Changes in the obligations of employers under Law No. 12-FZ

Labor legislation imposes many different responsibilities on the employer.

One of them is timely payment of salaries. Find out from this article whether it is possible to pay salaries ahead of schedule and whether the employer will be punished for frequent salary payments.

The Law “On Amendments to the Federal Law “On Enforcement Proceedings”” dated February 21, 2019 No. 12-FZ supplemented this obligation: it ordered employers to indicate a special code for the type of income when issuing payment orders for the payment of wages and (or) other income. The introduced encoding will allow banks and bailiffs to distinguish income from which debts can be withheld.

This innovation came into effect on June 1, 2020 (Article 2 of Law No. 12-FZ).

Legislators obliged the Bank of Russia to develop codes and describe a system for reflecting them in salary slips (clause 5.1 of Article 70 of the Law “On Enforcement Proceedings” dated 02.10.2007 No. 229-FZ as amended by Law No. 12-FZ). Which is what he did, issuing instructions dated October 14, 2019 No. 5286-U.

From October 1, 2022 (codes of individual entrepreneurs and other “private owners” in field 101)

There are innovations for individuals who pay taxes, fees, insurance and other payments administered by the tax authorities. The changes concern field 101 (the status of the payment originator is entered in it).

Until October 2022, when filling out field 101, these individuals must select one of the following values:

- “09” - individual entrepreneur who pays taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “10” - a notary engaged in private practice, paying taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “11” - a lawyer who has established a law office that pays taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “12” is the head of a peasant (farm) enterprise who pays taxes, fees, insurance premiums and other payments administered by the tax authorities.

- “13” is an “ordinary” individual.

Starting from October 2022, the values "09", "10", "11" and "12" will be eliminated. Instead, the value remains, the same for all individuals (“ordinary”, individual entrepreneurs, lawyers, etc.) - “13”. Changes were made by order No. 199n.

For what incomes in payment cards have new codes been introduced?

Employers who have to work with the new rules naturally have a question: for what payments do they need to indicate codes in their payment slips?

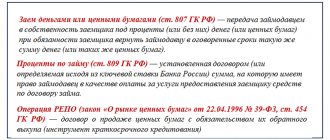

Law No. 12-FZ does not specify a specific list of income for which codes are required in payment documents, although their groups are generally outlined. These include wages and other income, in respect of which Art. 99 of Law No. 229-FZ establishes restrictions, as well as income that cannot be levied under Art. 101 of Law No. 229-FZ.

This material talks about the maximum permissible deductions from citizens' salaries.

Directive of the Central Bank No. 5286-U provides three codes:

| Code | When to bet | Examples of payments |

| 1 | In income payments for which there is a limit on the amount of debt withholding (Article 99 of Law No. 229-FZ) |

|

| 2 | In payments for payments, from which deductions are not made, except for compensation for damage to health (Article 101 of Law No. 229-FZ) |

|

| 3 | In payments for the payment of compensation for harm to health, as well as for budgetary compensation to victims of radiation or man-made disasters (subclauses 1 and 4 of clause 1 of Article 101 of Law No. 229-FZ). These are amounts from which only alimony can be withheld. | |

*What is included in the salary for these purposes can be found in paragraph 1 of the List of income from which child support is withheld, approved. Decree of the Government of the Russian Federation dated July 18, 1996 No. 841.

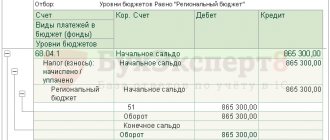

From January 1, 2022 (new BCC for personal income tax - 15%)

New budget classification codes have been introduced for personal income tax, calculated at an increased rate (see “New personal income tax rate and other innovations: what awaits individuals and tax agents in 2022”).

Let us remind you that the following personal income tax rates have been established for 2022:

- 13% if income for the year is 5 million rubles. or less;

- (650 thousand rubles + 15% of income exceeding 5 million rubles), if income for the year is more than 5 million rubles.

The Ministry of Finance, by order No. 236n dated October 12, 2020, added new codes to the BCC list (Table 1).

Table 1

KBC for transferring personal income tax on income exceeding 5 million rubles. in year

| Tax | 182 1 0100 110 |

| Penalty | 182 1 0100 110 |

| Fines | 182 1 0100 110 |

Also see “How to pay personal income tax at a rate of 15% and fill out 6‑personal income tax: read the explanations of the tax authorities.”

Generate personal income tax payment slips with current details

We prepare payment documents in a new way

The introduction of the encoding we are considering has led to the fact that now separate payments must be issued for different types of income. For example, it is no longer possible to transfer a person’s salary and travel allowances in one order.

The same applies to registers according to which payments are made as part of the salary project (for example, it is necessary to create separate registers for salaries and child benefits). The Central Bank indicates this on its website.

In the payment order, you must indicate the appropriate code in field 20 “Name. pl."

In addition to the income code in the purpose of payment in the payment slip or register, you now need to indicate the amount of deductions under writs of execution made from employee income.

How to indicate the amount of collection if, to pay wages, you create and send to the bank a register and a general payment slip for it, we described in this publication.

A sample of a completed payment slip according to the new rules from 06/01/2020 can be viewed and downloaded from ConsultantPlus. If you do not have access to the system, get trial access to K+ for free.

From January 1, 2022 (address of individual payer)

A change is provided for individual payers who are not individual entrepreneurs. Now, so that inspectors can clearly determine who the payment came from, the individual indicates his TIN. There is another option - instead of the TIN, fill in field 108 “Number of the document that is the basis for the payment”, or enter the UIN in field 22 “Code”. And in the absence of a UIN, it is permissible to indicate the address of residence or stay.

In 2022 and beyond, you will not have to enter the individual’s address on the payment slip. This follows from the updated version of the rules approved by Order of the Ministry of Finance dated November 12, 2013 No. 107n (amendments were made by Order of the Ministry of Finance dated September 14, 2020 No. 199n; hereinafter referred to as Order No. 199n). Now, in the absence of a TIN and UIN, it is enough to enter another identifier of information about an individual (for example, the series and number of a passport or SNILS).

If there is an error in the code or it is not specified

If you do not indicate the income code on the payment slip, there is a chance that the bank will not honor it. In this case, you risk being late on your salary. And for this there are various responsibilities. However, as the Central Bank explains, banks have no obligation to monitor the correctness of codes indicated by payers in payment orders, and payments without codes are subject to execution by the credit institution if the result of other acceptance procedures for execution is positive.

If you put code 1 instead of code 2 or 3, and the bank has a writ of execution for the employee, the bank will collect money that it cannot apply for. And this, at a minimum, is a claim against you from an employee. A trial is also possible.

The Central Bank of the Russian Federation spoke about how to correct the income type code.

The ConsultantPlus system has answers to questions about the application of the new rules. For example, you can find out what is the procedure for indicating the type of income code in a payment order when paying salaries or other income in this material. And if you don’t have access to the K+ system, get a trial demo access for free.

From October 1, 2022 (repayment of debt for expired periods)

Until October 2022, in payments issued when repaying debts for expired periods, in field 106 you can, if necessary, specify one of the following values:

- “TR” - repayment of debt at the request of the tax authority to pay taxes (fees, insurance contributions);

Generate a payment invoice for payment of tax (penalties, fines) in one click based on the request received from the Federal Tax Service

- “PR” - repayment of debt suspended for collection;

- “AP” - repayment of debt according to the inspection report;

- “AR” - repayment of debt under a writ of execution;

- “ZD” is the voluntary repayment of debt for expired tax, settlement (reporting) periods in the absence of a requirement from the tax authority to pay taxes (fees, insurance contributions).

Starting from October 2022, the values of “TR”, “PR”, “AP” and “AR” will be abolished. Instead, there remains a meaning that is the same for all the listed cases - “ZD”.

If field 106 contains “ZD”, then fields 108 and 109 must be filled out as shown in Table 2. Changes were made by Order No. 199n.

table 2

How to fill out fields 108 and 109 from October 2022 if the payment basis is “ZD”

| Document by which money is transferred | Field 108 “Document number” (filling sample) | Field “109” “Date of payment basis document” |

| Request from the tax authority to pay taxes (fees, insurance contributions) | TR0000000000000 | Request date |

| Decision to suspend collection | PR0000000000000 | Date of decision |

| Decision to prosecute (or refuse to prosecute) for committing a tax offense | AP0000000000000 | Date of decision |

| Executive document (enforcement proceedings) | AP0000000000000 | Date of the writ of execution (executive proceedings) |

Generate a tax payment in one click using data from the report

Results

From June 1, 2022, employers will need to indicate special codes for types of income in settlement documents for employee payments. With their help, banks will be able to distinguish the amounts from which debts can be withheld in enforcement proceedings.

Sources:

- Federal Law of October 2, 2007 No. 229-FZ

- Directive of the Bank of Russia dated October 14, 2019 No. 5286-U

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

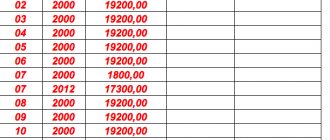

From January 1, 2022 (fields 15 and 17)

When filling out the recipient's details, you need to take into account changes in two fields. Innovations are associated with the transition to a new treasury service and treasury payment system.

- Field 17: the account number of the territorial body of the Federal Treasury (TOFK) is changed;

- Field 15: starting from January 2022, it is necessary to indicate the account number of the recipient's bank (the number of the bank account included in the single treasury account (STA)). In 2022 and earlier, this field was not filled in when paying taxes and contributions.

Fill out payment slips with current BCC, income codes and other mandatory details Fill in for free

The table with the new details is given in the letter of the Federal Tax Service dated October 8, 2020 No. KCH-4-8 / [email protected] (see “How account details for paying taxes and contributions will change in 2022: see the table from the Federal Tax Service”). For each region, the BIC and the name of the recipient bank are indicated (fields 14 and 13). And for each recipient bank - the corresponding new and outdated TOFK account (field 17), as well as the account number of the recipient bank (field 15).

Table with details

File

IMPORTANT

In January, February, March and April 2022, it is permissible to enter both a new and an outdated TOFK account in field 17 of the payment order. Starting from May 1st - only new ones.

When and how the “Code” field is filled in

The code field in the 2021-2022 payment order is filled out differently, depending on whether the payer independently transfers funds to the budget or fulfills the request of the fiscal authority.

IMPORTANT! From September 10, 2021, the form of the payment order and its content are determined by the Bank of Russia Regulation No. 762-P dated June 29, 2021, and until this date - by the Central Bank of the Russian Federation Regulation No. 383-P dated June 19, 2012. With the change in the regulatory legal acts, the form of payment has not changed. Read more here. Also keep in mind that in 2022 there have been changes to filling out bank details in payment orders for paying taxes. From 05/01/2021, be sure to fill out field 15 “Current account number”; the Treasury account and the name of the bank have also changed. For these details, see our material.

Check whether you are filling out payments for insurance premiums correctly with the help of explanations from ConsultantPlus. Get free trial access and see how to fill out the order line by line.

If the payer acts independently, sending an order for a transfer, then 0 is entered in the “Code” field. When a request to make payments to the budget comes from the fiscal authority, then in the payment order in this field the code must correspond to the UIN. This rule directly follows from clause 1.22 of Bank of Russia Regulation No. 762-P dated June 29, 2021, which states that the UIN must be included in the payment when it is assigned by the recipient of the funds.

However, the latest clarifications of the Federal Tax Service of the Russian Federation (letter dated March 13, 2017 No. ZN-4-1 / [email protected] ) indicate that filling out the UIN number does not add anything to the information about the payer if the latter’s TIN is given in the payment document. And the TIN for a payment order is a required requisite. That is, it is also permissible to indicate 0 in the UIN field when paying on demand.

Read more about this position of the Federal Tax Service in the material “Do I need a UIN in the payment for a fine?” .

IMPORTANT! In payment orders in 2021-2022, field codes intended for entering UIN cannot be left blank. If you do not have information about the UIN or there are reasons not to indicate it, you just need to enter 0. By leaving field 22 empty, you risk receiving a refusal to make a payment from the banking institution.

In what case is the UIN filled out when paying tax for a third party, see here .