Monthly reporting to the Pension Fund of the Russian Federation “Information about insured persons” in the form SZV-M was introduced by Federal Law No. 385-FZ of December 29, 2015 for all employers in relation to all insured persons working for them, if insurance contributions are paid from their remuneration to the Pension Fund of the Russian Federation.

This is established by clause 2.2 of Art. 11 of the Federal Law of April 1, 1996 No. 27-FZ “On individual (personalized) registration in the compulsory pension insurance system”).

The report form was approved by Resolution of the Pension Fund Board of February 1, 2016 No. 83p. The electronic format of information about insured persons was approved by Resolution of the Pension Fund Board of December 7, 2016 No. 1077P.

In this form, indicate SNILS, full name. and TIN.

Updated form

On May 30, Resolution of the Board of the Pension Fund of April 15, 2021 No. 103p comes into force, which approved a new form and instructions for filling out the SZV-M in 2022, and employers should use them when submitting the form for May.

The changes are technical, but the law obliges you to report to the Pension Fund only using current forms, otherwise the company or individual entrepreneur will be fined. IMPORTANT!

Despite the talk, the cancellation of SZV-M in 2022 is not planned. You will still have to report, but starting with the May form, using an updated template.

Use ConsultantPlus materials to fill out and submit the SZV-M.

Open instructions for filling out from ConsultantPlus experts

Late submission of SZV-M: how to avoid a fine

In order to avoid paying a fine, you must avoid violating the rules for submitting a report on insured persons . It is most convenient to prepare and submit documentation and reporting to the Pension Fund not on the deadline for submitting reports, but at least 2-3 days before the deadline allotted by inspectors for submitting documentation expires. This minimizes the risk of being late, for example due to technical failures. Otherwise, you may run into penalties for failure to provide SZV-M.

Read the step-by-step guide to filling out the SZV-M

When submitting reports, it is necessary to check the information sent to the Pension Fund as carefully and thoroughly as possible. Even after the transfer of documentation is completed. In the event that the policyholder independently discovers an error and does it earlier than the Pension Fund employee, the organization is exempt from paying penalties.

In a situation where the fine has already been issued and its amount is significant, do not be afraid to go to court . It is the arbitrators who will be able to decide what amount is appropriate for lateness or errors made in the SZV-M. Judicial practice confirms that judges often reduce the amount of penalties when an organization refers to a minor delay or the presence of mitigating circumstances, such as technical failures that were not the fault of the company, equipment breakdown, or in the case of a first-time offense.

use the Kontur.Extern web service to prepare and check reports feel most comfortable . All current updates and test programs are installed without user intervention. If the data entered by the policyholder does not meet the requirements for filling out the form and control ratios, the system will certainly warn him about this and tell him how to correct the errors. And timely correction of errors will save the accountant from the need to submit “clarifications,” go to court or pay fines.

SZV-M report: who submits it and when

Employers send monthly information about employees using the form “Information about insured persons” (SZV-M). But a complete list of who fills out information about the insured person is formed based on the concept of “insured persons” (see Article 7 of the Federal Law of December 15, 2001 No. 167-FZ “On Compulsory Pension Insurance in the Russian Federation”). These include employees with whom, during the reporting period, the following were concluded, continue to operate or were terminated:

- employment contracts;

- civil contracts, the subject of which is the performance of work, provision of services;

- copyright contracts;

- agreements on the alienation of exclusive rights to works of science, literature, and art;

- publishing licensing agreements;

- licensing agreements granting the right to use.

Thus, monthly reporting to SZV-M is provided by all insurers (organizations and individual entrepreneurs) in relation to insured persons who work under employment contracts and with whom civil contracts have been concluded, if insurance premiums are paid on their remuneration.

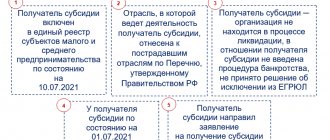

The current form, deadlines and rules for filling out SZV-M reports were approved by Resolution of the Board of the Pension Fund of the Russian Federation dated April 15, 2021 No. 103p. Reporting is submitted monthly no later than the 15th day following the reporting month. If the deadline for submitting the form falls on a holiday or weekend, it must be submitted on the next working day. The current regulations do not prohibit taking it earlier, in the current month. But provided that the employer is sure that he will not hire a new employee until the end of the month. Otherwise, there will be a fine for providing incomplete information.

The deadlines for submitting SZV-M in 2022 for individual entrepreneurs with employees and organizations do not differ. Taking into account all transfers, the report should be prepared and submitted within the following deadlines:

| Reporting period (2021) | Deadline |

| January | 15.02.2021 |

| February | 15.03.2021 |

| March | 15.04.2021 |

| April | 17.05.2021 (date moved from holiday) |

| May | 15.06.2021 |

| June | 15.07.2021 |

| July | 16.08.2021 (date moved from holiday) |

| August | 15.09.2021 |

| September | 15.10.2021 |

| October | 15.11.2021 |

| November | 15.12.2021 |

| December | 17.01.2022 (date moved from holiday) |

Is it necessary to report if there are no employees or persons working under GPC agreements?

Those companies that do not have a single employee registered are also required to submit the SZV-M form. According to current legislation, the general director, like the founder, are also employees, the Pension Fund of the Russian Federation clarifies in a statement.

Who to submit information to

The instructions on the procedure for maintaining individual (personalized) records of information about insured persons were approved by Order of the Ministry of Labor of Russia dated December 21, 2016 No. 766n (hereinafter referred to as the Instructions).

Form SZV-M is submitted both to full-time employees working under employment contracts, including remote workers, and to part-time workers, and to performers under civil contracts, for remuneration for which insurance premiums are (or should be) accrued.

Please note: information about the sole founder - the head of the company - must be included in the report, even if, along with the absence of an employment contract in paper form, he also does not receive a salary. Since the company conducts financial and economic activities, and he performs the function of the sole executive body, he is in an employment relationship with the company.

Who is exempt from reporting?

There are exceptions for certain categories of business entities and employees. The SZV-M report is not provided by:

- peasant farms where there are no hired workers;

- individual entrepreneurs, arbitration managers, privately practicing lawyers and notaries who pay fixed insurance premiums only for themselves;

- employers in relation to foreign citizens and stateless persons who are temporarily staying in Russia or working remotely, who are not covered by compulsory pension insurance;

- employers in relation to military personnel, employees of the Ministry of Internal Affairs and the Federal Security Service (with the exception of civilian employees), since compulsory pension insurance does not apply to them, and the state provides other guarantees for them.

Why do we need the supplementary form SZV-M?

The purpose of submitting corrective or supplementary SZV-M to the Pension Fund is to generate reliable and complete personalized information on the personal accounts of insured persons.

When and why you need to clarify previously provided information and how to do this, we tell you in our other materials:

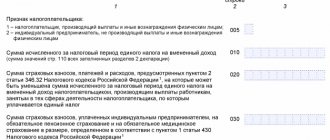

- “Features of the updated tax return 3-NDFL”;

- “How to submit an updated tax return under the simplified tax system”;

- “Updated calculation of insurance premiums in 2022 - 2021.”

In what cases is the cancellation SZV-M submitted and how to fill it out, read in ConsultantPlus. If you do not already have access to this legal system, trial access is available for free.

Where and in what form to submit SZV-M

Pay attention to the procedure for where to submit the SZV-M: to the territorial body of the Pension Fund of the Russian Federation in which the policyholder is registered (Clause 1, Article 11 of Law No. 27-FZ). Each branch separately submits information about employees and persons who perform work (provide services) under civil contracts.

According to paragraph 2 of Art. 8 No. 27-FZ, a company with less than 25 insured persons has the right to provide reports in the form of documents in writing (on paper). For others, the rules on how to submit a SZV-M report to the Pension Fund are strict - exclusively in electronic form. And the Pension Fund fines organizations that do not comply with the format required by law for submitting reports by 1,000 rubles.

How to submit a report

You can submit a report:

- on paper (in person or using postal services);

- in the form of an electronic document using public information and telecommunication networks, including the Internet, including the Unified Portal and the PFR website, a “personal account” that provides the ability to send and receive unambiguous and confidential information, as well as intermediate messages and response information in electronic form;

- through the multifunctional center.

All organizations that submit information for 25 or more insured persons must report electronically. The electronic document must be signed with an enhanced qualified electronic signature.

How to fill out a report

It is convenient to fill out a monthly report quickly and free of charge in the special program “PU Documents 6”. It is available for download on the official website of the Pension Fund in the “Free programs for employers” section.

You can also fill out a report in online services on the websites of accounting software developers - My Business, Kontur, Nebo and others. Some sites allow you to do this freely, but usually the services require a fee (up to 1000 rubles).

Instructions for filling out section I of the SZV-M

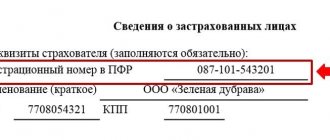

The form consists of 4 sections, each of which is required to be completed. Let us consider in detail how to fill out and submit the new SZV-M form for monthly reporting to the Pension Fund of the Russian Federation, starting with section 1. It should indicate the following details of the policyholder:

- registration number in the Pension Fund of Russia. It is indicated in the notification from the Pension Fund received upon registration. Upon request, it will be issued at the local branch of the Pension Fund of Russia, the tax office or on the website nalog.ru;

- name (short);

- in the “TIN” field, you should indicate the code in accordance with the received certificate of registration with the tax authority;

- Individual entrepreneurs do not fill out the “Checkpoint” field. When filling out the form, organizations indicate the checkpoint issued by the Federal Tax Service at their location (separate units indicate the checkpoint at their location).

IMPORTANT!

If a branch is reporting, then indicate the TIN of the main company, and the KPP - of a separate division.

Sample of filling out Section I of SZV-M

Instructions for filling out section II of SZV-M

Section 2 indicates the period for which the form is submitted. The reporting period code is a two-digit serial number of the month, the year consists of four digits.

Sample of filling out section II of SZV-M

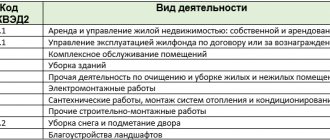

Instructions for filling out section III of the SZV-M

In section 3, you must indicate the type code of the transmitted report. It can take 3 values:

- “output” - the original form that the enterprise submits for the specified reporting period for the first time;

- “additional” is a complementary form. This code is indicated if the original report has already been submitted, but it needs to be corrected. For example, a new employee appeared or incorrect data was submitted for him;

- “cancel” is a canceling form. This code is used if it is necessary to completely exclude any employees from the submitted initial report. For example, the report contains data on an employee who quit and no longer worked in the current period.

Sample of filling out section III SZV-M

Instructions for filling out section IV of the SZV-M

The last section is presented in the form of a table, which contains a list of employees who have concluded labor contracts at the enterprise in the current period, including GPC agreements. The table consists of four columns:

- the first one contains the serial number of the line;

- in the second - full name. employee in the nominative case. If the patronymic is missing, it is not indicated;

- in the third - SNILS (employee registration number in the Pension Fund of Russia). This is mandatory information;

- in the fourth - TIN (employee registration number with the Federal Tax Service). This column is filled in if the policyholder has the necessary information.

You can enter data into the table either in alphabetical order or randomly.

Sample of filling out section IV SZV-M

At the end, the report is signed by the general director or entrepreneur, indicating the position and full name. The date of compilation of the form is also indicated here and a stamp is affixed if it is used in the company. Since the SZV-M form does not provide for the possibility of signing the report by a representative of the policyholder, it must be submitted personally either by the director of the organization or by the entrepreneur.

A sample document completely filled out according to the instructions looks like this:

Deadline

According to the general rules, information is submitted monthly, before the 15th day of the month following the reporting month.

For a supplementary report, the deadline for submission is not fixed by law. Submit “extra” immediately when you discover an error. If an organization discovers an error and corrects it before the Pension Fund discovers it, there will be no fine.

To clarify, after receiving the protocol from the Pension Fund of the Russian Federation, the policyholder must submit reliable information within 5 working days. In this case there will be no fine either.

The Pension Fund will issue a fine if it finds that not all data is included in the report. The fine is 500 rubles for each individual not specified.

Common mistakes when filling out SZV-M

| Error | It should be | How to fix |

| There is no information about the insured person | When filling out the form, you must indicate all employees with whom an employment contract or civil service agreement has been concluded (even if the person worked for only one day). Information is also submitted if there have been no accruals or payments to the employee at the Pension Fund of the Russian Federation, but he has not been fired. | Supplementary reporting is submitted, which indicates those employees who are not reflected in the original form. In the third section we put the form code “ADP”. |

| There is an extra employee present | The presence of records of redundant employees (for example, fired) is equivalent to false information. | A cancellation form must be provided indicating only the excess employees. In the third section we put the form code “OTMN”. |

| Incorrect employee tax identification number | Although the absence of the TIN itself when filling out the form is not an error, if it is indicated, enter it correctly. | Two forms are provided at the same time: a cancellation form - for an employee with an incorrect TIN, and along with it a supplementary one, in which the correct information is indicated. |

| Incorrect SNILS of an employee | The absence of a code, as well as incorrect information, is grounds for a fine. | If the report is not accepted, it must be corrected and resubmitted as outgoing. If only correct information is accepted, then corrections are provided to employees with errors in a supplementary form. |

| Incorrect reporting period | You must enter the correct month and year code. | It is necessary to re-submit the form with the status “outgoing”, correctly indicating the reporting period. |

Forgotten employees

The accountant submitted the SZV-M in a timely manner, but due to carelessness did not include one employee in the form. To correct this oversight, a supplemental form was submitted with the employee's information. However, the accountant did not manage to submit it on time. As a result, a fine of 500 rubles followed.

If there is only one forgotten employee or there are several, it doesn’t matter. But in large companies, such forgetfulness can result in very tangible problems.

Is it legal to impose a fine in such a situation? After all, only the supplementary form was submitted beyond the deadline for submitting reports, while the primary one was submitted on time. Arbitration practice is ambiguous, for example:

- Resolution dated December 25, 2017 No. F03-5001/2017. The judges sided with the Pension Fund. The argument is this: in the supplementary form, information about forgotten employees was submitted for the first time. They were missing in the original form, therefore information about them was received by the fund late.

- Resolution of the AS of the East Siberian District dated October 5, 2017 No. A78-1989/2017. The court supported the insured. In his opinion, the supplementary form SZV-M is, in essence, a correction of errors in the original report . And no fine is imposed for this.

So, judicial practice suggests that in such a situation there is still a chance to challenge the fine. So if the amount is really significant, you should go to court.

Sanctions and fines

For failure to submit the SZV-M form within the prescribed period, a fine of 500 rubles is provided. This amount will have to be paid for each employee for whom information has not been provided (Part 4, Article 17 of Law No. 27-FZ). The same fine is provided for submitting incomplete and/or false information in relation to each employee (Part 4, Article 17 of Law No. 27-FZ). In addition, for filing reports in the wrong form, the Pension Fund of Russia will fine the employer 1,000 rubles. In case of erroneous information, a fine can be easily avoided if you correct the inaccuracy yourself.

If errors in employee data

Errors in providing data on the insured may be the following:

- The employee's last name, first name, and patronymic name must be indicated in full in the report. If one of the components is missing, the report will not be accepted;

- if there is no data on the TIN, you cannot enter zeros;

- Full name and full name do not match and SNILS of the insured person.

In such reports, the Pension Fund sends the report for revision.

Therefore, in this case, the organization needs to submit an additional form SZV-M. It indicates only those employees for whom erroneous data was previously provided.