The current legislation of the Russian Federation determines that for each employee who works in the country, the employer is obliged to pay special payments - insurance premiums. This concept is explained by the Tax Code of the Russian Federation. Thus, insurance premiums should be understood as certain payments that are mandatory, paid by organizations and individual entrepreneurs for medical, social and pension insurance.

At the same time, each legal entity and individual entrepreneur has not only the obligation to make payments, but also to provide appropriate reporting. It is drawn up in strict accordance with certain rules.

Among other things, when filling out reports, special codes for the category of insured persons are used, the correct use of which causes difficulty for many employers. What codes should be used when submitting reports on the payment of insurance premiums, as well as their decoding, will be discussed later in this article.

What it is

Until 2022, the vast majority of insurance premiums were collected and administered by the Russian Pension Fund. At the same time, there was some confusion associated with reporting. However, from 2022, it was decided that insurance premiums began to be administered by the Federal Tax Service (FTS). This allowed, among other things, to unify reporting documentation.

Reference! Social insurance premiums for injuries continue to be administered by the Social Insurance Fund.

When reporting to the Federal Tax Service for paid insurance premiums, a single DAM report form is used. The procedure for filling it out is strictly regulated. This is largely due to the fact that the way you work with reports is largely automated.

The RSV form consists of several sections, one of which contains information about the insured persons.

Insured persons are individuals from whose wages and other forms of remuneration insurance contributions are paid by employers. It should be noted that individual entrepreneurs have the obligation to pay contributions both for their employees (if any) and for themselves.

Among other things, in a separate column it is necessary to indicate the category to which the insured person belongs. It is expressed in the form of a special code.

The list of codes is not arbitrary, but is established by law . You cannot submit a report without affixing the insured person's code.

What changed?

According to Art. 7 of Law No. 102-FZ dated 01.04.2020, organizations and individual entrepreneurs that are included in the register of SMEs can apply a reduced rate of 15% when calculating and paying insurance premiums from April 1, 2022 in relation to amounts of payments to employees that exceed the amount of the minimum wage. Unlike the reduced rate of 0%, this rate is unlimited and can be applied during the reporting period. The right to apply this reduced tariff does not depend on the OKVED code or type of activity; for this, the only condition must be met: to be in the SME register.

To fill out the RSV, such payers use a new tariff code - 20, as well as new codes of insured persons. This point is clarified in the Letter of the Federal Tax Service of the Russian Federation dated 04/07/2020 No. BS-4-11/ [email protected]

Features of reporting in 2022 on insurance premiums

In 2022, starting from the first quarter, the reporting procedure for insurance premiums has undergone some changes. Thus, the main ones concerned the need to submit it electronically.

If previously organizations were required to submit documentation electronically only if their staff number exceeded 25 people, now the obligation for electronic document management falls on companies with more than 10 employees. Accordingly, if an organization employs less than 10 people, then its management has the right to independently determine the form of submission of reporting documentation - electronically or on paper.

These changes apply to both DAM reports and other forms (4-FSS, SZV-M, SZV-STAZH).

In addition, there have been changes in 2022 that also affect the DAM report. Thus, additional fields have been added to Section 1 of this reporting form. In addition, the order and composition of the appendices to Section 1 were changed.

In practice, this means that using the old DAM form in 2020 is impossible. It is necessary to submit documents using the new form from the 1st quarter of 2022. The current form of the new DAM sample can be downloaded from the website of the Federal Tax Service.

How to fill it out?

Companies and individual entrepreneurs that are entitled to a reduced tariff fill out the “calculation of insurance premiums” report in the prescribed form, specified by Order of the Federal Tax Service dated September 18, 2019 No. ММВ-7-11/470. If the employer applies a 15% tariff, the following components of the DAM must be filled in:

This point is indicated in clauses 2.1 and 2.2 of the Filling Procedure, which was approved by Order of the Federal Tax Service dated September 18, 2019 No. ММВ-7-11/470.

The taxpayer fills out the title page in the same way as before. Filling out the appendices of section 1 of the DAM report occurs separately for payments within the minimum wage and payments that exceed 12,130 rubles. In line 001, for payments in the amount of the minimum wage, you must indicate the tariff code “01”, and for payments exceeding the minimum wage, code “20”.

When filling out section 3, add two entries each month:

And the remaining applications and sections of the report are filled out in the usual manner.

In subsections 1.1, 1.2 of section 1 and appendix 2 to section 1, tariff code 01 indicates non-taxable amounts along with payments within the limit of 12,130 rubles. In subsections with tariff code 20, only payments exceeding the minimum wage are issued, while 0 is entered in the lines for non-taxable amounts.

Data in section 3 of the new calculation

The section of the DAM report form is filled in with information regarding the personalized data of employees, that is, insured persons.

Thus, subsection 3.1 states the following:

- Full name of the person;

- TIN;

- SNILS;

- Date of Birth;

- floor;

- details of the identity document.

Subsection 3.2 must contain information about the amounts of payments that were made to pay insurance premiums for a specific insured person.

So, here is the following:

- amount of payments (per month);

- basis for calculating insurance premiums.

In addition, if necessary, fill in information about the payment of funds at an additional tariff, if it is accrued.

In the same subsection, payer category codes must also be indicated. Moreover, they must be registered for each period in which the insured person received income.

Error in RSV for Q3.

The question was asked by Marina M.

Responsible for the answer: Yulia Schelkunova (★9.81/10)

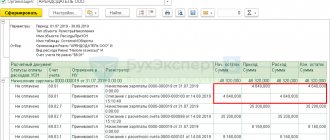

Hello, we are working on the latest version 3.1.10. Organization of SMEs. In VLSI when sending the DAM report for the 3rd quarter. An error occurs if employees exceed the base in all three months. Error: “The MS category code (VZHMS, VPMS) cannot be specified. A reduced tariff is applied if, according to the NR code (VZHNR, VPNR), the base for calculating SV p. 150 is equal to the minimum wage.” Please tell me, has anyone encountered a similar error and how to fix it? I am attaching a screenshot of section 3 for the employee who is experiencing the error.

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Codes with decryption

Many employees of organizations and individual entrepreneurs who are required to submit reports on insurance premiums to the Pension Fund have difficulty determining the code of the insured person. In addition, such encoding is often considered unnecessary. However, each line of documents submitted to the Federal Tax Service has practical significance for the regulatory authority.

The thing is that insurance premium rates are not the same for different categories of workers . For example, there are basic tariffs that are the same for everyone. However, individual policyholders have certain benefits when paying premiums.

In addition, a fairly large number of foreign citizens work in Russia on a permanent and temporary basis. Accordingly, for this category of workers there are also provisions that differ from the base rate.

Accordingly, the category code of the insured person makes it possible to determine the citizenship of the employee, the availability of certain benefits when calculating insurance premiums, as well as the grounds for applying a tariff different from the basic one.

Many people responsible for submitting reports on insurance premiums are wondering where they can find out what codes should be indicated in the DAM form. A complete list of codes is contained in documents published by the Federal Tax Service of Russia.

Their current nomenclature for mid-2022 is contained in Order of the Federal Tax Service of Russia No. ММВ-7-11 / [email protected] dated September 18, 2019 , namely Appendix No. 7 to the Procedure for filling out the calculation form for insurance premiums approved by this order.

Attention! Interested parties can familiarize themselves with the document on the website of the Federal Tax Service, when visiting the tax office, as well as in online versions of reference and legal systems, for example, in “Consultant Plus” or “Garant”.

The nomenclature of codes that was established by the Resolutions of the Board of the Pension Fund of the Russian Federation in certain periods was declared invalid, and therefore they cannot be used when filling out the DAM for the Federal Tax Service.

Below we will discuss in detail the currently used encodings of the status of insured persons in accordance with the latest current order of the Federal Tax Service.

HP

This code designation is the most common. It can be deciphered as “hired employee.” As follows from the decoding, HP is issued for employees with whom the organization or individual entrepreneur has an employment relationship.

In addition, this applies to both employees for whom insurance premiums are paid at the base rate, and personnel who work in special conditions associated with increased health risks. For the latter, the employer pays increased amounts. However, in the calculation they are calculated according to the HP code, as well as employees working under normal conditions.

This letter designation is used by payers of contributions using the simplified tax system, UTII and the general taxation system.

The HP code is entered only if contributions calculated according to the general tariff are paid for employees.

ODIT

The code abbreviation ODIT is assigned to persons who are engaged in activities in the field of modern technologies related to the transmission and storage of information. Some clarification is needed here.

Companies whose activities include information technology can use the services of individuals who perform work on the development of computer programs, databases, and so on. Regardless of the nature of their contractual relationships, organizations are required to pay insurance premiums on remunerations and payments to these individuals. Accordingly, when submitting the DAM for these persons, this code is indicated as such.

The taxation regime applied by organizations does not affect the category of the insured person. It should be noted that the ODIT code is not assigned to employees who are not directly involved in information technology work in the company.

ICS

Decoding the ICS code sounds like “Innovative. This letter designation marks individuals who have contractual relations with organizations that are official participants in the project for the implementation of R&D, development and commercialization of Skolkovo research work.

However, since 2022, activities have been launched to create other innovative scientific and technological centers, the list of which is growing. Accordingly, the ICI code is also entered by organizations participating in such projects when calculating insurance premiums for individuals who have contractual relations with them.

Important! The procedure for creating innovation centers and the participation of organizations in relevant projects is regulated by Federal Law No. 216-FZ of July 29, 2022.

ASB

The ASB code is indicated when submitting a report for insured individuals who receive wages and other remuneration for their activities in non-profit organizations that have the appropriate state registration as an NPO and carry out activities in the field of social services for citizens. In addition, this encoding is used by non-profit organizations involved in the field of mass sports.

Also, the ASB code is entered in the report by charitable foundations , including for persons for whom insurance premiums are transferred from remuneration provided for in civil law contracts.

This code in the DAM is indicated only by those NPOs and charitable organizations that apply a simplified tax system, regardless of its chosen form.

BSEC

The BSEC code is indicated by employers who pay contributions for medical, pension and social insurance for individuals who, by the nature of their activities in the organization, are crew members of river and sea vessels. In this case, the specifics of the activity of the vessel or the organization itself does not matter. The abbreviation itself stands for “ship crew member.”

The members of the ship's crew should be understood as the command staff and the ship's crew. If the ship is a passenger ship, then the crew also includes persons who are engaged in direct service to passengers, regardless of the nature of the labor relationship with its owner.

It is important to note that the BSEC code is assigned only to crew members of those ships that, in accordance with current legislation, are registered in the relevant Russian register.

Cattle

The KRS code is assigned to citizens who work in organizations in the Crimea and the city of Sevastopol.

It should be noted here that, in accordance with the legislation, the territory of these constituent entities of the Russian Federation is recognized as a special economic zone, where more favorable conditions for conducting economic activities apply.

So, among other things, this also applies to the special procedure for calculating tax payments and insurance premiums. In other words, economic entities registered in Crimea and Sevastopol have benefits when calculating the base of insurance premiums for their employees.

It has been established that the regime of a special economic zone on the territory of these two subjects of the Federation will be valid until 2040. However, if necessary, it can be extended, but such a decision must be reflected in the norms of federal legislation.

TOP

The abbreviation “TOR” stands for “territory of rapid socio-economic development”.

It should be understood as a part of the territory within a particular subject of the Russian Federation, on which a special legal regime is introduced that is favorable for the implementation of economic activity. Today there are dozens of such territories in the Russian Federation.

Companies that are interested in doing business under simplified conditions can become residents of one or another ASEZ, which gives them the right to certain benefits and concessions. Thus, the rate of insurance premiums for them is significantly lower than it is established on a general basis.

Accordingly, the insured persons for whom contributions are paid by residents of these preferential economic zones have the code designation TOP, which is indicated in subsection 3.2 of the form for calculating insurance premiums.

SPVL

This code designation is given to persons for whom funds are paid for medical, pension and social insurance, working in organizations recognized as residents of the free port of Vladivostok.

The definition of the latter should be discussed in more detail. In accordance with federal legislation, the free port zone of Vladivostok should be understood as a part of the territory of the Primorsky Territory, which has a special law enforcement regime that is favorable for economically active activities.

Subsequently, individual municipalities of other subjects of the Federation located in the Russian Far East were also included in the territory of the free port of Vladivostok, including:

- Sakhalin region;

- Khabarovsk region;

- Kamchatka Krai;

- Chukotka Autonomous Okrug.

In the territories belonging to the free port zone, its residents enjoy benefits on fiscal payments, as well as on the payment of insurance premiums. At the same time, residents in this case can be both commercial organizations in the form of a legal entity and individual entrepreneurs.

KLN

Under the code designation KLN, insured persons are noted in the report who receive monetary rewards for performing work from insurance premium payers who are residents of a zone that has a special law enforcement regime on the territory of the westernmost subject of the Federation - the Kaliningrad region.

The Kaliningrad region is a unique region of the Russian Federation. Due to the fact that it is, in essence, the only exclave, that is, it does not have a land border with other territories of the country, a special legal regime operates here, suggesting additional benefits for organizations, enterprises and other economic entities. In addition, the Kaliningrad region is completely surrounded (except for the sea) by the territories of EU member states, which implies active international cooperation.

Organizations and individual entrepreneurs in this Baltic region have certain tax breaks, as well as a reduced tariff for paying insurance premiums. That is why Kaliningrad payers indicate the corresponding code in the DAM form for their employees.

ASM

Insured persons who are involved in the production of animated audiovisual products are indicated in the report under the code ANM.

Here we should dwell in more detail on what audiovisual products are. Federal Law No. 77-FZ of December 29, 1994 establishes that cinema, audio recordings, video materials, and photographic materials are recognized as audiovisual products. In this case, the carrier of the product does not matter for its definition as such.

Animated audiovisual production is essentially animation.

Thus, the insured persons, who are designated in the report by the ANM code, are citizens engaged in the production of cartoons and animated series , as well as the sale of their products.

It should be noted that insurance premiums are paid by organizations for these individuals, regardless of the type and type of contractual relationship between them.

SAR

The SAR code can be deciphered as “special administrative region”. It should be understood as special zones of the territory of individual regions.

Federal Law No. 291-FZ of August 3, 2022 introduced this concept into circulation. According to its norms, a special administrative region refers to territories with the most favored economic status for economic entities on Russky Island in the Far East and on Oktyabrsky Island in the Kaliningrad Region.

At the same time, not all employees of organizations are indicated under the SAR code, but only those who are members of the ship’s crew. In other words, sailors.

That is, benefits on insurance premiums apply in these territories only to ship crew members. However, it should be taken into account that the Primorsky Territory (a significant part of it) and the Kaliningrad region are themselves special economic zones. Accordingly, the remaining insured persons are also assigned a special code.

VZHNR

The VNZHR code is also extremely common . It denotes employees from among the citizens of foreign states who have been granted temporary asylum, employees for hire in organizations and registered individual entrepreneurs.

Payers of insurance premiums for foreigners who are temporarily in the territory of our country can apply any tax regime - general, simplified tax system, UTII, and so on.

In accordance with tax legislation, insurance premiums for foreigners are paid only if the employee himself is an insured person in the social insurance, compulsory health insurance and compulsory medical insurance systems.

However, it should be taken into account that foreign citizens who carry out their activities remotely while outside our country are not insured persons, therefore the corresponding contributions from their income are not paid to the Federal Tax Service, and they do not appear in the calculation itself.

VZHIT

The code designation VZHIT is used to identify in the DAM insured persons who have foreign citizenship, who have received temporary asylum in the territory of the Russian Federation, from whose payments contributions are paid by Russian organizations conducting their main activities in the field of information technology.

Activities in the field of information technology should be understood as the development and implementation of computer programs and databases on any material or electronic medium.

Attention! The status of a foreign person in this case does not matter.

VZhTS

The VZHS code designates insured persons from among foreigners who are in Russia in accordance with the norms of the Federal Law of February 19, 1993 “On Refugees”, from whose income contributions are paid by organizations participating in the Skolkovo state project.

In accordance with the Federal Law of September 28, 2010, the innovative one was created in order to attract residents carrying out activities in the field of innovative scientific and technical developments and research, as well as the commercialization of their results.

Economic entities participating in the Skolkovo project have a number of concessions in taxation and payment of other mandatory payments, including insurance premiums.

In addition, the VZhTS code is used when filing DAM for insured persons from among foreigners by organizations that are participants in projects of innovation and technology centers.

The latter, in accordance with Federal Law No. 216-FZ of July 29, 2017, refers to a set of economic entities whose work is aimed at carrying out scientific and technical activities.

These organizations also have benefits related to the payment of taxes and other mandatory payments.

VZSB

The VZHSB code is used to designate foreign citizens insured in the compulsory insurance system, who are in Russia for the period of provision of temporary asylum, for whom mandatory payments are made by non-profit organizations whose activities are aimed at medical and social services for the population, as well as the implementation of statutory goals in the field of art , culture and mass sports.

In addition, the VZHSB code in the calculation is indicated by charitable organizations that transfer insurance premiums for foreigners if they have income not related to their statutory activities.

It should be noted that these non-profit organizations must make tax payments within the framework of the simplified taxation system. This is true for all types of similar organizations.

VZhES

The code designation VZhES identifies citizens insured in the OPS and Compulsory Medical Insurance systems who, being foreigners or stateless persons, are crew members of ships registered in the corresponding Russian registry. The legal status of foreign persons designated by this code is regulated by the Federal Law “On Refugees”.

It should be noted that current Russian legislation provides for fairly strict rules regarding the minimum crew size and requirements for it.

Thus, responsible persons from among the command staff and the ship's crew must have the qualifications corresponding to their position, and the number of crew members must be sufficient to ensure that the working hours on the ship are strictly observed, and they are not allowed to be overloaded with certain duties.

Foreign citizens who are members of the crews of Russian ships have the same rights and bear the same responsibilities as citizens of the Russian Federation in accordance with the Labor Code of the Russian Federation, the Merchant Shipping Code of the Russian Federation and other legal acts.

VZhKS

This code designation is for insured citizens of foreign countries who have received temporary asylum on the territory of the Russian Federation , for whom compulsory insurance premiums are paid by organizations and companies located and duly registered in the territory of the city of Sevastopol and the Republic of Crimea.

By virtue of Federal Law No. 377-FZ dated November 29, 2014, a special legal regime operates on the territory of these constituent entities of the Federation, providing preferential taxation, as well as economic benefits for business entities. Part of the preferences in accordance with this regulatory act involves a reduction in the basic tariff for the payment of insurance premiums.

The special legal regime in the territory of Crimea and Sevastopol is valid for 25 years after the entry into force of the legal act (from January 1, 2015).

VZhTR

If the payer of insurance premiums, that is, an organization or individual entrepreneur, is a resident of a territory of rapid socio-economic development, the legal regulation of which is carried out by the norms of the relevant federal law, then he has the right to apply a preferential tariff for their calculation.

The VZhTR code is entered by such organizations in calculations for individuals who have received temporary asylum in the Russian Federation . It should be noted that the form and type of work performed by a foreigner is not of fundamental importance. The defining feature in this case is only the fact that the organization is a resident of a priority development area.

VZHVL

The VZHVL code in the calculation is assigned to citizens of persons with foreign citizenship located on the territory of the Russian Federation on the basis of the Federal Law “On Refugees”. Moreover, in their calculations it is indicated only by those organizations that are duly registered as residents of the free port of Vladivostok.

Reference! The free port of Vladivostok is not limited to just the seaport of the city of Vladivostok. It includes a significant part of the Primorsky Territory of the Russian Federation, the city of Petropavlovsk-Kamchatsky, Vaninsky and Sovetsko-Gavansky districts of the Khabarovsk Territory, the cities of Korsakov and Uglegorsk of the Sakhalin Region, as well as the city of Pevek of the Chukotka Autonomous Okrug.

Residents of the free port of Vladivostok, among other things, have the right to receive tax benefits and other economic preferences . The same applies to relaxations in the payment of mandatory payments, including in terms of insurance premiums for their employees.

VZHKL

The code designation VZHKL is given to those insured persons from among foreigners and stateless persons who have temporary asylum on the territory of the Russian Federation, for whom insurance premiums are paid by organizations registered in the Kaliningrad region of Russia.

The Kaliningrad region, due to its unique geographical location, has been a territory since 2006 that has a special legal regime that provides maximum favorable conditions for the economic activities of business entities. First of all, the creation of a special economic zone on the territory of this region is necessary to attract foreign investors, taking into account the border status of the subject of the Federation.

The special legal regime in the Kaliningrad region implies certain relaxations for organizations in terms of paying taxes and other obligatory payments.

VZHAN

The VZhAN code is assigned to insured persons who, being foreigners, have received temporary asylum on the territory of the Russian Federation. Moreover, this designation is indicated in the report only by those organizations that produce animated audiovisual products.

It should be added that the VZhAN code is assigned to foreigners who are in the country on the basis of the Federal Law “On Refugees” by organizations that not only produce animated audiovisual products, but also sell their own.

VZHAR

The designation VZHAR in the calculation submitted to the tax office in 2020 is given to persons from among foreign citizens who arrived in Russia to obtain temporary asylum, and who are crew members of ships for whom insurance premiums are paid by organizations recognized as participants in special administrative entities in the Kaliningrad region and Primorsky Krai.

VPNR

Legal entities and individual entrepreneurs indicate the VPNR code in the RSV when paying insurance premiums for their employees with whom they have an employment relationship. Moreover, this code is entered only if the employees of organizations and individual entrepreneurs themselves are citizens of foreign countries. This code designation is one of the most common.

VPIT

The VPIT code is indicated by those organizations that operate in the field of information technology and pay insurance premiums for persons who are in the country temporarily and do not have citizenship of the Russian Federation.

VPCS

Organizations that are participants in the Skolkovo project, as well as other projects to create innovation and technical centers, paying insurance premiums for foreigners, indicate the code of the insured person VPCS in the corresponding calculation.

VPSB

In this way, insured persons are identified from among citizens temporarily staying on the territory of the Russian Federation, for whom contributions for compulsory insurance are paid by non-profit organizations with a socially oriented orientation, as well as charitable foundations, provided that these NPOs use a tax regime such as a simplified taxation system.

VPES

The VPES code is indicated in calculations for persons who are foreign citizens who are members of the crews of ships registered in the relevant register, when paying contributions for compulsory state insurance for them.

VPKS

There are insured persons temporarily located in the territory of the Russian Federation, for whom contributions are paid by organizations conducting their main activities in the territory of Crimea and the city of Sevastopol.

VPTR

The VPTR code is indicated by organizations that were residents of territories of rapid socio-economic development when submitting payments for citizens of foreign countries.

VPVL

This code is assigned to insured persons from among foreigners for whom contributions are paid by residents of the special economic zone of the free port of Vladivostok.

VPKL

The code is indicated in calculations when paying contributions for compulsory insurance of foreign citizens by economic entities registered in the Kaliningrad region.

VPAN

The VPAN code is entered in the DAM as a designation of the category of payers from among foreigners by organizations whose field of activity is the production and sale of animated audiovisual products.

VPAR

The VPAR code is prescribed in reports to designate the category of citizens of foreign states temporarily staying in the territory of the Russian Federation from among the crew members of sea and river vessels of the organization who are residents of special administrative regions in the territory of the Kaliningrad Region and Primorsky Territory.

MS category code cannot be specified

Publication date 04/08/2021

The organization is a small enterprise, is included in the Unified Register of Small and Medium Enterprises, and applies reduced rates for insurance premiums for SMEs. How can an organization fill out section 3 of the calculation of insurance premiums for the 1st quarter of 2022 for employees (citizens of Russia)?

Organizations and individual entrepreneurs that are included in the Unified Register of Small and Medium Enterprises (SMEs) have the right to pay contributions at reduced rates. Currently, the procedure for applying this tariff is regulated by paragraphs. 17 clause 1, clause 2.1 art. 427 Tax Code of the Russian Federation. Reduced contribution rates apply to payments in excess of the minimum wage in force at the beginning of the billing period (in 2022 - 12,792 rubles). Payments equal to the minimum wage or less than the minimum wage are taxed at general rates.

The form and procedure for filling out the calculation of contributions (hereinafter referred to as the Procedure for filling out the calculation) were approved by order of the Federal Tax Service of Russia dated September 18, 2019 No. ММВ-7-11/ [email protected]

By Order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11/ [email protected] a new category of insured persons was added to Appendix No. 7: “MS” - individuals who receive a portion of payments and remunerations determined based on the results of each calendar month as excess above the minimum wage, insurance premiums are calculated by SMEs.

In addition, a general category has been established for all insured persons - “NR”.

Thus, when filling out subsection 3.2.1 of the calculation of insurance premiums for employees who received an amount exceeding 12,792 rubles in the corresponding month of the first quarter, the above columns will be filled in twice (for each month):

In other words, for insured persons whose payments exceed 12,792 rubles. per month, you must fill out the indicators in columns 120-170 of section 3 of the calculation of insurance premiums twice. For insured persons whose payments do not exceed RUB 12,792. per month, columns 120-170 will be filled in only once with the code “NR”.

Reduced insurance premium rates

Let us remind you that from April 1 of this year, special rules apply to small and medium-sized enterprises (SMEs): insurance premium rates must be determined based on the amount of payments to employees for each individual month. At the same time, for accruals within the minimum wage and above the minimum wage, different contribution rates apply. That part of a particular employee’s salary that does not exceed the minimum wage should be subject to insurance contributions at general rates. For the rest of the payments (above the minimum wage), contributions must be transferred at reduced rates. Namely:

How to fill out a calculation: examples

Let's look at an example of how to apply a reduced tariff when calculating pension insurance contributions and filling out the calculation.

Example 1. The base is less than the minimum wage

Let's take the case mentioned above: in February, an employee received 16,000 rubles, 5,000 of which were disability benefits.

Contributions for February need to be calculated only at the basic rate, since 16,000 - 5,000 = 11,000 ( 12,792

This means that there is an excess from which contributions are calculated at a reduced rate. Let's look at the formula that the Federal Tax Service requires to calculate contributions. The payment for compulsory pension provision amounts to 3,035.04 rubles:

12 792 × 2 × 22 % + (35 000 — 12 792 × 2) ×10 % – 3 535,04 = 5 628,48 + 941,6 — 3 535,04 = 3 035,04

In the calculation in section 3 this will be reflected as follows:

Example 3. Base limit reached

The requirement for an amount equal to the minimum wage in line 150 of subsection 3.2.1 with code NR must be fulfilled only on a basis that does not exceed the size of the limit.

Let’s assume that an employee’s monthly payments are 500,000 rubles; there are no non-taxable payments. In March, we will exceed the maximum value of the base for OPS (1,465,000 rubles). The amount exceeding the limit of 35,000 rubles:

1 500 000 — 1 465 000 = 35 000

The base, which does not exceed the limit, in March is 465,000 rubles0 > minimum wage).

Using the formula for calculating contributions using a reduced tariff, the amount payable for compulsory pension insurance for March is obtained:

38,376 × 22% + (16) ×10% + 35,000 × 10% – 103,070.08 (contributions for January–February) = 51,535.04 rubles.

The personalized information does not reflect the base exceeding the limit and contributions from it. Here's how to fill out subsection 3.2.1 in section 3 of the calculation with the HP category code:

And here is a sample of filling out subsection 3.2.1 with the MS category code:

The base in excess of the limit and contributions from it will be reflected in subsection 1.1 of Appendix 1 with code 20 in lines 051 and 062.

What control ratios must be met in the DAM

The situation became even clearer after the Federal Tax Service published the control ratios that must be met for this category of payers in the form of the RSV (letter of the Federal Tax Service dated May 29, 2020 No. BS-4-11 / [email protected] ).

These new control ratios complement the previous list of controls for the DAM form (letter of the Federal Tax Service dated 02/07/2020 No. BS-4-11 / [email protected] ). In the list they are listed under numbers 1.193–1.199, 2.8–2.10. Then these control ratios were supplemented once again (letter of the Federal Tax Service dated June 23, 2020 No. BS-4-11/ [email protected] ).

Let us explain what the wording of these control ratios means.

| Contributions | Bid |

| For compulsory pension insurance | And up to the maximum value of the base (1,465,000 rubles), and above - 10% |

| For compulsory social insurance in case of temporary disability and in connection with maternity | |

| Control ratio - wording in the letter from the Federal Tax Service | What does it mean |

| If field 001 adj. 1 rub. 1 SV = 20, then the presence of adj. 1 rub. 1 SV with value 01 in field 001 is required | If there is an application with code “20” in the calculation, then there must also be an application with code “01” |

| If in subsection 3.2.1 p. 3 SV according to FL (according to SNILS + full name indicators) field value 130 = MS, then the presence of subsection 3.2.1 r. 3 SV for this FL with a value in the field of 130 = NR required | If in section 3 of an individual there is subsection 3.2.1 with the code “MS”, then subsection 3.2.1 with the code “NR” must be present |

| If in subsection 3.2.1 p. 3 SV according to FL (according to SNILS + full name indicators) field value 130 = MS, then in subsection 3.2.1 p. 3 SV for this FL with a value in field 130 = NR line 150 for each value of field 120 = minimum wage (based on a base not exceeding the limit value) | If in subsection 3.2.1 there is a line with the code “MS”, then in the line with the code “NR” for the same month the amount in column 150 (base) should be equal to the minimum wage. This requirement applies as long as the base does not exceed the limit |

Thus, the right to apply a reduced tariff appears if the base for calculating contributions for the basic tariff is not less than 12,792 rubles. If less, the reduced rate does not apply that month.

Will reduced insurance premium rates apply for SMEs in 2022?

Federal Law No. 102-FZ dated April 1, 2020 not only introduced a reduced tariff for SMEs from April 2022, but also made amendments to the Tax Code of the Russian Federation. The list of insurance premium payers for whom reduced rates apply has been supplemented with a new category (clause 17, clause 1, article 427 of the Tax Code of the Russian Federation):

And also, Art. 427 of the Tax Code of the Russian Federation has been supplemented with clause 2.1, according to which for payers specified in clauses. 17, starting from 2022, the following reduced insurance premium rates apply:

1) for compulsory pension insurance:

2) for compulsory social insurance in case of temporary disability and in connection with maternity - 0%; 3) for compulsory health insurance - 5%.

Thus, SMEs in 2022 and beyond continue to apply a reduced tariff to the part of the base for a calendar month that exceeds the minimum wage.