Sale of real estate: different rules for calculating income in accounting and tax accounting

When selling a building or premises, the seller must record income and calculate taxes on it. What specific taxes are depends on the taxation system used. If a company applies a general taxation system, then upon sale there is an obligation to calculate two taxes: VAT and income tax. If the property is a residential building or premises, then a VAT benefit applies (clause 22, clause 3, article 149 of the Tax Code of the Russian Federation).

Since ownership rights to any real estate are subject to state registration, when selling there is almost always a time gap between the transfer of the object under the deed and the registration of ownership of it. This circumstance leads to the emergence of temporary differences, which, in turn, lead to the emergence of a deferred tax asset (DTA). This is due to the fact that the moment of recording the proceeds from the sale of real estate in accounting and tax accounting is different.

In tax accounting, the date of sale of real estate is the date of transfer of this property under a transfer deed or other document on the transfer of real estate (clause 3 of Article 271 of the Tax Code of the Russian Federation). In accounting, to reflect revenue, the transfer of ownership from the seller to the buyer is important (clause “d”, clause 12 of PBU 9/99 “Income of the organization”). Therefore, in accounting, income from sales is shown only at the moment when the ownership right is registered to the new owner. This difference leads to the formation of temporary differences, and therefore to the formation of a deferred tax asset.

As for VAT, here, as well as for the purposes of calculating income tax, the fact of registration of the transfer of ownership does not matter. What is important is the fact that the object is transferred to the buyer according to the act (clause 16 of Article 167 of the Tax Code of the Russian Federation). It is at this moment that it is necessary to include the value of the sold property in the VAT tax base and, accordingly, issue an invoice for it.

What to do if there is no property

The procedure for selling property is carried out even if the debtor does not have property to be included in the bankruptcy estate. Let’s assume that a citizen who has decided to go bankrupt has only a single home and personal belongings: in this case, no property will be confiscated from him, and the procedure will go much faster.

If the debtor has no property, the financial manager:

- makes an inventory

- submits it to the court for consideration

- the court learns that the debtor does not have property that could be used to pay off the obligations

- debts are written off, bankruptcy proceedings are completed

That is why if you have no property, but have debts, then admitting financial insolvency is the best solution to the problem.

Special procedure for property tax

Real estate is subject to corporate property tax (with rare exceptions when the object is classified as preferential property). Until what point will the sold property form the tax base for the seller? Until it is transferred under the deed to the buyer.

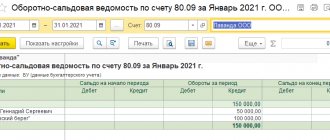

In accounting, it is at this moment that the property must be written off from the balance sheet, since it no longer meets all the characteristics of a fixed asset given in clause 4 of PBU 6/01 “Accounting for fixed assets.” Despite the fact that the seller actually continues to be considered the owner of the building, he is no longer obliged to pay property taxes on it. At the same time, in accounting, to reflect a retired fixed asset until the moment of recognition of income and expenses from its disposal, account 45 “Goods shipped” / a separate sub-account “Transferred real estate objects” can be used (letter of the Ministry of Finance of the Russian Federation dated January 27, 2012 No. 07-02-18 /01, dated 03/22/2011 No. 07-02-10/20).

There is one more feature that arises only for those companies whose real estate was located outside the location of the organization and which, in connection with this, were simultaneously registered with another tax office. Such companies must report property taxes to the Federal Tax Service at the location of the building (this procedure has been in effect since January 1, 2019).

Considering that the tax period for property tax is a calendar year, the declaration must be submitted at the end of the year. However, at that time, the organization will already be deregistered with the tax office at the location of the property, since most likely by that time the new owner will have registered his ownership and will automatically be registered with the Federal Tax Service at the location of the property, and the previous owner will be deregistered. Accordingly, the tax office will most likely not accept a declaration from a payer who is no longer registered with it as a current taxpayer.

How to be in this case? There is a solution. Paragraph 1 of Article 45 of the Tax Code of the Russian Federation allows taxpayers to pay taxes ahead of schedule. How does this relate to submitting a declaration? It’s very simple: the amount of tax payable to the budget is determined based on the declaration data. Accordingly, if tax is allowed to be paid early, then the declaration can also be submitted early. This, of course, is not directly stated in the Tax Code, but there are letters that contain such a conclusion (letter of the Federal Tax Service of Russia dated November 8, 2016 No. BS-4-21/21110). It states that the organization has the right to submit to the tax office a property tax declaration in relation to the sold real estate object during the calendar year before the general deadline for its submission.

Therefore, immediately after the company has transferred the property to the buyer under the deed, it can draw up a declaration and submit it to the tax office with which it is still registered at the location of the property.

What if the moment has already been missed, that is, the ownership has been re-registered and, accordingly, the seller of the property has already been deregistered with the tax office? It's OK. Officials explain that in this case the declaration should be sent to the tax office at the location of the organization (letters from the Federal Tax Service dated May 16, 2019 No. BS-4-21/9108, dated November 8, 2016 No. BS-4-21/21110). Although this procedure is not spelled out in the Tax Code of the Russian Federation, there is no other way to do it here. Please note: the authors of the letters warn that when filling out the declaration, it is necessary to indicate in it OKTMO at the location of the disposed real estate property. Thus, the tax itself, regardless of anything, should be paid at the location of the disposed property.

How to calculate VAT on the sale of property accounted for with input VAT

When selling property that was registered at the time of purchase at a cost that includes the amount of input VAT, a special procedure is established for calculating the tax base. The tax base in this case is determined as the difference between the price of the property being sold (including tax) and its purchase value (residual value taking into account revaluations if the fixed asset is sold) (Clause 3 of Article 154 of the Tax Code of the Russian Federation).

This procedure applies, in particular, when selling:

— property acquired for transactions exempt from taxation (Article 149 of the Tax Code of the Russian Federation);

- property acquired for the production and (or) sale of goods (work, services), the transfer of which is not recognized as an object of taxation (clause 2 of Article 146 of the Tax Code of the Russian Federation);

- company cars and minibuses purchased before January 1, 2001 (such vehicles were taken into account when purchasing including input tax);

— other property accounted for with input VAT.

Calculate VAT on the sale of such property as follows.

If the property being sold is subject to VAT at a rate of 18 percent, use the formula:

VAT = Sales price – Purchase (residual) value of property × 18/118

If the property being sold is subject to VAT at a rate of 10 percent, use the formula:

VAT = Sales price – Purchase (residual) value of property × 10/110

This procedure is established by paragraph 3 of Article 154 and paragraph 4 of Article 164 of the Tax Code of the Russian Federation.

An example of determining the tax base for VAT when selling property that was recorded at cost, taking into account input tax

In February 2014, Alfa CJSC purchased equipment for the production of prosthetic and orthopedic products for RUB 236,000. (including VAT – 36,000 rubles). The equipment was put into operation in the same month. When selling prosthetic and orthopedic products, the organization took advantage of the exemption from VAT provided for in Article 149 of the Tax Code of the Russian Federation. Therefore, the VAT paid to the supplier was taken into account in the original cost of the equipment. In both accounting and tax accounting, the useful life of the equipment was set at five years, and depreciation was calculated using the straight-line method. No revaluation of equipment was carried out.

In February 2015, it was decided to sell the equipment. According to the expert assessment of the appraisal organization, the market value of the equipment, taking into account its condition, amounted to 200,600 rubles. The equipment was sold for this price (including VAT).

The residual value of the equipment at the time of sale was RUB 188,800.

When selling equipment, the accountant charged VAT in the amount: (200,600 rubles – 188,800 rubles) × 18/118 = 1,800 rubles.

If property was acquired from an organization that is not a VAT payer, the provisions of paragraph 3 of Article 154 of the Tax Code of the Russian Federation are not applied when determining the tax base. That is, if the seller of the property was an organization that applies a special tax regime or uses an exemption from VAT under Article 145 of the Tax Code of the Russian Federation, when reselling this property, VAT must be charged on the entire cost (clause 1 of Article 154 of the Tax Code of the Russian Federation). This is explained by the fact that VAT was not included in the cost of the acquired property.

Similar clarifications are contained in letters of the Ministry of Finance of Russia dated October 20, 2011 No. 03-07-07/62 and dated May 16, 2005 No. 03-04-11/113.

Situation: what amount of residual value - according to tax or accounting data - should be used to calculate VAT when selling property that is recorded at cost including input tax?

To calculate, use the residual value of the property according to accounting data.

Such clarifications were given by the Ministry of Finance of Russia (letters dated October 9, 2006 No. 03-04-11/120 and dated March 26, 2007 No. 03-07-05/16).

An example of calculating VAT on the sale of property that is recorded at cost, taking into account input tax. The residual value of the property according to accounting and tax records does not match

CJSC "Alfa", engaged in the sale of folk arts and crafts of recognized artistic merit, has the right to be exempt from VAT (subclause 6, clause 3, article 149 of the Tax Code of the Russian Federation).

In 2012, Alpha acquired production equipment. This equipment was used in the main activity of the organization - the sale of folk arts and crafts of recognized artistic merit. Therefore, the input VAT paid to the supplier was included in the original cost of the equipment. Its initial cost (including the tax paid to the supplier) in both accounting and tax accounting amounted to 200,000 rubles.

Depreciation in both accounting and tax accounting for this equipment is calculated using the straight-line method according to the same standards (in accordance with the Classification approved by Decree of the Government of the Russian Federation of January 1, 2002 No. 1).

In December 2014, Alpha for the first time revalued fixed assets, including production equipment. By this time, the amount of accrued depreciation on equipment in both accounting and tax accounting amounted to 40,000 rubles. Based on the results of the revaluation, the equipment was valued by an independent appraiser at RUB 220,000. (excluding depreciation).

To adjust the depreciation accrued in accounting, the Alpha accountant calculated the revaluation coefficient: 220,000 rubles. : 200,000 rub. = 1.1.

The amount of depreciation (according to accounting data) of revalued equipment was: 40,000 rubles. × 1.1 = 44,000 rub.

In the working Chart of Accounts "Alpha" (approved as an appendix to the accounting policy) to account 83 "Additional capital" for the results of revaluation accounting, a subaccount "Revaluation of fixed assets" is provided.

Alpha's accountant made the following entries in accounting:

Debit 01 Credit 83 subaccount “Revaluation of fixed assets” – 20,000 rubles. (RUB 220,000 – RUB 200,000) – additional capital was increased by the amount of equipment revaluation;

Debit 83 subaccount “Revaluation of fixed assets” Credit 02 – 4000 rub. (RUB 44,000 – RUB 40,000) – additional capital was reduced by the amount of additional assessment of equipment depreciation.

The results of the revaluation are not taken into account in tax accounting (clause 1 of Article 257 of the Tax Code of the Russian Federation).

Thus, as of January 1, 2015, the residual value of the equipment was: - in accounting 176,000 rubles. (RUB 220,000 – RUB 44,000); — in tax accounting 160,000 rubles. (RUB 200,000 – RUB 40,000).

From January 1, 2015, it was decided to stop the production of folk arts and crafts, and the equipment, by decision of the Alpha management, was put into storage for a period of a year.

Depreciation on equipment transferred to conservation for a period of more than three months is not accrued either in accounting or tax accounting (clause 3 of article 256 of the Tax Code of the Russian Federation, clause 23 of PBU 6/01).

In April 2015, it was decided to sell the equipment. According to an independent expert, the market value of the equipment, taking into account its condition at the date of sale, amounted to 190,000 rubles. The equipment was sold for this price (including VAT).

The equipment was purchased by Torgovaya LLC. At this point (including the month of sale), the residual value of the equipment was: - in accounting - 176,000 rubles. (RUB 220,000 – RUB 44,000); — in tax accounting – 160,000 rubles. (RUB 200,000 – RUB 40,000).

Sales of equipment are subject to VAT at a rate of 18 percent (clause 3 of Article 164 of the Tax Code of the Russian Federation).

The accountant calculated the amount of VAT payable to the budget for this operation as follows (using accounting data): (190,000 rubles – 176,000 rubles) × 18/118 = 2136 rubles.

The working Chart of Accounts “Alpha” (approved as an annex to the accounting policy) provides that to account for the disposal of fixed assets, a separate sub-account “Retirement of fixed assets” is opened to account 01. The use of this subaccount to account 01 “Fixed Assets” is recommended by the Instruction approved by Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n.

Alpha's accountant made the following entries in accounting:

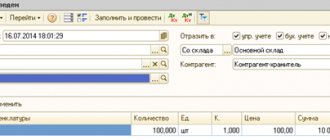

Debit 76 Credit 91-1 – 190,000 rubles. – income from the sale of fixed assets is reflected, as well as the buyer’s debt;

Debit 01 subaccount “Disposal of fixed assets” Credit 01 – 220,000 rub. – the replacement cost of the equipment is written off;

Debit 02 Credit 01 subaccount “Disposal of fixed assets” – 44,000 rubles. – the amount of accrued depreciation is written off;

Debit 91-2 Credit 01 subaccount “Disposal of fixed assets” – 176,000 rubles. – the residual value of the equipment is written off;

Debit 91-2 Credit 68 subaccount “VAT calculations” – 2136 rubles. – VAT payable to the budget has been accrued;

Debit 51 Credit 76 – 190,000 rub. – money received from the buyer.

Situation: is it necessary to pay VAT on the sale of property that is recorded at cost including input tax, if the purchase price of the property exceeds the sales price?

Answer: no, it is not necessary.

If the purchase price of the property exceeds its sale price, the tax base calculated in accordance with paragraph 3 of Article 154 of the Tax Code of the Russian Federation is taken equal to zero. This conclusion follows from the letter of the Ministry of Taxes and Taxes of Russia dated May 13, 2004 No. 03-1-08/1191/15. Therefore, there is no need to pay VAT on the sale of such property (accounted for at cost including input tax).

This conclusion is also confirmed by arbitration practice (see, for example, Resolution of the FAS Moscow District dated November 9, 2005 No. KA-A40/10790-05).

Situation: is it necessary to charge VAT on the difference between prices when selling a fixed asset that is simultaneously used in taxable and non-VATable transactions? The initial cost includes part of the “input” VAT paid to the supplier

Answer: yes, it is necessary.

In this situation, calculate VAT using the provisions of paragraph 3 of Article 154 of the Tax Code of the Russian Federation (i.e., from the difference between the market price of the property being sold and its purchase value (residual value taking into account revaluations)).

Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated March 26, 2012 No. 03-07-05/08.

An example of VAT calculation on inter-price differences. The organization sells fixed assets that were used in activities subject to and not subject to VAT

In January, ZAO Alfa acquired fixed assets worth RUB 354,000. (including VAT – 54,000 rubles). The fixed asset is intended for use in activities subject to and not subject to VAT. Therefore, when registering an object, the Alpha accountant distributed the amount of input VAT in proportion to the cost of shipped goods (work, services), subject to VAT and exempt from taxation, in the total cost of goods (work, services) shipped in January.

Based on the obtained proportion, the amount of VAT on the fixed asset, which Alpha has the right to deduct, amounted to 36,000 rubles. The amount of VAT to be included in the cost of the fixed asset is 18,000 rubles.

The fixed asset was accepted for accounting at its original cost of RUB 318,000. (RUB 354,000 – RUB 54,000 + RUB 18,000). Its operation began in January.

In November, Alpha sold its fixed asset. Sales price including VAT (corresponds to market level) – RUB 318,600. For the period from February to November, depreciation in the amount of 66,250 rubles was accrued in accounting for fixed assets. The residual value of the property as of the date of sale was RUB 251,750. (RUB 318,000 – RUB 66,250).

Sales of fixed assets are subject to VAT at a rate of 18 percent. When calculating VAT on inter-price differences, the calculated rate of 18/118 is used.

The amount of VAT accrued upon sale and presented to the buyer is equal to: (318,600 rubles – 251,750 rubles) × 18/118 = 10,197 rubles.

In November, transactions related to the sale of fixed assets were reflected in Alpha’s accounting records as follows:

Debit 76 Credit 91-1 – RUB 318,600. – income from the sale of fixed assets is reflected;

Debit 91-2 Credit 68 subaccount “VAT calculations” – 10,197 rubles. – VAT is charged on the sale of fixed assets (from the inter-price difference);

Debit 01 subaccount “Disposal of fixed assets” Credit 01 – RUB 318,000. – the original cost of the fixed asset is written off;

Debit 02 Credit 01 subaccount “Disposal of fixed assets” – 66,250 rubles. – the amount of accrued depreciation is written off;

Debit 91-2 Credit 01 subaccount “Disposal of fixed assets” – 251,750 rubles. – the residual value of the fixed asset is written off.

When selling the property, the accountant issued an invoice to the buyer for the price difference.

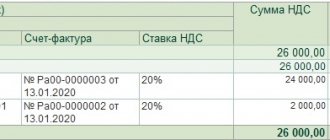

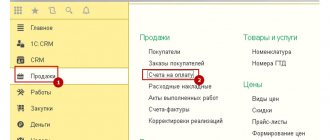

Invoices

When selling property that was recorded at cost including input VAT, draw up an invoice taking into account certain features. In column 7 “Tax rate” indicate the appropriate tax rate (10/110 or 18/118) with the note “from the inter-price difference”, in column 8 - the amount of tax calculated at the estimated rate, in column 9 - the cost of the property being sold (including VAT). This follows from the provisions of subparagraphs “g”–“i” of paragraph 2 of Appendix 1 to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137. In relation to filling out previous forms of invoices, similar recommendations were contained in the letter of the Federal Tax Service of Russia dated June 28, 2005. No. 03-1-03/1114/13.

Situation: is it necessary to issue an invoice to the buyer when selling property that is recorded at cost, including input VAT, if the purchase price of the property exceeds its selling price?

Answer: yes, it is necessary.

If the purchase price of the property exceeds its sale price, the tax base calculated in accordance with paragraph 3 of Article 154 of the Tax Code of the Russian Federation is taken equal to zero. However, the obligation to issue invoices when performing transactions recognized as an object of taxation applies to all taxpayers (clause 4 of article 169 of the Tax Code of the Russian Federation). Therefore, in column 8 “Tax amount” of the invoice, you should indicate the VAT amount equal to zero.

An example of calculating VAT on the sale of property that was recorded at cost including input tax. The purchase price of the property exceeds its sale price

CJSC "Alfa", engaged in the sale of folk art crafts of recognized artistic merit, has the right to be exempt from VAT (subclause 6, clause 3, article 149 of the Tax Code of the Russian Federation).

To deliver finished products from the production workshop to the warehouse, Alpha purchased a GAZ-3302 car.

The initial cost of the car, both according to accounting and tax records, was 350,000 rubles. The car was used in the main activity of the organization - the sale of folk arts and crafts of recognized artistic merit. Therefore, the VAT paid to the supplier was taken into account in the original cost of the car. The vehicle was not revalued.

In 2015, it was decided to sell the car. According to an automobile expert, the market value of the car, taking into account its condition at the date of sale, was 150,000 rubles. The car was sold for this price (including VAT). The car was purchased by Hermes Trading Company LLC.

At this point (including the month of sale), the amount of depreciation accrued on the car in both accounting and tax accounting amounted to 162,000 rubles. Thus, the residual value of the car at the time of sale was 188,000 rubles. (RUB 350,000 – RUB 162,000).

When selling property that is accounted for at cost, taking into account input VAT, the tax base is determined as the difference between the price of the property being sold (including tax) and its purchase value (residual value taking into account revaluations, if the fixed asset is sold) (clause 3 of Article 154 Tax Code of the Russian Federation). However, since the sale price of the car turned out to be less than its residual value at the time of sale, the tax base for this transaction is assumed to be zero. Consequently, the amount of VAT payable to the budget is also zero.

The working Chart of Accounts “Alpha” (approved as an annex to the accounting policy) provides that to account for the disposal of fixed assets, a separate sub-account “Retirement of fixed assets” is opened to account 01. The use of this subaccount to account 01 “Fixed Assets” is recommended by the Instruction approved by Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n.

Alpha's accountant made the following entries in accounting:

Debit 76 Credit 91-1 – 150,000 rubles. – income from the sale of fixed assets is reflected, as well as the buyer’s debt;

Debit 01 subaccount “Disposal of fixed assets” Credit 01 – RUB 350,000. – the original cost of the car has been written off;

Debit 02 Credit 01 subaccount “Disposal of fixed assets” – 162,000 rubles. – the amount of accrued depreciation is written off;

Debit 91-2 Credit 01 subaccount “Disposal of fixed assets” – 188,000 rubles. – the residual value of the car is written off;

Debit 51 Credit 76 – 150,000 rub. – received money from the buyer;

Debit 99 Credit 91-9 – 38,000 rub. (188,000 rubles – 150,000 rubles) – reflects the loss from the sale of a car (based on the results of the reporting month).

The Alpha accountant did not calculate VAT for payment to the budget.

Utility contracts have not been renewed

It often happens that the property has already been transferred to the buyer and even the ownership has been re-registered, but the new owner has not signed contracts with resource supply organizations (i.e., according to the documents, the seller of the building is still considered the user of utilities). To prevent the seller from having to bear the burden of costs for utilities that he does not actually use, the contract for the sale of real estate usually includes a provision for the buyer to compensate for these costs until he draws up utility contracts for himself.

At the same time, it is obvious that the cost of utilities reimbursed by the new owner cannot be included by the previous owner (real estate seller) in expenses taken into account for tax purposes. After all, he does not consume these services; they are consumed by the new owner, who reimburses him for utility costs.

Here the question arises: does this amount of compensation form taxable income for the seller of real estate?

We think not. However, local tax officials may have the opposite opinion. Unfortunately, there are no recent clarifications from departments on this topic. There is only an old letter from the Federal Tax Service for Moscow dated May 21, 2008 No. 19-11/048675, in which officials consider the situation with the relationship between the subscriber and the sub-subscriber of utility services. This, of course, is not exactly our case, but the conclusion drawn in this letter, in our opinion, can be extended to the situation under consideration. And the conclusion is this: the fee received as reimbursement of expenses from its recipient (subscriber) is not included in taxable income.

After all, what is income for tax purposes? Income from the sale of goods (work, services) and property rights and non-operating income. In our situation, the previous owner does not sell utilities to the new owner. He is just forced to pay the bills of resource supply organizations for some time. Reissue of these invoices to the new owner does not indicate the sale of utilities. This fact only speaks about the re-invoicing of costs in order to reimburse them under the current circumstances.

What about VAT? After all, the amount of this tax is probably taken into account in utility bills.

There is also a risk here that local tax authorities will consider that the VAT included in the refunded amount is a tax that must be paid by the seller of the property. We believe that this approach is wrong. The reasoning is the same as for income tax. The object of VAT taxation is transactions involving the sale of goods (work, services), as well as the transfer of property rights in the territory of the Russian Federation.

In this case, as we noted earlier, there is no fact of provision of utilities. This is the first thing. And secondly, the amount of compensation cannot be equated to the amount otherwise associated with payment for goods sold, which, by virtue of paragraphs. 2 p. 1 art. 162 of the Tax Code of the Russian Federation increases the tax base for VAT. After all, the refundable amount is not related to payment for the sold property. The property has its own fee, which the buyer pays separately.

Therefore, if during an audit the tax inspectorate tries to charge additional taxes, then in defense of its position you should refer to the arguments we have given.