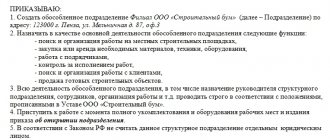

Peculiarities

Companies, in accordance with the Civil Code of the Russian Federation, can be created to conduct business activities in general or perform certain tasks. In this they are no different from other entities engaged in economic activities.

A legal entity has the opportunity to open its own separate divisions (hereinafter also referred to as OP). This right is enshrined in Art. 55 of the Civil Code. Let us clarify that merchants are formally deprived of this opportunity.

Opening an OP does not entail the creation of a separate legal entity. It is part of an already registered organization, which means it does not have the same scope of legal rights and obligations.

The Tax Code contains clear features that must necessarily be inherent in “separateness”:

- availability of stationary workplaces;

- different addresses for the head office and the OP.

The absence of at least one of these signs means that there are insufficient grounds for opening a new structure in the OP status. The creation of a “separateness” in this case will contradict Article 11 of the Tax Code. This means that there will not be a separate checkpoint of a separate unit .

The Civil Code mentions only two forms of OP:

- branch;

- representation.

At the same time, Art. 55 of the Tax Code of the Russian Federation provides another type of separate unit - equipped working positions.

The opening of branches and representative offices implies the appearance of data about them in the Unified State Register of Legal Entities (in the case of equipped workplaces with the status of EP, this does not happen). To do this, you must first fill out an application (there are approved forms) and send it to the tax authorities.

For more information about this, see “How to open a separate division of an LLC: instructions.”

General provisions on separate divisions

The Civil Code of the Russian Federation, as amended currently in force, allows for the creation and existence of legal entities that, along with other business entities, to one degree or another participate in business activities or are created to achieve specific goals (Article 48 of the Civil Code of the Russian Federation) .

Each legal entity has the right and can create separate divisions (Article 55 of the Civil Code of the Russian Federation). Domestic legislation distinguishes between separate divisions a representative office and a branch. It is important to remember that separate divisions are not legal entities, and therefore lack the legal capacity inherent in legal entities.

According to Art. 11 of the Tax Code of the Russian Federation, a separate division in any case must be territorially separate from the parent organization and have stationary jobs, i.e. jobs created for a period of more than one month. A separate unit is not only a branch or representative office, but also a separate stationary workplace.

Information about each separate division (with the exception of stationary workplaces) is indicated in the unified state register of legal entities, for which the organization creating them must submit completed applications to the tax office on approved forms.

After state registration, each branch and representative office can be assigned various codes, including the OKTMO code of a separate subdivision, which is the All-Russian classifier of municipal territories and characterizes the territory of the municipality on which the corresponding separate subdivision is located.

Basic codes

When the registration of an OP has occurred, it may be assigned special codes. But the parent organization and all its divisions will still have the same TIN. This is due to the fact that the OP is not a legal entity.

Thus, find out the checkpoint of a separate division using the TIN of the main enterprise by applying for an extract from the Unified State Register of Legal Entities.

The judgment that there is no need to obtain a separate TIN is based on an analysis of the regulatory document regulating the procedure for obtaining, using and changing the TIN (approved by order of the Ministry of Taxes of Russia dated 03.03.2004 No. BG-3-09/178). And it is valid only when registering or deregistering legal entities and individuals.

A TIN can only be assigned to the organization itself. None of its divisions, including separate ones, have the right to receive their own TIN. Only upon initial registration with the Federal Tax Service does the organization receive its TIN at the place of registration.

Why do you need to know the gearbox code?

Any large company may have several branches (separate divisions), which have different territorial affiliations, but this does not exempt them from registering with the tax office at their location.

Thus, each subsidiary will be assigned its own code, which can tell about a specific company and officially confirm the following data:

- recognize the identification of a legal entity based on a specific feature;

- determination of the fact of carrying out activities or the presence of own property on the territory;

- indicate the main place of activity of the organization and its branches in other regions.

However, to determine all these signs, you must be able to decipher the checkpoint.

Right to a reason code

Absolutely any business entity receives certain codes, as stated in the law. They are needed for the following purposes:

- identification in classification systems according to various criteria (territory, industry, etc.);

- maintaining records of subjects (for the purposes of taxes and insurance premiums, statistics, etc.).

And if for the main organization codes are an integral attribute, then separate divisions may have their own or coincide with the codes of the main organization.

Any organization must register with the tax service before starting its activities. This is enshrined in paragraph 1 of Article 83 of the Tax Code of the Russian Federation. But not everyone understands which inspectorate they need to contact in order to register. Belonging to the Federal Tax Service can be determined:

- the address of the organization itself (for an individual entrepreneur - the address of his permanent registration);

- the location of its real estate;

- OP's address.

The organization is required to register with the tax office at the address not only of the head office, but also of all separate divisions.

The company must inform the tax authorities about the opening of a separate division. After this, it is registered.

Despite the fact that the parent organization and all its separate divisions have one TIN, KPP is assigned to each of them. This will happen even if the organization does not submit an application to the checkpoint of a separate unit .

Then information about the checkpoint of a separate division is sent from the local tax office to the one where the parent company is registered.

According to the rules on TIN (approved by order of the Federal Tax Service dated June 29, 2012 No. ММВ-7-6/435), when creating any form of a separate unit, it must be assigned a checkpoint.

CPR in legislation

According to Article 83 of the Tax Code, separate divisions (hereinafter referred to as OP) are subject to tax control at the location of each of them. The stop is carried out by the department itself based on a message from the enterprise about the opening of an OP. Article 23 of the Tax Code of the Russian Federation, in addition to the obligation to register, sets an enterprise a period of one month for registering an OP.

According to Article 55 of the Civil Code, the OP is not a legal entity. This means that it acts on behalf of the head of the enterprise by proxy, is endowed with the company’s property and is not assigned a TIN. But he is assigned a checkpoint. This is done on the basis of Order of the Federal Tax Service of Russia dated June 29, 2012 N ММВ-7-6/ [email protected] .

How to find out

Before you understand the decoding of the assigned checkpoints in order to obtain information about the EP, you need to understand how you can find out including by TIN

Information about such structural divisions as branches and representative offices is displayed in the Unified State Register of Legal Entities (other types of EP do not appear in it). Tax officers transmit all checkpoint numbers of existing separate divisions to the inspectorate at the head office address.

Many people believe that to obtain information about the checkpoint of a separate unit, it is enough to go to the official website of the Federal Tax Service of Russia and request an extract from the Unified State Register of Legal Entities. The exact link is www.egrul.nalog.ru.

However, this won't help. The fact is that by order of the Ministry of Finance dated December 5, 2013 No. 115n, the exact composition of the information in the extract from the Unified State Register of Legal Entities was approved. And the checkpoint of the separate unit is not mentioned in it. Therefore, such an extract will not help to recognize the checkpoint of a separate unit by TIN .

Also see “Electronic services for accountants on the Federal Tax Service website: use wisely.”

Therefore, there are two options left:

- send a request to the tax office (or to the counterparty you are interested in);

- use various databases (but no one is responsible for their reliability).

How to find out the code of a separate division of an organization

Any large company with impressive financial turnover needs to register additional working branches in other regions. It is these subsidiaries that should be called separate divisions.

Any registration authority must accept “isolated organizations” as full-fledged organizations and assign them the appropriate checkpoint, regardless of their reflection in various organizational and administrative documents and assigned job responsibilities.

Registration of separate divisions is carried out with the Federal Tax Service at their location. This type of taxpayer can register itself as a company or division.

A representative office can be registered at the most remote points from the main place of work of the parent organization, and a branch, as a rule, operates at a short distance, performing the main functions of its company. It is the first four digits of the checkpoint that will indicate the location of the registration authority, namely, a specific tax office.

All additional companies have an identical INN , but different checkpoints depending on the region code of registration, determining their affiliation with a specific tax authority.

To find out the checkpoint of a specific separate division, you need to make a request to the tax authority. This information is entered into a special notice no later than five working days from the date of registration of the branch, and this document is issued to the authorized representative.

If the parent organization decides to close its branch or representative office, this must be reported in writing to the tax authority at the location of the closing company. No more than one month must pass from the date of closure.

Where does it appear?

The checkpoint must be indicated as part of the details of the legal entity in all official papers and forms of the organization. It must be reflected in the texts of contracts, various letters and powers of attorney.

There are a number of forms in which checkpoints are a mandatory element. For example, checkpoint in the invoice of a separate division . It is indicated when the OP sells something through himself.

EXAMPLE The sale of goods produced by the parent organization is carried out by its separate division. Then the checkpoint is written on the invoice not of the main office, but of the OP that makes the transaction. The same rule applies if goods are purchased by a separate division.

But the TIN is indicated to the parent organization, since the OP does not have its own.

The value of the checkpoint of a separate unit

The reason code for registration appears in the financial documentation of organizations and their affiliates and representative offices. There are frequent situations of disputes with tax inspectors regarding the checkpoint in the invoice of a separate division. By law, in addition to the parent company, only branches have the right to conduct commercial transactions. Therefore, close attention is paid to the meaning of the code.

The checkpoint consists of 8 signs, in which from left to right:

- XX – designation of the region of the main company;

- XX – number of the Federal Tax Service where the taxpayer is registered;

- XX – basis for registration;

- XX – ordinal number for a specific base.

The fifth and sixth digits of the checkpoint of a separate division are indicated in the letter of the Ministry of Finance No. CHD-6-6 / [email protected] dated 02.06.2008 and mean (old values are presented in brackets):

- 43 – branch (02, 03);

- 44 – representation (04, 05);

- 45 – separate office (OP), the value of which is assigned on the basis of a written message, and not registration in the Unified State Register of Legal Entities (31, 32).

The introduction of new designations in 2008 did not entail a requirement for a mandatory change of current certificates. Therefore the old numbers are valid.

Error in the checkpoint of a separate unit - what does it mean and what are the consequences of errors:

- The tax inspectorate, during a desk or field audit, having discovered the numbers 44, 45 in the invoice, will exclude the VAT amounts from those submitted for offset (refund) and charge fines;

- An erroneous setting in payment orders causes a delay in payments at the bank to clarify details, disputes with commercial partners, and legal conflicts due to court cases of counterparties.

Reasons and procedure for change

The reason for assigning a code to one or another organization on the territory of the Russian Federation is registration with the tax authorities in accordance with:

- its location, and a TIN is assigned;

- new location (the address of the organization changes, and it geographically begins to belong to a different tax division);

- with the address of each of the OPs that relate to the organization;

- with the new address of one of the OPs, if it has become part of a different tax division;

- with the location of its movable and immovable property;

- with grounds of a different kind noted in the Tax Code.

For foreign companies, the assignment of a code occurs simultaneously with the registration of the organization with the tax authorities and in accordance with:

- the location of each of the OPs belonging to the organization;

- the new location of the OP, if it begins to belong to a different tax division;

- where the movable and immovable property belonging to her is located;

- other reasons specified in the Tax Code.

Name and address of the consignee

If the consignee of the goods is a separate division of the organization (for example, a branch), line 4 “Consignee and his address” of the invoice indicates the details of this division (see letters of the Ministry of Finance of the Russian Federation dated May 4, 2016 No. 03-07-09/25719, dated April 13 .2012 No. 03-07-09/35). A similar point of view was expressed by officials earlier, regarding invoices issued according to the rules of Decree of the Government of the Russian Federation dated December 2, 2000 No. 914 (letters of the Federal Tax Service of Russia for Moscow dated March 24, 2009 No. 16-15/028080, dated March 20, 2008 No. 19-11/026593, Ministry of Finance of Russia dated 02.11.2011 No. 03-07-09/36).

For a sample of filling out an invoice addressed to a branch, see below

The procedure for filling out an invoice for services is different. You can familiarize yourself with a sample of filling out an invoice for the purchase of services by a branch of an organization from an individual entrepreneur in the material prepared by ConsultantPlus experts. Get trial access to the system and study the information for free.

Determination methods

By TIN

In accordance with the legislation of the Russian Federation, only the taxpayer himself can issue a TIN. In this case, the taxpayer is an organization that is registered as a legal entity.

An organization receives a checkpoint when it registers or when its territorially separate software units register. That is, the TIN is common to both the main organization and the software.

There are several ways to find out the checkpoint by TIN:

- Having studied the official website of the Federal Tax Service www.nalog.ru, or rather the section about information on registration of legal entities.

- Having studied the database of all organizations and legal entities.

- After reviewing the information displayed in the Unified State Register of Legal Entities.

- Having studied the Unified Federal Register, which displays the facts of the activities of legal entities.

- Using special online services.

From the Federal Tax Service in the extract

If necessary, a request for reliable company details can be sent to the Federal Tax Service, from where an extract from the Unified State Register of Legal Entities should later arrive. Nothing more reliable than a paper copy with an extract certified by the Federal Tax Service. you won't be able to find it.

The request is made through your personal account on the official website or in one of the divisions of the Federal Tax Service. But this request is paid; you will need to pay a state fee of 200 rubles. The waiting time for an extract is five working days. An urgent request is possible, but it will cost twice as much. To receive an extract in hand, you will need to present your passport.

Through information systems and databases of legal entities

At the moment, there are several paid systems that collect data on the actions of all legal entities of the Russian Federation. To search for a checkpoint, simply type the TIN in the search bar of the system. Once the correct legal entity is located, you will be able to find out:

- when and for what reason the gearbox change occurred;

- whether the managers were replaced;

- whether branches and divisions were opened and closed.

Unfortunately, information in such systems may be updated with a delay of up to two months.

By the address

You can also find out the checkpoint at the address through a request from the Federal Tax Service or through some online services.

On the invoice and other documentation

An invoice is an important document with strict filling rules, designed to display all the required information when maintaining accounting records. It must indicate the checkpoint, and this must be the checkpoint of the OP that is involved in the sale or purchase of property, goods or services.

How to change the details of an organization in the 1C program - watch this video.

about the author

Grigory Znayko Journalist, entrepreneur. I run my own business and know first-hand the problems and difficulties that individual entrepreneurs and LLCs face.