Work in progress - account in accounting

According to clause 63 of Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n “On approval of the Regulations on accounting…” in accounting, work in progress in accounting is considered to be products or work that have not completed the full cycle or all stages of the technological process.

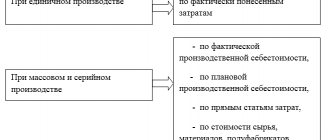

In addition, unfinished products include manufactured products that have not yet passed the necessary tests and technical acceptance or are not fully equipped. According to paragraph 64 of the same order, the value of work in progress is reflected in accounting in several ways, namely by:

- planned or actual production cost;

- direct cost items;

- cost of used raw materials, semi-finished products and materials.

These methods relate to serial or mass production, and in single production, cost estimation is carried out on the costs actually incurred to manufacture the product.

According to paragraph 1 of Art. 319 of the Tax Code of the Russian Federation, work in progress is a product that is partially ready, that is, it has not gone through all the stages of technological processing that are provided for by the applied production process. Work in progress for tax accounting purposes includes not only products, but also semi-finished products of own production, as well as materials transferred to production if they have undergone any processing.

When accounting for work in progress, account 20 “Main production” is used, the debit of which collects all costs incurred during the production process. At the end of the month, the cost of finished products is written off from the credit of account 20, and the balance that remains in debit is work in progress.

If you have access to ConsultantPlus, check whether you correctly account for work in progress in accounting. If you don't have access, get a free trial of online legal access.

Accounting in construction organizations

Accounting in construction organizations has always been considered one of the most difficult methodological issues.

Despite the presence of a number of regulatory documents in the form of accounting provisions regulating various accounting issues, including a specialized accounting provision “Accounting for construction contracts ” and simply a number of scientific articles on cost accounting in construction organizations, accountants of such organizations have problems Lots of questions about tax and accounting.

One of the complex and at the same time important issues is the procedure for economically justified determination of unfinished construction work and, accordingly, the correctness of determining the financial result of the work accepted by the customer. The procedure for recognizing expenses for completed construction work in tax and accounting is different, but there are clear instructions (taking into account the right of choice allowed to the organization to choose methods and methods, which is reflected in its accounting policy) on how to carry out the initial accounting of the cost of expenses incurred. In this article we would like to dwell on a problem that is of equal importance for both accounting and tax accounting purposes.

The object of this scientific work is cost accounting and its reflection in the accounting policies of a construction company. The subject of the study is the accounting of work in progress and the procedure for determining the financial result.

The relevance of the chosen topic is due to the need to eliminate gaps in the regulatory framework for determining work in progress and creating prerequisites for the competent construction of accounting policies. Based on the above reasons, we can conclude that the regulatory improvement of the cost accounting system will allow the organization to expand its ability to achieve efficiency and mobility, which will help increase the organization’s competitiveness in the market.

Moving on to a general overview of the issue, it is necessary to clarify the specifics of the subject being studied:

- Accounting for work in progress is determined by the contractor's company;

- The accounting policy does not specify the procedure for writing off costs for work in progress;

- The stages of acceptance of work are also not specified in the contract or for some reason are not followed.

Such a formulation of the problem can be considered legitimate, since it is the option proposed for consideration that prevails in economic realities and causes the greatest difficulties in accounting. Work in progress (hereinafter referred to as WIP) in construction for accounting purposes includes the contractor's costs at construction sites for unfinished and not delivered to the customer work performed in accordance with the construction contract. Recognition in accounting for expenses is associated with the moment of delivery of the object under the contract and according to the terms of the contract: the object can be handed over both in stages and as a whole. Thus, depending on the conditions (procedure) for the delivery of work on the construction project pre-established in the contract, the contractor’s accounting service opens to the accounting object either the entire contract or part of it, as a stage subject to separate accumulation of costs.

In a situation where the parties to the contract during the construction process adhere to the chosen procedure for accepting work, namely, according to the stages established in the contract or generally upon completion of construction, the contractor’s accounting service does not have any difficulties. In this case, if the construction customer accepts from his contractor the scope of work as a whole under the contract or part of it in the form of predetermined stages, then the contractor’s accounting service closes the value of the accumulated costs for the object of accounting for the scope of work accepted by the customer and generates a financial result. At the same time, at the end of the reporting period there is no work in progress for such an object. If at the end of the reporting period the customer does not accept the work, then all costs accumulated during the reporting period are not written off anywhere and are reflected as work in progress.

Civil legislation today gives significant freedom to business, including the right for the parties to choose the order of building their relationships, which leads to the fact (and this is widespread) that, when concluding a contract agreement, the parties determine in detail the scope of work only as a whole under the contract , without highlighting the stages of construction work. And in a situation where the customer subsequently begins to accept completed work in parts that were not previously allocated into separate stages subject to separate acceptance, the contractor’s accounting service faces a problem, the solution of which cannot be solved by the existing regulatory framework for both accounting and tax accounting.

The essence of this problem is as follows: if in advance the entire contract was singled out as an accounting object in the contractor’s accounting, then when the customer accepts part of the work (naturally described in the form of certain sections of the construction estimate), it becomes unclear what the value of the accumulated costs for the construction project at the time signing the act must be written off in the contractor’s accounting department. If, for example, the cost of accepted work to customers corresponds to 65% of the contract, this does not mean that 65% of already accumulated costs need to be written off against the accepted volume of work. As practice shows, as a rule, almost the entire (but not in full) value of accumulated costs for a construction project is subject to write-off.

And here it is appropriate to turn to the regulatory framework to clarify alternatives. A close examination shows that freedom is offered to businesses in such a situation. That is, organizations must independently resolve this issue and reflect it within the limits of their accounting policies.

The set of analogues of accounting standards approved today by the Russian Ministry of Finance, referred to as accounting provisions, does not regulate the procedure for determining the cost of work in progress. The specialized accounting provision “Accounting for construction contracts” also does not answer the question posed. The provision is aimed at determining the amount of work performed under the contract, even if the customer does not accept this work in the reporting period, introducing a method for assessing revenue “as ready,” which in itself already excludes the presence of work in progress as such.

A similar situation exists with tax legislation. The current version of Article 319 of the Tax Code of the Russian Federation (Tax Code of the Russian Federation) establishes that the taxpayer independently determines the procedure for distributing direct expenses for work in progress and for work performed in the current month.

It should be noted that until 2005, the previous version of Article 319 of the Tax Code of the Russian Federation provided for the procedure for determining work in progress, which was as follows: it was proposed that the cost of recorded direct costs be distributed among the balances of work in progress in proportion to the share of unfinished work in the total volume of work performed during the month. But this approach had certain limitations. It gave a more or less correct idea of the size of the work in progress, provided that in the reporting period there were many construction projects on which work was carried out, the volume and rate of return for which were approximately the same. But in a situation where the organization performed work under one contract during the reporting period, and only part of the work under this contract was accepted by the customer, this method of determining work in progress was not applicable.

In our opinion, in a situation where the contractor’s accounting service is faced with a situation where it is known that there may be partial acceptance of work by the customer for parts (stages) not provided for in the contract, we can propose to consider an approach to determining work in progress based on the planned rate of return of the project. When concluding construction contracts, a work estimate is always developed, which includes both the cost of the resources used and the planned rate of return on the project, which is agreed upon by the parties to the contract.

The essence of our proposal is to apply the planned rate of return to the volume of work accepted by the customer when determining the cost of this work. In this case, if during the term of the contract the customer accepts the completed volumes of work in parts, then the financial result from the completed work will be evenly distributed over the entire cost of the contract. In the course of the changes made in the accounting policy, that is, provided that the proposed method is prescribed in it, the following results will be achieved:

- Specification of accounting and tax accounting methodology in accounting policies;

- Increasing the accuracy and transparency of accounting and tax data;

- Systematization of data for analysis and audit purposes.

Article on the topic of Accounting for work in progress in construction organizations

Main aspects of assessing work in progress and calculation formula

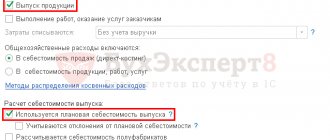

The method that was chosen in the organization to determine the cost of products must be enshrined in the accounting policy. The financial result of the reporting period, as well as the amount of corporate income tax, largely depends on it.

Attention! From 01/01/2021, work in progress is included in inventories, the accounting procedure for which is regulated by the new FSBU 5/2019 “Inventories”. PBU 5/01 has been cancelled.

How to take into account work in progress according to the new rules, read the Ready-made solution from ConsultantPlus. Trial access is available for free.

Let's take a closer look at the methods for assessing work in progress that are used in accounting:

1. Valuation at planned (standard) cost (clause 27 of FSBU 5/2019).

This method is based on the Standard Guidelines for the Application of the Standard Accounting Method dated January 24, 1983 No. 12, which reflects specific recommendations for application. It can be used in the production of complex products related to clothing, furniture, metalworking, engineering and similar industries with a long production cycle.

The accounting method at planned (standard) cost involves accurate accounting of available quantitative data on the balances of work in progress (hereinafter referred to as WP). It is based on the use of standards to account for all costs incurred, as well as deviations from standards in order to identify the causes and location of their occurrence.

Standard cost is a kind of accounting price, which is calculated for each group or type based on product cost calculations. In this case, the cost of work in progress is calculated as follows:

Cost of IR = Number of IR × Unit cost of IR.

2. Valuation at actual cost (clause 23 of FSBU 5/2019).

With this method, a complete calculation of the cost of manufactured products is carried out, according to which the assessment of work in progress in accounting is done based on direct and indirect costs. This method should be applied to all types of products, and therefore it should be used if the enterprise has a fairly small range of products or works.

The actual cost of work in progress, as well as finished products, will be calculated using the formula:

Actual cost = direct costs + production overhead + general operating expenses.

ATTENTION! FSBU 5/2019 does not provide for the assessment of work in progress at the cost of raw materials, materials and semi-finished products. That is, from 2022 this assessment method cannot be used.

Before 2022, the raw material method was most often used when production was considered material-intensive. At the same time, direct costs of raw materials and materials had the greatest share in costs.

Read about accounting methods in the article “Basic methods of accounting for production costs.”

What expenses form the actual cost of work in progress?

The actual cost of work in progress includes costs associated with the production of products, performance of work, and provision of services (clause 23 of FSBU 5/2019). Such costs include:

- material costs;

- labor costs;

- contributions for social needs;

- depreciation;

- other costs.

They, in turn, are divided into direct (directly related to the production of a specific type of product, work, service) and indirect (which cannot be directly attributed to the production of a specific type of product, work, service) costs (clause 24 of FSBU 5/2019 ).

The list of direct expenses that are attributed to work in progress must be specified in the accounting policy (their list is given in paragraph 23 of FAS 5/2019).

The company is also obliged to establish in its accounting policy an economically sound method for distributing indirect costs generated on account 25 between specific types of products (works, services) (clause 25 of FSBU 5/2019).

Previously, account 26 “General business expenses” was distributed to account 20 “Main production”. But from 2022 this cannot be done. Now account 26 is closed to account 90 “Sales”. This is a consequence of the abolition of the method of accounting for work in progress at full cost from 2022.

Cost increase factor

It is necessary to talk separately about the cost increase coefficient, which is a characteristic of the increase in costs per unit of production as the technological cycle progresses. It is used when it is necessary to determine how certain costs that have dynamics increase, for example, wages, electricity, depreciation of fixed assets.

The rise factor (K) is calculated using the following formula:

K = Cost of a unit of production in NP / Total amount of production costs.

This is the most general formula that reflects the basic essence of the coefficient.

IMPORTANT! In practice, more complex calculations based on the above formula can be used for different types of production. This depends on the purpose of the calculation and the characteristics of the production process itself.

Assessment of work in progress

Work in progress is valued in several ways.

At actual cost

This method is suitable for any organization, regardless of its scale of production - single, serial or mass.

The actual cost includes costs that are associated with the production process - material costs, labor costs, insurance premiums, depreciation, etc.

The actual cost does not include the following costs:

- appeared in connection with improper organization of the process (consumption of raw materials or energy above the norm, defects, violation of labor discipline, etc.);

- arising due to a natural disaster, fire, accident or emergency;

- impairment of other assets (regardless of whether they were used in this production or not);

- administrative expenses (with the exception of situations when they are directly related to the production of products, performance of work, provision of services);

- storage costs (with the exception of situations where storage is part of the technological process);

- advertising and promotion costs;

- other costs that are optional for this production process.

Attention! The actual cost includes both direct and indirect costs. The company independently develops a method for their distribution and consolidates it in its accounting policies. Sometimes the distribution is made in proportion to revenue, and sometimes in proportion to the number of items produced. In addition, other options are possible.

At standard cost

This method can only be used in serial or mass production. It is prohibited to use it in single production.

The company approves cost standards for the production of a particular product. The standard refers to the amount of costs required for its production. The calculation is made on the basis that the volumes of consumed raw materials, energy, labor and other resources, fuel, as well as capacity utilization are standard for this industry.

The standards must be periodically recalculated in accordance with the current conditions of the production process.

By direct cost items

This method is intended for batch or mass production only.

Its essence lies in the fact that the unit cost of production includes only direct costs, and indirect ones are not included. This method of assessment makes accounting easier.

At the cost of raw materials, semi-finished products or materials

This method is not provided for by the FSBU standard 5/2019. It turns out that it cannot be used from 2022. If the company had used it previously, it should have chosen a different method for valuing work in progress.

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

Work in progress account: what is the method for generating entries and writing off expenses for losses

At the end of the month, in order to identify the balance on account 20, you should take into account the costs that were incurred during the production process. It is necessary to understand that it accumulates all costs, both direct (attributable directly to the technological process) and indirect, also associated with production (general production and general economic).

The amount received in the debit of account 20 is the cost of manufactured products. It can be of 2 types:

- full, including direct, general production and general economic costs;

- reduced, including direct and general production costs.

IMPORTANT! The method for determining the cost of production must be enshrined in the accounting policy of the enterprise.

Then the generated cost of finished products is transferred to account 40 “Product Output”, account 43 “Finished Products” or account 90 “Sales”. Account balance 20 is work in progress.

Remains of work in progress can be used next month or written off to account 91.2 “Other income and expenses.” An example of such a situation is management’s decision that unfinished material assets in the future will not be used in the manufacture of products due to the abandonment of their production. Another situation may be the liquidation of the enterprise itself, and therefore the remaining unfinished products are written off as company expenses.

For more information about writing off work in progress, read the material “Procedure for writing off work in progress (nuances).”

What is incomplete

Reflection of work in progress (refinery) in accounting is regulated by the FSBK standard 5/2019 “Inventories”. In paragraphs “e” clause 3 of this document states that work in progress is the company’s expenses for:

- products that have not passed all production stages according to the technological process;

- incomplete products;

- products that have not been tested and have not passed technical acceptance;

- performance of work (provision of services) to other persons until the moment of recognition of sales revenue.

A similar definition of work in progress is specified in paragraph 63 of the Accounting Regulations, regulated by Order of the Ministry of Finance dated July 29, 1998 No. 34n.

Important! Until 2022, companies accounted for refineries on the basis of the no longer valid PBU 5/01. The transition to FSBU 5/2019 was carried out in two directions. If the organization had a retrospective transition method specified in its accounting policy, then it had to recalculate work in progress balances as of January 1, 2022 based on the requirements of the new standard. If a promising method was specified, then there was no need to recalculate.

Work in progress in accounting - transactions transactions

As mentioned earlier, for accounting of work in progress, account 20 “Main production” is used. To account for all transactions, the following entries are made:

- Dt 20 Kt 02, 10, 23, 25, 26, 60, 69, 70 - costs attributable to the production of products or performance of work are taken into account;

- Dt 40, 43, 90 Kt 20 - the cost of finished products or work performed is written off.

The balance resulting from the debit of account 20 after write-offs is the amount of work in progress.

Read more about account 20 in the material “Costs in work in progress - main account.”

In what account are balances recorded and how is work in progress from previous periods reflected?

So, from all of the above it is clear that the balance of work in progress is the balance of account 20, which is transferred from the end of the previous period to the beginning of the next. Thus, this amount does not leave the specified account if further use of work in progress in the technological process is planned.

It should be noted that if production has a long cycle, for example several months, then work in progress will move from one month to another until it reaches the readiness stage.

Valuation of work in progress in tax accounting

In accordance with Art. 319 of the Tax Code of the Russian Federation, work in progress in tax accounting means:

- products or work that have been produced but not yet accepted by the customer;

- balances of unfulfilled orders;

- semi-finished products of own production;

- raw materials or materials that have been sent to production and have undergone any processing.

The assessment of work in progress in tax accounting is carried out at the end of the month, using data on balances in quantitative terms by type of product, as well as the amount of direct costs incurred this month. Work in progress balances identified at the end of the tax period are carried forward to the beginning of the next one and are included in direct costs.

This transformation of work in progress into direct costs is possible if certain conditions are met, namely:

- The costs incurred must necessarily correspond to the products for the manufacture of which they were made. It is necessary to relate costs to a specific type of product, but if this is not possible, a mechanism for allocating costs across different types of products should be developed.

- The mechanism for allocating costs by type of product and the method for estimating work in progress balances must be enshrined in the accounting policy.

- This procedure for distributing costs by type of product must be used for at least 2 tax periods.

ConsultantPlus experts explained in detail how to take into account work in progress in income tax expenses. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

Entering WIP balances into 1C:ERP Enterprise Management

Author of the article: Vera Aleksandrovna Pikuren

She has been working at the Razdolye Exhibition Center since 2005. Currently – Project Manager. She started with the implementation of the 1C:UPP configuration, and since 2015 she has been implementing 1C:ERP. During this time, I successfully launched 6 factories on 1C:ERP. The last project (JSC NPO LEMZ) became the winner of the Corporate Automation Competition “1C: Project of the Year” in the category “Best Project of the Year in the subject area Accounting and Tax Accounting” (https://eawards.1c.ru/projects/1200-rabochih-mest -na-1s-erp-41612/ ).

The article complements the online course “Practical aspects of implementing regulated accounting and cost calculation in 1C:ERP at large industrial enterprises” -

I wrote this article due to the fact that both in our projects and in the projects that we see in the 1C:ERP implementation market, I often encounter issues with the correct entry of initial balances, especially in difficult situations. Currently, I have released a lot of methodological materials on entering initial balances, including a rather convenient table with summary information on which document should be used to enter this or that type of opening balance:

https://its.1c.ru/db/erp24doc#bookmark:remnanttypes:RemnantTypes.

However, some sections of accounting contain a number of nuances that not all consultants know.

In this regard, we have prepared a series of articles on entering balances, where we will analyze them in more detail.

I will consider examples based on the 1C:ERP 2.4.10.93 configuration.

Let's start with the most difficult block - work in progress.

Here is what is written in the table on the ITS:

| Account number | Account name | Documents for entering balances | More details |

| 20 | Primary production | Documents for entering initial balances ( Documents for entering initial balances ( | Remains of work in progress Goods and products in the organization’s own warehouses Balances of unallocated itemized expenses |

| 23 | Auxiliary production | Documents for entering initial balances ( Documents for entering initial balances ( | Remains of work in progress Goods and products in the organization’s own warehouses Balances of unallocated itemized expenses |

| 25 | General production expenses | Documents for entering initial balances ( Other expenses ) | Balances of unallocated itemized expenses |

| 26 | General running costs | Documents for entering initial balances ( Other expenses ) | Balances of unallocated itemized expenses |

| 28 | Defects in production | Documents for entering initial balances ( Documents for entering initial balances ( | Remains of work in progress Goods and products in the organization’s own warehouses Balances of unallocated itemized expenses |

| 29 | Service industries and farms | Documents for entering initial balances ( Documents for entering initial balances ( | Remains of work in progress Goods and products in the organization’s own warehouses Balances of unallocated itemized expenses |

In fact, the technology for entering initial balances will depend on two things: what exactly the client can give you from the old system and what scheme for working with the cost block is chosen for the current project.

The first question is the key one. It is often left at the start of the project development project, but in fact, the issue of residuals should be worked out by consultants at the very initial stage of the project (functional modeling, conceptual design, etc., it is called differently in different companies).

Let's start with material costs, namely, leftovers in the pantries. It is very rare that someone has them in the required 1C:ERP form: name of materials, their quantity and cost. Usually this is still a kind of “cauldron” with some options for maintaining additional records by masters in Excel.

The ideal option for the project is if the customer agrees to conduct an inventory of work in progress and collects the necessary data. But this decision is a big risk for the project, which consultants must, for their part, very carefully plan and monitor. What I mean: production inventory is a complex and slow process. No one will stop the plant just so that our program can be launched easily. A good inventory takes several weeks (and sometimes months), and is usually carried out by workshop: some workshop is stopped for several days and recalculated. You, as IT specialists, need to literally take the production manager by the hand and together with him, step by step, discuss the procedure for each workshop and its deadlines. Convey to him that it will be necessary not only to evaluate work in progress based on the percentage of orders completed, but to recalculate materials and semi-finished products in the workshops.

The peculiarity of the WIP inventory is that usually the members of the commission cannot always independently determine what exactly lies in front of them in the workshop. This is not a warehouse; there are usually no packages with names. Thus, first, the production workers themselves recalculate the work in progress, write labels with the article number, name and quantity on the materials and semi-finished products, which also takes some time. Then the commission members walk around the workshop, collecting these labels, selectively counting the parts. And then this information will still need to be manually entered directly into the program or into Excel for downloading.

I describe the process only to make clear its complexity and, as a consequence, duration. It’s impossible to cover the entire plant at once, so for some workshops you will have balances, for example, on December 20th, and for some – on January 15th. And, accordingly, you, as consultants, will need to come up with a work plan in ERP taking into account such deviations.

And you need to understand that in the end, at the output you will only receive the quantity of the item, according to which you will also need to determine the cost. And this cost will have to coincide with the balances according to regulated accounting that the accountants will give you. You and your economists or accountants need to come up with a scheme to “spread” the amount received from outside over the calculated quantity. At the same time, we should not forget that the amount will most likely be different for accounting and tax accounting, which must be taken into account in the distribution rules. And then, in March, when the accounting department closes the year, you will need to do this exercise again, with the adjusted amount.

Any scheme, be it “distribute according to the planned cost” or “distribute according to the price of the last purchase” will be based on certain assumptions that can lead to distortions in cost when you start writing off inventory items from the workshop storerooms into production. Thus, in order to secure the project, I recommend writing a separate technical specification for the transfer of WIP balances, which should be agreed upon with all services. Among other things, the technical specifications should include an inventory schedule.

After receiving the quantitative and total balances in the system, it is imperative, together with economists, to conduct an audit of 20% of the item items with the highest cost to determine the adequacy of their prices.

Additionally, it is worth noting that with 100% accuracy, WIP is unlikely to be recalculated. There will always be deviations, and even before starting, you need to decide what you will do in the event that workers in the workshop try to write off in the program something that is not listed in the storeroom. A simple and fast reaction mechanism is definitely needed, otherwise the start of the project will be bogged down in unaccomplished “production stage” documents. It’s a bad idea to delete something that interferes with the document, because then the problem will no longer be caught, and as a result of the first cost calculation, you may end up with a part costing 100 rubles instead of 10 thousand, which will undermine confidence in the program.

We usually temporarily allow shop managers to bring inventory items to their storerooms (on the 1st day of the launch month). This, firstly, gives us specific quantitative data on the quality of incoming residues, and secondly, it gives us some time to deal with them without stopping the process.

The point I'm trying to convey is that although formally issuing incoming balances for loading into the new system is the customer's task, it can easily ruin the entire project, so both parties need to take care of this problem.

For enterprises that fulfill government orders, the issue of assigning inventory balances in storerooms to contract numbers should be additionally worked out. Here, too, various options are possible, depending on the enterprise. Usually, if the client did not have such a division in his accounting, then at the entrance to the new system we consider all the materials in the storerooms to be the remainder of the organization, and we already do normal separate accounting from the moment the program is launched.

A more adequate option for the project is if the shop managers still maintain inventory balances somewhere, which can be relied upon when receiving balances. But the problem with the amount of BU and NU that will need to be distributed among them will still remain.

The best option is if, in the old information system, workshop storerooms were maintained in the form of warehouses on 10 units. That is, everything we need is already there: nomenclature, quantity, and cost. If the client is ready to transfer them to the new system at 20k for ease of work, then the balances are first entered precisely as balances to the auxiliary warehouse at 10k on December 31st according to the scheme that will be described below, and on January 1st a document “Transfer of goods” is created, which will transfer leftovers from the auxiliary warehouse to the workshop storerooms. The amount on 20k will appear after the close of January.

So, let’s say that you still received the necessary balances of materials. Now let's look at the technology, how exactly to introduce them into the program.

Balances in warehouses (regular and storerooms) are entered using the document “Entering initial balances”. They are located in the section “Master data and administration” - “Initial filling” - “Documents for entering initial balances”. Documents are entered with the transaction type “Own goods”.

The header of the document indicates the warehouse and division. The department is indicated for reference. In the event that the balances are entered into the workshop storeroom, then the unit will be put into motion precisely from the storeroom details, and not from the department that you indicated in the header of the document.

The document also indicates the type of activity for VAT purposes and the batch. If the first one is clear, then let's look at the game in more detail.

A batch can be either an internal invoice or a supplier invoice.

If an organization keeps records using FIFO, then the purpose of the batch is clear - it determines the date of receipt of inventory items at the warehouse. If in the old system there is where to get this information, then for each receipt it will be necessary to create a separate document for entering initial balances. If we are dealing with storerooms, then usually the information about the batch has already been lost, and then, in principle, it is possible to “plant” the balances into one batch, having previously discussed this with the chief accountant.

If an organization maintains average accounting, then the issue of specifying batches will depend on whether it maintains separate VAT accounting.

For cost accounting purposes, in the case of an average batch, a batch is not needed; balances can be entered in one batch. But for the purposes of separate VAT accounting, data on the batch is written to the accumulation register “Detailing of batches of goods for VAT and simplified tax system”, on the basis of which VAT will be restored in the event that inventory items are transferred between different types of activities. If such a situation is possible, then it is necessary to enter balances in the context of invoices, even in the case of accounting using the average. We will consider entering balances for VAT purposes in more detail in a separate article.

Now let's consider the option when the company is not ready to conduct an inventory. All you have as input are several cost items with amounts. For ERP, this is a very complex situation that requires step-by-step elaboration not so much from the point of view of the technology for entering balances, but from the point of view of the further operation of the system.

It’s good if material costs have already been assigned to some order for 20k. Then the balances for them are entered as a regular itemized expense, which I will talk about later. In this case, work with stages in the new system is built only according to the new nomenclature, which will begin to be transferred to the storerooms, and itemized costs hang on the order, awaiting releases. At the same time, it is necessary to understand that in reality the total 20k in accounting are specific inventory items that are in the workshop. And it is unlikely that a worker who will reflect in 1C the consumption of materials at the production stage will be able to distinguish what he received according to the new scheme from the initial balance. Thus, you, together with economists and production workers, need to immediately agree on what the operator will do in the program when some inventory items in the storerooms are not enough in the accounting, although in fact they are. Here you can consider the option of deleting such lines (assuming that the consumed inventory items have actually already been written off as costs in the previous IS), but you must understand that this decision will inevitably lead to large imbalances between the costs of the stages. If the production cycle is short, and the transitional stages will close within a few months, then this situation can be tolerated.

As an option, you can propose to allow all missing inventory items to be sent to the shop managers, and at the end of the month they will figure out from which stages the “extra” inventory items should be removed - here it all depends on the specific enterprise. But in any case, it is better to start working on this issue at the very start of the project, so that the operators in the workshop have two instructions at once: for the transition period and permanent.

The most difficult option for a project is when the WIP at the input is the notorious “boiler”, which now somehow needs to be transferred to the program logic. Here I would take this path (in terms of material costs):

- Enter the entire cost of materials as itemized expenses using a manual operation Dt 20 <Item entry of remaining materials> KT 000.

- Allow shop managers to capitalize inventory items that are missing in accounting. Receive inventory at the price of the last purchase or the average cost under the old program. In the “Capitalization” document, manually set the postings Dt 20 <storeroom, item> Kt 20 <Item for entering remaining materials>, because the program, of course, does not automatically allow you to receive materials at the expense of work in progress.

Such a scheme requires further elaboration from the point of view of maintaining management accounting (managerial balance sheet, etc.), but here everything will depend on the type of enterprise and project.

In addition, let me remind you about reports. We must not forget to discuss with the customer that he will be able to obtain a normal plan-actual cost analysis only after the transitional stages in the system are closed. Until this point, part of the material costs can be compared with the specification, and part will be shown by the system in the form of itemized costs. Usually customers are fine with this, otherwise they would have to give us not just the materials that are in production, but those that were installed on the products in the work in progress. I have not yet come across factories that kept such records. But if you suddenly come across them, then in ERP you can enter the following balances too:

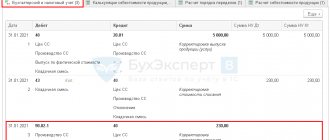

Such balances in 1C:ERP are entered into the program by the document “Initial WIP balances by production batches” on the “Materials and Works” tab.

The document indicates the batch, nomenclature, its quantity and cost.

The document generates movements in the “Cost of Goods” register in the “Work in Progress” accounting section.

The document is entered separately for each division and area of activity. Since I usually implement ERP at factories that carry out state defense orders, the area of activity there is a Contract with the customer. Stages of production are usually carried out under certain Contracts, and, accordingly, belong to a certain area of activity. That is, my input of initial balances will be divided not only into divisions, but also into contracts.

The document writes tasks in the RS “Tasks for cost calculation” and “Tasks for closing the month. Formation of financial results." The latter needs to be deleted, but the cost calculation for December will need to be performed.

When performing a month-end closing, the task to generate a financial result will still appear after reflecting the initial balances in regulated accounting. You will need to go to the list of documents “Routine operation”, mark the December ones for deletion and then again clear the entries in the PC “Tasks for closing the month”.

Now let's return to the document, namely the production batch. For 1C:ERP, this is a “Stage” document generated on the basis of a Production Order. One of the most creative challenges when entering WIP balances is to figure out how to transfer the cost collection object in the old system into our stages. It is impossible to give any universal solutions here. The main recommendation is to make this retranslation as transparent and simple as possible. It is better to avoid any complex distributions of incoming amounts between stages, because any distributions will lead to cost imbalances between stages, which will then be difficult to explain to the customer. It is much easier to attribute incoming WIP, for example, to the last stage (to the finished product itself), and leave semi-finished products without WIP, highlighting them in batches in accounting. But, I repeat, it all depends on the specific enterprise.

Now let's move on to labor costs. We typically enter these as itemized expenses. Even if the customer has information in the old system about how much and what types of work have already been spent on completing a particular order, this data rarely coincides with the balances of work in progress according to regulated accounting.

However, if you come across an enterprise with ideal accounting, then you can also enter the labor costs spent on the order using the document “Initial WIP balances by production batches” on the “Labor costs” tab.

The document indicates the batch, type of work, quantity, price, and actual cost.

A separate document is introduced for each division, as well as for each area of activity.

The document writes tasks in the RS “Tasks for cost calculation” and “Tasks for closing the month. Formation of financial results." The latter needs to be deleted, but the cost calculation for December will need to be performed.

When executed, the document generates entries in the RN “WIP Labor Costs” with filling in the quantity, standard and actual cost.

Debit entries to the document are established according to the department's accounting account with details by type of work.

The last block of costs is itemized costs. And here again, in customer accounting, two different options are possible: he may have costs already tied to order numbers. Or again an incomprehensible “boiler” that must somehow be made to work in the system.

In our projects, fortunately, the first option is mostly encountered.

Itemized costs that have already been allocated to orders are also entered using the document “Initial balances of work in progress by production batches” on the “Other expenses” tab.

A separate document is introduced for each division, as well as for each area of activity.

The document writes tasks in the RS “Tasks for cost calculation” and “Tasks for closing the month. Formation of financial results." The latter needs to be deleted, but the cost calculation for December will need to be performed.

When carried out, movements are generated in the RN “Other expenses of work in progress”

Debit entries in the document are established according to the department's accounting account, and not according to the expense item.

If you are faced with a “boiler”, then the best option is to first “scatter” the costs across open orders. Here the options for the development of events depend on the enterprise. For example, on one of the projects we took the following route: we collected the entire list of orders that were listed in the work in progress and calculated their cost based on the planned cost. We asked the production manager for the percentage of completion for each order. Based on it and the planned cost, we calculated the current estimated cost of the order, and distributed the WIP in proportion to it. Here I note that since this procedure is rather unobvious from the point of view of regulated accounting, it is reasonable for the consultant to request such balances of work in progress in paper form, signed by some responsible person.

Another option for analyzing the “boiler” that may occur is also based on the planned cost: in the system we begin to work with rolling orders, as usual. And at the time of production of the stage, the accumulated costs are compared with the planned cost. And if the amount for some expense items is less, then it is taken from the incoming boiler. I would like to note right away that this option is being implemented through the modification of 1C:ERP, and in principle it is not recommended by me, because it is an adjustment of the actual cost of production to the planned one.

So, I hope that this article has given you an idea of how to work with the initial balances of 1C:ERP, what problems you may have to face, and why this issue needs to be worked out from the very beginning of the project.

Next, we plan to continue the series of articles with other problematic accounts: VAT, reserves, etc.

We discuss many other complex issues of implementing regulated accounting and cost calculation at industrial enterprises in detail in the course: “Practical aspects of implementing regulated accounting and cost calculation in 1C:ERP at large industrial enterprises” -

Results

The following can be said about work in progress in accounting: these are material costs that have already gone into production, but have not yet gone through all stages of the production process, and therefore cannot be considered finished products. The value of work in progress balances can be assessed using one of several methods, which must be enshrined in the accounting policies of the enterprise.

Sources:

- Order of the Ministry of Finance of Russia dated November 15, 2019 No. 180n “On approval of the Federal Accounting Standard FSBU 5/2019 “Inventories”

- Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What is work in progress (WIP)

The reflection of work in progress for accounting purposes is regulated by FSBU 5/2019 “Inventories”. Subparagraph “e” of paragraph 3 of this standard states that work in progress is an organization’s expenses:

- for products that have not gone through all stages (phases, processing stages) provided for by the technological process;

- for incomplete products;

- for products that have not passed testing and technical acceptance;

- to perform work (provide services) to other persons until revenue from the sale is recognized.

- A similar definition of work in progress is given in paragraph 63 of the regulations on accounting and financial reporting (approved by order of the Ministry of Finance dated July 29, 1998 No. 34n).

Help

Until 2022, when accounting for work in progress, it was necessary to be guided by another regulatory document - PBU 5/01 (no longer valid). The transition to FSBU 5/2019 occurred as follows. If the company’s accounting policy established a retrospective transition method, it was necessary to recalculate the balances of work in progress as of January 1, 2021 based on the requirements of FAS 5/2019 (appendix to the letter of the Ministry of Finance dated January 18, 22 No. 07-04-09/2185). With the prospective method, recalculation was not required.

Get a sample accounting policy and do accounting in a web service for small LLCs and individual entrepreneurs Get it for free