Export VAT - what is it?

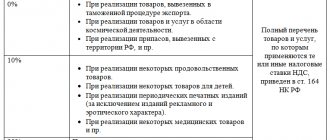

Export VAT is considered to be a tax that arises when goods are sold outside the Russian Federation. When exporting goods, the taxpayer applies a 0% rate, which effectively exempts him from paying tax on such transactions. But if it was not possible to justify the specified rate within the period allotted by the norms of the Tax Code of the Russian Federation, VAT will have to be paid to the budget.

The procedure for accounting for paid VAT on unconfirmed export transactions is reflected in the article “The Ministry of Finance explained when to reduce profit on VAT paid on unconfirmed exports .”

From 2022, the application of a 0% rate for exports is optional. You can refuse to use it. About this - in the material “Zero” VAT rate has become optional.”

When making “external” shipments, it is necessary to take into account the provisions of Art. 170 of the Tax Code of the Russian Federation on maintaining separate records of taxable and non-taxable transactions.

In order to understand how this type of accounting is carried out, we advise you to familiarize yourself with the topic “How is separate accounting of VAT carried out when exporting? "

When selling products abroad, there are 2 directions of shipments:

- to the countries of the EAEU;

- other foreign countries.

About VAT in transactions with foreign counterparties, read the article “Is a zero VAT rate possible if the foreign buyer is an individual? "

Calculation of VAT refund for export and profitable scenarios for its use

Trading on the foreign market has its advantages, the use of which allows you to increase the company’s production income. One of these benefits is the refund of VAT paid on exports.

Let's look at a simple example to see what the difference is in net income when selling goods on the Russian and foreign markets:

You sell this product at a market price of 150 rubles (margin 30 rubles), in this case the VAT amount will be 25 rubles. Of these, 5 rubles will go to the budget - the difference between 25 rubles. and 20r. As a result, you are left with 25 rubles of income.

However, if the same product is exported the following happens. The same product, the cost of which is 120 rubles and which is sold abroad also for 150 with a zero rate, the margin is 30 rubles.

Next, you pay the state 20 rubles of tax, but after completing the VAT refund procedure, this amount will be returned to you and the net revenue from one unit of goods will be about 50 rubles, instead of the previous 25.

And if you have supplies amounting to millions of rubles, then the benefits from this kind of procedure become very significant.

Features of confirming the 0% VAT rate when exporting to the EAEU countries

A distinctive feature of sales to the EAEU countries is the presence of a simplified export procedure, which is due to the agreement between the countries on mutual cooperation.

Therefore, the general list of documents justifying the 0% rate is small and consists of:

- from the contract;

- shipping and transport documents;

- import application or list of applications.

Clause 4 of Appendix 18 to the Treaty on the EAEU stipulates that one of the documents to confirm the zero rate is a bank statement. Why a bank statement is not in the above list, read the material “A bank statement is not required to confirm export to the EAEU” .

What documents can be used to confirm the zero rate if the buyer exports goods to the EAEU states independently, read the publication “Export to the EAEU states: how to confirm the zero VAT rate when goods are self-exported by the buyer”.

We also advise you to pay attention to the requirements for confirmation of the rate when exporting to other countries through the territories of the EAEU countries. You will learn about them from the article “How to confirm a 0% rate if goods are exported without border customs control .”

Like any shipment, exports require an invoice to be issued within 5 days from the date of sale. It is important to pay attention to the registration procedure in case of selling goods through a branch. Read about this in our material “ When exporting goods to Armenia, Belarus or Kazakhstan through a division, it is better to indicate the checkpoint of the head office in the invoice .

You can find out whether such an invoice should be submitted to the Federal Tax Service to justify the 0% rate here .

For information on how to take into account the amount of advance received by the exporter from its foreign counterparty, see the material “How to take into account advances from partners from the EAEU for VAT purposes? "

Are the rules for confirming a zero VAT rate when exporting to the EAEU countries and CIS countries the same, read the publication “ How to confirm a 0% VAT rate when exporting to CIS countries?” .

How to confirm the zero rate for an export transaction

The list of customs documentation attached to the VAT return and justifying the lawful application of the zero tax rate depends on the direction of export operations:

- export of goods to the countries of the Eurasian Economic Union (former republics of the USSR);

- shipment to other countries outside the EAEU.

Export to EAEU countries

When moving goods to the Eurasian Economic Union (EAEU) - Belarus, Armenia, Kazakhstan or Kyrgyzstan - simplified customs regulations are applied, so the list of documents required to justify the application of a 0% rate is quite limited. The seller must present the following documents to the tax service:

- transport and shipping documents for export cargo;

- application documents for the import of goods and confirmation of payment of indirect tax payments by the buyer;

- a contract between a Russian seller and a buyer from the EAEU countries.

Since two-way electronic exchange of data on the import/export of goods has been established between the customs and tax services, the presentation of paper documents is not necessary. It is enough for an exporting company to create a register of necessary documentation in electronic form and submit it to the tax office.

Export to other foreign countries

When exporting goods to countries outside the EAEU, you can confirm the application of a 0% VAT rate with the appropriate documents:

- a copy of the foreign trade contract or, in its absence, an acceptance or offer;

- agreement for the provision of intermediary services - if the export is carried out through a third party (attorney, agent, intermediary);

- customs declaration (copy or register in electronic form);

- commodity and transport documents (bill of lading, CMR waybill, air or combined waybills).

All documents presented must have official marks from customs services, indicating the actual export of goods from the territory of Russia.

During a desk audit, tax authorities may request bank statements or invoices for an export transaction, so it is advisable for the seller to prepare copies of documents to be attached to the VAT return.

Confirmation of 0% VAT rate when exporting to other countries

The main documents in this case are:

- customs declaration.

- Contract.

- shipping documents.

The customs declaration can be temporary or complete. Which one is suitable for export confirmation, read in this publication .

The customs declaration can be issued electronically. Whether you can use a paper copy of it to confirm your export, see here .

From the 4th quarter of 2015, some documents from the list can be replaced by registers, the formats of which can be found in the publication “Approved forms and formats of registers for confirming the VAT rate of 0%” . For registers of documents confirming the 0% rate, there are also control ratios. For more information about them, see the materials:

- “Control ratios for checking Registers have appeared to confirm the 0% rate”;

- “New control ratios for VAT”;

What rules for confirming the zero rate apply when exporting to the Donetsk People's Republic controlled by Ukraine, read the material “How to confirm the export of goods to the territory of the DPR” .

Are there any specific features of confirming the zero rate if ownership of the exported goods passes to a foreign buyer in Russia, read the publication “The moment of transfer of ownership is not important for the zero VAT rate .

When the zero VAT rate for export becomes non-zero

In accordance with Art. 165 of the Tax Code of the Russian Federation, if sellers selling goods for export do not collect a package of documents justifying the 0% rate, they will have to fulfill their obligation to pay tax. You will have to pay tax at rates of 10 or 20%. This is discussed in more detail in the article “What to do if the export is not confirmed within the prescribed period .”

At the same time, the VAT tax base will be increased by the cost of goods for unconfirmed exports. Its method of determination is discussed in the article “ Tax base for export - market value of goods under the contract .”

VAT refund when exporting goods

After submitting to the Federal Tax Service all necessary documents justifying shipment outside the Russian Federation, a desk audit begins, the purpose of which is to determine the validity of applying the export rate. The procedure for accounting and refunding export VAT can be found in the following articles:

- “What is the procedure for returning (reimbursing) VAT when exporting to Kazakhstan?”;

- “What is the procedure for accounting and refunding VAT when exporting?”;

- “What is the procedure for refunding VAT at a rate of 0% (receiving confirmation)?”.

It should be noted that, in accordance with the Tax Code of the Russian Federation, after 180 days from the date of a foreign trade transaction, in the event of non-confirmation of export, companies or individual entrepreneurs charge tax, however, this does not deprive them of the opportunity to use the 0% rate later.

However, tax legislation, while limiting the period of confirmation of export, does not indicate the moment from which the specified period should be calculated. This issue is discussed in more detail in the articles:

- «From what date does the calculation of the three-year period for VAT refund on export goods begin??»;

- «We are calculating the deadline for refunding VAT paid on unconfirmed exports: version of the Ministry of Finance».

The step-by-step procedure considered is outlined in the article “ How to properly refund VAT when exporting goods (instructions) .”

What is VAT

Value added tax, or VAT, is a markup on the price of a product or service that a seller makes. It goes to the state treasury in the form of an indirect tax. The main difference between VAT and other types of tax is that it is levied on each participant in production. This allows the state to receive more money than in the alternative case. Another difference is that this tax is paid in advance, as it were, before the goods are sold on the market itself.

However, if you sell your goods abroad, you have the opportunity to reclaim VAT on export. By collecting the necessary package of documents and contacting the tax service, you can get back the money previously paid to the state.

Deduction for export transactions

Exporter in accordance with Art. 172 of the Tax Code of the Russian Federation can take advantage of the deduction. At the same time, for export transactions, the deduction is applied to the amounts of input VAT, i.e., the tax paid upon the acquisition of goods (work, services) subsequently sent for export. From July 1, 2016, the deduction of input VAT for exporters of primary and non-commodity goods is carried out according to different rules.

You will learn which goods are classified as raw materials from the material “Which goods are raw materials for deducting VAT from the exporter .

Read about the use of deductions by exporters of non-commodity goods in the material “Non-commodity exporters apply deductions according to general rules .

Exporters of primary goods must restore input VAT on purchased goods (works, services) that are used for export operations. When this needs to be done, read the material “VAT on goods that are used for the export of raw materials is restored” .

In what cases is it not necessary to distribute input VAT on indirect costs, read the article “ Is it necessary to distribute “input” VAT on indirect costs between domestic and export sales?” .

You can also read about the specifics of applying the deduction within the framework of export operations in the article “ How to apply a VAT deduction for export operations .”

What are the risks with VAT during export operations?

The situation is as follows: the company carries out export operations to the countries of the EAEU (the 0% VAT rate cannot be waived) or to other countries (it could waive the 0% VAT rate, but has not done so). At the same time, the exporter decided to apply a rate of 20%, believing that there were no risks for him - the corresponding tax payments would go to the budget.

But there are certainly risks in this situation. The establishment of a 0% rate by tax legislation leads to the fact that for specific transactions there is no fact of presenting the VAT amount to the buyer. In addition, the mechanism of action in case of failure to confirm the right to apply the zero tax rate provides for the payment of calculated VAT from the exporter’s funds. In this regard, in the situation under consideration, there is no fact of presentation of VAT to the buyer.

Accordingly, if the exporter includes 20% VAT in the transaction amount, then he presents the tax to the buyer illegally.

Tax authorities evaluate this point in this way - the presented amount of VAT is not a tax in accordance with tax legislation. That is, it is not exactly a tax in the sense in which it appears in tax legislation. This amount is unjust enrichment.

In such a situation, tax risks regarding VAT and income tax are possible.

According to paragraph 1 of Art. 154 of the Tax Code of the Russian Federation, the tax base for the sale of goods (work, services) is established as their cost, calculated on the basis of prices determined in accordance with Art. 105.3 of the Tax Code of the Russian Federation (including excise taxes for excisable products and excluding VAT).

If we take into account that the presented amount of VAT is not considered a tax in its essence, then when calculating VAT, which must be calculated if the right to a 0% rate is not confirmed, the entire amount received from the buyer is included in the tax base. In other words, this is the amount taking into account the illegally claimed VAT. And then the amount of VAT may be calculated by tax authorities in an inflated amount.

Example 1

The carrier provided the service for 240 rubles, incl. VAT 40 rub. A tax of 40 rubles was paid to the budget, as calculated by the carrier. But the tax authorities came to the conclusion that in this situation the tax amount should be equal to 48 rubles. (240 RUR * 20%). It turns out that they must charge additional VAT in the amount of 8 rubles. (48 rubles - 40 rubles).

As for income tax, a tax risk also arises if the company includes in taxable income the amount of revenue minus the VAT charged to the buyer.

According to paragraph 1 of Art. 248 of the Tax Code of the Russian Federation, taxes imposed by the taxpayer on the buyer are excluded from income. Since the VAT charged to the buyer was presented in violation of the requirements of the Tax Code of the Russian Federation, the taxpayer has no grounds for excluding it when calculating taxable income.

Example 2

The conditions are the same as in the first example. The carrier included the amount of 200 rubles in income, since he calculated that the VAT amount of 40 rubles. may be excluded in the calculation.

The tax authorities came to the conclusion that the income tax base was underestimated by 40 rubles, since he should have included the entire amount - 240 rubles - in income. The amount of additionally accrued income tax will be 8 rubles. (40 RUR * 20%).

It is not a fact that tax authorities will come to such conclusions, but this risk cannot be excluded.

Also, the Federal Tax Service may consider that the company has committed a gross violation of the rules for accounting for income and expenses. In this regard, tax authorities may issue a fine under Art. 120 Tax Code of the Russian Federation.

Return of defects during export

The shipment and return of defective goods occurs not only in the domestic market, but also when sold for export. If a defective product is returned by a foreign supplier, the exporter faces questions: can such a return be regarded as an import and is it necessary to pay VAT in this case? You will find answers to them in the materials:

- “A contractor from the EAEU returned substandard goods—should I pay VAT when importing defective items back to Russia?”;

- “Is returning a defective export product an import?”.

Export invoices

When selling goods, works, services both on the domestic market and for export, it is necessary to draw up an invoice. When selling on the domestic market, an invoice can be drawn up electronically or a universal transfer document (UTD) can be issued.

Is it possible to create an electronic invoice or UTD when selling for export? Read the materials:

- “Is electronic invoice acceptable for export?”;

- “UPD can be used for export - as a replacement for an invoice”.