In what cases do foreign exchange transactions appear?

Currency transactions are difficult for an accountant if they are performed for the first time or not very often. The regulatory framework for performing such operations is quite extensive. Accountants should pay attention to Federal Law-173, PBU 3/2006 and Federal Law-402.

Currency transactions appear in the following cases:

- the use of currency values as means of payment in international circulation;

- conversion of money from one currency to another by individuals or legal entities;

- forwarding, importing, transporting currency values in the territory of the native country or abroad.

Entrepreneurs carry out currency transactions when importing and exporting goods, making international transfers, and performing cash and settlement transactions.

Revaluation of foreign currency in 1C 8.3

Revaluation in 1C is carried out:

- when making a payment: the currency balance at the end of the previous month is revalued;

- mutual settlements with the counterparty are revalued if there was a balance at the end of the month.

Learn more Revaluation of foreign currency at the end of the month

Next, we will consider accounting for currency transactions in 1C 8.3 using examples.

Control of currency transactions in Russia

The execution of foreign exchange transactions in Russia is controlled by Law No. 173 Federal Law and regulations of government bodies. Currency transactions in Russia are controlled by:

- exchange control agents;

- currency control authorities.

Currency control agents include Russian financial companies, the state organization Vnesheconombank, fiscal authorities, brokers and dealers.

Currency control bodies - the Central Bank, the Government of the Russian Federation, executive authorities.

Banking institutions ensure that currency transactions strictly comply with the law. Bank employees have the right to request documents to confirm the legality of using currency assets or crediting money to the company account. The legality is confirmed by contracts, agreements on transactions, and other documents.

Registration of a foreign exchange transaction is carried out after submitting a package of documents. The company must report and provide all supporting documents to the bank branch.

Note! Foreign exchange transactions will be prohibited if the bank suspects something. They can refuse either due to the lack of necessary documents or if errors are identified in their preparation.

Accounting for primary documents

During export and import operations, new forms of primary documents arise that you have not previously used. All documents are drawn up in two languages - Russian and the language of the counterparty. If your partner sent you a copy in only one language, you will have to make a translation. Typically, requests for translation come from the Federal Tax Service. The documents will be partially prepared by you, and partially by the foreign partner. The following primary will appear:

Contract. Directly the contract itself with the foreign counterparty. It reflects all the terms of the transaction and the rules of Incoterms 2022. This is a set of rules that defines the basic terms and provisions for foreign trade. In particular, it regulates issues related to the payment of expenses by the parties and the transfer of risks of loss.

An invoice is a document that the seller creates for the buyer. It reflects all information about the product: quantity, price, color, size and other quality characteristics. It also reflects the terms of delivery and details of the parties. An invoice is needed for customs and currency control. In domestic accounting, there is no full-fledged analogue to an invoice, but an invoice is in many ways similar to an invoice, although an invoice is more of a tax document, while an invoice is still an accounting document.

Customs declaration. Issued when importing and exporting goods. The cargo manager fills out a declaration form for each shipment of goods, and the customs inspector approves it. It contains all the information about the cargo, the sender, the recipient and the transport on which you are moving the goods.

Remember! The goods declaration confirms the legality of the transaction. If it is filled out with errors or is missing, customs officers will not allow the cargo to pass through.

Changes in documents will also affect VAT. In the standard VAT return you will have to fill in new lines. When importing goods from the countries of the Customs Union, fill out an application for the import of goods and payment of indirect taxes.

Transaction passport. Previously, this was a required document for exchange control, but from March 1, 2022, passports were canceled and new rules were introduced. Import contracts over 3 million rubles and export contracts over 6 million rubles are registered with the bank. To do this, provide the bank with information about the agreement and details of the other party. Be prepared for the bank to ask you for information on any foreign currency payment if it exceeds 200 thousand rubles, regardless of its registration.

Documents confirming the registration of the counterparty in another country . They will contain the details of your partner and confirm the fact that he is conducting legal activities.

Payment documents.

Other documents. The list is huge and depends on the specific operation. This includes licenses, certificates and insurance policies.

What applies to foreign exchange transactions at the legislative level?

Currency transactions are defined by Law No. 173-FZ of December 10, 2003. Article 1 lists the basic terms and the concept of foreign exchange transactions. According to the legislation of the Russian Federation, foreign exchange transactions include:

- acquisition, alienation by a resident from a non-resident (or vice versa) of any currency, securities, their use for payment;

- purchase, alienation of currency values between residents (this can be a gift, purchase and sale, inheritance);

- import into Russia and export from Russia of securities, currency, including rubles;

- acquisition, alienation of securities and currency between non-residents;

- transfer of securities and currency from a Russian account to a foreign one or vice versa;

- transfer of Russian currency from Russia abroad or vice versa, making a transfer to a resident’s account or as to one’s own;

- transfer by a non-resident of currency or securities from a Russian account to a foreign one.

Residents are individuals with Russian citizenship or people who permanently reside in the Russian Federation. Residents include organizations and companies registered in Russia, foreigners with a residence permit, and consular missions of the Russian Federation located abroad.

Non-residents are foreigners, representative offices of foreign states, interstate and intergovernmental organizations (their branches) in Russia. Non-residents can be companies registered and operating in other countries.

Law No. 173 Federal Law establishes that there are no restrictions on currency transactions between non-residents and residents. Article 9 of this law establishes restrictions only on foreign exchange transactions for payments for goods that were purchased from a Russian company. Payment can be made in rubles.

Classification of foreign exchange transactions

Classification of currency transactions is carried out according to different criteria. The object includes transactions with rubles, foreign currency, foreign and Russian securities. Operations are classified by subject:

- between non-residents;

- between currency residents;

- between currency residents and non-residents.

Foreign exchange transactions are divided into groups according to the nature of the transaction:

- export-import operations;

- transactions on the client’s bank foreign currency account;

- foreign exchange trading;

- international lending;

- the country's acquisition of foreign currency.

There is another classification of currency transactions performed:

- by deadlines (current, capital, cash transactions with currency);

- active and passive operations (in accordance with accounting);

- operations performed by residents and non-residents;

- aimed at achieving different goals (performed in the entrepreneur’s own interests or in the interests of clients).

There are other types of foreign exchange transactions:

- such transactions that take place through a bank or cash desk;

- purchase of intangible assets, fixed assets, inventories for foreign currency;

- expenses and income in foreign currency;

- fixed assets.

A separate group includes currency conversion transactions, which are carried out for the purpose of exchanging one currency for another. In this case, the difference in rates at the time of the currency transaction must be taken into account. Exchange rates change every day. When converting foreign currency into rubles, an exchange rate difference is formed. Such exchange rate difference must be attributed to the company's expenses or income.

Export operations

Export operations are the opposite of import operations. Now you are exporting goods from your country. Similar to imports, all export transactions go through customs and are subject to duties.

Maintain export accounting separately from trade within your country.

Export VAT

In terms of exports, the VAT rate is more lenient than for imports and is equal to 0%. The right to apply such a rate must be confirmed. To do this, within 180 calendar days from the moment the cargo is declared at customs, provide the following documents to the tax office:

- foreign trade contract with a foreign buyer;

- bank statement confirming receipt of proceeds from the counterparty;

- a copy of the customs declaration with customs marks;

- copies of documents confirming the export of goods abroad.

For a complete list of documents, see Article 165 of the Tax Code of the Russian Federation. All these documents are submitted simultaneously with the declaration at a 0% rate.

If you received an advance payment for products, pay VAT on it. Once title to the item has passed to the buyer, you can request a refund of the amount paid. To do this, submit a separate tax return with the documents listed in Art. 165 Tax Code of the Russian Federation.

Don't forget about tax deductions. Art. 172 of the Tax Code of the Russian Federation regulates which amounts are subject to deduction:

- amounts of VAT on advances from foreign buyers that can be deducted after sale;

- VAT amounts paid to contractors for materials, works and services for the production of export goods.

Important! To deduct, you must keep separate records of “input” VAT on internal and external transactions. The following options can be offered for tax distribution:

- according to the amount of actual costs;

- by the share of shipped export products in the total production volume;

- in proportion to the cost of exported goods to the total cost of shipped products.

Income tax

The purpose of export is to generate revenue, which means it occupies an important place in the calculation of income tax. In practice, it has developed that export operations fall into the category of the main activity. Therefore, consider income and expenses in terms of two categories:

- for production and sales of products;

- non-operating (Chapter 25 of the Tax Code of the Russian Federation).

Income will be the proceeds from the sale of products. Despite the fact that your products will be paid for in foreign currency, recalculate the proceeds at the Central Bank exchange rate on the date of sale.

Keep records of exports and imports using the simplified tax system in the Kontur.Accounting web service. Currency accounting and work instructions, taxes, automatic salary calculation and reporting in one service

Exchange differences

The exchange rate of the ruble against other currencies changes daily. This can affect you both for the better and for the worse, so there are positive and negative exchange rate differences. Let's look at examples (the rates of the Central Bank of the Russian Federation are conditional!)

Example . Equator LLC plans to purchase a batch of tomatoes from a foreign partner. However, the company does not hold foreign currency. To remedy this, it was decided to purchase $5,000 from the bank. May 31 - a purchase order was sent to the bank, which reserved 355,000 rubles for the purchase. The currency itself was purchased on June 3 at the rate of 69.9925 rubles. The exchange rate of the Central Bank of the Russian Federation as of June 3 is 68.9831 rubles.

| date | Debit | Credit | Sum | Description |

| 31.05.2020 | 57 | 51 | 355 000 | Funds for the purchase of currency were reserved by the bank |

| 03.06.2020 | 52 | 57 | 5 000 × 68,9831 = 344 915,5 | Foreign currency has been deposited into the foreign exchange account |

| 03.06.2020 | 51 | 57 | 355 000 — 5 000 × 69,9925 = 5037,50 | Excessively reserved funds were returned to the account |

| 03.06.2020 | 91.2 | 57 | (69,9925 — 68,9831) × 5 000 = 5 047 | The negative exchange rate difference between the purchase rate and the Central Bank rate is reflected |

Example 2. Pyramid LLC bought laser engraving equipment for $3,000 on June 4 (Central Bank of the Russian Federation exchange rate - 68.3413 rubles). The debt to pay for the equipment is subject to revaluation. The exchange rate of the Central Bank of the Russian Federation dropped to 68.0313 rubles on June 30. This created a positive exchange rate difference, since the amount of our liabilities decreased.

| date | Debit | Credit | Sum | Description |

| 04.06.2020 | 08 | 60 | 3 000 × 68,3413 = 205 023,9 | Purchased equipment for laser engraving |

| 30.06.2020 | 60 | 91.1 | 3 000 × (65,5547 — 64,5) = 930 | A positive exchange rate difference is reflected, as the amount of debt has decreased |

Current currency transactions

Current foreign exchange transactions include certain actions. For example, the following actions:

- issuing or receiving loans in foreign currency;

- transfers to the Russian Federation or from the home country of money in foreign currency for the purpose of import or export operations;

- transfers to Russia, from the country of interest and any payments related to the receipt of income;

- transfers of funds in the form of bonuses, wages, pensions and other payments;

- transfers of money for the purpose of purchasing non-property rights or property objects;

- investment carried out in the form of purchasing securities or acquiring shares in the capital of companies.

This is important to know! Transactions that are not on the list cannot be considered current currency transactions.

Accounting for funds in foreign currency

Organizations conducting foreign economic activity can open an account in foreign currency in addition to a ruble account. In this case, keep records of funds in foreign currency in account 52.

Currency accounting is subject to currency regulation. Convert cash balances into rubles upon completion of the transaction. Due to constant exchange rate fluctuations, you will experience positive and negative exchange rate differences.

Postings with account 52 are similar to those we considered above for accounts 50 and 51. The table contains specific transactions for currency accounting.

| Debit | Credit | Description |

| 57 | 51 | Rubles transferred for currency purchases |

| 52 | 57 | The currency is credited to the foreign currency account |

| 60 | 52 | Paid the debt to a foreign supplier |

| 71 | 52 | Issued currency for reporting |

| 52 | 62 | Received money from a foreign buyer |

Features of foreign exchange transactions in the foreign exchange market

Not only companies, but also individuals and banking institutions can carry out currency transactions. Companies are allowed to use cash currency when their employees go on business trips (overseas).

The procedure for performing currency transactions has changed and simplified since July 1, 2016, because some provisions of Law No. 173-FZ have lost force.

The requirement to carry out operations aimed at purchasing foreign currency through authorized banking institutions remains valid. Such banks must have a license to carry out any currency transactions.

Individuals have the opportunity to carry out various foreign exchange transactions on the domestic market. Individuals buy currency for their own needs.

When carrying out transactions with currency, certain requirements for personal identification are established. There is no information in the law about restrictions on the amount of currency purchased.

Accounting, posting currency transactions

Participants in currency transactions must keep records of them. Information about such transactions is contained in account 52. The debit of the account for the last month takes into account all foreign exchange receipts, as well as non-cash currency balances at the beginning of the month.

The accountant keeps records separately for different types of currencies. Transactions must be reflected in Russian rubles. If it is necessary to submit reports in foreign currency, then the documentation is duplicated. Exchange rates change daily, for this reason the recalculation date should be set correctly. For example, transactions that passed through the cash register are reflected on the day they were performed and on the reporting date. Non-current assets must be recorded at the time expenses are recognized.

The current account reflects the accounting of cash proceeds in foreign currency, interest received and other transactions. A special transit account is opened for the client by an authorized banking institution. The transit account displays the purchase and sale of currency. A regular transit account is needed to reflect funds for which the banking institution has not yet received information. Such an account confirms the “origin” of funds, the relationship to a legal agreement.

Account 55 is involved in foreign exchange transactions only in certain cases. Currency on deposits, letters of credit, and other forms of payments is taken into account. Account 57 reflects foreign currency amounts intended for sale, as well as rubles for the purchase of foreign currency.

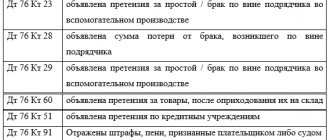

Different entries can be used in currency accounting:

- D57 K52, D51 - reflects currency transfer, revenue credited to the account;

- D57 K51, D52 - “reverse” transaction of purchasing foreign currency for rubles;

- D50 (52) K52 (50) - availability of currency at the cash desk or return to a banking institution;

- D52 K62, 66, etc. - crediting currency from buyers to the account, other receipts;

- D60, 66, 67, etc. - payment to suppliers in foreign currency, performance of other transactions with counterparties;

- D91(57) K57(91) - financial result from completed foreign exchange transactions.

Errors when processing currency transactions provoke problems with regulatory authorities. To prevent such problems from arising, you need to entrust accounting work to experienced specialists.

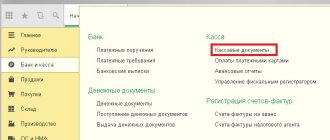

How to reflect currency transactions in 1C: Accounting 8

In the 1C:Accounting 8 program, currency transactions are supported by default - no additional functionality settings are required.

Currency accounting indicator in the Chart of Accounts

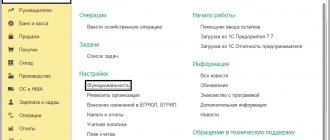

In the Chart of Accounts "1C:Accounting 8" edition 3.0 (section Main) for those accounts where currency accounting is supported (including accounting in conventional units, hereinafter - cu), in the Val column. the sign of currency accounting has been established (Fig. 1).

Rice. 1. Accounts with currency accounting feature

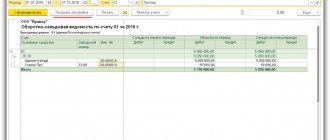

An entry for the debit or credit of an account with an established sign of currency accounting, along with the amount in rubles, will also contain a foreign currency amount. Accordingly, using any standard program report - account balance sheet or account analysis, which uses accounts with the currency accounting feature, you can analyze accounting data, both in ruble and currency equivalent.

Directory of currencies

The program supports multi-currency accounting and allows you to enter transactions and view reports in any currency presented in the Currencies directory. The directory can be accessed via the Currencies hyperlink from the Directories section.

Moreover, if no currency other than the Russian ruble is entered into the currency directory, then it is considered that the organization does not have foreign exchange transactions. Therefore, accounts with the currency accounting feature will not be available.

Working with the Currency directory involves two stages:

- filling out the directory;

- setting exchange rates.

There are two ways to fill out the Currency directory:

- using the All-Russian Currency Classifier OK (MK (ISO 4217) 003-97) 014-2000, approved. Resolution of the State Standard of Russia dated December 25, 2000 No. 405-st (hereinafter referred to as the Currency Classifier). The currency classifier, as well as other classifiers, are downloaded via a web service if there is an Internet connection and authorization on the 1C:ITS Portal;

- by manually creating a new currency.

The Create - By Classifier command allows you to add a new element of the Currency directory by selecting it from the Currency Classifier. In the Currencies directory element created in this way, the following details will be automatically filled in: Name of currency, Symbolic code, Numeric code. If the exchange rate of the selected currency can be downloaded via the 1C web service, the Loaded from the Internet flag will be set by default (Fig. 2).

Rice. 2. Currency card

The Create - New command allows you to add a new element of the Currency directory manually. As a rule, this method is used if the monetary obligation under an agreement with a counterparty, payable in rubles, is expressed in conventional units (cu). In this case, you must fill out all the details yourself.

It is not always necessary to create a Currency directory element with the selected currency in advance. When creating a new foreign currency account opened in a Russian bank, the currency will be determined by the account number and will be added to the Currency directory automatically.

As soon as at least one currency other than the Russian ruble appears in the currency directory, access to accounting accounts with the currency accounting feature opens.

There are three ways to set exchange rates:

- specify manually in the Exchange rates list;

- upload manually via 1C web service;

- automatically download through the 1C web service according to a specific schedule.

To automatically download currency rates according to a specific schedule, use the default routine task Loading currency rates. Users with administrator rights can independently configure routine tasks in the Routine and background tasks form (section Administration - Maintenance - Routine operations).

How to display exchange rates on the home page in “1C: Accounting 8” (rev. 3.0)

Contracts in foreign currency

If an organization keeps records with counterparties under agreements, then in the agreement card you can set up an agreement currency other than the Russian ruble. This can only be done if foreign currency is entered into the Currency directory.

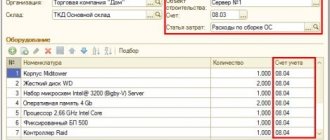

In the form of the directory element Contracts, you should expand the Calculations collapsible group and select the contract currency in the Price in field (Fig. 3).

Rice. 3. Agreement card in foreign currency

When you select a currency other than the ruble, the Payment in switch will appear, with which you can set the currency in which payments are made under this agreement.

Payment can be set in rubles (if the agreement is concluded in conventional units) or in the currency of the agreement (if the agreement is foreign currency).

Bank accounts

To record funds in accounts opened in credit institutions (banks), accounting accounts are intended (Chart of accounts for accounting of financial and economic activities of organizations, approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n):

- 51 “Current accounts”;

- 52 “Currency accounts”;

- 55 “Special bank accounts.”

Analytical accounting is maintained for each bank account.

To store information about Russian and foreign bank accounts of all legal entities and individuals (both their own organizations and third-party counterparties), the program uses the Bank Accounts directory. The list of bank accounts of your own organization or counterparty is determined by those bank accounts that are subordinate to the directory element Organizations, Counterparties and Individuals. The transition to the list of bank accounts is carried out using the link Bank accounts from the organization’s card (from the card of the counterparty or individual).

For each organization (each counterparty), you can select a main bank account. This account will be inserted by default into payment documents.

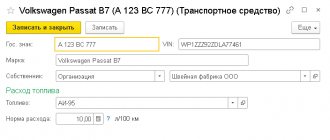

A new bank account, including a foreign one, is created by clicking the Create button. In the bank account card that opens, you should fill in the basic details: the bank in which the account is opened; Account number; currency of funds, correspondent bank for indirect settlements, as well as other additional information.

It is recommended to start filling out a bank account with the Bank field, since the specified bank affects the display of details in the bank account card and the composition of the input checks. To select a bank, simply enter the BIC or the first letters of the bank's name. When entering a value, the bank is searched in the Banks directory and the values are substituted into the remaining fields. If there is no bank with such a BIC, you need to add a new bank to the directory.

To enter a new entry about a Russian bank into the Banks directory, it is recommended to use the Create - By classifier command.

The Classifier of Russian Banks is a separate directory of the program, which contains detailed information about all Russian banks and is kept up to date. You can update information about banks using the Load classifier command. Using the switch you can select the boot option:

- Download updates via the Internet;

- Download updates from a file.

In the Russian Bank Classifier selection form that opens, you should find the required bank (you can use the search), highlight it with the cursor and click the Select button (also by double-clicking the mouse). A new element is introduced into the Banks directory, where basic information about the bank is automatically filled in (name, BIC, correspondent account, bank contact information, etc.).

To enter a new entry about a foreign bank into the Banks directory, you should use the Create - New command, refusing the program’s offer to select a bank from the classifier.

If a Russian bank is selected, the program allows you to enter only a Russian account number, consisting of 20 digits. In this case, a check will be performed using the account check digit. If the verification fails, a message will appear: the account number or bank was entered incorrectly. An incorrect Russian account number cannot be saved in the program.

Selecting a foreign bank allows you to enter a bank account in the formats provided for foreign banks. For foreign banks, it is possible to enter an account in IBAN format (for banks with SWIFT and located in countries registered in the IBAN Registry) or in national format.

For Russian bank accounts, the currency of funds is filled in automatically based on the correct account number being entered. If the specified currency is not in the Currency directory, it is created automatically. For foreign bank accounts, you must specify the currency by selecting a value from the Currencies lookup.

How to create a bank account for an organization or counterparty in 1C:Accounting 8 (rev. 3.0), including in foreign currency

Conversion of currency amounts

If a currency transaction is registered in the program by a standard document of the accounting system (for example, Receipt (act, invoice) or Sales (act, invoice), etc.), then the currency amounts reflected in the accounts with the attribute of currency accounting (except for advances accounting accounts) are automatically are converted into rubles. In accordance with the rules of accounting and tax accounting, to convert the amount of a foreign exchange transaction into rubles, the rate specified in the Currency Directory is used, which was in effect:

- on the date of transfer (receipt) of funds - in terms of prepayment (advance payment, deposit);

- on the date of the currency transaction - in the part exceeding the amount of the prepayment (advance payment, deposit).

In some cases, on the date of the currency transaction, a manual revaluation of currency balances will be required. For example, when issuing and receiving loans in conventional units, the accounting of which is not automated in the program.

| 1C:ITS For more information on the reflection of issued and received short-term interest-bearing loans in conventional units, see the “Directory of Business Transactions. 1C: Accounting 8" section "Instructions for accounting in 1C programs": short-term interest-bearing loan in cu. (accounting with the borrower), short-term interest-bearing loan in monetary units. (accounting with the lender). |

The monthly revaluation of currency funds, claims and obligations expressed in foreign currency is performed automatically by the regulatory operation Revaluation of currency funds, which is included in the Month Closing processing (Operations section). Balances in foreign currency recorded in accounts with the sign of currency accounting (except for advances accounting accounts) are recalculated into rubles at the rate indicated at the end of the month in the Currency directory.

When conducting currency transactions and routine operations for the revaluation of foreign currency funds, account balances specified in the Accounts with a special revaluation procedure are not revalued. This register is accessed from the program's Chart of Accounts using the Accounts with a special revaluation procedure hyperlink.

The Accounts with a special procedure for revaluation register stores information about accounting accounts on which currency accounting is provided, but which for one reason or another should not be automatically revalued in the general manner, with exchange rate differences written off to accounts 91.01 “Other income” and 91.02 “ Other expenses". For most users, the Accounts information register with a special revaluation procedure does not need to be filled out, while the accounts accounting for advances received and issued expressed in foreign currency are not revalued in any case. This register should be filled out in special rare cases when non-standard program documents or atypical situations are used.

1C: Accounting 8

“1C: Accounting 8” is the most popular accounting program that can take accounting automation to a whole new level. A convenient product and services connected to it will allow you to effectively solve the problems of the accounting department of any business!

- Support of different tax systems, maintaining accounting and tax records, submitting reports;

- Inventory accounting, batch accounting, settlements with counterparties, extracting primary documents;

- Payroll calculation, accounting of cash transactions;

- Integration with other 1C programs and websites;

- Working with electronic certificates of incapacity for work (ELS).

Try 30 days free Order

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter