Classification of errors in the RSV

Tax authorities have developed error codes encountered when preparing a report:

The first digits of the error code

The reporting procedure has been violated

Incorrect report file name

The report did not pass format control

The report did not pass logical control

The report data did not pass the reference check

We will pay maximum attention to code 040, since most of the inaccuracies of interest to policyholders are combined under this code.

What are the dangers of mistakes?

The greatest danger of errors with the corresponding codes when calculating insurance premiums is a possible underpayment of the specified deductions. As a result, the payer may make a mistake with the amount of contributions.

This may also cause a delay in the provision of reporting documentation.

As a consequence of such inaccuracies, possible penalties imposed on the enterprise by state tax authorities.

Calculation of insurance premiums: error code 0400500003

A notification from the Federal Tax Service with a similar error code indicates that personal information for individual employees does not correspond to the data in the Federal Tax Service database or is missing from it, but no discrepancies in the amounts of contributions have been identified. If the inspector only indicates this error code, then corrections must be made in the third section of the form. In the appendix to the notification, the Federal Tax Service Inspectorate lists the persons whose data identified personalized discrepancies (SNILS, full name, passport) and offers to clarify them. What should the policyholder do when receiving this document?

If the Federal Tax Service does not accept the Calculation of insurance premiums, and its compiler is confident that the data indicated is correct, it is worth sending the inspector a copy of the SZV-M with a Pension Fund mark or a letter confirming the veracity of the information provided, confirming it with attached copies of identification documents.

If the DAM compiler indicated incorrect personal data, then he will have to submit an updated version of the report, otherwise the insurance premiums of these employees will not go to their personal accounts. After determining reliable information, the policyholder draws up an updated calculation, correcting the data in subsections 3.1 and 3.2.

Example 1.

Example 2.

The employee changed his last name, and the accountant indicated outdated information in the DAM for 9 months of 2022. Having identified the inaccuracy, he submits an adjustment form in which he makes changes to subsections 3.1 and 3.2, but since the amounts of income and accrued contributions in the first copy are absolutely correct, no other corrections are made to the report.

What does error code 0400500003 mean?

0400500003 is a digital code from the error classifier for format and logical control of the file containing the calculation of contributions.

A notification from the tax office with such an error code means that personal information for individuals does not correspond to data from the tax authorities’ information base or is missing from it. In the appendix to the notification, tax officials detail the errors, including a list of information about individuals for whom inconsistencies in personal data were identified (SNILS, full name, tax identification number).

If there are no errors in the calculation other than error code 0400500003, controllers send the policyholder a notification to clarify individual data (inappropriate or missing).

If you need a sample of the ERSV for 2022, use the sample from ConsultantPlus experts. This can be done for free by getting trial online access to the system.

What to do when you receive such a notification:

- The policyholder, who is confident in the correctness of the personalized information reflected in the calculation, needs to send a letter to the controllers stating that the data on the employees is reliable, attaching photocopies of identity documents, SNILS and TIN.

- If, due to the fault of the policyholder, distorted individual information was included in the calculation, he needs to submit an updated calculation.

Find out what recommendations to follow when drawing up an updated calculation here .

To avoid making mistakes when filling out insurance premium calculations, use the tips from ConsultantPlus experts. Study the material by getting trial access to the K+ system for free.

Error 0400400011 in the calculation of insurance premiums

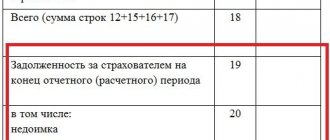

The notification of the Federal Tax Service about the presence of error 0400400011 in the report indicates that the equality of the indicators of the amount of deductions has been violated, i.e., the data in the first and third sections do not match. In particular, the following situations can lead to such an error:

There are discrepancies between the full name and SNILS specified in section 3;

Matches of SNILS numbers for several employees;

Incorrect display of reporting data (negative values entered by mistake, or with a discrepancy of several kopecks);

There is no payment for insurance premiums;

The Pension Fund of the Russian Federation did not transmit the necessary information to verify the data to the Federal Tax Service.

If there is an error 0400400011, submission of a correction form is required. To correct the inaccuracy and restore equality between the control figures of both sections, you must first find the reason, since tax authorities usually do not report the details of the discrepancy. Therefore you will have to:

Check the personal data reflected in section 3 for accuracy, for which you can use the “Personal Account” of a legal entity or individual entrepreneur on ]]> website ]]> Federal Tax Service;

Compare the summary data values of the 1st section with the amounts in the 3rd section down to the penny (rounding errors may cause refusal to accept the report). Error 0400400011 can occur for various reasons, but most often it is the result of statistical discrepancies in the reporting values with a difference of several kopecks. The accountant should show remarkable care in order to identify discrepancies and get rid of the error (it is better to use special services to check the correctness on the Federal Tax Service website: “ ]]> TESTER ]]>”, “ ]]> Legal Entity Taxpayer ]]>”).

If a total discrepancy is detected, you must:

make sure that the calculations of the amounts of the 1st section are correct;

check whether all employees are included in the 3rd section of the calculation;

check the correctness of the calculation of contributions personally for each employee, as well as whether all payments are taken into account in the report.

After making the corrections, the verified, updated report is submitted to the Federal Tax Service. Thus, filing adjustments is mandatory if incorrect or incomplete information submitted to the inspectorate is identified, as well as if an error is discovered that results in a distortion of the amount of contributions payable.

You can always view the full texts of regulatory documents in the current edition in ConsultantPlus.

Error code 0400400007 when submitting a calculation for insurance premiums - what does this mean?

As is known, the calculation of insurance premiums is a quarterly reporting form that is submitted by the Insured to the tax authority. The report contains data on contributions of various types - social, pension and medical security. This report is submitted by all entrepreneurs and organizations that are policyholders, even in a situation where they pay premiums irregularly.

When passing the RSV, a specialist may encounter various types of errors. The error we are interested in, 0400400007, belongs to error class 040 (the first three digits of the error), usually signaling that the received document did not pass logical control. That is, the system carried out a reconciliation of control ratios, filling in the required fields, and checking whether the document corresponds to the submitted version of the report. If a certain number of parameters in the calculations do not coincide (do not correlate with each other), then such a discrepancy will cause error class 040.

Usually, after sending the DAM, you receive a notification about refusal of acceptance, where the error code 0400400007 is indicated. Please note that in this case there is no need to create an adjustment report, since a document with this error is considered not submitted, and the data from it is not loaded into the Federal Tax Service database. Therefore, after correction, submit a report with the “primary” attribute, and it will be accepted.

The error 0400400007 we are considering has three main causes:

- The declaration contains an incorrect tax attribute (the value of an element or attribute does not meet a certain condition). Typically, the values of some fields in the submitted report must comply with certain requirements, which can be found on the website of the Federal Tax Service https://format.nalog.ru. Read the list of regulatory documents for this type of report, select the desired tax, period and type of report. Next, select the “Document Format” option, and then the “Composition and Structure of the Document” section. The sign of obligatory element can be indicated by the letter “U”, meaning the presence of special conditions for any value;

Select the required tax and review the data filling requirements

- The checkpoint does not pass verification as an element of the declaration. KPP (Reason Code for Registration) and INN (Individual Tax Number) are indicated in this report. If you do not fill in such data or indicate it incorrectly, then the inspection will not accept the report, and you will receive a refusal indicating error 0400400007;

- The user is using an outdated version of the program in which the report testing scheme has not been updated. In this case, for various reasons, the necessary updates are not installed in the system, and the responsible specialist uses an outdated version of the program. This will be another reason for error 0400400007.

Thus, there are three main reasons why the error we are considering in the report on insurance premiums may occur. Let's look at ways to fix error 0400400007 on your PC.

This is useful to know: What is “Dispose of overpayment” in the taxpayer’s personal account.

Error code 0400400011 “The condition for equality of the value of the amount of insurance premiums has been violated”

It is usually pointless to ask a tax specialist about the specifics of the problem that has arisen, since the analysis of the statements is carried out by the corresponding program, and it is this program that produces the mentioned negative result. Specific causes of error 0400400011 may be as follows:

- Incorrect values of reporting indicators (mismatch in checksums, difference of a couple of kopecks, etc.); Individuals in the report have the same SNILS (Individual Personal Account Insurance Number), some individuals may have two SNILS, and so on; It can also occur (I described its corrections in the article at the link); The report contains discrepancies between full name and SNILS; The PFR authorities did not transmit the data necessary for checking the reporting to the tax service on time.

To get rid of error 0400400011, I recommend doing the following: Check your report carefully again, make sure that all the numbers “play” and there are no differences in kopecks;

If the inspector only indicates this error code, then corrections must be made in the third section of the form.

In the appendix to the notification, the Federal Tax Service Inspectorate lists the persons whose data identified personalized discrepancies (SNILS, full name, passport) and offers to clarify them. What should the policyholder do when receiving this document?

If the Federal Tax Service does not accept the Calculation of insurance premiums, and its compiler is confident that the data indicated is correct, it is worth sending the inspector a copy with a Pension Fund mark or a letter confirming the veracity of the information provided, confirming it with attached copies of identification documents. If the DAM compiler indicated incorrect personal data, then he will have to submit an updated version of the report, otherwise the insurance premiums of these employees will not go to their personal accounts.

After determining reliable information, the policyholder draws up an updated calculation, correcting the data in subsections 3.1 and 3.2.

Example 1. The tax office does not accept calculations for insurance premiums - SNILS was not found in the Federal Tax Service Inspectorate database.

The essence and causes of dysfunction

As follows from the above text, the checking program of the tax authorities found a discrepancy in the checksums of the report, and therefore issued an error 0400400011. It is usually pointless to ask a tax specialist about the specifics of the problem that has arisen, since the analysis of the statements is carried out by the corresponding program, and it is this program that produces the mentioned negative result.

Specific reasons for the error may be the following:

- Incorrect values of reporting indicators (mismatch in checksums, difference of a couple of kopecks, etc.);

- Individuals in the report have the same SNILS (Individual Personal Account Insurance Number), some individuals may have two SNILS, and so on;

- An error code may also occur: 0400500003 (I described its corrections in the article at the link);

- The report contains discrepancies between full name and SNILS;

- The PFR authorities did not transmit the data necessary for checking the reporting to the tax service on time.

ATTENTION! RSV 2022. Refusals from the Federal Tax Service

These errors indicate that the Federal Tax Service database does not contain the amounts specified in Appendix 1 to Section 1 (cumulative total from the beginning of the year)

Error code 0000000002 The declaration (calculation) contains errors and is not accepted for processing

Thus, if the payer does not submit a declaration within the specified time frame, he will be charged a fine of five percent of the amount that had to be paid, but not less than 1 thousand rubles.

The tax return can be provided by the payer in the form of mail with the described attachment, and also sent electronically through special communication channels using the payer’s personal account.

Explanations on refusals of the Federal Tax Service on the RSV form

- <TextOsh>The condition of equality of the value of the amount of insurance premiums for the payer of insurance premiums to the total amount of insurance premiums for the insured persons has been violated <IdOsh>Information: Pr.1.1 line 001 (adjusted tariff) = 1 Amount for group 1 line 061 rule 1.1 = 233027.34 Amount for group 2 line 061 rule 1.1 + line 240 (1, 2.3 month pop) p.r.3.2.1 = 237977.34 difference = -4950.00

- <CodeOsh>0400400017 <TextOsh>The condition of equality of the value of the amount of payments and other remunerations accrued in favor of individuals for the payer of insurance premiums to the total amount for insured persons has been violated <IdOsh>Information: Pr.1.1 line 001 (adjusted tariff) = 1 Amount for group 1 line 030 pr.1.1 = 1146892.56 Amount for group 2 line 030 pr.1.1 + line 210 (1, 2.3 month pop) p.r.3.2.1 = 1169392.56 difference = -22500.00

- <TextOsh>The condition of equality of the value of the base for calculating insurance premiums for the payer of insurance premiums to the total amount for insured persons has been violated <IdOsh>Information: Ex.1.1 line 001 (adjusted tariff) = 1 Amount for group 1 line (050 - 051) ex.1.1 = 1059215.17 Amount for group 2 line (050 - 051) ex. 1.1 + p.220 (1,2,3 month pop) p.r.3.2.1 = 1081715.17 difference = -22500.00

What do the errors mean? These errors indicate that the Federal Tax Service database does not match the amounts specified in Appendix 1 to Section 1 (cumulative total from the beginning of the year) with the sum of the values for 3 months from Appendix 1 and the corresponding values for all employees for previous periods. These checks were implemented based on the order dated September 18, 2019 N ММВ-7-11/ [email protected] All checks listed in the letter were implemented in the service.

To avoid mistakes when filling out, read the instructions with an example of preparing a calculation for insurance premiums.

Analogues of errors . We have warnings similar to the indicated errors received from the Federal Tax Service:

- Must be equal to the sum of the values (030(2) and the sum in column 210 for previous reporting periods) for employees with the category code “КК” (= “value”).

- The difference in values 050(1) - 051(1) (= "value") should be equal to 050(2) - 051(2) + ∑values in column 220 for previous reporting periods for employees with category code "QC" (= " meaning").

Report easily and without errors. A convenient service for preparing and submitting reports via the Internet. We are giving access to Extern for 14 days!

How to check for errors

- Enter all the current year's drafts one by one. Check that the information is up to date. Current data is considered to be the data accepted by the Federal Tax Service, taking into account all adjustments.

To download several reports (corrective) in succession without deleting previous data, we recommend importing reports through the “Actions” menu in Section 3.

- Enter the draft of the current period and update the data for the previous period using the button in the lower left corner “Update data for the previous period.”

- In section 3, switch all fields to auto-calculation mode using the “Actions” button.

- Bring the amounts in the appendices to section 1 into line with section 3. You can use the automatic calculation of sections.

- Please check your report before submitting.

Reconciliations of amounts between sections 3 and 1 occur only if the report is original (on the title “adjustment number = 0”). If the report is corrective, you can change its attribute during the check, and after checking, return the adjustment attribute.

- If the data is up to date in all periods, the checks have been passed, there are no errors or warnings within the service, but a notification of refusal (clarification) is received with the wording indicated above, the issue of discrepancies in the database must be clarified with the Federal Tax Service.

Error 0400400018 in the calculation of insurance premiums

No. BS-4-11/14022. How to correct the unified calculation of insurance premiums. The company can receive from the inspection:

The Federal Tax Service gave instructions in case an error crept into section 3 of the calculation of insurance premiums.

An accountant has only two options. Error in individual information To clarify the personal data of individuals in section 3 “Personalized information about insured persons,” you need to fill out the calculation as follows:

Info So, the factors that cause errors in code 0400400011 may be different, but basically the reason lies in the discrepancy between the indicators indicated in the report.

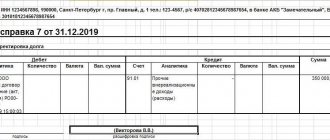

Correcting an error in personal data (section 3)

Errors identified in the personal information of employees must be corrected, otherwise insurance premiums will not go to their personal accounts. After the policyholder finds out the correct personal information about employees who were previously indicated with errors in the calculation, he needs to clarify the calculation. In the title page of the clarification, indicate the serial number of the correction.

Section 3 should only be completed for employees for whom errors have been identified. For 1 employee, fill out 2 Sections 3. The Federal Tax Service described the algorithm for correcting errors in individual information in letter No. BS-4-11/14022 dated July 18, 2017 (see the figure below):

Error code: 0400400017 in the calculation of insurance premiums - how to fix

Previously, section 3 could not be filled out for the specified employees, since benefits up to one and a half years are not subject to contributions to the Pension Fund. When submitting this report in column 1, the mentioned non-taxable benefit can be taken into account.

Also, the description of the error with code 0400400017 may have a more abstract text form: Let's figure out how to solve the error when submitting reports. This is interesting: The solution to error 0400400017 in the calculation of insurance premiums may consist of implementing a number of the points below: Once again, carefully and scrupulously check all the data you have submitted for relevance.

Why does an error occur when calculating insurance premiums?

Typically, this error occurs when submitting the “Calculation of Insurance Contributions” report to the appropriate department of the tax office. The massive occurrence of errors in the submitted reports dates back to the beginning of 2022, which is associated with letters from the Federal Tax Service dated January 13, 2022 No. GD-4-11/ [email protected] and dated January 29, 2022 N GD-4 11/ [email protected] on the use of new controls ratios.

The check of control ratios has been changed in accordance with the requirements of the Federal Tax Service

In addition to the above error text, the message text also contains an indication of the amount of the difference detected by the automatic complex of the Federal Tax Service, for example:

In this case, the amount in gr.1. line 030 (amount of payments to employees for the entire year) is automatically compared with the amount indicated in column 2 line 030 (amount of payments for the 4th quarter) + the value of column 210 for the previous period, usually 9 months. (usually pulled from the Federal Tax Service database). If the program detects a difference, the accountant receives error 0400400017.

If the value in column 1 is greater, then, probably, in previous periods the non-taxable benefit (benefits for employees who are on parental leave for up to one and a half years) was not shown in section 3, column 210. Previously, section 3 could not be filled out for the specified employees, since benefits up to one and a half years are not subject to contributions to the Pension Fund. When submitting this report in column 1, the mentioned non-taxable benefit can be taken into account.

Also, the description of the error can take a more abstract text form:

Let's figure out how to solve an error when submitting reports.

This is interesting: error code 0000000002 - how to solve.

Error 0400400011 in the calculation of insurance premiums

These may be CHECKXML+2NDFL 2022, “TESTER”, “Taxpayer Legal Entity”, “Contour”, “” for users of the Buhonline website, and other tools; You can call the tax officer who accepts reports from your organization and ask for clarification of the reason for the refusal .

Tax officials themselves advise to wait a couple of days first, and only then submit the payment to the tax office. At the same time, the tax base is also not immune from errors in it, and it is quite possible that the employee appears in it with completely different data (TIN or SNILS).

How to fix error 0400400011

To get rid of the error, I recommend doing the following:

- Once again, carefully check your report, make sure that all the numbers “play” and there are no differences in pennies;

- Check whether the SNILS of different people are the same, whether there are discrepancies between the full name and SNILS of an individual;

- Use various software tools and services to check the correctness of your reporting (CHECKXML+2NDFL 2022, “TESTER”, “Taxpayer Legal Entity”, “Contour”, “Checking reports online” for users of the Bukhonline website, and other tools);

- Call the tax service representative and ask about the specific reason for the error. Typically, performers are not eager to understand your reporting (errors occur not only with you), but perhaps you will be lucky and you will find a completely favorable tax official;

- Wait a couple of days. As I mentioned above, there are situations when the Pension Fund of the Russian Federation does not transmit the relevant data to the tax service on time, which is why all sorts of inaccuracies arise in the reports. In this case, tax specialists recommend waiting a couple of days, and then coming to the tax office again and trying to submit your report.

Computer help

The first is general annual indicators; The second is the indicators for the first three quarters with the addition of the amount for the last quarter. And I found a discrepancy as a result.

For the first time, the calculation of insurance premiums began to lead to this problem en masse at the beginning of last year (2018), when the state tax service began to use completely new control ratios.

Typically, the automatic program used for reconciliation with the Federal Tax Service also sends the actual amount of the difference that was discovered during the process. For example, the reason why error 0400400017 occurs may be the absence of any non-taxable benefits in the corresponding line.

An employee of the organization simply forgot to include such benefits in quarterly reports, while they were taken into account in the general report.

Mistake #3

If an employee who is subject to inclusion in Section 3 of the Calculation of Insurance Contributions (in the reporting quarter has a valid employment contract or civil service contract) has no income for the last 3 months, in table 3.2.1 of Section 3 the indicator of the first line of column 120 Month is mistakenly filled in with the value 0.

If, for example, a Parental Leave (Human Resources – Parental Leave and Returns from Leave) without payment of benefits or a Contract (work, services) (Salary – Contracts (including copyright)), then Section 3 Insurance premium calculations will look like this:

Such a report will not pass format and logical control when you try to send it. To eliminate the error, you need to download the External form for calculating insurance premiums on the page with the release number.

An external form for calculating insurance premiums is available for releases:

- version 3.1.13 – for releases 3.1.13.146 and 3.1.13.151;

- version 3.1.10 – for releases 3.1.10.376 and 3.1.10.378.

For more details, see - Connecting an external report form to ZUP 3 using the example of DAM

When is it necessary to submit an updated calculation?

Submission of an updated calculation is necessary if there are inconsistencies noted by the code in the reporting amounts or personal data (SNILS or TIN numbers). In this case, inaccuracies affect the correctness of the information in the calculation, so clarification is required with a new calculation.

The deadline for providing an updated calculation is no later than five days (excluding weekends and holidays) from the date of receipt of the corresponding notification from the Federal Tax Service.

An error in calculating insurance premiums, even if it is a minor inaccuracy, can be costly for an enterprise, with penalties imposed both on the organization itself and on individual performers whose fault this mistake was made.

Therefore, when calculating insurance premiums and submitting reports, it is important to eliminate any errors by thoroughly checking the correctness of the information entered before sending the reporting form.

How to correct the Federal Tax Service's calculation of insurance premiums

If the problem indicated by the code is related to the incorrect indication of the employee’s last name in the calculation (including due to a change), the responsible employee of the enterprise must prepare and send to the tax authorities a clarifying adjustment form, with changes in subsections 3.1 and 3.2.

In this situation, the code shows that the income indicators and the amounts of deducted insurance premiums are indicated correctly, so there is no need to provide additional documents.