VAT in payments

When paying for goods or services, you must indicate VAT information in the payment order in the “Purpose of payment” section.

This may be an allocated amount of value added tax or an indication that no tax is being paid. Information about VAT must be recorded on a separate line. Despite its apparent simplicity, errors regarding incorrectly indicated VAT occur quite often:

Colleagues, how do you convey to your clients, in decent words, that you should NOT write “No VAT” in the PP, but should write “0% VAT”?

Maybe there is a secret way to get drunks to read what is written? Tried ffse! From huge reminder fonts to threats of refunds. — Alla Kis

Accountants shared their experience on how to convey information to the counterparty that VAT in the payment order must be indicated correctly:

“Have you tried simply returning payments with the purpose “incorrect payment purpose”? Then demand payment again. If you don't get it, try again. This kind of training works for us” (Andrey Yudaev);

“To be honest, my suppliers once returned a payment to me due to incorrectly indicated VAT, explaining this by the fact that their program did not fit together. I paid correctly. There was also an option when they forced it through the client bank (!!)! send the letter about the payment change and the letter from me simply did not go through. Maybe try one of these options” (Vera Gorlova);

“I would indicate in the invoice: “In the purpose of payment, be sure to write “VAT 0%””, then in italics: “if you indicate “without VAT” - this is incorrect for this payment - here the VAT rate = “0%” and this is important!” . Usually they still look at the score, it will work for the majority” (Olga Denisova).

The insidiousness of numerology

The next point in our program is the inaccurate contract or account number. It will cause particular suspicion when purchasing goods from suppliers that inspectors consider to be at high risk. However, it is possible to make excuses. If the mere fact of an inaccurate contract or invoice number does not mean that the inspectors will consider the expenses unpaid. Provided that it is possible to determine which expenses the payment actually relates to. Confusion is possible if a company has several agreements with a counterparty. So it’s safer to indicate a specific contract or account number on the payment slip.

For example, a company has two contracts with a buyer. He must transfer payment for goods shipped under one contract. But he indicated the details of another agreement in the payment slip. It is not necessary to specify the purpose of the payment if it can be identified. That is, the receiving company can determine which contract and invoice the payment actually relates to. For example, if the buyer missed a digit in the invoice number.

If buyers often make mistakes in the purpose of payment, you can create a register. Indicate in it which payment purpose is correct. The register will come in handy if the bank requests an agreement or account specified in the payment order.

How to recycle old documents

Accounting documents must be kept for a certain period of time.

After the expiration of the storage period, the question arises: what to do with the documents? Accounting documents with a temporary storage period of up to 10 years inclusive are destroyed after the expiration of the storage period (paragraph 2, clause 2.3 of Order of the Ministry of Culture dated March 31, 2015 No. 526).

According to the list, a document destruction act is drawn up for disposal. The act can be drawn up in any form.

Documents are destroyed:

- grinding;

- burning;

— transfer for destruction to a specialized organization;

- in other ways.

Has anyone destroyed documents from old periods?

How is this all done? Otherwise, one organization has had folders dating back to 2008 (bank statements, acts, invoices, reporting, salaries, GPC agreements). I know that salaries, personnel, contracts with individuals must be kept for a long time. But other? The company is on the simplified tax system of 6% all its life. Can I just burn them at the dacha or should I contact a company that liquidates documents? — Elena Sokovinova

How the group members destroy documents after the expiration date:

“I burn them at the dacha. I don’t know how correct this is” (Anastasia Ko);

“Many people write that it’s in the trash... Well, if you don’t want to destroy it according to the act, then at least hand it over!! This is a recyclable material. And then we complain about the environment..." (Irina Tyukina);

“Documents for salary are stored for 75 years, for fixed assets, goods and materials, inventories - 5 years, documents for advance reports - 5 years (instructions for accounting), tax returns, requirements, and all sorts of clarifications for taxes - 5 years (instructions for NU) . We write off annually, according to the act. We call the archivist, he looks at it, checks it against the document, and writes a permit. We take it out ourselves and burn it” (Oksana Furman).

Procedure for paying VAT

According to the general rules, VAT is paid (clause 1 of Article 174 of the Tax Code of the Russian Federation):

- in the amount of 1/3 of the amount of VAT calculated for payment (page 040 of Section 1 of the VAT return);

- by the 25th day of each month of the quarter following the reporting one;

Payment is made to the Federal Tax Service:

- for VAT taxpayers - at the place of registration of the organization or individual entrepreneur (clause 2 of article 174 of the Tax Code of the Russian Federation).

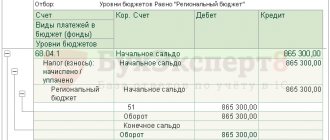

The completed payment order for VAT payment looks like this.

Let's take a closer look at the procedure for its formation and payment of VAT to the budget in the program.

In accordance with the VAT return for the 4th quarter of 2022. the amount of VAT payable amounted to RUB 720,000. The organization pays VAT monthly in the amount of 1/3 of the tax amount.

On January 25, the accountant prepared a payment order for the payment of VAT in the amount of 240,000 rubles. The tax was paid on the same day using a bank statement.

Calling an accountant to investigators

The life of an accountant is difficult and unprepossessing. A regular KUB participant told how her summons to the investigative committee went.

Tomorrow they are summoning me to the Investigative Committee for a confrontation with my ex-geno: to confirm my testimony that only he managed all the money.

So far the case is only related to labor legislation. Now this is the experience. — Inna Kosik

Inna says that this is not the first time this organization has called for questioning as witnesses.

The reason was a complaint from one of the employees who was not officially employed.

One of the unofficial employees (I can’t even say how long she worked - a week or more), I assume that she was not paid for her work (but these are just my assumptions), got angry and filed a complaint. The case was opened under the article “Fraud” - hiring people but not paying them wages.

Investigators asked questions:

- who hired

- who signed the employment documents,

- who paid the salary,

- who managed the cash register and account.

At the confrontation, you had to confirm your own testimony and answer the lawyer’s questions if he asked them.

In such a situation, it is useful for accountants to read the article:

We answer together: everything about the subsidiary liability of the chief accountant.

Possible errors when making payments to a counterparty

The value of the list of the most common errors makes it easier to check and identify shortcomings in specific payment orders. These mistakes are very often made:

- Incorrect TIN. If in all other respects the order is completed correctly, then the regulatory authorities do not have the right to demand clarification of the details.

- The basis for payment is incorrectly specified. This is also a minor error. The funds will be sent to the recipient. In this case, it makes sense to contact the recipient. His response clarifying the basis for the payment is attached to the order. This must be done, as otherwise there may be confusion. It can lead to difficulties in the work of accountants and tax representatives.

- Allocation of VAT if the order concerns counterparties under a special tax regime. For example, the counterparty may use the simplified tax system. In this case, he does not need to pay VAT. Accordingly, there is no need to highlight VAT in the payment order. If this is done, you need to send a clarifying letter to your bank. The latter sends a notification to the bank servicing the counterparty. The error must be corrected. Otherwise, the counterparty will have to pay tax at an increased rate.

- Incorrect designation of payment purposes. For example, the funds were actually transferred as an advance for the service. However, the order specifies a loan as the purpose. In this case, you also need to notify the bank about the error. If this is not done, the company will not receive a deduction for the advance payment.

- Incorrect information about the counterparty. The counterparty's details may be changed. However, the company does not always send out notifications about this. That is, the payment is sent using the old details. In this case, the transferred funds will be kept in the banking institution until the information is clarified. On the sixth day, the funds are returned to their sender. When making such an error, the company has two courses of action: submitting updated information to the bank or receiving funds back on the sixth day and then re-issuing the order.

Even if the error seems insignificant, in most cases it still needs to be corrected.

Errors that can be fixed

Let's look at correctable errors and the procedure for eliminating them:

- The purpose of the funds is incorrectly indicated. You need to perform a tax reconciliation with the Federal Tax Service, and then fill out a reconciliation report. It is signed by an accountant, as well as a representative of the Federal Tax Service.

- Inflated payment amount. There are several ways to proceed. First: redirection of funds. The overpaid money will be used to pay the next payments. Second: processing a refund of payment to the company’s bank account.

The listed errors are considered insignificant. They are relatively easy to fix.

Errors that cannot be corrected

Let's consider significant errors that cannot be corrected:

- Indication of the wrong BCC. For example, the code numbers are indicated incorrectly or the old KBK is taken. In this case, the payment is considered unclassified. The tax will be considered unpaid. That is, the payer will have to pay penalties and fines for late payment. To correct the situation, you need to send an application to the Federal Tax Service. It specifies a request to offset the transferred funds. A copy of the incorrect order and a bank statement are attached to the application.

- Underpayment. The tax is also not considered paid. To correct the situation, you need to add the missing amount to the budget.

- Indication of the BCC, which relates to another tax. In this case, you can act in several ways. This is, firstly, a return of funds to the payer’s bank account. Secondly, this is a repeated payment of the payment. What will happen to the old payment? It is credited under another tax, to which the KBK applies. An overpayment is created for this tax, which will be offset against the next payment.

- Invalid recipient account. This is the most difficult mistake. The money will have to be sent again. A penalty will be charged for late payments.

- The name of the banking institution is incorrect. Also an irreversible error.

- Indication of a non-existent BCC. A refund is being issued. The payment is sent again.

There is a big difference between a significant and an insignificant error. In case of correctable errors, the payer only needs to send a clarification. In this case, the payment will be considered paid. Errors that cannot be corrected mean that taxes or payments to counterparties are not considered paid. That is, fines and penalties will be imposed on the payer.

Other errors in the payment order

Other errors in the payment order, such as incorrectly indicated KBK, OKATO, INN, KPP and the name of the tax authority, do not prevent the receipt of tax to the budget (subclause 4, clause 4, article 45 of the Tax Code of the Russian Federation). If such errors are made, then the tax is considered paid, but, in accordance with the norm of paragraph. 2 clause 7 art. 45 of the Tax Code of the Russian Federation, it is required to submit an application to clarify the payment (letters of the Ministry of Finance of Russia dated January 19, 2017 No. 03-02-07/1/2145, dated July 16, 2012 No. 03-02-07/1-176, dated March 29, 2012 No. 03 -02-08/31, Federal Tax Service of Russia dated October 10, 2016 No. SA-4-7/19125, dated December 24, 2013 No. SA-4-7/23263).

For information on how to draw up such an application, read the material “ Sample application for clarification of tax payment (error in the KBK) ” .

If, as a result of an error, the tax was received by another BCC (for example, an inactive one), the taxpayer can apply for a tax offset. Penalties should not be accrued (letters of the Ministry of Finance of Russia dated July 17, 2013 No. 03-02-07/2/27977, dated August 1, 2012 No. 02-04-12/3002).