What documents are needed to receive an income tax refund for treatment?

Declaration 3-NDFL, application for deduction, certificate of income 2-NDFL, passport - with this set of documents any person who decides to exercise his right to receive a refund of personal income tax from the amounts spent on treatment will need to start processing the deduction.

IMPORTANT! The possibility of a tax deduction for treatment expenses is provided for in subparagraph. 3 p. 1 art. 219 of the Tax Code of the Russian Federation.

To ensure that collecting documents for a tax deduction for treatment does not turn into a waste of time, you first need to check whether all legally established conditions and restrictions associated with the use of a social deduction are met, clarifying the following points:

- The person who paid the medical expenses and received the medical service is the same person or the indicated persons are close relatives.

IMPORTANT! Close relatives are considered to be parents, spouses and children under the age of 18 (including adopted children and wards). See also “You can receive social benefits if the person ordering the treatment is your spouse.”

- The person who paid the medical expenses and the deductible claimant are the same person.

IMPORTANT! If the treatment was paid for by the company, the tax authorities will refuse the deduction.

- The taxpayer claiming the deduction has income taxed at a rate of 13% and paid personal income tax to the budget.

IMPORTANT! Pensioners or individual entrepreneurs using the simplified tax system and UTII will be able to claim a deduction only if they have income taxed at a rate of 13%.

If the above conditions are met, you can safely begin collecting the following documents to deduct personal income tax for treatment (this will be discussed below).

You can familiarize yourself with the procedure for filling out the 3-NDFL declaration in the article “Sample of filling out the 3-NDFL tax return” .

Sign up for a free trial access to K+ and get full information about the procedure for receiving a new social deduction for fitness starting in 2022.

Amount and features of tax deduction for treatment expenses

Employed citizens can return from the budget the amounts they spent on purchasing medicines and/or paying for the services of a medical institution that is licensed to provide medical services.

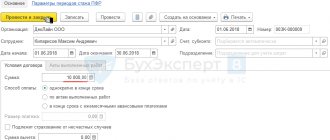

In other words, issue a social tax deduction provided for in Article 219 of the Tax Code of the Russian Federation. A tax deduction is a refund of the amount of income tax, calculated at a rate of 13%, paid in the reporting period (12 months). To obtain it, submit 3-NDFL.

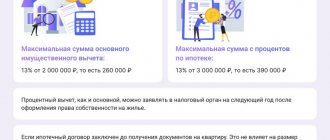

For payment for treatment and purchase of medicines, you can issue a refund within the approved limit. It amounts to 120 thousand rubles. in year. This is the general limit for all types of social payments. And these include not only treatment costs, but also tuition fees, as well as other expenses (Article 219 of the Tax Code of the Russian Federation).

Let's look at these features with an example.

Smirnov A.V. draws up a deduction for treatment costs for 2021. Their total amount was 26,000 rubles. But in 2022 he will only be able to receive 15,600 rubles.

ATTENTION! The taxpayer has the right to claim a deduction within three years from the date of expenses for medical services and the purchase of medicines. For example, the right to deduction arose in 2022, but the taxpayer for some reason did not file a return. In 2022, he has the right to file a 3-NDFL declaration for 2022. In 2023, this will no longer be possible, because the three-year period will expire.

The legislation has approved a list of expensive medical services, the costs of which are refunded in full without a limit of 15,600 rubles (resolution dated 04/08/2020 No. 458).

Expensive treatment: when is a personal income tax return declaration issued?

In some cases, there is a need for expensive treatment, and here you need to have a good idea of what documents are needed for 3-NDFL. The fact is that a tax deduction is allowed in such circumstances, and in an almost unlimited amount, but subject to certain conditions:

- firstly, the type of treatment must be included in the list approved by Decree of the Government of the Russian Federation dated 04/08/2020 No. 458 ();

- secondly, you should start filling out a return of income tax for treatment only after receiving a specific certificate issued by a medical institution (approved by order of the Ministry of Health of the Russian Federation No. 289).

When receiving a certificate, you should pay attention to the service code. For expensive treatment, the corresponding field should contain the number 2. When one appears there, the deduction will be limited to the usual limits of 120,000 rubles.

Certificate from a medical institution

When submitting documents to the tax office for a personal income tax refund for treatment, special attention should be paid to the certificate issued by the medical institution.

This paper will be needed if medical expenses have been paid.

IMPORTANT! The form of the certificate of payment for medical services was approved by order of the Ministry of Health and the Ministry of Taxes of Russia dated July 25, 2001 No. 289/BG-3-04/256.

At the same time, other documents confirming the fact of payment (receipts, checks, bills, etc.) are not needed, since this certificate is issued only if the services have already been paid for. This position is shared by both officials of the Ministry of Finance and tax authorities (letters of the Ministry of Finance of Russia dated March 29, 2018 No. 03-04-05/20083, dated April 17, 2012 No. 03-04-08/7-76, Federal Tax Service of Russia dated March 7, 2013 No. ED- 3-3/ [email protected] ).

See the material “Certificate or checks for treatment? The Ministry of Finance says - a certificate.”

Such a certificate can also be obtained after undergoing sanatorium-resort treatment. At the same time, it will not indicate the cost of the voucher, but only the price of treatment (less expenses for food, accommodation, etc.) and the amount of additionally paid medical services.

If you have the above certificate and the type of service provided is included in the list, to receive a deduction you will need 2 more documents from the medical institution that provided the service: a contract and a license. If the medical institution does not have a license to carry out medical activities or the treatment was carried out not by a Russian, but by a foreign clinic, the deduction will be denied.

Tax officials must provide a certified copy of the agreement with the medical institution. Particular attention should be paid to the terms of this document if expensive treatment was carried out, and you purchased materials or medical equipment at your own expense that were not available in this clinic. This will allow you to receive a full deduction.

The license is presented in the form of a certified copy. It is not necessary to attach a license separately if its details are specified in the contract.

News

November 9, 2018

Tax deduction for dental services.

Tax deduction for dental services.

The level of financial literacy in our country is not yet high enough. At the same time, citizens of the Russian Federation have a right, which I would like to talk about in more detail. Every person who receives an official salary and pays personal income tax can get part of their taxes back. But not everyone decides to do this, because they think that it is too difficult or impossible at all.

Everyone has had to go to dentists for some form of medical care. Dental services are quite expensive, but the state allows you to return part of the money spent in the form of a tax deduction under declaration 3 of personal income tax for dental treatment.

It should be noted that a tax deduction can be obtained when paying for dental treatment, including prosthetics, dental implants, installation of braces and other dental services in those clinics that have the appropriate licenses to carry out medical activities. If the medical institution where you had your teeth treated does not have a license, you will not be able to receive a tax deduction for the treatment.

In accordance with the Tax Code of the Russian Federation (subparagraph 3, paragraph 1, article 219 of the Tax Code of the Russian Federation), the amount of tax deduction depends on whether the treatment is expensive or not.

For expensive types of dental treatment, the amount of social tax deduction is accepted in the amount of actual expenses incurred.

For conventional treatment (medical services in dentistry) there is a limit on the amount of tax deduction - no more than 120,000 rubles. (i.e. you can return a maximum of 13% of 120,000 rubles - 15,600 rubles).

The specific tax refund amount is calculated in the 3rd personal income tax return.

Along with the 3-NDFL declaration, a Certificate of payment for medical services is provided to the tax authorities in the form approved by Order of the Ministry of Health of Russia N 289, Ministry of Taxes of Russia N BG-3-04/256 dated July 25, 2001. You can obtain this certificate from the medical organization that provided you with the service. The original certificate is submitted to the Federal Tax Service.

The certificate of payment for medical services indicates which code the dental treatment belongs to - service code 1 or service code 2 in dentistry can be indicated.

There are two lists:

· list of expensive types of treatment (code 2) and

· list of medical services (service code 1),

allowing you to determine whether dental treatment is an expensive treatment.

The list of expensive treatment for 3 personal income taxes (dentistry and other medical services) and the list of medical services are approved by Decree of the Government of Russia of March 19, 2001 No. 201. Determining the service code in the certificate (whether dental treatment is expensive) is within the competence of the medical institution that provided medical services. The clinic employee, knowing that this relates to expensive dental treatment, fills out the “service code” column. If you do not agree with the choice of medical service code in the certificate, you must contact the clinic for clarification.

The answer to the question “Is my treatment an expensive treatment or not?” depends on which dental service or type of dental treatment was paid for.

Not every dental prosthetics is an expensive treatment. Thus, the operation of implanting dentures is included in the list of expensive treatments for 3 personal income taxes in dentistry (according to Letter of the Ministry of Health and Social Development of the Russian Federation dated November 7, 2006 No. 26949/MZ-14 and Letter dated November 8, 2011 No. 26-3/378332-2065). In this case, the certificate of payment for medical services will indicate code 2 (expensive dental treatment).

Other dental prosthetics (orthopedic dentistry) refers to conventional treatment - it is not included in the list of expensive treatments (code 1 for dental treatment). Here, the amount of tax deduction is limited to a limit (RUB 120,000).

Installing braces is not an expensive dental treatment. Although braces are quite expensive, the legislator did not include them in the list of expensive treatments for 3 personal income taxes. Therefore, the certificate of payment for medical services will contain code 1, not code 2.

An important addition, in accordance with the legislation (Tax Code of the Russian Federation, Article 219, paragraph 3), a taxpayer can receive a tax deduction for his own treatment, treatment of a spouse, dental services provided to his parents, dental treatment for a child under 18 years of age. In this case, the certificate of payment for medical services indicates as a patient a family member of the taxpayer who received ordinary or expensive dental treatment, and as a taxpayer - the one who will receive a tax deduction for dental treatment and file a 3rd personal income tax return.

To summarize, in order to apply for a tax deduction for treatment you will need the following documents:

Passport or equivalent document. Certified copies of the first pages of the passport (basic information + pages with registration) are submitted to the Federal Tax Service.

Certificate of income in form 2-NDFL. You can obtain such a certificate from your employer. The original 2-NDFL certificate is submitted to the Federal Tax Service.

Note: if you worked in several places during the year, you will need certificates from all employers.

Certificate of payment for medical services in the form approved by Order of the Ministry of Health of Russia N 289, Ministry of Taxes of Russia N BG-3-04/256 dated July 25, 2001. You can obtain this certificate from the medical organization that provided you with the service. The original certificate is submitted to the Federal Tax Service. Agreement with a medical institution for the provision of medical services. A certified copy of the agreement is submitted to the Federal Tax Service.

License of a medical institution to carry out medical activities. A certified copy of the license is submitted to the Federal Tax Service. Application for a tax refund with account details to which the tax office will transfer the money to you. The original application is submitted to the Federal Tax Service.

Tax return in form 3-NDFL The original declaration is submitted to the Federal Tax Service.

When applying for a tax deduction for children, a copy of the child’s birth certificate is additionally provided.

When applying for a tax deduction for a spouse, a copy of the marriage certificate is additionally provided.

When applying for a tax deduction for parents, you are additionally provided with a copy of your birth certificate.

It should be noted that in order to avoid delays and refusals, it is better to contact the tax service with the most complete package of documents.

If you can collect documents yourself, then specialists from the MFC “My Documents” at the address: Belgorod, Slavy Ave., 25 will help you fill out the 3-NDFL declaration correctly.

You can obtain more detailed information on the service of filling out the 3-NDFL declaration by calling contact-Belgorod region and 8 800 707-10-03.

Recipe (form 107/1-у)

This small piece of paper will be required by the deductible applicant if the money was spent on medications that were prescribed by a doctor. The prescription is issued by the attending physician simultaneously with a similar form for the pharmacy. If form 107/1-у is missing, it can be obtained later from a medical institution based on the entries in the medical record.

The prescription must be stamped: “For the tax authorities of the Russian Federation, Taxpayer INN.” The stamp is also required after the cancellation of the medicinal list (see letter of the Ministry of Health dated December 30, 2019 No. 25-1/3144694-13771).

You can claim a deduction for the amount of paid medications for periods starting from 2019 for any medications prescribed by a doctor.

Tax officials must provide the original prescription and certified copies of payment documents. In this case, their presence is mandatory.

How to fill out 3-NDFL to refund treatment expenses?

To submit a declaration for the purpose of refunding tax for payment for medical services or the purchase of medicines, fill out the following sections:

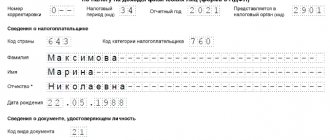

- title page;

- section 1 and 2;

- appendix 1 to section 1;

- appendices 1 and 5.

Appendix 2 is completed if the taxpayer has income from foreign sources. That is, from those employers who are located outside of Russia. The law does not prohibit working for them. But you must follow the rules for paying taxes.

Insurance policy

A deduction can also be obtained in cases where no medical procedures were performed, no medications were purchased, and the money was spent on paying for a voluntary health insurance policy. In this case, the deductible applicant will need a certified copy of the insurance policy or agreement with the insurance company.

A deduction will be possible only if the insurance contract provides for payment for treatment services, and the insurance organization has a license to carry out this type of activity.

A certified copy of the license is submitted to the inspection. Or a link to its details should be given in the contract.

The above documents must be accompanied by certified copies of payment documents indicating that the funds were spent on paying insurance premiums.

When can an employee expect compensation?

The state does not always and not reimburse everyone for the amount spent on medicines and medical services. After paying for treatment, the patient can return his own costs in the following cases:

- When paying for treatment of yourself or a close relative in one of the Russian clinics.

- When the treatment took place in an institution that has a license for this activity.

- Compensation for part of the expenses is provided for medical services clearly prescribed by law. The list was published in the RF PP dated March 19, 2001 No. 201.

A tax refund from the purchase of medicines will be available if:

- The citizen paid for medications prescribed by a doctor for himself and close relatives from his personal funds.

- The medications purchased by the patient are included in the list of medications for which part of the costs are allowed to be reimbursed. The list is defined in Government Decree No. 201.

When paying for voluntary health insurance, the client can receive part of the funds in several cases:

- If a citizen has paid insurance premiums for himself or close relatives from his own money.

- Insurance only covers payment for medical services.

- If the insurance organization officially carries out its activities and has a license.

The category of close relatives includes spouses, father and mother, minor children, both natural and adopted.

Birth certificate and other documents

A birth certificate will need to be submitted in the package of documents for deduction in 2 cases:

- if the deduction applicant wants to return the money spent on the treatment of children, the child’s birth certificate will be required;

- if the applicant’s parents were treated and the applicant paid for their treatment, the applicant’s birth certificate must be attached.

If the deduction is issued for the treatment expenses of the applicant's spouse, you will have to provide a marriage certificate.

All of the above evidence is needed to confirm the degree of relationship between the person who spent the money and the recipient of the medical service. They are transferred to the tax authorities in the form of certified copies.

IMPORTANT! Copies of documents for filing a tax deduction can be certified in 2 ways: notarized or independently by the deduction applicant (on each page of all documents you must write: “Copy is correct,” sign, decipher the signature and date it).

For information on income not taken into account when calculating personal income tax, read the article “Income not subject to personal income tax taxation (2021 - 2022).”

Having collected all the necessary documents, you can begin to prepare the 3-NDFL declaration. Our article will help you with this.

How many times and how often can I apply for a deduction?

The full cost of treatment should be indicated, even if it exceeds the possible deduction

You can apply for a tax deduction once a year. Since each time the declaration is submitted for the year that ended (i.e. in 2022, documents for 2017 are submitted), the deduction is issued for the same year.

The period during which you can submit documents is 3 years (i.e. in 2018 you can receive a deduction for 2022, 2016 and 2015).

The full cost of treatment should be indicated, even if it exceeds the possible deduction.

If treatment occurred at the end of one year and the beginning of another, then the declaration indicates only the amount spent in the past year.

If a citizen has already applied for tax deductions in previous years, this does not prevent him from applying for this type of refund. You can receive several types of deductions in one year, but their total amount is limited.

Results

It is not difficult to collect documents for income tax refund for treatment. You need to write an application, obtain 2-NDFL certificates, make a copy of your passport, take a certificate of payment for medical services or a prescription form (in case of purchasing medicines), attach copies of the contract, license for medical activities and payment documents, and also fill out a 3-NDFL declaration .

The specified list will have to be supplemented with documents confirming the degree of relationship (birth or marriage certificates) if the applicant of the deduction paid for the treatment of his close relatives.

A deduction can also be claimed for the costs of paying voluntary insurance premiums. In this case, you will additionally need a certified copy of the agreement with the insurance company or an insurance policy, as well as a copy of the license to carry out insurance activities and payment documents.

Sources:

- Tax Code of the Russian Federation

- Decree of the Government of the Russian Federation of 04/08/2020 No. 458

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Who can receive a tax deduction for treatment?

The procedure for receiving a social benefit for dental treatment is no different from receiving a deduction for any other type of treatment. If a citizen has income from which personal income tax is paid to the budget, he can claim a tax deduction in the amount of paid medical services. You can receive a tax deduction not only for yourself, but also when paying for the treatment of your close relatives - children and wards under 18 years of age, spouse, parents.