Child tax credit

Parents have the right to take advantage of deductions for children. At the same time, the Tax Code of the Russian Federation allows this application for each type of tax deduction for a child:

- standard child deduction;

- social deduction for a child.

NOTE! The spouse of the child's parent has the right to receive a tax deduction provided that the marriage with the child's father (mother) is officially registered.

See here for details.

Standard deduction for children in 2022

The following persons have the opportunity to apply for a tax refund (receive a deduction for children):

- father and mother of the child;

See also “The spouse of the child’s mother has the right to receive a “children’s” deduction .

- foster parents;

- persons who have obtained guardianship.

To receive the standard child deduction in 2022, the following conditions must be met:

- a child not older than 18 years old (24 years old for a full-time student);

- the amount of income paid to an individual, starting from January 1 of the year in which the deduction is claimed, is less than or equal to RUB 350,000. That is, the personal income tax deduction for children - 2022 is provided until the parent’s earnings exceed this limit. Previously, the limit on personal income tax deductions for children was 280,000 rubles.

See also “How to provide a “children’s” deduction to an employee who went on vacation at his own expense?” .

Example

Matveeva A.F. has a son aged 4 years. Her salary is 88,000 rubles. per month. Matveeva A.F. wrote an application to the employer to receive a standard tax deduction in the amount of 1,400 rubles. This amount will not be subject to income tax until Matveeva’s total income from the beginning of 2022 reaches the maximum threshold of RUB 350,000. That is, the standard deduction applies from January to March. In April, the employee will lose her right to apply the child deduction due to her total income exceeding the limit established by the code (from January to April, the amount of income will be equal to 352,000 rubles).

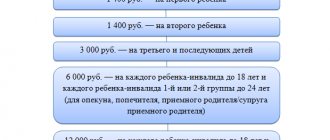

The standard child tax credit is:

- in 2011, the amount of the deduction for children was 1,000 rubles. for the first 2 children and 3,000 rubles. on subsequent ones;

- since 2012, the amount of the deduction for children was 1,400 rubles. and 3,000 rub. respectively.

Both mother and father have the right to take advantage of the children's deduction. In addition, one of the parents can apply for a double deduction, but only if there is a written refusal from the other.

If a child has only one parent, for example, there is only a mother, then it is possible to increase the deduction per child by 2 times. But the absence of the second parent means that he is dead, declared dead or missing. The fact that your parents are divorced does not give you the right to receive a double deduction.

Example

Sidorova E.K. (single mother) from January to March 2022 received a standard personal income tax deduction for 1 child in the amount of 2,800 rubles. She got married in April. From April, the deduction per child will decrease to 1,400 rubles.

IMPORTANT! If the child is disabled, then, regardless of the order of his birth, the amount of deduction per child is 12,000 rubles. parents and 6,000 rubles. guardians, trustees. Moreover, this deduction is added to the usual deduction provided by birth order.

Example

Koroviev V.D. has 2 children - 16 years old (disabled group II) and 14 years old.

His deductions for children:

- 16 years old - 13,400 rub. (1,400 + 12,000);

- 14 years old - 1,400 rubles.

Is there a deduction for a child if the employee has no income, ConsultantPlus experts explained. Get free demo access to K+ and go to the Ready-made solution to find out all the details of providing a deduction.

“Children’s” deduction for students and schoolchildren (Yamanova N.A.)

<*> As soon as the child turns 14 years old, guardianship over him is terminated. The guardian becomes his trustee. And guardianship ends when the child turns 18 years old or gets married (clauses 2 and 3 of Article 40 of the Civil Code of the Russian Federation).

The foster family agreement is terminated upon expiration, early termination, or in connection with the termination of guardianship or trusteeship (Clause 1, Article 153.2 of the RF IC).

A tax deduction can be provided before the beginning of the month in which the employee’s income exceeded RUB 280,000. (paragraph 17, paragraph 4, paragraph 1, article 218 of the Tax Code of the Russian Federation).

Deduction for a child under 18 years of age

An employee can take advantage of the “children’s” deduction from the month the child was born until the end of the year in which the child reached the age of 18 (Letter of the Ministry of Finance of Russia dated October 22, 2014 N 03-04-05/53291). It doesn’t matter whether the child is studying or not.

Example 1. A child graduated from school and did not enroll anywhere.

Daughters of employee R.N. Levitina turns 18 on May 26, 2015. She graduates from school in June.

Will the employee have the right to a deduction if his daughter does not enroll in a university and will neither study nor work by the end of the year?

Solution. An employee can take advantage of the deduction for all months until the end of 2015, provided that his income does not exceed 280,000 rubles.

To provide an employee with a deduction for a child under 18 years of age, it does not matter whether the child is studying full-time or part-time.

Example 2. The child graduated from school and is studying part-time

The son of employee A.N. Serebryakova turned 18 years old on January 2, 2015. In June 2015, he graduates from school.

Will the employee have the right to a deduction if her son enters a university as a correspondence student?

Solution. The deduction must be provided to the employee for all months until the end of 2015, provided that her income does not exceed 280,000 rubles.

In this case, the fact that the employee’s son is studying at a university by correspondence does not matter.

An employee will be entitled to a deduction even if the child has not graduated from school by age 18. But only during the period of the child’s education in an educational institution (school) (Letter of the Ministry of Finance of Russia dated 02/09/2012 N 03-04-06/5-28).

Example 3. The child is already 18 years old, but has not yet graduated from school

Daughters of employee V.V. Serova turned 18 years old in December 2014. In June 2015, she graduates from school.

Is the employee entitled to child tax deductions in 2015 and for which months:

- until the child graduates from school;

- until the end of the year in which the child graduates from school?

Solution. The deduction must be provided to the employee for all months of his child’s schooling, provided that the employee’s income does not exceed 280,000 rubles.

That is, V.V. Serov can receive deductions for six months of 2015 - from January to June inclusive.

How to provide a deduction if the employee’s daughter enters a university full-time in the same year, see example 10 on p. 29.

Deduction for a child under 24 years of age

An employee has the right to receive a standard deduction for a child - a full-time student, graduate student, resident, intern, student, cadet. The Russian Ministry of Finance also added full-time students to this list (Letter of the Russian Ministry of Finance dated March 19, 2013 N 03-04-06/8422).

The deduction is provided for the period of education of the child, but only until he turns 24 years old (paragraph 12, paragraph 4, paragraph 1, article 218 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated October 22, 2014 N 03-04-05/53291) .

Example 4. The child turned 24 years old before graduating from university

The son of employee E.M. Aivazova turned 24 years old on April 17, 2015. He is a full-time student and graduates from the university in July 2015.

Is the employee entitled to the deduction until the end of 2015 or only until July 2015 inclusive?

Solution. An employee can receive a deduction for her son only for four months of 2015 - January, February, March and April. A prerequisite is that her income should not exceed 280,000 rubles.

Since May 2015 E.M. Aivazova loses the right to a “children’s” deduction.

Important conditions for providing an employee with a child deduction are:

— full-time education for the child;

- the child’s age is up to 24 years.

If these conditions are not met, the employee loses the right to the standard deduction.

Example 5. The child graduated from university, but is not yet 24 years old

Daughter of employee O.P. Savrasova will complete her full-time studies at the university in June 2015 at the age of 22.

Is an employee entitled to a deduction if his daughter is not yet 24 years old?

Solution. From the month following the month of her daughter’s graduation, the employee will lose the right to deduction (Letter of the Ministry of Finance of Russia dated November 6, 2012 N 03-04-05/8-1251).

That is, the employee will receive deductions for six months - from January to June 2015, provided that his income does not exceed 280,000 rubles.

An employee will have the right to a deduction even if his child, a full-time student, is on academic leave (paragraph 19, paragraph 4, paragraph 1, article 218 of the Tax Code of the Russian Federation).

Example 6. The child took a leave of absence

Daughter of employee N.N. Vereshchagina (20 years old) is a 2nd year full-time student. Single. In April 2015, her child was born and she took a year off from school.

Does an employee have the right to a deduction if his daughter is temporarily not studying?

Solution. The employee does not lose the right to deduction. He must continue to be provided with the standard deduction until the end of 2015, until his income exceeds RUB 280,000.

The Tax Code does not deprive an employee of the right to a deduction for a child under 24 years of age studying full-time if the child has his own income.

Example 7. The child receives his own income

The son of employee G.N. Bryullova is 21 years old. He is a 3rd year full-time student. During the summer holidays - from July to September 2015 - the young man will work in the same company where his mother works.

Will the employee lose the right to a deduction if her son receives income in July-September?

Solution. The standard deduction must be provided to the employee for all months until the end of 2015, until her income exceeds RUB 280,000. She does not lose the right to deduction.

One of the conditions for applying the deduction is that the child must be supported by the parent (clause 4, clause 1, article 218 of the Tax Code of the Russian Federation).

If a child gets married, he ceases to be supported by the parent. Therefore, a deduction is not allowed for it (Letter of the Ministry of Finance of Russia dated March 31, 2014 N 03-04-06/14217).

Example 8. An employee’s child got married

Daughter of employee N.V. Makovsky is a 2nd year full-time student, she is 20 years old. In April 2015, she got married and changed her last name.

Should the employee continue to provide the standard child deduction?

Solution. The deduction must be provided to the employee before the month of the daughter’s marriage—April 2015 inclusive. From May (the next month after the daughter’s marriage), the employee is deprived of the right to deduction.

During the year, the form of a child's education may change. In this case, the deduction must be provided only for those months when the child was a full-time student (Letter of the Ministry of Finance of Russia dated August 15, 2012 N 03-04-06/8-241).

Example 9. The child first studied part-time, and then full-time

Son of employee D.A. Repinoy was a student in the evening department in January 2015, and in February he was transferred to the full-time department. This fact is reflected in the certificate of the educational institution.

From what month should the employee be provided with a child deduction - starting from January 2015 or only from February?

Solution. The deduction must be provided to the employee starting in February 2015 until her income exceeds RUB 280,000. For January 2015, she was not entitled to a deduction, since the child was an evening student.

Let's consider another case where the deduction is not provided to the employee for several months of the year.

Example 10. A child graduated from school at the age of 18 and in the same year entered a university as a full-time student.

Daughters of employee V.V. Serova turned 18 years old in December 2014. She graduates from school in June 2015. Let’s assume that the girl enters a university full-time this same year. She will be a student from September 1, 2015.

For which months of 2015 should V.V. be deducted? Serov, if his income does not exceed 280,000 rubles?

Solution. The deduction must be provided to the employee:

- for January - June 2015 - time spent at school;

- September - December 2015 - daughter will be a university student.

Both periods of study must be confirmed by certificates from educational institutions.

In July and August, V.V.’s daughter Serova was no longer a schoolgirl, but had not yet become a student. Her father is not entitled to a deduction for these months.

Documents to confirm the right to a child deduction

To provide an employee with a standard deduction for a child under 18 years of age, you need to receive from him (clause 4, clause 1, article 218 of the Tax Code of the Russian Federation):

- written statement;

— documents confirming the employee’s right to a tax deduction (Table 2 below).

table 2

Documents confirming the right to a child deduction

Standard child deduction in 2022: procedure for receiving

Individuals can receive a standard personal income tax deduction from the birth of a child, but for this they need:

- draw up an application to the company in which the parent is registered to apply an income tax deduction;

- send this application along with a package of documents confirming the right to apply the child deduction to the company.

In this case, the list of documents may vary depending on:

- full-fledged family or not;

- parents are adopted or guardianship has been issued;

- whether there are children with disabilities or not;

- the child is a student or is under 18 years of age.

IMPORTANT! The basic documents are the child’s birth certificate and marriage certificate (if both parents are present), the rest are added according to the situation.

Situation 1. A mother is raising a child alone. Then you will need:

- a copy of the mother's passport (including the marital status page);

- certificate/certificate that the father is dead/missing.

Situation 2. The child was adopted and taken into custody:

- confirmation of the fact that the child is adopted or guardianship has been issued over him.

Situation 3. Disabled child:

- certificate indicating the child's disability.

Situation 4. Student child:

- certificate about the form of training.

For information on the procedure for obtaining a deduction for a disabled child, see the material “Armed Forces of the Russian Federation: the deduction for a disabled child does not absorb the usual “children’s” deduction, but complements it .

Controversial situation

Legally, we are talking about the period for providing a standard personal income tax deduction for a child who is a full-time student when he or she reaches 24 years of age.

For example, it is not always clear to parents until what month they have the right to a standard children’s personal income tax deduction for a full-time student if he turned 24 in mid-2022, and the year of graduation is still 2020. At the same time, the employee-parent did not exceed the annual income limit.

The state provides a standard deduction for personal income tax not only for student children, but also for graduate students, residents, interns, and cadets.

Personal income tax deduction for children for studying in 2022

A parent who pays for the education of his own children, wards or adopted children, can use the personal income tax deduction for children in 2021. Moreover, the amount of the deduction for the child (each of the children) should not exceed 50,000 rubles. for both parents (subclause 2, clause 1, article 219 of the Tax Code of the Russian Federation).

You can take advantage of the deduction provided that the age limit for deductions for personal income tax - 2022 for children is not exceeded:

- up to 18 years old;

- up to 24 years of age, provided that the child is a full-time student, graduate student, resident, intern, student, etc.

NOTE! The deduction is provided for distance learning (letter of the Ministry of Finance of Russia dated September 25, 2017 No. 03-04-07/61763).

See here for details.

Documents for deducting personal income tax for a child’s education:

- form 3-NDFL;

- certificate 2-NDFL;

- child's birth certificate;

- a certificate indicating the method of obtaining education;

- education agreement;

- papers confirming payment;

- educational institution license.

IMPORTANT! The agreement and payment documents should indicate the details of the parent - the applicant for the deduction (letter of the Ministry of Finance of Russia dated October 28, 2013 No. 03-04-05/45702), i.e. to those who are entitled to a personal income tax deduction for the child’s education.

Example

Ivanov has a child aged 20 who is studying full-time at the institute. The cost of his training for 2022 was 140,000 rubles. For 2022, Ivanov can submit a 3-NDFL with a package of documents to the Federal Tax Service and reimburse the personal income tax, i.e., take advantage of the right to a deduction for the child’s education, in the amount of 6,500 rubles. (RUB 50,000 × 13%).

Find out the nuances of receiving social benefits for children's education in the following materials:

- “Procedure for the return of income tax (NDFL): nuances”;

- “The receipt is issued for a child: the parent will not receive social benefits?”;

- «Is a husband entitled to a social deduction if he pays for his wife’s child’s education?”.

How to take advantage of the social tax deduction for education? The answer to this question is in ConsultantPlus. To do everything correctly, get trial access to the system and go to the material. It's free.

Application for deduction to the tax office

To receive compensation through the tax office, in addition to the collected documents, the citizen must submit an application for tax refund and 3-NDFL. The entire set of documents is sent to the territorial tax office according to your registration or place of residence.

The application will be satisfied within 3 months if all other documents have been completed correctly. The money will be transferred to a bank account or to the account of any card that the citizen specifies.

Personal income tax deduction for treatment and insurance of a child in 2021

In addition to reimbursement of expenses for a child’s education, a taxpayer can also refund personal income tax on the costs of treating a minor child, as well as on other social grounds:

- purchasing medications;

- carrying out therapeutic and recreational activities;

- directing payments towards his voluntary insurance;

- by paying contributions towards pension payments.

All of the above costs can be reduced by up to RUB 120,000. For expensive treatment, tax can be reimbursed on the entire amount of expenses.

IMPORTANT! During one tax period, only RUB 120,000 can be reimbursed. in the aggregate of all types of social costs - this is the limit of deductions for personal income tax 2020-2021 for children. Until changes are made to the Tax Code, personal income tax deductions per child for treatment and education (general) will be limited to this amount.

Example

Petrov V.S. paid for his son’s education in the amount of 70,000 rubles in 2022. and transferred contributions for voluntary health insurance (VHI) for 60,000 rubles. In 2022, Petrov can file a 3-personal income tax with an amount to be reimbursed of 120,000 rubles, and not 130,000 rubles.

The justification for the deduction for children will be:

- 2-NDFL;

- child's birth certificate;

- documents on payment of training and insurance premiums;

- contract for the provision of services (treatment, insurance, etc.);

- a license to carry out a particular activity (providing medical services, voluntary health insurance services, Pension Fund services);

- certificate of payment for medical services (including for expensive treatment).

These documents are submitted to the tax authority along with 3-NDFL at the end of the year in which the expenses were incurred.

For more details on the specifics of receiving a social deduction, see this material .

When to apply for compensation

You can only reimburse your own education expenses for the year in which payments were made. But you can submit an application and receive a deduction next year. That is, a student who paid for training in 2022 will be able to apply for a refund in 2020. If the employee for some reason did not have time to do this in 2020, he can write an application for a refund of the deduction within the next 2 years - in the example given, these are 2022 and 2022. The main thing is that in 2022 the citizen officially receives a salary from which taxes would be withheld.

The process of reimbursement of training costs takes no more than 4 months. The longest period is spent checking supporting documents by the tax service.

Starting from 2016, you can apply for a refund not only through the tax office, but also through the accounting department where the student works. In this case, the calculated refund amount is not transferred to the employee’s account, but goes to him in the form of 13% of the salary. They are usually withdrawn to pay income taxes, but in this case they will not be withheld.

The employee will receive compensation until the full amount of the deduction is returned. The employee has the right to submit an application for payment of the remaining amount next year if the total amount has not been returned by the end of the current year.