Simplified accounting methods

Three groups of organizations have the right to use simplified methods of accounting, including simplified accounting (financial) reporting. The first of them includes small businesses. The second group includes organizations that have received the status of participants in the Skolkovo project. And finally, the third group includes non-profit organizations (the accounting statements of non-profit organizations are also described in our other article).

At the same time, simplified methods of accounting may not be used by:

- organizations whose accounting (financial) statements are subject to mandatory audit in accordance with Russian legislation;

- housing and housing construction cooperatives;

- credit consumer cooperatives (including agricultural credit consumer cooperatives);

- microfinance organizations;

- public sector organizations;

- political parties, their regional branches or other structural units;

- bar associations;

- law offices;

- lawyer consulting;

- bar associations;

- notary chambers;

- non-profit organizations included in the register of non-profit organizations performing the functions of a foreign agent as provided for in paragraph 10 of Article 13.1 of the Law of January 12, 1996 No. 7-FZ.

These are the requirements of parts 4 and 5 of Article 6 of the Law of December 6, 2011 No. 402-FZ.

Organization of accounting

Accounting and storage of accounting documents is organized by the head of the organization (Part 1, Article 7 of Law No. 402-FZ of December 6, 2011).

He must choose one of the following options and consolidate this in the accounting policy:

- entrust accounting maintenance to the chief accountant or other responsible employee of the organization;

- conclude an agreement on the provision of accounting services with a third-party organization (specialist);

- take charge of accounting (for small and medium-sized businesses, as well as non-profit organizations that have the right to use simplified accounting methods).

This is stated in Part 3 of Article 7 of the Law of December 6, 2011 No. 402-FZ.

Accounting service

Outsourcing companies also offer accounting services. This method helps to build high-quality and effective accounting. Wherein:

- an analysis of the company’s activities and business specifics is carried out;

- a taxation system is selected, which allows you to select the optimal tax burden using legal methods;

- selecting a suitable method of accounting and tax accounting;

- internal rules and a document flow schedule are drawn up;

- accounting policies are formed, plans of working accounts are developed, forms of primary documentation are created.

This method is used by companies that are interested in creating a high-quality system, regardless of who will be in charge of accounting in the future.

To summarize, it is worth noting that, if necessary, you can always turn to professionals who will help create the basis for accounting. is ready to provide services for setting up accounting, developing accounting policies and other services that will create an effective and reliable platform for reflecting business transactions in your company.

Requirements for the chief accountant of a joint-stock company

Special requirements for the chief accountant are established in the JSC.

The person charged with accounting (for example, the chief accountant) must meet the following requirements:

- have a higher education (and not necessarily by profession);

- have work experience related to accounting, reporting or auditing for at least three years out of the last five calendar years. If there is no higher education in the field of accounting and auditing, then the experience must be at least five years out of the last seven calendar years;

- he should not have an unexpunged or outstanding conviction for crimes in the economic sphere (Section VIII of the Criminal Code of the Russian Federation).

Such rules are established by Part 4 of Article 7 of the Law of December 6, 2011 No. 402-FZ.

If the manager entrusts accounting to a third-party specialist, the latter must also meet the specified requirements. If an agreement for the provision of accounting services is concluded with an organization, it must have at least one employee who meets such requirements.

This is established by part 6 of article 7 of the Law of December 6, 2011 No. 402-FZ.

Federal legislation may establish other additional requirements for the chief accountant (another person entrusted with accounting) (Part 5, Article 7 of the Law of December 6, 2011 No. 402-FZ).

These requirements do not apply if the chief accountant (other person) began his duties before January 1, 2013 (Part 2 of Article 30 of the Law of December 6, 2011 No. 402-FZ).

Attention: Part 4 of Article 7 of the Law of December 6, 2011 No. 402-FZ refers to the chief accountants of open joint-stock companies (OJSC). However, as of September 1, 2014, such an organizational and legal form does not exist. Now all JSCs that place shares by public subscription are considered public joint-stock companies (PJSC). That is, in essence, the requirements for education and work experience apply specifically to the chief accountant of the PJSC, and officials will make a technical amendment to Part 4 of Article 7 of the Law of December 6, 2011 No. 402-FZ in the near future.

Legislative regulation and basic definitions of accounting

Today, accounting is mandatory when conducting business and economic activities, because this provision is enshrined in the domestic legislative framework. The main provisions are set out in the Regulations “On Accounting and Financial Reporting in the Russian Federation”, as well as in the Federal Law “On Accounting” No. 402-FZ, which came into force on January 1, 2013.

All requirements are enshrined at the legislative level and must be complied with without fail throughout the country for representatives of non-banking commercial structures.

Responsibility for violation of accounting rules

For gross violation of accounting rules, the tax inspectorate may fine an organization under Article 120 of the Tax Code of the Russian Federation. Thus, a gross violation of the rules for keeping records of income and expenses is the absence of primary documents, invoices, accounting registers, systematic (twice or more during a calendar year) untimely or incorrect reflection of assets and business transactions in accounting.

If an organization commits such a violation during one tax period, the fine will be 10,000 rubles. And if within several, the fine will increase to 30,000 rubles. If at the same time the organization also underestimated the tax base, then 20 percent of the amount of each unpaid tax, but not less than 40,000 rubles, will have to be paid to the budget.

There are also penalties for officials of the organization. It is prescribed in the Code of the Russian Federation on Administrative Offences. Sanctions are provided for gross violation of accounting requirements, including financial reporting. For such actions, a fine of from 5,000 to 10,000 rubles is provided. Repeated violation faces a fine of 10,000 to 20,000 rubles. or disqualification for a period of one to two years.

The punishment upon application of the tax inspectorate is imposed by the court (Part 1 of Article 23.1, Article 15.11 of the Code of Administrative Offenses of the Russian Federation).

In each specific case, the perpetrator of the offense is identified individually. In this case, the courts proceed from the fact that the manager is responsible for organizing accounting, and the chief accountant is responsible for its correct maintenance and timely preparation of reports (clause 24 of the resolution of the Plenum of the Supreme Court of the Russian Federation of October 24, 2006 No. 18). Therefore, the chief accountant (an accountant with chief rights) is usually found guilty of a violation. A leader is recognized as such only if:

- the organization did not have a chief accountant at all (resolution of the Supreme Court of the Russian Federation dated June 9, 2005 No. 77-ad06-2);

- accounting and calculation of taxes was carried out by a third-party specialized organization (clause 26 of the resolution of the Plenum of the Supreme Court of the Russian Federation of October 24, 2006 No. 18);

- the reason for the violation was a written order from the manager, with which the chief accountant did not agree (clause 25 of the resolution of the Plenum of the Supreme Court of the Russian Federation of October 24, 2006 No. 18).

If the head of the organization has not organized accounting, then the court may recognize such actions as abuse of authority. And if at the same time they prove that he pursued selfish goals, then the court may sentence him to liability under Article 201 of the Criminal Code of the Russian Federation.

Reasons for the need for accounting

The first and most significant reason why it is necessary to keep accounting records of an enterprise according to a generally accepted procedure is that this requirement is enshrined in law. Therefore, there is no choice; if an entrepreneur wants to work, he must conduct his activities according to the letter of the law.

There is no provision in the law that would allow an organization not to keep accounting records, because they are mandatory. If accounting records were never kept, business transactions were not recorded properly, and reports were not submitted to regulatory authorities, then the entrepreneur will be held liable:

- provided that the fiscal authorities have not received information about economic activities within a clearly defined time frame, citizens will be required to pay a fine of 100-300 rubles for each identified case, as well as a 300-500 ruble fine for an official for each case of failure to provide data or delay (according to Article 15.6 of the Code of Administrative Offenses).

- in case of gross neglect and non-compliance with the rules for maintaining records and providing accounting documentation, as well as the procedure and deadlines for saving accounting documents, the official is obliged to pay a fine of 2000-3000 rubles in accordance with Art. 15.11 Code of Administrative Offenses.

How to avoid fines

It is possible to avoid punishment when it comes to distorting accounting data, due to which the organization did not pay additional tax to the budget. Firstly, there will be no fine if you submit an updated tax return (calculation) to the inspectorate, and before that pay off the arrears and pay penalties. Secondly, you can correct errors and submit revised financial statements to the inspectorate. This is stated in paragraph 2 of the note to Article 15.11 of the Code of the Russian Federation on Administrative Offenses.

Advice : if inspectors issued a fine for an accounting error that did not affect the amount of tax in any way, then such a penalty can be challenged.

The most common errors in accounting, which are often considered gross, are presented in the table.

| What do inspectors see as a mistake? | Why is a mistake considered gross? | Is it possible to challenge a fine? |

| Input VAT was deducted based on copies of invoices due to the supplier delaying the originals | Data on accounts 19 and 68 subaccount “VAT calculations” was distorted | The fine can be challenged, since the accountant violated the rules for deducting VAT provided for in Chapter 21 of the Tax Code of the Russian Federation. Accounting legislation does not regulate this issue. Moreover, the data on accounts 19 and 68 comes from tax registers - purchase books and sales books. Important clarification about errors in invoices. If inaccuracies do not prevent inspectors from identifying the buyer, seller, name of goods, works, services, as well as their cost, VAT rate and tax amount, then inspectors do not have the right to refuse a deduction (clause 2 of Article 169 of the Tax Code of the Russian Federation). And then there can be no talk of distortion of data on the accounts. |

| Input VAT was deducted on the basis of invoices containing errors | ||

| Input VAT was deducted in the wrong tax period | Data on account 68 sub-account “Calculations for income tax” was not reflected in a timely manner | |

| Tax expenses were written off based on copies of the original document due to the fact that the supplier delayed the originals | Data on account 68 subaccount “Calculations for income tax” was distorted | The fine can be challenged if we are talking about expenses that the organization recognizes when calculating income tax on the basis of special tax registers. For example, any regulated costs (representation, advertising expenses, interest on loans, compensation for the use of an employee’s personal property in the service, etc.). Organizations, as a rule, take into account such expenses on the basis of certificates or other tax registers. And if so, then we cannot talk about distortion in accounting |

| Tax expenses were written off based on the primary report, which contains errors | ||

| Tax expenses were written off based on copies of the original document due to the fact that the supplier delayed the originals | Data on account 68 sub-account “Calculations for income tax” was not reflected in a timely manner | |

| The value of a fixed asset item was understated on account 01 (03) | Property tax is underestimated because the wrong amount is reflected in account 01 (03) | It will not be possible to challenge the fine, since the error is directly related to distortions in accounting. After all, the tax base is the average annual value of property, which the company determines according to accounting data (clause 1 of Article 375 of the Tax Code of the Russian Federation). Please note that since 2014, regional authorities may prescribe in legislation a different procedure for some objects: the cadastral value will become the basis, not the accounting value |

Fundamental Accounting Principles

The accounting process requires scrupulousness and accuracy, therefore it is based on the following principles:

- The principle of double entry - absolutely all business transactions of an organization must be simultaneously displayed as a debit to one accounting account and a credit to another account for a similar amount.

- The principle of autonomy - each organization must exist as an independent legal entity. Therefore, accounting records the property that directly belongs to a specific enterprise or organization.

- The principle of objectivity lies in the fact that all business transactions must be reflected in accounting, as well as registered at each stage of the process and confirmed by the relevant documentation on the basis of which accounting is carried out.

- The principle of prudence implies extreme caution in making judgments used in making calculations under conditions of uncertainty. This will help avoid future understatements of expenses and liabilities, as well as overstatement of projected income and assets. Strict adherence to the principle of prudence will help prevent excessive inventories and hidden reserves, deliberate understatement of income and assets, or deliberate overstatement of expenses and liabilities.

- The principle of a functioning organization. If an operating organization plans to maintain its position in the market in the future, then it is very important to pay off its own obligations to partners on time.

- Accrual principle - transactions are carefully recorded as they occur, without waiting for payment, and then they will begin to relate to the reporting period in which the transaction was made. This principle can be divided into two components: the principle of correspondence - this is when income for the reporting period must be correlated with the expenses with the help of which these incomes were received; the principle of recording income (in other words, revenue) - according to the rules, income must be reflected in the period when it is received, and not at the time of payment.

- The periodicity principle obliges the preparation of balance sheets and statements for the following periods: month, quarter, half-year and year. Thanks to this principle, it is possible in the future to easily compare reporting data, calculate financial results and make forecasts for the future.

- The principle of confidentiality. Data from internal accounting documentation is a trade secret of the company, therefore liability before the law is provided for damage or disclosure.

- The principle of monetary measurement - the results of economic activities must be measured in monetary units, that is, in the currency of the country where the organization operates.

Basic accounting rules

Organizations must maintain accounting records in compliance with the requirements of the Law of December 6, 2011 No. 402-FZ and a number of regulatory documents. So, when doing accounting you need to be guided by:

- federal and industry standards. Before their approval, documents regulating the accounting procedure approved before January 1, 2013 should be applied (Part 1, Article 30 of the Law of December 6, 2011 No. 402-FZ). In this case, these documents are applied to the extent that they do not contradict the Law of December 6, 2011 No. 402-FZ (information of the Ministry of Finance of Russia dated December 4, 2012 No. PZ-10/2012);

- accounting provisions (small businesses, guided by Part 4 of Article 6 of the Law of December 6, 2011 No. 402-FZ, have the right not to follow PBU 18/02, PBU 2/2008, PBU 16/02 and PBU 8/2010, PBU 11/2008);

- recommendations in the field of accounting (for example, letters from the Ministry of Finance of Russia);

- standards of an economic entity (i.e., these are instructions and regulations that the organization itself approved in order to streamline accounting);

- other documents in the field of accounting regulation.

This follows from the provisions of Articles 4 and 21 of the Law of December 6, 2011 No. 402-FZ.

The legislation establishes a number of requirements for accounting:

1. The organization is obliged to keep accounting records in rubles.

2. Accounting statements must be maintained continuously from the date of state registration until the date of termination of activities (as a result of liquidation or reorganization).

3. All accounting objects must be reflected in the accounting registers without omissions or exceptions (that is, each object must be documented and reflected in accounting).

4. Reflection of imaginary and feigned accounting objects in accounting registers is not allowed.

5. Accounting must be done using the double entry method (unless otherwise established by federal standards). In this case, it is not allowed to maintain accounting accounts outside the applicable accounting registers.

Such rules are established by part 3 of article 6, parts 2 and 3 of article 10, part 2 of article 12 of the Law of December 6, 2011 No. 402-FZ.

Micro-enterprises and non-profit organizations have the right to keep accounting using a simple system (without using double entry), having provided for this in their accounting policies (clause 6.1 PBU 1/2008, part 4 of article 6 of the Law of December 6, 2011 No. 402-FZ) .

Main tasks of accounting

The main and primary task of accounting is the constant formation of up-to-date and reliable information regarding the activities of the organization, as well as the full property status. This accounting information is necessary for a wide range of users: founders, owners of the organization’s property, managers, creditors, members of the organization, investors and other users of financial statements. With proper analysis, the data allows you to solve a whole range of problems:

- identification of internal reserves that are necessary to ensure the financial stability of the company;

- minimizing risks and preventing future negative indicators of the organization’s economic activity;

- control over the movement and availability of obligations, as well as property;

- control of the necessity and feasibility of business operations;

- careful control over compliance with legislation in the process of carrying out activities;

- monitoring compliance of activities with estimates, standards and approved standards;

- control over the use of financial, material and labor resources of the organization.

PBU 18/02 from the middle of the year

Situation: how to start using PBU 18/02 if an organization has lost the right not to apply it in the middle of the year (for example, it has lost its status as a small enterprise)?

PBU 18/02 must be applied from the beginning of the calendar year.

This is explained as follows. The income tax that must be paid to the budget is defined as a tax calculated from the organization’s accounting profit, adjusted to the amounts of permanent tax liability, permanent tax asset, deferred tax asset and deferred tax liability (clauses 20, 21 of PBU 18/02).

Income tax is calculated based on the results of the tax period - the year (clause 1 of Article 285, clause 2 of Article 286 of the Tax Code of the Russian Federation). Therefore, in order to do this correctly based on accounting data and their relationship with tax indicators, PBU 18/02 must be applied from the beginning of the calendar year.

In this case, it will be necessary to identify all the differences between accounting and tax accounting that arose from January 1 to the beginning of the quarter in which the organization lost its status as a small business entity. As of this date, permanent and deferred tax liabilities (assets) must be reflected. That is, an organization that has lost the right not to apply PBU 18/02 in the middle of the year must make additions to its accounting, reflecting all the necessary adjustments for the period when this provision was not applied. Do this in the period in which the obligation to apply PBU 18/02 arose.

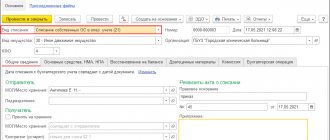

An example of how to reflect the differences between accounting and tax accounting. The organization has lost its status as a small business entity

Alpha LLC lost its status as a small business entity in September 2016. The accountant reflected the differences according to PBU 18/02 from January 1, 2016. In the organization’s accounting since January 1, 2016, the accountant identified only one difference between accounting and tax accounting: in the residual value of the fixed asset item. In tax accounting it amounted to 50,000 rubles, and in accounting – 60,000 rubles. The depreciation rate per month in tax accounting is 1,389 rubles, and in accounting – 1,667 rubles. There are 24 months left until the end of the useful life (both in accounting and tax accounting).

The accountant of Alpha LLC made the following entries in 2016:

Debit 68 subaccount “Calculations for income tax” Credit 77 – 2000 rubles. ((RUB 60,000 – RUB 50,000) × 20%) – deferred tax liability is reflected;

Debit 44 subaccount Credit 02 – 1667 rub. – depreciation has been calculated;

Debit 77 Credit 68 subaccount “Calculations for income tax” – 56 rubles. ((RUB 1,667 – RUB 1,389) × 20%) – reflects the decrease in deferred tax liability.

Over the course of 24 months, the accountant will charge depreciation and write off the deferred tax liability.

Make additional entries based on supporting documents (Part 1, Article 9 of Law No. 402-FZ of December 6, 2011). For example, these could be:

- primary documents indicating the emergence of differences between accounting and tax accounting;

- accounting certificate justifying the entries made.

If necessary, make a change to the organization's accounting policy for the current year: specify the obligation to use PBU 18/02 and the procedure for its application (clause 10 of PBU 1/2008).

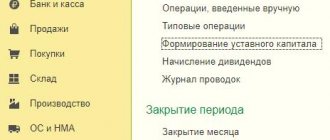

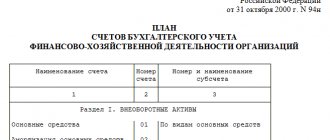

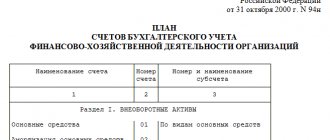

Working chart of accounts

The obligation to approve the working chart of accounts is established in paragraph 4 of PBU 1/2008. When developing a chart of accounts, it is necessary to rely on accounting policies for accounting purposes. At the same time, the working chart of accounts must take into account the specifics of the organization’s activities. This can be achieved if synthetic and analytical accounting is optimally constructed.

The work plan should include only those synthetic accounts that the organization will use in practice. Please note that new synthetic accounts (not provided for in the chart of accounts) can be added to the work plan only with the approval of the Russian Ministry of Finance. This is stated in paragraphs 4 and 6 of the Instructions for the chart of accounts.

An organization can determine the structure of analytical accounting (types of subaccounts, depth of analytics, etc.) independently. In this case, analytical accounting data must correspond to the turnover and balances of synthetic accounting accounts.

In the Instructions for the chart of accounts, after the characteristics of each synthetic account, a typical scheme of its correspondence with other synthetic accounts is given. If facts of economic activity arise, correspondence for which is not provided for in the standard scheme, the organization can supplement it, observing the uniform approaches established by the Instructions (letter of the Ministry of Finance of Russia dated March 24, 2009 No. 07-02-06/90).

Continuity, double entry and currency

All the main and basic requirements for accounting on the territory of the Russian Federation are formulated in Article 8 of Law No. 402-FZ. In particular, it is provided that:

- Accounting must be carried out continuously from the moment the organization comes into existence until its liquidation for one reason or another.

- To reflect the state of property, liabilities and business transactions, the double entry method is used in the accounting accounts included in the current plan. This means that the accountant must make any entry simultaneously on two accounts: debit and credit.

- The cost of goods, materials, works, services and other assets and liabilities can only be taken into account in the currency of the Russian Federation - rubles. Accounting and reporting in foreign currency are acceptable for organizations with foreign participation, but are secondary in relation to ruble expression.

- The main requirements for accounting are also its continuity and completeness of entering into registers all transactions without exception. Companies do not have the right to independently change the terms or conditions for entering information about all business transactions, balances and inventory results into accounting accounts. Omissions or deletions of any transactions from the credentials are unacceptable.

- Analytical accounting must correspond to the turnover and balances of synthetic accounting accounts. Analytics is needed to detail, group and decipher transactions, and synthetic accounting data is needed to compile a balance sheet.

- For some types of operations, for example, for current costs of business activities and capital investments, separate accounting is provided.

- The method of accounting and its features must be prescribed in the accounting policy of the organization.

These are the accounting requirements briefly set forth by law. All this information also serves as the basis for calculating taxes, although accounting and tax transactions are accounted for separately. In addition, recording transactions by accountants involves many other important conventions:

- mandatory document flow and primary documents, as well as their storage;

- the presence in the organization of at least one accountant with specialized education;

- preparation and submission of reports to Rosstat and the Federal Tax Service;

- conducting annual inventories;

- other conditions.

Also, in each field of economic activity, such as banking, insurance, construction or trade, there are special requirements applicable to a specific situation or group of transactions. Accounting procedures in the Russian Federation are regulated by federal standards, which are equivalent to PBUs and international standards, which are gradually being introduced by the Ministry of Finance. In many matters, accountants have to rely on letters from officials, since the legislation does not fully disclose them.

Disagreements between the chief accountant and the director

Situation: what should the chief accountant do if disagreements arise between him and the head of the organization regarding the reflection of a particular transaction in accounting?

The chief accountant needs to request a written order from the manager to formalize the controversial transaction.

It is with the written order of the head of the organization that one can reflect or not reflect accounting objects and take into account (or not) the data of primary documents in a situation where there is a disagreement on this issue between the director and the one who is responsible for accounting. In this case, the manager is solely responsible for the accuracy of the reflection of the financial position, financial result, cash flow and other information.

This conclusion follows from Part 8 of Article 7 of the Law of December 6, 2011 No. 402-FZ.

Without a written order from the manager, dubious documents should not be accepted for execution.

Situation: how to transfer affairs when changing the chief accountant?

If the chief accountant resigns, he is obliged to transfer to his successor all documents and material assets for which the accounting department is responsible. In practice, they usually draw up an act of acceptance and transfer of documents or a special inventory. At the same time, keep in mind that accounting documents, in particular primary reports, registers, accounting policies, audit reports, etc., must be stored for at least five years (Article 29 of the Law of December 6, 2011 No. 402-FZ). That is, all such documents for such a period must be included in the inventory or in the act.

Accounting objects

The main objects of accounting are considered to be:

- the entrepreneur’s agreements are also obligations;

- property assets owned by a commercial organization;

- transactions that are carried out in the process of doing business.

Property or property assets, in turn, consist of current (for example, money in cash and accounts, inventories of raw materials, accounts receivable) and non-current assets (for example, capital investments, land, fixed assets). The organization's obligations include: wages, bills payable, taxes payable, etc.

Internal control

The organization is obliged to organize and carry out internal control of the facts of economic life (Part 1, Article 19 of the Law of December 6, 2011 No. 402-FZ). How exactly it is necessary to organize such control is not explained in the legislation. In practice, for this purpose, an internal control service of the organization is usually created or a responsible employee is appointed. Specify the functions and tasks in the job descriptions of employees who are responsible for internal control and in the Regulations on Internal Control.