Standard

The new rules are due to the adoption of several regulations.

- Federal Law No. 12-FZ of February 21, 2019 “On Amendments to the Federal Law “On Enforcement Proceedings”;

- Directive of the Central Bank No. 5286-U dated October 14, 2019 “On the procedure for indicating the type of income code in orders for the transfer of funds,” registered with the Ministry of Justice on January 14, 2020;

- Letter of the Central Bank No. 45-1-2-OE/8224 dated 06/08/2020.

What payments do banks accept?

Not only are tax agents confused with the method of filling out field 110, but bank employees also do not have clear instructions on which payments to accept. Some employees make payments using documents with “0” in field 110. Others, citing the law, require that the field be left blank or have a space in it. But for some there is no difference.

Attention! Even if there is insufficient funds in the tax agent’s current account, the bank employee must accept the payment with zero or completely blank line 110, but it will be executed only after the account has been replenished with a sufficient amount.

In order for the execution of a financial order to be carried out in accordance with all the rules, and for the money to reach the recipient on time, you should adapt to the requirements for payment documents and field 110 established by the bank servicing the enterprise.

Codes

Law 12-FZ establishes that persons paying a citizen a salary or other income, in respect of which Article 99 FZ-229 (on enforcement proceedings) establishes restrictions or for which, in accordance with Article 101 229-FZ, cannot be levied, are required to indicate in the payment documents the corresponding code for the type of income.

What is it for? The fact is that the bank needs this information in order to understand whether it is possible to write off funds from the amount received on the card according to the executive document or not.

Central Bank Directive No. 5286-U regulates the procedure for indicating the code in the payment order. The code of the type of income is indicated in detail 20 “Name. pl." payment order.

List of codes and cases of their use:

When transferring funds that are not income, for which restrictions are established by Articles 99, 101 of Federal Law No. 229-FZ, the type of income code is not indicated.

Where to find field 110 on the sample form

Payment of taxes and insurance contributions to the budget system of the Russian Federation through a non-cash transaction obliges tax agents to fill out payment orders. They indicate the required details - type and type of payment. By order of the Bank of Russia, in accordance with the order of the Ministry of Finance of Russia, a separate column is allocated for these purposes.

Attention! Cell 110 is located in field 110 at the bottom of the payment document, where information about the recipient is reflected.

In the example below you can see that field 110 in the payment slip is in the lower right corner.

Purpose of payment

Federal Law 12-FZ introduced another innovation for accountants.

Persons paying wages or other income to the debtor by transferring them to the debtor’s bank account, from June 1, 2022, were required to indicate in the payment order the amount collected under the writ of execution.

The Central Bank explained how to do this in letter No. IN-05-45/10 dated February 27, 2020.

When transferring income from which amounts were withheld under executive documents, in the “Purpose of payment” details you must indicate:

- symbol "//";

- combination of letters “VZS”, that is, the amount collected;

- symbol "//";

- the amount collected in numbers (rubles from kopecks must be separated by a dash sign “-„, if the collected amount is expressed in whole rubles, then after the dash sign “-” “00” is indicated);

- symbol "//".

For example, when withholding alimony in the amount of 10,000 rubles, the following is indicated: //VZS//10000-00//.

What is it for? The fact is that executive documents also come to banks where employees have accounts. And it turns out that the bank does not know that some income has already been withheld within the amount established by law.

When is it necessary to fill out field 110

Filling out detail 110 in the payment order depends on the type of payments, the transfer of which is formalized by such a financial document. It is necessary to enter information in field 104 together with cell 110 of the payment order when:

- Wages and remuneration are paid to employees of enterprises owned by the state.

- Payments are being made to government employees.

- Beneficiaries receive pensions, benefits or compensation from the Pension Fund.

- Scholarships are provided to young promising specialists.

- Documents are being drawn up to pay the lifelong salaries of judges.

Important! When making such transfers, field 110 should be filled in, indicating the payment code - “1”.

For all other payments, including transfers of legal entities and individual entrepreneurs by bank transfer and payment of mandatory contributions to the budget, the method of entering information in column 110 does not change. The field must remain empty, without dashes or numbers.

Code “1” in field 110 when making non-cash transfers from budgetary structures means that money can only be credited to accounts to which a MIR debit card is attached. If the bank client does not have such a means of payment, his actions should be as follows:

- After the money arrives at the bank, it will be detained in the company’s accounts until the circumstances of the transfer are clarified.

- The next day, the recipient will be sent a notification with a requirement to visit a bank branch within 10 business days to receive the transfer amount in cash using their passport.

- If the client has another account through which it is possible to carry out monetary transactions using the MIR card, information on its details must be provided to the bank employee.

- After the ten-day period, if the recipient specified in the financial order has not visited the bank and provided new account information, the funds will be transferred back to the sender.

Important! The requirements for filling out payment slips in 2022 are relevant both for electronic document management and for the generation of financial orders on paper.

Example 3

Child benefit was transferred to the employee

By the way, the payment card for transferring child care benefits has one more feature. The Central Bank indicated this in a letter dated August 14, 2019 No. 45-1-2-07/22917.

The fact is that some benefits, including child care benefits up to 1.5 years old, must be transferred to a bank account attached to the Mir card. This applies to payments assigned after May 1, 2022.

In this case, the payment slip must indicate code 1 in the “110” field.

New in filling out field 110

More details about the innovations for fields 110 and 107 are described in the material “New details have been introduced into the payment card.” Here is a brief summary of the new rules for filling out payment orders (latest news) in 2020.

Based on the Regulation of the Bank of Russia dated June 19, 2012 No. 383-P, in field 110 in the payment order in 2022, it is necessary to enter the payment code when transferring funds from the budget in favor of individuals. This innovation was introduced by the instructions of the Central Bank of the Russian Federation dated July 5, 2018. Until this moment, the field remained empty.

The changes were required so that banks could track compliance with legal requirements for non-cash payments from the budget only for issued Mir payment cards. Currently, when making a transfer in favor of individuals using budget funds, senders are required to record this in field 110.

When and what type of payment 110 to indicate in a payment order is easy to remember:

- when transferring funds from the budget, the number 1 is placed in the required place;

- when carrying out regular operations using own funds, field 110 is not filled in.

Filling out this field is necessary to verify whether the account owner has a Mir card. The bank's further actions depend on whether such a card is available or not. If the owner does not have it, the bank is obliged to reflect the transfer amounts on the account for accounting for amounts of unknown purpose with all the ensuing consequences.

New code

If a payment is received by an individual at the expense of the Russian budget system, then it is assigned code “1”, which is entered in field 110. Today this applies to the following payments:

- salary/remuneration/salary of civil servants;

- salaries of personnel of state and municipal bodies/institutions/state extra-budgetary funds;

- scholarships from the state;

- pensions and other social benefits from the Pension Fund of Russia;

- monthly lifelong maintenance for judges.

It is possible that this list will soon be expanded. Law No. 161-FZ provides for such a possibility.

In other cases, as before, field 110 is left empty.

Therefore, these changes do not affect:

- transfer of obligatory payments to the treasury;

- mutual settlements between firms, enterprises, entrepreneurs, and other individuals.

How to fill out a payment order

To begin, you need to specify:

- The date of the document and its number - it must be no more than six characters.

- Payment type. It can have the meaning “Urgent”, “Telegraph”, “Mail”. If you send a payment through a client bank, indicate the encoded value accepted by the bank. This field can also be left blank: in our example of a payment order (above) it is empty.

- Payer status - code from 01 to 20, specifying the person or organization that transfers the money.

- Payment amount. It must be indicated in words from the beginning of the line with a capital letter (kopecks - in numbers). In this case, “ruble” and “kopeck” are written without abbreviations.

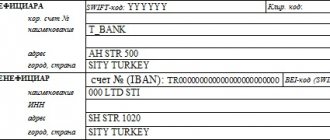

Further, in the details of the payment order in 2022, information about the payer and recipient is indicated:

- TIN, checkpoint,

- Name of the organization,

- account number, bank name, BIC, etc.

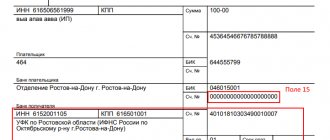

After this, fill in the fields with additional codes:

- Type of operation - the payment order has code 01.

- Sequence of payments.

- Reserve field. Leave it blank.

- Code. For tax and non-tax payments you need to enter 0. If necessary, a unique accrual identifier (UIN) is entered in the same field - a code of 20 or 25 digits.

In 2022, the UIN code in the payment order is indicated only when paying a penalty, fine or arrears at the request of the Federal Tax Service, Pension Fund or Social Insurance Fund.

After that, fill out the bottom table in the document.

- In the “Recipient” field (field 104), enter the budget classification code, which shows the type of receipt to the budget: tax, trade fee, etc. KBK Directory - here >>

- In field 105, enter the OKTMO code. In the 2022 payment order it is indicated instead of OKATO.

- In field 106, enter the basis for the payment. The code consists of 2 letters, for example, OT - repayment of deferred debt. If the list of codes does not contain the payment you need, enter 0.

- In field 107, if the payment is tax, fill in the indicator of the tax period - how often the tax is paid: MS - monthly, CV - quarterly, PL - every six months, GD - annually. The date is written after the letter designation.

- In fields 108 and 109, indicate the payment basis number. You must enter the document number on the basis of which the payment is made and the date. Test yourself using the example of filling out a payment order.

- Field 110 (payment type) in the payment order in 2022 does not need to be filled in, since the KBK is indicated. Enter 0 in this field.

- The form is signed by the person whose signature is on the bank card.

The payment order is valid for 10 calendar days from the date of its preparation.

Payment order: payment type in field 110

Code 110 in a payment order indicates the type of payment and is located in the recipient information block. Please note that the requirements of the Central Bank of the Russian Federation for the design of this field change quite often. It seems that this is due not only to interdepartmental disagreements and imperfect legislative norms, but also to the development of technology.

Thus, the Ministry of Finance of the Russian Federation, by order No. 126n dated October 30, 2014, canceled filling out line 110 of the payment order from 2015, but practically at the same time, the Central Bank of the Russian Federation notes the need to fill out this field and in letter No. 234-T dated December 30, 2014, establishes the obligation to enter O.

Further, the Central Bank of the Russian Federation, by instruction No. 3844-U dated November 6, 2015, changed the previous order by canceling the completion of field 110 in the payment order for everyone without exception. These changes were effective from March 28, 2016.

The situation changed last year. Directive of the Central Bank of the Russian Federation dated July 5, 2017 No. 4449-U introduced new changes to regulation No. 383-P concerning the rules for transferring money. They began to operate on 08/08/2017. We will explain the reasons for the next adjustment and tell you which payments they will affect.

The Bank of Russia had to update the requirements for filling out this field due to the adoption of a new version of the Law “On the National Payment System” No. 161-FZ dated June 27, 2011. In essence, the changes under consideration were the result of the deployment of a state program to introduce domestic payment systems, the advantage of which is independence from foreign instruments and sanctions.

Cause

On July 31, 2022, the Russian Ministry of Justice registered the Central Bank’s instruction dated July 5, 2017 No. 4449-U. It made adjustments to the fundamental regulation of the Central Bank of the Russian Federation dated June 19, 2012 No. 383-P “On the rules for transferring money.”

The main subject of all innovations is field 110 of the payment, where the type of payment is indicated. However, recently it was allowed not to fill it out at all.

For more information, see “Type of payment in payment order: field 110”.

The Central Bank had to update the rules for filling out this field due to the new edition of Law No. 161-FZ of June 27, 2011 “On the National Payment System” - MIR (hereinafter referred to as Law No. 161-FZ). Therefore, in fact, the changes under consideration are part of the state program to introduce domestic payment systems into circulation. Their advantage is that they:

- do not depend on foreign elements;

- should not suffer from foreign sanctions.