Inventory is a responsible and serious process for entrepreneurs involved in retail trade. Almost every businessman involved in the sale of a wide range of goods has encountered mis-grading in his work.

- What is this phenomenon?

- Why might it occur?

- How to minimize its occurrence?

- And if it is nevertheless identified, how to correctly reflect the misgrading in accounting and tax records?

We will help clarify all questions regarding regrading in this material.

How to take inventory during reorganization ?

Re-grading - what is it?

The term “re-grade” came to us from the Soviet heritage - it refers to goods of the same name, but of different grades.

It is officially mentioned in accounting documents, but tax legislation does not give it a strict definition.

Re-grading is the result of an inventory that reveals a discrepancy between goods of different types having the same name, and the shortage of one type of product is covered by a surplus of another type.

NOTE! The concept of “product name” is also not reflected in the regulatory framework, so it can be interpreted in different ways. The Ministry of Finance recommends using the data from the All-Russian Product Classifier.

For example, according to the inventory commission of a furniture store, according to the documents, the balance should have included 10 “Antoshka” and 8 “Masha and the Bear” chairs, but in fact it turned out to be 8 “Antoshka” and 10 “Masha”: thus, a surplus of 2 chairs is recorded "Antoshka" and a simultaneous shortage of 2 units of "Masha and the Bear". This means that some sold “Antoshka” chairs turned out to be capitalized as “Masha”.

Is it possible as a result of regrading in tax accounting

Natural decline and re-grading in trade

As a result of natural physical and chemical processes (weathering, drying, spraying, crumbling, freezing, leakage, spillage (when pumping and dispensing liquid goods), and so on), the weight of the product may change during storage. In addition, the product may deteriorate during transportation or unloading due to its natural fragility, tenderness (fruit) or other properties. It is generally accepted that the listed processes lead to a natural loss of goods.

The peculiarity of such losses is that they actually cannot be documented, therefore, to determine their value, special norms of natural loss are developed and approved, within which the organization can write off commodity losses as production or distribution costs, and also take them into account for taxation.

For tax accounting purposes, losses from shortages and (or) damage during storage and transportation of inventories within the limits of natural loss norms approved in the manner established by the Government are recognized as material expenses (subclause 2, clause 7, article 254 of the Tax Code of the Russian Federation).

In pursuance of this norm of tax legislation, on November 12, 2002, the Government adopted Resolution No. 814, regulating the procedure for approving norms of natural loss by the relevant ministries. However, today not all the norms of natural loss that are necessary have been approved in the proper manner, therefore the Law of 06.06.2005 No. 58-FZ “On Amendments to Part 2 of the Tax Code of the Russian Federation and some other legislative acts of the Russian Federation on taxes and fees" allowed taxpayers, until the approval of the norms of natural loss, to properly apply the "old" standards previously approved by the relevant federal executive authorities.

So, trade organizations

in addition to the norms approved in the proper manner, the following “old” norms of natural loss have the right to apply:

- Norms of natural loss of food products in trade, approved by order of the Ministry of Trade of the RSFSR dated April 2, 1987 No. 88;

- Norms of natural loss of fresh potatoes, vegetables and fruits in the retail trade network, approved by order of the Ministry of Trade of the RSFSR dated February 22, 1988 No. 45;

- Norms of natural loss of fresh potatoes, vegetables and fruits during long-term and short-term storage in bases and warehouses of various types, approved by order of the USSR Ministry of Trade dated March 26, 1980 No. 75, etc.

Official regulation of misgrading

During the Soviet Union, the concept of “regrading” was used quite widely, being in common use, so modern legislators did not consider it necessary to make additional adjustments to its regulation. There are only a few regulations that address this phenomenon.

- Among the regulatory documents relating to regrading, we can highlight the Letter of the Federal Tax Service of Moscow dated February 17, 2010 No. 16-15/016379 “On accounting for profit tax purposes of the balances of goods by an organization engaged in retail trade,” in which it is officially given the current definition of misgrading, and its possible causes are listed.

- The procedure for reconciling material assets, as a result of which, in particular, misgrading can be identified, has been in effect since July 13, 1995 - it was then that Order No. 49 of the Ministry of Finance of the Russian Federation came into force, which put into force the “Methodological Instructions for Inventory.”

- The accounting reflection of the re-grading of goods is carried out in accordance with clause 28 of the Accounting Regulations, which was approved by Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n.

Is it necessary to restore VAT if a shortage is detected ?

Possible reasons for misgrading

The situation when documents indicate one type of goods instead of another can arise under various circumstances:

- absence or violation of the established procedure for receiving, storing and issuing goods from the warehouse;

- problems with document management;

- lack of internal control over product dynamics;

- unintentional error of one or another employee (storekeeper, supply manager, loader, seller and other persons with access to goods);

- poor performance of their duties by financially responsible persons (negligence or guilty actions).

Who can use regrading?

Regrading, along with writing off defects, is one of the stages of product movement that is available for fraudulent transactions on the part of the organization’s employees. This is explained by the fact that in these situations the characteristics of the products change and the staff can “work for themselves” by selling cheaper goods at the cost of expensive ones. We remind you that the responsibility to prove the facts that caused the loss of confidence in the employee lies with the employer. It does not matter in what form the employee committed illegal actions: intentional abuse or negligence, negligence in the performance of his job duties. If guilt in committing specific actions has not been established, the employee cannot be dismissed on the grounds of loss of confidence, even despite the shortage, damage or mis-grading of inventory items. And, as you know, the most important thing is fraud prevention. Therefore, the role of effective accounting of finished products remains very significant at all stages of its movement.

When is offset possible?

Logic dictates that when regrading, the easiest way is to offset the missing and excess goods. But this can be done legally (according to the Methodological Instructions) only if a number of conditions are simultaneously met:

- discrepancies between goods of different grades were identified in the same accounting period (during the general inventory);

- responsibility for both shortages and surpluses is assigned to one person;

- the discrepancy between goods is identical in quantitative terms (surpluses cover shortages, and vice versa).

For example, if a surplus of “Bera” pears is found in one warehouse, and a shortage of “Duchess” pears is recorded in another, this cannot be recognized as misgrading and offset, since different people are responsible for different warehouses. It is also impossible to offset, for example, a shortage of tubes of toothpaste and the same excess of soap - these are goods of different names.

How to reflect in the organization's accounting the offset of the shortage of materials with surpluses due to re-grading identified during the inventory?

If excess is detected

As a rule, regrading is carried out in order to reduce the amount of losses caused to the enterprise by the shortage (waste) of finished products and other material assets. But sometimes (though extremely rarely) as a result of an error in the production report or in the accounting department, more products end up in the warehouse than are listed in the accounting records. The following situation is also possible: identified shortages are quantitatively greater than surpluses, but in terms of value, on the contrary, there are more surpluses. In these cases, the accountant should reflect the excess of surpluses over deficits in accounting. Obviously, the traditional correspondence of accounts Debit 41 Credit 91-1 is suitable for this when identifying surpluses.

Example 2. Let’s change the conditions of the previous example: let’s assume that during the inventory, a shortage of beef tripe (70 kg) and a surplus of brisket (50 kg) was revealed for one financially responsible person and for one reporting period. The shortfall in value terms amounted to 4,200 rubles. (70 kg x 60 rubles/kg), and the surplus is 5000 rubles. (50 kg x 100 rub/kg). The market valuation of finished products corresponds to the accounting value.

In quantitative terms, the shortage is greater than the surplus, but in monetary terms, the surplus is greater than the shortage. The credit will be made for 50 kg, the difference in value terms will be 2000 rubles. (50 kg x 100 rubles/kg - 50 kg x 60 rubles/kg). The discrepancy will be included in other income. 20 kg of beef tripe will remain unaccounted for, the damage for the shortage will be 1200 rubles. (20 kg x 60 rub/kg). Therefore, despite the fact that according to accounting data there is a surplus, the employee will still be responsible for the shortage.

The following entries will be made in the organization's accounting:

| Contents of operation | Debit | Credit | Amount, rub. |

| Beef tripes and briskets were counted (50 kg) | 43-1 | 43-1 | 3000 |

| The cost excess of the surplus over the shortage is reflected | 43-1 | 91-1 | 2000 |

| Reflects a shortage that exceeds the surplus in quantity | 94-1 | 43-1 | 1200 |

| The difference between the shortage and surplus after regrading was attributed to the guilty parties | 73 | 94 | 1200 |

The first of the previously considered options for reflecting misgrading in accounting was selected.

Thus, no matter how high the estimate of the surplus is (if, for example, the market value is higher than the book value), the employee will still have to answer if the quantity of missing products is greater than that found in the surplus. Expensive surpluses will increase the organization's other income and will not reduce the employee's debt.

What to do if misgrading is detected and recognized?

IMPORTANT! Recommendations for documenting regrading from ConsultantPlus are available here

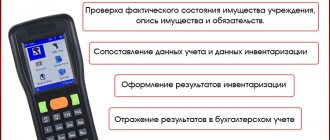

The algorithm for detecting mis-grading of goods as a result of inventory consists of the following sequential actions.

- Establishment of the person financially responsible for these goods. The employee financially responsible for the area where misgrading was detected (for example, a storekeeper) needs to write a detailed explanation for the inventory commission. It is drawn up in the form of an explanatory note, which describes all the data regarding non-matching goods, indicates the reason for the discrepancy (it could be, for example, similar packaging), and also proposes measures to prevent this from happening in the future. The text can be completed with a request for offset of misgrading.

- Settlement proposal. The chairman of the inventory commission prepares a document on the basis of which the regrading can be offset. This document is addressed to the head of the organization. It contains information about the result of accounting for goods, detailed data on misgrading, provides codes for mismatched goods according to OKP, and quotes an explanatory note from the financially responsible person.

- Issuance of an order. The manager, if he agrees with the proposal received, issues a corresponding order to the chief accountant to offset the re-grading of goods and further calculations based on the updated data. The order duplicates information from the text of the proposal about the name and quantity of mixed up goods.

- Comparison statements. They are prepared by accounting employees (the standard INV-19 form is provided for them). One of the 2 copies is intended for accounting, the second will be given to the financially responsible employee. The conclusion is drawn up according to the summary statement INV-26, which indicates whether offset occurs, whether shortfalls are written off or losses are attributed to the guilty party.

IMPORTANT INFORMATION! If the financially responsible person is found guilty, then the losses must be compensated at his expense by depositing money into the organization’s cash desk.

IMPORTANT! The regrading date indicated in all documents will not be the actual date when the error occurred (it is most often impossible to establish accurately), but the day when it was discovered, that is, the inventory date.

How to apply for regrading

The main document recording the results of a warehouse inspection is the inventory list of the INV-3 form. It lists all goods (by nomenclature and grades) listed according to accounting data. As the audit progresses, information about the goods available on the audit date is entered into the inventory. The inventory is compiled in 2 copies - one remains with the responsible person, the other is transferred to the accounting department. If discrepancies are identified between accounting and actual balances, the accountant draws up a matching statement based on the results of the inventory of the INV-19 form, which provides a field where the misgrading is recorded - these are columns No. 18-23

Since the beginning of 2013, unified forms are not mandatory for use, therefore, instead of a comparison sheet, when confusion is detected in varieties, enterprises fill out a more simplified version - a regrading act, a sample of which may be as follows:

With mechanized accounting, in particular in the 1C program, the regrading report is drawn up automatically. Based on the results of the audit, the inventory commission prepares proposals for regulating discrepancies between the availability of MC and accounting data, offsetting shortages at the expense of surpluses, and then this information is submitted for consideration to the head of the organization.

Accounting entries

In accounting documents, the misgrading of goods is recorded according to the following scheme:

- debit 41 subaccount “Name of surplus goods”, credit 41 subaccount “Name of goods with shortage”: – amount of discrepancy (“Shortage taken into account...”);

- debit 94, credit 41 “Goods with shortage” – amount (“The difference in the cost of goods discovered during misgrading is reflected”);

- debit 73, credit 94 – amount (“The identified difference is attributed to the guilty party”);

- debit 50, credit 73 – amount (“The specified amount was deposited into the cash register by the person responsible for the shortage”).

What to do if the culprit is not identified?

In this case, the difference is recognized as a shortage in excess of the norm of natural loss and, accordingly, is written off as costs. In such a situation, the head of the enterprise must document the absence of the culprit. The inventory commission, in turn, in its conclusion must justify the reasons why it is impossible to recover losses from the responsible persons.

As established in the Tax Code (Article 265, paragraph 2), losses can be attributed to non-operating expenses. If items in surplus are more expensive than those in short supply, the difference is written off as other income. It must be said that regrading is reflected differently in tax and accounting. In the first case, it is necessary to indicate the entire amount of detected deficiencies and surpluses. To put it simply, in taxation, regrading is the write-off of some products and the capitalization of others.

Re-grading act

As a template for drawing up this document, you can use the INV-3 form, approved by Decree of the State Statistics Committee of the Russian Federation dated August 18, 1998 No. 88, which provides for an inventory list based on the actual availability of goods and according to accounting data. 1 sheet of this form must contain the following information:

- name of the organization (structural unit);

- OKPO codes;

- basis for assigning an inventory;

- its date (beginning and ending);

- number of the act and the date of its signing;

- information about material assets in relation to which a discrepancy has been identified;

- explanatory note from the financially responsible person;

- the date when the remaining inventory items were recorded.

Sheets 2 and 3 of the form are filled out according to the diagram below.

This form is not approved, but only recommended, therefore the enterprise is not prohibited from drawing up an act according to its own scheme, approved in internal documents.

Reflection of data on misgrading in reports

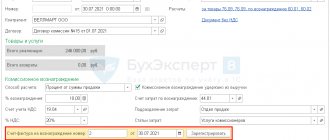

To check the results, we will generate a report “Statement of goods in warehouses” for the recalculation period. It is available on the warehouse reports page:

Warehouse and delivery / Warehouse reports

In our example, the report displays the receipt of “Hoverboard 2” and the consumption of “Hoverboard 1”, according to the registered re-grading of goods.

To analyze the cost of goods, you must first calculate it. To do this, let's close the month:

Financial result and controlling / Closing the month / Closing the month

Then open the financial results reporting page:

Financial results and controlling / Financial results reports

In the subsection “Cost of inventories” we will generate a report “Cost of goods”. It also reflects the receipt and consumption of goods as a result of re-grading. In this case, the cost values of the goods received and written off are equal, in accordance with the settings of the regrading document.

Read the article about printing inventory statements: printing INV-3 and INV-19 based on the results of the recalculation.