VAT deduction based on air tickets

Question: An enterprise that is a VAT payer and is interested in input VAT, purchased air tickets by bank transfer for an employee’s business trip. In the documents provided by the supplier - invoice, UPD with status "2" - VAT is not highlighted. However, VAT is indicated on the electronic ticket (route/receipt). Supplier with reference to clause 7 of Art. 171 of the Tax Code of the Russian Federation, clause 18 of the Rules for maintaining a purchase book used in VAT calculations, approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137, proves that a VAT deduction can be applied on the basis of an electronic ticket, regardless of the presence/absence of an invoice . On the basis of which document can a VAT deduction be accepted, and is it possible that there is a discrepancy in the data in the documents provided by the supplier?

Answer:

In paragraphs 1 clause 3 art. 169 of the Tax Code of the Russian Federation provides for the possibility not to draw up invoices with the written consent of the parties to the transaction if the buyer is not a VAT payer (exempt from taxpayer obligations). Taking into account the above provisions, as well as the fact that individuals are not payers of VAT and do not accept it for deduction, the Federal Tax Service of Russia indicated that when providing passenger transportation services on the basis of an air ticket paid by individuals by bank transfer, in which the amount of VAT is highlighted in a separate line , the airline may not issue invoices.

Regarding the application of deductions based on air tickets.

Paragraph 1 of Article 172 of the Code establishes that deductions of tax amounts are made on the basis of invoices issued by sellers when selling goods (work, services), or on the basis of other documents in the cases provided for in subparagraphs 3, 6–8 of Article 171 of the Code.

According to paragraph 7 of Article 171 of the Code, amounts of value added tax paid on business trip expenses accepted for deduction when calculating corporate income tax are subject to deductions.

Based on clause 18 of the Rules for maintaining a purchase book used in calculations of value added tax, approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137, when purchasing services for the rental of residential premises and services for transporting employees to the place of business travel and back in the book purchases intended to determine the amount of value added tax to be deducted, invoices are registered, strict reporting forms filled out in the prescribed manner (or copies thereof) with the amount of value added tax highlighted in a separate line, issued to the employee and included by him in the report on business trip.

Thus, in our opinion, the itinerary/receipt of an electronic ticket with the VAT amount allocated in it (issued in accordance with Order of the Ministry of Transport of Russia dated November 8, 2006 No. 134) is a sufficient basis for applying a tax deduction in the event that an employee of an enterprise purchases air transportation in cash or via payment card.

In case of non-cash payment for an air ticket by an organization.

Clause 1 of Art. 172 of the Tax Code of the Russian Federation establishes that deductions of tax amounts are made on the basis of invoices issued by sellers when selling goods (works, services), or on the basis of other documents provided for in clauses 3, 6–8 of Art. 171 Tax Code of the Russian Federation.

Clauses 3, 6–8 of Art. 171 of the Tax Code of the Russian Federation and other norms of the Tax Code of the Russian Federation, no other special documents are provided for deductions for business trips (except for the above-mentioned purchase of a ticket by an employee), accordingly, the organization in the situation under consideration has the right to a tax deduction for air travel of a business trip employee in the general manner - if there is an appropriate invoices.

Thus, in the case of an organization purchasing an air ticket and paying for it by bank transfer, the VAT tax deduction is applied on the basis of a properly executed invoice.

In addition, in case of discrepancies in the data in the primary documents (VAT is not highlighted in the UPD, VAT is highlighted in the electronic ticket (route/receipt)), the organization faces the risk of additional VAT charges during a tax audit in relation to the VAT amounts claimed for deduction.

In preparing the answer, the author used materials from the Tax Guide, a Practical Guide to VAT, Letters of the Federal Tax Service of Russia dated May 21, 2015 No. GD-4–3/8565 “On the procedure for applying VAT” and the Thematic issue “Value Added Tax: Interesting Issues from Tax Tax Practice.” consulting" (edited by Bryzgalin A.V.) ("Taxes and financial law", 2013, No. 11), presented in the legal reference system "ConsultantPlus".

ANNA ZADUBROVSKAYA

, TAX LAWYER, AUDITOR, GENERAL DIRECTOR OF PROFCONSULTING LLC

Source of publication: information monthly “The Right Decision” issue No. 3 (173) release date of 03/20/2017.

The article was posted on the basis of an agreement dated October 20, 2016, concluded with the founder and publisher of the information monthly “Vernoe Reshenie” LLC “.

VAT on air and railway tickets in 2022

Many organizations send their employees on business trips. Accordingly, upon the employee’s return, he reports for the funds spent, including on travel tickets. Sometimes accountants wonder whether these amounts can be reduced when calculating taxes.

There is an official position of the Ministry of Finance on this matter, which says that if the amount of tax is written on the ticket itself, then it can be taken into account in the company’s expenses.

From 2022, specifically on the tickets themselves, a zero VAT tax rate is provided. All additional fees and services are subject to a 20% rate. At the same time, in order for VAT to be safely deducted, the ticket must clearly indicate which amount of tax relates to the service fee or additional services.

| Tax rate | When to use |

| 20% | The rate is generally accepted and applies to all services. |

| 10% | Reduced rate applies to tickets for domestic flights, except for flights to Crimea |

| 0% | Reduced rate applies to tickets for domestic rail transport, flights to Crimea and international transport |

Taxes on S7 Airlines tickets

A significant part of the price of S7 Airlines tickets consists of taxes, and you cannot refuse them. On the ticket, this data is indicated next to the total cost of the flight. But what are they for and can they be returned?

Taxes are intended to pay for airport services and reservation systems. Each type of such surcharge is assigned an abbreviation (YQ, ZZ, YR, etc.). Some of them are non-refundable, and if you return the ticket, you will only get back the fare price.

Basically, the fee includes airport and aircraft services. But some of them also cover other expenses of the airline - for example, fees for passenger no-show, for each point of arrival and departure (for flights with transfers), advance reservation of a seat on the plane, provision of special meals, valuable luggage, rest in the VIP lounge, refund air ticket, etc. It depends on the type of tax.

Note! If you were on a business trip and you need to hand over your air ticket to your company’s accounting department, know that in this case the final cost of the ticket (including fees and taxes) will be reimbursed.

BSO in the field of air transportation

BSO in the field of air transportation was approved by orders of the Ministry of Transport dated November 8, No. 134, dated January 29, 2008, No. 15. These forms are:

- air ticket;

- e-ticket itinerary receipt;

- baggage receipt;

- extracts from the air transportation registration information system.

All these documents must contain the mandatory BSO details, the list of which is established in paragraph 1 of Article 4.7 of Law No. 54-FZ. The Ministry of Finance drew attention to this in a letter dated October 28, 2022 No. 03-07-09/93693.

Read in the berator “Practical Encyclopedia of an Accountant”

Mandatory details of cash receipt and BSO

Travel documents

As a general rule, the carriage of passengers (baggage) is carried out on the basis of a contract of carriage, which, in turn, is certified by a ticket. Regardless of the type of transportation, a ticket is a document of strict accountability (Order of the Ministry of Transport of Russia dated 05.08.2008 No. 120, Order of the Ministry of Transport of Russia dated 29.08.2001 No. NA-334-r).

As you know, recently an increasing number of people, when purchasing travel tickets, use the corresponding Internet sites, i.e., purchase so-called electronic tickets. It is worth noting that the route/receipt of an electronic air ticket and the control coupon of an electronic railway ticket are also strict reporting documents (clause 1 of the appendix to the order of the Ministry of Transport of Russia dated November 8, 2006 No. 134, clause 2 of the order of the Ministry of Transport of Russia dated August 21, 2012 No. 322). These electronic travel documents contain all the necessary information about the passenger, the flight, as well as tariffs and costs of transportation. Consequently, such a document can be accepted for accounting as justification.

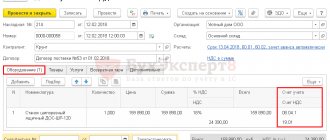

Reflection of the purchase of air tickets on accounting accounts.

According to the chart of accounts, approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94 n, paid air tickets are accounted for in account 50-3 “Cash documents”. Tickets should be received on the day they are received by the organization. The procedure is equally applicable for tickets on paper and for tickets in electronic form.

It is a mistake to include the price of a flight as an expense at the time of purchase or issuance. The cost of air travel can be included in expenses only when the business trip has taken place and the employee has submitted an advance report. Purchasing a ticket does not prove the fact of a decrease in economic benefits; the trip may not take place and the ticket will have to be returned with certain monetary losses.

Example 1: On February 13, Tekhnoservice LLC transferred non-cash funds for a flight to Beijing for V.F. Shchekotkin, director of science, who was going to China for negotiations. On February 14, an itinerary receipt was sent by email and sent to Shchekotkin. On February 25, the director of science returned from China and submitted an advance report with documents.

Postings

| Date of operation | Debit account | Account credit | Supporting documents | |

| 13.02. | Paid for the flight to Beijing from a bank account | 60 “Settlements with suppliers and contractors” | 51 “Current accounts” | Invoice, agreement, payment order |

| 14.02. | Received itinerary receipt in electronic form | 50.3 “Cash documents” | 60 “Settlements with suppliers and contractors” | Cash receipt order, route receipt |

| 14.02. | Ticket issued to Shchekotkin | 71 “Settlements with accountable persons” | 50.03 “Cash documents” | Account cash warrant |

| 25.02. | Business trip report provided | 26 “General business expenses” | 71 “Settlements with accountable persons” | Boarding pass, advance report |

Example 2: On September 23, money was transferred from the cash desk of Tekhnoservice LLC to the account of an employee of the enterprise, Zavalina E.A. for a trip to the city of Krasnodar in order to conclude an agreement for the supply of raw materials. Zavalina independently bought a ticket at the ticket office and, after returning from Krasnodar on September 26, reported for the accountable money.

Postings

| Date of operation | Debit account | Account credit | Supporting documents | |

| 23.09. | Money was issued from the cash register of Zavalina E.A. | 71 | 50.01 "Cash desk" | Account cash warrant |

| 26.09. | An advance report was submitted to the accounting department of Technoservice | 26 | 71 | Ticket, advance report |

Controversial situations when purchasing tickets

Let's imagine the situation. The director of the organization went on a business trip. In order to provide himself with comfortable conditions, he decided to buy an entire compartment for the trip. Upon returning from a business trip, the tickets, along with the advance report, were submitted to the accounting department and their cost was accepted as expenses. How will the tax authority look at this?

The situation is twofold. On the one hand, the amount of travel expenses is not limited in any way, that is, such expenses are accepted upon actual receipt. On the other hand, it will be quite problematic to prove that expenses in such an amount are economically justified and appropriate. Accordingly, the tax authorities will consider the cost of additional tickets to be the income of the posted worker and will additionally charge personal income tax, insurance premiums, as well as late fees and fines for non-payment on this amount. In this case, the company has the right to go to court and try to prove that such expenses are indeed targeted and were made for the benefit of the company.

There are decisions where the court sided with the companies; such amounts were recognized as expenses. However, each situation is unique and everyone decides for themselves whether to recognize such disputed amounts as expenses or not.

Thus, we see that in most cases, VAT on tickets is levied at a preferential rate of 0%. To do this, tickets must contain the required details, and the organization must have the appropriate OKVED. It is worth paying special attention to accepting amounts for tickets as expenses. This applies to train and flight tickets. Judicial practice on controversial situations exists, there are decisions in favor of taxpayers. However, each company or entrepreneur decides for themselves whether it is worth the risk in such situations.

What are taxes and fees and why are they needed?

Taxes and fees are not just an extra charge on an airline ticket.

10 very useful products for air travel

Taxes are essentially payment for passenger service at the airport. This also includes ensuring security in the terminal building and technical equipment of aircraft. They are installed by the airport itself. Passengers pay international terminal fees, customs fees, immigration fees, and sometimes even airport development fees.

The fees include passenger fees for fuel, ticketing services and insurance. Sometimes passengers are charged fees for flying over another country and for departing from a “foreign” airport.

History of appearance

Taxes on airline tickets appeared relatively recently. In the early 2000s, one of Britain's largest airlines introduced a surcharge for passengers. It was only 2.5 euros. This was explained by the fact that with the increase in fuel prices, the company’s work was in question.

To avoid problems with the tax service, a decryption was attached to the air ticket. This move helped the carrier remain in the global market, and other companies followed suit.

Do I need an invoice?

When asked whether the carrier should issue an invoice for the travel pass being sold, officials answer that no, it should not, since we are talking about settlements directly with the population. And the method of payment for travel is not important here. So, if, when paying in cash, the seller gave the buyer a cash receipt or other document of the established form (in this case, a travel ticket), then invoices are not drawn up (clause 7 of Article 168 of the Tax Code of the Russian Federation).

Regarding the issuance of invoices when paying for travel tickets by bank transfer, officials also refer to tax legislation. Since the invoice serves as the basis for the buyer to deduct VAT amounts, if the buyer is not a VAT payer or is exempt from paying tax, the invoice is not issued (clause 1, subclause 1, clause 3, Article 169 of the Tax Code RF). The only condition is the written consent of the parties not to draw up the document.

However, in this case, it should be taken into account that the buyer is an individual, and as is known, individuals do not pay VAT. And, accordingly, there is no basis for deducting tax amounts for this category of payers. Thus, the carrier has the right not to issue an invoice to the buyer, even if payment was made by bank transfer. It is enough just to highlight the VAT amount in a separate line on the ticket.

Fees on S7 Airlines tickets

The presence of this surcharge allows us to maintain airports, provide existing services at a high level and introduce new ones.

Additional payments on air tickets may include costs for fuel, maintenance of the Aeroflot, payment for automatic booking, aviation security and airport maintenance. There are also service costs - in this case, online booking services, transportation fees, etc. are paid. Service surcharge is non-refundable.

For reference. Sometimes the ratio of tariff and surcharge looks ridiculous. For example, you can find a Moscow-Sochi flight, where the fare for the flight will be 100 rubles, and the additional payment will be 1,500 rubles.