On December 4, a webinar organized by Taxcom took place. It was dedicated to the abolition of UTII and the choice of an alternative tax regime. The simplified taxation system (STS) is one of the regimes that organizations and individual entrepreneurs can switch to. Company expert Sergei Anisimov examined the advantages and disadvantages of the simplified tax system.

The simplified tax system is a more complex tax regime than NPD or PSN, but much simpler than OSNO. It is not for nothing that this taxation system is called simplified. Let's consider the criteria and limitations for its application.

—

Income for the year should not exceed 150 million rubles. (letter of the Ministry of Finance dated August 25, 2017 No. 03-11-06/2/54808). There is a relaxation of this limit to 200 million rubles, but then there is an increased tax rate.

—

The average number of employees should be no more than 100 people during the reporting period (this number includes external part-time workers and employees under civil law contracts). This limit can also be increased to a larger number of employees, but then the tax rate will also increase.

—

The residual value of fixed assets does not exceed 150 million rubles. (the criterion is applicable only for organizations, since individual entrepreneurs do not indicate this information anywhere).

—

The maximum share of other organizations in the authorized capital is no more than 25% (also applies only to organizations).

—

An organization should not have branches (Article 55 of the Civil Code of the Russian Federation), but may have separate divisions. A branch differs from a separate division in that information about it must be entered into the Unified State Register of Legal Entities, and the branch can perform the functions of the parent company.

—

There is a ban on the use of the simplified tax system when performing certain types of activities prescribed in paragraph 3 of Art. 346.12 Tax Code of the Russian Federation. For example, these are budgetary and government institutions, various banks, insurers, non-state pension funds, manufacturers of excisable goods, and notaries.

—

This tax regime cannot be combined with OSNO.

An important point: when switching from UTII, the condition on income for 9 months does not need to be determined (clause 2, article 246.12 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of the Russian Federation dated October 5, 2010 No. 03-11-11/255). The income that was for the previous 9 months according to UTII will not be taken into account.

Advantages of the simplified tax system over other tax systems

The demand for “simplified taxation” among business representatives is quite understandable: it has a number of parameters that distinguish it favorably from other tax regimes. For example:

- Companies operating on the simplified tax system, instead of several types of taxes, pay one. That is, unlike those who apply OSNO, they do not have to pay property tax, income tax, VAT, etc.;

- Possibility to choose the so-called object of taxation. There are two options here: income minus expenses 15% and income 6%.

- “Simplified” can be combined with other tax regimes, for example, UTII;

- Due to the fact that maintaining accounting and tax records using the simplified tax system is not very difficult, individual entrepreneurs and founders of organizations can do this on their own, without resorting to specialized accounting assistance. In some cases, this allows you to significantly save the enterprise budget;

- One return must be submitted to the territorial tax service based on the results of the annual reporting period.

Accounting for taxes and fees

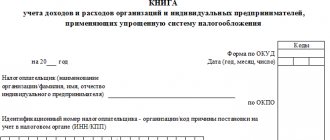

Under this article, “simplifiers” include in expenses the amounts of taxes and fees paid in accordance with the law.

These may be the following taxes and fees: land tax, transport tax, state duty, trade fee (established by the Tax Code from January 1, 2015 in the federal cities of Moscow, St. Petersburg and Sevastopol, introduced from July 1, 2015 in Moscow) . Expenses for paying taxes and fees are taken into account in the amount actually paid. If there is a debt to pay taxes and fees, the costs of its repayment are taken into account as expenses within the limits of the amounts actually paid in those reporting (tax) periods when the “simplified” pays off this debt (clause 3, clause 2, article 346.17 of the Tax Code of the Russian Federation) .

The single tax itself cannot be included in expenses (clause 22, clause 1, article 346.16 of the Tax Code of the Russian Federation). As for VAT, it must be taken into account as follows. When purchasing fixed assets and intangible assets, input tax is included in the cost of the purchased assets. When purchasing goods (works, services), raw materials, VAT is taken into account in expenses (clause 8, clause 1, article 346.16 of the Tax Code of the Russian Federation).

Disadvantages of the simplified tax system

Along with some obvious advantages, the simplified mode also has its disadvantages. These include:

- Inability to develop business in other cities and regions, including opening representative offices or branches. Besides. “simplified” cannot engage in banking, legal, insurance business and some other types of activities;

- Those individual entrepreneurs and organizations that work under the simplified tax system do not use VAT in their work, and this can significantly narrow the circle of partners. Large companies most often apply VAT and require the same from their counterparties;

- Legal entities and individual entrepreneurs using the simplified tax system cannot offset all their expenses as expenses and thereby reduce the tax base;

- If strictly established limits are exceeded, for example, on the number of personnel or profit margins, companies lose the right to work on the simplified tax system. It will be possible to return only from the beginning of next year and subject to compliance with the framework established by law.

Disadvantages of simplification

Compliance with strict restrictions

Application of the simplified tax system requires your organization to comply with a number of conditions:

- Income limit for 9 months. In 2022, in order to switch to the simplified tax system, income for the first nine months of the year when the notice of transition was submitted must not exceed 116.1 million rubles (112.5 million rubles × 1.032 deflator coefficient).

- Income limit for the year . In the future, income should not exceed 200 million rubles during the reporting (tax) period (from 2022 the deflator coefficient will begin to be applied).

- The average number of employees for the tax (reporting) period is no more than 130 people.

- The residual value of fixed assets must be less than or equal to 150 million rubles.

- The share of other organizations in the authorized capital of a legal entity should not exceed 25%.

- Lack of branches.

Such restrictions slow down the development of the organization in the market. If at least one of the conditions is not met, the enterprise loses the right to simplification. In this case, you need to return to OSNO in a timely manner. Here we wrote how to switch from simplified to basic mode.

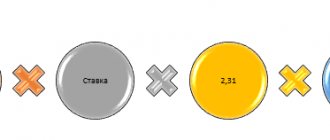

From 2022, the income and number of employees limits were softened, but increased tax rates were introduced. Thus, the tax on the simplified tax system “income” will increase from 6% to 8%, and on the simplified tax system “income minus expenses” from 15% to 20% in the following cases:

- the amount of income since the beginning of the year has exceeded 150 million rubles;

- the average number of employees exceeded 100 people.

The tax at the new rate will have to be calculated from the beginning of the quarter in which the corresponding violation was committed.

And even if they comply with all the limits and restrictions, not all organizations can apply the simplified tax system. Banks, insurers, companies and individual entrepreneurs - producers of excisable goods, as well as those extracting and selling minerals, etc., are deprived of this right. The full list is given in paragraph 3 of Article 346.12 of the Tax Code.

Closed list of expenses and minimum tax

The “income minus expenses” method of calculating the tax base has its disadvantages. When using it, the company is faced with a closed list of expenses. You can only take into account the costs listed in the law. For example, entertainment expenses, penalties under contracts with counterparties, and losses due to shortages or theft of property do not reduce the tax base.

The second disadvantage is the presence of a mandatory minimum tax. It is equal to 1% of the organization's income. A company or individual entrepreneur calculates tax based on the results of the tax period using the selected base. If this amount is below the minimum tax, then it is paid to the budget. The difference can be included in expenses in subsequent periods. However, this year this may have a negative impact on the results of work.

Problems with counterparties

A VAT evader is an unprofitable partner for buyers of his products/works/services if they are on the OSNO regime. The simplifier sets his price without VAT. Consequently, the counterparty cannot allocate this amount for deduction. This threatens refusal of cooperation. If a company or individual entrepreneur on a simplified basis wants to retain its existing connections, it may have to reduce the price.

Obligation to restore VAT

There is another problem with VAT. Let's say your company plans to switch to the simplified tax system starting next year. At the same time, it is obvious that part of the company’s assets acquired earlier will be used in the future. However, VAT on the purchase has already been refunded. Thus, the enterprise must recover part of the tax on purchased raw materials, residual value of equipment and a number of other asset items. The following example can be given. In November 2022, the company purchased materials worth RUB 320,000. VAT including amounted to RUB 53,333.33. and was presented for deduction. The organization will switch to the simplified tax system next year. By the end of the year, only 25% had been spent. Accordingly, the company re-calculates the deducted tax and pays it in the amount of: 53,333.33 * 0.75 = 39,999.99 rubles. Here we told you how to restore VAT when switching to the simplified tax system.

Author of the article: Valeria Tekunova

Keep records of the simplified tax system in the cloud service Kontur.Accounting. The service will tell you what taxes need to be paid and when, and will generate payments and reports. Use the service for free for the first 14 days.

Try for free

How to switch to simplified tax system

In short, switching to “simplified” is not a difficult matter. It is possible in two ways:

- Immediately after registering an individual entrepreneur or LLC. Here you just need to attach to the main package of documents a notice of the transition to the “simplified language”;

- Change the taxation system during the operation of the enterprise. This is usually done in order to optimize taxation, or if the right to work under other tax regimes has been lost, for example, the types of activities of the enterprise have changed, or the individual entrepreneur has lost the opportunity to apply the patent system.

For your information! You can switch to the simplified tax system once a year, with the beginning of a new calendar year. At the same time, those wishing to do so must submit a notification to the territorial tax authority about the upcoming transition to “simplified taxation” in advance.

Prohibited list for “simplified people”

Switching to a simplified system is easy.

However, not everyone can do this. Article 346.12 of the Tax Code lists those whom the law prohibits from working for the simplified tax system. Thus, they do not have the right to become “simplified”:

- companies that have branches (from January 1, 2016, the presence of representative offices does not prevent the use of the simplified tax system). If an organization has created a separate division that is not a branch, and has not indicated this division as a branch in its constituent documents, then it has the right to apply the simplified tax system, subject to compliance with the norms of Chapter 26.2 of the Tax Code;

- banks;

- insurers;

- non-state pension funds;

- investment funds;

- professional participants in the securities market;

- pawnshops;

- producers of excisable goods;

- developers of mineral deposits (except for common ones);

- companies involved in gambling business;

- notaries engaged in private practice;

- lawyers who have established law offices and other forms of legal entities;

- participants in production sharing agreements;

- persons who have switched to paying the Unified Agricultural Tax;

- firms with a share of participation of other companies in them of more than 25%. Organizations that are not subject to this restriction are listed in subparagraph 14 of paragraph 3 of Article 346.12 of the Tax Code. This rule also does not apply to companies with a stake in them of the Russian Federation, constituent entities of the Russian Federation and municipalities, since these entities do not fall under the definition of “organization” for the purposes of applying tax legislation (letter of the Ministry of Finance of the Russian Federation dated June 2, 2014 No. 03-11- 06/2/26211).

The limitation on the share of participation of other organizations in the authorized capital of the company must be observed:

- firstly, on the date of commencement of work on the simplified tax system. Otherwise, the company will not acquire the right to use the simplified system;

- secondly, during the use of the simplified tax system. An organization that violates this requirement during this period loses the right to apply this special regime.

In a letter dated December 25, 2015 No. 03-11-06/2/76441, the Russian Ministry of Finance clarified that if the share of participation of the founding company has become no more than 25%, then such an organization can switch to the simplified tax system from January 1 of the next year. In other words, in order to apply the simplified tax system from January 1, changes made to the company’s constituent documents, according to which the share of other organizations is reduced to a value not exceeding 25%, must be entered into the Unified State Register of Legal Entities before January 1 of the same year.

In addition, the following are not entitled to apply the simplified tax system:

- organizations and entrepreneurs with an average number of employees of more than 100 people;

- organizations whose residual value of fixed assets, according to accounting data, exceeds 150 million rubles;

- state and budgetary institutions;

- all foreign companies in Russia;

- organizations and entrepreneurs who did not submit notification of the transition to the simplified tax system within the established time limits;

- microfinance organizations;

- private employment agencies that provide labor to workers (from January 1, 2016).

Let us note that if a recruitment agency on the simplified tax system provides recruitment services and does not enter into employment contracts with applicants, it has the right to continue to use the “simplified system”. The fact is that if an employee is sent to work for the receiving party under a personnel supply agreement, then the employment relationship between him and the private employment agency does not terminate. At the same time, labor relations do not arise between this employee and the receiving party (Article 341.2 of the Labor Code of the Russian Federation).

And vice versa. If a private agency provides personnel selection services to organizations without concluding employment contracts with employees, then these employees formalize labor relations with these organizations.

This means that if a personnel recruitment agency does not enter into employment contracts with persons sent to work in the customer’s organization, it does not carry out activities to provide labor for workers and, accordingly, has the right to apply the simplified tax system (letter of the Ministry of Finance of Russia dated March 11, 2016 No. 03-11 -06/13564).

Others who want to start working for the simplified tax system must meet certain criteria:

- income level (of the organization);

- number of employees (organizations and entrepreneurs);

- residual value of fixed assets (organization).

Please keep in mind that the list of entities that are not entitled to apply the simplified tax system is closed. For example, it does not mention individual entrepreneurs - tax non-residents of the Russian Federation. Consequently, such individual entrepreneurs have the right to apply the simplified system on a general basis (letters of the Ministry of Finance of the Russian Federation dated July 1, 2013 No. 03-11-11/24963 and dated January 28, 2013 No. 03-11-11/35).

Read in the taker

You can find out who can apply the simplified tax system and what conditions must be met in order to do so, in the “STS in Practice” berator.

Objects of the simplified tax system: income 6% or income minus expenses 15%

Companies and individual entrepreneurs who have chosen the simplified tax system as their main tax system must then decide on the object of taxation. In simplified terms, there are two of them:

- Income minus expenses 15%. Here, tax payment is made from the difference between the profit and expenses of the organization; At the same time, we must not forget that not all expenses can be taken into account, but only those that are prescribed in the Tax Code of the Russian Federation. That is why it is necessary to keep careful and detailed records of the costs incurred within the framework of commercial activities;

- Income 6%. In this case, tax is paid exclusively on income. The main advantage here is that you do not need to keep track of expenses, that is, collect all kinds of checks, receipts, etc. supporting papers. In addition, it is believed that tax authorities rarely carry out inspections of those individual entrepreneurs and organizations that use the simplified tax system in their activities with a taxable income of 6%.

Attention! The more expenses an entrepreneur has, the more profitable it is for him to apply the object of taxation of income minus expenses of 15%. That is why it is often used by either novice businessmen or those who plan to actively develop their business.

Important! In some cases, for example, if an individual entrepreneur or a company located on the simplified tax system is engaged in social, scientific or industrial projects, it is exempt from paying this tax for a two-year period. True, this possibility can only be realized if local authorities have agreed to it.

Fill out section 2.1.2

This section is completed by trade tax . It serves to calculate the amount by which they are allowed to reduce tax. Accordingly, non-payers of the trade tax do not have this section in the declaration, as do those who pay the fee, but do not reduce the tax.

Lines 110-143 indicate the same data as in section 2.1.1, but only in relation to the activities that are subject to the trade tax.

If an entity on the simplified tax system conducts activities that are and are not subject to trade taxes, it should maintain separate records . This applies not only to revenue, but also to expenses that reduce tax.

Tax is reduced on contributions according to the same rules as in section 2.1.1

Lines 150-153 reflect the trading fee that was actually paid in 2022, including for 2022. Lines 160-163 indicate the amount of the fee that reduces the tax.

The trade tax is deducted from the tax due and reduces it down to zero.

The amount of the tax-reducing fee is calculated by subtracting from lines 130-133 the values indicated in lines 140-143 for the corresponding period. If the result obtained is greater than the amount of the trading fee, then the value of lines 150-153 is repeated in lines 160-163. If less, then what is calculated is indicated.

Let's say in line 130 the tax amount is 50,000 rubles. Line 140 indicates the amount of contributions and other expenses that reduces the tax - 25,000 rubles. In line 150, the amount of the trading fee is 25,000 rubles. Line 160 reflects the entire fee paid for the 1st quarter.

Rules for filing a declaration on the simplified tax system

Another procedure that simplifies the simplified tax system is filing a tax return. Those who work on the simplified exam must take it no more than once a year. Moreover, LLCs must transfer it to the tax authorities no later than March 31, and individual entrepreneurs - before April 30.

There are several ways to submit your tax return:

- In person at the tax office;

- By sending a letter with notification of delivery by Russian Post. It is advisable to include a description of the attachment with the letter. In this case, the deadline for filing the declaration will be the date of its dispatch;

- Through a trusted person. Here you will need a power of attorney certified by a notary;

- Through the website of the Federal Tax Service.

Who can work under the simplified tax system

The prevalence of “simplified” can be explained by the fact that it is acceptable for use by those representatives of the sphere of medium and small businesses who are engaged in providing a certain, and quite wide, range of services and work in relation to the population, as well as other individual entrepreneurs and legal entities. But there are also exceptions. For example, according to the simplified tax system the following are not allowed to work:

- Non-state insurance and pension funds;

- Those companies whose main activity is organizing and conducting gambling, etc.;

- Companies engaged in the extraction and sale of mineral resources;

- Lawyers, notaries;

- Foreign organizations;

- Any financial structures: investment funds, banks, pawnshops, microfinance organizations, etc.;

- Some other business representatives;

- A more complete list is presented here.

This list undergoes periodic changes, so if necessary, it can be clarified by the tax service.

General taxation system

This is the basic taxation option, which is set automatically upon registration or exceeding the limits for the special regime. OSNO LLCs are required to pay the following taxes:

- Income tax. It is calculated from the difference between income received and expenses incurred. The base rate is 20%, in some regions it can be reduced by decision of local authorities. The existence of expenses must be documented, and the expenses must be justified and understandable to the Federal Tax Service. If an LLC receives income of less than 15 million rubles per quarter, then income tax should be paid quarterly, if the amount of income is larger, then monthly.

- Property tax. You pay for the use of your real estate in business activities, the rate is not fixed, and its value is set in different regions. Typically this is 2.2% of the property value. Tax payment is due at the end of each quarter.

- VAT. Tax is imposed on the value of goods or services at a rate of 20%. If the company has the right to apply the benefit, then the rate can be reduced to 10% or even be zero. A company may not apply this tax if its income for the quarter is no more than 2 million rubles. VAT is paid every month.

Enterprises on OSNO have reporting obligations:

- corporate property tax declaration – at the end of the year;

- financial statements – annually;

- VAT return – at the end of each quarter;

- income tax return – at the end of each quarter.

It is important to calculate and pay all taxes on time, as well as submit reports - fines for this can reach 30% of the amount of contributions.

Advantages and disadvantages of OSNO

The advantages of the general system include:

- absence of any restrictions on profit margins, number of employees and area of rented premises;

- many types of expenses that are deductible;

- the ability to apply VAT and cooperate with payers of this tax, often large companies with large orders;

- absence of a minimum tax amount, if or even at a loss, then there is no need to pay to the budget.

Disadvantages of OSNO:

- increased attention to the activities of the organization from the Federal Tax Service;

- a large number of reports;

- complexity of tax calculations and accounting;

- high tax burden.

Despite the complexities of accounting and a large number of taxes, OSNO allows a business to gain good momentum right from the start - you can hire many employees, engage in any activity, sell your goods in bulk, import products, etc.

Working conditions under the simplified tax system

Those companies and organizations that work on the simplified tax regime must remember that there are certain conditions under which the simplified tax system loses the right to apply this tax regime. This:

- Excess number of employees. Only those companies that employ more than 100 people have the right to use the simplified tax system;

- Exceeding the established income limit. That is, if an enterprise receives more than 60 million rubles a year, then it does not have the right to be on the simplified tax system;

- The share of participation of outside legal entities in an LLC using the simplified system should not exceed 25%.

- Legal entities with branches and representative offices also cannot operate under the simplified taxation system.

That is, if an enterprise has plans for serious business development, then it is better to abandon the simplified tax system.

Simplified taxation system

This tax regime was created specifically to ensure that small and medium-sized businesses develop as quickly as possible. Subjects on the simplified tax system are obliged to:

- pay income tax - quarterly in advance payments;

- pay property tax if the company has real estate;

- submit a simplified version of reporting - an income statement once a year;

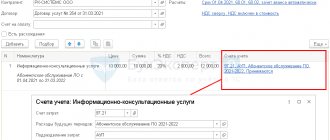

- keep a book of income and expenses.

Companies using the simplified tax system must apply VAT when making payments to state-owned enterprises or when importing products.

In order to switch to a simplified taxation system (or stay on it for a year), a company must meet the following requirements :

- the main type of activity is permitted for the application of the simplified tax system;

- number of employees up to 130 people;

- LLC has no branches, separate representative offices and other organizational units outside the main enterprise;

- cost of fixed assets up to 150 million rubles;

- income for the year is not more than 206.4 million rubles;

- other LLCs participate in the authorized capital by no more than 25%.

The simplified tax system does not apply to the following types of activities:

- lawyers, notaries;

- conducting gambling;

- MFOs and pawnshops;

- extraction and sale of minerals;

- production of excise goods (except wine);

Types of simplified tax system

A simplified system can be of two types:

- “Income” – the tax rate is 6% if the enterprise’s income is up to 154.8 million rubles and the number of employees is up to 100 people. The tax rate is 8% if income is more than 154.8 million rubles and 101-130 employees.

- “Income minus expenses” – the tax rate is 15% if the enterprise’s income is up to 154.8 million rubles and the average number of employees is 100 people. The tax rate is 20% if the income is 154.8-206.4 million rubles and 101-130 employees.

In the second case, all expenses will need to be supported by documents - checks, invoices, certificates of work performed, etc. You cannot change the type of simplified tax system during the year - the transition is possible only upon an application submitted to the Federal Tax Service before the end of December of the current year.

Advantages and disadvantages of the simplified tax system

The advantages of “simplified” include:

- low interest in the work of the enterprise on the part of tax authorities;

- simplicity of accounting and minimal reporting;

- the ability to reduce the tax base through expenses in the simplified tax system “Income minus expenses”.

The disadvantages of the simplified tax system are:

- the need to pay a single tax regardless of whether the company’s activities were profitable or not;

- a limited list of expenses that can be deducted in the simplified tax system “Income minus expenses”.

The simplified taxation system has a number of requirements for entities that can apply it. However, most small and medium-sized businesses fully comply with all the conditions of the simplified tax system, so the main question is how to choose between the simplified tax system “Income” and the simplified tax system “Income minus expenses”. To decide, you need to at least roughly calculate the share of expenses relative to income - if it is 60% or less, then it is better to choose the option with a 6% rate, if more, then a 15% rate.