What it is

According to the new federal standard, approved by Order of the Ministry of Finance No. 257n dated December 31, 2016, the residual value of fixed assets is an indicator of property assets in the current period.

It is formed after deducting depreciation charges and impairment losses. According to accounting standards, the residual value of fixed assets is determined as the accounting price for a specific date (end of the reporting period) - the original price reduced by the amount of accrued depreciation. Knowing the value of assets by balance, management sees the degree of their moral and physical deterioration and, accordingly, their efficiency of use. This allows you to plan the current renewal of the institution’s material and property funds.

Signs of initial and residual value

Non-current assets are characterized by various types of valuation, such as initial and residual value. The initial price is understood as the price that is paid for the fixed asset at the time of its acquisition. It is determined by a number of characteristics, which together form the price of the property:

- the direct price of the fixed asset itself;

- transportation costs;

- taxes, customs duties and duties;

- estimated cost of services for commissioning equipment.

The initial estimate is a constant value. It remains unchanged from the moment of acquisition and registration of the fixed asset and for the entire period of its use, except in cases of revaluation of the asset (revaluation or discount), its modernization or liquidation.

Residual value is a variable value. It decreases monthly as a result of depreciation charged on the original price. This is an indicator that is necessary to determine the current technical and moral condition of the main property.

The initial assessment is the indicator by which an object is accepted for accounting, and the residual assessment is a value characterizing the condition of the object during the period of its use.

The essence of the concept of residual value

Residual value is derived for non-current asset type. It represents the initial purchase price adjusted to the value expression of the degree of deterioration of the property. The level of wear and tear is regulated through depreciation charges, which are determined cumulatively over the period of operation of the fixed asset.

FOR REFERENCE! Residual value is the amount that will be expensed when the asset is written off the balance sheet.

The residual value indicator is the basis for determining property tax liabilities. In management accounting, the monetary expression of the current price of an asset is required to calculate the level of operating efficiency of the fixed assets available to the company. The residual value is required:

- when concluding exchange transactions, if the subject of the agreement is property assets;

- when selling equipment and other types of fixed assets;

- when applying for a loan for which the collateral is the property of the enterprise;

- in the case of using fixed assets in the form of a contribution to the authorized capital;

- to determine the amount of the insured amount, if necessary, insure the organization’s property;

- to provide judicial authorities in the form of reference information during proceedings on a property dispute;

- at the beginning of measures for bankruptcy of the institution.

Methods for calculating residual value

The value of the object by balance is calculated monthly - as of the time of reporting, based on the results of the inventory, or at the end of the period determined by the accountant. In addition to the initial and residual costs, replacement costs are also distinguished. It is determined only for those objects for which revaluation was organized at the reporting date.

Here is a formula that shows how to calculate the residual value of fixed assets:

In the formula:

- OSB(B) - initial, replacement cost. When using this formula to determine the operating cost, the organization does not have the right to choose between the initial and replacement cost. The replacement value is used if a revaluation was previously carried out for specific fixed assets, which determined the replacement value of the assets. In accordance with clause 15 of PBU 6/01, revaluation is carried out once a year as of December 31 of the reporting year;

- A is depreciation accrued at the reporting date.

Here's how to determine the residual value of fixed assets when calculating the indicator using analytical accounting accounts:

The debit of account 01 takes into account the initial and replacement cost, and the debit of account 02 takes into account the depreciation accumulated on the calculation date. To make correct calculations, from the aggregate data of account 02, it is necessary to subtract the depreciation that was accrued on the funds accounted for in account 01, since the Kt of account 02 also takes into account the depreciation of fixed assets carried out under 03 “Income-bearing investments in material assets” (Order of the Ministry of Finance No. 94n dated October 31, 2000).

Depreciation charges are determined for all types of fixed assets. The rules for their calculation are enshrined in PBU 6/01. Depreciation for intangible assets is calculated in accordance with the procedure established by PBU 14/2007.

Formula for calculating residual value

Mathematically, calculating the residual value of an asset is quite simple; only 2 indicators are used:

Residual value = Original (replacement) cost – Accumulated depreciation.

Please note: the original cost is taken into account if revaluations have not been carried out. If there is a replacement cost after revaluation, only this is taken into account for calculation.

This method of calculating residual value can be rewritten into the “language” of accounting balances:

Residual value = Balance Dt 01 – Balance Kt 02.

When determining the amount of depreciation, the accountant should take into account that account 02 accumulates depreciation accrual not only for fixed assets, but also for objects in account 03 “Profitable investments in tangible assets.” Such investments include those operating systems that are provided for temporary possession or use for a fee.

Therefore, during the calculations, the credit balance of account 02 is reduced by the amount related to the objects of account 03. When compiling the balance sheet, fixed assets and investments are reflected at the residual value and in different lines (1150 and 1160, respectively).

Estimation of residual value

The decision to revaluate the main assets is made by management. Revaluation is carried out once a year, but not more often, and only for assets that belong to the enterprise as a property. This is not a mandatory procedure; the decision is made voluntarily. The rule applies: if the revaluation has not been carried out previously, but was organized once in the institution, then it will have to be carried out regularly. The procedure is organized at the end of the billing period - year (as of December 31).

As a result of the revaluation, the amount of recovery is determined. The replacement cost of a fixed asset is the new valuation of a particular asset after it has been revalued.

To carry out revaluation, the manager issues an order that lists homogeneous objects that need revaluation. The basis for calculation is the current value of property assets. When revaluing objects, the accountant must perform the following actions:

- recalculate the current cost of the operating system;

- calculate the updated depreciation amount;

- reflect new amounts in accounting;

- enter the amount of additional valuation into additional capital;

- reflect the resulting markdown as other expenses.

The results of the procedure are entered into the balance sheet in a separate line.

Residual value: calculation examples

We will calculate the book value of property in different situations.

Calculation of residual value of equipment

When compiling the annual balance sheet of an organization that has production equipment, the following data is taken into account:

- the initial cost of the fixed assets was RUB 2,300,600;

- the total amount of accumulated depreciation of fixed assets is RUB 900,800;

- depreciation on rental property – RUB 200,700.

First, let’s determine the amount of equipment depreciation taken into account:

900,800 – 200,700 = 700,100 (rub.) – accumulated depreciation on production equipment.

The residual value of fixed assets, which will be reflected on line 1150 of the balance sheet as of December 31, will be:

2,300,600 – 700,100 = 1,600,500 (rub.).

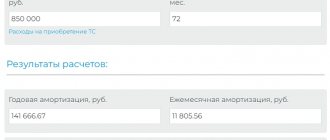

Calculation of residual value of a car

Kompas LLC, which uses OSNO, accepted for accounting on November 16, 2015 a car purchased at its own expense at a price of RUB 826,000, including 18% VAT.

The initial cost of the object was (excluding deductible VAT):

826,000 – 826,000 x 18/118 = 826,000 – 126,000 = 700,000 (rub.).

The vehicle is assigned to depreciation group 3 with a useful life of 5 years (60 months).

For the first time, depreciation was accrued for December 2015 and then the monthly cost of the car was repaid in the amount of:

700,000 / 60 = 11,666.67 (rub.).

In February 2022, the management of Kompas LLC decided to sell the car and turned to an appraiser. The latter needed the residual value of the car to determine the current market price. To determine it as of February 1, 2022, the following calculations were made:

- number of months of depreciation using the straight-line method – 50 (from December 1, 2015 to January 31, 2020);

- amount of accumulated depreciation: 50 x 11,666.67 = 583,333.50 (RUB);

- residual value of the car: 700,000 – 583,333.50 = 116,666.50 (rub.).

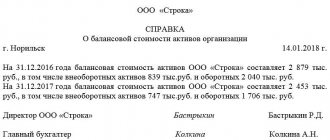

Similar information without unnecessary calculations can be seen in the balance sheet of Kompas LLC as of February 1, 2020:

- the debit balance of account 01 reflects the initial cost of the car - 700,000 rubles;

- on the credit balance of account 02 - accumulated depreciation for the object is 583,333.50 rubles.

Use in accounting

To calculate property tax, the residual value of fixed assets is simply necessary: it serves as the basis for calculating the annual average for the reporting and previous periods. The calculated value is used for:

- carrying out purchase and sale transactions and property exchanges and resolving property disputes;

- issuing loans secured by property;

- calculating the amount of insurance amounts;

- carrying out bankruptcy of an organization;

- restructuring of the enterprise's existing debt, etc.

Those institutions in which the total residual value of assets exceeds the established limit of 150 million rubles are not entitled to apply the simplified taxation system (clause 16, clause 3, article 346.12 of the Tax Code of the Russian Federation).

Methods for calculating residual value. Gordon model

To determine the residual value of an enterprise at the end of the forecast period, the following methods can be used:

- Gordon model;

- proposed sale;

— net asset value;

- liquidation value.

Gordon's model is based on the following basic principles:

— the owner of the company does not change;

— in the remaining period, the amounts of depreciation and capital investments are equal;

— the forecast period should continue until the growth rate of the enterprise stabilizes; It is assumed that stable long-term growth rates should be maintained for the remainder of the period.

Calculation of the residual value of an enterprise using the Gordon model is carried out according to the formula:

Profit (cash flow) in the first year

post-forecast period

Residual value = ––––––––––––––––––––––––––––––––––––––––

(discount rate - long-term growth rate)

The estimated sale method consists of recalculating cash flow or profit at the end of the forecast period using special coefficients.

Net asset value valuation method - the expected residual book value of assets at the end of the forecast period is used as the residual value. Not the best approach to evaluate an existing profitable enterprise.

Valuation method based on liquidation value - the expected liquidation value of assets at the end of the forecast period is used as the residual value. It is also not the best approach to evaluate an existing profitable enterprise.

According to any of these methods, the residual value of the enterprise is calculated at the end of the forecast period, and in this regard, when determining the estimated value of the enterprise, this amount must be discounted (reduced to the current value).

Control questions

1. Which function shows the growth of the monetary unit deposited?

2. Which function shows what, at the end of the entire period, the value of a series of equal amounts deposited at the end of each periodic interval will be?

3. Which function shows the amount of an equal periodic contribution, which, together with interest, is necessary in order to accumulate 1 unit by the end of a certain period?

4. How is the present value of an advance annuity calculated?

5. Which function is the reciprocal of the accumulated sum of one?

6. Which function shows the equal periodic payment required to fully amortize the loan?

7. Which function shows the present value of a uniform stream of income (the first receipt occurs at the end of the period)?

8. What are the differences and similarities between the income capitalization method and the discounted cash flow method?

9. The risk-free rate of return is 7% in real terms. The average market return on the stock market is 21% in nominal terms. The profitability of the company under evaluation in the previous period increased by 4%, the average market profitability - by 2%. It is necessary to calculate the nominal rate of return for the company being valued.

10. What will be the present value of the resale price of the enterprise using the Gordon model if the cash flow in the final year of the forecast period is CU 12,000, the discount rate is 15%, and the long-term growth rate is 4%.

To determine the residual value of an enterprise at the end of the forecast period, the following methods can be used:

- Gordon model;

- proposed sale;

— net asset value;

- liquidation value.

Gordon's model is based on the following basic principles:

— the owner of the company does not change;

— in the remaining period, the amounts of depreciation and capital investments are equal;

— the forecast period should continue until the growth rate of the enterprise stabilizes; It is assumed that stable long-term growth rates should be maintained for the remainder of the period.

Calculation of the residual value of an enterprise using the Gordon model is carried out according to the formula:

Profit (cash flow) in the first year

post-forecast period

Residual value = ––––––––––––––––––––––––––––––––––––––––

(discount rate - long-term growth rate)

The estimated sale method consists of recalculating cash flow or profit at the end of the forecast period using special coefficients.

Net asset value valuation method - the expected residual book value of assets at the end of the forecast period is used as the residual value. Not the best approach to evaluate an existing profitable enterprise.

Valuation method based on liquidation value - the expected liquidation value of assets at the end of the forecast period is used as the residual value. It is also not the best approach to evaluate an existing profitable enterprise.

According to any of these methods, the residual value of the enterprise is calculated at the end of the forecast period, and in this regard, when determining the estimated value of the enterprise, this amount must be discounted (reduced to the current value).

Control questions

1. Which function shows the growth of the monetary unit deposited?

2. Which function shows what, at the end of the entire period, the value of a series of equal amounts deposited at the end of each periodic interval will be?

3. Which function shows the amount of an equal periodic contribution, which, together with interest, is necessary in order to accumulate 1 unit by the end of a certain period?

4. How is the present value of an advance annuity calculated?

5. Which function is the reciprocal of the accumulated sum of one?

6. Which function shows the equal periodic payment required to fully amortize the loan?

7. Which function shows the present value of a uniform stream of income (the first receipt occurs at the end of the period)?

8. What are the differences and similarities between the income capitalization method and the discounted cash flow method?

9. The risk-free rate of return is 7% in real terms. The average market return on the stock market is 21% in nominal terms. The profitability of the company under evaluation in the previous period increased by 4%, the average market profitability - by 2%. It is necessary to calculate the nominal rate of return for the company being valued.

10. What will be the present value of the resale price of the enterprise using the Gordon model if the cash flow in the final year of the forecast period is CU 12,000, the discount rate is 15%, and the long-term growth rate is 4%.

Which accounting accounts to use

The value of the property valuation by balance is also determined by the indicators of the accounting account - by comparing the balances of certain accounts. The accountant must create a turnover sheet for accounts 01 and 02 for a certain period and, using the totals of turnover, calculate the required indicator.

Account 01 “Fixed Assets” is used in accounting to reflect the initial cost of fixed assets. Account 01 takes into account all costs for the acquisition, production and commissioning of the property. These expenses are reflected in the debit of account 01. Therefore, to calculate the residual value, it is necessary to determine the debit balance for a specific date.

Account 02 “Depreciation of fixed assets” is used to record accounting data for depreciation charges. Depreciation accrued on property is carried out on the loan and accumulates the total of deductions until the moment the fixed assets are written off from the balance sheet. To calculate the residual value, the accountant must identify the total credit turnover for a certain number.

We described in detail the formula and procedure for calculating the difference between the turnover of 01 and 02 accounting registers earlier. The action itself is performed as follows: OST = balance for Dt 01 – balance for Kt 02.

IMPORTANT!

Depreciation is charged not only on property assets according to the 01 accounting register, but also on assets formed in the form of profitable investments in material assets. When calculating, it is necessary to highlight depreciation accrued only on fixed assets.

Here's what the residual value of fixed assets includes on the balance sheet:

- line 1150 - residual value of property assets recorded in account 01;

- line 1160 is a similar value for profitable investments in material assets.

The balance value for groups of intangible assets of an enterprise is also calculated. It is necessary to generate turnover in accounts 04 “Intangible assets” and 05 “Amortization of intangible assets”. In account 04, information about the original price of intangible assets is displayed, and in account 05 the accrued depreciation is indicated. The residual value for intangible objects is calculated as the difference between the total for debit turnover 04 and the total balance for credit 05.

If an organization decides to sell property, when selling it, the amount of residual value must be indicated, which is written off separately from depreciation charges. Write off not only the value of the balance, but also the original cost. The documentary basis for the transaction is a certificate calculating the residual value of the sold property. To write off fixed assets from the balance sheet upon sale, you must open a subaccount 01.11 - “Disposal” for account 01. It reflects the sales price, which is different from the purchase price of the property.

Residual price estimate

Legislation allows commercial business entities to revaluate the assets they own. The frequency of such manipulations should not be more than once per year. This operation is carried out at the end of the reporting year. For revaluation, groups of similar objects are formed. The current value is taken as a basis.

If the revaluation of property assets was carried out once, then in the future it will be carried out on a regular basis. This is necessary to create conditions for the correspondence of the price of the object in the accounting data with the cost assessment of the restoration type. Scheme of actions of an accountant when revaluing property:

- recalculation of the asset value;

- recalculation of depreciation for the facility;

- reflection of updated data in accounting separately from other indicators;

- the amount of the additional valuation is entered into additional capital;

- the amount of the markdown is equal to other costs that are used to derive the financial result of the enterprise.

In the balance sheet, the results of revaluation are shown as a separate line.

IMPORTANT! Revaluation can be initiated only in relation to assets that the organization owns by right of ownership.

Techniques for changing the estimated value are used by enterprises to bring the accounting price to the market value. This is necessary to make the accounting information realistic in the context of current market trends. For example, a year ago the company bought a computer:

- it has an initial cost of 87,000 rubles;

- depreciation on it was accrued in the total amount of 7,500 rubles;

- The estimated residual value is RUB 79,500. (87000–7500);

- the forecast price at which the company could sell the equipment at the current moment does not exceed the threshold of 66,000 rubles;

- to bring the book price into line with the realities of market conditions, a revaluation is carried out in accounting;

- the result of the change in value at the end of the reporting period was a markdown in the amount of 13,500 rubles;

- the replacement assessed value is equal to the market price of used computer equipment.

NOTE! Revaluation is always voluntary. Legislative norms do not oblige property owners to make markdowns or revaluations; accounting rules give enterprise management the authority to independently make decisions on the issue of value adjustment.

What wiring to use

Let's present the main accounting records in the table:

| Wiring | Contents of operation | A document base |

| Dt 140110172 Kt 110134410 | Write-off of OST for a budgetary institution | Act on write-off of OS-4 and accounting certificate-calculation |

| Dt 91.2 Kt 01.2 | Write-off for commercial and non-profit organizations | Write-off act, certificate-calculation |

| Dt 02 Kt 01 | Write-off of accumulated depreciation for an object | Calculation of depreciation charges |

Features of simplified taxation

For a simplified taxation system, it is allowed to account for income from sales at the time of receipt of revenue. For OSNO, as a result of the write-off of property, both profit and loss appear. The loss must be reflected in accounting by posting Dt 99 Kt 91. The resulting loss is taken into account as part of the costs evenly - in equal parts over a certain billing period. The time period in this case is a month. To derive the accounting period, the accountant performs the following actions: subtracts the actual period of its use in the organization from the planned service life of the property (calculated in months).

The period changes taking into account decreasing or increasing factors calculated on the basis of the depreciation premium. If the accelerated method of calculating depreciation was used, then the specialist is recommended to reduce the calculation period (letter of the Ministry of Finance No. 03-03-06/1/511 dated 08/04/2009). If a reduction factor was used, the billing period, on the contrary, increases (letter of the Ministry of Finance No. 03-03-06/2/280 dated November 23, 2011).