Registration of a manufacturing enterprise is the most important stage, which determines how much taxes you will pay and how complex accounting you will have to keep. What type of taxation is optimal for production: OSNO or simplified tax system? If the simplified tax system, then which of the two? And, most importantly, what will be the consequences for business in each case? Read this article to find out the answers and avoid common mistakes of new entrepreneurs!

Which tax system to choose for production

For most micro and small enterprises, the optimal choice is the simplified tax system of 15% (“Income minus expenses”), because There are usually significant costs for materials, raw materials, tools, labor and services.

STS 6% (“Income”) is preferable if expenses are difficult or impossible to document, which means they cannot be taken into account when calculating the taxable base. For example, an organization accepts scrap ferrous metals and produces products from it. There are two people on staff, registered for the minimum wage; scrap is brought to them without any documents, payment for it is made unofficially, and the cost of the finished products is high. It turns out that the revenue is large, but the expenses are insignificant, so paying 15% of the difference is unprofitable. In addition, you will have to take into account and document costs, which takes time. For such productions, the simplified tax system of 6% is suitable.

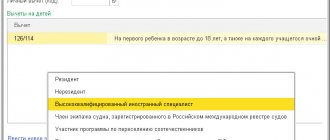

OSNO is chosen by large manufacturers, as well as small enterprises that, for some reason, do not have the right to use the “simplified tax” or sell finished products primarily to VAT payers.

Let's summarize:

- If you plan to officially purchase raw materials, materials, tools, pay for work and services, choose the simplified tax system of 15%. The simplified taxation system “Income minus expenses” is optimal for production, because Instead of three taxes (VAT, income tax and property tax), you need to pay one. But keep in mind that the use of this system is associated with the need to collect and record expense documents.

- If the share of documented expenses is minimal or there are none at all, a simplified tax system of 6% is suitable.

- If the majority of buyers are VAT payers or you cannot use the simplified tax system, stay on OSNO.

Do you have doubts about the choice of taxation system?

We will help you choose the best option taking into account the specifics of your business, draw up documents in accordance with tax requirements and submit them without your presence. The result is guaranteed! Take the first step towards your own business!

How can production switch to a simplified taxation system?

By default, all new individual entrepreneurs and LLCs use the OSNO, unless during registration or within 30 days from the date of submission of documents they have declared their desire to switch to the simplified tax system. Later, it will also be possible to change the taxation system, but the transition will be carried out only from January 1 of the next year.

You can use the simplified tax system if:

- the type of activity allows it. The list of those who do not have the right to switch to the “simplified system” is given in;

- you have no more than 100 employees.

The right to use the simplified tax system will be lost if the annual turnover exceeds 150 million rubles or the number of employees exceeds one hundred ( ).

Conditions for the transition to the simplified tax system for existing individual entrepreneurs and LLCs:

- income for 9 months of the year in which the application was submitted did not exceed 112.5 million rubles ( ). This restriction does not apply to individual entrepreneurs ();

- the residual value of working capital does not exceed 150 million rubles;

- for LLC: no branches and the share of other organizations in the authorized capital does not exceed 25%.

Is it possible to clarify the payment?

The Tax Code provides that if an error in a payment order does not result in the tax not being transferred to the budget to the required Federal Treasury account, it can be corrected. To do this, you must submit an application to the Federal Tax Service with a request to clarify the payment (Clause 7, Article 45 of the Tax Code of the Russian Federation). As we have already found out, if the OKATO code is indicated incorrectly, the tax still goes to the budget. And, for example, the court of the West Siberian District, examining a similar dispute, indicated that an error in the OKATO code when transferring personal income tax to the location of the organization, and not the OP, can be corrected by filing an application to clarify the payment (Resolution of the Federal Antimonopoly Service ZSO dated June 23, 2010 in case No. A27-19112/2009, dated June 23, 2010 in case No. A27-14315/2009). As a rule, tax authorities clarify the entire payment. And in the situation under consideration, only part of the incorrectly listed personal income tax needs to be clarified. That is, in the application for clarification of payment, it is necessary to indicate that such and such an amount of personal income tax from the payment slip, to which the tax was transferred to the location of the organization, is due for payment by employees of the OP with such and such OKATO code. The Federal Tax Service Inspectorate, in principle, can decide to partially clarify the personal income tax payment; there are no obstacles to this (Order of the Federal Tax Service of Russia dated April 2, 2007 N MM-3-10 / [email protected] ). If the tax authorities refuse to partially clarify your payment and say that they can transfer only the entire personal income tax amount indicated in the payment to another OKATO code, then you should not agree to this. After all, if you make such a clarification, you will have an underpayment of personal income tax at the location of the organization. It also makes no sense to make clarifications only for some payments (for example, transfer the entire January personal income tax to the OP, leave the entire February one to the organization). At first glance, it seems that this will help distribute payments between the organization and the OP and reduce the amount of penalties. But in reality, difficulties will arise if at some point there is an overpayment for the OP’s employees. As we have already said, the Federal Tax Service believes that the amount transferred to the budget and exceeding the tax withheld from employees is not an overpayment of personal income tax (Letter of the Federal Tax Service of Russia dated July 4, 2011 N ED-4-3/10764). And the tax authorities will not count such overpaid amounts against future personal income tax payments.

How to choose OKVED codes for production

The process of selecting codes seems simple, but only until you first open the classifier, which has more than 400 pages. If the codes do not correspond to the activity being carried out, you can:

- receive a fine of up to 10,000 rubles for failure to provide, untimely provision of information contained in the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs or for providing inaccurate or unreliable information;

- lose the opportunity to apply preferential tax regimes. This happens when, according to the codes, you carry out activities for which the simplified tax system, for example, cannot be used, but in practice you are doing something else;

- receive a refusal to deduct VAT, for the application of which goods that are not related to the registered activity are indicated;

- not receive benefits or assistance from the state intended for individual entrepreneurs and LLCs from certain areas;

- pay injury premiums at a higher rate.

The concept of a separate unit

According to Article 11 of the Tax Code of the Russian Federation, a division is recognized as separate if it satisfies two conditions:

- geographically isolated from the organization;

- has stationary jobs created for a period of more than a month.

In a letter dated August 18, 2015 No. 03-02-07/1/47702, the Russian Ministry of Finance explained that the territorial isolation of a unit from an organization is determined by an address different from the address of the specified organization. The concept of a workplace is defined by Article 209 of the Labor Code of the Russian Federation as a place where an employee must be, or where he needs to arrive in connection with work and which is directly or indirectly under the control of the employer (letter of the Ministry of Finance of Russia dated September 13, 2016 No. 03-02-07/1 /53392).

If a separate division through which business activities are carried out has not been registered for tax purposes, then the organization can be held liable under paragraph 2 of Article 116 of the Tax Code of the Russian Federation (see, for example, resolution of the Arbitration Court of the North Caucasus District dated July 21, 2015 No. F08 -4287/2015 in case No. A32-29169/2014). According to this article, conducting activities by an organization or individual entrepreneur without registering with the tax authority entails a fine in the amount of 10 percent of the income received during the specified time as a result of such activities, but not less than 40 thousand rubles.

Accounting and taxation in production

We have figured out what taxes production pays - let’s move on to the features of accounting and warehouse accounting.

Accounting for the consumption of material assets

Production is associated with the transformation of materials, raw materials or semi-finished products into finished products, so it is important to develop internal regulatory documents in accordance with which materials and raw materials will be written off. You must know exactly how much and what goes into a unit of finished product.

Having such documentation helps:

- plan purchases of raw materials and materials;

- correctly calculate the cost and selling price of goods;

- control the consumption of materials and losses, which allows minimizing the risk of theft and overspending;

- organize accounting of production costs and losses;

- resolve disputes with the tax authorities - if the inspector considers the costs to be too high, you will be able to confirm the volume and cost of materials needed to produce a batch of goods.

Standards for defects must also be approved - if a batch contains more damaged products than expected, this is a reason to conduct an inspection and identify the reasons. Having discovered the culprit, you can recover the amount of damage caused from him: amicably or through the court.

Important! Costs of marriage can be fully taken into account when calculating income tax ( ), but not when calculating the simplified tax system “Income minus expenses” ( ), because they are not included in the list of eligible expenses.

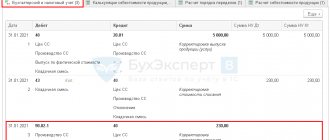

Production cost accounting

One of the most common methods is custom-made, when the cost of a batch of goods is calculated, which is then distributed among finished products (plan minus scrap). It is used in small-scale production, as well as during experimental, experimental, repair and similar work.

When calculating the cost and forming the selling price, it is important to take into account not only direct (materials, raw materials, wages of workers), but also indirect costs. These include, for example, the salaries of employees who were not directly involved in the production of products. The wages of those who are indirectly related to production (production manager, storekeeper, etc.) can be attributed to the costs of producing a batch, and those who are not connected with it in any way (accountant, marketer, etc.) can be written off directly to the financial result without reference to specific batches/orders. Don't forget about the costs of advertising and marketing, maintenance and repair of equipment, legal support, etc.

The more complete the information, the easier it is for you to manage and optimize consumables. It may turn out, for example, that the purchase price of materials is higher than it could be, which will make it possible to quickly find a more suitable supplier. Or renting a workshop is too expensive - it’s time to study the offers and find a cheaper alternative.

Cost accounting under simplified tax system 15%

The cost of materials can be taken into account when you write them off for production, until the release and sale of finished products. This is a fundamental difference between accounting and taxation in production and in trading enterprises: retailers and wholesalers can write off the cost of goods as expenses only after ownership of it is transferred to the buyer.

Taxation of enterprises on OSNO

- When shipping goods or receiving money from the buyer, the obligation to charge VAT arises; when purchasing materials, works and services, the right to deduct appears (if there is input VAT).

- Materials written off as expenses do not enter the financial result; only the cost of the finished product that is shipped to the buyer is included there. Only after the transfer of ownership can you understand whether your work was positive or negative.

We will help you get rid of errors leading to overpayment of VAT, problems with writing off defective products and expired goods.

Connect to the accounting department with a financial guarantee of a million rubles!

We also recommend reading our article about legal ways to optimize your tax burden.

Insurance premiums

After registering an individual entrepreneur, the entrepreneur will be automatically registered with pension and medical funds. He will receive a document confirming registration in connection with the payment of contributions for himself. The entrepreneur does not submit reports on such contributions, but only pays them to the Federal Tax Service at the place of registration. The exception is self-employed individual entrepreneurs. They pay pension insurance contributions for themselves only voluntarily.

When an individual entrepreneur hires workers, he is also registered with pension and medical funds as an employer. You don’t need to do anything for this either; the funds will receive all the information from the tax office. But you will have to register as an employer with social insurance yourself, for example, through government services.

Insurance premiums for employees are paid to the Federal Tax Service at the place of residence of the individual entrepreneur:

- for pension insurance;

- for health insurance;

- for social insurance in case of temporary disability and in connection with maternity.

Contributions for accidents and occupational diseases are paid to social insurance. You can find out payment details on the FSS website by selecting your branch.

Reports on insurance premiums for employees submitted to the Pension Fund:

- SZV-M;

- SZV-STAGE;

- SZV-TD.

To the tax office - calculation of insurance premiums (DAM). In social insurance - calculation according to form 4-FSS.