Personal income tax calculation: tax agent entries (basic)

First, let’s clarify: personal income tax is a tax on personal income. From the name itself it follows that the payers of this tax are individuals:

- residents of the Russian Federation;

- non-residents of the Russian Federation receiving income in the Russian Federation (Article 207 of the Tax Code of the Russian Federation).

Who is a resident for personal income tax, read the article “Tax resident of Russia for personal income tax purposes.”

On the website of the Federal Tax Service of the Russian Federation there is a Service for confirming the status of a tax resident of the Russian Federation.

The procedure for calculating and paying personal income tax is regulated. 23 Tax Code of the Russian Federation. Following the rules set out in this chapter, an organization paying income to an individual is obliged to calculate, withhold and transfer personal income tax to the budget on accrued income, and to pay the individual income minus personal income tax (clause 1 of Article 226 of the Tax Code of the Russian Federation). Thus, when paying income to an individual, an organization becomes a tax agent for personal income tax (Article 226 of the Tax Code of the Russian Federation).

If you have access to ConsultantPlus, find out how a tax agent calculates personal income tax. If you don't have access, get a free trial of online legal access.

Correctly determining the tax withholding date is important for filling out the 6-NDFL report. Read more about this in the article “Date of tax withholding in form 6-NDFL” .

Tax accounting is carried out on account 68, subaccount “NDFL”. Accruals are reflected on the credit of this account in correspondence with accounts selected depending on the situation. Let's take a closer look at them.

Here are the main cases that a company may encounter when paying income to an individual.

Postings for personal income tax

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

To account for personal income tax, account 68 “Calculations for taxes and fees” is used, on which the “NDFL” subaccount is opened. When calculating personal income tax for payment to the budget, it is reflected on the credit account. 68 in correspondence with the income accounts of an individual. Tax payment is reflected in the debit of account 68.

Postings for withholding and paying personal income tax

| Debit | Credit | Operation name |

| 75 | 68 | Personal income tax is withheld from dividends of founders and shareholders. |

| 70 | 68 | Personal income tax is withheld from employee wages. |

| 73 | 68 | Tax payable on financial assistance to employees. |

| 76 | 68 | Tax payable on civil income. |

| 66 | 68 | Tax is withheld from income in the form of interest payable from a short-term loan or a loan from an individual. |

| 67 | 68 | Tax is withheld from income in the form of interest payable from a long-term loan or loan from an individual. |

| 68 | 51 | The total personal income tax payable is transferred to the budget |

Example of personal income tax calculation on dividends

Ivanov I.A., who is the founder, received dividends in the amount of 50,000 rubles. How is personal income tax calculated on Ivanov’s dividends in this example, and what transactions are made?

Founders' dividends are subject to a tax rate of 9%. From 2015, the rate on dividends increases to 13%; read about the taxation of dividends at.

Personal income tax = 50,000 * 9% / 100% = 4,500 rubles.

Postings for withholding personal income tax from dividends

| Sum | Debit | Credit | Operation name |

| 50000 | 84 | 75 | Dividends accrued to Ivanov |

| 4500 | 75 | 68 | Dividend tax withheld |

| 45500 | 75 | 50 | Dividends paid to Ivanov |

| 4500 | 68 | 51 | Tax payable is transferred to the budget |

An example of calculating personal income tax on interest received on a loan

The company received a short-term loan from Ivanov I.A. in the amount of 200,000 rubles. Interest on the loan amounted to 10,000 rubles. Let's calculate the personal income tax in this example and make the necessary entries.

A personal income tax rate of 13% is applied to income in the form of interest from a short-term loan.

Personal income tax = 10,000 * 13 / 100 = 1,300 rubles.

Postings for withholding personal income tax from loan interest

| Sum | Debit | Credit | Operation name |

| 200 000 | 50 | 66 | Received a short-term loan from Ivanov |

| 10000 | 91 | 66 | Interest accrued for using the loan |

| 1300 | 66 | 68 | Personal income tax accrued on interest |

| 208 700 | 66 | 50 | Borrowed funds were returned including interest |

| 1300 | 68 | 51 | Tax payable is transferred to the budget |

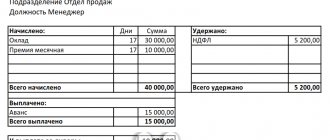

An example of calculating personal income tax from wages

Ivanov received a salary including a bonus of 30,000 rubles. Ivanov has the right to a deduction of 500 rubles, and he also has one child. Let's calculate the personal income tax on this salary and make the necessary entries to withhold it:

Salary minus deductions is subject to a tax rate of 13%.

Personal income tax = (30,000 - 500 - 1400) * 13 / 100 = 3653 rubles.

Ivanov will receive a salary in hand = 30,000 - 3653 = 26,347 rubles.

Postings for calculating personal income tax from salary

| Sum | Debit | Credit | Operation name |

| 30000 | 44 | 70 | Ivanov's salary accrued |

| 3653 | 70 | 68 | Tax withheld from salary |

| 26347 | 70 | 50 | Ivanov's salary was paid |

| 3653 | 68 | 51 | Tax payable is transferred to the budget |

You can also see an example of calculating personal income tax from wages in the article “Example of payroll.”

The posting of personal income tax withholding from wages is made on the last day of the month for which wages are accrued.

Personal income tax on other income is calculated on the day the employee receives this income.

This concludes our discussion of personal income tax. We have dealt with the concept of personal income tax, the features of calculation, the tax base and tax rates, you can also look at personal income tax reporting and the register of information on the income of individuals. Next, let's get acquainted with another tax - income tax.

How to calculate personal income tax under an employment contract (formula)

The main type of income for which an organization becomes a tax agent for personal income tax is accruals under an employment contract.

As a rule, such payments are: wages, bonuses of various types, allowances, compensation in excess of the norm related to the employment contract.

In what cases are bonuses not subject to personal income tax, read the article “Are bonuses subject to personal income tax?”

From all these payments, minus the deductions provided (Articles 218, 219, 220 of the Tax Code of the Russian Federation), tax is withheld: monthly in the amount of 13% for residents and 30% for non-residents, except for those listed in Art. 227.1 Tax Code of the Russian Federation.

The formula for calculating personal income tax is as follows:

Personal income tax = (Dex – Deductible) × St,

Where:

- Personal income tax - the amount of tax to be withheld;

- Doh - the amount of employee income for the month, including bonuses, allowances, etc.;

- Deduction - the amount of deductions (children's, property, social) provided at the request of the employee;

- St - tax rate (13% for residents, 30% for non-residents).

Postings are made:

- Dt 44 (20, 26) Kt 70 “F.I.O. employee" - wages accrued;

- Dt 70 “F.I.O. employee" Kt 68 "Personal Income Tax" - personal income tax is accrued (withheld);

- Dt 70 “F.I.O. employee" Kt 51 (50) - wages issued;

- Dt 68 “Personal Income Tax” Kt 51 - Personal income tax is transferred to the budget.

The article “Calculation of personal income tax (personal income tax): procedure and formula” can also help you calculate personal income tax.

Registration

“Visa-free” foreigners (foreign citizens who arrived in Russia in a manner that does not require a visa and have reached the age of 18) can work on the basis of a patent (Article 227.1 of the Tax Code of the Russian Federation). These include:

- foreign citizens engaged in labor activities for hire from individuals for personal, household and other similar needs not related to business activities;

- foreign citizens working for hire in organizations and (or) individual entrepreneurs, as well as notaries engaged in private practice, lawyers who have established law offices, and other persons engaged in private practice in accordance with the procedure established by law.

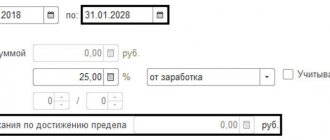

During the period of validity of the patent, you need to pay fixed advance payments for personal income tax. They must be paid at the place of business on the basis of the patent. The fixed advance payment is 1200 rubles per month. This amount is adjusted by the deflator coefficient and the regional coefficient, established annually by the laws of the constituent entities of the Russian Federation. If a subject of the Russian Federation has not established a regional coefficient, then its value is assumed to be equal to one.

Fixed advance payments for personal income tax are paid for the period of validity of the patent (clause 2 of article 227.1 of the Tax Code of the Russian Federation).

Fixed advance payments for personal income tax for a foreign “patent” employee can be paid by the employer. Letter of the Federal Tax Service of Russia dated June 20, 2022 No. BS-4-11/ [email protected] Tax officials noted that for reliable accounting of payments with the tax authorities, it is important that the payment document is filled out correctly by the payer and on the basis of it it is possible to clearly determine whose obligation to pay tax payments is fulfilled.

Fixed advance payments for a patent, the validity of which relates to different tax periods, must be calculated taking into account the deflator coefficient established on the date of payment. That is, if a foreigner received a patent, for example, in 2015, which expires in 2016, and paid personal income tax in the form of fixed advance payments for it using the deflator coefficient established for 2015, then recalculate these payments taking into account the new There is no need for a deflator coefficient for 2016 (letter of the Federal Tax Service of Russia dated January 27, 2016 No. BS-4-11/ [email protected] “On personal income tax when a foreign citizen receives (renewed) a patent valid in different tax periods”).

If a foreign citizen, in order to extend the validity of a patent, transferred funds to pay a fixed advance payment for personal income tax, but on the date of transfer the patent expired and was not subject to renewal, the funds transferred by the foreign citizen are recognized as an overpaid amount of tax. In this case, a foreign citizen has the right to apply to the tax authority for a refund of the overpaid amount of tax (letter of the Ministry of Finance of the Russian Federation dated May 19, 2015 No. 03-04-07/28585).

The tax agent has the right to reduce the calculated amount of tax by the amount of fixed advance payments paid by the taxpayer for the period of validity of the patent (patents) in the corresponding tax period, regardless of the place of payment of the fixed advance payments. The main thing is the presence of a notice confirming the right of a foreign worker to reduce the final personal income tax.

If a foreign worker simultaneously has two valid patents in the territory of different constituent entities of the Russian Federation, the tax agent has the right to reduce the calculated amount of tax by the amount of all payments paid for the period of validity of all patents.

The tax agent has the right to reduce the amount of tax by the amount of all advance payments paid by a foreign employee, including if he is transferred to another unit of the employing organization in the territory of another constituent entity of the Russian Federation. There is no need to contact the employer with a new application so that he can receive from the Federal Tax Service at the location of the separate division a new notification about the employee’s right to reduce personal income tax (letter of the Federal Tax Service dated September 26, 2016 No. BS-4-11/18086).

Personal income tax on the income of foreign citizens working in the Russian Federation on the basis of a patent is withheld using a tax rate of 13% (letter of the Ministry of Finance of the Russian Federation dated March 16, 2016 No. 03-04-05/14470).

The basis is Article 227.1 of the Tax Code, which deals with employment activities in the Russian Federation on the basis of a patent issued in accordance with Federal Law No. 115-FZ of July 25, 2002 “On the legal status of foreign citizens in the Russian Federation.”

The annual amount of personal income tax for foreigners working for organizations, individual entrepreneurs or individuals engaged in private practice must be calculated and paid by the employer - tax agent. In order for a tax agent to reduce the calculated amount of tax on fixed advance payments paid, he will need:

- a written application from a foreign employee with a request to reduce personal income tax for the tax period by the amount of fixed advance payments paid by him;

- documents confirming payment of advance payments.

The employer sends the employee’s application to the tax office to receive a Notification of the legality of reducing the employee’s personal income tax by the amount of advance payments made. Without such notification, the tax agent has no right to reduce the annual personal income tax amount by advance payments.

The procedure for calculating personal income tax on material benefits (example)

When receiving a low-interest or interest-free loan from an organization, the employee receives a material benefit in terms of savings on interest.

IMPORTANT! Starting from 2022, new conditions for taxation of personal income tax for this type of financial benefit have been introduced. Read more here.

It matters in what currency the loan agreement is drawn up.

If it is issued in rubles, then the threshold rate is 2/3 of the current refinancing rate established by the Central Bank of the Russian Federation on the date of receipt of income (clause 2 of Article 212 of the Tax Code of the Russian Federation).

IMPORTANT! Since 2016, the refinancing rate has been equal to the key rate (directive of the Central Bank of the Russian Federation dated December 11, 2015 No. 3894-U). See its sizes for different periods here.

If the loan is issued in foreign currency, then the established threshold value is 9% per annum (clause 2 of Article 212 of the Tax Code of the Russian Federation).

If interest is less than the threshold values or is not charged at all, personal income tax is withheld from the difference at a rate of 35%.

It is better to consider the postings for calculating personal income tax using a specific example.

The organization issued a loan to employee Ivanov I.I. (resident of the Russian Federation) for a period of 1 year in rubles at a rate of 3% per annum with interest paid at the end of the loan term. Loan size - 500,000 rubles.

Dt 73 “Ivanov I. I.” Kt 50 - 500,000 rub. — the loan amount was issued to Ivanov on January 15, 2021.

Income from the amount of financial benefits since 2016, regardless of the date of payment of interest, is determined monthly on the last day of the month. Let's calculate the amount of interest on the loan for January 2022. There was no partial repayment of the loan in January. The number of days for which material benefits are calculated from 01/16/2021 to 01/31/2021 is 16.

500,000 × 0.03 × 16/365 = 657.53 rubles.

Dt 73 “Ivanov I. I.” Kt 91 - 657.53 rub. — interest was accrued for using the loan for January 2022.

Let's calculate personal income tax on the amount of material benefit (at a Central Bank rate of 6.25%).

2/3 × 6.25% = 4.17% - threshold, taking into account the current refinancing rate.

4.17 – 3 = 1.17% - interest on material benefits.

500,000 × 0.0117 × 16 / 365 = 256.44 rubles. — material benefit for January 2022. Let's calculate personal income tax (35%) from it: 256.44 × 0.35 = 90 rubles.

If Ivanov were a non-resident of the Russian Federation, then the tax would be withheld at a rate of 30% (clause 3 of Article 224 of the Tax Code of the Russian Federation).

Dt 70 (73) “Ivanov I. I.” Kt 68 “NDFL” - 166 rubles. — Personal income tax on material benefits for January 2022 is withheld from the employee’s salary (or other income).

Dt 68 “NDFL” Kt 51 - 166 rubles. — Personal income tax from savings on interest for January 2022 is transferred to the budget.

Is it necessary to charge personal income tax if a third party paid the tax for an individual, ConsultantPlus experts explained. Learn the material by getting trial access to the system for free.

Types of income on which personal income tax should be charged (posting)

Most often, accountants are faced with the need to calculate taxes and make correct entries in several cases. Such income of individuals (residents and non-residents receiving income from sources in the Russian Federation), from which personal income tax is subject to withholding, includes (clause 1 of Article 208 of the Tax Code of the Russian Federation):

- Wages and other income established by the employment contract, as well as remuneration for the performance of other duties, provision of services, performance of work under GPC agreements with individuals.

- Material benefit in the form of interest savings due to receiving an interest-free loan from the employer.

- Dividends and interest paid by an enterprise to individuals.

- Other income listed in the specified article of the Tax Code.

Salary: personal income tax postings

Let's first consider the withholding of personal income tax and its posting using the example of wages. The employer is obliged to independently calculate the amount of income tax payable and transfer it to the budget. The personal income tax rate on wages in the general case is: 13% for a resident employee (clause 1 of Article 224) and 30% of the income of a non-resident employee (taking into account the exceptions of clause 3 of Article 224 of the Tax Code of the Russian Federation).

The withholding of personal income tax from wages is reflected by the following posting:

- Dt 70 Kt 68/NDFL – personal income tax is withheld.

For example, Ivan Sergeevich Petrov received a salary for January of 30,000 rubles. This employee is a resident of the Russian Federation and has one child aged 5 years.

Personal income tax is calculated as follows: the difference between the employee’s income and the child deduction is multiplied by the tax rate.

- (30,000 – 1400) x 13% = 3718. Thus, personal income tax on wages is 3718 rubles.

The tax withholding transaction will look like this:

- Dt 70 Kt 68/NDFL – 3718.00 personal income tax was accrued from the salary of Petrov I.S.

No later than the next day after payment, the salary tax is transferred by the agent to the budget:

- Dt 68/NDFL Kt 51 – 3718.00 tax is transferred to the budget.

Personal income tax withheld: posting from material benefits

An enterprise can provide an employee with a low-interest or interest-free loan for a short period. In this case, the employee has a kind of profit - material benefit in the form of savings on interest. To account for the loan, account 73/1 “Settlements on loans provided” is used in correspondence with accounts 50 or 51:

- Dt 73/1 Kt 50(51) – loan issued to employee

- Dt 73/1 Kt 91/1 – interest accrued on the loan if the loan is interest-bearing

- Dt 50 (51, 70) Kt 73/1 - the employee returned the loan amount and interest.

On the day the loan is repaid, personal income tax is withheld from the income paid to the employee by the employer at a rate of 35% (for interest-free loans and those where the interest rate is less than 2/3 of the key rate of the Central Bank of the Russian Federation):

- Dt 70 Kt 68/NDFL – personal income tax is charged on material benefits on the loan

- Dt 68/NDFL Kt 51 – tax transferred to the budget

Personal income tax withheld: posting for payment of tax on dividends

Dividends recognize the profit of the founders of the organization. The personal income tax rate is 13%, and for non-residents - 15%.

In the entries when withholding personal income tax from an individual's dividends, Debit indicates account 70 if the founder is an employee of this company, or account 75 if the founder does not work for the organization. Personal income tax is paid to the budget no later than the next day after the payment of dividends to the founder (Article 226 of the Tax Code of the Russian Federation).

- Dt 84 Kt 70 (75) – dividends accrued to the founder

- Dt 70 (75) Kt 68/NDFL – personal income tax withheld from dividends

- Dt 70 (75) Kt 50(51) – dividends paid to the participant

- Dt 68/NDFL Kt 51 – the tax is transferred to the budget.

Calculation of personal income tax on travel expenses

Travel expenses in terms of daily allowance and unconfirmed costs for renting residential premises, in accordance with clause 3 of Art. 217 of the Tax Code of the Russian Federation are standardized for personal income tax purposes. Daily allowances in excess of the norm and expenses for renting residential premises that are not documented are subject to personal income tax at a rate of 13%.

The norms for daily allowance are set within the following limits: for business trips in Russia - no more than 700 rubles. per day, for business trips abroad - no more than 2,500 rubles. in a day.

Read about similar restrictions that apply to daily allowances regarding the calculation of insurance premiums in this article.

When an organization pays daily allowance to an employee by internal order above the established norm, the following entries are made:

Dt 71 "F. Acting employee" Kt 50 (51) - an advance was issued to the accountable person for travel expenses.

Dt 44 (20, 26) Kt 71 “F. Acting employee”—travel expenses are accrued.

Dt 70 "F. Acting employee" Kt 68 "Personal Income Tax" - personal income tax is charged on amounts for business trips that exceed the norm. Since 2016, the date of receipt of such income is considered to be the last day of the month in which the corresponding advance report is approved (subclause 6, clause 1, article 223 of the Tax Code of the Russian Federation). Previously, it was taken into account on the date of approval of the advance report.

Dt 68 “NDFL” Kt 51 - paid by personal income tax to the budget.

Accrual of personal income tax on dividends paid

Dividends are the income of the founders. If the founder is an individual, then his income is subject to personal income tax at a rate of 13%. Accounting for paid dividends for founders who are employees of the organization can be kept in both account 70 and account 75, but if the founder is not an employee of the organization, then only account 75 is used.

Dt 84 Kt 75 “F. Acting founder”—dividends accrued.

Dt 75 "F. Acting founder" Kt 68 "Personal income tax" - personal income tax is accrued (withheld) from dividends.

Dt 75 "F. Acting founder" Kt 51 - dividends were paid to the founder minus personal income tax.

Dt 68 “NDFL” Kt 51 - paid by personal income tax to the budget.

Find the KBK for paying personal income tax on dividends paid in this article.

What transactions are used to reflect personal income tax?

When an accountant calculates income taxes, he does not make any entries. Entries in the accounting program are necessary only when withholding and transferring personal income tax to the state treasury. Depending on the situation, do the following lines:

| Wiring | What does it reflect? |

| Dt 70 – Kt 68.01 | Withholding income tax from the salary of a hired specialist, from the amount of his vacation pay |

| Dt 70.01 – Kt 68.01 | Withholding personal income tax from dividends paid to the company's shareholders. For ease of calculations and analytics, we recommend that the accountant open a separate sub-account for the account. 70 to reflect settlements with the founders. |

| Dt 73 – Kt 68.01 | Withholding of income tax on other types of payments transferred to the employee by the employing company. For example, the cost of gifts exceeding 4,000 rubles, financial assistance in excess of limits, etc. |

| Dt 76 – Kt 68.01 | Accrual of personal income tax on payments in favor of individuals who are not employees of the company. For example, citizens providing services to a company under a civil contract. |

| Dt 75 – Kt 68.01 | Withholding income tax on dividends paid to non-employee shareholders |

| Kt 67 – Dt 68.01 | Withholding personal income tax on interest paid on a long-term loan previously received from an individual |

| Kt 66 – Dt 68.01 | Calculation of income tax on interest paid to an individual for the use of short-term borrowing |

| Dt 68.01 – Kt 51 | Transfer of the calculated tax amount to the state budget from the company's current account |

As you can see, the main personal income tax accounting account is 68.01.

The general logic of reflecting personal income tax on accounting accounts is that when accruing it, it is shown on the credit account. 68.01 in correspondence with an account intended to reflect the corresponding type of income of individuals. When the total tax calculated by the accountant is transferred to the state treasury, the account is credited. 51.

Purchasing works and services from an individual

Another situation that may arise is the purchase of work or services (for example, rental of non-residential premises) by an organization from an individual. By virtue of Art. 226 of the Tax Code of the Russian Federation, in this case, the organization is obliged to withhold personal income tax from the amount of payments, pay it to the budget, and transfer the amount to the seller minus personal income tax at a rate of 13% (with the exception of income listed in Article 217 of the Tax Code of the Russian Federation).

In this case, the following transactions are made:

Dt 20 (26, 44) Kt 76 “F. AND ABOUT." (60) - services and work were purchased from an individual.

Dt 76 "F. AND ABOUT." (60) Kt 68 “Personal Income Tax” - personal income tax is accrued (withheld).

Dt 68 “Personal Income Tax” Kt 51 - Personal income tax is transferred to the budget.

Dt 76 "F. AND ABOUT." (60) Kt 51 - the amount for services and work to an individual is transferred minus personal income tax.

The main thing to remember is that personal income tax is taken from the income of a specific individual, and no matter what account is used when calculating it, it is necessary to conduct analytics on it for each individual from whose income personal income tax was withheld. It should also be remembered that tax-free income of an individual is established by law - all of them are listed in Art. 217 Tax Code of the Russian Federation.

Read more about non-taxable income in the article “Income not subject to personal income tax” .

Results

Business entities paying income to individuals become tax agents for personal income tax and are required to withhold and transfer the calculated amount of tax to the budget. Personal income tax accounting is carried out using account 68, the personal income tax subaccount, in correspondence with the accounts corresponding to the transaction being carried out.

Sources:

- Tax Code of the Russian Federation

- Directive of the Bank of Russia dated December 11, 2015 N 3894-U

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.