Special sections of the declaration

For exporters, the VAT declaration provides:

- section 4 – to reflect the tax in the case where the zero rate is confirmed;

- section 5 – to reflect tax deductions;

- Section 6 – to reflect tax when the zero rate is not confirmed.

In the same sections, report on exports to member states of the Customs Union. For the purposes of calculating VAT for Russian organizations, the following is equivalent to the export of goods:

- manufacturing of goods intended for export to countries participating in the Customs Union (clause 9 of Appendix 18 to the Treaty on the Eurasian Economic Union);

- transfer of goods under a leasing agreement, which provides for the transfer of ownership to the lessee, as well as under trade credit or trade loan agreements (clause 11 of Appendix 18 to the Treaty on the Eurasian Economic Union).

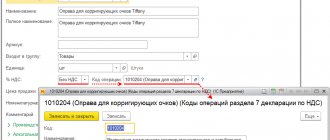

Examples of transaction codes in Section 1 of the VAT return

We can show various transaction codes for filling out a VAT return, which may be indicated in Section 1 of the relevant document, as an example in the following table.

| Code | Meaning |

| 1010800 | Corresponds to business transactions that are not subject to taxation |

| 1010801 | Corresponds to the operations reflected in clause 3 of Art. 39 Tax Code of the Russian Federation |

| 1010802 | Reflects the gratuitous transfer of real estate and infrastructure to state and municipal authorities |

| 1010803 | Corresponds to the transfer of privatized property |

| 1010804 | Reflects the performance of work or services by authorities within the framework of exclusive powers |

| 1010805 | Fixes the gratuitous transfer of fixed assets in favor of authorities, as well as state or municipal institutions and enterprises |

| 1010806 | Corresponds to transactions related to the sale of land plots |

| 1010807 | Reflects the transfer of ownership rights of a legal entity to its legal successor - one or more |

| 1010808 | Reflects the transfer of funds or real estate in order to replenish the capital of an NPO in the manner prescribed by federal legislation |

| 1010809 | Corresponds to transactions that are associated with the implementation by taxpayers in the status of organizers of the Olympic Games of various property rights |

| 1010810 | Complies with the provision of services related to permitting the passage of vehicles on toll public highways |

| 1010811 | Reflects the sale of products, the place of sale of which cannot be recognized as the territory of Russia |

| 1010812 | Reflects the sale of works or services, the place of sale of which cannot be recognized as the territory of Russia |

| 1010813 | Reflects the provision of services related to the free transfer of state and municipal property in favor of NPOs |

| 1010814 | Reflects the fact of performing work or providing services related to additional activities that are aimed at improving the situation on labor markets in the regions of the Russian Federation |

These are the features of entering the indicators under consideration into Section No. 1. Let us now study what transaction code in the VAT return can be recorded in Section No. 2 of the corresponding reporting document. Let's also make a small table for this.

Section 4

In section 4, reflect export transactions for which the right to apply the zero rate has been confirmed. Indicate in it:

- on line 010 – transaction code;

- on line 020 – for each transaction code, the tax base for confirmed export transactions;

- on line 030 – for each transaction code, the amount of deductions of input VAT on goods (work, services) used to conduct confirmed export transactions;

- on line 040 - for each transaction code, the amount of VAT previously calculated for these transactions when the export had not yet been confirmed;

- on line 050 – for each transaction code, the recoverable amount of input VAT previously accepted for deduction when the export had not yet been confirmed.

Lines 040 and 050 of Section 4 must be completed if the organization was previously unable to confirm the export on time.

Fill in lines 070 and 080 when returning goods for which the right to apply a zero rate has not been confirmed. On line 070, reflect the amount of adjustment to the tax base, and on line 080, the amount of adjustment of tax deductions. These lines must be completed in the tax period in which the exporting organization recognized the return of goods (the parties agreed on the return).

If the price of exported goods for which a zero rate was confirmed has changed, indicate the adjustment amounts on lines 100 (if increasing) and 110 (if decreasing). Reflect the adjustment in the tax period in which the exporting organization recognized the price change.

On line 120, reflect the amount of tax to be reimbursed:

| Line 120 = (Lines 030 + Lines 040) – (Lines 050 + Lines 080) |

On line 130, reflect the amount of tax payable:

| Line 130 = (Lines 050 + Lines 080) – (Lines 030 + Lines 040) |

This is stated in section IX of the Procedure, approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

Situation: how to reflect in section 4 of the VAT return the amount of VAT on the cost of services of a customs broker who carries out customs clearance for the export of goods? The broker works under a fee-based service agreement. Different VAT rates are established for exported goods

The amount of tax deduction for brokerage services must be distributed.

Customs brokerage services may be subject to VAT either at a zero rate or at a rate of 18 percent. The zero rate can only be applied if the broker provides services under a transport forwarding agreement when organizing international transportation. This was stated in the letter of the Ministry of Finance of Russia dated August 14, 2015 No. 03-07-08/46977. In the situation under consideration, there is no such agreement, so the tax rate of 18 percent applies. Since the input tax presented by the broker simultaneously applies to goods subject to VAT at different rates, when filling out section 4, its amount must be distributed.

The fact is that section 4 reflects:

- with code 1011410 – operations for the export of goods for which the VAT rate is set at 18 percent;

- with code 1011412 – operations for the export of goods for which the VAT rate is set at 10 percent.

Transaction codes are indicated on line 010 of section 4 of the VAT return. Line 020 of this section reflects the tax base for confirmed export operations, and line 030 - the amount of tax deductions for goods (work, services) used to carry out these operations.

Such instructions are contained in paragraphs 41.1–41.3 of the Procedure approved by Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

Nothing is said about the reflection of tax deductions for goods (work, services) that simultaneously relate to transactions with codes 1011410 and 1011412 in the Procedure approved by Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558. However, in order to correctly fill out the declaration, the amount of such tax deductions should be distributed proportionally to the tax bases for transactions with codes 1011410 and 1011412. To do this, use the following formulas:

| The amount of tax deduction for goods (work, services) used in the sale of goods for export, not specified in paragraph 2 of Article 164 of the Tax Code of the Russian Federation | = | The amount of tax deduction for goods (work, services) used in the sale of goods for export, specified and not specified in paragraph 2 of Article 164 of the Tax Code of the Russian Federation __________________________________________ | × | The cost of goods sold for export not specified in paragraph 2 of Article 164 of the Tax Code of the Russian Federation |

| The total cost of goods sold for export, specified and not specified in paragraph 2 of Article 164 of the Tax Code of the Russian Federation |

| The amount of tax deduction for goods (work, services) used in the sale of goods for export, specified in paragraph 2 of Article 164 of the Tax Code of the Russian Federation | = | The amount of tax deduction for goods (work, services) used in the sale of goods for export, specified and not specified in paragraph 2 of Article 164 of the Tax Code of the Russian Federation | – | The amount of tax deduction for goods (work, services) used in the sale of goods for export, not specified in paragraph 2 of Article 164 of the Tax Code of the Russian Federation |

The amounts of tax deductions received after distribution should be reflected on line 030 of section 4 of the VAT return according to the corresponding transaction code.

An example of reflecting in section 4 of a VAT return the amount of VAT on the cost of brokerage services related to the export of goods specified and not specified in paragraph 2 of Article 164 of the Tax Code of the Russian Federation

Alpha LLC entered into a contract for the supply to Finland of:

- children's clothing made of natural sheepskin and rabbit (the VAT rate is set at 10% (paragraph 3, subparagraph 2, paragraph 2 of Article 164 of the Tax Code of the Russian Federation));

- products made of genuine leather and natural fur (VAT rate is set at 18%).

The total cost of the export contract is 16,000,000 rubles. At the same time, the cost of children's clothing is 3,200,000 rubles, the cost of products made from genuine leather and natural fur is 12,800,000 rubles.

For customs clearance of goods, Alpha used the services of a customs broker. The cost of brokerage services amounted to 118,000 rubles, including VAT - 18,000 rubles.

Within the prescribed period, the organization collected all the necessary documents confirming the right to apply the zero tax rate. The amount of VAT on the cost of brokerage was distributed in proportion to the cost of children's clothing and products made from genuine leather and natural fur.

In section 4 of the VAT return, Alpha’s accountant indicated:

1) on the line with code 1011410 (sales of goods not specified in clause 2 of Article 164 of the Tax Code of the Russian Federation):

- on line 020 (tax base) – 12,800,000 rubles;

- on line 030 (tax deductions) – 14,400 rubles. (RUB 18,000: RUB 16,000,000 × RUB 12,800,000);

2) on the line with code 1011412 (sales of goods specified in clause 2 of Article 164 of the Tax Code of the Russian Federation):

- on line 020 (tax base) – RUB 3,200,000;

- on line 030 (tax deductions) – 3600 rubles. (RUB 18,000 – RUB 14,400).

Procedure for filling out a VAT return

Operation codesCode Name of transaction Grounds (article, paragraph, subparagraph of the Tax Code of the Russian Federation 1 2 3 1010800 Section I. Operations not recognized as an object of taxation Article 146 of the Code, paragraph 2 1010801 Operations specified in paragraph 3 of Article 39 of the Code Article 146 of the Code, paragraph 2, subparagraph 1 1010802 Transfer, free of charge, of residential buildings, kindergartens, clubs, sanatoriums and other social, cultural and housing and communal facilities, as well as roads, electrical networks, substations, gas networks, water intake structures and other similar facilities to government bodies and local government bodies (or by decision of these bodies - specialized organizations that use or operate the specified objects for their intended purpose) Article 146 of the Code, paragraph 2, subparagraph 2 1010803 Transfer of property of state and municipal enterprises purchased through privatization Article 146 of the Code, paragraph 2 , subparagraph 3 1010804 Performance of work (provision of services) by bodies included in the system of state authorities and local self-government bodies, within the framework of the exercise of the exclusive powers assigned to them in a certain field of activity in the event that the obligation to perform the specified work (provision of services) is established by the legislation of the Russian Federation Federation, legislation of the constituent entities of the Russian Federation, acts of local self-government bodies Article 146 of the Code, paragraph 2, subparagraph 4 1010805 Transfer of fixed assets free of charge to state authorities and management bodies and local self-government bodies, as well as state and municipal institutions, state and municipal unitary enterprises Article 146 of the Code, paragraph 2, subparagraph 5 1010806 Sale of land plots (shares in them) Article 146 of the Code, paragraph 2, subparagraph 6 1010807 Transfer of property rights of an organization to its successor(s) Article 146 of the Code, paragraph 2, subparagraph 7 1010808 Transfer of funds non-profit organizations for the formation of endowment capital, which is carried out in the manner established by the Federal Law “On the procedure for the formation and use of endowment capital of non-profit organizations” Article 146 of the Code, paragraph 2, subparagraph 8 1010809 Sales operations by taxpayers who are Russian organizers of the Olympic Games and Paralympic Games in in accordance with Article 3 of the Federal Law “On the organization and holding of the XXII Olympic Winter Games and the XI Paralympic Winter Games of 2014 in the city of Sochi, the development of the city of Sochi as a mountain climatic resort and amendments to certain legislative acts of the Russian Federation”, goods (works, services) and property rights, carried out in agreement with persons who are foreign organizers of the Olympic Games and Paralympic Games in accordance with Article 3 of the Federal Law “On the organization and holding of the XXII Olympic Winter Games and the XI Paralympic Winter Games of 2014 in the city of Sochi, the development of the city of Sochi as mountain climatic resort and amendments to certain legislative acts of the Russian Federation", as part of the fulfillment of obligations under the agreement concluded by the International Olympic Committee with the Russian Olympic Committee and the city of Sochi for the holding of the XXII Olympic Winter Games and XI Paralympic Winter Games 2014 in the city of Sochi Article 146 of the Code , paragraph 2, subparagraph 9 1010811 Sale of goods, the place of sale of which is not recognized as the territory of the Russian Federation Article 147 of the Code 1010812 Sale of work (services), the place of sale of which is not recognized as the territory of the Russian Federation Article 148 of the Code 1010200 Section II. Operations not subject to taxation (exempt from taxation) Article 149 of the Code 1010201 Provision by the lessor of premises for rent on the territory of the Russian Federation to foreign citizens or organizations accredited in the Russian Federation Article 149 of the Code, paragraph 1 1010204 Sales of the following medical goods of domestic and foreign production according to the list, approved by the Government of the Russian Federation: the most important and vital medical equipment; prosthetic and orthopedic products, raw materials and materials for their production and semi-finished products for them; technical means, including motor vehicles, materials that can be used exclusively for the prevention of disability or rehabilitation of disabled people; glasses (except for sunglasses), lenses and frames for glasses (except for sunglasses) Article 149 of the Code, paragraph 2, subparagraph 1 1010211 Sale of medical services provided by medical organizations and (or) institutions, doctors engaged in private medical practice, with the exception of cosmetic , veterinary and sanitary-epidemiological services (except for veterinary and sanitary-epidemiological services financed from the budget) Article 149 of the Code, paragraph 2, subparagraph 2 1010221 Sales of care services for the sick, disabled and elderly, provided by state and municipal social protection institutions to persons the need for care for which is confirmed by the relevant conclusions of health authorities and social protection authorities Article 149 of the Code, paragraph 2, subparagraph 3 1010231 Implementation of services for the maintenance of children in preschool institutions, conducting classes with minor children in clubs, sections (including sports) and studios Article 149 Code, paragraph 2, subparagraph 4 1010232 Sales of food products directly produced by student and school canteens, canteens of other educational institutions, canteens of medical organizations, preschool institutions and sold by them in these institutions, as well as food products directly produced by public catering organizations and sold their specified canteens or specified institutions Article 149 of the Code, paragraph 2, subparagraph 5 1010234 Sales of services for the preservation, acquisition and use of archives provided by archival institutions and organizations Article 149 of the Code, paragraph 2, subparagraph 6 1010235 Sales of services for the transportation of passengers: urban passenger transport public use (except for taxis, including minibuses) under uniform conditions for the transportation of passengers at uniform fares established by local governments, including the provision of all travel benefits approved in the prescribed manner; by sea, river, railway or road transport (except for taxis, including minibuses) in suburban transport, subject to the carriage of passengers at uniform tariffs with the provision of all travel benefits approved in the prescribed manner Article 149 of the Code, paragraph 2, subparagraph 7 1010237 Sales of funeral services, work (services) for the production of tombstones and decoration of graves, as well as sales of funeral accessories (according to the list approved by the Government of the Russian Federation) Article 149 of the Code, paragraph 2, subparagraph 8 1010238 Sales of postage stamps (with the exception of collectible stamps), marked postcards and marked envelopes, lottery tickets for lotteries held by decision of the authorized body Article 149 of the Code, paragraph 2, subparagraph 9 1010239 Sales of services for the provision of residential premises for use in the housing stock of all forms of ownership Article 149 of the Code, paragraph 2, subparagraph 10 1010242 Sales coins made of precious metals (except for collectible coins) that are the currency of the Russian Federation or the currency of foreign states Article 149 of the Code, paragraph 2, subparagraph 11 1010243 Sale of shares in the authorized (share) capital of organizations, shares in mutual funds of cooperatives and mutual investment funds, valuable securities and instruments of futures transactions (including forward, futures contracts, options) Article 149 of the Code, paragraph 2, subparagraph 12 1010244 Sale of services provided without charging additional fees for the repair and maintenance of goods and household appliances, including medical goods, in the warranty period of their operation, including the cost of spare parts for them and parts for them Article 149 of the Code, paragraph 2, subparagraph 13 1010245 Sales of services in the field of education for non-profit educational organizations to conduct training and production (in the areas of basic and additional education specified in the license ) or educational process, with the exception of consulting services, as well as services for leasing premises Article 149 of the Code, paragraph 2, subparagraph 14 1010246 Implementation of repair and restoration, conservation and restoration work carried out during the restoration of historical and cultural monuments, protected by the state, religious buildings and structures used by religious organizations (with the exception of archaeological and earthworks in the area of historical and cultural monuments or religious buildings and structures; construction work to reconstruct completely lost historical and cultural monuments or religious buildings and structures; works on the production of restoration, conservation structures and materials; activities to control the quality of work performed) Article 149 of the Code, paragraph 2, subparagraph 15 1010248 Implementation of work performed during the implementation of targeted socio-economic programs (projects) of housing construction for military personnel as part of the implementation of these programs (projects), including: works on the construction of social, cultural or household facilities and related infrastructure; work on the creation, construction and maintenance of professional retraining centers for military personnel, persons discharged from military service, and members of their families Article 149 of the Code, paragraph 2, subparagraph 16 1010251 Sales of services provided by authorized bodies, for which a state fee is charged, all types licensing, registration and patent duties and fees, customs duties for storage, as well as duties and fees levied by state bodies, local governments, other authorized bodies and officials when granting organizations and individuals certain rights (including payments to budgets for the right to use natural resources) Article 149 of the Code, paragraph 2, subparagraph 17 1010252 Sales of goods placed under the customs regime of a duty-free shop Article 149 of the Code, paragraph 2, subparagraph 18 1010253 Sales of goods (work services), with the exception of excisable goods sold (performed , provided) within the framework of providing gratuitous assistance (assistance) to the Russian Federation in accordance with the Federal Law “On gratuitous assistance (assistance) to the Russian Federation and introducing amendments and additions to certain legislative acts of the Russian Federation on taxes and on the establishment of benefits for payments to state extra-budgetary funds in connection with the provision of gratuitous assistance (assistance) to the Russian Federation" Article 149 of the Code, paragraph 2, subparagraph 19 1010255 Implementation of services provided by cultural and art institutions in the field of culture and art, which include: services for the rental of audio and video media from the funds of the specified institutions, sound equipment, musical instruments, stage production equipment, costumes, shoes, theatrical props, props, post-production supplies, cultural equipment, animals, exhibits and books; services for making copies for educational purposes and teaching aids, photocopying, reproduction, photocopying, microcopying from printed materials, museum exhibits and documents from the funds of these institutions; services for sound recording of theatrical and entertainment, cultural, educational and entertainment events, for making copies of sound recordings from the record libraries of these institutions; services for delivery to readers and collection of printed materials from library collections; services for compiling lists, certificates and catalogs of exhibits, materials and other items and collections that make up the fund of these institutions; services for the provision of rental stage and concert venues to other budgetary institutions of culture and art, as well as services for the distribution of tickets specified in paragraph three of subparagraph 20 of paragraph 2 of Article 149 of the Code; sale of entrance tickets and subscriptions to theater and entertainment, cultural and educational and entertainment events, attractions in zoos and cultural and recreation parks, excursion tickets and excursion vouchers, the form of which is approved in the prescribed manner as a strict reporting form; implementation of programs for performances and concerts, catalogs and booklets Article 149 of the Code, paragraph 2, subparagraph 20 1010266 Sale of works (services) for the production of film products performed (provided) by cinematography organizations, rights to use (including rental and screening) of film products that have received a national certificate film Article 149 of the Code, paragraph 2, subparagraph 21 1010267 Sales of services provided directly at airports of the Russian Federation and the airspace of the Russian Federation for aircraft maintenance, including air navigation services Article 149 of the Code, paragraph 2, subparagraph 22 1010268 Sales of work (services, including repair services) for servicing sea vessels and inland navigation vessels during stays in ports (all types of port dues, services of port fleet vessels), as well as pilotage Article 149 of the Code, paragraph 2, subparagraph 23 1010269 Sales of services of pharmacy organizations for the manufacture of medicines funds, as well as for the manufacture or repair of spectacle optics (with the exception of sun protection), for the repair of hearing aids and prosthetic and orthopedic products listed in subparagraph 1 of paragraph 2 of Article 149 of the Code, services for the provision of prosthetic and orthopedic care Article 149 of the Code, paragraph 2, subparagraph 24 1010274 Sale of scrap and waste of ferrous and non-ferrous metals Article 149 of the Code, paragraph 2, subparagraph 25 1010256 Sale of exclusive rights to inventions, utility models, industrial designs, programs for electronic computers, databases, topologies of integrated circuits, production secrets (know -how), as well as the rights to use the specified results of intellectual activity on the basis of a license agreement Article 149 of the Code, paragraph 2, subparagraph 26 1010271 Sale (transfer for one’s own needs) of religious objects and religious literature (in accordance with the list approved by the Government of the Russian Federation on the representation of religious organizations (associations), produced by religious organizations (associations) and organizations, the only founders (participants) of which are religious organizations (associations), and sold by these or other religious organizations (associations) and organizations, the only founders (participants) of which are religious organizations (associations), within the framework of religious activities, with the exception of excisable goods and mineral raw materials, as well as the organization and conduct by these organizations of religious rites, ceremonies, prayer meetings or other religious activities Article 149 of the Code, paragraph 3, subparagraph 1 1010272 Implementation (in including transfer, fulfillment, provision for one’s own needs) of goods (except for excisable goods, mineral raw materials and minerals, as well as other goods according to the list approved by the Government of the Russian Federation upon submission of all-Russian public organizations of disabled people), works, services (except for brokerage and other intermediary services) produced and sold by organizations specified in subparagraph 2 of paragraph 3 of Article 149 of the Code Article 149 of the Code, paragraph 3, subparagraph 2 1010276 Carrying out banking operations by banks (except for collection) Article 149 of the Code, paragraph 3, subparagraph 3 1010277 Banking operations services related to the servicing of bank cards Article 149 of the Code, paragraph 3, subparagraph 3.1 1010278 Operations carried out by organizations providing information and technological interaction between payment participants, including the provision of services for the collection, processing and distribution of information on transactions with bank cards to payment participants Article 149 Code, paragraph 3, subparagraph 4 1010279 Carrying out certain banking operations by organizations that, in accordance with the legislation of the Russian Federation, have the right to carry them out without a license from the Central Bank of the Russian Federation Article 149 of the Code, paragraph 3, subparagraph 5 1010281 Sales of folk art crafts of recognized artistic merit (for exclusion of excisable goods), the samples of which are registered in the manner prescribed by the authorized by the Government of the Russian Federation by the federal executive body Article 149 of the Code, paragraph 3, subparagraph 6 1010282, the provision of insurance, compassion and reinsurance of insurance organizations, as well as the provision of non -governmental retirement services non -state support Pension funds Article 149 of the Code, paragraph 3, subparagraph 7 1010283 Organization of totalizers and other games based on the risk of games (including slot machines) by organizations or individual entrepreneurs of the gambling business Article 149 of the Code, paragraph 3, subparagraph 8 1010284 The holding of lottery conducted by the decision of the authorized executive body, including the provision of services for the sale of lottery tickets, Article 149 of the Code, paragraph 3, subparagraph 8.1 1010285 The sale of ore, concentrates and other industrial products containing precious metals, scrap and waste of precious metals for the production of precious metals and the staging; the sale of precious metals and precious stones by taxpayers (with the exception of the Code of Article 164 specified in subparagraph 6 of paragraph 1 of Article 164) of the State Fund for Precious Metals and Gemstones of the Russian Federation, the funds of precious metals and precious stones of the constituent entities of the Russian Federation, the Central Bank of the Russian Federation and banks; the implementation of precious stones in raw materials (with the exception of unprofitable diamonds) for processing to enterprises regardless of ownership for the subsequent sale of export; the implementation of precious stones in raw materials and robbed by specialized foreign economic organizations, the State Fund for Precious Metals and precious stones of the Russian Federation, the funds of precious metals and precious stones of the constituent entities of the Russian Federation, the Central Bank of the Russian Federation and banks; The sale of precious metals from the State Fund for Precious Metals and Gemstones of the Russian Federation, from the funds of precious metals and precious stones of the constituent entities of the Russian Federation, specialized foreign economic organizations, the Central Bank of the Russian Federation and banks, as well as the sale of precious metals in ingots by the Central Bank of the Russian Federation and central banks The Bank of the Russian Federation and banks, including under agreements, commission or agent agreements with the Central Bank of the Russian Federation and banks, regardless of the placement of these ingots in the repository of the Central Bank of the Russian Federation or the storage of banks, as well as to other persons, provided that these ingots remain in one of the storage facilities (state storage of values, the storage of the Central Bank of the Russian Federation or the storage of banks) Article 149 of the Code, paragraph 3, subparagraph 9 1010286 Implemented diamonds to processing enterprises of all forms of ownership Article 149 of the Code, paragraph 3, subparagraph 10 1010287 Intra -system implementation ( Transfer, fulfillment, provision for own needs) by organizations and institutions of the criminal-executive system of goods they have produced (performed work, services rendered) Article 149 of the Code, paragraph 3, subparagraph 11 1010288 transfer of goods (performance of work, provision of services) free of charge within the framework of charity activities In accordance with the Federal Law “On Charitable Activities and Charitable Organizations”, with the exception of excisable goods, Article 149 of the Code, paragraph 3, subparagraph 12 1010289 Implementation of input tickets, the form of which is approved in the prescribed manner as a strict report form, physical education and sports organizations for conducted they are sporting and entertainment events; The provision of services for the provision of sports facilities for these measures is Article 149 of the Code, paragraph 3, subparagraph 13 1010291, the provision of services by colleges of lawyers, lawyers, lawyers of the constituent entities of the Russian Federation or the Federal Chamber of Lawyers in connection with their professional activities Article 149 Code, paragraph 3, subparagraph 14 1010292 Operations for the provision of loans in cash, as well as the provision of financial services for the provision of loans in cash, Article 149 of the Code, paragraph 3, subparagraph 15 1010294 Performance of research and development at the expense of budgets as well as funds of the Russian Fund for fundamental research, the Russian technological development fund and the extra -budgetary funds of ministries, departments, associations formed for these purposes in accordance with the legislation of the Russian Federation; The implementation of scientific and development work institutions of education and scientific organizations on the basis of business contracts Article 149 of the Code, paragraph 3, subparagraph 16 1010257 The implementation by organizations of research, development and technological work related to the creation of new products and technologies or to technologies or technologies or to Improving the products and technologies, if scientific, development and technological work includes the types of activities provided for in subparagraph 16.1 of paragraph 3 of Article 149 of the Code of Article 149 of the Code, paragraph 16.1 1010295 Service of sanatorium-resort organizations and organizations and organizations rest, rest organizations and recovery of children, including children's health camps located on the territory of the Russian Federation, drawn up by tickets or courses, which are strict reporting forms Article 149 of the Code, paragraph 3, subparagraph 18 1010296 Carrying out work (provision of services) to extinguish forest fires Article 149 of the Code, paragraph 3, subparagraph 19 1010297 The sale of products of their own production of organizations engaged in the production of agricultural products, the share of income from which in the total amount of their income is at least 70 percent, at the expense of the natural remuneration, natural delivery issues for wages, As well as for the public catering of workers involved in agricultural work Article 149 of the Code, paragraph 3, subparagraph 20 1010298 Implementation of residential buildings, residential premises, as well as shares in them Article 149 of the Code, paragraph 3, subparagraph 22 1010273 transfer of a share in the right to total property In an apartment building during the sale of apartments, Article 149 of the Code, paragraph 3, subparagraph 23 1010275 Transfer for goods (works, services), the costs of purchasing (creation) of which are not exceeded 100 rubles Article 149 of the Code, paragraph 3, subparagraph 25 1010258 of the operation on the assignment (acquisition) of the rights (claims) of the creditor for obligations arising from the contracts for the provision of loans in cash and (or) credit agreements, as well as to execute the borrower of obligations to the new creditor under the initial agreement under the concession agreement Article 149 of the Code , paragraph 3, subparagraph 26 1010259 Carrying out work (provision of services) by residents of the port special economic zone in the port special economic zone Article 149 of the Code, paragraph 3, subparagraph 27 1010261 Gratuitous provision of services for the provision of airtime and (or) print area in accordance with the legislation The Russian Federation on elections and referendum Article 149 of the Code, paragraph 3, subparagraph 28 1010400 Section III. Operations taxed at 0 percent of Article 164 of the Code 1010401 The sale of goods exported in the customs mode of exports, as well as goods placed under the customs regime of the free customs zone (not specified in paragraph 2 of Article 164 of the Code) Article 164 of the Code, paragraph 1, subparagraph 1 1010402 The sale of goods exported in the customs mode, as well as goods placed under the customs regime of the free customs zone (specified in paragraph 2 of Article 164 of the Code) Article 164 of the Code, paragraph 1, subparagraph 1 1010403 The sale of goods (not specified in paragraph 2 of Article 2 164 of the Code) to the Republic of Belarus, taxable for article 2 of Agreement 1010404 The sale of goods (specified in paragraph 2 of Article 164 of the Code) to the Republic of Belarus, which is taxable for Article 2 of Agreement 1010405 The implementation of work (services) directly related to the production and sale of goods specified in subparagraph 1 of paragraph 1 of Article 164 of the Code. Such works (services) include work (services) on the organization and maintenance of transportation, transportation or transportation, organization, support, loading and overload of goods delivered to the territory of the Russian Federation or goods carried out to the territory of the Russian Federation, performed (provided) by Russian organizations or individual entrepreneurs (with the exception of Russian carriers in railway transport), and other similar work (services), as well as work (services) for the processing of goods placed under the customs regime of processing in the customs territory Article 164 of the Code, paragraph 1, subparagraph 2 1010407 Implementation of work ( services), directly related to the transportation or transportation of goods placed under the customs regime of international customs transit, Article 164 of the Code, paragraph 1, subparagraph 3 1010408 Implementation of services for the transportation of passengers and baggage, provided that the departure point or the purpose of passengers and baggage are located outside Territories of the Russian Federation, during the registration of transportation on the basis of unified international transportation documents Article 164 of the Code, paragraph 1, subparagraph 4 1010409 The sale of goods (works, services) in the field of space activity Article 164 of the Code, paragraph 1, subparagraph 5 1010411 The sale of precious metals by taxpayers providing Their production or production of scrap and waste containing precious metals, the State Fund for Precious Metals and Gemstones of the Russian Federation, the funds of precious metals and precious stones of the constituent entities of the Russian Federation, the Central Bank of the Russian Federation, banks Article 164 of the Code, paragraph 1, subparagraph 6 1010412 goods (works, services) (not specified in paragraph 2 of Article 164 of the Code) for official use of foreign diplomatic and equated representatives or for the personal use of the diplomatic or administrative-technical personnel of these representative offices, including their family members Article 164 of the Code , paragraph 1, subparagraph 7 1010413 The sale of goods (works, services) (specified in paragraph 2 of Article 164 of the Code) for official use of foreign diplomatic and equated representative offices or for the personal use of the diplomatic or administrative-technical personnel of these representative offices, including those living together with They are members of their families Article 164 of the Code, paragraph 1, subparagraph 7 1010414 The implementation of supplies exported from the territory of the Russian Federation in the customs mode of supplies of supplies Article 164 of the Code, paragraph 1, subparagraph 8 1010415 implementation of work (services) performed by Russian carriers for transportation (services) for transportation or the transportation of goods exported outside the territory of the Russian Federation and the export from the customs territory of the Russian Federation of processing products in the customs territory of the Russian Federation, as well as those related to such transportation or transportation of work (services), including work (services) for the organization of transportation, support, Loading, overload Article 164 of the Code, paragraph 1, subparagraph 9 1010416 Implementation of the constructed vessels subject to registration in the Russian International Court of Courts Article 164 of the Code, paragraph 1, subparagraph 10 1010417 The sale of goods (works, services) (not specified in paragraph 2 of Article 164 of the Code for official use by international organizations and their representative offices engaged in activities in the Russian Federation Article 165 of the Code, clause 12 1010418 The sale of goods (works, services) (specified in paragraph 2 of Article 164 of the Code) for official use by international organizations and their representative offices engaged in activities that carry out activities carrying out activities that carry out activities. On the territory of the Russian Federation, Article 165 of the Code, clause 12 1010419 The implementation of works (services) named in Article 4 of the Protocols between the Government of the Russian Federation and the Government of the Republic of Belarus on the procedure for the collection of indirect taxes in the performance of work, the provision of services of March 23, 2007 Article 4 of the protocol 1011700 Section IV. Operations carried out by tax agents Article 161 of the Code 1011711 The sale of goods of foreign persons who are not registered as taxpayers, as well as the implementation of the work, services of foreign persons who are not registered as taxpayers, using non -proprietary forms of calculations, Article 161 of the Code, paragraph 1 1011712 Implementation of work, services of foreign persons who are not registered as taxpayers, with the exception of the implementation of work, services of foreign persons who are not registered as taxpayers, with the use of non -proprietary forms of calculations, Article 161 of the Code, paragraph 1 1011703 of state authorities and services of state authorities and the services of state authorities and administration and local governments for the provision of federal property, property of the constituent entities of the Russian Federation and municipal property, including under agreements, under which the tenants are the state authority and administration, local government, as well as the sale (transfer) of state property, not assigned to state enterprises and institutions constituting the state treasury of the Russian Federation, the treasury of the republic as part of the Russian Federation, the treasury of the region, the region, the city of federal significance, the autonomous region, the autonomous district, as well as the municipal property not assigned to municipal enterprises and institutions that make up the municipal The treasury of the corresponding urban, rural settlement or other municipality is Article 161 of the Code, paragraph 3 1011705 The sale in the territory of the Russian Federation of confiscated property, property sold by the court decision (including when carrying out bankruptcy proceedings in accordance with the legislation of the Russian Federation), mismanagements, merciful values, merciful values stores and bought up values, as well as values that have been the right to inherit inheritance Article 161 of the Code, clause 4 1011707 The sale of goods, transfer of property rights, the performance of work, the provision of services in the Russian Federation by foreign persons who are not registered with tax authorities as taxpayers as taxpayers , on the basis of the agreements of the order, agreements of the commission or agency agreements, Article 161 of the Code, clause 5 1011709 Payment of tax by tax agents specified in paragraph 6 of Article 161 of the Code, at the time the vessel is excluded from the Russian International Register of Courts or non -power of the vessel to the Russian International Register within 45 Days from the moment of transfer of ownership from the taxpayer to the customer Article 161 of the Code, paragraph 6 1011800 Section V. Operations on real estate objects Article 171 of the Code, paragraph 6, paragraph Fourth 1011801 property, completed by contracting organizations Article 171 of the Code, paragraph 6, paragraph Fourth 1011802 Real Estate, completed by capital construction in the implementation of construction and installation works for own consumption Article 171 of the Code, paragraph 6, paragraph Four 1011803 Real Estate, acquired under a civil law agreement Article 171 of the Code, paragraph 6, paragraph Fourth 1011805 Modernization (reconstruction) real estate object Article 171 of the Code, paragraph 6, paragraph Fourth

Section 5

Section 5 should be completed in the declaration for the period when the right to deduct VAT on export transactions (previously confirmed and not confirmed) arose. For example, if you previously collected documents and confirmed the zero rate, but did not fulfill the conditions for applying the deduction.

On line 010, indicate the year in which the declaration was submitted, which reflected transactions for the sale of goods. On line 020 - tax period code in accordance with Appendix No. 3 to the Procedure, approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

Fill out Section 5 separately for each tax period, information about which is reflected in the indicators on lines 010 and 020.

Please indicate:

- on line 030 – transaction code;

- on line 040 - the tax base relating to already confirmed export transactions (i.e. for which Section 4 was submitted to the tax office, but which could not be accepted for deduction at that moment);

- on line 050 – the amount of input VAT related to confirmed exports;

- on line 060 - the tax base related to unconfirmed exports (i.e. for which Section 6 had already been submitted to the tax office, but which could not be accepted for deduction at that moment, for example, in the absence of an invoice);

- on line 070 – the amount of input VAT related to unconfirmed exports.

Such instructions are contained in section X of the Procedure, approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

Codes in books and magazines: governing legislation

The list of relevant codes is also fixed by law. The main source of law in which they are given is Order of the Federal Tax Service of the Russian Federation No. ММВ-7-3/136, issued on March 14, 2016. Transaction codes in accordance with the specified source of law can be recorded:

— in purchase books that are used as part of VAT calculations, additional sheets to them;

- the sales book, as well as on the sheet supplementing it.

In addition, the noted legal act contains codes for the types of transactions that are necessary for the taxpayer to maintain a journal of invoices.

Section 6

Section 6 is intended to reflect transactions for which the deadline for submitting documents confirming the right to apply the zero VAT rate has expired.

The duration of this period is 180 calendar days. For exported goods, the 180-day period is counted:

- from the date of shipment (for deliveries to countries participating in the Customs Union) (clause 5 of Appendix 18 to the Treaty on the Eurasian Economic Union);

- from the date of placing goods under the customs export procedure (for deliveries to other countries) (clause 9 of article 165 of the Tax Code of the Russian Federation).

In relation to work (services) related to the export of goods (import of goods into Russia), the procedure for determining the 180-day period depends on the type of work (service).

On line 010, enter the operation code. For each transaction code, fill in lines 020–040.

On line 020 reflect the tax base.

On line 030, indicate the amount of VAT calculated based on the tax base on line 020 and the VAT rate (10 or 18%).

Line 040 reflects the amounts of tax deductions:

- input VAT paid to the seller;

- VAT paid when importing goods into Russia;

- VAT paid by the tax agent when purchasing goods, works, services.

Fill in lines 050–060 only on the first page, and put dashes on the rest.

On line 050, reflect the total amount of VAT (the sum of all lines 030 for each transaction code).

For line 060, enter the summed indicator of lines 040 for each transaction code.

If the buyer returned some of the goods to the exporter, fill in lines 080–100:

- on line 080 – the amount by which the tax base is reduced;

- on line 090 – VAT adjustment (the amount by which the calculated VAT is reduced);

- on line 100 – the amount of VAT that needs to be restored (previously accepted for deduction).

If you increase or decrease the price, fill in lines 110–150:

- on line 120 - the amount by which the tax base is increased;

- on line 130 – the amount by which VAT is increased;

- on line 140 – the amount by which the tax base is reduced;

- on line 150 – the amount by which VAT is reduced.

Calculate the amount of VAT payable to the budget for line 160 as follows:

| Line 160 = (line 050 + line 100 + line 130) – (line 060 + line 090 + line 150) |

Calculate the VAT refund amount for line 170 as follows:

| Line 170 = (line 060 + line 090 + line 150) – (line 050 + line 100 + line 130) |

Please take into account the amounts of VAT payable (reduced) reflected in sections 4–6 when filling out section 1 of the VAT return (clauses 34.3, 34.4 of the Procedure approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558) .

Codes in books and magazines: application

What can this or that code mean, the use of which is provided for by Order of the Federal Tax Service of the Russian Federation No. ММВ-7-3/136?

For example, code 01, given in the above-mentioned Order of the Federal Tax Service of the Russian Federation, corresponds to transactions related to the release, transfer or acquisition of certain goods, services or work, including those provided by intermediaries, as well as property rights. It is assumed that the corresponding transaction code can be used in all types of books and journals used by the taxpayer.

Let us now consider which transaction code in the VAT return can be recorded when filling out the corresponding reporting document for the Federal Tax Service of Russia. They can be classified based on their assignment to one of the 5 sections of the declaration - in fact, in this form, as we noted above, they are given in the main source of law regulating their application.

Sections 8 and 9

In section 8, enter information from the purchase book for those transactions for which the right to deduction arose in the reporting quarter.

In section 9 of the declaration, indicate information from the sales book. For more information on the procedure for filling out sections 8 and 9, see How to draw up and submit a VAT return.

If changes have been made to the purchase book or sales book, you will need to fill out Appendix 1 to sections 8 and 9.

An example of filling out a VAT return for export transactions

Alpha LLC is registered in Moscow and is engaged in the production of furniture (OKVED code 36.1). The organization did not carry out any transactions on the domestic market that should be reflected in the VAT return for the first quarter of 2016.

Alpha has a long-term contract for the supply of furniture of its own production to Finland.

In January 2016, under this contract, Alpha supplied:

- children's beds (VAT rate - 10%) (paragraph 5, subparagraph 2, paragraph 2 of Article 164 of the Tax Code of the Russian Federation) - in the amount of 7,800,000 rubles;

- wooden cabinets (VAT rate - 18%) - in the amount of 10,000,000 rubles.

The total cost of the export contract was 17,800,000 rubles.

For customs clearance of goods, Alpha used the services of a customs broker. The cost of brokerage services amounted to 141,600 rubles, including VAT - 21,600 rubles.

In February 2016, the organization collected all the necessary documents confirming the right to apply a zero tax rate, and accepted for deduction the amount of input VAT presented to it when purchasing materials for the manufacture of export products:

- from the cost of materials for children's beds - 57,800 rubles;

- from the cost of materials for wooden cabinets - 89,350 rubles.

The amount of VAT on the cost of brokerage was distributed in proportion to the cost of children's beds and wooden cabinets. The amount of VAT accepted for deduction for each product item is:

- for cabinets - 12,135 rubles. (RUB 21,600 × RUB 10,000,000: (RUB 7,800,000 + RUB 10,000,000));

- for beds – 9465 rub. (RUB 21,600 × RUB 7,800,000: (RUB 7,800,000 + RUB 10,000,000)).

In February 2016, Alpha received an invoice for transportation costs (cost - 118,000 rubles, including VAT - 18,000 rubles) for an export transaction completed in November 2015. Then the organization sold products worth RUB 2,360,000. (including VAT – 360,000 rubles). A package of documents confirming the application of a 0 percent rate for this operation was collected in December 2015; the amount of deduction for raw materials and supplies spent on the production of export products is reflected in the VAT return for the fourth quarter of 2015.

In addition, in February 2016, Alpha expired the period (180 calendar days) allotted for collecting documents confirming the application of the zero VAT rate for the export transaction completed in the third quarter of 2015. The organization’s accountant charged VAT at a rate of 18 percent on unconfirmed export proceeds. At the same time, he prepared an updated VAT return for the third quarter of 2015. In addition to the information previously reflected in the declaration, the accountant filled out section 6. In it, for the transaction with code 1010401, he showed the tax base (912,300 rubles), the accrued amount of VAT (164,214 rubles) and the amount of tax deduction (90,000 rubles).

The Alpha accountant began filling out the VAT return for the first quarter of 2016 with the title page. On it he indicated general information about the organization, as well as the tax office code and the code for the location of the organization - 214.

Then the accountant filled out section 4, in which he indicated:

1) according to code 1010410 (sale of goods not specified in clause 2 of Article 164 of the Tax Code of the Russian Federation):

- on line 020 (tax base) – 10,000,000 rubles;

- on line 030 (tax deductions) – 101,485 rubles. (RUB 89,350 + RUB 12,135);

2) according to code 1010412 (sales of goods specified in paragraph 2 of Article 164 of the Tax Code of the Russian Federation):

- on line 020 (tax base) – RUB 7,800,000;

- on line 030 (tax deductions) – 67,265 rubles. (RUB 57,800 + (RUB 21,600 – RUB 12,135));

3) on line with code 120:

- RUB 168,750 – the amount of tax calculated for reduction under this section.

After this, the accountant filled out section 5. In it, he indicated the amount of VAT accepted for deduction on transport services in the amount of 18,000 rubles.

The accountant finished drawing up the declaration by filling out section 1. In it, he indicated the total amount of tax to be reimbursed under the declaration - 186,750 rubles. (RUB 168,750 + RUB 18,000).

The VAT return for the first quarter of 2016, signed by the General Director of Alpha Lvov, was submitted by the organization to the tax office on April 22, 2015.

Situation: when do you need to submit a VAT return for export transactions?

Submit sections of the declaration provided for export operations as part of the general tax return.

Starting from January 1, 2015, submit VAT returns to the inspectorate no later than the 25th day of the month following the expired tax period (clause 5 of Article 174 of the Tax Code of the Russian Federation). The expired tax period should be understood as the quarter in which the organization collected documents confirming the right to apply the zero tax rate. Submit supporting documents at the same time as your declaration.

To collect documents confirming the right to apply the zero VAT rate, the organization is given 180 calendar days:

- from the moment of release of goods in the export procedure to countries that are not members of the Customs Union;

- from the moment of shipment of goods to a country that is a member of the Customs Union.

This period is established by paragraph 9 of Article 165 of the Tax Code of the Russian Federation, paragraph 5 of Appendix 18 to the Treaty on the Eurasian Economic Union.

The end of the 180-day period allotted for collecting documents is not associated with the established deadline for filing the declaration, but with the tax period in which this period expires. If the complete package of supporting documents is collected by the organization within a period not exceeding 180 calendar days, reflect export transactions in section 4 of the VAT return for the tax period in which the day the documents were collected falls. Regardless of the fact that this day is not the end of the tax period.

For example, the 180-day period allotted for collecting documents expires on November 20, 2015. In fact, the documents necessary to confirm the right to a zero VAT rate were collected on October 15, 2015. In this case, the right to apply a zero tax rate must be declared in the VAT return for the fourth quarter of 2015, which must be submitted no later than January 25, 2016. If the documents had been collected at least a day later (November 21, 2015), then the organization would not have had any grounds to reflect the export operation in the declaration for the fourth quarter.

This conclusion is confirmed by letters of the Ministry of Finance of Russia dated April 17, 2012 No. 03-07-08/108, dated October 6, 2010 No. 03-07-15/131 and dated June 3, 2008 No. 03-07-08/137 .

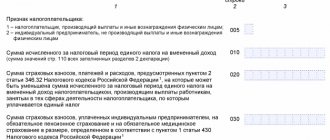

When to fill out section 7

The current value added tax report form was approved by Order of the Federal Tax Service No. ММВ-7-3/ [email protected] dated 10/29/2014, as amended on 11/20/2019. The same standard establishes what to indicate in section 7 of the VAT return - in block XII of Appendix No. 2 of the Order.

IMPORTANT!

We submit the report for the third quarter on a new form. Its form was approved by Order of the Federal Tax Service of Russia No. ED-7-3 / [email protected] dated March 26, 2021.

Here's who fills out this block according to the rules of the Tax Code of the Russian Federation:

- those who carried out sales operations that are not subject to value added tax and are exempt from tax (Article 149 of the Tax Code of the Russian Federation);

- those who carried out transactions not related to objects of taxation (clause 2 of article 146, clause 3 of article 39 of the Tax Code of the Russian Federation);

- those who sold goods, works and services outside the Russian Federation (Articles 147, 148 of the Tax Code of the Russian Federation).

The Tax Code of the Russian Federation does not have a direct answer as to whether section 7 of the VAT tax return is filled out when selling used batteries, but if the used batteries are not scrap, then their sales are subject to VAT in the generally established manner, and block No. 7 is not filled out. If these batteries are scrap metal, then upon sale the responsibility for calculating and paying value added tax rests with the buyer (tax agent). In this case, section 7 is also not filled out (letter of the Federal Tax Service No. SD-4-3 / [email protected] dated 04/19/2018):

- buyers from clause 8 of Art. 161 of the Tax Code of the Russian Federation fill out blocks No. 3, 8 and 9 of the declaration;

- buyers and VAT non-payers form blocks No. 2 and 9.

Completion is required for taxpayers who have received payment or advance payment (partial payment) for future supplies of goods, works and services produced or performed for longer than six months. Such information is reflected in line 010 of block No. 7.

IMPORTANT!

Non-operating income does not apply to transactions not subject to value added tax. In such receipts there is no actual sale of goods, works or services: an object of taxation is not formed (clause 1, article 39, clause 1, article 146 of the Tax Code of the Russian Federation).

Examples of transaction codes in Section No. 2 of the declaration

| Code | Meaning |

| 1010200 | Reflects transactions that may not be subject to value added tax |

| 1010201 | Reflects the provision by the lessor of certain premises in favor of citizens of other states or foreign companies |

| 1010202 | Corresponds to the implementation of services related to the accreditation of operators who carry out technical inspections in accordance with the legislation of the Russian Federation |

| 1010203 | Corresponds to the implementation of services for technical inspection by operators in accordance with the legislation of the Russian Federation |

| 1010211 | Reflects the implementation of medical services provided by legal entities or individual entrepreneurs operating in the field of medicine |

| 1010221 | Reflects services related to care for the sick, citizens with disabilities, and the elderly, if this care is provided in accordance with a medical report |

| 1010225 | Corresponds to the transfer of ownership rights represented by a contribution under an agreement within an investment partnership, as well as when one of the partners receives a share when dividing assets |

| 1010226 | Corresponds to services related to the organization of gambling |

| 1010227 | Reflects services related to the trust management of pension investments in accordance with the legislation of the Russian Federation |

| 1010228 | Reflects transactions related to the assignment of claims within the framework of obligations arising on the basis of financial legal relations in the process of forward transactions |

| 1010229 | Reflects various operations carried out by clearing companies |

| 1010231 | Corresponds to services related to the supervision and care of children in kindergartens, clubs, sections, studios |

| 1010232 | Corresponds to sales of food products that are directly produced by canteens established by educational and educational organizations |

| 1010234 | Corresponds to services related to archive management, which are carried out by specialized organizations |

| 1010235 | Corresponds to sales of services related to the transportation of passengers on public transport |

These are the features of reflecting indicators in Section No. 2 of the reporting document under consideration. Let's move on.