Updated form

On May 30, Resolution of the Board of the Pension Fund of April 15, 2021 No. 103p comes into force, which approved a new form and instructions for filling out the SZV-M in 2022, and employers should use them when submitting the form for May.

The changes are technical, but the law obliges you to report to the Pension Fund only using current forms, otherwise the company or individual entrepreneur will be fined. IMPORTANT!

Despite the talk, the cancellation of SZV-M in 2022 is not planned. You will still have to report, but starting with the May form, using an updated template.

Use ConsultantPlus materials to fill out and submit the SZV-M.

Open instructions for filling out from ConsultantPlus experts

Pension Fund programs

They can be found in the “free programs for employers” section. Several programs are suitable for preparing SZV-M: “PU 6 Documents”, “Spu_orb”, “PD SPU”, “PsvRSV”. However, in order to understand the difference between them and correctly install the selected program, you will need the advice of a specialist who understands these issues.

To create a personal account on the Pension Fund website, you will have to go through a difficult registration procedure. This can only be done without leaving the office using an electronic digital signature. Or you need to contact the Pension Fund in person and receive a registration card to enter the office.

SZV-M report: who submits it and when

Employers send monthly information about employees using the form “Information about insured persons” (SZV-M). But a complete list of who fills out information about the insured person is formed based on the concept of “insured persons” (see Article 7 of the Federal Law of December 15, 2001 No. 167-FZ “On Compulsory Pension Insurance in the Russian Federation”). These include employees with whom, during the reporting period, the following were concluded, continue to operate or were terminated:

- employment contracts;

- civil contracts, the subject of which is the performance of work, provision of services;

- copyright contracts;

- agreements on the alienation of exclusive rights to works of science, literature, and art;

- publishing licensing agreements;

- licensing agreements granting the right to use.

Thus, monthly reporting to SZV-M is provided by all insurers (organizations and individual entrepreneurs) in relation to insured persons who work under employment contracts and with whom civil contracts have been concluded, if insurance premiums are paid on their remuneration.

The current form, deadlines and rules for filling out SZV-M reports were approved by Resolution of the Board of the Pension Fund of the Russian Federation dated April 15, 2021 No. 103p. Reporting is submitted monthly no later than the 15th day following the reporting month. If the deadline for submitting the form falls on a holiday or weekend, it must be submitted on the next working day. The current regulations do not prohibit taking it earlier, in the current month. But provided that the employer is sure that he will not hire a new employee until the end of the month. Otherwise, there will be a fine for providing incomplete information.

The deadlines for submitting SZV-M in 2022 for individual entrepreneurs with employees and organizations do not differ. Taking into account all transfers, the report should be prepared and submitted within the following deadlines:

| Reporting period (2021) | Deadline |

| January | 15.02.2021 |

| February | 15.03.2021 |

| March | 15.04.2021 |

| April | 17.05.2021 (date moved from holiday) |

| May | 15.06.2021 |

| June | 15.07.2021 |

| July | 16.08.2021 (date moved from holiday) |

| August | 15.09.2021 |

| September | 15.10.2021 |

| October | 15.11.2021 |

| November | 15.12.2021 |

| December | 17.01.2022 (date moved from holiday) |

Is it necessary to report if there are no employees or persons working under GPC agreements?

Those companies that do not have a single employee registered are also required to submit the SZV-M form. According to current legislation, the general director, like the founder, are also employees, the Pension Fund of the Russian Federation clarifies in a statement.

How to fill out the SZV-experience for employees - future retirees?

Many employers will have to fill out this form for employees retiring. Therefore, we provide a detailed procedure for filling out the report. SZV-experience is filled out if, in order to assign a pension, it is necessary to take into account the period of work in a calendar year, the deadline for submitting reports for which has not yet arrived.

First of all, when an employee is preparing to retire due to old age or disability, he turns to the policyholder with a request to submit a SZV-experience report for him with the type “Pension Assignment”. The employer is obliged to satisfy this request so that the months worked in the current year are included in the employee’s length of service.

In this case, ask the employee for an application to submit a SZV-experience report to the Pension Fund (a sample application is given below). After this, prepare a report on the employee and send it to the Pension Fund no later than three calendar days from the date of submission of the application. This procedure is provided for in paragraph 2 of Art. 11 of Federal Law No. 27-FZ of April 1, 1996.

Sample application:

To the director of Romashka LLC, I.I. Ivanov, from florist P.P. Petrova.

STATEMENT.

In accordance with paragraph 2 of Art. 11 of Federal Law No. 27-FZ of April 1, 1996 and Part 6 of Art. 21 of Federal Law No. 400-FZ of December 28, 2013, I inform you that on June 17, 2022 I will turn 56.5 years old. In connection with reaching retirement age and having the necessary work experience, from June 17, 2022, I have the right to receive an old-age pension.

Please provide the necessary personalized accounting information in the SZV-STAZH form, necessary for assigning a pension, to the territorial office of the Pension Fund of the Russian Federation within 3 calendar days from the date of submission of this application.

05/10/2021 Petrova P.P. ___________

When filling out the SZV-experience form in the name of an employee - a future pensioner, make the following notes:

- Section 1 “Information about the policyholder.” In the “Type of information” field, mark the “Pension assignment” field with a cross.

- Section 3 “Information about periods of work of insured persons” . Indicate the periods when the person worked, was on vacation, was on sick leave, or was absent from the workplace for other reasons. In the “Period of work” column, reflect the date preceding the date of expected retirement: if the employee’s application was written before reaching retirement age, then this is his closest date of birth; if the application is written after reaching retirement age, this is the date when the employee intends to provide documents to the Pension Fund (in this case, ask the employee to indicate the date in his application). In column 11 you need to indicate the period of work in special conditions, hazardous work. This applies to those who have the right to retire early. For the same reasons, columns 8-10, 12, 13 are filled out.

- Section 4 “Information on accrued (paid) insurance premiums for compulsory health insurance” . Please indicate whether pension insurance contributions have been accrued for the period specified in section 3. Place an “X” in the “Yes” or “No” fields, respectively.

- Section 5 “Information on paid pension contributions in accordance with pension agreements for early non-state pension provision” . Fill out only if the future pensioner worked in harmful or dangerous industries for which there is an agreement with the NPF on early pension provision. Indicate the periods for which contributions were paid.

- Attach the EDV-1 inventory to the SZV-experience form: in the “Reporting period” field put “0”, in the “Year” field - the year of submission of information, in the field with the type of information “Initial” put a cross and indicate the number of employees for whom you are submitting information .

Who is exempt from reporting?

There are exceptions for certain categories of business entities and employees. The SZV-M report is not provided by:

- peasant farms where there are no hired workers;

- individual entrepreneurs, arbitration managers, privately practicing lawyers and notaries who pay fixed insurance premiums only for themselves;

- employers in relation to foreign citizens and stateless persons who are temporarily staying in Russia or working remotely, who are not covered by compulsory pension insurance;

- employers in relation to military personnel, employees of the Ministry of Internal Affairs and the Federal Security Service (with the exception of civilian employees), since compulsory pension insurance does not apply to them, and the state provides other guarantees for them.

In what form is the SZV internship submitted?

When the form is filled out, we indicate the position of the manager and certify the report with his signature; if available, we affix a stamp. Before sending the SZV-experience forms to the Pension Fund, we collect them in a bundle and make an inventory of them according to the OVD-1 form, without which the reports will not be accepted. In EFA-1, put 0 in the “Reporting period (code)” field, in section 3 indicate the number of employees in the SZV-experience, do not fill out section 4.

You can submit your work experience in paper or electronic form - it depends on the number of people whose work experience information is submitted by the employer. If there are less than 25, information can be submitted on paper; if there are 25 or more, only electronic submission is acceptable.

You can submit your SZV-experience report in 2022 from the online service Kontur.Accounting. You can also keep records, calculate salaries, send reports, use the support of our experts and other service capabilities. The first 14 days of operation are free for all new users.

Try for free

Where and in what form to submit SZV-M

Pay attention to the procedure for where to submit the SZV-M: to the territorial body of the Pension Fund of the Russian Federation in which the policyholder is registered (Clause 1, Article 11 of Law No. 27-FZ). Each branch separately submits information about employees and persons who perform work (provide services) under civil contracts.

According to paragraph 2 of Art. 8 No. 27-FZ, a company with less than 25 insured persons has the right to provide reports in the form of documents in writing (on paper). For others, the rules on how to submit a SZV-M report to the Pension Fund are strict - exclusively in electronic form. And the Pension Fund fines organizations that do not comply with the format required by law for submitting reports by 1,000 rubles.

Online services on an ongoing basis

Another option to fill out the SZV-M without any problems is to use online services.

There are several portals that allow you to fill out the SZV-M report online: “My Business”, “Contour”, “Sky”.

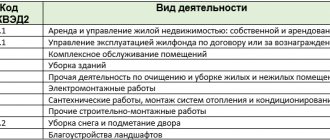

For clarity, here is a table of these services:

| Service name | Who is it aimed at? | Advantages | Price |

| My business | Individual entrepreneur on the simplified tax system and UTII | Specializes in the most popular tax regimes for small businesses. | From 3990 per year. |

| Contour.Extern | Small businesses using the simplified tax system and UTII, medium-sized businesses (including in the field of alcoholic beverages) and budgetary enterprises located in St. Petersburg and the Leningrad region. | The ability to generate reports to all government agencies, including RPN and RAR, the ability to work from different computers, free access to the promotion for 3 months. | From 2900 per year |

| Sky | Companies wishing to submit reports electronically. It is possible to draw up declarations of the simplified tax system, UTII, EUND, VAT. | There is a free tariff “Reporting only” | 100–170 rubles for one document when sending the document at the same time in the presence of the Sky ES. |

Now let's see how to fill out the SZV-M in these programs.

How to fill out a report

It is convenient to fill out a monthly report quickly and free of charge in the special program “PU Documents 6”. It is available for download on the official website of the Pension Fund in the “Free programs for employers” section.

You can also fill out a report in online services on the websites of accounting software developers - My Business, Kontur, Nebo and others. Some sites allow you to do this freely, but usually the services require a fee (up to 1000 rubles).

Instructions for filling out section I of the SZV-M

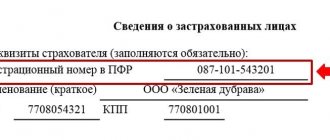

The form consists of 4 sections, each of which is required to be completed. Let us consider in detail how to fill out and submit the new SZV-M form for monthly reporting to the Pension Fund of the Russian Federation, starting with section 1. It should indicate the following details of the policyholder:

- registration number in the Pension Fund of Russia. It is indicated in the notification from the Pension Fund received upon registration. Upon request, it will be issued at the local branch of the Pension Fund of Russia, the tax office or on the website nalog.ru;

- name (short);

- in the “TIN” field, you should indicate the code in accordance with the received certificate of registration with the tax authority;

- Individual entrepreneurs do not fill out the “Checkpoint” field. When filling out the form, organizations indicate the checkpoint issued by the Federal Tax Service at their location (separate units indicate the checkpoint at their location).

IMPORTANT!

If a branch is reporting, then indicate the TIN of the main company, and the KPP - of a separate division.

Sample of filling out Section I of SZV-M

Instructions for filling out section II of SZV-M

Section 2 indicates the period for which the form is submitted. The reporting period code is a two-digit serial number of the month, the year consists of four digits.

Sample of filling out section II of SZV-M

Instructions for filling out section III of the SZV-M

In section 3, you must indicate the type code of the transmitted report. It can take 3 values:

- “output” - the original form that the enterprise submits for the specified reporting period for the first time;

- “additional” is a complementary form. This code is indicated if the original report has already been submitted, but it needs to be corrected. For example, a new employee appeared or incorrect data was submitted for him;

- “cancel” is a canceling form. This code is used if it is necessary to completely exclude any employees from the submitted initial report. For example, the report contains data on an employee who quit and no longer worked in the current period.

Sample of filling out section III SZV-M

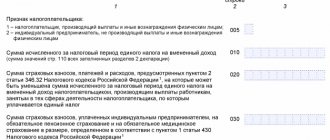

Instructions for filling out section IV of the SZV-M

The last section is presented in the form of a table, which contains a list of employees who have concluded labor contracts at the enterprise in the current period, including GPC agreements. The table consists of four columns:

- the first one contains the serial number of the line;

- in the second - full name. employee in the nominative case. If the patronymic is missing, it is not indicated;

- in the third - SNILS (employee registration number in the Pension Fund of Russia). This is mandatory information;

- in the fourth - TIN (employee registration number with the Federal Tax Service). This column is filled in if the policyholder has the necessary information.

You can enter data into the table either in alphabetical order or randomly.

Sample of filling out section IV SZV-M

At the end, the report is signed by the general director or entrepreneur, indicating the position and full name. The date of compilation of the form is also indicated here and a stamp is affixed if it is used in the company. Since the SZV-M form does not provide for the possibility of signing the report by a representative of the policyholder, it must be submitted personally either by the director of the organization or by the entrepreneur.

A sample document completely filled out according to the instructions looks like this:

Instructions for filling out a new SZV-M

The form, as before, consists of four points (sections). The first contains the following data:

- The policyholder number that the Pension Fund assigned to him upon registration.

- Name. It can now be written in both shortened and full form. Previously, a short name was entered. It is allowed to indicate the name of the organization in Latin. Individual entrepreneurs indicate their full name.

- TIN and KPP (for individual entrepreneurs - only TIN). If the form is submitted in relation to a separate unit, then the checkpoint at its location is indicated.

Section 2 reflects the reporting period: month in MM format (for example, January – “01”, September – “09”), year – in YYYY format (“2022”).

In Section 3 of the SZV-M, the full name of the report type should be indicated: “Initial”, “Additional” or “Cancelling”. In the old form, a short code should have been indicated in this field - “output”, “additional” or “o” is selected if the monthly report is submitted for the first time. The “Additional” type should be specified when you need to supplement a previously submitted form. If you need to cancel information submitted with an error, select the SZV-M “Cancelling” type.

The data of insured individuals is reflected in section 4. The filling rules are as follows:

- Column 1 indicates the serial number of the record for a specific employee. The numbering of individuals in the report must be continuous, without omissions or repetitions.

- Column 2 contains the last name, first name and patronymic of the insured person. They must be indicated in full, in the nominative case.

- In column 3 - SNILS in the format: XXX–XXX–XXX–CC or XXX–XXX–XXX CC.

- Column 4 contains the TIN of the insured. The number may not be entered if the employer does not know it.

The finished report is signed by the head of the organization or an authorized person. It is mandatory to indicate the name of the signatory’s position, as well as a transcript. The individual entrepreneur certifies the form with a personal signature. The date should be entered in the format DD.MM.YYYY. If available, the seal of the organization or individual entrepreneur is affixed.

Common mistakes when filling out SZV-M

| Error | It should be | How to fix |

| There is no information about the insured person | When filling out the form, you must indicate all employees with whom an employment contract or civil service agreement has been concluded (even if the person worked for only one day). Information is also submitted if there have been no accruals or payments to the employee at the Pension Fund of the Russian Federation, but he has not been fired. | Supplementary reporting is submitted, which indicates those employees who are not reflected in the original form. In the third section we put the form code “ADP”. |

| There is an extra employee present | The presence of records of redundant employees (for example, fired) is equivalent to false information. | A cancellation form must be provided indicating only the excess employees. In the third section we put the form code “OTMN”. |

| Incorrect employee tax identification number | Although the absence of the TIN itself when filling out the form is not an error, if it is indicated, enter it correctly. | Two forms are provided at the same time: a cancellation form - for an employee with an incorrect TIN, and along with it a supplementary one, in which the correct information is indicated. |

| Incorrect SNILS of an employee | The absence of a code, as well as incorrect information, is grounds for a fine. | If the report is not accepted, it must be corrected and resubmitted as outgoing. If only correct information is accepted, then corrections are provided to employees with errors in a supplementary form. |

| Incorrect reporting period | You must enter the correct month and year code. | It is necessary to re-submit the form with the status “outgoing”, correctly indicating the reporting period. |

Sending SZV-M in electronic format

The Pension Fund does not provide employers with the opportunity to send a report from their personal account on the Pension Fund website, so you can send the form electronically through an electronic document management (EDF) operator.

EDF operators are specialized companies that provide services not only for generating reports, but also for sending them to tax authorities via secure communication channels using an electronic digital signature.

To do this, you will need to enter into an agreement with the EDF operator in order to connect to its service and receive an electronic digital signature, and notify the Pension Fund of the Russian Federation about the submission of documents electronically.

Sanctions and fines

For failure to submit the SZV-M form within the prescribed period, a fine of 500 rubles is provided. This amount will have to be paid for each employee for whom information has not been provided (Part 4, Article 17 of Law No. 27-FZ). The same fine is provided for submitting incomplete and/or false information in relation to each employee (Part 4, Article 17 of Law No. 27-FZ). In addition, for filing reports in the wrong form, the Pension Fund of Russia will fine the employer 1,000 rubles. In case of erroneous information, a fine can be easily avoided if you correct the inaccuracy yourself.

Responsibility for failure to submit and violation of deadlines for filing SZV-M

Violation of the established deadlines and procedure for submitting SZV-M, submitting incomplete reports or indicating false information in them is recognized as an offense. In such cases, the insured as a violator is held accountable on the basis of Federal Law No. 27, Art. 17.

As a punishment, fines are applied to the perpetrator. (click to expand)

| Offense | Amount of financial sanctions applied |

| Failure to submit SZV-M within the required time frame; submission of false or incomplete information | 500 rub. for each employee for whom information has not been submitted |

| Failure to comply with the procedure for submitting the electronic version of the SZV-M (for example, the policyholder submitted the report on paper instead of the electronic version) | 1000 rub. |

Upon receipt of a demand for payment of a fine, the policyholder is obliged to pay the amount of the sanction within 10 subsequent days. If he does not do this or pays partially, the Pension Fund has the right to collect it through the court.

The listed financial sanctions may be written off due to their hopelessness. The Pension Fund of the Russian Federation does this when it is impossible to collect money for legal, economic, or social reasons.

The insured is not punished for an offense if 3 years have passed at the time of making the decision to prosecute (due to the statute of limitations). By this time, the legal consequences cease.

Example 1. Sample compilation of CMEA-M for the November period

LLC "Project" compiles SZV-M for the November period of the current year. In it, the policyholder should include information on two insured citizens working for him. Both work on the basis of an employment agreement. The policyholder enters data on Valentin Petrovich Grigoriev into the table (only SNILS, since there is no information on the TIN). For the second employee Galina Semenovna Petrovskaya, all data is entered.

In the first position, the details of Project LLC are written down (No. in the Pension Fund of Russia, Taxpayer Identification Number, short name, KPP). The company reports for November, therefore, “11” is entered in the appropriate position for the period. Next, “ISHD” is indicated, since the report is being submitted for the first time.

Sample of filling out SZV-M in 2022