According to the general rule enshrined in paragraph 1 of Art. 284 of the Tax Code of the Russian Federation, the income tax rate is 20%, unless otherwise established by this article. For example, by virtue of clause 1.1, a 0% rate is applied to the tax base determined by organizations engaged in educational and (or) medical activities, taking into account the features provided for in Art. 284.1 Tax Code of the Russian Federation.

Please note that the above standards are valid from 01/01/2011 to 01/01/2020. That is, these organizations have a little more than a year left to take advantage of the designated benefit (unless legislators make appropriate changes and extend the established period).

Based on the explanations given in the letters of the regulatory authorities, we will consider the procedure for applying Art. 284.1 Tax Code of the Russian Federation.

Who is eligible to apply the 0% tax rate?

Based on the provisions of paragraphs 1 , 2 of Art. 284.1 of the Tax Code of the Russian Federation , organizations carrying out educational and (or) medical activities in accordance with the legislation of the Russian Federation have the right to apply a tax rate of 0% subject to a number of conditions established by this article.

The zero rate applies to the entire tax base determined by such taxpayers throughout the entire tax period .

For the purposes of applying this article, educational and medical activities are recognized as activities included in the List of types of educational and medical activities (hereinafter referred to as the List ).

Activities related to spa treatment are not considered medical activities.

Sanatorium and resort organizations providing medical treatment include organizations that have the status of treatment and preventive organizations and operate on the basis of a license to conduct medical activities granted in accordance with the legislation of the Russian Federation.

Taking into account the fact that for the purposes of applying the provisions of Art. 284.1 of the Tax Code of the Russian Federation , activities related to sanatorium and resort treatment do not apply to medical activities; the application of a 0% rate by organizations engaged in sanatorium and resort activities is not provided for ( Letter of the Ministry of Finance of Russia dated May 18, 2012 No. 03-03-06/1/252 ).

Organizations that have expressed a desire to apply a 0% tax rate, no later than one month before the start of the tax period from which this rate is applied, submit to the tax authority at their location an application, copies of the license (licenses) to carry out educational and (or) medical activities issued (issued) in accordance with the legislation of the Russian Federation ( clause 5 of Article 284.1 of the Tax Code of the Russian Federation ).

Please note that

the Tax Code does not establish the obligation of educational or medical organizations that switched to using a 0% tax rate from the beginning of the tax period and continue to apply it in subsequent tax periods if they meet the conditions provided for in Art. 284.1 of the Tax Code of the Russian Federation , annually submit relevant statements to the tax authorities. Thus, an application for a transition to the application of a 0% tax rate is submitted by the organization once for the entire period of application of this rate (see Letter of the Ministry of Finance of Russia dated December 27, 2011 No. 03-03-06/4/151 ).

Conditions for applying a zero rate for income tax

According to paragraph 3 of Art. 284.1 of the Tax Code of the Russian Federation, organizations have the right to apply a tax rate of 0% if the following conditions are met:

- the organization has a license (licenses) to carry out educational and (or) medical activities, issued (issued) in accordance with the legislation of the Russian Federation ( clause 1 );

- The organization's income for the tax period from educational activities, childcare and (or) medical activities, as well as from R&D, constitutes at least 90% of its income taken into account when determining the tax base in accordance with Chapter. 25 of the Tax Code of the Russian Federation , or the organization for the tax period does not have income taken into account when determining the tax base in accordance with Chapter. 25 of the Tax Code of the Russian Federation ( paragraph 2 );

- in the staff of an organization carrying out medical activities, the number of medical personnel with a specialist certificate in the total number of employees continuously during the tax period is at least 50% ( clause 3 );

- the organization continuously employs at least 15 employees during the tax period ( clause 4 );

- The organization does not carry out transactions with bills and derivative financial instruments during the tax period ( clause 5 ).

Let's look at these conditions in more detail.

About the availability of a license

Relations arising between executive authorities and business entities in connection with the licensing of certain types of activities are regulated by the Licensing Law . The list of activities for which licenses are required is established in Part 1 of Art. 12 of this law, which, among others, mentions educational ( clause 40 ) and medical activities ( clause 46 ) (with the exception of activities carried out by organizations located in the territory of the innovation).

According to clause 2, part 1, art. 5 of the Law on Licensing The Government of the Russian Federation approves provisions on licensing of specific types of activities and adopts regulatory legal acts on licensing issues.

Thus, the regulation on licensing medical activities was approved by Decree of the Government of the Russian Federation dated April 16, 2012 No. 291 , on licensing of educational activities - by Decree of the Government of the Russian Federation dated October 28, 2013 No. 966 .

The procedure for licensing educational activities is also regulated by paragraph 91 of the Law on Education .

Is it legal for an educational (medical) organization to apply a zero rate in the current tax period (2018) if the license expires in December of this period?

Explanations on this issue are given in the Letter of the Federal Tax Service for Moscow dated January 30, 2012 No. 16‑12/ [email protected] . For the current period they should be applied as follows.

The organization must have a valid license to carry out educational and (or) medical activities at the end of the tax period (as of December 31, 2018). Otherwise, she cannot apply the zero rate in her income tax return for this period. Accordingly, if a similar condition is not met in the next year, 2022, then the 0% tax rate should not be declared in declarations for the reporting periods of 2022 before the date of registration of the new license.

Results

The absence of data to be included in the declaration or receipt of a zero tax amount for payment does not exempt the income tax payer from filing a declaration. If there is no data on income and expenses to fill out sections of the declaration, it is considered zero. Its presentation is carried out within the usual time frame for profit reporting. Responsibility for failure to submit a zero declaration is minimal: a fine of 1000 rubles. for the annual declaration and 200 rubles. for declarations of reporting periods.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated September 23, 2019 No. ММВ-7-3/ [email protected]

- Order of the Ministry of Finance of the Russian Federation dated July 10, 2007 No. 62n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

About the income structure

One of the conditions for applying the 0% tax rate is the criterion according to which the organization’s income for the tax period from educational activities, childcare and (or) medical activities, as well as from R&D activities constitute at least 90% of its income ( Subclause 2, Clause 3, Article 284.1 of the Tax Code of the Russian Federation ).

However, the provisions of this norm do not establish requirements for rounding the specified criterion to whole units. Thus, if the percentage was less than 90% of income, for example, 89.8%, then the organization does not have the right to apply a zero tax rate. This opinion was expressed by the Ministry of Finance in Letter dated May 23, 2012 No. 03-03-06/4/46 .

Let us note that from a literal reading of the above norm of the Tax Code it follows that in order to apply the zero rate it is necessary to observe the percentage of income only based on the results of the tax period , which the organization states on the basis of clause 6 of Art. 284.1 of the Tax Code of the Russian Federation at the end of the tax period, during which it applied a tax rate of 0%, within the time limits established by Ch. 25 of the Tax Code of the Russian Federation for submitting a tax return, reports to the tax authority at the place of its location in the form contained in the appendix to the Order of the Federal Tax Service of Russia dated November 21, 2011 No. ММВ-7-3/ [email protected] . Such clarifications are given, in particular, in the Letter of the Federal Tax Service for Moscow dated June 20, 2012 No. 16‑15/ [email protected] .

When determining the structure of income, it is necessary to take into account that the income referred to in Art. 251 of the Tax Code of the Russian Federation are not taken into account for tax purposes. For example, for medical and educational organizations this includes income in the form of:

– property received free of charge from the founder of the organization, whose share in the authorized capital is more than 50%, provided that this property is not transferred to third parties within one year from the date of its receipt (except for funds) ( clause 11 p. 1 );

– property received in the form of targeted financing, subject to separate accounting of income (expenses) received (produced) within the framework of such financing ( clause 14, clause 1 );

– property received free of charge by state and municipal educational institutions for conducting main types of activities, as well as property received free of charge by organizations carrying out educational activities, which are non-profit organizations, for conducting educational activities (clause 22, paragraph 1 ).

By virtue of clause 2 of Art. 251 of the Tax Code of the Russian Federation, when determining the tax base, target revenues (with the exception of target revenues in the form of excisable goods) for the maintenance of non-profit organizations and the conduct of their statutory activities are also not taken into account.

In addition, it should be remembered that when determining the 90% ratio, the numerator must take into account income received from activities included in the List .

For example, income in the form of positive exchange rate differences generated in connection with the revaluation of foreign currency loans raised for the reconstruction of a building does not apply to income received from medical activities included in the List . Consequently, such exchange rate differences do not participate in determining the share of income received from medical activities in the total amount of income for the tax period.

Do not include income received from medical (educational) activities, and income in the form of penalties and reimbursement of legal expenses for late fulfillment of obligations under the contract ( Letter of the Ministry of Finance of Russia dated April 25, 2018 No. 03-03-06/1/27941 ).

Let us note that if, when carrying out paid medical activities according to the types of medical activities established by the List , a component of the medical service is the use of special medical products, then, in the opinion of the Ministry of Finance, the cost of these products should form the cost of such a medical service ( Letter dated 02/07/2018 No. 03- 03‑06/1/7248 ).

What should a manager know about income tax?

14 October 2021

If an organization operates under the general tax regime, the main tax for it is income tax. Profit is defined as the difference between income and expenses in the reporting period.

In order to calculate and pay taxes correctly, not only an accountant, but also a manager needs to understand the taxation of profits. This checklist contains key questions and nuances.

1. Regulatory framework

Everything you need to know about income tax is collected in Chapter 25 of the Tax Code of the Russian Federation (Articles 246–333)

2. Payers

Russian legal entities and foreign companies operating in the territory of the Russian Federation, receiving income from Russian sources and having permanent representative offices pay income tax.

3. Who doesn't pay?

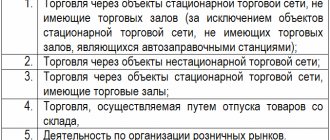

The corporate income tax is irrelevant for those who work for the Unified Agricultural Tax or the simplified tax system. Representatives of the gambling business and residents of special economic zones also do not pay tax.

4. Taxable period

It is necessary to calculate income tax based on the results of the calendar year.

5. Reporting period

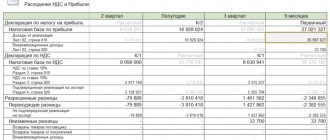

There are several reporting periods in a tax period. For those who pay advance payments quarterly, there are three such periods: quarterly, 6 and 9 months.

6. Principle of tax payment

Profit taxation involves the payment of advance payments during the tax period plus the payment of tax at the end of the year.

7. Payment of advance payments

Advance payments are paid monthly or quarterly. The quarterly transfer scheme is available to those whose sales income does not exceed 15 million rubles per quarter over the previous four quarters. Everyone else counts and pays advances monthly.

8. Calculation of advance payments

Monthly advance payments are calculated based on estimated income, quarterly payments based on actual income.

9. How to calculate advances and taxes?

You can use online calculators to pre-calculate the amounts to be paid.

10. Deadlines

The annual income tax must be transferred to the budget by March 28 of the year following the reporting year.

11. Formula

The formula for calculating income tax is extremely simple: tax base x tax rate.

12. Rates

The standard income tax rate is 20%. At the same time, 3% is paid to the federal budget and 17% to the regional budget.

Special rates apply for certain organizations and types of income. For example, in the IT sector, 3% is paid to the federal budget, and 0% to the regional budget. Income from certain securities is subject to a 15% tax. From dividends of a foreign company, up to 13% is paid to the budget.

13. The tax base

The tax base is the profit of the organization. It is calculated on a cumulative basis during the reporting period. If a company has profits from activities that have different tax rates, the basis for each rate is calculated separately.

14. Taxable income

Income for tax purposes is recognized as economic benefit received by an organization in the reporting period in kind, in cash. Taxable income is divided into sales and non-sales income.

15. Tax-free income

A closed list of tax-free income is given in Art. 251 Tax Code of the Russian Federation. Such income includes, for example, deposits, pledges, advances received, and targeted financing.

16. Expenses for tax purposes

Expenses for profit tax purposes must meet certain requirements (Article 252 of the Tax Code of the Russian Federation). Firstly, this is the presence of primary accounting documents confirming the transaction. Secondly, economic justification. When calculating the tax base, only justified expenses related to the nature of the organization’s activities and aimed at generating profit are taken into account.

17. Selling expenses

Profit taxation includes expenses for the maintenance of fixed assets, production of goods, their storage, delivery, and organization of business processes. Also included in expenses are salaries, costs of education and training of personnel (Article 253 of the Tax Code of the Russian Federation).

18. Non-operating expenses

Expenses that are not directly related to production processes and sales, but related to the activities of the organization (legal costs, payment for banking services, payment of interest on loans, etc.) are also included in the taxation of profits (Article 265 of the Tax Code of the Russian Federation).

19. Expenses outside of income taxation

Not all expenses are taken into account when calculating the tax base. The list of those who do not participate in profit taxation is established by Art. 270 Tax Code of the Russian Federation. The law prohibits reducing the tax base by the amount of contributions to the authorized capital, remuneration of members of the board of directors, accrued fines, penalties, etc.

20. Source documents

There is no clear list of the necessary primary accounting documents to confirm expenses in the Tax Code of the Russian Federation. The number of supporting documents for one operation has not been established. The main requirement for the initial report is that it is clear what expenses are incurred.

21. Preparation of supporting documents

The organization can approve forms confirming income and expenses itself. Documents must be drawn up in accordance with the norms of business document flow and the requirements of current legislation.

22. Reporting

Income tax payers submit:

- Current reporting (for a month, a quarter) – until the 28th day of the month following the reporting one.

- Annual reporting – until March 28 of the next year.

Current reporting is submitted in a simplified manner, annual reporting is submitted in the usual manner.

23. How to report to those who pay tax monthly?

For a taxpayer, the reporting period is a calendar month. Accordingly, from January to November, simplified declarations are submitted monthly (by the 28th day of the month following the reporting month). The final annual declaration is due by March 28 of the following year.

24. How to report if income tax is zero?

Organizations that do not have taxable income submit declarations in the general manner.

25. How to report to those who apply the zero rate?

Taxpayers with a 0% income tax must submit returns in the general manner, attaching documents confirming the right to apply the special rate.

26. How to report to an NPO?

Non-profit organizations with zero income tax submit a simplified return in the same manner and within the same time frame as other taxpayers.

27. How to reduce income tax?

If a company does not fall into a preferential category for income taxation, legal ways to reduce the amount of tax can be achieved by outsourcing the work to specialists, training employees and taking into account training costs, creating reserves, useful inventories, and increasing fixed assets.

28. What reserves reduce the tax base?

To optimize income tax, reserves for doubtful debts, vacation pay, warranty service and repairs, and repairs of fixed assets are suitable.

Important: the types of reserves used to optimize taxation must be specified in the accounting policy. Failure to comply with this rule will result in additional tax charges!

29. It is profitable to write off losses

The tax base can be reduced by up to half by writing off losses from previous years. Remind your accountant about this before submitting your income tax return.

30. Investment deduction reduces tax amount

If the entity in which your activities are carried out has adopted a law on investment deduction and the company owns objects of depreciation groups III–VII, put into operation since the beginning of 2018, fix the provision on the right to apply the deduction in the accounting policy by the end of the current year. The latter will allow reducing the federal and regional part of the tax (Article 286.1 of the Tax Code of the Russian Federation).

As you can see, paying direct tax, income tax, cannot be avoided. But the tax burden can and should be optimized. Use available preferential rates, legal ways to reduce your basis. And monitor the confirmation of income, expenses, and the economic feasibility of the latter in order to minimize tax risks and avoid additional charges.

Tags for this publication:

Income tax

On determining the number of medical staff

The provisions of paragraphs. 3 p. 3 art. 284.1 of the Tax Code of the Russian Federation establishes that the zero rate for income tax for medical organizations is applied, in particular, if the number of medical personnel with a specialist certificate in the total number of employees continuously during the tax period is at least 50 in the staff of the organization carrying out medical activities. %.

Since the Tax Code of the Russian Federation does not regulate the procedure for determining the number of employees of organizations, taking into account the provisions of paragraph 1 of Art. 11 of the Tax Code of the Russian Federation, to calculate the specified number, the procedure for determining the payroll number of employees established by Rosstat Order No. 772 , which approved the Instructions for filling out a number of federal statistical observation forms (hereinafter referred to as the Instructions ), including No. P-4 “ Information on the number and wages of employees.”

Such recommendations are given, in particular, in the Letter of the Ministry of Finance of Russia dated 06/05/2018 No. 03-03-10/38599 . It also notes the following.

In accordance with paragraph 80 of the Instructions , an employee registered in one organization as an internal part-time worker is counted in the payroll as one person (a whole unit).

If the main activity of a full-time employee of an institution is scientific activity, and part-time work is medical activity with a specialist certificate, then the specified employee is counted in the total number of employees as one full-time unit.

Taking into account that when calculating medical personnel, its number is taken from the total number of employees of the organization, it is unlawful to consider the same employee (as a staff unit) first as a research employee, and then as a staff member of medical personnel.

Sample of filling out the declaration form

The declaration is submitted by an organization on the OSN, paying quarterly advances with monthly payments. The organization does not have income tax benefits; the tax rate is 20%.

Sheet 01

Subsection 1.1 Section 1

Sheet 02

Appendix 1 to Sheet 02

Appendix 2 to Sheet 02

On carrying out transactions for which it is impossible to apply a 0% rate

Subclause 5 of clause 3 of Art. 284.1 of the Tax Code of the Russian Federation determines that organizations engaged in medical activities can apply a tax rate of 0% if they do not carry out transactions with bills of exchange and financial instruments of futures transactions during the tax period.

The question arises: does the accrual of interest on bank deposit agreements apply to operations to which this article relates the impossibility of applying a zero rate?

The Ministry of Finance believes that it does not apply and in the case of placing temporarily free funds in deposit accounts in a bank, a medical organization has the right to apply a 0% rate if other conditions provided for in Art. 284.1 Tax Code of the Russian Federation . In this case, income received from the placement of funds is subject to inclusion in non-operating income and is not taken into account when determining the share of income from medical activities.

Submission of information in a timely manner

According to paragraph 6 of Art. 284.1 of the Tax Code of the Russian Federation , organizations applying a tax rate of 0% in accordance with this article, at the end of each tax period during which they apply a zero rate, within the deadlines established for submitting an income tax return (no later than March 28), submit to the tax authority at its location the following information:

– on the share of the organization’s income from educational and (or) medical activities in the total income of the organization;

– on the share of the organization’s income from educational activities, childcare and (or) medical activities, as well as from scientific research and (or) development, in the total amount of income of the organization taken into account when determining the tax base;

– about the number of employees in the organization’s staff;

– on the number of medical personnel with a specialist certificate in the organization’s staff (for organizations engaged in medical activities).

For your information,

organizations must provide this information in the form approved by Order of the Federal Tax Service of Russia dated November 21, 2011 No. ММВ-7-3/ [email protected] . The specified reporting can be sent to the Federal Tax Service in electronic form via telecommunication channels in accordance with the format approved by Order of the Federal Tax Service of Russia dated December 30, 2011 No. YAK-7-6 / [email protected] .

What is the liability for failure to submit a zero declaration?

Since submitting a zero income tax return is the responsibility of the taxpayer, failure to submit or late return may result in a fine under Art. 119 of the Tax Code of the Russian Federation. Its amount is determined as a percentage of the amount of tax not paid on the basis of a failed/late declaration.

In this case, the tax amount is 0, so they can collect a fine from you only in the minimum amount - 1000 rubles. But only for the annual declaration. For declarations based on the results of reporting periods, you will be fined no more than 200 rubles. - according to Art. 126 of the Tax Code of the Russian Federation.

Read more about liability for failure to file tax reports in this article.

If the conditions are not met (information not provided)

The fulfillment of the condition regarding the share of income from educational and (or) medical activities, as well as from R&D in the total amount of income is determined as a whole for the tax period (that is, the calendar year).

Other conditions for applying a tax rate of 0% (availability of appropriate licenses, number of employees of organizations, qualification requirements for them, absence of transactions with bills and financial instruments of futures transactions) must be met continuously during the tax period.

At the end of each tax period, during which organizations applied a tax rate of 0%, they submit information to the tax authority containing information about the fulfillment of the conditions established by the Tax Code of the Russian Federation.

According to paragraphs 4 and 6 of Art. 284.1 of the Tax Code of the Russian Federation , if an organization fails to comply with at least one of the conditions established by clause 3 of this article, or fails to provide the above information from the beginning of the tax period in which the non-compliance with the conditions occurred (or for which information was not provided), the tax rate provided for in clause 1 tbsp. 284 Tax Code of the Russian Federation (20%). In this case, the tax amount is subject to restoration and payment to the budget with payment of the corresponding penalties accrued from the day following the one established by Art. 287 of the Tax Code of the Russian Federation on the day of tax payment (advance tax payment). In addition, the organization must submit to the tax authority updated tax returns for the reporting periods and a return for the tax period as a whole, calculating advance payments and the amount of tax at generally established rates.

Explanations on this issue are given in letters of the Ministry of Finance of Russia dated August 30, 2017 No. 03-03-06/1/55615 , dated December 28, 2012 No. 01-02-03/03-482 .

Organizations must be diligent in adhering to reporting deadlines. Otherwise, even a one-week delay may lead to the fact that the amount of income tax will be recalculated at the general rate for the entire previous tax period, as happened in the situation considered by the AS ZSO in Resolution No. F04-6027/2017 dated January 30, 2018 case No. A81-813/2017 .

The tax authority came to the conclusion that the taxpayer unreasonably applied the 0% rate when calculating income tax for 2015, since in violation of clause 6 of Art. 284.1 of the Tax Code of the Russian Federation, documents and information to confirm the right to apply a tax rate of 0% were submitted to him only on 04/07/2016, that is, in violation of the established deadline - no later than 03/28/2016.

The tax arbitrators supported it, since the information and documents provided for in paragraph 6 of Art. 284.1 of the Tax Code of the Russian Federation , were not submitted to the tax authority within the period established by law.

Please note:

The possibility of a taxpayer applying a 0% rate on income tax is conditioned not only by the organization’s compliance with the general conditions provided for in paragraph 3 of Art. 284.1 of the Tax Code of the Russian Federation , but also by timely submission to the tax authority at the place of registration of information and documents confirming compliance with these conditions for the expired tax period.

When property tax is zero

Property tax is zero in two cases:

- if all the company’s real estate is preferential, that is, exempt from taxation;

- when all real estate of the company is taxed at the average annual cost, but is fully depreciated, that is, its residual value is zero.

In both cases, the company is required to submit a zero property tax return, since the amount of tax payable is equal to zero.

Read in the berator “Practical Encyclopedia of an Accountant”

Who is exempt from corporate property tax

The list of taxpayers exempt from paying property tax of organizations in relation to property used by them to conduct statutory activities is established by Article 381 of the Tax Code of the Russian Federation. These include, for example:

- pharmaceutical industry organizations - manufacturers of veterinary immunobiological drugs intended to combat epidemics and epizootics;

- specialized prosthetic and orthopedic enterprises;

- bar associations, law offices and legal consultations;

- organizations with the status of a state research center, etc.

To prepare a zero report, use the declaration form approved in Appendix No. 1 to the order of the Federal Tax Service dated August 14, 2022 No. SA-7-21 / [email protected] as amended by the order dated December 9, 2022 No. KCH-7-21 / [email protected ] The filling procedure was approved by the same order.

Read in the berator “Practical Encyclopedia of an Accountant”

Reporting on property tax of organizations