1C:Accounting provides for complete automation of the VAT accounting process. At the same time, there is often a need to introduce taxes manually. In particular, when maintaining a simplified document, or when its cancellation, adjustment or clarification is necessary. It is for this purpose that the option “Reflection of VAT for deduction” is provided in “VAT Operations”. The location of this option is shown in Figure 1.

Display indicating the billing document

If it is necessary to adjust the tax position, the following algorithm applies. A new document form is created, all necessary details are filled in, including the payment document with the supplier that was presented before.

- If the “Use as a purchase ledger entry” position is not selected, the tax will be reflected in the “deductible” position, similar to incoming documents. In such a situation, in order for the purchase book to contain the corresponding entry, an additional formatting document must be entered.

- Selecting the second option will generate a posting for the tax crediting process.

- If you select an additional sheet entry position, then the document posting record will be reflected in the additional sheet for the period specified by the user.

- Selecting the fourth option will result in the settlement document being reflected in accounting.

This option is selected if it is necessary to correct the movement of settlement documents. It is necessary to pay attention to the “Operation code” position, since the value must be selected independently from the proposed list.

We go to the “Products and Services” tab. Click the “Fill” position and select the required command.

The list of values will be filled in automatically from the corresponding initial document, where in the column “Type of value” a non-detailed type of material assets is noted. This action is quite enough to record the purchase in the books.

After filling out the tabular part, the adjustment amount is entered with a “+” or “-” sign. To change the tax rate, several lines must be filled in. In the first - reversing. In the second, the new rate and amount are indicated. In case of adjustment, the invoice is not entered into the basis.

Reflection of VAT for deduction in 1C:BP

In the 1C: Enterprise Accounting program, VAT transactions are automated, however, there are cases when it is necessary to enter an adjustment or clarification. Also, for organizations that are on a simplified taxation system, these transactions must be entered manually.

In order for the program to correctly calculate such transactions, you must use “Reflection of VAT for deduction”. (Transactions - VAT)

Reflection of VAT indicating the calculation document.

Let's create a document in the program in which we will fill in all the necessary details; you also need to fill out the “Calculation Document” - select the calculation document, according to which the tabular part is filled out. If on the Invoice tab the Use settlement document as an invoice checkbox is selected, then the settlement document is used for recording.

It is also necessary to check the boxes in this document.

- “Use as a sales ledger entry. Operation code. Receipt of goods, works, services.” — this functionality will display the tax deductible in the receipt document and in the purchase book; you will also need to additionally enter a generation document.

- “Generate transactions” – will generate transactions that will display the tax crediting.

- “Recording an additional sheet for a period” - this functionality will record document transactions on an additional sheet in the period for which the user specifies.

- “Use settlement document as an invoice” - is set when the document needs to be adjusted for movement and the settlement will be reflected in accounting.

Let's also consider which “Operation code” is in the program. This list is standard in the program and the user himself will select this code in accordance with the operation.

By going to the “Products and Services” tab, you can click on the “Fill” button and select one of the filling options to transfer the data to the tabular section.

In the tabular part, the place of the item name is indicated as “type of value” without details. To reflect the transaction in the purchase ledger.

After filling out the tabular part, you can proceed to adjustments. The document must indicate the amounts plus or minus.

Formation of VAT bases for calculation documents.

In order to generate VAT for deduction without a settlement document, fill in all the necessary details, except for “Calculation document” and do not check the “Use settlement document as an invoice” checkbox. If an invoice needs to be registered, this can be done in the document itself by clicking on the “Register” button.

On the “Products and Services” tab, the user independently indicates the nomenclature and changes in data. If the user still checks the box that generates an invoice, then the type of value must be detailed and all the necessary data must be specified manually. Display in the purchase book can be specified on the “Payment Documents” tab.

Document movement

When the “Document Postings” checkbox is checked, postings will be generated. We also see that this document generates entries in the “VAT Purchases” register.

If you uncheck the “Generate transactions” checkbox, only the entry in the “VAT Purchases” register will be displayed in the movement of the document.

VAT accounting analysis

Let’s use “VAT Accounting Analysis” (Reporting - Accounting Analysis)

In this report we can see the changes that we made using the document “Reflection of VAT for deduction”

Using this functionality, the user can easily change the VAT amounts and reflect it correctly in reports.

Display if there is no settlement document

If there is no calculation document, there is no need to indicate it, therefore the fourth option (checkbox) is not selected. In this situation, there is no need to fill out the subsection “Calculation Document”.

An invoice is entered based on the process of recording tax for deduction, for example, in the absence of primary documentation of receipt.

In the position - “Goods and services”, in independent mode, all the necessary data is entered.

If you select the fourth option, regarding using the document as an invoice, instead of items, you must mark the types of values. Otherwise, you will have to specify each one, indicating prices, tax rates and its account. Payment can be displayed in the purchase book by indicating in the “Payment Documents” section.

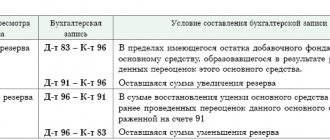

Reflection of advance transactions in the declaration: postings, restoration

In accounting, VAT is charged on the advance received from the buyer using the following entries:

To reflect the accrual of VAT on advance payments, the chart of accounts provides a subaccount “VAT on advances received (prepayments)” to account 62 “Settlements with buyers and customers” and account 76 “Settlements with various debtors and creditors”. This allows:

- keep in accounting data on advances received and VAT on them (according to Kt 62, 76);

- in the balance sheet, reflect the amounts of advances received (excluding VAT, accounted for on the Dt of the relevant accounts) as accounts payable.

Please note that the previously received advance payment at the time of sale of goods (services or work) is counted towards the prepayment amount. An invoice is issued for the shipped product (service or work). On the date of offset of advances, the company accepts for deduction VAT on advances received. Please note that the deduction is made in the amount of tax calculated on goods (services or work) shipped for which advances were received. It is understood here that if VAT on advances is charged at a rate of 20/120%, and the product (service or work) is shipped at a rate of 10%, then VAT on advances received is credited at a rate of 10/110%.

In the VAT return, the advance received is reflected in section 3 on line 070 in column 3, and the amount of tax on the advance is reflected in column 5.

The deduction of VAT on advances received is reflected in section 3 of the declaration on line 170 in column 3 for the tax period in which the goods were shipped.

Reflection in accounting of VAT on the advance paid to the supplier is reflected by postings.

Account 19 is used for the purpose of separating VAT from an advance, when the issuance of an advance and the deduction of VAT are separated in time. If advance VAT on the reporting date is not accepted for deduction, then the tax reflected in account 19 is recorded in the balance sheet as a current asset separately from the “receivables” for the transferred advance payment.

To separate VAT from advances issued, you can use separate subaccounts “VAT on advances issued (prepayments)” to account 60 “Settlements with suppliers and contractors” or to account 76 “Settlements with various debtors and creditors”. Thereby:

- the accounting stores data on advances paid, including VAT (according to Dt 60, 76);

- the balance sheet shows “receivables” (minus VAT accounted for in the KT of the relevant accounts) in the form of advances issued.

VAT on advances received, accounted for under Dt 62-VAT (76-VAT), is not indicated in the balance sheet, as well as VAT on advances issued, accounted for under Kt 60-VAT (76-VAT). In the balance sheet, tax amounts are reduced by the “debtor” in the form of advances issued and the “creditor” in the form of advances received.

Reflected in account 19 from the advance VAT issued, which was not accepted for deduction by the end of the reporting period, must be included in the balance sheet. This VAT is indicated in line 1220 “VAT on acquired assets.”

Advances issued are not reflected in the VAT return, but the tax on these advances accepted for deduction is indicated in section 3 on line 130.

Please note that for the advances listed by the suppliers, the buyer acts according to the following scheme:

1) receives an invoice for the advance payment, records it in the purchase book, and accepts the advance VAT for deduction;

2) after shipment of goods (services, works), records the shipping invoice in the purchase book;

3) indicates the previously registered advance invoice in the sales book, thus recovering VAT from the advance payment issued.

Kontur.VAT+ allows you to avoid discrepancies in the quotas and reconciles invoices for transactions with advances for all quarters.

Find out more

Regarding the recovery of VAT from an advance received, the situation is as follows. The seller, having received an advance payment, charges VAT on it. Having sold the goods (service, work), he draws up an invoice for the sale and accepts VAT from the previously received advance for deduction. That is, in this case the term “restoration” is incorrect to use. The seller records an advance invoice in the sales book, and later, after shipment of the goods (service, work), an invoice for sales. At the same time, the seller registers an invoice for the advance payment in the purchase book, thereby deducting advance VAT. Oh, that is, the deduction, VAT on the advance received is not limited, the main thing is that the deduction is declared in the quarter in which all the conditions for the deduction are met.

Document movement report

Let's consider the types of transactions that appeared as a result of the adjustment document.

As a result, after reflecting the adjustment, you can see all the transactions generated by the program. In addition, the fields in the “Purchase VAT” accumulation register have been filled in.

If the “Generate transactions” option is not selected, the program will fill in the fields only in the cumulative register.

Thus, the system makes it possible to make changes to tax amounts manually. At the same time, every change is included in the reporting.

Postings generated upon receipt of goods and services in 1C 8.2

Postings generated by the document receipt of goods and services for accounting

Postings for accounting for “input” VAT in 1C 8.2 are created by the document Receipt of goods and services:

Postings generated by the document receipt of goods and services for tax accounting

The following entries were created in the VAT accumulation register:

- An entry with the type of movement Receipt in the VAT register presented – event Presented by VAT by the supplier. This entry is a potential purchase ledger entry:

- Entry with the type of movement Receipt in the VAT register for acquired values , type of value Materials - for tax amounts accepted for accounting related to a specific batch of goods and materials:

Analysis of VAT accounting

To do this, you need to go to the section - “Reporting-Accounting Analysis-VAT Accounting Analysis”.

As you can see from the figure, every change is reflected in this report.

“1C: Accounting” allows you to adjust VAT amounts manually using the document “Displaying VAT for deduction”.

By skillfully operating this document, using the necessary capabilities and settings, the user can make all the necessary adjustments to the credentials. As a result of the program, the necessary transactions will be generated, and all the necessary information will be displayed correctly.

Still have questions? Order a free consultation with our specialists!

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter