What are active and passive accounting accounts?

Simply put, active financial accounting accounts are those accounts that specialize in accounting for all of a company's assets. While passive type accounts are accounting accounts that are designed to account for the organization’s liabilities, that is, its own funds: capital, reserves and other liabilities.

Based on a more significant difference, it can be noted that active accounting is created to account for the following items:

- Tangible and intangible property of the organization. This includes the company's fixed assets, its inventories and intangible assets.

- Cash in all forms, that is, in paper cash and in current accounts and bank deposits;

- costs associated with the production of the product, work in progress, semi-finished products;

- Various financial investments: short-term and long-term.

Due to the fact that active accounts involve accounting for the property and finances of the enterprise, the balances on such accounts can be exclusively in debit, that is, have a positive value.

The sources of creation of a company's assets reflect the liability side of the financial balance sheet. So, passive accounts are:

- capital of an economic entity;

- obligations assumed by the enterprise to be fulfilled;

- loan, credit and loans received;

- additional expenses, for example, depreciation;

- reserve funds for unfavorable debts.

Accordingly, the passive account has an exclusively credit balance at the end of the reporting period, and the debit balance on the passive account informs about errors in accounting. An increase in the coefficients on a passive account, as a rule, is formalized using credit turnover, and a reduction in the number of liabilities, capital or writing off necessary expenses is considered an operation to debit the passive account.

In the financial balance sheet, passive accounts respectively determine the section - liability. The generated balances at the end of the reporting period are distributed along certain lines of the liability side of the financial balance sheet, in accordance with the current rules for the formation of financial statements.

Active-passive accounts are also used when working with various invoices. In addition, they can highlight settlements with participants in business relationships.

It happens that some financial accounts contain credit or debit balances. Such accounts are also called active-passive. This may include accounting accounts that are capable of reflecting information about settlements with consumers or suppliers. It follows from this that during the shipment of any goods to the consumer, a receivable is created in the accounting account, and when the supplier receives a certain advance payment from the same buyer, an account payable is created in the accounting account.

It is worth considering that some financial accounts cannot be categorically classified as active or passive. For example, account 60, which is aimed at settlements with persons involved in supplies and contractors. The debit of such an account indicates a reduction in credit debt, that is, a liability, as well as an increase in receivables, in other words, an asset. In the same way, using the credit of accounting account 62, aimed at settlements with buyers and customers, it is possible to trace financial transactions that create not only an asset, but also a liability.

For example, if an enterprise bought products, but did not have time to pay for them, this means that on credit 60 of the account, the buyer has a payable debt to pay for goods or services. However, if the company gave an advance to the person supplying the products, then before the goods and materials are delivered on the debit of account 60, a receivable will appear. First we are talking about the passive accounting account, and then about the active one. Based on the fact that account 60 is directly related to certain economic aspects, this account is considered active-passive.

As a rule, it is customary to distinguish two main types of active-passive accounting accounts, namely:

- with one-sided balance;

- with a bilateral balance.

An active-passive accounting account with a one-sided balance implies a debit or credit balance. A striking example is account 99, which implies the company's profits and losses. So, if an organization’s total income significantly exceeds the amount of production and other expenses, then the difference between these amounts gives net profit; accordingly, the balance is considered a credit balance, because the credit turnover exceeds the debit one. Income is the main source of creation of tangible and intangible property of the company, which is visible in the liability side of the balance sheet. However, if losses occur in the organization, then the balance of the accounting account is considered debit, because the debit turnover is greater than the credit turnover.

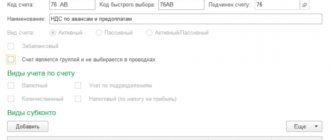

An active-passive accounting account with a two-way expanded balance indicates simultaneously both a debit and a credit balance. An example is account 76, indicating settlements with various debtors and creditors. In this case, the debit balance refers to the debts of the company's counterparties to it, in other words, accounts receivable, while the credit balance refers to accounts payable. Thus, debit entries in such an account mean an increase in accounts receivable or, conversely, a decrease in the organization’s debt, which it must repay.

Characteristics of account 04 “Intangible assets”

Intangible assets (IMA), in accordance with clause 4 of PBU 14/2007, include scientific research, literary works, computer software, inventions, brand, know-how. Separately, business reputation is distinguished as part of intangible accounting objects.

The answer to the question whether account 04 is active or passive is clear – active. Acceptance of objects for accounting is reflected in debit, and disposal is recorded in credit. When an intangible asset arrives at an enterprise, intermediate entries are made in accounting with the participation of account 08, from the credit of which, at the time the object is fully ready for operation, the cost of the intangible asset is written off to debit 04.

The characteristics of account 04 assume that intangible assets are reflected in accounting at their actual cost. It is formed from the costs of acquiring or creating an object, the costs of its delivery, customs duties and commissions of intermediaries of the purchase and sale transaction. VAT amounts are not included in the cost of intangible assets.

There are no sub-accounts for systematizing intangible assets; if necessary, you can introduce your own system of analytical accounting of intangible assets and consolidate it in the working chart of accounts. Account 04 accumulates information about objects with a long period of operation. They may be subject to depreciation, with the exception of assets with an indefinite useful life. No more than once a year, additional valuation or depreciation of intangible assets is allowed.

Active accounting accounts

First of all, it is necessary to determine the types of active accounting accounts. They are generally divided into the following four categories:

- Inventory accounts that take into account all the property of the organization, namely:

– fixed assets of the enterprise;

– intangible assets of the company, this also includes investments in research and development work;

– materials that are used to account for the quantity of materials, raw materials, semi-finished products, and so on;

- Cash accounts, which reflect the company's funds in both cash and non-cash form;

- Collection and distribution accounts, which serve for various expenses of the enterprise. They are not directly related to the production process, however, they are included in the calculation due to the distribution in proportion to any attribute;

- Cost or costing accounts, which are created to form the cost of finished goods and services.

Here are the main active accounting accounts:

- 01 “Fixed assets”;

- 03 “Profitable investments in material assets”;

- 04 “Intangible assets”;

- 07 “Equipment for installation”;

- 08 “Investments in non-current assets”;

- 09 “Deferred tax assets”;

- 10 "Materials";

- 11 “Animals in cultivation and fattening”;

- 15 “Procurement and acquisition of material assets”;

- 16 “Deviation in the cost of material assets”;

- 19 “Value added tax on acquired assets”;

- 20 “Main production”;

- 21 “Semi-finished products of own production”;

- 23 “Auxiliary production”;

- 25 “General production expenses”;

- 26 “General business expenses”;

- 28 “Defects in production”;

- 29 “Service industries and farms”;

- 40 “Product release”;

- 41 "Products";

- 43 “Finished products”;

- 44 “Sales expenses”;

- 45 “Goods shipped”;

- 46 “Completed stages of work in progress”;

- 50 "Cashier";

- 51 “Current accounts”;

- 52 “Currency accounts”;

- 55 “Special bank accounts”;

- 57 “Translations on the way”;

- 58 “Financial investments”;

- 81 “Own shares”;

- 94 “Shortages and losses from damage to valuables”;

- 97 “Deferred expenses”.

Rules for maintaining accounts

It should be understood that the report on financial accounts is submitted based on a certain procedure.

The main characteristic of an active-passive account is that it can be heterogeneous. So, on an active-passive account, the balance can be expressed as a credit or a debit, depending on the situation. Therefore, the balance on synthetic accounts can be determined solely by the final accounting on second-order accounts, as well as on accounts intended for detailed and specific information about the presence, condition and movement of funds and their sources in synthetic accounts, in other words, on analytical accounts.

It is necessary to understand that it is impossible to expand the balance on analytical accounts, however, it can change, that is, for one period it can be debit, and for another – credit. In case of full repayment of obligations, such an account may already be successfully closed. It follows that the sequence of calculations may change based on the instructions for using charts of accounts.

The balance can be expanded on a synthetic active-liability account, provided that there is a balance on both sides of the chart of accounts. Similarly, if a particular form has debts to suppliers or customers, they are reflected in the credit of this account, which is open for accounting, and such debt can be repaid by debiting the corresponding account. But when a receivable is detected, the entire process of repayment occurs on the credit of a specific account.

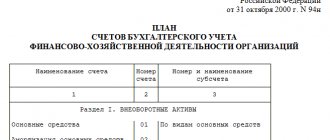

What is a Chart of Accounts and how to learn it?

Novice accountants are usually scared by this “scary” book - the Chart of Accounts. Many people doubt that they will ever be able to learn it. In fact, the book is not scary at all, but very necessary and useful. There is no need to learn it by heart. Firstly, many accounts are not even useful in practice, and secondly, why study it if you can open the Plan at any time and read about the account you are interested in.

The plan is an official document that contains a list of all 99 accounting accounts and 11 off-balance sheet accounts. The descriptions for each account describe in detail what it is used for and what is taken into account on it.

There is also such a thing as a working chart of accounts - this is a list of accounts that are useful for accounting for transactions in a particular organization.

For example, a company was opened, the management determined what it would do. Based on the type of activity and size of the organization, the accountant selects from the Plan which accounts will be useful to him. That is, he draws up his own working Plan. Small businesses can get by with 20. In the future, the accountant reflects all current transactions using postings on these accounts; we will easily study how to learn how to make postings further.

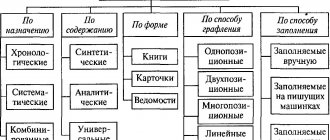

What is synthetic accounting?

Synthetic accounting is the recording of all information on types of property, business transactions, debts, taking into account their economic characteristics. Such accounting is carried out on synthetic accounts in accordance with the Accounting Law.

Synthetic accounts are of both first order and second, that is, subaccounts. The balance is grouped in Form No. 1 of the accounting report.

Such accounts are used to work with various types of information about large accounting objects, but exclusively in monetary terms. Synthetic accounting can only be carried out in national currency.

Account 04 in accounting - a case study

Kleps LLC ordered a video from the Prodvizhenie agency for an advertising campaign for a new product. The cost of the service in full - 45,000 rubles (excluding VAT) was paid in advance. After receiving a record of the advertising appeal, the local documents of Kleps LLC recorded a useful life of 14 months, and the preferred depreciation method was linear. After 2 months the video was lost.

Account 04 in accounting will participate in the following correspondence:

- D60 – K51 – in the amount of 45,000 rubles when making an advance payment for the video recording.

- D08 – K60 – in the amount of 45,000 rubles, the posting reflects the cost of the advertising video as part of the investment in intangible assets.

- D04 – K08 the asset was accepted for accounting at the actual cost of 45,000 rubles.

- D26 - K04 depreciation was calculated for 2 months of airing of the commercial, the total amount of depreciation is 6,428.57 rubles (45,000 / 1 x 2).

- D91 - K04 the asset at its residual value is written off due to loss, the transaction amount is 38,571.43 rubles (45,000 - 6428.57).

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What is analytical accounting?

Analytical accounting is carried out both in material and in other accounting accounts. It must group certain information about the property, business transactions and debts of all synthetic accounts.

An analytical accounting account is formed in the process of creating a synthetic account for all its components. It includes detailed and complete financial data about the enterprise values and all the activity found inside all synthetic accounts.

Each organization creates such accounts independently, taking into account all the features of its focus. This is how the accounting policy of a particular enterprise appears.

The analytical account provides the receipt of all accounting characteristics, including concluded contracts with the borrower or party to the contract in civil law relations. Such accounting is also carried out in any foreign currency or even together with the national one at the same time.

Features of active and passive accounts

Active and passive accounting accounts form the basis of accounting accounts. However, they differ greatly in appearance.

Thus, active accounts imply objects in which the organization invests its funds. They create entries in ascending order of assets and record the current balance in the debit side. If assets are reduced, it is assigned to credit accounting.

The main difference is that the primary balance and the final balance are always debit. To calculate the value of the final balance, use the following formula: Sk = Sn + Add – Kob Sk.

- Sk – initial balance;

- DOB – debit turnover;

- KOB – loan turnover.

At the same time, passive accounts determine all movements of the organization; they are classified as sources of funds.

Its difference is that the initial and final balances are always credit. Therefore, to calculate the closing balance, use the following formula:

Sk = Sn + ObK – ObD.

- Сн – initial balance;

- DOB – debit turnover;

- KOB – loan turnover.

How is accounting done in a company using accounts?

To reinforce the concept, let’s look at how the business activities of an enterprise are recorded using an accounting account. As written earlier, an accounting account is a plate consisting of two columns, debit and credit. At the beginning of each month, it opens again, the final balance (balance) from the previous month is transferred to its beginning, if the final balance was debit, then it is accordingly entered in debit, if credit, then in credit. Then, during the month, all current business transactions are reflected in the account (debit or credit, depending on the type of transaction).

To make it easier to understand how accounting is kept at an enterprise, let's look at an example. Let's take account as an example. 51 "Current account".

At the end of the previous month, a certain amount remained on the company’s account, let’s say 1000 rubles, this is the final balance for the previous month or the opening (opening) balance (Cn) for the current month. We debit account 51 with 1000 rubles. During the month, various cash flows occurred, they came in and out of the enterprise. Each operation is reflected in account 51. Receipt by debit, disposal by credit. an>

In our example, 600 and 300 rubles came into the account (recorded on the left side of the table in debit), 500 and 200 rubles went out (on the right side of the table in credit). At the end of the month, the turnover for the month is calculated, that is, all amounts are added up separately for debit (Od) and separately for credit (Ok).

In our example: Od=600+300=900, Ok=500+200=700. Then the final balance is calculated Sk=Сн+Од-Ок=1000+900-700=1200, if the final balance has a plus sign, then the balance is debit and is recorded as a debit, if it is a minus sign, then it is a credit balance and is recorded as a credit.

In our example, the final balance Sk=1200 has a “+” sign, which means the balance is debit and we write it on the left side of the table.

| Debit | Credit |

| 1000 600 300 | 500 200 |

| 1200 |

Sk=1000+600+300-500-200=1200

After the final balance has been calculated, the account is closed and reopened at the beginning of the next month. The ending balance from the previous month is transferred to the newly opened account, in which it will already act as the initial one. Next, we continue to enter all incoming and outgoing amounts of non-cash funds throughout the month, at the end of the month we again count the turnover and display the final balance, transfer it to the next month and so on ad infinitum. The accounting process in accounting is continuous!

In this way, records are kept of each type of business transaction in the appropriate accounts.

What should you remember from this article?

Accounting for all transactions in an enterprise is reflected in the accounting accounts using entries. An account is a two-sided table: debit on the left, credit on the right. A separate account is used for each group of similar operations; there are 99 of them in total, but not all of them are used in practice. All of them are reflected in the Chart of Accounts, from which the working Plan used in daily accounting is formed.

I hope that now the concept of “accounts” does not cause any difficulties for anyone. If you have questions or additions, write in the comments! Your opinion is important to me!

Determining the final balance on an active-liability account

In order to identify the final balance on an active-passive account, it is recommended to add up all debit amounts and find out the final credit amount. Thus, the final balance will be on the side where the amount will be greater and, nevertheless, will be equal to the difference between the credit and debit amounts.

The main thing to understand is that receivables arise when an organization is required to return funds after an agreed period of time, but if receivables arise during a loan.

1C: Accounting 8

“1C: Accounting 8” is the most popular accounting program that can take accounting automation to a whole new level. A convenient product and services connected to it will allow you to effectively solve the problems of the accounting department of any business!

- Support of different tax systems, maintaining accounting and tax records, submitting reports;

- Inventory accounting, batch accounting, settlements with counterparties, extracting primary documents;

- Payroll calculation, accounting of cash transactions;

- Integration with other 1C programs and websites;

- Working with electronic certificates of incapacity for work (ELS).

Try 30 days free Order

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter