○ Legislation in the field of business activities.

The current legislation has clear regulations for the procedure for registering the beginning and termination of the activities of an individual entrepreneur. Suspension of work at the request of a businessman is not provided for by law.

Opening or closing an individual entrepreneur is a citizen’s right. Once the status of individual entrepreneur is registered, a person can be deprived of it only in cases provided for by law. Lack of profit or actual non-conduct of business are not such grounds.

Clause 1 of Art. 22.3 Federal Law No. 129 of 08.08.2001 “On state registration of legal entities and individual entrepreneurs”:

State registration upon termination by an individual of activities as an individual entrepreneur in connection with his decision to terminate this activity is carried out on the basis of the following documents submitted to the registration authority:

- An application for state registration signed by the applicant in the form approved by the federal executive body authorized by the Government of the Russian Federation.

- Document confirming payment of state duty.

Please note that applications for temporary suspension of activities are not provided for by law.

What expenses are required for individual entrepreneurs?

The question of how to suspend the activities of an individual entrepreneur for a while arises, first of all, due to the need to pay insurance premiums for oneself. The amount of these fixed payments in 2022 is 43,211 rubles. If business activity does not generate income or is not carried out at all, then contributions must be paid from personal funds.

Now let's look at taxes. If the taxation system on which the individual entrepreneur operates is related to real income, then when the business is suspended, there is no need to pay them. These are the simplified taxation system, OSNO, and ESKHN modes. But when choosing UTII or PSN, the obligation to pay taxes is not related to whether the entrepreneur has income from the business or not.

○ Is it possible to simply “not work”?

A businessman may not actually operate, but he will not receive an exemption from his obligations under the law. He will also have to:

- Provide reports, declarations and other documentation to government agencies.

- Transfer mandatory contributions for yourself to the Pension Fund and the Federal Compulsory Medical Insurance Fund.

Thus, despite the lack of profit, you will still have to pay the prescribed insurance premiums. If this is not done, the citizen will be held administratively liable.

Additional costs arise if there are employees. In the absence of activity, they cannot be reduced, which means that the businessman is obliged to pay wages and fulfill other obligations to employees.

If work is suspended for a while, you can agree with employees to terminate the employment contract. If they do not agree, the dismissal will be considered illegal.

✔ Maintaining the tax burden.

Until the individual entrepreneur ceases to operate in accordance with the procedure established by law, he must report to the tax office and pay mandatory payments. The size of these payments depends on the applicable taxation system.

Thus, businessmen operating on OSNO or simplified tax system have the right to submit zero declarations, that is, there is no need to transfer any funds in the absence of profit. Entrepreneurs working on UTII or PSN must make mandatory payments, regardless of whether they are operating or not.

✔ Obligations to the Pension Fund.

Regardless of the presence or absence of employees at an individual entrepreneur, you will still have to pay contributions to the Pension Fund for yourself. There is no need to submit reports.

If an individual entrepreneur has employees, their rights cannot be infringed. When there is no activity and no wages are accrued, employees can be placed on leave without pay. In this case, reporting to the Pension Fund will be zero and there is no need to pay contributions.

The vacation option is not always possible. In such a situation, you will have to pay wages, and, therefore, calculate and pay taxes and contributions to funds.

How to avoid paying insurance premiums?

In accordance with the provisions of paragraph 1 of Art. 430 of the Tax Code of the Russian Federation, individual entrepreneurs are required to pay insurance premiums for compulsory pension and medical insurance. The amount of such contributions is fixed. However, with an income of 300,000 rubles, all money earned above this amount increases the load by 1%. For example, if you earn 320,000 rubles, you must pay an additional 200 rubles for pension insurance in addition to the fixed contribution. It will not be possible to get rid of the obligation to pay insurance premiums even if the individual entrepreneur does not actually conduct business.

If an individual entrepreneur was temporarily deregistered during the year, insurance premiums are calculated in proportion to the days worked. Find out exactly how to calculate the amount of fixed contributions in ConsultantPlus. To do everything right, get trial access to the system and study the material for free.

However, there are a number of cases in which an individual entrepreneur is temporarily exempt from the need to make contributions to the Pension Fund and the Compulsory Medical Insurance Fund. This list is established by clauses 6 and 7 of Art. 430 Tax Code of the Russian Federation. In accordance with the provisions of the norm, you will not have to pay:

- persons undergoing military service;

- a parent caring for a child until he reaches 1.5 years of age;

- persons caring for a disabled child, a person who has reached 80 years of age, or a group I disabled person;

- spouses of military personnel living together with them in those territories where business activities are impossible;

- spouses of diplomats living abroad due to the need for the diplomat to carry out his professional activities.

If an entrepreneur falls into one of these categories, he should take advantage of his legal right to exemption from payments.

○ Is closing an individual entrepreneur an option?

Closing an individual entrepreneur is the only way out to avoid paying taxes and fees. In the future, when circumstances change again, it will be possible to register again as an individual entrepreneur and resume activities.

It is important to take the necessary actions provided by law. There are not many of them.

✔ Putting things in order.

Before closing an individual entrepreneur, it is necessary to resolve all issues with employees, contractors and the tax office. You will need to list payments on all debt obligations and prepare the necessary papers.

Preparatory steps include:

- Payment of taxes, fines and penalties to the tax office.

- Dismissal and full settlement with employees, if the individual entrepreneur has them.

- Transfer of insurance premiums for yourself.

- Preparation and submission of declarations for the past period (even if this is not a full reporting year).

- Deregistration from the Social Insurance Fund (for individual entrepreneurs with employees).

- Closing a bank account.

- Deregistration of a cash register, if it was used.

After putting things in order, you can proceed to the next steps.

✔ Drawing up an application.

When closing an individual entrepreneur, the established application form P65001 is used. The document can be filled out by hand (in black ink in capital letters) or on a computer (Courier New font, 18).

The application will need to indicate your full name, INN and OGRNIP, as well as contact information and the method of submitting the document to the tax office. When submitting an application in person, the signature is placed in the presence of a Federal Tax Service employee.

✔ Providing a receipt for the fee.

In addition to the application, a receipt for payment of the state fee is required. Its size is 160 rubles.

You can generate a receipt on the official website of the Federal Tax Service. To do this you will need to fill in the required information. You can also get it at the territorial tax office.

The receipt is paid at bank branches, in the Internet banking system or through a terminal.

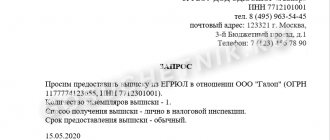

✔ Extract from the Pension Fund.

Previously, it was necessary to attach a certificate from the Pension Fund to the application and receipt. Now this requirement has been abolished, since the Federal Tax Service can request the necessary information on its own.

It does not matter whether you paid the contribution to the Pension Fund or not at the time of closure of the individual entrepreneur. According to tax legislation, payment can be made until December 31 of the current year.

Clause 1 of Art. 423 of the Tax Code of the Russian Federation: The billing period is the calendar year.

How to reduce the fiscal burden if individual entrepreneurs do not operate?

Suspension of the activities of an individual entrepreneur without liquidation implies a temporary cessation of all business processes and, as a result, a lack of income and profit. The calculation of the amount of tax payments payable to the budget depends on which tax regime the individual entrepreneur has chosen. All types of tax regimes can be divided into two groups:

- the amount of tax depends on the income received by the entrepreneur - OSNO, Unified Agricultural Tax, simplified tax system;

- the amount of tax depends on the type of activity of the entrepreneur, the region in which he operates, as well as on a number of other factors; in this case, the amount of revenue received by the businessman is not taken into account - PSN.

Registered individual entrepreneurs are often interested in how to suspend an individual entrepreneur so as not to pay taxes. If an entrepreneur works in any of the regimes included in the first group, he can submit zero tax returns - this will be enough to comply with the law and not pay extra money to the budget.

If the entrepreneur has chosen a tax regime with a fixed amount of mandatory payment, he will still have to transfer money to the Federal Tax Service.

Practical experience

Stopping an individual entrepreneur's business is illogical. The law does not establish deadlines for starting and finishing activities; the registration procedure may even be unlimited. While the case is stopped in fact, the law still obliges the business owner to fulfill his obligations .

If the individual entrepreneur has not worked for a long time, but this form of ownership is still registered, then there are obligations to submit reporting forms. Moreover, it is required to make fixed contributions to the Pension Fund, as well as transfer other amounts to the required accounts.

If the entrepreneur does not receive income , a zero declaration . If you have hired employees, you should not forget about the duties of a tax agent and respect the labor rights of employees.

If we talk about the consequences , then during the suspension of activities they were not observed. The main thing is that there are no violations of the current legislation. But in life there are various situations that force an individual entrepreneur to end his activities.

Is this real

Within the framework of the legislation of the Russian Federation, the possibility of suspending individual entrepreneurship is not envisaged . It is incorrect to believe that in case of termination of business, entrepreneurs are exempt from taxes, fees and other contributions to the state treasury. No one exempts you from submitting documents - declarations, reports, certificates, etc.

If you look at the situation from the other side, fulfilling your duties is not a difficult process, especially considering the fact of filing zero returns and not paying taxes on revenue/profit.

Why are activities suspended?

A small business faces suspension for:

— violation of sanitary regulations in catering, hairdressing salons;

— garbage removal not in accordance with sanitary regulations;

— violation of fire safety in the premises;

— dangerous working conditions for sellers and craftsmen;

— trade in goods without age markings;

- labor of foreigners without a work permit or failure to notify the migration service;

- concerts with obscenities in a bar.

For example, cafes and restaurants are often closed under Art. 6.6 of the Code of Administrative Offenses of the Russian Federation for violations of sanitary regulations in the kitchen.

They don't close for any violation. Inspectors must see a threat to people, order, morality or nature. The principle is this: if you don’t close it now, it will get worse later.

For minor violations they are not closed, but fined.

Fire safety requirements in simple words