Today, a popular service of banks is issuing loans for any period. Individuals and legal entities have the opportunity to obtain a loan for both a short and longer period. Many banks provide loans on favorable terms with minimal interest rates. It is important to know what long-term loans and short-term loans are, as well as how to apply for them correctly.

What are short-term loans?

Cash issued to customers for a period of up to 1 year is called short-term loans. The client can receive money by providing the bank with a minimum package of documents. The response to such a request comes within a short period of time.

This type of lending is considered the most popular. This is because the loan size itself is relatively small and can be obtained on the same day of application. An additional advantage is the possibility of early repayment of the loan at any time, without charging commission fees. Only those clients who have a positive credit history with third-party credit organizations can receive funds from the bank.

What is a short-term loan?

As the name suggests, it has a short repayment period. Typically, this term refers to loans that must be repaid within a period of up to one year. However, often the repayment period of short-term loans is even shorter - loans can be issued for up to 30 days. For this reason, short-term loans are rarely issued in large amounts, most often from a couple of hundred to a thousand euros. Applying for them is usually much faster and easier—short-term loans can be processed in as little as 15 minutes because lenders don't conduct in-depth credit history checks like they do with long-term loans.

Given the above, it is not surprising that short-term loans are often associated with the need to urgently obtain additional funds. However, with them, borrowers receive high interest rates, short repayment periods and other rather unfavorable conditions. And most importantly, the monthly payment will also usually be much higher, having a significantly greater impact on the borrower's monthly budget, as a result of which loans are not always repaid on time.

Interest rate on short-term loans

Each person has the right to decide for himself what kind of loan he needs. The fact is that the interest rate on short-term loans is much higher than on those products that are provided for a period of over 5 years.

Lenders respond to this by saying that any short-term loan carries more risks in repaying it. In this case, the bank does not require the borrower to provide a full package of documents and guarantees. In addition, any individuals can borrow money for a short period of time, the requirements for which are minimal. This makes the loan rate higher.

Which is better: short-term or long-term loan

Short-term loans are a good solution for those who need money urgently and who are confident that they can cope with a high monthly payment. In addition, the shorter the repayment period, the lower the interest rate will be. The main thing is to plan your family budget and, if possible, take into account unforeseen expenses so that the monthly payment does not become too high.

Long-term loans mean monthly payments for at least a year, so you need to clearly plan your budget and understand that any delays will increase the already considerable amount. In any case, we advise you to first calculate how much you can pay for a loan without compromising your budget, and only then choose the loan term.

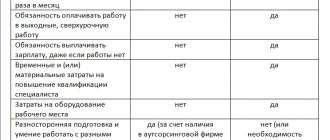

| Short-term loan | Long-term loan | |

| Loan terms | 15-60 days, sometimes up to 1 year | From 180 days or more |

| Sum | Up to 50,000 rubles | Any amount, including a car loan or mortgage |

| Interest rate | 1% per day | Calculated for the entire loan term |

| Decor | Online | Only in the office of a bank, microfinance organization |

| Requirements for the borrower | Minimum | Preparation of certificates, collateral, checking credit history |

Certified specialist

Types of short-term loans

There are many different types of loans available for short periods. However, the most famous of them are:

- Overdraft. It is considered widespread not only in Russia, but also abroad. This type of lending involves the conclusion of a specialized agreement between the parties. A client who has issued an overdraft has the right, within the limit, to go into the red, that is, to spend the funds provided by the bank. The interest rate on such loans is small, and if you systematically replenish your bank account, the interest is recalculated automatically.

- To provide working capital. This loan is available only to legal entities. Thanks to the funds provided, organizations are able to solve their difficulties on favorable terms with minimal overpayment.

- Credit card. It is considered the most popular type of lending. An individual can issue a card on the day of application. Based on the interests of the client himself and his level of reliability, the bank sets a certain credit limit on the card, which he can use for 3-5 years. If you pay all monthly payments on time and maintain a good credit history, the bank will increase the limit on the card over time.

Why are bank loans more profitable?

Today it has become popular to borrow money before payday from microfinance organizations. Experienced specialists advise individuals and legal entities to contact such companies only in emergency cases. The fact is that when using borrowed funds from an MFO, the client pays fairly high interest rates, although the loan period is limited to 1-2 months. Unlike microloans, borrowed funds from banks are provided on more favorable terms.

Why can an MFO refuse?

There are several reasons why you may be denied a microloan:

- The client contacts a microfinance organization for the first time. As practice shows, such companies are more loyal to regular borrowers. Those with a bad reputation or credit history are usually denied loans. To increase company loyalty, you can take out a short-term loan and quickly repay it.

- The borrower provides incorrect information about himself. If the information provided in the application is not true, the microloan will be denied. At the same time, your requests will be processed more carefully in the future.

- You still have debts from previous loans. If you previously borrowed money and did not repay the funds, microfinance organizations will not agree to give a second microloan.

Microfinance companies reserve the right not to explain the reason for refusing to issue a loan. If you were not given a loan, analyze your credit history. Companies are interested in issuing both long-term and short-term loans, since they earn money on interest.

Why do you need to have a credit card?

Today, cash payments are becoming irrelevant, since many of them are carried out electronically. Electronic payment method is used not only for serious monetary transactions, but also in everyday life. Each person has the opportunity to use a credit card in any of the stores, or pay for various services at home.

The advantage is that at the end of each month a person can analyze the largest item of his expenses and take measures to reduce the family budget. In addition, any card is protected from fraudulent activities.

Important! Many lenders are developing various discounts on goods and services when paying with credit cards.

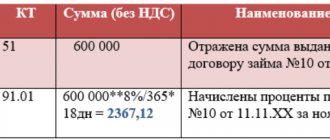

Indication of short-term loans in the company’s statements

Today, all commercial organizations operate by providing long-term as well as short-term loans. This is necessary for enterprises, otherwise they simply will not have enough funds to further develop their business, purchase goods and timely payments for tax payments and to suppliers.

Short-term loans in the balance sheet of an enterprise are classified as liquid funds. This balance sheet line characterizes the organization from the point of view of its excellent solvency. Accounting for such loans must be carried out based on the legislative documents of the authorities. This will enable legal organizations to timely pay debts and correctly submit annual reports. A legal entity that pays off a loan every month will be of interest not only to credit institutions, but also to investors.

Features of long-term loans and borrowings

Funds issued by a lender at interest for a period of 3 or more years are classified as long-term loans. By concluding an agreement, the client undertakes to return the funds in full within the period specified in the agreement. As a rule, the bank issues long-term loans for specific purposes, for example, for the purchase of real estate, business development, and more. This means that taking out such loans for small purchases will be impractical.

The main differences between long-term lending and short-term lending are the availability of collateral and insurance. The bank presents such demands because it bears the risk of repaying the borrowed funds for a long period.

Important! Only a borrower with a positive credit history can obtain credit funds for a long term.

Advantages and disadvantages of long-term loans

Let's look at the advantages of consumer loans issued for a long period of time:

- Acceptable conditions with minimal overpayment. The bank provides the client with the opportunity to pay small monthly payments during the entire term of the agreement. If you take out a long-term secured loan, the interest rate will be even lower.

- Availability of loan options based on the client’s needs. It is in the interests of the bank not only to issue funds to the client for a long period of time, but also to receive additional income during this period for secondary transactions. For example, a borrower can use loan funds to pay for housing and communal services or make transfers with a commission.

- Availability of an opportunity for a legal entity to open its own business and buy assets.

The negative aspects of long-term loans include:

- Long and complex design. Since long-term loans are classified as targeted loans, the client is required to provide the bank with a complete list of documents, including papers confirming the purpose of borrowing funds. In addition, the borrower must provide proof of income.

- Availability of a guarantor, collateral and insurance. Focus on the fact that the bank has the right to issue funds only if there are two types of security.

- Strict requirements for the client. Their presence is due to the fact that during the client’s life any difficult situations may arise that will cause non-payment of the loan.

Types of loans

Common types of loans from microfinance organizations:

- PDL (Pay Day Loans) - short-term;

- POS (Point of Sale) - loans at points of sale, from several months to a year or two;

- Installments are usually long-term, with repayment in equal installments over the entire term.

Loans are classified according to the method of issuance:

- cash - issuance of the loan amount through the lender's cash desk or transfer by transfer;

- to card - money is transferred according to the specified card account details;

- through payment systems - the most popular WebMoney, Yandex.Money, Qiwi;

- to a current bank account - for the convenience of borrowers.

By method of provision:

- unsecured - for the purchase of goods or payment for services. For example, to purchase furniture or equipment, to pay for studies or special events, for treatment;

- under guarantee - a separate agreement is signed with the guarantor (relatives or third parties can act);

- secured - lending with the provision of collateral (except for residential real estate, the use of which as collateral is prohibited by law). The collateral or guarantee will be the guarantor of loan repayment. As a rule, they are drawn up when agreeing on an increased loan amount for a long period.

By payment method:

- annuity - repayment in equal parts every month;

- differentiated - interest is charged on the balance of the debt.

By registration method:

- online loans - the entire application procedure from submitting an application to transferring the loan amount takes place via the Internet at any time of the day;

- classic - are issued at the office of the microfinance organization in the personal presence of the borrower.

The championship is occupied by online loans without collateral or guarantee.