authorities and courts use the concept of “advertising”, given in the Federal Law of March 13, 2006 No. 38-FZ “On Advertising”.

Advertising is information disseminated in any way, in any form and using any means. It is addressed to an indefinite circle of people and is designed to attract attention to the object of advertising, create or maintain interest in it and its promotion on the market.

it is important

Entertainment expenses do not include expenses for organizing entertainment, recreation, prevention or treatment of diseases.

Advertising expenses

Advertising expenses have specific features of how they are reflected in accounting. This is due to the fact that advertising is caused by a different composition of expenses depending on the field of activity of the advertiser enterprise, the life cycle of products, goods, work, services.

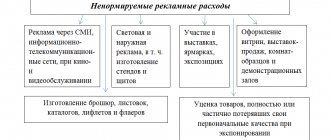

All advertising expenses for profit tax purposes are divided into two types (clause 4 of article 264 of the Tax Code of the Russian Federation):

- non-standardized, which are taken into account for profit tax purposes in full;

- normalized - taken into account in an amount not exceeding 1 percent of revenue from the sale of goods (works, services) excluding VAT and excise taxes. The table shows the classification of advertising expenses for accounting and tax purposes.

Table. Classification of advertising expenses for accounting and tax purposes

| Standardized expenses | Irregular expenses |

| Expenses on printed advertising (for the production and distribution of advertising printed products, except brochures and catalogues) | Media advertising costs: television, radio, print media |

| Expenses for souvenir advertising | Costs for the production of advertising brochures and catalogs of various types |

| Expenses for video and audio advertising | Online advertising costs |

| Telephone advertising expenses | Outdoor advertising expenses |

| Postal advertising costs | Expenses for organizing fairs and exhibitions |

| Transport advertising expenses | Costs for decorating shop windows, showrooms, rooms with trade samples |

| Advertising expenses at points of sale (for the creation, installation and operation of jumbies, mobiles, wobblers and other dummies, for scented advertising) | Expenses for advertising campaigns (for promotions related to sales, “free” transfer of goods for advertising purposes and discounts) |

| Expenses for holding competitions and lotteries | Promotion costs |

Advertising costs in tax accounting are included in other expenses associated with production and sales (subclause 28, clause 1, article 264 of the Tax Code of the Russian Federation). Without any restrictions, the following expenses are recognized as expenses:

- for advertising events through the media (including advertisements in print, radio and television broadcasts) and the Internet (for more information on how to take into account such expenses, read the article “Advertising in the Media”);

- for illuminated and other outdoor advertising, including the production of advertising stands and billboards;

- to participate in exhibitions, fairs, expositions;

- for the design of shop windows, sales exhibitions, sample rooms and showrooms;

- for the production of advertising brochures and catalogs containing information about the work and services performed and provided by the company, or about the company itself;

- for the discounting of goods that have completely or partially lost their original qualities when exhibited at exhibitions.

All other advertising expenses are included in other expenses in an amount that should not exceed 1 percent of sales revenue. In addition, the amount of costs for the purchase or production of prizes awarded to the winners of drawings during mass advertising campaigns is regulated.

It should be borne in mind that the legislation does not clearly differentiate between entertainment and advertising expenses. Therefore, taxpayers and tax authorities interpret it differently when it comes to classifying expenses as advertising or entertainment expenses. This often leads to disputes between organizations and tax authorities, which are resolved in court. Let's look at what expenses are considered hospitality expenses.

Entertainment expenses

Representation expenses include the costs of an enterprise for the official reception and service of representatives of other companies who participate in negotiations (clause 2 of Article 264 of the Tax Code of the Russian Federation). Entertainment expenses may also include the costs of servicing representatives of your organization participating in the negotiations. The expenses also include the costs of receiving and servicing participants who arrived at a meeting of the company’s board of directors, regardless of the location of the event.

Thus, entertainment expenses include the following costs:

- for an official reception (organization of breakfast, lunch or other similar event);

- for transportation support for the delivery of company representatives to the place of negotiations or meetings of the board of directors;

- for buffet service during negotiations;

- to pay for the services of translators who are not on the company’s staff.

At the same time, the concepts of “reception” and “service” themselves are quite broad. In this regard, organizations often experience difficulties in classifying certain costs as entertainment expenses.

Controversial issues

1. Formal or informal reception. If a meeting of representatives of two organizations is not official, but personal in nature, then the costs arising in connection with such a meeting cannot be attributed to representation expenses (letter of the Federal Tax Service of Russia for the city of Moscow dated December 23, 2005 No. 20-12/97007). It states that the costs of holding an informal meeting in a cafe with potential partners, organized by an employee of the organization, are not recognized as entertainment expenses and are not taken into account for income tax purposes.

However, this opinion can be challenged. If the head of the enterprise, by order, approved an official assignment for an employee, which states the holding of a hospitality event, its plan and cost estimate for such an event, then the accountant can classify such expenses as entertainment expenses.

2. An entrepreneur or individual as the other party to the negotiations. Another incident arises if the meeting is held with an individual entrepreneur or individual. There are no grounds for recognizing such expenses as entertainment expenses. In a letter dated November 24, 2005 No. 03-03-04/2/119, the Ministry of Finance of Russia explained one of these situations in which an individual - a client of an organization - is offered soft drinks, tea, coffee, cookies, etc. To the question The Ministry of Finance answered negatively about whether the costs of purchasing the relevant products are entertainment expenses. In this case, it is important to determine whether these costs are legal, that is, whether they are aimed at generating income, are economically justified, are documented and, accordingly, can be considered expenses (Clause 1 of Article 252 of the Tax Code of the Russian Federation).

3. Travel and accommodation of representatives. One of the most common causes of dispute between organizations and tax authorities is the issue of the procedure for accounting for the costs of travel and hotel accommodation for persons invited to participate in entertainment events.

Typically, such costs are recognized as travel expenses by the sending party. However, in the case of negotiations, their initiator is, as a rule, the receiving party. Therefore, it is logical to assume that she should bear the burden of these costs.

According to the regulatory authorities, if negotiations last several days, then the expenses of the host party to pay for the accommodation of arriving representatives are not representative (letter of the Ministry of Finance of Russia dated April 16, 2007 No. 03-03-06/1/235, Federal Tax Service of Russia for the city of Moscow dated December 6, 2007 No. 21-11/116748, dated April 12, 2007 No. 20-12/034115).

Expenses for breakfasts, lunches, and dinners that are not of an official nature must be paid by representatives of the delegations arriving for the negotiations. Payment of expenses can be made from daily allowances paid when employees are sent on business, or from their own funds (letter of the Ministry of Finance of Russia dated April 5, 2005 No. 03-03-01-04/1/157).

Expenses for paying for air and railway tickets along the route from a foreign state to the border of the Russian Federation and across its territory are not considered representative expenses. The cost of a visa is also not taken into account (letters from the Federal Tax Service of Russia for the city of Moscow dated December 6, 2007 No. 21-11/116748, dated November 11, 2004 No. 26-12/73173).

However, arbitration practice in this matter is on the side of taxpayers. For example, the Federal Antimonopoly Service of the West Siberian District, in a resolution dated March 1, 2007 in case No. F04-9370/2006 (30552-A81-27), indicated that the costs of hotel services for representatives of other organizations participating in the negotiations are classified as representative expenses. The FAS of the Moscow District (resolution of December 23, 2004 in case No. KA-A40/12097-04) and the FAS of the North-Western District (resolution of May 17, 2004 in case No. A56-21571/03) also think so.

attention

The costs of purchasing alcoholic beverages when organizing meetings can be taken into account as entertainment expenses.

4. Venue of negotiations. The Tax Code does not indicate where exactly entertainment events should be held (clause 2 of Article 264 of the Tax Code of the Russian Federation). At the same time, there is a restriction according to which expenses for organizing entertainment and recreation are not representative expenses.

Arbitration courts often side with taxpayers in disputes of this kind. The FAS Moscow District, in a resolution dated September 12, 2005, September 5, 2005, in case No. KA-A40/8426-05, took the side of the organization that held negotiations in restaurants and cafes due to the inability to hold official events in the premises occupied by the company . The court concluded that these expenses were representative expenses. They are recognized within the standards, provided for in the estimate and confirmed by relevant primary documents. In the decision made in favor of the organization, the arbitrators emphasized that the tax authority did not provide evidence that the disputed expenses were related to the organization of entertainment and recreation.

Nevertheless, there is arbitration practice in favor of the tax authorities. For example, the organization included fees for renting bowling alleys as entertainment expenses during negotiations. Despite the taxpayer’s assertion that the organization had to incur the disputed expenses, the arbitration court accepted the arguments of the tax inspectorate (decision of the Federal Antimonopoly Service of the North-Western District dated October 27, 2005 in case No. A56-3124/2005).

5. “Executive” souvenirs and alcohol. Quite often, during negotiations, participants exchange various souvenirs with the symbols of the organization (pens, notebooks, calendars, lighters, etc.). As explained in letter No. 02-5-10/51 of the Ministry of Taxes of Russia dated August 16, 2004, the cost of such products, due to the certainty of the circle of persons receiving them, cannot be recognized as advertising expenses. But at the same time, the corresponding amount can be taken into account as part of entertainment expenses.

With regard to alcoholic beverages, taxpayers, regulatory authorities and arbitration courts are unanimous - the costs of their purchase can be taken into account as entertainment expenses. This conclusion can be found in letters of the Ministry of Finance of Russia dated June 9, 2004 No. 03-02-05/1/49, dated November 19, 2004 No. 03-03-01-04/2/30, as well as in resolutions of the FAS North -Western District dated December 26, 2005 in case No. A44-2051/2005-9, dated May 12, 2005 in case No. A56-24907/04, dated April 25, 2005 in case No. A56-32729/04, FAS Central District dated December 16, 2005 in case No. A68-AP-456/11-04, FAS West Siberian District dated June 29, 2005 in case No. F04-1827/2005(12476-A27-33).

attention

Souvenir products with the image of the company's trademark are classified as promotional products, as they are intended for an indefinite number of people.

Exhibition expenses and tasting

Negotiations with representatives of other companies can be carried out at exhibitions, seminars and similar promotional events. Therefore, it is necessary to determine whether the expenses incurred are representative expenses or whether they are advertising expenses. The Federal Arbitration Court of the Moscow Region (ruling of May 15, 2006 in case No. KA-A40/3982-06) considered the dispute when the tax authorities recognized the organization’s expenses as representative expenses and refused to take them into account. The court, having analyzed the list of activities for organizing and conducting a presentation of the production process and other documents, noted that these are advertising expenses, therefore, they can be taken into account.

1. Advertising exhibition expenses. The Tax Code does not spell out exactly what is meant by “expenses for participation in exhibitions.” In letter No. 23-10/4/69784 of the Department of Tax Administration of Russia for the city of Moscow dated December 15, 2003, the opinion was expressed that these should include the costs of paying entrance fees, permits, etc. for participation in such exhibitions. Tax authorities also classify as such expenses any costs that are directly related to the organization and holding of exhibitions, fairs and expositions.

Typically, in connection with the organization and holding of an exhibition, most of its participants bear the following costs:

- rent for renting space and stands in the exhibition complex;

- payment for advertising agency services;

- payment for the services of security companies;

- entry fee for participation in the exhibition.

In addition, arbitration courts recognized as lawful the actions of taxpayers who took into account the following expenses as advertising expenses for participation in exhibitions:

- for the production of printed materials and uniforms with a logo (resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated January 13, 2005 in case No. A43-1729/2004-32-152);

- to pay for the services of a third-party organization that provided window dressing and delivery of products to the exhibition (resolution of the Federal Antimonopoly Service of the Volga Region dated March 2, 2006 in case No. A55-11685/2005);

- the cost of alcoholic products transferred by the manufacturer to trade organizations for participation in exhibitions (resolution of the Federal Antimonopoly Service of the North-Western District dated February 2, 2006 in case No. A26-5845/2005-216).

Another category of costs for participation in the exhibition is associated with the production of promotional products, which are intended for free distribution to visitors: souvenirs with the company logo (calendars, pens, bags, notepads, lighters, brochures, catalogs, etc.) Read more about accounting for the costs of such products, read the article “Gifts are different.” Souvenir products with the image of the company's trademark (pens, lighters, watches, etc.) by their characteristics belong to advertising products. The fact of its acquisition and distribution can be confirmed by a supply contract, a certificate of completion of work, cost estimates, measures for the preparation of the exposition and the participation of society in the exhibition, duly approved. The absence in these documents of specific names of organizations to which souvenir products were distributed also serves as confirmation that these products are advertising, since they are intended for an indefinite number of people.

2. Tasting. If product tasting is carried out in stores, at fairs, on the street, that is, with the purpose of familiarizing an indefinite number of consumers with these products, then such expenses are classified as advertising (letters of the Ministry of Finance of Russia dated August 1, 2005 No. 03-03-04/1/ 113, Federal Tax Service of Russia for the city of Moscow dated November 19, 2004 No. 26-12/74944, dated September 29, 2004 No. 26-12/62976, resolution of the Federal Antimonopoly Service of the North-Western District dated May 3, 2007 in case No. A13- 16685/2005-21).

If such a circle of people is limited, for example, when conducting tastings in kindergartens and schools, which are potential buyers of the organization, then we are not talking about advertising costs, but about the gratuitous transfer of property, the value of which is not taken into account for tax purposes (clause 16 Article 270 of the Tax Code of the Russian Federation).

It is possible and sometimes even necessary to argue with the tax service, but only in this case you need to be completely confident that you can prove the economic justification and document your expenses.

I. Ivanova, deputy general director

What is advertising and who should it be addressed to?

In practice, accounting for advertising costs can be difficult. Some aspects of this topic were explained by the Deputy Director of the Department of Tax and Customs Tariff Policy of the Ministry of Finance, Actual State Councilor of the Russian Federation, 3rd class, Sergei Razgulin.

The official pointed out that not all information disseminated about goods and services is advertising. Its definition is given in the Federal Law “On Advertising” dated March 13, 2006 No. 38-FZ. According to the law, advertising is information disseminated in any way, in any form and using any means and aimed at attracting attention to the object of advertising, generating and maintaining interest in it and promoting it on the market. In this case, an important condition must be met: the advertisement is addressed to an indefinite circle of people, it does not indicate specific recipients. If this requirement is not met, the information cannot be considered advertising.

Advertising encouraging people to pay taxes on time

The law allows targeted advertising when distributed via telephone, fax, mobile radiotelephone communications (for example, SMS messages). Distribution by regular mail to a database of potential clients intended for specific individuals cannot be considered advertising, and related expenses are not recognized as advertising. This was stated in the letter of the Ministry of Finance dated July 5, 2011 No. 03-03-06/1/392. Another letter from the Ministry of Finance (dated July 15, 2013, No. 03-03-06/1/27564) clarifies: in the case of sending advertising brochures by mail to specific addresses, but without specifying the recipient, the costs of producing brochures are recognized as advertising costs. If advertising is sent to specific addresses indicating the full names of specific recipients, the costs should be taken into account “as other expenses associated with production and (or) sales” (clause 49, clause 1, article 264 of the Tax Code).

Rules for calculating VAT when writing off advertising goods and materials as expenses

Most companies have advertising expenses that can be attributed to costs taken into account when taxing profits (clause 28, clause 1, article 264 of the Tax Code of the Russian Federation). But in this case, promotional items must be written off with VAT charged on them.

However, VAT does not always need to be charged. In what cases should this be done?

To answer the question, you need to consider the following points:

- the object of VAT taxation arises when the goods are transferred to a specific person. Sales mean the transfer of ownership of a product from one person to another (Clause 1, Article 39 of the Tax Code of the Russian Federation). If a company transfers materials for the design of an advertising exhibition, then in this case there is no object of VAT taxation. However, if a company gives away T-shirts with its logo among its customers, then in such a situation there is an object of VAT taxation - the ownership of the T-shirt passes to the winner;

- Not every transfer of advertising materials is considered subject to VAT. The transferred material is a gratuitous sale for VAT purposes if it is a product;

- you need to take into account the purchase price of the advertised product. If it is no more than 100 rubles, then the operation to transfer it is considered preferential (clause 25, clause 3, article 149 of the Tax Code of the Russian Federation). And then the taxpayer needs to ensure separate accounting for VAT, as indicated in paragraph 4 of Art. 149 of the Tax Code of the Russian Federation.

What are the characteristics of a product for VAT purposes?

In order for advertising material to be recognized as subject to VAT, it must correspond to the characteristics of the product - be characterized by its own consumer qualities, i.e. consumer value for the recipient.

Thus, if the transmitted advertising material does not have its own consumer qualities, then it is not recognized as a product. In this case, its gratuitous transfer is not considered an operation in which an independent object of VAT taxation is formed. And in such a situation, it does not matter what its purchase price is.

This conclusion is indicated in Letters of the Ministry of Finance dated December 23, 2015 No. 03-07-11/75489, dated October 23, 2014 No. 03-07-11/53626, dated September 19, 2014 03-07-11/46938. The courts adhere to the same opinion, as indicated, for example, in paragraph 12 of the Resolution of the Plenum of the Supreme Arbitration Court of May 30, 2014 No. 33.

Examples of advertising materials that are not goods include booklets, postcards, leaflets, calendars, catalogs and notebooks that contain advertising information (Resolution of the Moscow District Administrative District dated March 29, 2017 No. F05-3154/2017).

Examples of advertising materials containing product features:

- electric shavers, knives, electric kettles (Resolution of the Moscow District Administration of June 20, 2018 No. F05-8543/2018);

- promotional souvenirs with the company logo, for example, calendars, baseball caps, gift books, hard drives, diaries (Resolution of the AS of the West Siberian District dated September 27, 2017 No. F04-3736/2017).

Input VAT, which is paid as part of the cost of gifts for advertising purposes, can be deducted (Letter of the Ministry of Finance dated 06/04/2013 No. 03-03-06/20320). If the goods were purchased from a VAT taxpayer, then when they are distributed for advertising purposes and VAT is calculated, the tax burden for this tax for this transaction will be zero, because the calculated tax is equal to the tax deduction.

Do advertising expenses always reduce the tax base?

It happens that an organization advertises not itself, but someone else: say, a supplier encourages people to buy his product from dealers. Expenses for such advertising will not be recognized, since this is advertising in favor of third parties (which contradicts Article 252 of the Tax Code).

Advertising costs of regulated types made in excess of the norm (i.e., in excess of 1% of sales revenue) are also not taken into account.

The adviser noted that the list of non-standardized advertising expenses is clearly defined in the Tax Code and is exhaustive. All expenses not included in this list must be taken into account as normalized. This setup can create additional complications. For example, product displays often take place not only at an exhibition, but also in a salon, at a forum, etc. Is it permissible to take into account the costs of this as non-standardized? In law enforcement practice, a broad interpretation is often encountered: in particular, the Ministry of Finance allowed the costs of printing not only catalogs and brochures, but other printed materials, such as leaflets, booklets, flyers, leaflets, to be classified as non-standardised. However, the opposite situations can also be encountered.

Advertising flea treatment for dogs

The law classifies expenses on outdoor advertising as non-standardised. But nothing is said about advertising placed in transport, including the subway. This means that, according to the Tax Code, the costs associated with it relate to the costs of “other types of advertising” and are standardized.

On the maximum amount of standardized advertising expenses

The maximum amount of standardized advertising expenses should be calculated as 1% of sales revenue (that is, from all receipts for sold goods, works, services, property rights) without VAT and excise taxes.

Income tax is calculated on an accrual basis during the tax period (year). Therefore, if excess advertising expenses arose in one reporting period, then in the event of revenue growth they can be taken into account in the following reporting periods of the year or at the end of the year.

The official gave practical advice on how to avoid exceeding the limit for normalized advertising expenses. If possible, it is better to keep separate records of expenses incurred as part of advertising campaigns. Thanks to this, it will be possible to take into account some costs not as advertising ones. For example, the cost of renting a hall for holding an event is separate from the cost of producing souvenirs. And if some souvenir products (say, pens and notepads) were used in the activities of the company itself, the costs of its production can be taken into account as expenses for stationery (clause 24, clause 1, article 264 of the Tax Code of the Russian Federation).

About depreciation of fixed assets

A separate question is how to take into account advertising expenses, as a result of which fixed assets or intangible assets (large advertising structures, videos) were created or acquired. Should the cost of such advertising be written off through depreciation over its useful life, or is a lump sum write-off acceptable?

The official indicated that property and intellectual property are subject to depreciation if their useful life is more than 12 months and the original cost is more than 100 thousand rubles. Thus, to avoid disputes, it is better to have evidence that the advertising property has been used for less than 12 months. As a rule, new goods and services are advertised; the use of outdated advertising is inappropriate. This means that there is no reason, for example, to classify an outdated advertising video as an intangible asset and charge depreciation on its cost. Its cost should be written off as a lump sum as advertising expenses. (See resolution of the Federal Antimonopoly Service of the Moscow District dated March 16, 2012 No. A40-100845/10-4-498).

Non-standardized expenses can be taken into account in full

The list of non-standardized expenses is contained in paragraph 4 of Art. 264 Tax Code of the Russian Federation. These include expenses:

- For advertising in cinema and media: newspapers and magazines, radio and television.

- For advertising via the Internet: contextual, targeted, banner and other types of online advertising. Website promotion services also fall under this category.

- For illuminated and other outdoor advertising: billboards, stands, banners, electronic displays, other advertising structures on buildings and bus stops. This category does not include advertising on transport and inside buildings.

- For participation in exhibitions and fairs: rent for a stand or area in the exhibition complex, entrance fee for participation in the exhibition, etc.

- For the design of shop windows and showrooms.

- To create advertising brochures, catalogs, booklets, flyers with information about products or the seller.

- For the markdown of goods that were used as a sample and because of this lost their appearance.

The costs of such advertising should be taken into account when calculating the tax without restrictions. If you spent 100 thousand rubles on contextual advertising, you can write off this amount in full.

Documentary evidence, personal income tax and VAT

We should not forget that accepting advertising expenses for accounting is possible only if there are properly executed supporting documents - contracts, certificates of completion of work, estimates, orders for promotions, acts for writing off materials, samples and photographs of advertising products, etc.

Social advertising: “Smoking causes blindness”

Prizes given to individuals during promotions may be subject to personal income tax (in the case where the value of prizes received by a person during the year exceeds 4 thousand rubles - see clause 28 of article 217 of the Tax Code).

In addition, if the transmitted advertising materials have their own consumer qualities, then they are goods. And the transfer of goods whose value exceeds 100 rubles per unit is subject to VAT. Moreover, when issuing an advertising kit, this amount should include the cost of all components. If the cost of purchasing or creating a unit of goods does not exceed 100 rubles, then the transfer of such goods for advertising purposes is not subject to VAT (subclause 25 of clause 3 of Article 149 of the Tax Code of the Russian Federation).