general characteristics

Compensation is reimbursement from an employer for expenses incurred in providing food purchases to its employees. For the most part, the responsibility for providing employees with food is assigned to the organization by legal acts, but sometimes the company’s management makes such a decision independently.

Issues of providing compensation at an enterprise are stipulated in several legal acts:

- Collective agreement.

- Employment contract.

An example of agreed compensation for the cost of food in an employment contract - Other local acts.

The treatment of expenses incurred may vary significantly depending on the reason for which the employee is compensated. Therefore, it is the employer’s responsibility to determine in advance when payment of compensation is an obligation and when it is a right.

Providing compensation for food or food itself is mandatory in the following cases:

- The employee is engaged in work with hazardous working conditions. By law, such an employee must receive milk or equivalent products. If an employee writes a statement, then instead of milk he is paid monetary compensation.

Classes of working conditions - Working in hazardous conditions. The law does not provide for the possibility of receiving compensation; it is the employer’s responsibility to provide employees with food.

- Sending an employee on a business trip. The employer must provide the employee with compensation in the form of daily allowance, but a separate payment for food is not provided.

Accounting employees should know the specifics of taxation of such payments.

Article 164 of the Labor Code of the Russian Federation “The concept of guarantees and compensation”

Article 165 of the Labor Code of the Russian Federation “Cases of providing guarantees and compensation”

What income is not subject to personal income tax?

The income of individuals that are not subject to personal income tax withholding is listed in Article 217 of the Tax Code of the Russian Federation. The list of these incomes does not include compensation for meals for employees; accordingly, they do not fall under Article 217 of the Tax Code of the Russian Federation and such payments are income that is taxed in the general manner.

Buffet costs or personal income?

Some taxpayers and their agents, trying to circumvent tax laws, transferred personal payments for food to a buffet form, where it is impossible to accurately determine which employee received income in kind and to what extent. On this issue, the Ministry of Finance in its letter dated May 17, 2018 N 03-04-06/33350 indicates that to determine the income of each employee, the cost of food must be divided by the number of people (employees).

Interpretation of legislation

There are contradictions in the legislation regarding the interpretation of forms for providing compensation payments to employees. In particular, the SAC Resolution states that insurance premiums are not assigned in relation to the following types of payments:

- If such payments are not conditional on working conditions.

- If the payments are of an incentive nature.

- If the payments are not remuneration for the employee’s work.

However, regulatory authorities do not agree with the above interpretation, which is reflected in the Letter of the Ministry of Labor. This act contains an indication that preferential tax conditions do not apply to compensation payments for employee meals.

Is payment for food compensatory?

The Ministry of Finance believes that not all payments are compensation. The department refers to an article of the Labor Code of the Russian Federation, namely Art. 164, which states that compensation is a payment that is intended to reimburse the employee’s costs associated with the performance of his labor duties. These costs are established by the Labor Code and other federal laws.

Thus, payment for food to an employee is not compensation, and therefore is subject to insurance premiums and personal income tax (Letter of the Ministry of Finance dated October 23, 2017 No. 03-15-06/69405).

Judicial practice of resolving disputes regarding the calculation of personal income tax and insurance premiums

In Resolution No. Ф09-10766/09-С2 dated 01/19/2010 in case No. A07-633/2009, the FAS UO determined that the tax inspectorate must establish a specific circle of individuals who received the benefit. It is also necessary to indicate the amount of such benefit. If the tax inspectorate cannot establish these facts, then the employer had the right not to charge personal income tax.

But still this is a rare and isolated case. In most cases, the Court sides with the Federal Tax Service. To win the dispute, tax authorities only need to make simple calculations by calculating the total annual income of each employee in accordance with the provisions of paragraphs. 7 clause 1 art. 31, art. 41 Tax Code of the Russian Federation.

Taxation of compensation

Compensation payments may or may not be subject to taxation and calculation of contributions to funds. There are several cases when compensation is not subject to personal income tax:

- If such an obligation arises for the employee due to the fact that the employee works at work with harmful working conditions. In such a situation, the costs incurred do not relate to wages, so the organization’s accounting department has the right to include these costs in employee benefits, which will reduce the tax rate on the profit received by the organization.

- When issuing compensation as daily allowance. The legislation stipulates maximum amounts of payments that are not subject to taxes; if the amount is exceeded, the remainder is subject to both personal income tax and contributions.

Attention! If an organization provides buffet meals to its employees, the tax authorities consider this as a payment of income. If the employer can prove that such a desk is available not only to its employees and is not a mandatory part of the employment relationship, then the services may be recognized as tax-free.

Article 210 of the Tax Code of the Russian Federation “Tax base”

Read also: Revaluation of fixed assets

Article 217 of the Tax Code of the Russian Federation “Income not subject to taxation (exempt from taxation)”

Employee meals: income tax

In paragraph 25 of Art. 255 of the Tax Code of the Russian Federation states that in labor costs an organization may include other payments in favor of employees not mentioned in paragraphs 1 - 24 of Art. 255 of the Tax Code of the Russian Federation, provided that they are provided for in the employment contract or local regulations. This position is also shared by officials of the Ministry of Finance. Thus, Letter No. 03-03-04/1/344 dated November 8, 2005 states: the cost of free lunches provided is taken into account when determining the tax base for income tax as part of labor costs, provided that such meals are provided for in the employment contract.

It is also worth noting that since free or reduced-price meals for employees are labor costs, such expenses must be personalized (that is, the total amount of food expenses must be clearly distributed among employees). If there is no such distribution between employees, then it is impossible to determine the amount that each employee received. Consequently, it is generally impossible to include such “general” food expenses either in the cost of paying for his labor or in other expenses (Letter of the Ministry of Finance of the Russian Federation dated March 4, 2008 N 03-03-06/1/133).

Compensation options

Let's take a closer look.

Buffet

To avoid personalization of income in an organization, an employer can provide meals to its employees buffet style.

This position is actively supported by the Ministry of Labor and most of the courts, since with this form of catering at an enterprise it is impossible to determine the exact tax base calculated for each employee. Accordingly, with such a catering arrangement, the organization cannot act as a tax agent, and therefore should not calculate personal income tax.

A similar rule applies when calculating insurance contributions, since employers who cannot personalize accounting for social insurance cannot calculate contributions for each of their employees.

Personalization of expenses

If meals for employees in an organization are carried out in strict accordance with the requirements of Article 255 of the Tax Code, then the employer has the right to write off the expenses incurred.

It is stipulated that all expenses must be transparent and specified in an individual employment contract with each employee of the organization or in a general collective agreement.

Payments for each employee must be personalized, that is, there must be documentary evidence of expenses incurred for food for each employee. The Ministry of Labor argues for this requirement by saying that the provision of compensation payments is a kind of salary, which requires documentary evidence.

When providing compensation to an employee, the employer should not have any problems with personifying the expenses incurred, since all payments are taken into account in the salary.

Article 255 of the Tax Code of the Russian Federation “Labor expenses”

Refusal to charge VAT

According to the law, monetary compensation paid to employees for meals is not subject to VAT if the company does not have a buffet. This option may be inconvenient for the management of the organization, since in this case they lose profit on the possibility of deducting input VAT.

VAT rates

Kitchen in the office

In recent years, many companies have begun to convert one of their office rooms into a kitchen for shared use by staff. Such kitchens, as a rule, are equipped with everything necessary: a sink, furniture, household appliances, kitchen utensils.

The requirements for the equipment and maintenance of such premises are specified in SNiP; in particular, they state that the use of kitchens on office premises is possible only if the number of workers at the enterprise is no more than 30 people per shift.

If the company has chosen this particular path to provide food for employees, then the collective agreement should include a clause on providing employees with this premises as a kitchen. At the same time, it will help justify the costs of converting the office into a dining room.

In terms of accounting, all kitchen purchases and expenses should be accounted for as “Other Expenses.” In cases where the price of kitchen equipment is above 40 thousand rubles, with a service life of more than a year, it will have to be paid off through depreciation .

Thus, there are several of the most common ways an employer organizes meals for employees during the working day. The management of each company chooses the optimal path, taking into account its own capabilities and the interests of its personnel. But, regardless of which method is chosen, the main thing is not to forget to write down its essence in the collective labor agreement.

Popular mistakes

- The first mistake: the employer feeds employees buffet style and then transfers compensation to the employees for meals. If during an audit the tax inspectorate suspects that the company’s management is simply selling its products in this way, then VAT will be additionally charged on compensation payments.

- The second mistake: the employee requires his employer to pay a salary supplement in the amount of compensation for his food. If a compensation payment in an organization is provided in the form of an increase to the official salary, then these funds are considered as a person’s income and are subject to taxes.

Payment of the cost of food for employees in 1C: ZUP ed. 3.1

Published 25.11.2020 15:54 Author: Administrator In practice, accountants are increasingly faced with issues of employee nutrition. Options for paying for food are distinguished by their diversity: a specialized organization can bring ready-made food to your enterprise; you can issue ready-made food products yourself; an employee can be compensated for a certain amount that he spends on food at his own discretion; the employee is provided with food in the canteen, which is regarded as wages, i.e. income in kind, thereby increasing his income. Naturally, the option you choose must be secured by an employment or collective agreement, or the Regulations on remuneration. In this article we will consider the last option, i.e. payment of food costs for employees.

clause 1 art. 210 of the Tax Code of the Russian Federation states that when determining the tax base for personal income tax, all income of the taxpayer received by him both in cash and in kind is taken into account. Since income in kind includes, in particular, payment for food to the taxpayer, according to paragraphs. 1 item 2 art. 211 Tax Code of the Russian Federation. Consequently, the cost of food paid by the organization for its employees is subject to personal income tax in the generally established manner.

However, there are exceptions to this rule and the cost of meals for employees is not always subject to personal income tax. If, in accordance with the law, the employer is obliged to provide an employee with free food, then the cost of food is considered as compensation related to the performance of work duties. For example, it is mandatory to provide free food and meals to employees who are employed in jobs with harmful and especially harmful working conditions (Article 222 of the Labor Code of the Russian Federation). In this case, the cost of food is exempt from taxation (clause 1 of Article 217 of the Tax Code of the Russian Federation).

In general, payments to employees within the framework of labor relations are subject to insurance contributions to extra-budgetary funds (clause 1 of Article 420 of the Tax Code of the Russian Federation, clauses 1, 2 of Article 20.1 of the Federal Law of July 24, 1998 No. 125-FZ). Payment for meals established by the collective agreement of the organization is not a compensation payment provided for by law, which is exempt from insurance premiums on the basis of paragraphs. 2 p. 1 art. 422 Tax Code of the Russian Federation, paragraphs. 2 p. 1 art. 20.2 of Federal Law No. 125-FZ, therefore it is subject to contributions in the generally established manner.

In our example, the collective agreement of Petrovskie Zori LLC provides for payment of meals to an employee for a month worked in the amount of 4,500 rubles. Meals are provided in the organization's canteen, where the number of meals provided is recorded. If an employee has not worked for a full month, then the cost of food is calculated for the days actually worked. If the food cost limit is exceeded, the employee is charged the difference in cost.

Employee Vishnevskaya S.N. I worked for 6 days in August and quit. Food expenses amounted to 1950 rubles. We will charge the cost of food within the limit established by the organization, calculate and deduct the additional payment for the cost of food.

We will simulate the example in the 1C program: ZUP ed. 3.1. Let's do some setup first.

Setting up a program to calculate natural income (cost of food)

Step 1. Open the “Settings” - “Payroll” section.

Step 2. Follow the hyperlink “Setting up the composition of charges and deductions”.

Step 3. On the “Other accruals” tab, check the “In-kind income is recorded” checkbox. Click Apply and Close.

As a result of this setting, the accrual “Income in kind” with the accrual purpose type – “Income in kind” will become available in the directory of accrual types.

Step 4. Go to “Settings” - “Accruals”.

Step 5. Open the accrual card. This accrual is entered as a fixed amount for a separate document.

This calculation procedure does not coincide with our condition. Therefore, we will create a new accrual.

Creating and setting up the “Payment for food” accrual

Step 1. In the “Accruals” directory, click the “Create” or “Create by copying” button.

Let's define the accrual in the same way as income in kind, and set the procedure for performing the accrual. More meanings apply to our type of accrual:

• is carried out according to a separate document - in this case, the document “Income in kind” is entered to accrue it.

• monthly – introduced by personnel orders.

Next we will look at both options.

Let's set our own calculation procedure.

To do this, set the switch to the “Result is calculated” position and set the formula – hyperlink “Edit formula”.

In our example, the cost of paid meals for an employee depends on the number of days worked and we need to set it somewhere. Therefore, we need to define and enter our indicators for calculation.

The formula should look like this:

Cost of Food/NormDays*TimeInDays

Where:

Food Cost is a new indicator that is given a value. In our example, this is 4,500 rubles.

NormaDays is the norm of days according to the schedule for the employee;

TimeinDays is the employee’s actual time worked, determined automatically by the program.

Step 2. To enter the formula, create the Cost of Food - the “Create indicator” button.

Step 3. Fill in the data: name, short name, identifier.

The purpose of the indicator can be set for:

• organizations;

• divisions;

• employee.

Since we have the same cost of food for the entire organization (4,500 rubles), we indicate the value “For the organization.” In the future, we will indicate this cost in the settings.

Click "Save and Close".

Step 4. Double-click on the indicator or click “Add indicator” to create a calculation formula. In this case, you can use arithmetic signs and functions (for example, OKR - rounding).

Click “Check”, save the formula and the created accrual type.

Our new accrual card “Payment for food” looks like this.

Step 5. On the “Time Accounting” tab, set the time type to “Working time”. Without this, the program will not save the accrual and will remind you of this.

Step 6. On the “Taxes, contributions, accounting” tab, check that the personal income tax code is 2510 – “Payment for the taxpayer for goods, work, services or property rights, including utilities, food, recreation, training in his interests” .

Let's save and check how our calculation works. But before that, let’s set up the value of the employee food cost indicator.

Setting the food cost metric value for your organization

Before entering our indicator, let's do some adjustments, because... There is no form for entering the indicator in the program yet.

Step 1. Go to the “Settings” “Input Data Input Templates” section.

Step 2. In the “Input Data Entry Templates” reference book, click “Create”.

Step 3. Set the name and presentation. In the "Salary Metrics" section, set the radio button to "Continuous" and select our new "Meal Cost" metric.

Step 4. Save the template using the “Save and Close” button.

What did this give us? Let's look further...

Step 5. Go to the “Salary” - “Data for salary calculation” section.

Step 6: Click Create. An inscription appeared in the menu: “Cost of employee meals” - i.e. This is our template for entering food cost data.

Step 7. Set the date and cost of meals - 4,500 rubles.

So we established the value of the indicator and this data was recorded in the “Data for Payroll Calculation” journal. When the value of this indicator changes, a document with current data is also entered.

Assigning payment to an employee for food costs

We can assign meals to an employee either as a separate document or monthly. Let's consider both configuration options.

Payment of food costs according to a separate document

If it is established in the accrual card that the accrual is entered in a separate document, then to accrue payment for the cost of food to an employee within the established amounts, the document “Income in Kind” in the “Salary” section is used. Let's consider it.

Step 1. Open the “Income in Kind” journal in the “Salary” section.

Step 2. Fill out the header of the document (months, date, department). Select the type of income “Payment for food” and indicate the date the income was received. Fill out the tabular part with employees - the “Selection” or “Add” buttons. The table will be automatically filled with indicators and display the calculation.

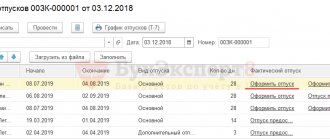

Employees who have worked for a full month are credited with the full amount. And employee Vishnevskaya S.N. I quit after working for 6 days.

The program automatically calculated the cost of paying for food based on the actual time worked and the standard time according to the schedule. In August, the five-day work schedule is 21 working days.

4500/21*6=1285.71 rub.

Our formula works correctly.

Payment of food costs monthly

Let’s consider the option of paying for an employee’s meals if the accrual setting is set to “Monthly”.

In this case, such payment is fixed by personnel orders when hiring, personnel transfer, changing wages, assigning planned accrual, etc. You can assign an accrual using any document that contains the “Payment” section.

Let's consider the assignment of accrual to employees for payment of food costs from August 1 using the document “Assignment of planned accrual”.

Step 1. Go to the “Human Resources” section - “Change employee pay”. Click “Create” and select the “Planned Accrual Assignment” document.

Step 2. Fill out the header of the document: date, accrual name, validity period. Select a list of employees. The accrual indicator “Cost of food” is entered in the document itself. To do this, click the “Fill in indicators” button and indicate the value of the indicator – 4,500 rubles. Click “Ok” and the value will be transferred to the table for all employees.

When you enter an accrual using personnel documents and assign it to an employee, the entry will appear when accruing at the end of the month when you enter the “Payroll and Contributions” document.

Step 3. Accrue your salary and check the accrual lines “Payment for food”.

Having considered two methods of entering accruals, you can decide which method is more convenient for you.

Let's consider the situation further. We have introduced the accrual “Payment of the cost of food” in the amount determined by the norm at the enterprise - 4,500 rubles. In fact, the employee ate for a large amount. How to reflect this in the program? Let's look further.

Withholding for employee meals above a certain norm

Creating and setting up a new hold

Let's create a new retention and assign it to the employee.

Step 1. Go to “Settings” - “Holds”. Click New and set your retention options.

• Set the deduction purpose to “Deduction for settlements on other transactions.”

• Retention is carried out – “Monthly”.

• Set the calculation order.

When the deduction is set to a fixed amount, this order of entry will not raise any questions. It will be enough to enter the amount of the difference for food in the document, and it will be included in the salary calculation. But we will try to automate our calculation as much as possible, so we will set the calculation formula - the “Edit formula” hyperlink. Next, we will enter the indicators that will be specified in the document for employees.

Step 2. Enter a new indicator “Actual cost of employee food”. It will be entered by documents and requires entering a value. This setup is optimal for us.

Step 3. Using the new indicator, we will set the calculation formula.

Let’s immediately make a reservation that when calculating the difference in the cost of food, we use the “Calculation base” . For what? After all, the idea immediately arises of calculating this way: “Cost of food” minus “Cost of employee food (actual).”

But with this calculation, the program will not take into account that the employee may not work for a full month, but will make the calculation based on the cost standard that we set in the settings. By entering the “Calculation base” indicator, the user sets this base independently. And by indicating the “Payment for food” accrual as part of the calculation base, the program will take the actually accrued amount, taking into account the days worked. This can obviously be seen in employee S.N. Vishnevskaya, who did not work for a full month.

Step 4. Set the calculation base on the “Base calculation” tab using the “Selection” button.

Step 5: Click “Save and Close.” The hold has been created.

Entering and calculating the deduction of the cost of food above the norm for an employee

To enter the created hold, follow these steps:

Step 1. Go to the “Salary” - “Alimony and other deductions” section. Create a new document “Deductions for other transactions”.

This type of document appeared in the list because... When creating a hold, we specified this type of operation in the settings.

Step 2. Fill out the document indicating the actual cost of employee meals for the period.

Employee Vishnevskaya S.N. quit on August 10 and the calculation is made based on the days actually worked (6 days). The actual cost of food for these days was 1950 rubles. Based on the norm, she was credited (see example earlier) 1285.71 rubles. Accordingly, we need to calculate and maintain the difference in nutrition (664.29 rubles)

Step 3: Click "Swipe and Close". The document has been entered, the actual cost of the employee’s meals is recorded.

When calculating wages, the program will automatically calculate the withholding. Let's check this, because according to employee S.N. Vishnevskaya. a dismissal order has been entered; wages are calculated in this document.

Step 4. Let's recalculate its accruals and deductions.

Payment of accrued food costs is reflected on the “Accruals” tab (subject to configuration - entered monthly, NOT as a separate document).

The “Deductions” tab shows the calculation of the difference in payment for food. As you can see, the calculation is correct. The calculation takes into account the actual accrued cost for food, taking into account the days worked. The document shows the calculation indicators:

• actual cost of food – 1950 rubles.

• calculation base - the cost of food according to the standard, based on the actual time worked - 1285.71 rubles.

• retention period and calculation result – 664.29 rubles.

The retention is calculated.

Step 5. Create an “Employee Payslip”.

Please note that the “Payment for food” accrual is reflected at the bottom of the pay slip, in the “For reference” section. Retention of the cost of food above the norm is reflected, as usual, in the “Retention” section. In the calculation of the line “Debt of the enterprise at the end”, the amount “Payment for food” is not included, because This is income in kind.

You can, of course, use fixed amounts in your calculations, but try to automate the calculation process as much as possible, thereby making your work easier in the future.

Author of the article: Olga Kruglova

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

JComments

4) Kitchen nearby

A fairly common option today is to convert one of the company’s offices into a kitchen, equipping it with various household appliances and furniture. In Art. 223 “Sanitary, medical and preventive services for workers” of the Labor Code of the Russian Federation provides for the employer’s obligation to improve the premises for meals during working hours.

Free food is the norm

Free meals in the organization are provided by law only for certain categories of personnel. The list of these professions, positions and industries is determined by order of the Ministry of Health and Social Development of Russia dated February 16, 2009 No. 46n.

At the same time, personal income tax and contributions for compulsory pension (social, medical) insurance are not charged (clause 3 of article 217 of the Tax Code of the Russian Federation, clause 2 of part 1 of article 9 of the Federal Law of July 24, 2009 No. 212-FZ).

The standards by which a room for eating should be equipped are established in SNiP 2.09.04-87 “Administrative and domestic buildings” (approved by Decree of the USSR State Construction Committee dated December 30, 1987 No. 313). So, according to clauses 2.48 - 2.52 of SNiP 2.09.04-87, if the number of workers is less than 30 people per shift, you can equip a room for meals (for up to 200 people - a canteen or canteen-dispensing room).

In order to justify the costs of allocating premises for a dining room, as well as the purchase of household appliances, a condition on providing employees with this premises for meals should be stated in the collective agreement or local regulations.

Based on paragraphs. 7 clause 1 art. 264 of the Tax Code of the Russian Federation, the costs of arranging dining rooms should be taken into account as other costs associated with the production and sale of goods (work, services).

If the cost of purchased furniture and equipment for equipping a kitchen exceeded 40 thousand rubles, and the service life is more than 12 months, it will have to be repaid by calculating depreciation (clause 1 of Article 256 of the Tax Code of the Russian Federation).

How does an employer provide food for employees?

Payment for employee meals

The form in which the company provides employees with meals depends on the characteristics of the organization, the number of employees on staff, the location of the enterprise and other circumstances.

Currently, the following methods of providing employees with food are widely used:

- food in the company canteen;

- delivery of lunches to the office;

- compensation for food expenses based on receipts from catering establishments.

Let's look at the implementation features of each of the above methods:

- Meals in your own dining room. In this case, the employer provides meals to employees in the canteen, which is a structural unit of the enterprise. Employees receive lunches on the basis of coupons, coupons, or on the basis of a document confirming current employment at the enterprise (for example, a pass or certificate). Lunches can be served either a la carte or as a buffet.

- Delivery of lunches to the office. If we are talking about a small company, then maintaining its own canteen to provide food for employees is impractical for the employer. Companies with a small staff, as a rule, order lunches to the office, thereby receiving services from a third party.

- Reimbursement for food expenses. There are often cases when an employer does not pay for meals for all employees, but only for employees of a certain department or top managers. In this case, the organization reimburses expenses actually incurred by the employee and confirmed by relevant documents.

Personalization of data

The amounts transferred for food for employees are their income in kind and are subject to personal income tax (clause 1 of Article 210, clause 1 of clause 2 of Article 211 of the Tax Code of the Russian Federation).

When organizing meals on a buffet basis, the amount of such natural income for a specific employee cannot be determined. The Ministry of Finance of Russia recognizes that in the absence of the opportunity to personify and evaluate the economic benefit received by each employee, income subject to personal income tax does not arise (letter of the department dated April 15, 2008 No. 03-04-06-01/86, resolution of the Federal Antimonopoly Service of the Ural District dated 08/20/2009 No. Ф09-5950/09-С2).

And yet, in order to avoid claims from regulatory authorities, it is advisable to organize meals for employees in such a way that it is possible to determine the income received by each of them.

As for compensation and subsidies, these forms of payment for food are subject to personal income tax. The calculated amount of tax must be withheld directly from the employee’s income upon actual payment (Clause 4 of Article 226 of the Tax Code of the Russian Federation). In this case, the withheld tax amount cannot exceed 50% of the payment amount.

Tailed Employee

A dog, as you know, is a friend of man, but also a faithful and reliable guard. To protect their office from uninvited guests, the management of some companies makes a simple decision - to place a booth at the entrance and put a guard dog on a chain. And everything would be fine, but in order to avoid claims from regulatory authorities, pets will have to be kept according to the standards established by kennel clubs, depending on the breed of guard dogs (clause 4 of the letter of the State Tax Inspectorate for Moscow dated November 24, 1998 No. 11- 13/35186).

In accounting, the costs of maintaining dogs are taken into account in account 26 “General business expenses”. In tax accounting, it would be correct to classify such expenses as other expenses (clause 6, clause 1, article 264 of the Tax Code of the Russian Federation).

Let’s not forget to accrue insurance contributions: they are subject to taxation into extra-budgetary funds of payments in favor of employees made within the framework of labor relations, including those provided for by labor and collective agreements, local regulations (letter of the Ministry of Health and Social Development of Russia dated May 19, 2010 No. 1239 -19 and dated August 5, 2010 No. 2519-19).

...and judges are against insurance premiums

However, the main value of the buffet is the ability to avoid insurance premiums. Like personal income tax, insurance premiums are targeted (personal) in nature. If it is impossible to establish a base for assessing contributions for each employee, then there is nothing to pay contributions from.

Here the courts are in solidarity with the companies. The arbitrators argue that social payments that are not stimulating and do not depend on the employee’s qualifications, complexity, quality, or conditions of work, do not relate to remuneration, and therefore are not subject to insurance contributions (resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 3, 2013 No. No. 10905/13, dated May 14, 2013 No. 17744/12). These are established by the collective agreement:

- lump sum payments in connection with retirement;

- financial assistance to single parents;

- scholarships under student contracts, since they are not payments either within the framework of labor or civil law relations;

- payment by the employer for the rental of premises for non-resident employees invited to work;

- compensation for part of parental fees for maintaining a child in a preschool institution;

- payment for health resort vouchers for employees;

- cost of free meals for employees, etc.

The fact that the cost of free meals is not included in the insurance premiums base is also stated in the resolution of the Arbitration Court of the North Caucasus District dated March 3, 2016 No. A32-6050/2015.

The policyholder and the Pension Fund were arguing. Based on the collective agreement and the order of the manager, the company partially reimbursed food expenses to employees. For each employee, the accounting department kept analytical records of lunches and withheld personal income tax. Inspectors from the Pension Fund of the Russian Federation considered that insurance premiums should be charged on the compensation amounts, since when personal income tax was withheld, these amounts were included in the total income of employees.

But the judges did not support the officials. The disputed payments were neither remuneration nor compensation for expenses incurred by employees in the performance of their labor duties. The inclusion of these amounts in the personal income tax base does not mean that they are recognized as part of remuneration. This means that there is no need to pay insurance premiums on them.

The daily distribution of free meals must be documented.

Currently, there is no unified form for this operation, so the organization can develop it itself and reflect it in the accounting policy, paying attention to the fact that the form contains all the mandatory details provided for in paragraph 2 of Art. 9 Federal Law dated December 6, 2011 N 402-FZ “On Accounting”.

Milk and other therapeutic and prophylactic food purchased for distribution to employees are accepted for accounting as part of inventories (debit to account 10 “Materials”) at the actual cost, equal to the amount of actual costs for its acquisition without VAT, and when issued it is written off to debit one of the accounts 20 “Main production” from the credit of account 10.

For all other employees in Art. 41 of the Labor Code of the Russian Federation establishes that a collective agreement may provide for the employer’s obligation to partially or fully pay for employees’ meals. To do this, in the section on wages, it is necessary to indicate that “the employer undertakes to provide employees with free lunches,” and in employment contracts it is necessary to provide a link to the corresponding clause of the collective agreement.

DANGEROUS COSTS OF "SIMPLIERS" (USN: INCOME - EXPENSES)

It is also necessary to prepare the following internal organizational and administrative documents:

- issue an order from the manager to organize free meals for the organization’s employees;

- keep a timesheet of working hours, allowing you to determine monthly the number of actually working employees who received free food, broken down by departments of the organization (excluding employees on vacation, business trips, sick leave, etc.);

- daily menu approved by an authorized person (for example, HR department). The last two documents may not be published if the contractor provides a report at the end of the month indicating the number of employees and the menu (list of products).

Accounting for employee meals depends on the method of providing such meals, they can be:

- ordering catering services from third-party organizations with delivery of lunches to the customer’s office (catering services);

- organizing meals for employees in the canteen (cafe) on the territory of the catering organization;

- creating your own canteen where employees are provided with free lunches;

- organizing a buffet;

- payment of monetary compensation to employees for food.

When ordering catering services from third parties, the following entries are made in the organization’s accounting records:

| Debit 60 "Settlements with suppliers and contractors" | Credit 51 "Current accounts" | Lunch costs paid |

| Account debit 70 "Settlements with personnel for wages" | Account credit 60 "Settlements with suppliers and contractors" | Lunch provided to employees |

| Debit accounts 20 (25, 26) “Main production” | Account credit 70 "Settlements with personnel for wages" | The cost of lunches is included in labor costs |

| Debit accounts 20 (25, 26) “Main production” | Credit account 69 “Calculations for social insurance and security” | Insurance premiums accrued |

| Debit account 68 "Calculations for taxes and fees" | Account credit 70 "Settlements with personnel for wages" | Personal income tax withheld from the cost of lunches |

The second method of providing food is not much different from the first, and in both cases, an agreement for the provision of paid services is concluded between organizations. The difference lies only in the nature of the service itself; as for the accounting procedure, it is similar to accounting when ordering catering services from third-party organizations.

DO YOU NEED A TAX AUDIT? CONTACT ROSCO!

Some organizations open their own canteens (cafes) and prepare lunches themselves. When carrying out this type of activity, one should not forget about the sanitary and epidemiological requirements, which receive increased attention from the inspection authorities. This applies to the entire cycle of providing public catering services, starting with the production of ready-made dishes and culinary products and ending with the creation of conditions for their purchase. So, for example, in a letter from Rospotrebnadzor (Letter of the Federal Service for Supervision of Consumer Rights Protection and Human Welfare dated August 22, 2007 N 0100/8417-07-32 “On strengthening state sanitary and epidemiological supervision over the circulation of food products”, GOST R 50762-95 “ Public catering. Classification of enterprises") indicates that special attention should be paid to food industry enterprises and catering establishments, as well as to increase the efficiency of State Sanitary and Epidemiological Surveillance over the production of epidemiologically significant food products, including confectionery and culinary products, meat, dairy and fish products. If violations of sanitary norms and rules are detected, administrative coercive measures should be applied, up to the suspension of the operation of food facilities and the transfer of materials to investigative authorities.

For violation of sanitary and epidemiological requirements for the organization of catering for the population in specially equipped places (canteens, restaurants, cafes, bars and other places), including during the preparation of food and drinks, their storage and sale to the population, an administrative fine may be imposed on citizens in the amount of one thousand to one thousand five hundred rubles; for officials - from two thousand to three thousand rubles; for persons carrying out entrepreneurial activities without forming a legal entity - from two thousand to three thousand rubles or administrative suspension of activities for a period of up to ninety days; for legal entities - from twenty thousand to thirty thousand rubles or administrative suspension of activities for a period of up to ninety days (Article 6.6 of the Code of Administrative Offenses of the Russian Federation).

If an organization has its own canteen, accounting is carried out as follows:

| Debit of account 29 “Service production and facilities” | Account credit 02 “Depreciation of fixed assets” or 10 “Materials”, 60 “Settlements with suppliers and contractors” | Reflects the costs of providing food services to employees |

| Account debit 70 "Settlements with personnel for wages" | Account credit 90 "Sales" | The transfer of canteen products to pay for labor is reflected |

| Account debit 90 “Sales”, VAT subaccount | Credit to account 68 “Calculations for taxes and fees” | VAT is charged on the cost of catering services provided based on market prices |

| Account debit 90 "Sales" | Credit to account 29 “Servicing industries and farms” | The cost of food provided by the employee is written off |

Power card as a tool for monitoring all business processes

Any of the above schemes can be implemented using a card. It is issued separately to each employee, which means that the card base will become a single client base. It is used as an electronic pass when paying for lunch, to control working hours from those eating to the service desk. The card can be magnetic, proximity, or not be plastic at all - virtual for a personal account, a bracelet with a barcode, an electronic key, a fingerprint, etc.

The balance is replenished by the enterprise, for example, by deduction from the salary. either as subsidies, or by the employee himself in payment terminals. Using such a terminal you can place a pre-order . An employee inserts a card into the kiosk and selects dishes for today, tomorrow, a week or a month - whatever your heart desires. The order is stored in the system on his card and is available to both the cardholder and the cashier. Knowing the final number of dishes, the kitchen will be able to calculate the required amount of ingredients for a specific day and purchase as efficiently as possible. What does it mean? No surplus on salads and cereals, no shortage of your favorite stew or hodgepodge. So, with the license “RestArt: Payment Kiosk”, the employee will be able to independently manage the account and his lunch at any time and anywhere, and the enterprise will receive a well-fed = satisfied employee and the most efficient operation of the kitchen.

The card also serves as a carrier of information about employees. Not only for identification, but also about data with turnover, balance, credit, restrictions. The receipt can print the contents of the order, the amount of subsidies and the amount of payment, the amount of deduction and the period. Separately, it is possible to print a report on the card by the cashier. By the way, even if the card is lost, it will not be possible to pay. In “RestArt: DDS Administrator” you can set a password for the card, upon payment of which it will be requested.