On what grounds can you obtain a simplified tax deduction?

In general cases, personal income tax taxpayers have the right to receive the deduction due to them either from the employer or through the tax office.

In the first case, you must write an application and attach supporting documents to it.

All the advantages and disadvantages of receiving a deduction at the place of work were discussed by the experts of the reference and legal system “ConsultantPlus” in a special material. To view it, please sign up for trial access to the system. It's free.

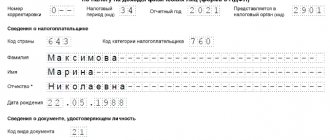

In another case, you need to submit to the tax office a correctly completed 3-NDFL declaration, to which supporting documents must also be attached. In this case, the declaration is submitted at the end of the year in which the right to the deduction arose.

From May 21, 2022, a simplified procedure for obtaining personal income tax deductions came into effect. But it concerns only two types of deductions:

- investment, provided under sub. 2 p. 1 art. 219.1 of the Tax Code of the Russian Federation and associated with depositing funds into an individual investment account;

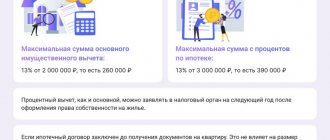

- property, provided in the amount of expenses actually incurred for the acquisition of land, housing and for the payment of mortgage interest under sub. 3 and 4 clauses 1 art. 220 Tax Code of the Russian Federation.

For other types of deductions, the procedure for applying and receiving them remains the same.

Let us note that the simplified procedure for obtaining tax deductions is regulated by Article 221.1 of the Tax Code of the Russian Federation. It was introduced into the code by federal law dated April 20, 2021 No. 100-FZ.

Deadline for filing 3-NDFL for tax deductions

If you need to receive social or property tax deductions not at work, but through the Federal Tax Service, fill out 3-NDFL and submit it at the end of the calendar year. When is the 3-NDFL declaration submitted in this case? The deadline until April 30 does not apply. That is, you can submit a return just to receive a deduction at any time throughout the year. In this situation, there is no need to focus on the deadline for submitting the 3-NDFL declaration.

The statute of limitations for filing a 3-NDFL declaration when applying for tax deductions is not established by law. But only 3 years are allotted for filing an application for a tax refund, counted from the moment this payment is made (clause 7 of Article 78 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated November 17, 2011 No. 03-02-08/118).

Please note that if you declare in 3-NDFL both income subject to declaration and the right to tax deductions, then you are required to submit such a declaration no later than April 30.

For example, when selling property owned for less than 5 (and in certain situations - 3) years, you need to report before April 30 of the year following the year of sale (clause 1 of Article 229 of the Tax Code of the Russian Federation). Therefore, if you decide to reduce the income from the sale of housing by expenses associated with its acquisition, and at the same time apply to it the deduction provided for the purchase of housing, then the declaration must be submitted no later than April 30.

How to fill out the 3-NDFL declaration when selling and buying apartments during the year? The answer to this question is in ConsultantPlus. To do everything correctly, get trial access to the system and go to the material. It's free.

Read more about the impact of the period of ownership of property on the taxation of income from its sale in the material “Sale of real estate below cadastral value - tax consequences.”

How does the simplified procedure for obtaining personal income tax deductions work?

The main advantage of the new procedure is that now for the types of deductions indicated in section 1 of the article, it is not necessary to submit a 3-NDFL declaration with supporting documents. Tax authorities may receive confirmation of the right to deduction from sources other than the taxpayers themselves. A desk audit of received information will now take no more than one month, and the return of funds to the taxpayer’s current (or personal) account will take no more than 15 days.

Let us remind you that a desk audit of the 3-NDFL declaration in standard situations takes three months, and the tax authorities transfer the money up to 30 days. That is, the procedural time frame under the simplified system for obtaining a tax deduction is significantly reduced.

You can learn about the intricacies of a desk audit from the article “How is a desk audit of a 3-NDFL tax return carried out?” Get free demo access and read all the most useful information regarding income tax.

Who will act as a source of information for the tax authorities?

For simplified tax deductions from 2022, all information for tax authorities is prepared by tax agents, banks, and executive authorities. All these entities must interact within the framework of a special program. But the rules of its functioning stipulate that participation in it is carried out exclusively on a voluntary basis. That is, no one will be forced to participate, but if a subject has a desire to join the information interaction, then he must meet certain criteria, namely:

- the bank must have a license from the Central Bank of the Russian Federation to carry out banking operations;

- a professional participant in the securities market must have a license from the Central Bank of the Russian Federation to carry out brokerage activities or to manage securities.

Personal income tax taxpayers can always contact the bank where the agreement for the purchase of property was signed, or a professional broker with whom an agreement was concluded to maintain an individual investment account, to clarify information about whether a simplified receipt of a tax deduction is available to them.

Specific transactions for investment deduction

Investment deduction is discussed in Art. 219.1 of the Tax Code of the Russian Federation, introduced by the Law “On Amendments...” dated December 28, 2013 No. 420-FZ.

An individual has the right to this deduction if he:

- received income from transactions with securities traded on the organized securities market;

- deposited personal savings into your IIS (individual investment account);

- received income from transactions placed on the IIS.

Find out how to get an investment deduction for personal income tax in ConsultantPlus. Learn the material by getting trial demo access to the system. It's free.

We talk about the nuances of how organizations use the investment deduction in the article “Investment tax deduction for income tax.”

Taxpayer actions for a simplified tax deduction option

The fact that the tax deduction has been simplified does not mean that an individual should not take any action. On the contrary, it must monitor the situation constantly.

Firstly, the taxpayer is required to register an account on the State Services or on the Federal Tax Service website. Otherwise, the simplified method will not be available and you will have to fill out a paper declaration (or pay for filling it out), photocopy supporting documents and take the entire package to the tax office.

Secondly, it is necessary to monitor all information messages from the tax authority received by LKN. The message should arrive immediately after the tax authorities receive information from sources of information interaction - banks, tax agents, etc. If the right to deduction is confirmed, the message will contain a pre-filled application. The taxpayer will only need to enter the details of his current or personal account and approve it with an electronic signature.

There are special deadlines for generating and sending an application to LKN:

- if all the necessary information was received by the tax authority before March 1, then the application must be generated by it and sent to the taxpayer before March 20;

- if the information reaches the tax authorities after March 1, then they are required to submit an application within 20 days from the date of receipt.

If it turns out that it is impossible to obtain a tax deduction in a simplified manner, then the tax authorities will refuse this method with the help of an information message, but be sure to indicate the reasons. The deadlines for refusal are the same as for filing an application.

Actions of the tax authority after receiving an application from the taxpayer

Having received an application from the taxpayer, tax officials will conduct an audit. As we have already said, 30 calendar days are allotted for it from the date of receipt. In situations where controllers find signs of a possible violation of the law, the deadlines are extended to a maximum of three months.

The inspection ends with the inspectors making a decision to grant or deny a deduction.

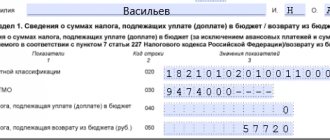

If the right to deduction is confirmed, then the next step of the tax authorities will be to check the taxpayer’s debt to the budget for taxes, fines and penalties. If such is detected, the tax authority will offset the amount of the deduction to pay off the debt.

The money must be transferred to the individual’s account within 15 working days from the date of the decision. If the deadline is violated, then the person has the right to claim interest calculated based on the refinancing rate of the Central Bank.

Results

So, in 2022, legislators made it easier to get a tax deduction. The new procedure is designed to make life easier for taxpayers in that now they will not have to fill out a 3-NDFL declaration and collect supporting documents. But it does not apply to every personal income tax deduction. You are allowed to take advantage of a simplified tax deduction only when purchasing an apartment, including with a mortgage, and when working with an individual investment account.

Under the simplified procedure, an individual needs to wait for a pre-filled application from the tax authorities, enter information about his current account into it and send it back to the tax authorities. The entire procedure is carried out through the taxpayer’s personal account. In this regard, we recommend that you register in a timely manner on the State Services website or on the Federal Tax Service website in order to be guaranteed to take advantage of the simplified procedure for receiving a tax deduction for 2021-2022 and in subsequent periods.

Sources:

- Tax Code of the Russian Federation

- Federal Law of April 20, 2021 No. 100-FZ “On Amendments to Parts One and Two of the Tax Code of the Russian Federation”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Maximum standard tax deduction

The rules for obtaining a standard tax deduction are regulated by the Tax Code of the Russian Federation, Article 218. The standard tax deduction is aimed at supporting the disabled, Heroes of Russia and citizens with children. Let's take a closer look at the last category.

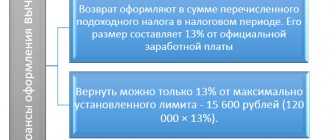

The state allocates a certain amount of funds for children, from which 13% is not withheld. You will not receive this money in cash; the calculation principle is different. 13% will be withheld not from the entire monthly income, but from the salary minus the amount of compensation.

The maximum amount of income for the year is 350,000 rubles; after reaching it, no tax deduction is provided. Tax deduction amount: for the first child 1,400 rubles, for the second child another 1,400 rubles, for the third and subsequent children 3,000 rubles.

Let's give an example of a calculation. Smirnova A.I. - environmentalist and mother of two minor children. Monthly salary - 65,000 rubles. The amount by which the base for calculating contributions to the budget is reduced every month is 2800 rubles, 1400 rubles for each child.

Let's calculate the tax base by month. January - 65,000, February - 130,000, March - 195,000, April - 260,000, May - 325,000 rubles. The calculation is made only through May inclusive, since in June the income will already exceed the maximum amount, and the benefits will cease to apply.

Accordingly, in the listed months the employer will withhold tax not from 65,000 rubles, but from 62,200. Calculation: (65,000 – 2800) * 13% = 8086 rubles. Smirnova will receive 56,914 rubles = (65,000 – 8086).