Appendix No. 6

According to the letter of the Federal Tax Service of Russia dated October 31, 2022 N BS-4-21 / [email protected] before changes are made to this order when filling out tax returns for land tax starting from the tax period of 2022 by taxpayers claiming the right to benefits under subparagraph 13 of paragraph 1 of Article 395 of the Tax Code of the Russian Federation, code 3021198 may be indicated for organizations - residents of a special economic zone, with the exception of organizations specified in paragraph 11 of Article 395 of the Code - in relation to land plots located on the territory of a special economic zone, for a period of five years from the month of occurrence ownership rights to each land plot

Corporate property tax benefits: benefit codes

The organization is required to submit a property tax return, and if advance tax payments have been introduced in the region, then tax calculations for these payments to the tax authorities. The forms of these documents are different and are filled out according to different (albeit similar) rules. These rules are contained in the same document that approved both forms - in the order of the Federal Tax Service of Russia dated March 31, 2017 No. ММВ-7-21 / [email protected] During 2022, for interim tax reporting, it was allowed to use the forms contained in earlier the current order of this department dated November 24, 2011 No. ММВ-7-11/895 (letter of the Federal Tax Service of Russia dated June 23, 2017 No. BS-4-21/12076). Both in the declaration and in the tax calculation in sections 2 and 3 there are lines to reflect tax benefit codes:

- to exempt property from tax;

- application of a reduced rate;

- reducing the amount of tax already accrued.

The numbering of these lines in the declaration and tax calculations differs, but the structure of the line (composed of 2 parts) is the same everywhere and the principle of filling out the lines remains the same. The first part indicates the codes of tax benefits for property tax, which the taxpayer selects from Appendix 6 to the Procedure for filling out the relevant document (declaration or tax calculation). Most of the codes are tied to certain articles of the Tax Code of the Russian Federation, which give the right to benefits. But there are also codes that reflect regional benefits. For them, the 2nd part of the code line is used, which reflects the details of the norm of the regional law that gives the right to the benefit.

However, not all benefits presented in the Tax Code of the Russian Federation have established codes. The Federal Tax Service proposes to use property tax code 2010257 in such cases, which is used for fixed assets - movable property items registered on 01/01/2013. Exceptions for the application of tax benefit 2010257 for property tax are specified in paragraph 25 of Art. 381 of the Tax Code of the Russian Federation (letter of the Federal Tax Service of the Russian Federation dated December 12, 2014 No. BS-4-11/25774).

Category “Land tax benefits”

You must pay for the use of a land plot, regardless of whether it is owned or registered for use in various ways. An option to pay for such operation is to pay land tax. Who must pay this tax and who can be exempted from this obligation? How to qualify for tax benefits? The entire procedure for paying this tax is regulated by Chapter 31 of the Tax Code of the Russian Federation. Within the framework of this chapter, not only the main provisions for paying this fee are considered, but also the benefits that are provided for use by certain categories of individuals and organizations are highlighted.

Results

Current legislation provides for the possibility of applying benefits when calculating property tax for organizations. Benefits are established at both the federal and regional levels. In tax reporting, each type of benefit is coded in a certain way. Code 2010257 refers to the benefit for movable property registered on January 1, 2013. Since 2022, the very possibility of applying this benefit and its conditions began to depend on decisions made in the region. At the same time, a new rate was introduced for 2022 for movable property acquired after 2012 (1.1%), which is the maximum for it and is applied if the region has not introduced the benefit or, having introduced the benefit, has not established a lower rate for the property falling under it.

Sources:

- Tax Code of the Russian Federation

- Letter from the Federal Tax Service of Russia dated December 12, 2014 N BS-4-11/ [email protected]

- Decree of the Government of the Russian Federation dated 01.01.2002 N 1

- Order of Rosstandart dated April 21, 2016 N 458

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

P 2 Article 387 Tax Code of the Russian Federation benefit code 3022400

Tax benefit codes Name of benefit and category of taxpayer Ground 3021000 TAX BENEFITS PROVIDED AT THE FEDERAL LEVEL Chapter 31 “Land Tax” of the Tax Code of the Russian Federation 3021100 TAX BENEFITS PROVIDING EXEMPTION FROM TAXATION Article 395 of the Tax Code Russian Federation 3021110 Organizations and institutions of the penal system of the Ministry Justice of the Russian Federation - in relation to land plots provided for the direct performance of the functions assigned to these organizations and institutions Clause 1 of Article 395 of the Tax Code of the Russian Federation 3021120 Organizations - in relation to land plots occupied by public state highways Clause 2 of Article 395 of the Tax Code of the Russian Federation 3021160 Religious organizations - in relation to land plots owned by them on which buildings, structures and structures for religious and charitable purposes are located Clause 4 of Article 395 of the Tax Code of the Russian Federation 3021170 All-Russian public organizations of disabled people (including those created as unions of public organizations of disabled people), among members of which disabled people and their legal representatives constitute at least 80 percent - in relation to land plots used by them to carry out statutory activities Clause 5 of Article 395 of the Tax Code of the Russian Federation Tax Code of the Russian Federation 3021180 Organizations whose authorized capital consists entirely of contributions from the specified all-Russian public organizations disabled people, if the average number of disabled people among their employees is at least 50 percent, and their share in the wage fund is at least 25 percent, in relation to land plots used by them for the production and (or) sale of goods (except for excisable goods, mineral raw materials and other minerals, as well as other goods according to the list approved by the Government of the Russian Federation in agreement with all-Russian public organizations of disabled people), works and services (except for brokerage and other intermediary services) Clause 5 of Article 395 of the Tax Code of the Russian Federation 3021190 Institutions, the sole owners of the property of which are the specified all-Russian public organizations of disabled people - in relation to land plots used by them to achieve educational, cultural, medical and recreational, physical education and sports, scientific, information and other purposes of social protection and rehabilitation of disabled people, as well as to provide legal and other assistance to disabled people, disabled children and their parents Clause 5 of Article 395 of the Tax Code of the Russian Federation 3021191 Organizations of folk arts and crafts - in relation to land plots located in places where folk arts and crafts traditionally exist and used for the production and sale of folk arts and crafts products Clause 6 Article 395 of the Tax Code of the Russian Federation 3021192 Individuals belonging to the indigenous peoples of the North, Siberia and the Far East of the Russian Federation, as well as communities of such peoples - in relation to land plots used to preserve and develop their traditional way of life, farming and crafts Clause 7 Article 395 of the Tax Code of the Russian Federation 3021194 Organizations - residents of a special economic zone for a period of 5 years from the moment the ownership of the land plot granted to a resident of the special economic zone arises Clause 9 of Article 395 of the Tax Code of the Russian Federation 3021200 TAX BENEFITS REDUCING THE AMOUNT OF THE TAX BASE PROVIDED IN AS A TAX-FREE AMOUNT Clause 5 of Article 391 of the Tax Code of the Russian Federation 3021210 Heroes of the Soviet Union, Heroes of the Russian Federation, full holders of the Order of Glory Subclause 1 of clause 5 of Article 391 of the Tax Code of the Russian Federation 3021220 Disabled persons with III degree of disability, as well as persons who have I and II disability groups established before January 1, 2004 without issuing a conclusion on the degree of limitation of the ability to work Subparagraph 2 of paragraph 5 of Article 391 of the Tax Code of the Russian Federation 3021230 Disabled since childhood Subparagraph 3 of paragraph 5 of Article 391 of the Tax Code of the Russian Federation 3021240 Veterans and disabled people of the Great Patriotic War, as well as veterans and disabled people of combat Subparagraph 4 of paragraph 5 of Article 391 of the Tax Code of the Russian Federation 3021250 Individuals entitled to receive social support in accordance with the Law of the Russian Federation of May 15, 1991 N 1244- 1 “On the social protection of citizens exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant” (Vedomosti of the Congress of People's Deputies and the Supreme Council of the RSFSR, 1991, No. 21, Art. 699; Gazette of the Congress of People's Deputies and the Supreme Council of the Russian Federation, 1992, No. 32, art. 1861) (as amended by the Law of the Russian Federation of June 18, 1992 N 3061-1), in accordance with the Federal Law of November 26, 1998 N 175-FZ “On the social protection of citizens of the Russian Federation exposed to radiation as a result of the accident in 1957 year at the Mayak production association and the discharge of radioactive waste into the Techa River" (Collection of Legislation of the Russian Federation, 1998, N 48, Art. 5850; 2000, N 33, Art. 3348; 2004, N 35, Art. 3607) and in in accordance with the Federal Law of January 10, 2002 N 2-FZ “On social guarantees for citizens exposed to radiation as a result of nuclear tests at the Semipalatinsk test site” (Collected Legislation of the Russian Federation, 2002, N 2, Art. 128; 2004, N 12, Article 1035; N 35, Article 3607) Subparagraph 5 of paragraph 5 of Article 391 of the Tax Code of the Russian Federation 3021260 Individuals who, as part of special risk units, took direct part in testing nuclear and thermonuclear weapons, eliminating accidents of nuclear installations at weapons and military facilities Subparagraph 6 of paragraph 5 of Article 391 of the Tax Code of the Russian Federation 3021270 Individuals who received or suffered radiation sickness or became disabled as a result of tests, exercises and other work related to any types of nuclear installations, including nuclear weapons and space technology Subparagraph 7 of paragraph 5 of Article 391 Tax Code of the Russian Federation 3022000 LAND TAX BENEFITS ESTABLISHED BY REGULATIVE LEGAL ACTS OF REPRESENTATIVE BODIES OF MUNICIPAL FORMATIONS (LAWS OF THE FEDERAL CITIES OF MOSCOW AND ST. PETERSBURG) Clause 2 of Article 387 Tax New Code of the Russian Federation 3022100 Land tax benefits provided in the form of a tax-free amount Clause 2 of Article 387 of the Tax Code of the Russian Federation 3022200 Land tax benefits that reduce the calculated amount of tax and (or) in the form of a reduction in the tax rate Clause 2 of Article 387 of the Tax Code of the Russian Federation 3022300 Land tax benefits in the form of a non-taxable area of a land plot Clause 2 of Article 387 Tax Code of the Russian Federation 3022400 Benefits for land tax in the form of tax exemption Clause 2 of Article 387 of the Tax Code of the Russian Federation 3029000 BENEFITS (EXEMPTION) FOR LAND TAX PROVIDED FOR INTERNATIONAL TREATIES OF THE RUSSIAN FEDERATION Article 7 of the Tax Code of the Russian Federation Code Category Basis by law 3021000 Benefits, established at the federal level Chapter 31 of the Tax Code of the Russian Federation 3021100 Benefits for which complete exemption occurs Article 395 3021110 Institutions and organizations created by the Ministry of Justice of the Russian Federation - regarding areas that are provided for them to perform their direct functions Clause 1 of Art. 395 Tax Code of the Russian Federation 3021120 Organizations engaged in the operation and maintenance of public roads - regarding areas that are occupied by state public roads Clause 2 of Art. 395 Tax Code of the Russian Federation 3021160 Religious organizations created in accordance with current legislation - regarding land plots on which buildings and other structures are located for the implementation of religious and charitable activities Clause 4 of Art. 395 Tax Code of the Russian Federation 3021170 Organizations created by people with disabilities and having the status of all-Russian ones, if among their members at least 80% of the participants are people with disabilities or their representatives - regarding the sites that are used by such organizations to carry out their activities, recorded in the statutory documents of such organizations, Article 5. . 395 Tax Code of the Russian Federation 3021180 Organizations, if their authorized capital is created entirely from contributions from public organizations of disabled people, provided that the number of disabled people employed in such organizations is at least 50%, and at least 25% are allocated from the wage fund to pay for their activities % - regarding areas that are used for the direct implementation of the functioning of such an organization through the production and sale of certain types of products (except for the exceptions listed in paragraph 5 of Article 395 of the Tax Code of the Russian Federation) Clause 5 of Art. 395 Tax Code of the Russian Federation 302119 Institutions and organizations, the sole owner of which are all-Russian organizations of disabled people - regarding plots of land that are used for educational, socio-cultural, sports, recreational and other purposes, as well as to achieve the goals of social protection, rehabilitation and legal assistance disabled persons P. 5 tbsp. 395 Tax Code of the Russian Federation 3021191 Organizations involved in the preservation and promotion of officially registered folk crafts of an artistic nature - regarding lands that are located in the territories where such crafts existed, if such areas are used for the production and sale of products of such crafts Clause 6 of Art. 395 Tax Code of the Russian Federation 3021192 People who, according to current legislation, belong to the indigenous peoples of Siberia, the North and the Far East, as well as their communities - regarding lands that are used for the preservation and development of traditional crafts, farming and way of life P. 7 Art. 395 of the Tax Code of the Russian Federation 3021194 Organizations and institutions recognized as residents of special economic zones - for five years in relation to the land plot to which ownership has been registered based on the results of its provision to a resident of such a zone, Clause 9, Art. 395 Tax Code of the Russian Federation 3021200 Benefits that can reduce the tax base if they are presented in the form of a non-taxable amount P. 5 Art. 391 Tax Code of the Russian Federation 3021210 For Heroes of the USSR, Russian Federation, full holders of the Order of Glory Clause 1 Clause 5 Art. 391 of the Tax Code of the Russian Federation 3021220 Disabled people of group 3 with limitations in work activity, as well as groups 1 and 2, which was established before January 1, 2004, if a conclusion was not made regarding such persons regarding the limitation of ability to work Sec. 2 P. 5 tbsp. 391 Tax Code of the Russian Federation 3021230 Persons recognized as disabled from childhood Sec. 3 P. 5 tbsp. 391 Tax Code of the Russian Federation 3021240 Disabled people and veterans of the Second World War, as well as disabled people and veterans of officially recognized military operations Sec. 4 P. 5 tbsp. 391 Tax Code of the Russian Federation 3021250 Persons recognized as entitled to social support measures in accordance with the Law of the Russian Federation No. 1244-1 of May 15, 1991 “On the social protection of citizens exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant”, Federal Law No. 175-FZ of 11/26/1998 “On the social protection of citizens of the Russian Federation exposed to radiation as a result of the accident in 1957 at the Mayak production association and the discharge of radioactive waste into the Techa River”, Federal Law No. 2-FZ of 01/10/2002 “On social guarantees for citizens exposed to radiation as a result of nuclear tests at the Semipalatinsk test site" Pt. 5 P. 5 tbsp. 391 Tax Code of the Russian Federation 3021260 People who, as part of special units, took direct part in testing nuclear and thermonuclear weapons, and were also involved in the elimination of accidents at nuclear installations of weapons and military facilities Sec. 6 P. 5 Art. 391 Tax Code of the Russian Federation 3021270 People who received radiation sickness or suffered it, as well as became disabled as a result of participating in tests, exercises and other work related to the use of any types of nuclear installations, including nuclear weapons and space technology Sec. 7 P. 5 art. 391 Tax Code of the Russian Federation 3022000 Benefits established by regulations of representative bodies of municipalities (and laws of cities of federal significance) Clause 2, Art. 387 Tax Code of the Russian Federation 3022100 Benefits in the form of a non-taxable amount P. 2 Art. 387 Tax Code of the Russian Federation 3022200 Benefits that reduce the calculated amount of tax or in the form of a reduction in the rate P. 2 Art. 387 Tax Code of the Russian Federation 3022300 Benefits in the form of non-taxable land area P. 2 Art. 387 Tax Code of the Russian Federation 3022400 Benefits in the form of exemption from taxation Clause 2, Art. 387 Tax Code of the Russian Federation 3029000 Benefits provided for by international treaties Art. 7 Tax Code of the Russian Federation

Please note => General building needs for sanitation in 2019

The Federal Tax Service has supplemented the codes of benefits for land and property taxes

- organizations recognized by funds, management companies, subsidiaries of management companies of innovative scientific and technological centers;

- organizations that are participants in innovative scientific and technological centers, in relation to property located on the territory of these centers.

The deadlines for payment of land tax and advance payments thereon are established by the legal acts of municipalities. Moreover, the municipality may not establish tax reporting periods (clause 3 of Article 393 of the Tax Code of the Russian Federation). In this case, organizations do not pay advance tax, and the tax is paid at the end of the year.

The Federal Tax Service has introduced new codes for property tax returns

The Federal Tax Service of the Russian Federation has clarified which codes must be indicated in reporting on property taxes for organizations from affected industries that are exempt from paying taxes for the second quarter of 2022.

The corresponding letter dated June 10, 2020 No. BS-4-21/ [email protected] was published on the official website of the Federal Tax Service.

The agency recalls that Federal Law No. 172-FZ dated June 8, 2020 introduced amendments to the Tax Code of the Russian Federation, which exempted the following from taxes:

- organizations and individual entrepreneurs included in the Unified Register of Small and Medium-Sized Enterprises and operating in industries most affected by the coronavirus.

- organizations included in a special register of socially oriented non-profit organizations (including religious organizations).

In particular, organizations are exempt from the obligation to make payments:

- for transport and land taxes - in terms of taxes and advance payments on these taxes for the period of ownership of taxable objects from April 1 to June 30, 2022 in relation to taxable objects used (intended for use) in business and (or) statutory activities;

- for corporate property tax - in terms of tax and advance payments for this tax for the period of ownership of the taxable object from April 1 to June 30, 2022.

If an organization will prepare declarations on these taxes during liquidation or reorganization during 2022, the Federal Tax Service recommends taking into account a number of features.

Transport tax declaration

Thus, if an organization is exempt from transport tax (advance payment) for the period of ownership of transport from April 1 to June 30, 2022, then in the first part of the indicator on line code 240 of section 2 of the declaration one of the tax benefit codes is indicated (10201, 10202, 10203 , 10204). In the second part of the indicator, zeros are indicated, and on the line with code 250 of section 2 of the tax return, the amount of the tax benefit in rubles is indicated.

If an organization is exempt from transport tax (advance payment) for the period of ownership of transport from April 1 to June 30, 2022 and in relation to this organization the law of a constituent entity of the Russian Federation also establishes a tax benefit that reduces transport tax, then in the first part of the indicator on the line with code 240 of section 2 declarations indicate one of the tax benefit codes (10205, 10206, 10207, 10208).

The second part of the indicator sequentially indicates the number or letter designation of the corresponding structural unit (article, part, clause, subclause, paragraph, other) of the law of the subject of the Russian Federation, in accordance with which the corresponding tax benefit is provided.

On line code 250 of section 2 of the tax return, the amount of the tax benefit in rubles is indicated (including taking into account the amount of the advance payment for the period of ownership of the taxable object from April 1 to June 30, 2022).

Land tax declaration

If an organization is exempt from land tax (advance payment) for the period of land ownership from April 1 to June 30, 2020, then in the first part of the indicator on line code 220 of section 2 of the land tax declaration, one of the tax benefit codes is indicated (3021501, 3021502, 3021503, 3021504).

In the second part of the indicator, zeros are indicated, and on the line with code 230 of section 2 of the tax return, the amount of the tax benefit in rubles is indicated.

If an organization is exempt from land tax (advance payment) for the period of ownership of a plot from April 1 to June 30, 2020 and a tax benefit has been established for it by local authorities that reduces land tax, then in the first part of the indicator on line code 220 of section 2 of the tax return one of the tax benefit codes is indicated (3021505, 3021506, 3021507, 3021508).

The second part of the indicator consistently indicates the details of the regulatory legal act of the municipality, in accordance with which the corresponding tax benefit is provided.

On line code 230 of section 2 of the tax return, the amount of the tax benefit in rubles is indicated (including taking into account the amount of the advance payment for the period of ownership of the taxable object from April 1 to June 30, 2022).

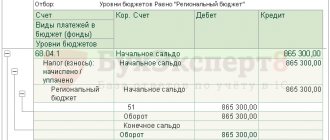

Reporting on property tax of organizations

If an organization is exempt from paying property tax (advance payment) for the period of ownership of the taxable object from April 1 to June 30, 2022, then:

- in the first part of the line with code 230 of section 2 of the tax return, one of the tax benefit codes is indicated (2010501, 2010502, 2010503, 2010504);

- in the second part of the indicator zeros are indicated;

- on line code 240 of section 2 of the tax return, the calculated amount of the advance tax payment for the period of ownership of the taxable object from April 1 to June 30, 2020 is indicated;

- in the first part of the line with code 110 of section 3 of the tax return, one of the tax benefit codes is indicated (2010501, 2010502, 2010503, 2010504);

- in the second part of the indicator zeros are indicated;

- line with code 120 indicates the calculated amount of the advance tax payment for the period of ownership of the taxable object from April 1 to June 30, 2022.

If an organization is exempt from paying property tax (advance payment) for the period of ownership of a taxable object from April 1 to June 30, 2022, and the law of a constituent entity of the Russian Federation establishes for it a benefit that reduces property tax, then:

- in the first part of the line with code 230 of section 2 of the tax return, one of the tax benefit codes is indicated (2010505, 2010506, 2010507, 2010508);

- the second part of the indicator indicates the number or letter designation of the corresponding structural unit (article, part, clause, subclause, paragraph, other) of the law of the subject of the Russian Federation, which establishes a benefit that reduces property tax;

- on line code 240 of section 2 of the tax return, the calculated amount of the tax benefit is indicated (including taking into account the amount of the advance payment for the period of ownership of the taxable object from April 1 to June 30, 2022);

- in the first part of the line with code 110 of section 3 of the tax return, one of the tax benefit codes is indicated (2010505, 2010506, 2010507, 2010508);

- the second part of the indicator indicates the number or letter designation of the corresponding structural unit (article, part, clause, subclause, paragraph, other) of the law of the subject of the Russian Federation, which established a tax benefit in the form of a reduction in the amount of calculated tax payable to the budget;

- on line code 120 of section 3 of the tax return, the calculated amount of the tax benefit is indicated (including taking into account the amount of the advance payment for the period of ownership of the taxable object from April 1 to June 30, 2022).

At the same time, new tax benefit codes for applying Article 2 of Federal Law No. 172-FZ dated 06/08/2020 are separately attached to the letter.

In accounting solutions "1C:Enterprise 8", the codes recommended by the Federal Tax Service for declarations on transport, land taxes, corporate property tax and the procedure for filling them out will be supported with the release of the next versions. For deadlines, see “Legislation Monitoring.”

Tax benefit codes

All-Russian public organizations of disabled people (including those created as unions of public organizations of disabled people), among whose members disabled people and their legal representatives make up at least 80 percent - in relation to land plots used by them to carry out the statutory activities of the Institution, the only owners of which are the specified All-Russian public organizations of disabled people - in relation to land plots used by them to achieve educational, cultural, medical and recreational, physical education, sports, scientific, information and other purposes of social protection and rehabilitation of disabled people, as well as to provide legal and other assistance to disabled people and children -disabled people and their parents

Who is exempt from paying property tax

The following organizations are exempt from paying property tax:

- penal system;

- religious;

- all-Russian public organizations of disabled people;

- pharmaceutical manufacturers;

- prosthetic and orthopedic special enterprises;

- state research centers;

- residents of a special economic zone;

- participants of the Skolkovo project.

The following types of fixed assets are also exempt from taxation:

- land;

- facilities used for defense and law enforcement needs;

- cultural heritage sites;

- nuclear installations, space objects, icebreakers, ships registered in the Russian International Register;

- federal highways;

- highly energy efficient facilities, in accordance with the list of the Government of the Russian Federation;

- movable fixed assets registered on January 1, 2013, if such a decision was made by a subject of the Federation;

- fixed assets assigned to the first and second depreciation groups.

Tax benefits for land tax

- Heroes of Russia and the Soviet Union, full holders of the Order of Glory,

- disabled people of groups 1 and 2, as well as people with disabilities since childhood,

- veterans and disabled people of the Great Patriotic War and other military operations,

- persons affected by the Chernobyl disaster, the accident at the Mayak production facility and nuclear tests at the Semipalatinsk test site,

- individuals who took part in nuclear tests and liquidation of accidents at nuclear installations,

- persons who received radiation sickness or disability in connection with testing of nuclear and space technology.

Federal law does not provide for special benefits for land tax for labor veterans, nor for pensioners. But they may have benefits at the local level, so it is better to find out about their availability from your tax office or the district administration. For example, in the Kaliningrad region, the tax base is reduced for single pensioners and pensioners - veterans of labor, and there are also benefits for land tax for large families: a reduction in the tax base by 10,000 rubles, and low-income families are completely exempt from tax.

Please note => For what period of non-payment of housing and communal services can a plug be placed?

Land tax benefits

The Tax Code controls the receipt of benefits for both organizations and citizens. Federal benefits allow legal entities to bypass taxation. Article 395 of the Tax Code describes the categories of citizens applying for benefits (explained below). This group includes all kinds of organizations: Article 395 of the Tax Code establishes the category of persons exempt from paying tax. Citizens who belong to the indigenous peoples of the North, Siberia and the Far East can be exempted from paying tax duties in relation to plots used to maintain economic activity.

Regulation by law

General issues related to the regulation of issues related to various land legal relations are carried out by the Land Code.

It determines the possibility of registering a plot of land as a property and formulates the obligation for any land exploiter to pay for this opportunity by contributing a land tax to the state budget. The entire procedure for paying this tax is regulated by Chapter 31 of the Tax Code of the Russian Federation. Within the framework of this chapter, not only the main provisions for paying this fee are considered, but also the benefits that are provided for use by certain categories of individuals and organizations are highlighted.

Article 395 of the Tax Code of the Russian Federation talks about who can be completely exempt from paying land tax and for how long such exemption can be granted.

In the event that complete exemption is not possible, at the municipal level a regime for paying compensation for making tax transfers to the treasury for the use of land property can be established. At the same level, the maximum tax rate is established, which will be different for each category of land.

Updated land tax reporting

Let us remind you that land tax refers to local taxes. It is introduced in Chap. 31 of the Tax Code of the Russian Federation and regulatory legal acts of representative bodies of municipalities. They establish tax rates, as well as tax benefits, grounds and procedures for their application, including the amount of tax-free amounts for certain categories of taxpayers. The updated declaration is submitted to the tax authority in the form that was in force during the tax period for which the corresponding changes are made. When recalculating the tax base and the amount of land tax, the results of tax audits conducted by the tax authority for the tax period for which the tax base and the tax amount are recalculated are not taken into account.

Order of the Federal Tax Service of Russia No. ММВ-7-1

5.9. Line code 2400 of the Report reflects the cadastral value (standard price for the city of Sevastopol and the Republic of Crimea) of land plots of individuals. If for a unique cadastral number of a land plot there is more than one record that satisfies the order of line formation, when calculating the indicator using line code 2400, the cadastral value is taken into account once. If a taxpayer has several objects of taxation and for one of them a benefit has been applied and/or a tax has been calculated and/or a tax rate of 0 rubles has been applied, then, if a rate of 0 rubles has been applied, he is accounted for using line code 1170 of the Report and not is accounted for by line code 1110 and/or 1120 of the Report; if a benefit is applied, then it is accounted for by line code 1120 and not accounted for by line code 1110.

Please note => Clause 1, Article 28.1 of the Federal Law of November 24, 1995, 181 Federal Law

Filling out a new land tax declaration form for 2011

Cadastral value (share of cadastral value) of a land plot (line 050 ) - indicates the cadastral value (share of cadastral value) of a land plot as of January 1 of the year, which is the tax period. Section 1 of the declaration is filled out by the taxpayer for all land plots located within the relevant municipalities (shares of land plots located within the boundaries of the relevant municipalities (federal cities of Moscow or St. Petersburg), shares in the right to a land plot).

Filling out a land tax return

- TIN of the organization (the cells allocated for the TIN are filled in from left to right; a dash is placed in the last two cells);

- KPP (assigned to the organization by the tax inspectorate upon registration at the location of the land plot);

- adjustment number (for the primary declaration – “0–”, for the updated declaration – “1–”, “2–”, etc.);

- tax period code (must be “34”);

- reporting year (in the declaration for 2013, this field should contain “2013”);

- code of the tax office with which the organization is registered as a land tax payer, according to tax registration documents;

- code corresponding to the place of submission of the declaration to the tax office (according to Appendix 3 to the Procedure, approved by Order No. ММВ-7-11/696). For example, when submitting a declaration on the location of a land plot, you must indicate “270”;

- full name of the organization;

- contact phone number of the organization;

- code of the type of economic activity according to the OKVED classifier;

- the number of pages on which the declaration is drawn up;

- the number of sheets of supporting documents (copies thereof) attached to the declaration, including documents (copies thereof) certifying the authority of the representative of the organization who submits the declaration.

On line 130 of section 2, you must indicate the tax base. It is defined as the cadastral (if not established, then as the standard) value (share of the cadastral value) of the land plot as of January 1 of the reporting year. Depending on the type of benefit applied, when calculating the tax base, one should take into account the features provided for in paragraph 5.15 of the Procedure approved by Order No. ММВ-7-11/696.

How to include it in your transport tax return

The transport tax declaration form was approved by order of the Federal Tax Service of Russia dated December 5, 2016 No. ММВ-7-21/ [email protected] Note that the declaration consists of the following sections:

- title page;

- Section 1 “Amount of transport tax payable to the budget”;

- Section 2 “Calculation of the amount of transport tax for each vehicle.”

Starting with reporting for 2022, there will be no need to submit declarations for transport and land taxes. At the same time, organizations must still calculate the tax and transfer it to the budget (clauses 4-7 of Article 363 of the Tax Code of the Russian Federation). However, if during 2020 the organization ceases its activities through liquidation or reorganization, then these declarations still need to be submitted.

Therefore, we will consider how to reflect a three-month exemption from transport tax in reporting.

In the first part of the indicator on line 240 of section 2, you need to indicate one of the tax benefit codes according to the table (shown below): 10201, 10202, 10203, 10204, in the second part of the line - zeros. On line 250 of section 2, indicate the amount of the tax benefit in rubles.

If your region has also established a tax benefit, then in the first part of the indicator on line 240 of Section 2 you need to indicate one of the tax benefit codes according to the table (shown below), namely: 10205, 10206, 10207, 10208. In the second part of the indicator, sequentially indicate the number or letter designation of the corresponding structural unit (article, part, paragraph, subparagraph, paragraph, other) of the law of the subject of the Russian Federation, in accordance with which the benefit is provided. According to line 250 of section 2 - the amount of the tax benefit in rubles, including taking into account the advance payment.

Read in the berator “Practical Encyclopedia of an Accountant”

How to fill out a transport tax return

Tax benefits for land tax 2022: to whom and how much

Payers of land tax are all citizens who have land in their ownership or lifetime use (Article 388 of the Tax Code of the Russian Federation). This means that owners of private houses, summer residents, as well as those who have an allotment for gardening are required to pay it. The payment has local significance, that is, it goes not only to the federal, but also to the regional and local budgets. Therefore, the authorities of the constituent entities of the Russian Federation and municipalities have the authority to establish: At the same time, the procedure and deadlines for taxpayers to provide documents confirming the right to reduce the tax base are established by regulatory legal acts of the represented municipal bodies. Along with the documents, the taxpayer must submit an application in the form approved by Order No. ММВ-7-21 dated November 14, 2019/ [email protected] It can be filled out either by hand or on a computer. When filling out by hand, you must write in capital block letters and in black ink. On your computer you need to use a font size of 16-18. There should be no empty cells, so you need to put dashes if there is free space left.

15 Jan 2022 marketur 1164

Share this post

- Related Posts

- What is included in the total area of a residential building?

- Buy a metro ticket for a schoolchild

- How to properly certify a copy of a work book sample

- Rent with option to buy trucks