Account 76 in accounting

Account 76 - active-passive. Here information is collected on settlements with debtors and creditors that has not found a place on other accounts for settlements with counterparties.

Find out more about account 76:

- what is it for?

- what subaccounts are opened for account 76;

- about account 76 in the balance sheet;

- about standard accounting entries for account 76.

Next, we will consider the features of using account 76.

Subaccount 76.AV “Value added tax on advances and payments”

Account 76.AB allows you to summarize information on calculations for paying VAT from preliminary payments. Accounting is maintained with those customers and buyers from whom money has been received in advance for the planned shipment of goods or for the provision of various types of services.

Business transactions may be different. For example: D68.02 K76.AV – accounting for value added tax on payment received from the client in advance. D 76.AV K68.02 – VAT accrual on funds received in advance from customers. Account 76. AB has the following sub-accounts (analytical characteristics): “Counterparties”, “Invoices”.

Account 76: accounting for insurance settlements

Subaccount 76.1 traditionally reflects transactions related to settlements under commercial insurance contracts. At the same time, a company can enter into such agreements both for itself (usually for property insurance) and for the benefit of employees - for example, under voluntary health insurance agreements.

The following typical transactions for the subaccount in question can be distinguished:

- Dt 20 Kt 76.1 - the amount of payment under the insurance contract was accrued as part of production costs;

- Dt 76.1 Kt 51 - payment was made under the contract in favor of the insurance organization;

- Dt 51 Kt 76.1 - payment was received from the insurance company for the insured event;

- Dt 76.1 Kt 73 - payment for the insured event is accrued to the employee;

- Dt 76.1 Kt 91 - insurance compensation accrued for property damage;

- Dt 99 Kt 76.1 - loss of property not compensated by insurance compensation is included in losses.

Within subaccount 76.1, various analytical subaccounts can be opened to account for individual insurers and contracts with them.

Account 76: subaccounts 1 and 2

Since monetary transactions can be different, accounts payable and accounts receivable are usually divided into several categories. The first (76.1) includes insurance of property and personnel, with the exception of payments for medical and social insurance.

Transfers of funds to an organization are reflected in a debit, and write-offs of funds are reflected in a credit. For example, D76 K73 – insurance compensation due to an employee of the organization according to the contract. D51 K76 – receipt of funds by the organization in accordance with regulations. D99 K76 – write-off of uncompensated insurance claims or damage from a force majeure event.

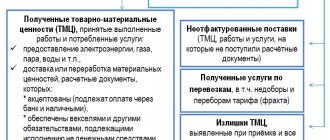

Subaccount 76.2 reflects calculations for claims that may be presented:

- to suppliers, transport agencies and contractors regarding price discrepancies found, when computational errors are identified after accounting completion, as well as when there is a shortage of cargo (D76 K60);

- to organizations for violation of quality standards, non-compliance with specifications (D76 K60);

- to credit institutions for erroneously written off or transferred amounts on the organization’s accounts;

- for downtime or defects arising from suppliers, contractors (correspondence with Section III of the chart of accounts);

- on fines and penalties for non-compliance with obligations in the contract (correspondence with account 91).

The credit of subaccount 76.2 reflects received payments. If it turns out that the funds are not recoverable, they are treated as a debit.

Account 76: accounting for claims settlements

Subaccount 76.2 reflects transactions on claims that arise mainly when the counterparty fails to fulfill contractual obligations. The claim may be resolved out of court or through arbitration.

Typical accounting entries:

- Dt 76.2 Kt 60 - reflects the amount of the claim against the supplier;

- Dt 76.2 Kt 10 (41) - short delivery detected after acceptance;

- Dt 76.2 Kt 91.1 - reflects the amount of the penalty from the supplier who did not fulfill the terms of the contract;

- Dt 51 (50, 52) Kt 76.2 - money within the framework of the claim was credited to the account;

- Dt 91.2 Kt 76.2 - receivables that could not be collected from the counterparty are written off as other expenses.

Additional analytical accounts to subaccount 76.2 can be opened to account for individual counterparties and claims.

Account 76: dividend payments

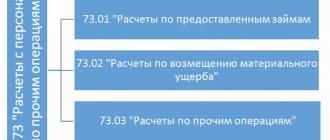

Subaccount 76.3 is used to account for the income of a business entity from investing in the capital of third-party legal entities, which periodically make interest payments to investors in relation to their shares.

In this case, the investor will reflect the following entries in accounting:

- Dt 76.3 Kt 91.1 - dividends are accrued as a type of other income;

- Dt 51 (50, 52) Kt 76.3 - receipt of dividend payment to the current account.

Additional analytical accounts for the subaccount in question are opened for each source of payments.

Dividend calculation

To record settlements with individuals and legal entities regarding income, accounting account 76 is used. This is subaccount 76.07 “Calculations for due dividends and other income.” The funds that need to be paid are reflected in the debit of subaccount 76.07 and in the credit 91.01.

Intangible assets transferred to the organization as income are listed in the debit of asset accounting accounts and credit 76.07. Patents, copyrights, brands, and licenses for the production of a certain type of product can be transferred as intangible assets.

Account 76: accounting of deposited amounts

Subaccount 76.4 is used to account for deposited amounts - wages that were accrued but not paid to the employee from the cash desk (for example, due to his failure to appear at the accounting department on time).

Accountant upon expiration of the established period:

- reflects the fact of depositing wages that the employee did not collect Dt 70 KT 76.4;

- transfers the deposited amount to the bank from the cash desk Dt 51 Kt 50.

As soon as the employee applies for a salary, the accountant:

- transfers money from the account to the cash desk to pay salaries Dt 50 Kt 51;

- issues wages from the cash register Dt 76.4 Kt 50.

If the employee never applies for the deposited salary (the statute of limitations expires, which in general is 3 years from the date of its accrual), the organization includes its amount in other income Dt 76.4 Kt 91.1.

Additional analytical accounts to account 76.4 can be opened for each individual employee.

Account 76: accounting for settlements with subsidiaries (dependent) companies

Organizations that have subsidiaries can make a variety of settlements with them. However, do not forget: a subsidiary and a dependent company are not the same thing.

Simply put, subsidiaries include those economic entities where the main enterprise has more than 50% of the shares (authorized capital), and dependent ones are those in which the main enterprise owns 20% or more of the shares (authorized capital).

Let's consider the entries used when accounting for settlements of an enterprise with subsidiaries and dependent companies (for this, a subaccount 76.5 can be opened to account 76):

- Dt 08 (10, 41...) Kt 76.5 - the enterprise acquired fixed assets, materials, goods from a subsidiary;

- Dt 76.5 Kt 90, 91.1 - the enterprise sold property to a subsidiary;

- Dt 91.2 Kt 76.5 - the enterprise included the losses of the subsidiary, which it is obliged to repay, into other expenses;

- Dt 76.5 Kt 51 - the enterprise transferred funds to repay the losses of the subsidiary.

A significant part of business transactions between the main enterprise and a subsidiary (dependent) company is reflected by correspondence using not only account 76, but also account 58.

Example 1

Payment of a share in the authorized capital of a subsidiary by transfer of property.

To begin with, the main enterprise, on account 76, registers the formation of a payable debt corresponding to the amount of debt for a contribution to the authorized capital of a third-party organization: Dt 58 Kt 76.5.

Repayment of this debt can be made by different types of property:

- If these are funds, their transfer in favor of a subsidiary is shown by posting Dt 76.5 Kt 51.

- If this is an item of fixed assets (FPE) that was in operation, then the postings will be as follows: Dt 58 Kt 76.5 - reflects the cost of the transferred property, previously agreed upon by the parties;

- Dt 02 Kt 01 - reflects the write-off of accrued depreciation from the moment of commissioning of an asset until the moment of its disposal;

- Dt 76.5 Kt 01 - reflects the write-off of the residual value of the fixed asset.

If the residual value of the fixed assets is lower than that agreed upon by the parties in order to repay the debt on the contribution to the authorized capital, then the enterprise records other income: Dt 76.5 Kt 91.1. If higher - other consumption: Dt 91.2 Kt 76.5.

- If intangible assets (intangible assets) are transferred to the authorized capital, then the correspondence is applied: Dt 58 Kt 76.5 - accounts payable are reflected in the agreed value of the transferred intangible assets;

- Dt 05 Kt 04 - reflects the write-off of depreciation on assets accrued at the time of their alienation;

- Dt 76.5 Kt 04 - reflects the write-off of the residual value of intangible assets.

If the residual value of the intangible asset is less than the agreed value, other income is recorded: Dt 76.5 Kt 91.1. And if more - other expenses: Dt 91.2 Kt 76.5.

- If materials are transferred to the authorized capital, then the correspondence will be as follows: Dt 58 Kt 76.5 - accounts payable have arisen in the amount of the agreed cost of materials;

- Dt 76.5 Kt 10 - reflects the write-off of the actual cost of materials.

If the actual cost turns out to be lower than the agreed value, other income is recorded: Dt 76.5 Kt 91.1 If more, other expenses: Dt 91.2 Kt 76.5.

Example 2

The company acquired shares, but has not yet paid for them.

The fact of transfer of ownership of shares to an enterprise, if it has not paid for them by the time of such transfer, is reflected by posting Dt 58 Kt 76.5.

Example 3

The enterprise has made an advance payment for shares to which it will become entitled later:

- Dt 76.5 Kt 51 - reflects the amount paid for the shares;

- Dt 58 Kt 76.5 - the right to the shares transferred to the enterprise, the shares were registered.

Example 4

The company resells previously purchased shares to the public:

- Dt 76.5 Kt 91.1 - other income received from the sale of shares;

- Dt 91.2 Kt 58 - the cost of shares sold is written off;

- Dt 51 Kt 76.5 - payment received for shares sold.

Account 91 “Other Income and Expenses” Postings and Examples

Chart of accounts Account 99 “Profit and Loss” Account 84 “Reformation of the balance sheet” Accounting news

Accounting 91 Postings and Examples

Account 91 reflects income and expenses not related to the main activities of the company.

Postings for closing accounting account 91 “Other income and expenses”:

Dt 91.1 Kt 91.9 - subaccount 1 is closed,

Dt 91.9 Kt 91.2 - subaccount 2 is closed.

As a result, account 91.9 is written off to account 99 , and account 99 is written off to account 84 when the balance sheet is reformed at the end of the year.

During the year, a balance accumulates in subaccounts. When closing the month, the account is closed to subaccount 91.9 and at the end of the year, account 91.9 is transferred to account 99 “Profit and Loss” when reforming the balance sheet.

. .

Accounting for account 91:

The debit of account 91 takes into account expenses, and the credit - income.

Account 91.1 is other income;

Account 91.2 is other expenses.

Example 1.

Sale of fixed assets

Kalina LLC sells equipment at a replacement cost of 250,000 rubles.

The amount of accrued depreciation is 150,000 rubles.

Negotiated price (excluding VAT) – 150,000 rubles.

| No. | Debit | Credit | Sum | Contents of operation |

| 1 | 01 “Disposal of Fixed Assets” | 01 "Fixed Assets" | 250 000 | The amount of the original (replacement) cost of the disposed object is written off |

| 2 | 02 “Depreciation of fixed assets” | 01 “Disposal of fixed assets” | 150 000 | Written off Depreciation |

| 3 | 91.01 “Other Income” | 01 “Disposal of Fixed Assets” | 100 000 | The amount of the residual value of the fixed asset is written off |

| 4 | 91.01 | 68 "VAT" | 27,000 (150,000 x 18%) | VAT charged |

| 5 | 62 | 91.02 | 177 000 (150 000 + 27 000) | The buyer was presented with documents for the amount of the contractual cost of the fixed assets |

| 6 | 51 | 177 000 | Payment received from buyer | |

| 7 | 91.9 “Balance of other income and expenses” | 50 000 (177 000 – 100 000 – 27 000) | Profit from the sale of fixed assets is reflected |

Account 99 “Profit and Loss”

Example 2.

Rental income on account 91.01

Kalina LLC, in addition to its main activities, rents out premises.

Postings:

| No. | Debit | Credit | Contents of operation |

| 1 | 91 | 02, 10, 23, 69, 70 (production cost accounts) | Reflects the amount of expenses for maintaining the premises |

| 2 | 91 | 68 | VAT has been charged on the rental amount |

| 3 | 91 | Rent accrued to the tenant | |

| 4 | 62 | 98 “Deferred income” | The rental amount under the contract for a future period is reflected |

| 5 | 98 | 91 | The rental amount is reflected at the beginning of the period |

Postings from the Tenant:

| No. | Debit | Credit | Contents of operation |

| 1 | 001 “Leased Fixed Assets” | Reflects the amount of the cost of the premises (fixed asset) | |

| 2 | 97 “Deferred expenses” | 76 “Settlements with various debtors and creditors” | The rental amount for future reporting periods is reflected |

| 3 | 20, 23, 26, etc. | 97 | The amount of rent for the corresponding period is reflected |

Example 3.

Fines, penalties, penalties for receipt (are reflected in the Credit of account 91), and for payment - in the Debit of account 91.

Fines, penalties, penalties for violation of the terms of contracts, as well as compensation for losses caused to the organization are taken into account in the amounts awarded by the court or recognized by the debtor.

Postings:

| No. | Debit | Credit | Contents of operation |

| 1 | 76.2 “Calculations for claims” | 91.1 | Reflects the fine to be collected from the supplier for under-delivery |

| 2 | 51 | 76.2 | Received a fine |

| 3 | 91.2 | 76.2 | Claim admitted or awarded |

| 4 | 76.2 | 51 | Claim funds transferred |

Example 4.

Amounts of accounts receivable and accounts payable for which the statute of limitations has expired

Postings:

| No. | Debit | Credit | Contents of operation |

| 1 | (76) | 91.1 | The amount of overdue accounts payable to the supplier was written off |

| 2 | 91.2 | 62 (76) | The amount of overdue accounts receivable has been written off buyers |

. .

What does accounting account 91 include for Debit and Credit?

Other income (account 91.1) includes:

- income from the rental of fixed assets and intangible assets;

- dividends from contributions to the authorized capital of other organizations;

- interest on securities;

- proceeds from the sale of fixed assets, materials (if this is not the main activity of the organization);

- fines, penalties, penalties received from counterparties;

- assets received free of charge;

- income received in the form of compensation for losses caused to the organization;

- profits from previous years revealed in the current year;

- expired accounts payable;

- exchange differences;

- revaluation of assets.

Other expenses (account 91.2) include:

- rental related expenses;

- expenses associated with participation in the authorized capitals of other organizations;

- expenses associated with the write-off, sale and disposal of fixed assets, intangible assets, materials;

- interest on loans, borrowings;

- payment for bank services;

- contributions to reserves;

- paid fines, penalties, penalties;

- compensation for damages caused;

- losses from previous years;

- expired accounts receivable;

- exchange differences;

- asset write-down;

- charitable expenses;

- other expenses.

Chart of accounts Account 99 “Profits and Losses” Account 62 “Settlements with buyers and customers”

Account 84 “Reformation of the balance sheet” Accounting news

Account 76: application by non-profit organizations (HOA)

An HOA is a typical example of a non-profit organization. They function due to:

- targeted financing - from the budget or from homeowners;

- permitted business activities.

Account 76 is used by the HOA to reflect exactly those transactions that are related to targeted financing. Common postings (we will agree to use subaccount 76.6 for the purposes under consideration) include the following:

- Dt 76.6 Kt 86 - The HOA records the debt upon receipt of targeted funding (in practice, it makes an accrual for payments that citizens must pay);

- Dt 51 Kt 76.6 - the debt is repaid upon receipt of funds to the HOA account.

An alternative to cash financing may be for the HOA to obtain certain types of property—for example, materials. Their receipt is reflected by postings:

- Dt 76.6 Kt 86 - receivables accrued in the amount of contributed property;

- Dt 10 Kt 76.6 - property included.

The costs of the current period associated with the maintenance and management of the property of the HOA are reflected by posting Dt 20 Kt 76.6.

Account 76: application by partnerships

The main purpose of creating partnerships is to make a profit as a result of joint business by several organizations. If there is profit, then it is distributed in proportion to the size of the contributions of each of the partners. Losses are distributed in a similar way. In both cases the score 76 is used.

Each of the partnership organizations that has the right to income records the following entries in the accounting registers:

- If there is profit: Dt 76.3 Kt 91.1 - profit from joint activities is reflected;

- Dt 51 Kt 76.3 - reflects the receipt of money on account of profit from joint activities.

- Dt 91.2 Kt 76.3 - loss from joint activities is reflected;

Account 76: application in commission agreements

Account 76 is also used to reflect transactions under a commission agreement. Let us recall that a commission agent is an economic entity that provides intermediary services under an agreement with the principal.

For commission transactions, we agree to consider the following subaccounts:

- 76.80 - for settlements with the commission agent;

- 76.81 - for settlements with the principal;

- 76.82 - for settlements with the buyer.

These subaccounts are used within the following standard correspondence:

- In the accounting of the commission agent who participates in the calculations: Dt 76.82 Kt 76.81 - the buyer has an obligation to redeem the goods received by the commission agent from the principal;

- Dt 51 Kt 76.82 - money was received in the commission agent’s bank account for goods sold;

- Dt 76.81 Kt 90.1 - commission accrued;

- DT 76.81 CT 51 - payment for the goods is transferred to the principal minus the commission.

If the commission agent does not participate in the settlements, then the proceeds from the sale go to the principal himself.

- In the principal's accounting: Dt 44 Kt 76.80 - commission agent's services are included in sales expenses;

- Dt 19 Kt 76.80 - reflected VAT on intermediary services;

- Dt 76.80 Kt 62 - based on the commission agent’s report, the intermediary’s services were credited against the payments due for the goods sold.

Securing an application at an electronic auction

Companies participating in electronic auctions, as a rule, have a special account, which is opened for them by an authorized bank (the list of banks can be found in the order of the Government of the Russian Federation dated July 13, 2018 No. 1451-r, which is regularly updated).

The application collateral is blocked in a special account at the end of the acceptance of applications on the electronic platform (ETP). The ETP operator sends a request to the bank, and if there are enough funds in the special account, the bank blocks the required amount. Unfreezing will occur when the ETP transmits the relevant information to the bank. All participants who submitted bids but lost the auction will have their money unfrozen within one business day. To the winner of the auction - after the conclusion of the contract.

In addition, if the organization becomes the winner of the auction, ETP will charge a fee for its services. The fee is also charged from a special account.

The TenderPlan service will help you fully automate and customize your system for working with tenders.

In accounting, the amounts of funds transferred to a special account are taken into account in account 55. It is rational to open sub-accounts for it: “Free funds”, “Blocked funds”. Funds blocked by the operator must also be accounted for in off-balance sheet account 009.

The postings will be as follows:

- D 55 “Free funds” K 51 - money was transferred to a special account;

- D 55 “Blocked funds” K 55 “Free funds” - the amount of the security payment is blocked;

- D 009 - the amount of the application security is reflected;

- D 55 “Free funds” K 55 “Blocked funds” - the amount is unblocked on the personal account;

- K 009 - the amount of the application security is written off from accounting.

When withdrawing funds back to the organization’s current account, we make the following entry:

- D 51 K 55 “Free funds” - money was transferred to the current account.

If ETP has withheld a fee for services, we reflect it as follows:

- D 76 K 55 “Blocked funds” - ETP remuneration withheld.

- D 91-2 K 76 - expenses for ETP services are reflected.

Expenses must be documented. The following must be received from the ETP: an act of provision of services and an invoice or UPD. If documents are transmitted electronically, they must be signed with an electronic digital signature.

There are cases when the application security will not be returned to the organization. In particular, if the organization:

- evaded (refused) from concluding a contract;

- did not provide (provided in violation of the conditions) security for the performance of the contract before its conclusion;

- rejected 3 applications in 2 parts on one ETP during one quarter of the calendar year.

Then the organization’s accountant, based on the decision of the Federal Antimonopoly Service, can write off these funds for other expenses:

- D 91-2 K 55 “Blocked funds” - the security payment is withheld by the ETP operator and transferred to the customer.

Read about how to avoid being included in the register of unscrupulous suppliers here.

Interest may accrue on funds in a special account. They are recorded in accounting like any interest on deposits - as part of other income.

On the interest accrual date, the accountant will make the following entries:

- D 76 K 91-1 - interest accrued on a special account

- D 55 “Free funds” K 76 - interest went to a special account.

Account 76: application in leasing

Account 76 is also used to reflect leasing transactions. Let’s agree that for this we use three subaccounts: 76.9 - “Debt on leasing payments”, 76.10 - “Rental obligations”, 76.11 - “Debt on repurchase of property”.

If the property is on the balance sheet of the lessor:

- Dt 76.9 Kt 51 - lease payment transferred;

- Dt 20 Kt 76.9 - the lease payment is reflected in the accounting;

- Dt 19 Kt 76.9 - VAT is taken into account in the lease payment.

If the property is listed on the lessee's balance sheet:

- Dt 08 Kt 76.10 - the leasing object is accepted for accounting;

- Dt 19 Kt 76.10 - presented VAT by the lessor;

- Dt 76.9 Kt 51 - lease payment transferred;

- Dt 76.10 Kt 76.9 - monthly lease payment is taken into account;

- Dt 76.10 Kt 76.11 - the debt on the redemption value of the leased property is reflected;

- Dt 76.11 Kt 51 - the redemption value of the leased object is listed.

Other deductions

Account 76 is used if there are other transactions not directly related to the activities of the company. Entries using the account may be as follows:

| Dt | CT | Contents of operation |

| 20, 25, 26, 44 | 76 | Accrued payment under the leasing agreement |

| 76 | 51 | Advance lease payment |

| 76.AB | 68.02 | VAT is charged on the advance received from the buyer |

| 68.02 | 76.AB | VAT is accepted for deduction |

| 68.02 | 76.VA | VAT deduction based on advance payment to the supplier |

| 76.VA | 68.02 | Tax based on prepayment results is credited |

Account 76 is intended for other irregular transactions. The reasons for making entries on account 76 are quite varied; it is necessary to keep analytical records for each event.

Application of account 76: VAT

Account 76 is also used in VAT-related transactions. Let's look at a few examples.

Example 5

Reflection of VAT on advances received.

For the upcoming delivery of goods, the company received an advance payment of 120,000 rubles from the buyer. , from which she charged VAT: 120,000 * 20 / 120 = 20,000 rubles. Then the goods were shipped, and VAT was deducted.

In the supplier company’s postings, these operations look like this:

- Dt 51 Kt 62 - advance payment received from the buyer;

- Dt 76.AV Kt 68 - VAT is charged on the advance payment.

- Dt 62 Kt 90 - goods shipped to the buyer;

- Dt 90 Kt 68 - VAT is charged on sales;

- Dt 68 Kt 76.AV - VAT is deducted after shipment and prepayment is offset.

Example 6

Reflection of VAT on advances issued.

To account for the upcoming receipt of materials, the company transferred an advance to the supplier in the amount of 60,000 rubles, adding VAT: 60,000 * 20 / 60 = 10,000 rubles. Later the materials were received and capitalized.

Let's write down the wiring:

- Dt 60 Kt 51 - advance payment transferred to the supplier;

- Dt 68 Kt 76.AV - VAT is charged on the advance;

- Dt 10 Kt 60 - materials from the supplier have been capitalized;

- Dt 19 Kt 60 - VAT on delivery is allocated;

- Dt 76.AV Kt 68 - VAT on advance has been restored;

- Dt 68 Kt 19 - VAT is claimed for deduction.

Example 7

Reflection of VAT on advance payment from the buyer-tax agent.

The tax agent company bought scrap metal from the seller for 100,000 rubles, having previously paid an advance payment of half the amount - 50,000 rubles.

In the buyer’s accounting entries there will be 76 accounts, and more than one:

- Dt 60 Kt 51 - advance payment to the seller of 50,000 rubles;

- Dt 76.NA Kt 68 - VAT is charged on an advance of 10,000 rubles. ((50,000 + 50,000 * 20%) * 20 / 120);

- Dt 68 Kt 76.AV - deduction of VAT on an advance payment of 10,000 rubles.

- Dt 41 Kt 60 - scrap in the amount of 100,000 rubles was accepted for accounting.

- Dt 76.NA Kt 68 - VAT charged on the shipment of scrap 20,000 rubles. ((100,000 + 100,000 * 20%) * 20/120);

- Dt 68 Kt 76.NA - deduction of VAT calculated when transferring the advance - 10,000 rubles;

- Dt 68 Kt 76.NA - deduction of VAT on purchased scrap 20,000 rubles;

- Dt 76.AV Kt 68 - VAT, previously accepted for deduction on the advance payment of 10,000 rubles, has been restored.

Account 76 does not appear in the scrap seller's accounting.

Debit 76 Credit 51

An accountant can post Dt 76 Kt 51 in the following cases:

- Payment has been made for property or personal insurance of personnel. Dt 76.1 Kt 51 - 10,000 rub. The accountant paid the insurance company the annual fee for the employee's insurance. Then, when receiving money from the insurance company upon the occurrence of an insured event, the Fastmil accountant will make a debit entry to account 51 in correspondence with account 76. And the accrual of insurance compensation to the employee will be reflected by entry Dt 76 Kt 73.

- The accounts payable to the counterparty has been repaid. A company can record settlements with suppliers both on account 62 and 76. In practice, accountants most often record on account 76 secondary counterparties, settlements with which occur infrequently.

- The supplier is paid for the claim or fine. In this case, mutual fines of 2 companies can be offset by posting Dt 76 Kt 76.

Example 2

I discovered that one of the archival shelves purchased from Bumazhny Dvor was deformed. And Bumazhny Dvor, in turn, filed a claim for the short supply of refrigerators.

According to the agreement between the parties, they are obliged to pay the counterparty a fine in the amount of 10,000 rubles. and remove the goods at your own expense. However, Bumazhny Dvor has the right to expect to receive monetary compensation from Fastmil for shortfalls in delivery. The fine is 5,000 rubles. The parties signed an act of mutual settlement for part of the mutual claims in the amount of 5,000 rubles.

In accounting it will be reflected as follows: Dt 76 Kt 76 - in the amount of 5,000 rubles. (mutual claims between are taken into account).

The paper yard accountant will make the following entries in accounting:

- Dt 76 Kt 76 - in the amount of 5,000 rubles. (part of the fine is offset against the due monetary compensation);

- Dt 76.2 Kt 51 - in the amount of 5,000 rubles. (a fine was paid for the supply of low-quality archival shelving).

Important! Tip from ConsultantPlus If you refuse a low-quality product and return it to the supplier, you have the right to return the money for it... The procedure for returning money can be specified in the contract or a separate agreement. If it is not indicated anywhere, ask the supplier in writing to return the money. In case of non-return, send him a claim and then file a lawsuit. For detailed refund procedures, see K+, after receiving free trial access to the system.

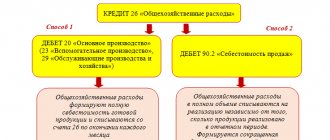

Application of account 76: non-tax payments

There are types of budget payments that do not relate to taxes (customs duties and fees, recycling fees, etc.), and therefore it is not practical to reflect them on account 68 “Calculations for taxes and fees”.

To account for such non-tax amounts, you can use account 76. For example, when registering an imported car, the postings look like this:

- Dt 76 Kt 51 - fees and duties are transferred to the budget;

- Dt 08 Kt 76 - fees and duties are included in the initial cost of the imported car.

In the case under consideration, subaccounts corresponding to the type of fee or duty paid can be opened to account 76.

Results

The debit of account 76 reflects various transactions: personnel insurance, settlements of claims and fines issued to counterparties, deposited amounts, the amount of debt purchased from another company. Posting Dt 76 Kt 76 reflects transactions carried out under the assignment agreement. When offsetting, a posting is also made Dt 76 Kt 76 .

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Application of account 76: shared construction agreements

Another area of application of account 76 is legal relations in the field of shared construction contracts. Let's look at the entries in the developer's accounting, compiled using escrow accounts - according to the new payment scheme between the investor and the developer, mandatory for use after 07/01/2019:

- Dt 009 subaccount “Funds of shareholders in escrow accounts” - the shareholder transferred funds to the escrow account;

- Dt 51 Kt 67 - the bank issued a targeted loan for the construction of a real estate property;

- Dt 91.2 Kt 67 - interest was accrued for using the loan;

- Dt 20 Kt 60 - the cost of work carried out by the contractor is included in construction costs;

- Dt 43 Kt 20 - reflects the book value of the property;

- Dt 76 “Settlements with shareholders” Kt 43 - the apartment was transferred to the investor after the property was put into operation;

- Dt 76 “Settlements with equity holders” Kt 90 - revenue from the sale of housing is recorded;

- Dt 67 Kt 76 “Settlements with shareholders” - funds from shareholders credited to the escrow account are used to repay the loan and interest;

- Dt 51 Kt 76 “Settlements with shareholders” - the balance of funds of shareholders was received from escrow accounts after repayment of the loan and interest;

- KT 009 “Funds of equity holders in escrow accounts” - completion of settlements through an escrow account.

Let's sum it up

- Account 76 of the accounting system collects information on settlements with counterparties that has not found a place on other settlement accounts.

- The list of transactions for account 76 discussed above is far from exhaustive. It can be used to reflect any transactions with debtors and creditors - if they methodologically cannot be reflected in accounting accounts 60-75.

- If necessary, it is possible to open any sub-accounts for account 76 in addition to those given in the general Chart of Accounts.