The essence of autonomous institutions and the directions of their work

Autonomous institutions (AI) mean non-profit organizations created in such areas of activity as:

- science and education;

- job search for the population and its employment;

- health and social protection;

- culture, physical education and sports.

The formation of autonomous entities is carried out by the subjects of the Russian Federation, as legal entities that have the opportunity to act on their own behalf, disposing of property and exercising non-property rights.

Payment procedure

In accordance with paragraph 4 of Art. 9.2 of the Law on Non-Profit Organizations, the procedure for determining fees for basic paid services provided by budgetary and autonomous institutions is established by the founder, unless otherwise provided by federal law.

For institutions that are local government bodies and, by necessity, carry out income-generating activities, the procedure for determining the amount of payment for the provision of paid services (works) is established by a regulatory legal act of the representative body of local government, this directly follows from Part 3 of Art. 9 of the Federal Law of July 27, 2010 No. 210-FZ “On the organization of the provision of state and municipal services.”

There is also a reference to this right in clause 4, part 1, art. 17 of the Federal Law of 06.10.2003 No. 131-FZ “On the general principles of organizing local self-government in the Russian Federation”, which states that the establishment of tariffs for services provided by municipal enterprises and institutions, unless otherwise provided by federal laws, is also within the powers of the authorities local government.

Non-core paid services, in turn, are not included in the charter among the main activities of the institution. At the same time, a budgetary or autonomous institution has the right to provide (perform) them to achieve the goals for which this institution was created.

Unlike the main ones, the institution has the right to set the amount of fees for non-core paid services or work independently.

It is assumed that if a budgetary institution conscientiously performs its tasks in accordance with the charter, instructions and instructions of the founder, and does not receive funding in the form of subsidies for such expenses, then all relations with legal entities in this type of activity are established in accordance with the Civil Code of the Russian Federation on the basis of contractual agreements. relations, that is, the service (work) is provided for a fee.

Features in autonomous accounting policy institutions

It is established by law that the requirements of the accounting regulations do not apply to corporate entities. They work on the basis of special regulatory documents that establish uniform methodological rules.

In the AC it is necessary to take into account separately:

- Funds that represent subventions and subsidies. Expenses incurred at their expense are also taken into account separately.

- Income and costs, the formation of which occurs in the process of economic activity.

- Real estate and especially expensive property, which is funded by the founder of the organization and assigned to him while the organization is functioning. Also OS purchased using funds invested by him (the founder).

The accounting policy of accounting companies is formed based on the peculiarities of their structure, belonging to a certain industry, and the powers they exercise. Its construction should ensure rational and effective accounting, commensurate with the scale and capabilities of the management. By order regarding accounting policies, the following is adopted:

- A working chart of accounts, which indicates all the necessary accounts.

- Methods on the basis of which property and liabilities are assessed.

- The order of their inventory.

- Rules for processing information on accounting and features of document flow.

- Forms and forms of primary accounting. They must indicate the details provided for in the instructional materials.

- Construction of internal audit and financial control.

Important! It is allowed to enter additional codes (analytical) into the internal chart of accounts of the AU, which should ensure the formation of objective accounting information that is accessible only to users within the AU, but also to external ones.

Autonomous institutions: features of accounting organization

Starting from 2012, educational institutions will face the critical question of choosing the type of institution.

An analysis of current standards shows that the most difficult transition is to the autonomous type. How to organize accounting in this case? This is discussed in the article. Legal aspects So, let's start with the fact that the legal provisions of autonomous institutions were determined by Federal Law of November 3, 2006 No. 174-FZ “On Autonomous Institutions”.

According to Article 2 of this regulatory act, an autonomous institution is recognized as a non-profit organization created by the Russian Federation, a constituent entity of the Russian Federation or a municipal entity to perform work, provide services in order to exercise the powers of state authorities (local government bodies) in the fields of science, education, healthcare, culture, social protection , employment, as well as in other areas in cases established by law. Thus, an autonomous institution can conduct both activities financed from budget funds (subsidies for the implementation of state or municipal tasks, subsidies for other purposes, budget investments, health insurance funds) and income-generating activities. After Federal Law No. 83-FZ of May 8, 2010 introduced a number of significant changes to the aforementioned Law No. 174-FZ, the legal status of autonomous and budgetary institutions became as close as possible. In particular, budgetary institutions were given additional rights to make independent decisions on the use of their own funds, and similar rights of autonomous institutions were somewhat limited. The definitions of budgetary and autonomous institutions given in federal laws No. 7-FZ and No. 174-FZ practically coincide. Budgetary and autonomous institutions are liable for their obligations with the property they have under the right of operational management, with the exception of real estate and especially valuable movable property assigned to them by the founder or acquired using funds allocated by the founder. Uniform approaches are established by law for the formation of state and municipal tasks in relation to autonomous and budgetary institutions. There is also almost complete similarity in terms of determining the sources of financial support for the main activities of institutions - these are subsidies from the relevant budget (determined on the basis of the approved standard) and other sources not prohibited by federal laws. But there are still differences, and some of them are quite significant. Main responsibilities and powers

To identify the advantages of the chosen organizational and legal form, we will compare the legal regime of an autonomous and budgetary institution.

Since the legal status of the latter is also common among educational institutions. Currently, the main differences between autonomous and budgetary institutions can be reduced to the following elements. Scope of activities of institutions.

The lists of the main areas of activity in which autonomous and budgetary institutions can carry out their activities are the same.

However, for budgetary institutions this list is essentially open; autonomous institutions can engage in activities not directly specified in Federal Law No. 174-FZ only if they are specified in other laws. Creation of governing bodies.

Unlike a budgetary institution, an autonomous institution must create a supervisory board, which, among other things, is given the right to carry out major transactions.

Conclusion of commercial contracts for the supply of goods, works and services.

The requirements of Federal Law No. 94FZ of July 21, 2005 (Law on Public Procurement) do not apply to autonomous institutions.

That is, the procedure for concluding contracts has been significantly simplified, and there are practically no restrictions. Consequently, when concluding contracts, autonomous institutions are guided by the norms of civil law. Raising borrowed funds.

Budgetary institutions may be subject to restrictions on attracting loans and credits. A similar rule has not been established for autonomous institutions. In addition, in connection with the changes made to part two of the Tax Code of the Russian Federation, autonomous institutions are given the right to use a simplified taxation system (provided that the institution does not have branches or representative offices). Budgetary institutions cannot apply this special tax regime (subclause 17, clause 3, article 346.12 of the Tax Code of the Russian Federation). Financiers also drew attention to this in a letter dated October 7, 2011 No. 03-11-06/2/140. But educational, health and social security institutions cannot be transferred to pay UTII in terms of business activities for the provision of public catering services, if the provision of these services is an integral part of the process of functioning of the institutions and these services are provided directly by these institutions. In this case, the ban on the use of UTII correlates with the field of activity of the institution, and not with its organizational and legal form.

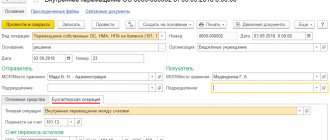

Organization of accounting

The main regulatory act that should be followed when organizing and maintaining accounting in institutions is the Instructions for the application of the Unified Chart of Accounts (Order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n). It establishes general principles for organizing the accounting of assets and liabilities of institutions of all organizational and legal forms (state, budget and autonomous), and also determines the features of accounting in institutions, determined by their legal status and the specific use of sources of financing for various types of activities. As applied to autonomous institutions, the norms of Instruction No. 157n are detailed in the Instructions for the Application of the Chart of Accounts for Autonomous Institutions (Order of the Ministry of Finance of Russia dated December 23, 2010 No. 183n). Accounting in autonomous institutions is organized and maintained on the basis of the institution's accounting policy, which recommends disclosing organizational and methodological aspects.

>>Everyone who subscribes to the magazine for 2012 will have access to the “Accounting Policy 2012” service. It includes a compiler program that will help you create this important document without unnecessary hassle and taking into account innovations.|< Since one of the main goals of accounting is to provide interested users with the necessary information, when organizing accounting, you should take into account the requirements for grouping and detailing data for the purposes financial statements, that is, be guided by the requirements of the Instructions on the financial statements of institutions (Order of the Ministry of Finance of Russia dated March 25, 2011 No. 33n). The main difference between accounting in autonomous institutions (compared to state-owned and budgetary ones), in our opinion, is that here the codes of receipts and disposals are not used in the accounting account numbers. Instead, it is recommended to use codes (defined by each autonomous institution or a higher (or financial) body for a group of institutions) used in the institution’s financial and economic activity plan. This circumstance should also be taken into account when organizing the accounting of transactions for authorizing expenses (the fifth section of the Chart of Accounts) and preparing financial statements. KOSGU codes - in account numbers for accounting expenses and expenses can be used in the same way as in budgetary institutions.

>|It is planned that from January 1, 2012, new Instructions on the procedure for applying the budget classification of the Russian Federation will come into force. Relevant draft regulations have been prepared (letter of the Ministry of Finance of Russia dated September 29, 2011 No. 02-04-09/4372). Transition tables have also been developed (letter of the Ministry of Finance of Russia dated October 6, 2011 No. 02-04-09/4467).|

Accounting for materials in autonomous institutions

Material reserves act as a kind of foundation in the work of an autonomous institution. They are varied in their purpose and functions for which they are purchased. The purchase of materials using subsidies is reflected as follows:

- Acceptance of various types of raw materials and materials for accounting (their actual cost):

- DT 4.105. (36). 340

- CT 4.302. (34). 730

- Issue to the person with whom the agreement on financial liability is concluded:

For Debit and Credit 4.105. (36). 340

When funds received from commercial activities were spent on the purchase of raw materials and various types of materials, or the purchase passed through accountable persons, the notes are as follows:

- Taking material assets into accounting accounts:

- DT 2.105 (36) 340;

- KT 2.208 (34) 660

- Transfer to an employee with a liability agreement:

For Debit and Credit 2.105 (36) 340

- Write-off of materials:

- Debit 2.109.(61).272;

- Credit 1.105.(36.440).

Materials are recorded on accounts to the nearest penny.

Benefits and advantages

Each form of ownership is characterized by certain features. At the same time, autonomous enterprises are considered more profitable.

Autonomous institution

The advantages of this form include the following:

- independent distribution of all income by the autonomous institution;

- no need to apply the norms of the Federal Law “On placing orders for the supply of goods, performance of work, provision of services for state and municipal needs”;

- the ability to take out loans;

- lack of control over the expenditure of funds by the Federal Treasury;

- sharing of responsibility with tax authorities;

- the possibility of switching back to the budget form without re-registration of documentation.

Budgetary

Despite the obvious advantages of the autonomous form, not all enterprises can use it. If the scope of the organization’s activities is not included in the legally established list, it is impossible to switch to an autonomous form. At the same time, it is important to understand that the financial and economic independence of budgetary organizations is greatly limited.

Tax aspects of the work of autonomous institutions

According to the provisions of the Tax Code (Article 251), subsidies that come to the AU from the founder:

- act as a means of financing for clearly defined purposes;

- cannot be included in determining the income tax base.

AUs must take into account income and costs separately for activities that are financed from the treasury, and extra-budgetary ones, when money is earned through commerce. It is unacceptable to reduce the amount of income that results from off-budget functioning by the amount of costs financed by subsidies.

Taxation of entrepreneurial activities of the AU according to income tax and VAT occurs in the same way as in commercial organizations. The entire amount of income from sales received through commerce is included in the tax base.

A distinctive feature is that AUs can exercise their right to make quarterly advance payments. But there is a mandatory condition: sales revenue for four quarters cannot exceed 15 million rubles. (quarterly average).

AU is available to the simplified tax system, but only when the revenue for 9 months before the transition to the simplified system does not exceed 112.5 million RUB (2017). If the amount of annual revenue crosses the 150 million mark for operating entities already working on the simplified tax system, they will have to switch to OSNO.

“Simplified” exempts from payment of income tax, property tax and VAT. But not all AU can use it. The simplified tax system is not available to autonomous institutions that:

- there are branches and representative offices;

- the average number of staff for the reporting year is more than one hundred people;

- the cost of fixed assets subject to depreciation (depreciable property) is more than 150 million rubles.

Important! The tax base does not include the amounts of subsidies and targeted financing allocated by the owner.

Profit management

The final stage of the procedure for providing paid services is receiving and disposing of profits. In this article we will only touch on the procedure for disposing of profits for budgetary and autonomous institutions.

According to paragraph 3 of Art. 298 of the Civil Code of the Russian Federation, profit received by budgetary and autonomous institutions from income-generating activities (including from the provision of basic and non-core paid services) comes to the independent disposal of these institutions. At the same time, institutions have an obligation to spend such revenues exclusively in accordance with the approved Financial and Economic Activity Plan. Taking into account the fact that the procedure for spending funds from income-generating activities is not established by legal acts of the constituent entities of the Russian Federation or municipalities, the institution has the right to independently determine such a procedure.

Important to remember

, that if basic paid services in the cases established by federal laws are included in the state (municipal) task, then the amount of the subsidy for the state (municipal) task should be reduced by the amount of funds planned to be received from consumers of these services (works), as stated in the Letter of the Ministry of Finance No. 12-08-06/44036.

Moreover, even in the case of the provision of paid services within the framework of a state (municipal) assignment, revenues from income-generating activities are not income of the corresponding budget of the budget system of the Russian Federation.

Heads of budgetary and autonomous institutions will find the following information useful: if a major transaction is planned involving funds received from income-generating activities, then such an operation can be carried out by the institution only with the prior approval of the founder, in accordance with clause 13 of Art. 9.2 of the Law on Non-Profit Organizations 01/12/1996 No. 7-FZ.

This law also has a definition of a major transaction - a major transaction is considered to be a transaction the price of which exceeds 10% of the book value of the assets of a budgetary institution, determined according to its financial statements as of the last reporting date, unless the charter of the budgetary institution provides for a smaller size of a major transaction.

Autonomous institutions: reporting and deadlines for its submission

AU reporting is generated based on data from the General Ledger and related registers. Data on business transactions is filled in with an increasing amount, reflecting not only rubles, but also kopecks.

AUs are required to prepare financial statements:

- intermediate (quarterly);

- annual.

The deadline for the latter is set in February-March. It is presented in paper form and electronically. For each type of application, the deadline for submitting documents is different.