What is accounting policy

The accounting policy (hereinafter referred to as the AP) is the basis document on which the company’s accounting and tax accounting is built. Sometimes a separate UE is made for each type of accounting, but this is not necessary - you can combine them into one document. Every organization should have a management program, regardless of:

- organizational and legal form;

- type of activity;

- tax systems;

- scale of production;

- other conditions.

Accounting legislation is not always interpreted unambiguously, but on certain issues it gives the right to choose. The UP must reflect which option the organization will adhere to in its work. For example, methods of writing off inventories are by FIFO, by unit cost or by average cost. There is no need to include mandatory accounting rules in the UE.

The tax part of the UP is regulated by Art. 313 Tax Code of the Russian Federation, accounting - PBU 1/2008. The laws contain a requirement for mandatory approval of the management program by order or directive of the head of the organization.

Keep records, pay salaries and report to Kontur.Accounting. The service already has accounting policy options for different tax regimes and forms of ownership.

Is developing an accounting policy a right or an obligation for an individual entrepreneur?

The answer to this question depends on:

- type of accounting policy (AP);

- structure and features of the activities of individual entrepreneurs;

Most often in practice, the following types of UE are issued:

- for accounting purposes;

- for tax accounting;

- for management accounting.

Get acquainted with the intricacies of management accounting using the materials posted on our website:

- “Accounting policies for management accounting purposes”;

- “We are drawing up a regulation on management accounting (example)”;

- “Management accounting according to IFRS - main advantages”.

At the same time, an individual entrepreneur has the right to develop and apply any types of software - there are no restrictions in the legislation in this regard.

The decision on the need to form a management company is also influenced by the scale of the individual entrepreneur’s activities.

For example, if an entrepreneur’s activities are varied, he strives to effectively organize work and optimize taxation; to resolve these issues, he:

- can implement a budgeting system;

- analyzes the accounting methods used;

- selects the most suitable taxation regimes;

- applies other methods and techniques to improve accounting procedures.

To organize this process, the individual entrepreneur himself is interested in the development and implementation of all three types of accounting policies.

If an entrepreneur provides services of one type, is both a performer and a manager, and does not have employees, then he usually does not need to develop a management program.

However, he will not be able to do without the UP completely due to legal requirements. You will learn from the following sections what legal norms oblige individual entrepreneurs to draw up an accounting policy.

Who develops and approves accounting policies

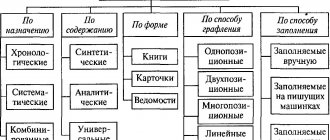

The UP is formed by the chief accountant of the company or another employee who is entrusted with accounting. In accordance with PBU 1/2008, the UP states:

- work accounts that the organization will use for accounting;

- forms of primary documents, internal documents and accounting registers;

- inventory procedure;

- methods for assessing property and liabilities;

- document flow procedure;

- basics of operations control;

- other solutions for organizing accounting.

The manager does not participate in the development unless he wants to. But he must read and approve the finished document.

The tax office asks to show the accounting policy during the audit. And companies often have problems with regulatory authorities when it turns out that there is no order to approve the UE and there never was. At the same time, the order not only confirms the manager’s consent to the application of the management program, but also determines the persons responsible for compliance with the rules approved in the policy.

There is no standard form for an order, so you can compose it arbitrarily. But it must contain mandatory details: name of the document, date of preparation, signature. The provisions of the accounting policy are stated in the text of the order or attached to it in the form of appendices.

Where can an individual entrepreneur get a sample accounting policy?

An accounting policy is a document with individual properties. If an individual entrepreneur develops a management program taking into account all the features of his work, and describes in detail the necessary accounting methods and instructions, he will solve several important problems at once:

- streamline accounting processes;

- will be able to generate complete and reliable information about taxable objects;

- accurately calculate your tax obligations;

- painlessly for the accounting process will be able to transfer (if necessary) the functions of tax accounting to new employees or a third-party company;

- will allow you to justify the accounting methods reflected in the CP and used in practice before controllers and the judiciary.

The software program will not be able to cope with the solution of these problems if it is simply downloaded from some website and does not take into account the nuances of the individual entrepreneur’s work. However, samples of accounting policies developed taking into account the characteristics of different taxation regimes can become useful assistants for individual entrepreneurs when developing their own management system.

Examples of individual entrepreneur accounting policies for tax purposes can be downloaded for free from ConsultantPlus. This ready-made solution will help you correctly draw up an individual entrepreneur’s program on the simplified tax system. A sample for an individual entrepreneur on OSNO, prepared by K+ experts, can be downloaded here. If you do not have access to the K+ system, get a trial online access for free.

You can get acquainted with the peculiarities of forming a unitary enterprise under various tax regimes on our website:

- “Accounting policy under the Unified Agricultural Tax - features of formation”;

- “Accounting policy under the simplified tax system “income minus expenses””.

When is the accounting policy approved?

According to the general rules, each organization has 90 days or 3 months from the date of creation to develop and approve the MP. The day of creation is considered to be the registration of the organization in the Unified State Register of Legal Entities. This applies to newly created and reorganized companies.

For already existing organizations the procedure is different. The manager must issue an order to approve the new UE no later than the last day of the expiring year, since the accounting rules apply from the year following the approval. Therefore, it is not worthwhile to date the order on the UP for 2019 later than December 29, 2018.

In small companies, the UE may remain unchanged for years. It can be developed once and applied year after year, even until liquidation. There is no need to approve a new document annually. But changes and additions need to be made to the document.

Is it still necessary to approve the accounting policy every year?

Thus, legislative and regulatory acts do not contain requirements for approval of accounting policies every calendar year.

The decision to approve the accounting policy for the new calendar reporting year is made by the entity itself. The company organization independently establishes and consolidates the procedure for approving accounting policies either annually or as necessary.

When making this decision, the subject must take into account the following facts:

| • If the accounting policy does not change from period to period, it is reasonable to apply the principle of rationality - instead of the annual approval of the accounting policy, during its initial registration, indicate the date from which the specified document is subject to application (instead of indicating the next year). • Make all changes and additions to the UP without “re-affirming” the entire current UP, i.e. adding them when changing the accounting method - from the beginning of the year, with amendments to the legislation - from the moment they enter into force. |

If certain facts arise, the accounting policy will need to be reviewed in full, for example, a decision was made to categorically change either tax or accounting accounting.

When making changes to the accounting policy, you must:

1.Prepare a text that contains changes explaining the reasons for the changes;

2.Set the date from which the relevant changes will take effect;

| 3.Check whether individual points of the previously approved policy are violated; 4.Changes are approved by an order of management, which is an integral part of the existing order under the Accounting Policy of the entity. An example of changes to the accounting policy regarding tax accounting from 01/01/2022.

| |||||||||||

Who doesn't ask for a company's accounting policy today? The chief accountants are surprised why this document could be needed by anyone other than tax specialists and auditors. Let's explain this below.

Banks

Bank employees request reports when deciding whether to provide a loan to a company or not. They want to see if the company balances its balance sheet frequently so they can ask for the latest accounting policies.

Consulting firms

Interest in accounting policies is understandable when it comes to accounting or tax consulting. Consultants may choose the accounting method and want to find out how the client usually does things. Or they have found a solution for the organization and it must be agreed with the company rules.

Ministries

To receive a free subsidy, a business needs to collect documents according to a list approved by local authorities. Often it contains a clause about a copy or extract from the accounting policy. Or the obligation to provide a copy of the accounting policy is prescribed in the agreement for the provision of financial assistance (order of the Moscow Department of Media and Advertising dated February 22, 2012 No. 49).

The accounting policy, for example, can confirm that the company keeps separate records of income from the type of activity for which the subsidy is given. The policy must be submitted if it is a mandatory document on the list. Otherwise you will not receive a subsidy.

Prosecutor's office

A request from the prosecutor's office for the provision of accounting policies will be received by the company about which the tax authorities provided information there. Consequently, the organization is suspected of tax violation, and it may become criminal. Prosecutors may need the accounting policy to verify separate accounting for state defense orders (Article 8 of Federal Law No. 275-FZ of December 29, 2012).

Judges

In court, accounting policies are needed not by the judge, but by the organization. She can win a tax dispute if she presents accounting policies.

Founder

The business owner has the right to know what methods the company uses in its work. The organization is obliged to provide him with access to any of its internal and mandatory documents within 5 working days (clause 2 of article 50 of the Federal Law of 02/08/1998 No. 14-FZ). These include accounting policies.

The amount of taxes affects the amount of net profit. Therefore, the founder is interested in finding out how the company organized tax accounting.

Funds

Funds also request accounting policies, but what they need them for is not clear. An order that approves the document is enough for the funds. Previously, the Pension Fund of the Russian Federation required an order on accounting policies when it controlled the payment of contributions (approved by order of the Board of the Pension Fund of the Russian Federation dated 02/03/2011 No. 34r). But now the contributions are under the control of the tax authorities.

To tax officials

When and why do tax authorities need accounting policies?

Tax inspectors can request the company’s accounting policies during any audit: on-site, desk, and even on counter.

Inspectors may not use the policy immediately, but reserve it for the duration of the on-site inspection. If a company notices shortcomings in a document, tax authorities will notice this when they compare it with their copy. In any case, you should not send the entire text of the accounting policy to any request from inspectors, so as not to give them unnecessary information.

The company has the right to refuse tax authorities when they ask for everything during a desk audit (Clause 7 of Article 88 of the Tax Code of the Russian Federation). They are required to specify which deficiencies in the declaration require explanations and supporting documents. If this is not clear from the request, ask supervisors to clarify the requirement. At the same time, find out exactly what accounting policies the inspectors are interested in.

In a counter-inspection, inspectors do not have the right to demand the company’s accounting policies. Tax officials may request information about the counterparty and the transaction (Clause 1, Article 93.1 of the Tax Code of the Russian Federation). The way a company keeps its records is not related to the activities of the counterparty.

How to provide accounting policies to tax inspectors.

At the request of inspectors, the company is obliged to send certified copies of documents (clause 2 of article 93 of the Tax Code of the Russian Federation). If necessary, inspectors must be given the opportunity to familiarize themselves with the original.

When it comes to accounting policies, tax authorities are usually loyal. The document can be sent:

- by email as a text file or scanned copy;

- Tax officials will also be happy with an extract from the accounting policy;

- sometimes an order that the policy has been approved is enough for them.

Controllers rarely require the presentation of the original accounting policies, which were approved before January 1 of the current year. The original may be requested during an on-site tax audit.

Do I need to submit an accounting policy?

Inspectors do not make a difference between accounting policies for tax and accounting when they require a document. If the controllers do not explain which policy they are interested in, then both parts must be sent. They need accounting when they check property taxes or income taxes.

The accounting policy itself may not be useful to them. The amount of taxes rarely depends only on the accounting method.

The material was prepared within the framework of the project of the Russian Chamber of Commerce and Industry “Navigator of Success”

Last modified Thursday, May 30, 2022

How to register innovations

A change in accounting policy must be introduced by order of the head of the budget organization.

In the document, indicate the reasons and points that you are changing.

Here is a sample of changes to accounting policies made in connection with changes in legislation - for example, a new order of the Ministry of Finance came into force.

Conclusion

Accounting policy includes the basic rules for organizing accounting and tax accounting.

The principles for developing accounting policies are the same for most organizations. Entrepreneurs can draw up accounting policies voluntarily if they maintain accounting records.

The procedure for forming a tax accounting policy depends on the tax regime applied by the businessman. This applies to both legal entities and entrepreneurs.

Using accounting policies, you can reduce the tax burden on a business. This primarily applies to income tax payers, but other tax regimes also have some opportunities for optimization.