Current and major repairs, passing periodic technical inspections of cars are an urgent need to maintain the property in a condition suitable for use in order to make a profit. During these activities, expenses arise that must be reflected in tax and accounting records. Such expenses include the purchase of spare parts, repair work by service station technicians, repair shops, and preventive inspections of equipment.

Question: How to reflect in the accounting of the lessee organization the costs of routine repairs of a vehicle received under a bareboat rental agreement, carried out by the organization’s auxiliary production? The cost of current car repairs amounted to 40,000 rubles. (including materials, employee wages, insurance premiums). In the month of completion of repair work, materials used cost 24,000 rubles. paid in full, and salaries and insurance premiums are paid next month. The car is used in the main production of the organization. The organization did not create a reserve for the repair of fixed assets (FPE) for profit tax purposes. The organization prepares interim financial statements on the last day of each calendar month. View answer

The occurrence of car expenses and their current accounting

The organization operating the car can carry out repairs on its own, or it can outsource maintenance and repair work to specialists. In tax accounting, such expenses are classified as other expenses in accordance with clause 1 of Art. 260 Tax Code of the Russian Federation. They should be recognized in the period in which they were implemented. Accounting is carried out on the basis of primary documents confirming expenses incurred.

Let's look at accounting for repairs using OSNO as an example.

Question: An organization on OSN purchased a car on lease. In January, an accident occurred through no fault of the lessee, as a result of which the car could not be repaired. Is it possible to take into account leasing payments from January to July before the end of the leasing term as part of income tax expenses? View answer

Third Party Repair and Maintenance

The legislation does not provide for an exhaustive list of documents. Practice has developed the following procedure for processing work:

- concluding an agreement with a service station or service center, usually for a year;

- drawing up a repair request with a list of work and necessary spare parts;

- certificate of acceptance and transfer of the car for repair with a description of defects and problem areas;

- drawing up a work order with a detailed description of the work and its cost;

- work acceptance certificate after completion;

- invoice (if necessary);

- act of acceptance and transfer of the car in kind.

Question: How to reflect in the accounting records of a dealer organization the warranty repair of cars sold (purchased from a distributor), if the repair costs are reimbursed by the distributor in the amount of expenses incurred? The organization recognizes an estimated liability in connection with the need for warranty repairs in accounting, but it has already been fully used earlier, and the costs incurred are not covered by it. In tax accounting, a reserve for warranty repairs is not created. The cost of the warranty repairs was 52,000 rubles. (including the cost of spare parts - 20,000 rubles (excluding VAT), the amount of VAT previously accepted for deduction when purchasing them - 4,000 rubles). A report on the cost of work performed and spare parts used is sent to the distributor. Reimbursement was received to the bank account in the reporting period in which the warranty repair was performed. View answer

Let Zvezdochka LLC decide to contact a third-party organization to repair the KamAZ vehicle. The cost of the work, according to the invoice, amounted to 175,000 rubles, including VAT.

The postings will look like this:

- Dt 25 Kt60 - 175,000.00 rub. Service station debt;

- Dt 19 Kt 60 — 26694.92 rub. VAT reflected;

- Dt 60 Kt 51 - 175,000.00 rub. Paid to the service station for the work;

- Dt 68 Kt 19 — 26694.92 rub. Submitted for VAT deduction.

To what extent can a lessor organization take into account for income tax purposes the costs of repairing an insured car leased out (clause 1 of Article 260 of the Tax Code of the Russian Federation)?

In-house repair and maintenance

As a rule, the following documents are used within the organization to record and confirm repairs:

- repair plan;

- defective statements;

- applications from persons responsible for the condition of the fleet for the purchase of spare parts, primary invoices, invoices and other documents;

- invoice requirements for the issuance of spare parts;

- acts for writing off spare parts and materials for repairs;

- inventory cards and books with notes on repairs.

Let Zvezdochka LLC repair KamAZ on its own. The cost of spare parts was 75,000 rubles, and the wages of workshop workers involved in repairs were 25,000 rubles.

The postings will be like this:

- Dt 25 Kt 10/5 - 75,000.00 rub. Spare parts written off for repairs;

- Dt 25 Kt 70 - 25,000.00 rub. Salary accrued;

- Dt 25 Kt 68.69 - 7500 rub. Deductions to funds from wages.

Creating a reserve for repairs

Reserving funds for future repairs is the right of the organization, not its responsibility. It is necessary to specify the need for such a reserve in the accounting policy. The calculation of contributions to the reserve is based on the data of defective statements, the cost of the car, its service life and technical characteristics. An annual estimate for vehicle repairs and maintenance is drawn up.

Let the estimated cost for the year be 360,000.00 rubles, for the month - 30,000.00 rubles.

The postings and calculations used are as follows: Dt 25 Kt 96 RUB 30,000.00.

Zvezdochka LLC repaired a KamAZ truck at a service station in January for the amount of 75,000 rubles, including VAT of 11,440.68 rubles. The reserve amounted to RUB 30,000.00. Amount excluding VAT RUB 63,559.32:

- Dt 60 Kt 51 - 75000.00 rub. Service station repairs were paid for;

- Dt 96 Kt 60 - 30000.00 rub. Repairs at the expense of the fund.

63779,32 — 30000,00 = 33779, 32

- Dt 97 Kt 60 — 33779.32 rub. The remaining amount is included in deferred expenses;

- Dt 19 Kt 60 - 11440.68 rub. VAT included;

- Dt 68 Kt 19 - 11440.68 rub. VAT is claimed for deduction.

It should be said about the features of accounting for repairs in cases where a car is rented or taken under a leasing agreement.

OS overhaul in accounting - postings

Once the decision on the need for a major overhaul of fixed assets has been made, the facility can be restored by the organization itself or by using equipment and workers from a third-party company on a contract basis. If you go the route of overhaul by the organization’s services, then you need to take into account that expenses will include the cost of spare parts and materials, wages, and insurance premiums.

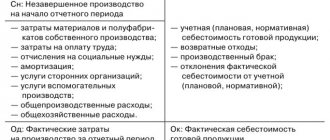

Accounts for carrying out major repairs in various ways will be as follows:

- if there is a structural unit (repair service):

Dt 23 Kt 10 (16, 69, 70) - repair costs collected;

Dt 20 (25, 26, 29, 44) Kt 23 - expenses are written off depending on the use of the operating system (the account on which depreciation is recorded is debited);

- if there is no repair service, account 23 is not used, and the costs are written off directly to the cost account:

Dt 20 (25, 26, 29, 44) Kt 10 (16, 69, 70);

- If the repair is carried out by a contractor, the cost entry will be:

Dt 20 (25, 26, 29, 44) Kt 60.

For long-term overhauls, it is recommended to transfer objects to a separate subaccount of account 01 “OS under repair”.

For more information about what costs are considered justified, read the material “What are the costs of repairing fixed assets?”.

The recommendations of ConsultantPlus experts will help you write off materials for OS repairs in accounting and for income taxes. Get free trial access to the system and go to the Ready-made solution.

Car for rent

There are two types of car rental agreement:

- without crew;

- with crew (temporary charter).

In the first case , according to Art. 642 of the Civil Code of the Russian Federation, the tenant receives the right to temporarily use the car, including driving it, and maintaining it in proper condition. The lessor receives a fee for using his car. Further, in accordance with the provisions of Art. 644 of the Civil Code of the Russian Federation, current and major repairs of the car are required to be carried out by the lessee. He also maintains the proper technical condition of the car, recognizing the costs according to the law.

Article 264 (clause 11-1) allows organizations using the OSNO to do this, and Article 346.16 (clause 12) allows those using the simplified tax system. All expenses must be documented, based on properly executed primary documents.

Expenses for repairs and maintenance of rental cars are recognized without problems for organizations using OSNO:

- if the car is depreciable - on the basis of Art. 260 of the Tax Code of the Russian Federation, regardless of whether it is stated in the contract or not;

- if the car is not subject to depreciation (for example, rented from a private person or organization on a special regime) - on the basis of Art. 264 of the Tax Code of the Russian Federation (clause 1-49).

Expenses for repairs and maintenance of cars rented from an organization using the simplified tax system are recognized unambiguously only if these cars are depreciated. This is stated in Art. 346.16 (clause 4) of the Tax Code of the Russian Federation: the list of fixed assets includes those fixed assets that are recognized as depreciable (based on the provisions of Chapter 25 of the Tax Code of the Russian Federation). Therefore, only the costs of depreciable vehicles can be taken into account in expenses. Simplified people do not have any indication of the possibility of including in expenses the repair and maintenance of cars rented from private individuals, which are not subject to depreciation. A situation may arise that the tax authorities have the right to interpret not in favor of the lessor.

In the second case, the car is rented with a crew. The lessor provides, for a fee, in addition to the car itself, the services of a driver. Here, according to Article 634 of the Civil Code of the Russian Federation, the lessor independently carries out repairs, both current and major.

Attention! It will be impossible for the organization to recognize the costs of purchasing spare parts as expenses, since their acquisition is, by law, the responsibility of the lessor and is included in the concept of car repairs.

Major and current repairs of the OS, unlike other recovery methods

In the production activities of organizations during the operation of the operating system, wear and tear of the operated objects naturally occurs, and breakdowns occur.

Their timely restoration allows you to increase their service life and avoid the cost of purchasing new equipment. Recovery is possible through modernization, reconstruction and repair. Modernization and reconstruction are recognized as work that improves or creates new technical and economic characteristics of an object. Whereas repair includes a set of measures aimed at replacing individual structures, parts, and maintaining its working condition. Repairs are divided into current and major. Current repairs are aimed at prevention, maintaining the facility in working order and eliminating minor faults. Capital - guarantees the restoration of the technical parameters of the object and its working condition.

Overhaul can be comprehensive, covering the entire facility, or selective, including the repair of individual parts of the facility.

The validity of OS repairs is established by the technical services of organizations by determining the order of scheduled preventive maintenance, while assigning the type of repair.

A feature of accounting for major repairs compared to other types of restoration is that repair costs are included in current costs, while costs for modernization and reconstruction are included in capital costs.

For key differences between repair and OS modernization for tax purposes, see ConsultantPlus. Trial access to the legal system is free.

Car on lease

According to Law No. 164-FZ dated 10/29/98, which deals with issues of leasing (financial lease), the lessee is obliged to repair, perform maintenance, and protect the property accepted by him under the contract. Unless otherwise stated in the contract, the provisions of Art. 17-1 Federal Law 164 are the basis for including these costs in calculations for tax purposes. This rule is also confirmed by the instructions of Art. 260 of the Tax Code of the Russian Federation (clauses 1.2). In this case, it does not play a significant role whether the car is on the balance sheet of the lessor or the lessee - as a general rule, the costs for it lie with the organization that received the property.

Attention! Primary documents and accounting data must not only confirm the fact of expenses for the car, but also contain an indication of the use of this car for production purposes, to generate income for the organization, and confirm the economic justification of the expenses.

Briefly

- Vehicle repairs and maintenance are carried out both internally and externally.

- Some business entities create reserves to cover future repairs. This procedure is their right, not their obligation. It must be specified in the accounting policy.

- Rented cars are repaired at the expense of the lessee if a car rental agreement without a crew is concluded.

- Leased property is repaired and maintained at the expense of the organization that received the car under the contract, regardless of whose balance sheet the property is on.