What is primary accounting and what does it include?

Primary accounting is a system of actions of an organization to document the economic events that have taken place at the enterprise, to register all internal and external business operations that have taken place.

Employees who conduct primary accounting in the company are also responsible for the subsequent storage of such documents about the company's activities. Primary accounting involves the following work:

- collecting information about economic events occurring in the company;

- measurement of such events;

- registration of these events using primary accounting documents;

- ensuring the safety of primary documents during the time period established by the legislator.

The company carries out primary accounting in all areas of the company’s activities: at the stage of procurement of resources, at the stage of production, at the stage of subsequent sale of such products to customers, etc.

At the same time, at all of these stages, the preparation of primary documents is of key importance for ensuring primary accounting, so accounting specialists should clearly understand how to prepare such documents.

What primary accounting documents can a company have?

A primary document is one with the help of which a company or individual entrepreneur records the fact of committing a particular action (business transaction) on its part. Such a document serves as evidence that a certain economic event in the life of the company actually took place. The primary document indicates a number of basic characteristics of such a business event (for example, how much goods were transferred, at what price, name and details of the seller, etc.)

IMPORTANT! The primary document is the basis for the subsequent reflection of the corresponding business transaction in the accounting registers of the entity.

There is no uniform and mandatory list of forms of primary accounting documents for all companies. However, until 2013 a unified list existed. Despite the fact that today such forms are no longer mandatory, most companies continue to use them in practice (due to convenience and business customs).

ConsultantPlus experts have collected all the forms into a single material. Get trial access to the system and go to Help information for free.

Details are in the article “Unified forms of primary documents (list).”

Depending on the specifics of the company and its industry focus, the composition of the primary documents will differ. At the same time, it is possible to carry out some classification of primary documents. In particular, depending on where the document was compiled, we can distinguish:

- external documents, i.e. compiled outside the organization, but received by it as confirmation of the transaction, as well as documents that the company transfers to external contractors (for example, invoices, waybills, etc.);

- internal, i.e. documents with which the company itself formalizes its business event (certificates, statements, etc.).

The company’s internal primary documents, in turn, can be divided into the following groups:

- Directives, i.e. documents in which the company prescribes an order or some kind of imperative instruction to someone. For example, internal orders of the company are administrative.

- Executive. With the help of such documents, the company records the very fact of the transaction. An example of executive primary documents are acts of disposal of fixed assets, acceptance of raw materials, etc.

- Combined, i.e. documents that are both administrative and executive in nature (for example, advance reports of seconded employees, cash orders (receipt and expense), etc.).

- Accounting documents. The company draws up such primary documents if the company’s business transaction cannot be recorded using existing standard forms. In addition, the documents of this group are used to compile general summaries of previously issued administrative and executive documents.

Types of accounting

Currently, the following types of accounting are distinguished:

- memorial-warrant;

- journal-order;

- "magazine-main" form;

- simplified;

- electronic or automated.

Previously, this list could be supplemented with a simple accounting form. This type is characterized by the fact that accounting is carried out bypassing the double entry method. That is, business transactions are reflected in only one account. But in our country the single entry method is not used.

Each of the named types of accounting has a number of distinctive features, which we will consider further. Note that the characteristics of accounting forms depend on:

- types of primary documentation and registers used in an economic entity;

- the order of chronological reflection of records and their systematization;

- degree of accounting automation;

- sequence of entries made in accounting registers.

What must a primary accounting document contain?

Despite the fact that there is currently no single list of forms for primary documents, the legislator has established clear requirements for their content. After all, each such document must confirm the fact of an economic event that took place at the enterprise (clauses 1, 3, article 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ), and therefore reflect the main characteristics of such an event.

In paragraph 2 of Art. 9 of Law No. 402-FZ provides a list of details that any primary document must contain, regardless of which group (from the above) it belongs to. These details are:

- Name. Any document must contain a clear and correct name. A document without a name may be considered to have no legal force.

- The date on which the relevant document was executed by the company.

- Information about the compiler company (name, address of the company).

- Information directly about the business event that is documented by this document. In most cases, the content of a business transaction is clear from the title of the document, while the body of the document contains a detailed description of the event.

- Numerical and monetary characteristics, measures of the completed transaction (for example, how many units of manufactured products were sold to the buyer under a supply agreement and for what amount).

- Information about the person who compiled this primary document, as well as the signature of such person.

It is important for a specialist who is involved in drawing up a primary document to remember two main points. Firstly, such a document must be drawn up either immediately at the moment when the economic event took place, or immediately after the completion of such an event. Secondly, such a specialist must promptly submit the compiled primary document to the company’s accounting department so that its employees reflect the transaction in accounting.

Simplified form of accounting

Small businesses can also use a simplified form of accounting. Such companies include small firms with a small number of fixed assets that make payments based on advance or subsequent payment. In addition to accounting registers, this form uses statements generated on the basis of a primary account for one account group. Today, there are 3 ways to conduct simplified accounting:

- full;

- abbreviated;

- simple.

Complete is similar to the method of conventional accounting, since all transactions are also recorded using the double entry method. This form is suitable for companies that use the accrual method, as well as those that have a fairly diverse business transaction.

The short form is suitable for those small businesses that use the cash method. It is most convenient for companies that have mostly monotonous business operations. The simplest form involves organizing accounting without using double entry (that is, without posting at all). However, only micro-companies with no more than 15 employees and whose revenue does not exceed 120 million rubles for the last tax period can conduct accounting in this way.

What should you remember when doing primary accounting?

Maintaining primary accounting records in an organization involves certain aspects for an accountant. The first of these is error correction. At the same time, specialists drafting primary documents should understand that nothing can be corrected in the text of such documents without permission (clause 4.1 of the regulations on documents in accounting, approved by the USSR Ministry of Finance on July 29, 1983 No. 105).

If it is still necessary to correct the document, then any correction is made according to the following rules (Article 4 of Regulation No. 105):

- the old value is crossed out with one line so that the old value remains readable;

- a new meaning is written above the crossed out one, and o is also written;

- the signatories of the document put their signatures under the corrected values, after which the date of correction is indicated.

The second important aspect of primary accounting is the organization of document flow. As follows from Art. 5 of Regulation No. 105, the document flow of primary documents in the company is organized by a special schedule.

IMPORTANT! Document flow refers to the preparation of one’s own primary documents, transferring them to counterparties, receiving documents from counterparties, submitting documents to the archive and other document movements.

In such a schedule, the company should reflect how in each division of the company primary documents will be created, verified, and processed (who will do this and in what time frame).

The said schedule is drawn up by the chief accountant, who is also responsible for how the company’s divisions follow the schedule.

From 2022, FSBU 27/2021 “Document Flow” will become mandatory for use. ConsultantPlus experts explained how to organize document flow for accounting purposes under the new Federal Accounting Standards. Get trial demo access to the K+ system and upgrade to the Ready Solution for free.

You may also be interested in the question of storage periods for accounting documents. This is discussed in the article “Basic storage periods for documents in an organization (archive).”

Accounting forms

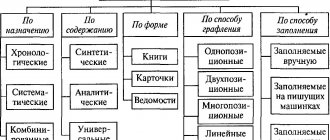

The form of accounting is understood as a certain system of using accounting registers, which establishes the forms, sequence and methods of accounting records.

The purpose of all forms of accounting is the same; they are intended to register business transactions, group homogeneous data and reflect them on synthetic and analytical accounts, calculate turnover and account balances, summarize calculations in the balance sheet and reporting. Therefore, the features that distinguish one form of accounting from another are: the content and form of the registers used, the relationship between the registers of synthetic and analytical accounting, the sequence and methods of entries in the accounting registers. The company chooses its own form of accounting.

The main forms of accounting are:

- journal-order;

- memorial warrant;

- simplified accounting form for small businesses;

- automated form, using accounting automation programs.

Journal-order form of accounting

The journal-order form of accounting is currently the most progressive and widespread. This is what is typically used in accounting automation programs.

The journal-order form combines chronological and systematic, analytical and synthetic accounting registers. Order journals are maintained on the basis of primary documents.

The sequence of filling out accounting registers in the journal-order form of accounting can be presented in the form of a diagram (Fig. 6.1).

Rice. 6.1. Journal-order form of accounting

1. Based on primary documents, business transactions are recorded in accumulative statements, that is, they are recorded in the business transactions journal. An example of an organization's business transaction journal for January is given in Table. 6.1.

Table 6.1

| Contents of operation | Amount, rub. | Debit | Credit |

| 1. Short-term loan received | |||

| 2. Money was received at the cash desk from the current account | |||

| 3. The debt of the accountable person has been repaid | |||

| 4. Bill for materials paid | |||

| 5. Revenue received from product sales | |||

| 6. Salary issued | |||

| 7. Receivables are paid off to the cash desk | |||

| 8. Money was issued for a business trip |

2. Then these business transactions are recorded in order journals and additional statements.

As an example, the order journals and statements for accounts 50 and 51, compiled on the basis of data from the business transactions journal, are given.

The results of business transactions for one account or group of accounts are transferred to order journals, therefore order journals have certain numbers, for example, order journal No. 1 is kept under account 50 “Cash” (Table 6.2), order journal No. 2 is maintained according to account 51 “Settlement accounts” (Table 6.3), journal order No. 3 - for accounts 55 “Special accounts in banks”, 57 “Transfers in transit”, journal order No. 4 - for accounts 66 “Settlements on short-term loans and loans”, 67 “Calculations for long-term loans and borrowings”, etc. Order journals are compiled according to the credit characteristics of the accounts, i.e. they reflect transactions that took place on the credit of this account in correspondence with the debit of other accounts.

Additional statements are kept for cash accounts 50 and 51: statement No. 1 for account 50 (Table 6.4) and statement No. 2 for account 51 (Table 6.5). The statements are compiled according to the debit characteristics of the accounts, i.e., they reflect transactions that took place in the debit of this account in correspondence with the credit of other accounts.

3. The final data for each order journal is transferred to the General Ledger, which is opened for a year and maintained for each account, for example, account 50 “Cashier” (Table 6.6).

Table 6.2

| Operation No. | Credit account 50 from debit account | Total |

| … | … | |

| Total | … |

Table 6.3

| Operation No. | To the credit of account 51 from the debit of accounts | Total | |

| … | … | … | |

| Total | … | … | … |

Table 6.4

| Balance at the beginning of the month - 500 rubles. | ||

| Operation No. | To the debit of the account 50 from the credit of the accounts | Total |

| … | … | |

| Total | … | … |

| Balance at the end of the month - 18,200 rubles. |

Table 6.5

| Balance at the beginning of the month - 25,000 rubles. | |||

| Operation No. | To the debit of account 51 from the credit of accounts | Total | |

| … | … | … | |

| Total | … | … | … |

| Balance at the end of the month - 63,000 rubles. |

Table 6.6

| Month | Debit turnover | Loan turnover | Balance | |||

| … | Debit | Credit | ||||

| As of 01/01/20… | ||||||

| January | … | … | ||||

| February | … | |||||

| March | ||||||

| … | ||||||

| … | ||||||

| Total | … | … | … | … | … | … |

4. Based on the General Ledger, a turnover sheet and balance sheet are drawn up.

The advantages of the journal-order form of accounting are a successful combination of analytical and synthetic accounting and more convenient forms for reporting, but the disadvantage is the complexity of constructing the main registers.

Memorial-warrant form of accounting

The sequence of filling out accounting registers in the memorial-order form of accounting can be presented in the form of a diagram (Fig. 6.2).

- Based on primary documents, all business transactions are recorded in cumulative statements, which are maintained in the form of a journal of business transactions.

- Homogeneous business transactions, i.e. accounting transactions on one accounting account or a group of several dependent accounts are transferred to memorial orders, which record the content of the transaction, the amount and correspondence of the accounts.

Memorial orders have certain numbers, for example, memorial order No. 1 is maintained in account 50 “Cash Office” (Table 6.7), memorial order No. 2 is maintained in account 51 “Cash Accounts” (Table 6.8), memorial order No. 3 is maintained in accounts 60 “Settlements with suppliers and contractors”, 71 “Settlements with accountable persons”, 76 “Settlements with various debtors and creditors”, memorial order No. 4 - for account 70 “Settlements with personnel for wages”, memorial order No. 5 - on account 20 “Main production”, etc.

Rice. 6.2. Memorial-warrant form of accounting

Table 6.7

| Contents of operation | Debit | Credit | Amount, rub. |

| 1 . Accountable money returned | |||

| 2. Money received from the bank to the cash desk | |||

| 3. Salary issued | |||

| 4. Report issued | |||

| Total |

Table 6.8

| Contents of operation | Debit | Credit | Amount, rub. |

| 1. Received money from buyers to the bank account | |||

| 2. Supplier invoice paid | |||

| 3. Partially repaid the bank loan | |||

| 4. Money from the cash register is deposited in the bank | |||

| Total |

3. The final data of memorial orders at the end of the month is recorded in chronological order in the registration journal (Table 6.9). The total amount in the registration journal should be equal to the sum of debit and credit turnover for all synthetic accounts.

Table 6.9

| Memorial order number | Order filling date | Amount, rub. |

| 2.02 | ||

| 2.02 | ||

| … | … | |

| … | … | |

| … | … | … |

| … | … | … |

| … | … | … |

| Total for January | … |

4. Data from memorial orders is posted to the General Ledger accounts, for example, to account 50 “Cashier” (Table 6.10). Turnovers in the General Ledger are compared with the total amount of all memorial orders in the ledger. If the turnovers coincide, then the postings to the synthetic accounts are posted correctly.

Table 6.10

| date | No. m/o | Account credit 50 | Total | date | No. m/o | Account debit 50 | Total | ||

| … | … | ||||||||

| 02.02 | 02.02 | ||||||||

| Total | … | … | … | … | Total | … | … | … | … |

5. Based on the General Ledger, checkerboard and turnover statements are compiled.

In table 6.11 shows a chess sheet containing data from memorial orders No. 1 and 2.

Table 6.11

| Credit/Debit | Total | ||

| Total | … | … | … |

6. According to the General Ledger and the turnover sheet, the enterprise’s balance sheet for the reporting period is filled out.

The advantages of the memorial-order form of accounting include the ease of filling out accounting registers, the ease of checking the correctness of transactions, and the ability to correct errors when reconciling data. Disadvantages include the repeated recording of the same amount in different registers, which leads to more complicated work and an increase in the likelihood of errors, as well as the lag between analytical accounting and synthetic accounting and the complexity of reporting.

Simplified form of accounting

A simplified form of accounting is used in small enterprises with a small number of business transactions.

In a simplified form of accounting based on primary documents, a Book of Business Operations is kept (Table 6.12), which reflects account balances at the beginning of the year. During the year, all business transactions are recorded in the book, which are simultaneously reflected in the accounting accounts.

The accounting book contains all the accounting accounts used by a small enterprise, which allows you to keep records of business transactions on each of them.

Table 6.12

| Contents of operation | … | |||||||

| D | TO | D | TO | D | TO | D | TO | |

| Initial balance | ||||||||

| 1. Materials written off for production | ||||||||

| 2. Money received at the cash desk | ||||||||

| … | … | … | … | … | … | … | … | |

| Total | … | … | … | … | … | … | … | … |

The accounting book is a combined register and combines chronological and systematic recording of transactions. At the end of the reporting period, debit and credit balances for all accounts are calculated, which serve as data for drawing up a balance sheet.

Automated forms of accounting

Currently, dozens of programs have been developed to automate accounting in enterprises using personal computers.

All programs offer a standard set of tools to facilitate and automate the work of an accountant. Most programs are universal and make it possible to automate accounting of any complexity.

The most popular automated accounting programs include: Accounting, Info-Accountant, Turbo-Accountant, Parus, etc.

The main source of information in accounting automation programs is the journal of business transactions. Data is entered into the journal in the form of primary documents, transactions or standard transactions, the list of which can be changed and supplemented. By processing this journal, programs post transactions to accounts, determine turnover and balances, draw up a turnover sheet, prepare a final balance sheet and other reports. The programs allow you to maintain various types of accounting: synthetic and analytical, summative and quantitative, currency accounting, and calculate wages and current taxes.

The software package includes a standard set of forms for primary documents and reporting, as well as other documents that comply with current legislation. The programs have the ability to quickly adjust the chart of accounts, tax rates, and add new reporting forms in accordance with any changes in legislation.

The form of accounting is understood as a certain system of using accounting registers, which establishes the forms, sequence and methods of accounting records.

The purpose of all forms of accounting is the same; they are intended to register business transactions, group homogeneous data and reflect them on synthetic and analytical accounts, calculate turnover and account balances, summarize calculations in the balance sheet and reporting. Therefore, the features that distinguish one form of accounting from another are: the content and form of the registers used, the relationship between the registers of synthetic and analytical accounting, the sequence and methods of entries in the accounting registers. The company chooses its own form of accounting.

The main forms of accounting are:

- journal-order;

- memorial warrant;

- simplified accounting form for small businesses;

- automated form, using accounting automation programs.

Journal-order form of accounting

The journal-order form of accounting is currently the most progressive and widespread. This is what is typically used in accounting automation programs.

The journal-order form combines chronological and systematic, analytical and synthetic accounting registers. Order journals are maintained on the basis of primary documents.

The sequence of filling out accounting registers in the journal-order form of accounting can be presented in the form of a diagram (Fig. 6.1).

Rice. 6.1. Journal-order form of accounting

1. Based on primary documents, business transactions are recorded in accumulative statements, that is, they are recorded in the business transactions journal. An example of an organization's business transaction journal for January is given in Table. 6.1.

Table 6.1

| Contents of operation | Amount, rub. | Debit | Credit |

| 1. Short-term loan received | |||

| 2. Money was received at the cash desk from the current account | |||

| 3. The debt of the accountable person has been repaid | |||

| 4. Bill for materials paid | |||

| 5. Revenue received from product sales | |||

| 6. Salary issued | |||

| 7. Receivables are paid off to the cash desk | |||

| 8. Money was issued for a business trip |

2. Then these business transactions are recorded in order journals and additional statements.

As an example, the order journals and statements for accounts 50 and 51, compiled on the basis of data from the business transactions journal, are given.

The results of business transactions for one account or group of accounts are transferred to order journals, therefore order journals have certain numbers, for example, order journal No. 1 is kept under account 50 “Cash” (Table 6.2), order journal No. 2 is maintained according to account 51 “Settlement accounts” (Table 6.3), journal order No. 3 - for accounts 55 “Special accounts in banks”, 57 “Transfers in transit”, journal order No. 4 - for accounts 66 “Settlements on short-term loans and loans”, 67 “Calculations for long-term loans and borrowings”, etc. Order journals are compiled according to the credit characteristics of the accounts, i.e. they reflect transactions that took place on the credit of this account in correspondence with the debit of other accounts.

Additional statements are kept for cash accounts 50 and 51: statement No. 1 for account 50 (Table 6.4) and statement No. 2 for account 51 (Table 6.5). The statements are compiled according to the debit characteristics of the accounts, i.e., they reflect transactions that took place in the debit of this account in correspondence with the credit of other accounts.

3. The final data for each order journal is transferred to the General Ledger, which is opened for a year and maintained for each account, for example, account 50 “Cashier” (Table 6.6).

Table 6.2

| Operation No. | Credit account 50 from debit account | Total |

| … | … | |

| Total | … |

Table 6.3

| Operation No. | To the credit of account 51 from the debit of accounts | Total | |

| … | … | … | |

| Total | … | … | … |

Table 6.4

| Balance at the beginning of the month - 500 rubles. | ||

| Operation No. | To the debit of the account 50 from the credit of the accounts | Total |

| … | … | |

| Total | … | … |

| Balance at the end of the month - 18,200 rubles. |

Table 6.5

| Balance at the beginning of the month - 25,000 rubles. | |||

| Operation No. | To the debit of account 51 from the credit of accounts | Total | |

| … | … | … | |

| Total | … | … | … |

| Balance at the end of the month - 63,000 rubles. |

Table 6.6

| Month | Debit turnover | Loan turnover | Balance | |||

| … | Debit | Credit | ||||

| As of 01/01/20… | ||||||

| January | … | … | ||||

| February | … | |||||

| March | ||||||

| … | ||||||

| … | ||||||

| Total | … | … | … | … | … | … |

4. Based on the General Ledger, a turnover sheet and balance sheet are drawn up.

The advantages of the journal-order form of accounting are a successful combination of analytical and synthetic accounting and more convenient forms for reporting, but the disadvantage is the complexity of constructing the main registers.

Memorial-warrant form of accounting

The sequence of filling out accounting registers in the memorial-order form of accounting can be presented in the form of a diagram (Fig. 6.2).

- Based on primary documents, all business transactions are recorded in cumulative statements, which are maintained in the form of a journal of business transactions.

- Homogeneous business transactions, i.e. accounting transactions on one accounting account or a group of several dependent accounts are transferred to memorial orders, which record the content of the transaction, the amount and correspondence of the accounts.

Memorial orders have certain numbers, for example, memorial order No. 1 is maintained in account 50 “Cash Office” (Table 6.7), memorial order No. 2 is maintained in account 51 “Cash Accounts” (Table 6.8), memorial order No. 3 is maintained in accounts 60 “Settlements with suppliers and contractors”, 71 “Settlements with accountable persons”, 76 “Settlements with various debtors and creditors”, memorial order No. 4 - for account 70 “Settlements with personnel for wages”, memorial order No. 5 - on account 20 “Main production”, etc.

Rice. 6.2. Memorial-warrant form of accounting

Table 6.7

| Contents of operation | Debit | Credit | Amount, rub. |

| 1 . Accountable money returned | |||

| 2. Money received from the bank to the cash desk | |||

| 3. Salary issued | |||

| 4. Report issued | |||

| Total |

Table 6.8

| Contents of operation | Debit | Credit | Amount, rub. |

| 1. Received money from buyers to the bank account | |||

| 2. Supplier invoice paid | |||

| 3. Partially repaid the bank loan | |||

| 4. Money from the cash register is deposited in the bank | |||

| Total |

3. The final data of memorial orders at the end of the month is recorded in chronological order in the registration journal (Table 6.9). The total amount in the registration journal should be equal to the sum of debit and credit turnover for all synthetic accounts.

Table 6.9

| Memorial order number | Order filling date | Amount, rub. |

| 2.02 | ||

| 2.02 | ||

| … | … | |

| … | … | |

| … | … | … |

| … | … | … |

| … | … | … |

| Total for January | … |

4. Data from memorial orders is posted to the General Ledger accounts, for example, to account 50 “Cashier” (Table 6.10). Turnovers in the General Ledger are compared with the total amount of all memorial orders in the ledger. If the turnovers coincide, then the postings to the synthetic accounts are posted correctly.

Table 6.10

| date | No. m/o | Account credit 50 | Total | date | No. m/o | Account debit 50 | Total | ||

| … | … | ||||||||

| 02.02 | 02.02 | ||||||||

| Total | … | … | … | … | Total | … | … | … | … |

5. Based on the General Ledger, checkerboard and turnover statements are compiled.

In table 6.11 shows a chess sheet containing data from memorial orders No. 1 and 2.

Table 6.11

| Credit/Debit | Total | ||

| Total | … | … | … |

6. According to the General Ledger and the turnover sheet, the enterprise’s balance sheet for the reporting period is filled out.

The advantages of the memorial-order form of accounting include the ease of filling out accounting registers, the ease of checking the correctness of transactions, and the ability to correct errors when reconciling data. Disadvantages include the repeated recording of the same amount in different registers, which leads to more complicated work and an increase in the likelihood of errors, as well as the lag between analytical accounting and synthetic accounting and the complexity of reporting.

Simplified form of accounting

A simplified form of accounting is used in small enterprises with a small number of business transactions.

In a simplified form of accounting based on primary documents, a Book of Business Operations is kept (Table 6.12), which reflects account balances at the beginning of the year. During the year, all business transactions are recorded in the book, which are simultaneously reflected in the accounting accounts.

The accounting book contains all the accounting accounts used by a small enterprise, which allows you to keep records of business transactions on each of them.

Table 6.12

| Contents of operation | … | |||||||

| D | TO | D | TO | D | TO | D | TO | |

| Initial balance | ||||||||

| 1. Materials written off for production | ||||||||

| 2. Money received at the cash desk | ||||||||

| … | … | … | … | … | … | … | … | |

| Total | … | … | … | … | … | … | … | … |

The accounting book is a combined register and combines chronological and systematic recording of transactions. At the end of the reporting period, debit and credit balances for all accounts are calculated, which serve as data for drawing up a balance sheet.

Automated forms of accounting

Currently, dozens of programs have been developed to automate accounting in enterprises using personal computers.

All programs offer a standard set of tools to facilitate and automate the work of an accountant. Most programs are universal and make it possible to automate accounting of any complexity.

The most popular automated accounting programs include: Accounting, Info-Accountant, Turbo-Accountant, Parus, etc.

The main source of information in accounting automation programs is the journal of business transactions. Data is entered into the journal in the form of primary documents, transactions or standard transactions, the list of which can be changed and supplemented. By processing this journal, programs post transactions to accounts, determine turnover and balances, draw up a turnover sheet, prepare a final balance sheet and other reports. The programs allow you to maintain various types of accounting: synthetic and analytical, summative and quantitative, currency accounting, and calculate wages and current taxes.

The software package includes a standard set of forms for primary documents and reporting, as well as other documents that comply with current legislation. The programs have the ability to quickly adjust the chart of accounts, tax rates, and add new reporting forms in accordance with any changes in legislation.

Results

Primary accounting in a company implies the correct documentation of past business events using primary documents. Each company’s primary documents, depending on the specifics of its activities, may be different.

There are no single universally binding templates for primary registration today. At the same time, any primary document must contain the mandatory details specified in Art. 9 of Law No. 402-FZ.

The chief accountant needs to build a rational document flow schedule, which will indicate who in each division is responsible for documenting ongoing business events.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Who has the right to keep simplified accounting

Simplified accounting allows small companies to operate in full compliance with the law, but without using certain elements of generally accepted accounting. After all, the turnover of such companies is very small, and spending time on distributing small amounts across many separate registers and then putting them together to generate financial statements is not always rational.

Simplified accounting is not available to everyone. It is entitled to be conducted by organizations that are included in the unified register of small and medium-sized enterprises (SMEs).

Tax authorities update this register monthly. The newly created organization will be included in the register on the 10th day of the month following the month of state registration.

In addition to the “kids”, the right to maintain simplified accounting is reserved for NPOs and participants in the Skolkovo project (Clause 4, Article 6 of Law No. 402-FZ of December 6, 2011)