In Russia, to regulate the sphere of social and economic legal relations (including the provision of state support to various categories of citizens in need), two interrelated concepts are used: the living wage and the minimum wage. Further, the following abbreviations will be used to denote them in the article: PM and minimum wage.

Unlike the minimum wage, which can be set “at will” in a region, the minimum monthly wage must be determined for each subject of the Russian Federation by local authorities. In the article we will discuss the indicators of the Moscow region, in particular, what is the minimum wage and the cost of living in the Moscow region in 2022 - from January 1, the indicators for the 3rd quarter of 2022 will be in effect.

Legal assistance:

Free in Russia: 8

Dear readers!

The free legal assistance hotline is available for you 24 hours a day!

General provisions

Both the size of the monthly minimum wage and the size of the “minimum wage” are set strictly per person, the amount is precisely determined for a specific period:

- The federal minimum wage is set for a year, the frequency of the regional minimum wage is not established, but usually for a year or two;

- PM is approved quarterly, in addition to the indicator for pensioners to determine the amount of social supplement, this PM is also set for a year.

Currently, for the Moscow region, the minimum wage for 2019 is 14,200 rubles and the monthly minimum wage for the 3rd quarter of 2022. The figure for the 4th quarter of 2022 is expected in February-March next year, and for the 1st quarter of 2022 will be determined closer to the summer.

The minimum wage is set uniformly; the minimum wage differs depending on the citizen’s membership in a specific socio-demographic group. There are three in total:

- Working-age citizens (virtually the entire adult population).

- Pensioners.

- Children.

That is, there is one minimum wage per person, and the minimum wage can be of three different types. In addition, such an indicator as the subsistence minimum per capita is calculated. These provisions are contained in federal laws: Federal Law-82 on the minimum wage and Federal Law-134 on PM.

Minimum wage in Moscow from January 1, 2022 - what will be the minimum wage?

What is the cost of living in the Moscow region in 2020?

The cost of living in the Moscow region for the 4th quarter of 2020 is set: per capita 13,169, for the working population 14,586, for pensioners 9,866, for children 12,867 rubles.

Decree of the Government of the Moscow Region dated January 29, 2021 No. 49/3.

Compared to the 3rd quarter of 2022 decreased:

- per capita -411 rub. (-3.12%);

- for able-bodied people -401 rub. (-2.75%);

- for pensioners -285 rub. (-2.89%);

- for children -664 rub. (-5.16%);

How are minimum wages and monthly wages calculated?

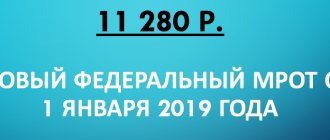

The minimum wage, according to the norms of the Labor Code of the Russian Federation and a specialized federal law, will now be equal to the monthly minimum wage for the second quarter of the previous year. If the procedure for determining this indicator is quite simple, then the situation with the formation of PM is more complicated.

Federal Law 134 establishes the following principles:

- determination of PM based on data on the consumer basket;

- the consumer basket as a list of basic goods and services necessary for a person to carry out life activities is determined at the level of the Russian Federation and regions once every five years, also for the main socio-demographic groups;

- in the Russian Federation as a whole, it is established by a separate law, in the constituent entities of the Russian Federation - by a separate legislative act at the local level, taking into account the characteristics of the region;

- when forming the indicator, statistical research data on the level of consumer prices for the above list of goods and services are also taken into account;

- regions can supplement this procedure, but usually local acts duplicate federal norms;

- When developing a consumer basket and PM, the level of needs of representatives of specific categories is taken into account, according to general methodological recommendations (for pensioners and children it is lower than for working citizens). Therefore, the cost of living for a child is always less than for an able-bodied person, and the lowest minimum wage is set for pensioners.

What is the cost of living in the Moscow region now?

| 3rd quarter 2020 | |||

| Per capita | RUB 13,580/month | ||

| For the working population | RUB 14,987/month | ||

| For pensioners | RUB 10,151/month | ||

| For children | RUB 13,531/month | ||

Dynamics of PM in the Moscow region for 2014-2021

| Period | Per capita (RUB/month) | For the working population (RUB/month) | For pensioners (RUB/month) | For children (RUB/month) | Resolution |

| III quarter 2020 | 13580 | 14987 | 10151 | 13531 | No. 972/41 dated 12/16/2020 |

| II quarter 2020 | 13509 | 14941 | 10103 | 13317 | No. 673/30 dated 09/23/2020 |

| I quarter 2020 | 12536 | 13876 | 9411 | 12248 | No. 350/18 from 06/23/2020 |

| IV quarter 2019 | 12272 | 13598 | 9240 | 11887 | No. 128/7 from 03/24/2020 |

| III quarter 2019 | 12897 | 14300 | 9660 | 12540 | No. 958/43 dated 12/13/2019 |

| II quarter 2019 | 13115 | 14547 | 9848 | 12688 | No. 637/31 dated 09.19.2019 |

| I quarter 2019 | 12493 | 13844 | 9396 | 12118 | No. 379/19 dated June 26, 2019 |

| IV quarter 2018 | 11764 | 13038 | 8862 | 11378 | No. 149/9 from 03/25/2019 |

| III quarter 2018 | 12181 | 13496 | 9100 | 11925 | No. 942/43 dated 12/12/2018 |

| II quarter 2018 | 12229 | 13528 | 9137 | 12057 | No. 677/34 dated 09/28/2018 |

| I quarter 2018 | 11608 | 12841 | 8701 | 11396 | No. 402/21 dated June 25, 2018 |

| IV quarter 2017 | 11365 | 12581 | 8535 | 11097 | No. 199/12 dated March 30, 2018 |

| III quarter 2017 | 11365 | 12581 | 8535 | 11097 | No. 199/12 dated March 30, 2018 |

| II quarter 2017 | 11865 | 13146 | 8918 | 11522 | No. 806/34 dated 09/27/2017 |

| I quarter 2017 | 11280 | 12495 | 8480 | 10962 | No. 554/21 dated 07/04/2017 |

| IV quarter 2016 | 11021 | 12214 | 8285 | 10688 | No. 212/9 from 03/23/2017 |

| III quarter 2016 | 11346 | 12592 | 8489 | 10997 | No. 929/45 dated 12/12/2016 |

| II quarter 2016 | 11275 | 12482 | 8434 | 11064 | No. 684/33 dated 09.22.2016 |

| I quarter 2016 | 10916 | 12082 | 8178 | 10697 | No. 491/21 dated June 24, 2016 |

| IV quarter 2015 | 10460 | 11598 | 7867 | 10117 | No. 185/8 dated 03/17/2016 |

| III quarter 2015 | 10786 | 11990 | 8071 | 10373 | No. 1131/45 dated November 30, 2015 |

| II quarter 2015 | 11229 | 12472 | 8400 | 10848 | No. 764/34 dated 09/08/2015 |

| I quarter 2015 | 10705 | 11876 | 8029 | 10365 | No. 459/22 dated June 16, 2015 |

| IV quarter 2014 | 9150 | 10163 | 6896 | 8747 | No. 150/10 dated 03/19/2015 |

| III quarter 2014 | 9063 | 10083 | 6804 | 8641 | No. 1060/48 dated 12/10/2014 |

| II quarter 2014 | 9162 | 10186 | 6864 | 8793 | No. 705/35 dated 09/04/2014 |

| I quarter 2014 | 8533 | 9478 | 6402 | 8209 | No. 484/23 dated June 23, 2014 |

Citizens whose income is lower than the legally established minimum wage are officially assigned the status of low-income people. This gives them the right to social assistance from the state.

Based on what is it calculated?

The calculation of the living wage is carried out by the capital's authorities quarterly based on data on indices and dynamics of consumer prices provided by the local body of the Federal Statistical Service.

The legislative basis for the approval of the living wage is:

- Law No. 134-FZ, which came into force on October 24, 1997;

- Moscow Law No. 23, which came into force on May 15, 2002;

- Resolution of the Moscow Government.

Current and projected inflation rates, the general situation in the capital’s consumer market, and the current level of income and spending of the population are taken into account.

How the value is used

The indicator is one of the main economic parameters used by the Moscow leadership to calculate:

- childbirth benefits for young Moscow families;

- one-time compensation payments provided for by law to reimburse costs arising from the adoption of a child;

- “children’s” benefits paid every month;

- monthly compensation payments intended for single mothers due to an increase in the cost of living;

- one-time financial assistance to Muscovites who find themselves in difficult life situations.

The value is taken into account when determining the rights of low-income students to receive a social pension. The indicator is taken into account when registering citizens in need of improved living conditions, when calculating subsidies for housing and communal services and residential premises, as well as when providing free legal assistance.

PM is also taken into account when forming the city budget, when establishing the amount of non-taxable income, determining measures of state targeted support, calculating unemployment benefits and a number of other social, financial, and economic indicators.

Regulation of indicators at the regional level

Minimum wage in the regions, according to Art. 133.1 of the Labor Code of the Russian Federation, can be determined in accordance with a tripartite agreement between representatives of employers, employees (through the mediation of trade unions) and local authorities. It cannot be less than the federal one. When developing, the parties are guided by the local PM level.

The subsistence minimum in the regions is determined once a quarter based on the principles set out above, taking into account consumer prices and the list of goods from the consumer basket. In the Moscow region, a separate law on this procedure was adopted - No. 13/98-OZ of April 28, 1998; its provisions practically duplicate the norms of the federal act.

Setting a living wage in the Moscow region

The subsistence minimum in the Moscow region is intended, among other things, to justify the minimum wage established in the region, the amount of scholarships, benefits and other social payments, as well as to provide social assistance to low-income citizens.

When the cost of living is reduced for the next quarter, in order to provide the necessary social support to low-income citizens, the cost of living established for the quarter preceding the quarter in which the first reduction in the cost of living occurred is applied. This value of the subsistence minimum is applied until a different value of the subsistence minimum is established that exceeds the specified one.

The importance of PM for social legal relations

There are several areas of social policy for which this indicator is especially important:

- according to Art. Art. 2 and 6 FZ-134, it is used for benefits to the poor; in general, citizens whose income is less than the minimum wage are recognized as such;

- from January 1, 2022, the PM for children will be applied to benefits for a child under 3 years of age (at a certain level of income);

- PM is specially established once a year for pensioners. If the income of such a citizen is less than the minimum, he is given an additional payment up to the minimum wage.

The cost of living for pensioners in the Moscow region in 2020 will be applied in the same amount as it was in 2019 - 9,908 rubles.

It is used only to assess the level of income of a pensioner in order to provide him with a social supplement. If the pension is less than 9,908 rubles, and there is no other income, then the person will be paid extra up to the minimum wage from budget funds.

What is the minimum wage (minimum wage) in St. Petersburg in 2019-2020?

Living wage table in the Moscow region

| Period | Living wage (rub.) | Decree of the Government of the Moscow Region | |||

| per capita | for the working population | for pensioners | for children | ||

| 1st quarter 2021 | The cost of living in the Moscow region for the 1st quarter of 2022 is expected at the end of June 2022. | ||||

| 4th quarter 2020 | 13169 | 14586 | 9866 | 12867 | dated January 29, 2021 No. 49/3 |

| 3rd quarter 2020 | 13580 | 14987 | 10151 | 13531 | dated 12/16/2020 No. 972 / 41 |

| 2nd quarter 2020 | 13509 | 14941 | 10103 | 13317 | dated 09/23/2020 No. 673/30 |

| 1st quarter 2020 | 12536 | 13876 | 9411 | 12248 | dated June 23, 2020 No. 350/18 |

| 4th quarter 2019 | 12272 | 13598 | 9240 | 11887 | dated March 24, 2020 No. 128/7 |

| 3rd quarter 2019 | 12897 | 14300 | 9660 | 12540 | dated 12/13/2019 No. 958/43 |

| 2nd quarter 2019 | 13115 | 14547 | 9848 | 12688 | dated September 19, 2019 No. 637/31 |

| 1st quarter 2019 | 12493 | 13844 | 9396 | 12118 | dated June 26, 2019 No. 379/19 |

| 4th quarter 2018 | 11764 | 13038 | 8862 | 11378 | dated March 25, 2019 No. 149/9 |

| 3rd quarter 2018 | 12181 | 13496 | 9100 | 11925 | dated 12/12/2018 No. 942/43 |

| 2nd quarter 2018 | 12229 | 13528 | 9137 | 12057 | dated September 28, 2018 No. 677/34 |

| 1st quarter 2018 | 11608 | 12841 | 8701 | 11396 | 25.06.2018 № 402/21 |

| 4th quarter 2017 | 11365 | 12581 | 8535 | 11097 | dated March 30, 2018 No. 199/12 |

| 3rd quarter 2017 | 12156 | 13478 | 9071 | 11881 | dated December 25, 2017 No. 1116/46 |

| 2nd quarter 2017 | 11865 | 13146 | 8918 | 11522 | dated September 27, 2017 No. 806/34 |

| 1st quarter 2017 | 11280 | 12495 | 8480 | 10962 | dated 04.07.2017 No. 554/21 |

| 4th quarter 2016 | 11021 | 12214 | 8285 | 10688 | dated March 23, 2017 No. 212/9 |

| 3rd quarter 2016 | 11346 | 12592 | 8489 | 10997 | dated 12/12/2016 N 929/45 |

| 2nd quarter 2016 | 11275 | 12482 | 8434 | 11064 | dated 09/22/2016 N 684/33 |

| 1st quarter 2016 | 10916 | 12082 | 8178 | 10697 | dated June 24, 2016 N 491/21 |

| 4th quarter 2015 | 10460 | 11598 | 7867 | 10117 | dated March 17, 2016 No. 185/8 |

| 3rd quarter 2015 | 10786 | 11990 | 8071 | 10373 | dated November 30, 2015 No. 1131/45 |

| 2nd quarter 2015 | 11229 | 12472 | 8400 | 10842 | dated 09/08/2015 No. 764/34 |

| 1st quarter 2015 | 10705 | 11876 | 8029 | 10365 | dated June 16, 2015 No. 459/22 |

How is the cost of living calculated?

The concept of “rules for calculating the living wage” is formulated by Federal Law No. 134 of October 24, 1997 “On the living wage in the Russian Federation.” According to the regulatory document, the indicator is calculated taking into account the price, in a particular subject of the Russian Federation, of a certain list of food and non-food products, services necessary to ensure the life of each citizen.

When calculating social benefits, only the applicant’s income is taken into account. The difference in retail prices explains the imbalance in the cost of living in the regions.

The indicator also differs for citizens of working age, pensioners, and children. The smallest amount is for people of retirement age.

The cost of living varies

The cost of living in 2022 throughout the country is a value that is officially approved by the law on the federal budget (and not by a decree of the Government of the Russian Federation). When calculating the living wage, they take into account: it should be 44.2% of the median per capita income.

The living wage is established not only uniformly for Russia as a whole, but also for socio-demographic groups. That is, in addition to the general value, subsistence minimums are determined separately for the working population, children and pensioners. They are calculated as a percentage of the cost of living in the Russian Federation as a whole (clause 2 of Article 4 of Law No. 134-FZ). So, knowing the general cost of living, you can always calculate the rest by simple mathematical operations and rounding.

| “Type” of living wage | Share of the cost of living in the Russian Federation as a whole |

| for the working population | 109% |

| for pensioners | 86% |

| for children | 97% |

Minimum wage in Moscow 2022

According to the current rules, the level of the minimum wage in the capital is reviewed quarterly. This procedure was established by the decree of the Moscow Government “On the draft Moscow tripartite agreement for 2019-2021 between the Moscow Government, Moscow trade union associations and Moscow employers’ associations.” According to it, this indicator in Moscow is subject to a mandatory increase in the event of an increase in the cost of living of the working population of Moscow, and in the event of a decrease in the cost of living, the minimum level of wages will remain unchanged.

Currently, the minimum wage in Moscow is 20,589 rubles

Living wage

The cost of living from January 1, 2022 is calculated using a new method and will amount to 44.2% of the average per capita income of the population for the past year. Currently in the city of Moscow the living wage is:

- per capita - 18,029 rubles;

- for the working population - 20,589 rubles;

- for pensioners - 12,722 rubles;

- for children - 15,582 rubles.