What changes in legislation have affected operations related to the sale of scrap?

Until 2022, the sale of scrap ferrous and non-ferrous metals was an operation exempt from the accrual and payment of VAT.

However, starting from 01/01/2018, sub. 25 clause 2 art. 149 of the Tax Code of the Russian Federation was abolished, as a result of which the sale of scrap was subject to VAT. This happened with the entry into force of the law “On Amendments...” dated November 27, 2017 No. 335-FZ. Its provisions not only abolished the scrap tax exemption, but also defined a completely new category of tax agents. Now these are those who purchase scrap metal, be it non-ferrous or ferrous metal, secondary aluminum and its alloys, as well as raw hides.

IMPORTANT! Transactions related to the sale of raw animal skins were not previously given preferential treatment. VAT was calculated and paid by the seller in the usual manner.

Next, we will look at how the functions of a VAT tax agent will fall on the business entity purchasing scrap and how it can cope with them.

What has changed for sellers and buyers of scrap metal (scrap dealers)

The main change is the transfer of the obligation to pay VAT on the sale of scrap metal from sellers to buyers.

This means that from 01/01/2018, buyers of scrap are recognized as tax agents for VAT and are required to fulfill all obligations in this regard (paying tax and filing a declaration). Two questions immediately arise: why did this affect scrap metal sellers (and not some other material or product) and why did this happen specifically from 01/01/2018?

The legislation does not contain direct answers to these questions, but conclusions can be drawn based on indirect signs:

- According to legislators (based on an analysis of practice), in the field of scrap metal circulation there is a significant number of violations of VAT payment at all stages of work with this type of material.

- The date of introduction of innovations is associated with successive activities of legislators related to the struggle for full receipt of VAT into the budget.

How this systematic work to remove VAT “from the shadows” took place, see the figure:

This transfer of responsibilities from sellers to buyers of scrap metal is an experiment by legislators, which can subsequently be extended to all sectors of the economy.

Under what circumstances will the party receiving the scrap act as a withholding agent?

Economic entities - purchasers of scrap - will have to perform agency functions for VAT, but only if the sellers are on the general regime and do not apply any tax exemptions. In such situations, it does not matter at all whether the agent is a VAT payer or not.

IMPORTANT! Intermediaries purchasing scrap metal, etc. for third parties do not act as tax agents. All obligations related to the calculation and payment of tax will have to be fulfilled by the buyers of the specified goods - the principals and principals.

The procedure for completing a transaction will be as follows:

- When receiving an advance payment or issuing shipping documents, the seller makes a special note on the invoice “VAT is calculated by the tax agent.”

- The party receiving the scrap, upon receipt of the above document from the seller, calculates the base and charges the tax payable.

When scrap is purchased from special regime persons, persons exempt from VAT, individuals without entrepreneurial status - in a word, VAT evaders, the buyer does not need to act as a VAT agent. Special regime officers and Osvobozhdeniye soldiers issue an invoice from Fr. If it is not set, this mark must be present in the transfer document (invoice, purchase act) or a separate condition is specified in the contract.

We will discuss the specifics of issuing and processing all the necessary documentation in more detail in each of the above situations in the sections below, and then we will talk about cases when the party selling scrap metal independently calculates and transfers VAT to the budget.

What is a tax agent?

A tax agent is an agent who is responsible for withholding from the taxpayer and transferring tax to the state budget.

Tax agents are required to calculate and pay the appropriate amount of VAT to the budget, regardless of whether they perform the duties of a VAT payer or not.

The buyer's obligations as a tax agent arise only when scrap or non-ferrous metal is purchased from VAT payers.

In order for the buyer of scrap to know that he is purchasing goods from a VAT non-payer, the seller must make an entry in the contract and in the primary accounting document “Without VAT” or at least put such a mark.

The seller must pay VAT in the following cases:

- When selling scrap metal to an individual;

- Sending scrap metal abroad, that is, for export;

- The seller loses the right to a special tax regime or is exempt from VAT.

How does a tax agent calculate taxes payable to the budget?

The VAT payable to the budget for the quarter, which is the tax period for the stipulated tax, must be calculated by the buyer of scrap metal - the tax agent - according to the established formula.

EXAMPLE of VAT calculation by a tax agent when purchasing scrap metal from ConsultantPlus: Organization Alpha purchased scrap metal from organization Beta. Both organizations are VAT payers. The cost of supplying scrap metal was 500,000 rubles. (excluding VAT). When the scrap metal seller shipped it, the Alpha organization charged VAT in the amount of... For the calculation, see K+. It's free.

The buyer needs to restore VAT (paragraph 4, subparagraph 3, paragraph 3 and paragraph 6, subparagraph 4, paragraph 3, Article 170 of the Tax Code):

- upon receipt of metal scrap, on account of which an advance was previously transferred and VAT was accepted for deduction;

- return of advance;

- reducing the cost/quantity of scrap by agreement with the seller, i.e. when adjusting the amount of tax previously claimed for deduction.

VAT deductions for the purchaser of scrap are described in clause 4.1 of Art. 173 NK.

Features of filling out a VAT return for scrap metal with a tax agent

Filling out a VAT return by a tax agent when purchasing scrap is slightly different than filling out the usual scheme for filling out a return by tax agents.

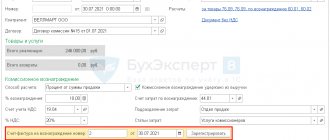

Let's take a closer look at the following example:

Titan LLC entered into a supply agreement with Sokol LLC for the purchase of metal waste. Both companies are VAT payers.

At the end of July, an advance payment under the concluded agreement in the amount of 45,000 rubles was received in the settlement account of Sokol LLC, in response to which the seller generated an invoice dated July 30, 2022 No. 485 with the note “VAT is calculated by the tax agent.” The buyer calculates VAT on the advance payment using the formula:

((45,000 + 45,000 × 18%) × 18/118) = 8,100 rub.

At the beginning of August, Titan LLC received from Sokol LLC the entire batch of metal waste in accordance with the concluded agreement worth 220,000 rubles and a sales invoice dated 08/09/2022 No. 603 with the note “VAT is calculated by the tax agent.”

Buyer (Titan LLC):

- calculated VAT on the cost of the purchased lot:

((RUB 220,000 + RUB 220,000 × 18%) × 18/118) = RUB 39,600;

- accepted VAT from the advance for deduction, then restored the advance VAT and accepted shipping VAT for deduction;

- Using the recommendations of the Federal Tax Service, I filled out a VAT return at the end of the quarter.

Despite the fact that Titan LLC acts as a VAT tax agent in this transaction, it does not fill out Section 2 of the VAT return, which is usual for tax agents (a feature of filling out a VAT return in 2022 for scrap metal buyers).

If Titan LLC has no other transactions in the reporting quarter, then the tax payable will be 0 rubles. (accrued tax equals deductions).

Results

So, we found out that when selling scrap, the acquiring party must charge and pay VAT. But she will do this only if the scrap seller is a VAT payer and is not exempt from paying tax, for example, under Art. 145 of the Tax Code of the Russian Federation. There are also some features in the issuance of invoices for advance payments and for shipment by taxpayer sellers, which we also examined. In addition, we described how tax registers for VAT accounting are filled out by each party participating in a transaction for the sale of scrap.

If the scrap seller is exempt from VAT or applies a special tax regime, the buyer does not have the obligations of a tax agent. The main thing is to approach the preparation of the initial documents (contracts, invoices, acts, etc.) very carefully so that the controllers do not have any claims against either the selling or acquiring party.

Sources:

- Tax Code of the Russian Federation

- Federal Law of November 27, 2017 No. 335-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Which section of the declaration and who should fill it out?

The algorithm for filling out a VAT return is described in the letter of the Federal Tax Service “On the procedure for filling out a VAT return by tax agents specified in paragraph 8 of Article 161 of the Tax Code of the Russian Federation” dated 04/19/2018 No. SD-4-3 / [email protected] :

Note! The VAT declaration was updated by order of the Federal Tax Service dated March 26, 2021 No. ED-7-3/ [email protected] The form is used from the reporting campaign for the 3rd quarter of 2022.

You will find a line-by-line algorithm with examples of filling out all twelve sections of the report in ConsultantPlus. Trial access to the system can be obtained for free.

To uniformly reflect transactions for the sale of scrap in invoices, purchase and sales books, special codes are used:

How to fill out an invoice for scrap metal, read here.

Find out about the coding of transactions in the VAT return by following the link .

Whether or not to pay personal income tax when selling scrap

You can find out about the duty regarding the delivery of scrap metal by an individual from Art. 217 and 218 of the Tax Code of the Russian Federation. Personal income tax is paid in cases where it is impossible to confirm the fact of use for 3 years or more. Thus, personal income tax does not need to be paid in the following situations:

- the seller is not a resident of Russia;

- the right to property is documented (presence of checks, alienation agreements, acceptance certificates);

- use from 3 years.

PS: a wide selection of certified non-ferrous metal, as well as rolled aluminum, copper, brass and bronze products in Russia is offered by Fox Metal. If you or your company need, for example, to buy brass sheets in Moscow wholesale or retail at one of the most favorable prices, then you should contact the company’s specialists and place an order. Contact us!

Good luck!

Acceptance of VAT deduction when purchasing scrap metal

Tax agents who pay VAT on the purchase of scrap metal have an important advantage - they can deduct VAT as buyers. That is, they are entitled to a tax deduction as if they had purchased scrap metal from the seller at a cost that included VAT.

Thus, the buyer may not pay VAT to the budget because if he buys scrap metal for 100 rubles, he calculates 18 rubles in tax, but at the same time he can claim the same 18 rubles as a deduction.

However, not all buyers can claim a deduction, but only those who are VAT payers. Since only in this case is it permissible to take such a deduction into account.