Unified forms of primary accounting documents - what does this mean?

For many years, until 2013, only documents compiled according to specially approved forms could be used as primary documents for accounting and tax accounting purposes.

These forms are called unified. It was allowed to draw up in free form only those documents for which there was no unified form. With the entry into force of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, economic entities received the right to develop document forms independently, subject to compliance with certain requirements for them.

However, many companies continue to use unified forms, because... they comply with all legal requirements. ConsultantPlus experts have collected all the forms into a single material. Get trial access to the system and go to Help information for free.

After this, most of the unified forms of primary documents became recommended, but some remained mandatory. We will talk about them further.

According to the instructions

The job description includes a list of functional responsibilities, indicates the subordination structure and limits of responsibility, lists the qualification requirements for the position, and contains other aspects depending on the personnel policy of the organization. The Labor Code does not oblige employers to have such a document, but it is very useful. The labor function is indicated in the employment contract, but it is inconvenient to describe the responsibilities in detail there, so a separate document is used for this. It is a local regulatory act of the organization and is approved like other regulatory acts. It can be an annex to an employment contract or an independent LNA. When making changes, we recommend that you follow the letter of Rostrud No. 4412-6 dated October 31, 2007.

The introduction of new DI occurs when something changes in the existing ones (for example, due to the emergence of professional standards, there is a need to revise qualification requirements and functions for positions) or new positions appear. Government agencies receive requests for changes from ministries and departments to which these structures are subordinate.

What unified forms of primary accounting documentation are mandatory?

Forms of primary documentation established by authorized bodies in accordance with and on the basis of other federal laws continue to be mandatory (see letter of the Ministry of Finance of Russia dated March 6, 2013 No. 03-03-06/1/6700). For example this:

- Cash documents from the album of unified forms, approved by Decree of the State Statistics Committee of the Russian Federation dated August 18, 1998 No. 88 (information of the Ministry of Finance of Russia No. PZ-10/2012, letter of the Ministry of Finance of Russia dated February 28, 2013 No. 03-03-06/1/5971).

- Consignment note in the form from Appendix 4 to the Rules for the transportation of goods by road, approved by Decree of the Government of the Russian Federation dated 04/15/2011 No. 272 (this follows from letters of the Ministry of Finance of Russia dated 09/06/2016 No. 03-03-06/1/52112, dated 07/20/2015 No. 03-03-06/1/41407, Federal Tax Service of the Russian Federation dated May 17, 2016 No. AS-4-15/ [email protected] )..

Thus, the mandatory use of unified forms applies not only to cash documents, but also to the waybill.

Find out how to properly prepare primary documents in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

You can find a transport bill of lading in the article “Confirmation of transport costs - with what documents?” or in the material “Transportation costs are confirmed by only one document.”

The forms established for state employees are also mandatory. They can be found in the Order of the Ministry of Finance dated March 30, 2015 No. 52n on the approval of forms of primary documents and accounting registers of government agencies and public sector employees and instructions for their use.

Main topics of the month

“HR Practitioner” opens access to closed sections of the portal

Everything about covid-19 and labor relations

Electronic document management in personnel was introduced

Everything about electronic work books, SZV-TD, STD-R

Here you can familiarize yourself with the forms of personnel documents and samples of their completion.

And even more samples

and document forms in the ICS reference database are available to subscribers of the HR Practitioner magazine

- Sample order for approval of forms of primary documents

- Approved forms of primary documents (appendix to the order)

- Commentary on the order approving forms of primary documents

What does “album of unified forms of primary accounting documentation” mean (examples)

An album of unified forms is usually called the so-called thematic selection of document forms. So, there are accounting albums:

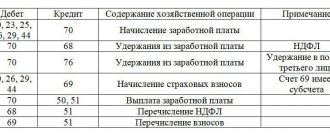

- personnel, working hours and settlements with personnel for wages;

- cash transactions;

- trading operations;

- fixed assets and intangible assets;

- materials;

- products, inventory items in storage areas;

- inventory results;

- works in capital construction and repair and construction work, etc.

Unified forms of personnel documents (timesheets, statements, etc.)

Unified forms of personnel documents were approved by Decree of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1. Conventionally, they can be divided into 2 groups:

- Documents directly related to personnel records - from hiring to dismissal:

- order (instruction) on hiring;

Cm. .

- employee personal card;

See “Unified form No. T-2 - form and sample filling” .

- staffing schedule;

See “Unified Form No. T-3 - Staffing (form)” .

- order (instruction) on granting leave to the employee;

Cm. .

- vacation schedule;

See "Unified Form No. T-7 - Vacation Schedule" .

- dismissal order, etc.

See “Unified form No. T-8 - form and sample filling” .

- Documents reflecting data for settlements with personnel:

- time sheets according to forms No. T-12 and T-13;

See “Unified Form No. T-12 - Form and Sample” and “Unified Form No. T-13 - Form and Sample” .

- salary slips: payroll, settlement and payroll;

See “Unified Form No. T-49 - Form and Sample” , “Unified Form No. T-51 - Calculation Sheet” and .

- personal account, etc.

See “Unified Form No. T-54 - Personal Account” .

List of orders for the main activities of the enterprise

From the content of the previous section it is clear that the AML group is the most voluminous and unpredictable in diversity, affecting all aspects of the company’s financial and economic activities. Let us highlight the main subgroups of orders:

- structural;

- regulatory;

- organizational;

- supervisory;

- reporting;

- financial;

- security;

- informational.

Structural AML

The “Structural AML” subgroup has been accompanying the company since its inception. From their content, it becomes clear how management sees the structure of the company and what measures it takes to form it wisely. The same group of orders is also used during structural transformations (expansion, merger, etc.).

If the company is small in scale of activity and number of personnel, and its structure is stable, this subgroup of orders will be minimal in volume and uniform in form.

Regulatory AML

This set of management orders is aimed at streamlining all company activities. With their help, all internal company local acts are approved (labor regulations, provisions on business trips, bonuses, remuneration, introduction of summarized recording of working hours, etc.), as well as various methodological developments, instructions, etc.

Study internal local acts using materials from our website:

- “Internal labor regulations - sample”;

- “Regulations on business trips - sample”.

Organizational AML

This subgroup may include the following types of orders:

- on approval of the staffing table;

- on the creation of structural divisions;

- on the creation of a commission to investigate industrial accidents;

- other similar orders.

Supervisory AML

This group includes orders, the content of which is related to control and supervisory functions in the company, for example:

- on conducting an inventory of property and liabilities before drawing up annual accounting (financial) statements;

- on carrying out control measures on labor protection;

- on conducting employee certification, etc.

Reporting AML

Reporting orders are usually issued in large holdings, when in addition to financial statements, a lot of other reporting documentation is generated within the company: managerial, financial, analytical, statistical. These orders establish the frequency of reports, specify responsible persons and executors, specify reporting data, etc.

Orders of this group may overlap with AML from the previous subgroup (supervisory). For example, the order “On the appointment of an unscheduled audit of interim management reporting” can be attributed to both groups.

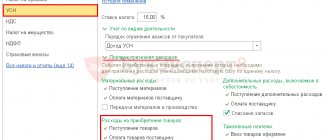

Financial AML

This subgroup accompanies the financial activities of the company - from the content of such orders one can understand the company’s financial strategy, management decisions regarding the main financial flows, forms and types of investments, etc.

Security AML

With the help of security-related AML, the administration resolves issues of material and technical support for the company, organizes supply activities, and regulates other similar issues.

Information AML

The orders of this subgroup cover a wide range of issues and management decisions. For example, this includes the following orders: “On the organization of the work of the archive, etc.

Find out how long to store orders for your main activities in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

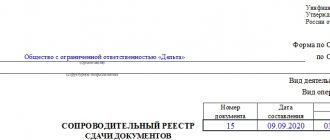

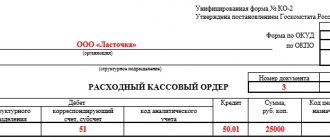

Unified documentation for recording cash transactions

Again, these forms are required. This means that you are required to draw up cash documents strictly according to the forms that are present in the album approved by Decree of the State Statistics Committee of the Russian Federation dated August 18, 1998 No. 88. These are well-known to everyone:

- cash receipt order;

See “Unified form No. KO-1 - cash receipt order” .

- account cash warrant;

See "Unified Form No. KO-2 - Cash Order" .

- cash book, etc.

See “Unified Form No. KO-4 - Cash Book”

Look for other documents on the cash register on our website in the section “Online cash registers KKT KKM”.

And you will find the main forms of primary accounting documentation for other areas and objects in the section “Accounting > Accounting Documents”.

NOTE! On our website there are completed samples for all documents, which can not only be viewed on the website, but also downloaded in Word or Excel formats.

Results

The organization has a choice: to independently develop primary documents or use their unified forms. But there is an exception: when carrying out operations involving the transportation of goods by road or the acceptance/issuance of funds, it is still necessary to use the form of the bill of lading approved in the regulatory documents and documents for processing cash transactions (receipt/expenditure cash orders, cash book).

Sources: Law “On Accounting” dated December 6, 2011 No. 402-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.